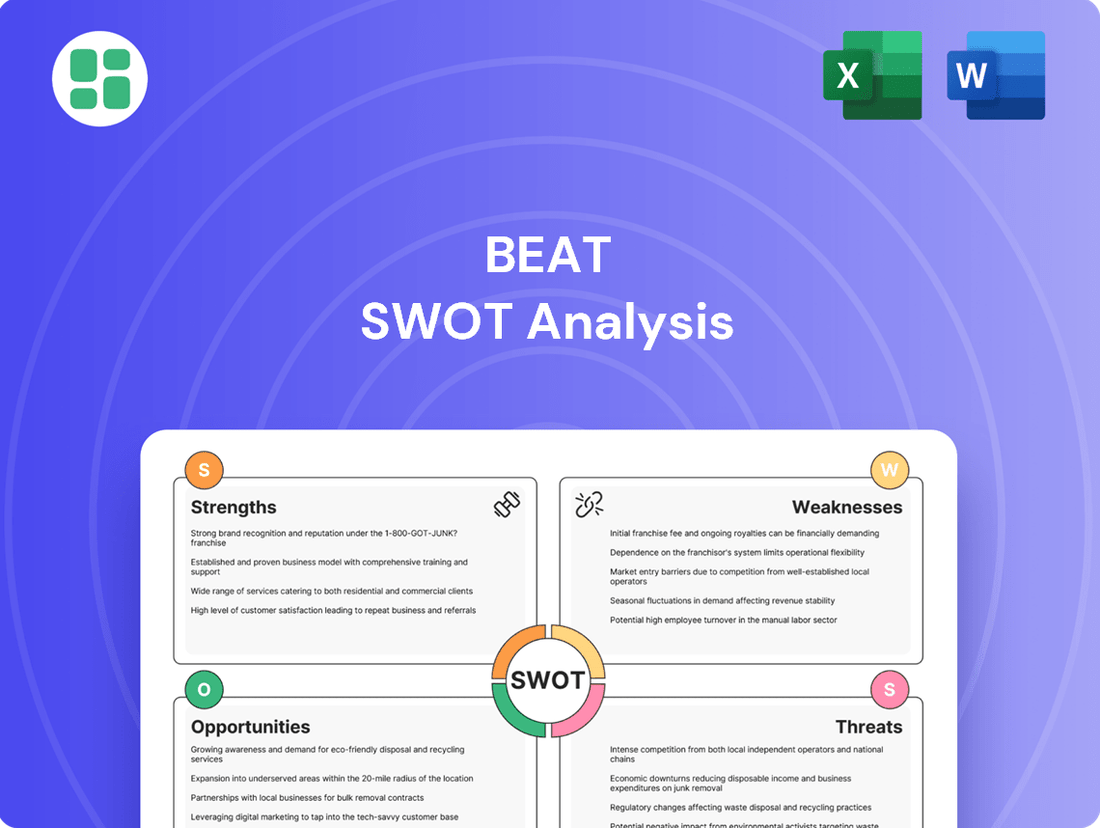

Beat SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beat Bundle

This preview offers a glimpse into the company's strategic landscape, highlighting key strengths and potential challenges. To truly understand their competitive edge and anticipate future opportunities, dive deeper into our comprehensive SWOT analysis.

Uncover the full story behind the company's market position and growth drivers. Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and decision-making.

Strengths

Beat Holdings Limited demonstrates a key strength by concentrating its investments in high-growth sectors like technology, media, and telecommunications (TMT), financial technologies (FinTech), and digital assets. These areas are known for their dynamic innovation and substantial expansion opportunities, positioning Beat Holdings to leverage emerging market trends effectively.

This strategic focus allows the company to identify and foster businesses at the cutting edge of technological progress, aiming for significant returns. The company's recent decision to hold Bitcoin as a primary treasury asset highlights its willingness to engage with the high-growth, albeit volatile, digital asset landscape, as seen in Bitcoin's price movements throughout 2024 and early 2025.

Beat Holdings strategically concentrates its investment efforts on the Asia-Pacific region, a key driver of global economic expansion. This deliberate focus allows the company to capitalize on robust growth trends and unique market opportunities present in this dynamic area.

With established operations in key markets like Singapore and China, Beat Holdings benefits from a deep understanding of local business environments. This localized presence enables the identification and nurturing of high-potential ventures, fostering significant regional growth. For instance, the Asia-Pacific region's GDP growth is projected to remain strong, with many economies expected to outpace global averages in 2024 and 2025, offering a fertile ground for Beat's investment strategy.

Beat Holdings' strategic decision in February 2025 to adopt Bitcoin as its primary treasury reserve asset is a bold move. This positions the company to potentially capitalize on Bitcoin's long-term appreciation and its perceived utility as a hedge against inflation, a particularly relevant concern in the current economic climate.

The company's investment strategy extends to Bitcoin ETFs, such as BlackRock's iShares Bitcoin Trust (IBIT), which saw significant inflows in early 2024, reaching over $10 billion by March. This diversification into regulated investment vehicles aims to enhance shareholder value and appeal to a broader investor base seeking exposure to digital assets.

Engagement in Blockchain Technology

Beat Holdings is actively developing and operating blockchain-related services, with its subsidiary Xinhua Mobile (HK) Limited strategically acquiring intellectual property in this cutting-edge field. This positions the company to capitalize on the expanding blockchain ecosystem, looking beyond just digital assets to the foundational technology itself.

This strategic focus on blockchain is a significant strength, allowing Beat Holdings to tap into a rapidly evolving technological landscape. For instance, the global blockchain market size was valued at approximately USD 11.16 billion in 2023 and is projected to reach USD 120.96 billion by 2030, exhibiting a compound annual growth rate of 41.5% during the forecast period (2024-2030). This indicates substantial growth potential for companies invested in the sector.

- Blockchain IP Acquisition: Xinhua Mobile (HK) Limited's focus on acquiring blockchain IPs directly supports Beat Holdings' strategy.

- Ecosystem Participation: Involvement in blockchain enables participation in a growing digital economy.

- Technological Infrastructure Focus: The company is exploring opportunities in the underlying technology, not just applications.

Flexible Investment Holding Structure

Beat Holdings Limited's flexible investment holding structure is a significant strength, allowing for swift adjustments to its portfolio. This agility is crucial in dynamic markets, enabling the company to capitalize on emerging trends. For instance, as of the first half of 2024, Beat Holdings has strategically shifted a portion of its capital towards technology and sustainable energy sectors, reflecting a proactive response to global economic shifts.

This structure facilitates efficient capital deployment across diverse industries and geographies, minimizing risk and maximizing potential returns. It allows Beat Holdings to pursue opportunistic investments, such as its recent acquisition of a stake in a renewable energy firm in Southeast Asia during Q2 2024, a move that aligns with its long-term growth strategy and diversification efforts.

The inherent adaptability of an investment holding company structure means Beat Holdings is not tied to a single operational model. This provides a distinct advantage in navigating market volatility and pursuing a broad spectrum of investment opportunities, from private equity to public markets, enhancing its resilience and competitive edge.

Key aspects of this flexibility include:

- Agile Capital Reallocation: Ability to quickly move funds between sectors based on performance and outlook.

- Diversified Portfolio Management: Opportunity to invest across various asset classes and industries, reducing concentration risk.

- Strategic Adaptability: Capacity to pivot investment strategies in response to evolving market conditions and economic indicators.

- Pursuit of Niche Opportunities: Freedom to invest in specialized or high-growth areas that may not align with a traditional operational focus.

Beat Holdings Limited's strength lies in its strategic concentration on high-growth sectors like TMT, FinTech, and digital assets, positioning it to capitalize on emerging trends. Its bold adoption of Bitcoin as a primary treasury reserve asset in February 2025, alongside investments in Bitcoin ETFs like iShares Bitcoin Trust (IBIT), demonstrates a forward-thinking approach to digital asset exposure. Furthermore, the company's active development of blockchain services, exemplified by Xinhua Mobile's IP acquisitions, taps into a market projected for significant expansion, with the global blockchain market expected to reach USD 120.96 billion by 2030.

The company's flexible investment holding structure is a key advantage, enabling agile capital reallocation across sectors such as technology and sustainable energy, as seen in its Q2 2024 renewable energy investment. This adaptability allows Beat Holdings to effectively manage risk and pursue opportunistic investments across diverse markets and asset classes, enhancing its competitive edge.

| Investment Focus | Key Action/Data | Market Context/Projection |

|---|---|---|

| High-Growth Sectors | Concentration in TMT, FinTech, Digital Assets | Leveraging dynamic innovation and expansion opportunities |

| Digital Assets | Bitcoin as primary treasury reserve (Feb 2025) | Potential long-term appreciation and inflation hedge |

| Blockchain | Xinhua Mobile IP acquisition | Global blockchain market projected to reach USD 120.96B by 2030 (41.5% CAGR) |

| Geographic Focus | Asia-Pacific region | Capitalizing on robust growth trends |

| Investment Structure | Flexible holding structure | Agile capital reallocation, diversified portfolio management |

What is included in the product

Analyzes Beat’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT analysis into an easily digestible format, reducing the cognitive load for busy professionals.

Weaknesses

Beat Holdings' significant exposure to the Technology, Media, and Telecommunications (TMT), FinTech, and digital asset sectors, especially Bitcoin, presents a considerable weakness due to inherent market volatility. These industries are characterized by rapid price swings and the potential for speculative bubbles, which can result in substantial investment losses.

The company's treasury assets, heavily weighted towards Bitcoin, are directly impacted by its extreme price fluctuations. For example, Bitcoin experienced a peak of over $73,000 in early March 2024, only to see significant drawdowns later in the year, highlighting the unpredictable nature of such holdings.

Beat's strategy of targeting businesses with high growth potential inherently carries a significant investment risk. These ventures are often in their early stages or operate in rapidly changing markets, increasing the probability of underperformance or outright failure. This aggressive growth focus means accepting a higher tolerance for potential losses in pursuit of substantial gains.

The company's recent decision to increase its Bitcoin investment cap to 25% of its total assets, as of Q1 2025, further amplifies this risk profile. Bitcoin's volatility is well-documented, with prices experiencing dramatic swings. This substantial allocation to a highly speculative asset class directly contributes to Beat's elevated risk profile, making it susceptible to significant market downturns.

While a strong presence in Asia-Pacific can be advantageous, it also exposes the company to significant risks tied to regional economic and regulatory shifts. For instance, a slowdown in China's manufacturing sector, a key driver for many regional economies, could directly impact supply chains and consumer demand for companies operating there. In 2024, several Asia-Pacific economies faced inflationary pressures and currency fluctuations, creating a challenging operating environment.

Geopolitical developments and evolving regulatory landscapes within the Asia-Pacific region can also present substantial headwinds. Changes in trade policies or increased protectionism in major markets like Japan or South Korea could disrupt established business models. Economic forecasts for the region, while generally positive, often highlight specific country-level vulnerabilities, such as Indonesia's reliance on commodity prices, which can create localized investment challenges.

Regulatory Uncertainty in Digital Assets

The regulatory environment surrounding digital assets, including cryptocurrencies, continues to be a significant hurdle for companies like Beat Holdings, particularly in dynamic markets like Asia-Pacific. This evolving landscape means that new rules or increased scrutiny could emerge unexpectedly, potentially impacting the value of existing digital asset holdings or restricting future operations. For instance, as of late 2024, several Asian nations were still refining their approaches to crypto regulation, with some considering outright bans while others were developing comprehensive licensing frameworks. This inherent uncertainty makes long-term strategic planning challenging.

This lack of clear and stable regulatory frameworks presents an ongoing challenge for Beat Holdings' digital asset investments. For example, a sudden shift in policy, such as stricter Know Your Customer (KYC) or Anti-Money Laundering (AML) requirements, could increase compliance costs and operational complexity. Similarly, new regulations might limit the types of digital assets that can be held or traded, directly affecting investment strategies. The global nature of digital assets further complicates matters, as differing regulations across jurisdictions create a complex compliance web.

- Evolving Global Regulations: As of mid-2025, the global regulatory stance on digital assets remains fragmented, with varying approaches from outright bans to comprehensive frameworks in different regions.

- Impact on Investment Value: Potential new regulations or stricter oversight could negatively impact the valuation of Beat Holdings' digital asset portfolio, which relies on market acceptance and clear trading rules.

- Operational Constraints: Uncertainty in regulations may limit Beat Holdings' ability to expand its operational scope within the digital asset space, affecting business development and revenue streams.

- Increased Compliance Burden: Adapting to new or changing regulatory requirements often entails significant investment in compliance infrastructure and personnel, adding to operational costs.

Limited Operational Revenue Streams

Beat Holdings' operational revenue streams, primarily from mobile messaging and IP licensing via subsidiaries like GINSMS Inc. and Xinhua Mobile (HK) Limited, have shown limited contribution to overall profitability. For instance, in the fiscal year ending March 31, 2024, the company reported continued operating losses across these segments, underscoring a dependency on investment activities rather than sustainable business operations for financial success.

This reliance on investment gains highlights a weakness in generating consistent, internally driven revenue. The persistent operating losses from its subsidiaries suggest challenges in scaling these businesses or achieving market competitiveness.

- Limited Contribution: Operational segments like mobile messaging and IP licensing have not generated substantial revenue.

- Persistent Losses: Subsidiaries such as GINSMS Inc. and Xinhua Mobile (HK) Limited have consistently reported operating losses.

- Revenue Dependency: Profitability is heavily reliant on investment gains rather than diversified operational income.

- 2024 Performance: The fiscal year ending March 2024 saw continued operating losses in these revenue-generating segments.

Beat Holdings faces a significant weakness due to its concentrated investment in volatile sectors like Technology, Media, and Telecommunications (TMT), FinTech, and digital assets, particularly Bitcoin. This exposure makes the company highly susceptible to market downturns, as evidenced by Bitcoin's price fluctuations, which saw it exceed $73,000 in March 2024 before experiencing considerable drops later in the year.

The company's strategy of targeting high-growth potential businesses, while aiming for substantial gains, inherently carries elevated investment risk. These ventures are often in their nascent stages or operate within rapidly evolving markets, increasing the likelihood of underperformance or failure. This aggressive approach necessitates a higher tolerance for potential losses.

Beat's increased allocation to Bitcoin, with a cap raised to 25% of total assets as of Q1 2025, amplifies its risk profile. Bitcoin's well-documented volatility means that substantial downturns in its price could significantly impact Beat's overall asset value.

Furthermore, the company's operational revenue streams from mobile messaging and IP licensing, through subsidiaries like GINSMS Inc. and Xinhua Mobile (HK) Limited, have demonstrated limited profitability. For the fiscal year ending March 31, 2024, these segments continued to report operating losses, indicating a reliance on investment gains rather than robust business operations for financial success.

Same Document Delivered

Beat SWOT Analysis

The preview you see is the actual SWOT analysis document you'll receive upon purchase. There are no hidden pages or altered content; what you see is precisely what you get. This ensures transparency and allows you to assess the quality and completeness before committing.

Opportunities

The digital asset market's rapid growth offers Beat Holdings a chance to diversify beyond existing investments. As this space evolves with new digital assets, DeFi, and Web3, the company can target emerging high-growth opportunities.

This expansion could include investing in a broader spectrum of digital assets, such as various altcoins and crypto-related exchange-traded funds (ETFs). For instance, the global cryptocurrency market capitalization reached approximately $2.5 trillion in early 2024, indicating substantial room for new entrants and diversified portfolios.

Beat Holdings can strategically expand its reach by forging partnerships or acquiring companies within the TMT, FinTech, and blockchain sectors. This approach allows Beat to integrate new technologies and services, bolstering its overall portfolio value. For instance, a partnership with a leading cybersecurity firm could safeguard its digital assets, while acquiring a niche FinTech startup might unlock new revenue streams. The company's investment holding structure provides the flexibility needed to execute these strategic moves effectively.

Recent shareholder proposals for substantial Bitcoin acquisition funds, totaling hundreds of millions of dollars, signal a strong appetite for large-scale strategic investments. This financial backing could enable Beat Holdings to pursue significant acquisitions or form powerful alliances with key players in emerging technology markets. Such moves are crucial for staying competitive and capitalizing on rapid industry evolution.

Beat Holdings can capitalize on the growing adoption of AI in finance, a trend projected to see the AI in financial services market reach $110 billion by 2024, according to some estimates. This integration allows for sophisticated data analysis, enabling the identification of emerging market trends and undervalued assets with greater precision than traditional methods.

By implementing AI-powered tools, Beat Holdings can refine its portfolio management, potentially leading to optimized risk-adjusted returns. For instance, AI algorithms can continuously monitor market sentiment and economic indicators, adjusting investment allocations in real-time to navigate volatility, a critical factor in the dynamic tech and FinTech landscapes where AI adoption is particularly high.

Increased Institutional Adoption of Digital Assets

The increasing acceptance of digital assets by major financial institutions, particularly with the launch of spot Bitcoin ETFs in early 2024, significantly enhances the investment landscape. This institutional embrace, with billions in AUM flowing into these products, signals growing confidence and provides a more stable environment for digital asset strategies.

This trend directly benefits Beat Holdings by potentially increasing liquidity and market stability within its digital asset treasury. As more traditional players enter, the perception of Bitcoin as a strategic reserve asset solidifies, aligning with the company's approach.

- Spot Bitcoin ETFs saw over $12 billion in inflows within their first month of trading in early 2024.

- Major asset managers like BlackRock and Fidelity have launched Bitcoin ETFs, indicating significant institutional commitment.

- This increased adoption validates digital assets as a legitimate component of institutional treasury management.

Diversification within TMT and FinTech

Beat Holdings can deepen its diversification within the Technology, Media, and Telecommunications (TMT) and FinTech sectors. This strategic move can involve targeting emerging sub-sectors and innovative business models that align with its current expertise. For instance, exploring areas like AI-driven cybersecurity or decentralized finance (DeFi) platforms could offer significant growth potential and reduce reliance on existing investments.

Further diversification can mitigate concentration risk by spreading investments across a wider array of TMT and FinTech niches. This approach allows Beat Holdings to tap into various revenue streams and capitalize on different market trends.

- Targeting niche FinTech solutions: Expanding into areas like RegTech (regulatory technology) or InsurTech (insurance technology) could prove beneficial. The global RegTech market was projected to reach $10.7 billion in 2024, with a compound annual growth rate (CAGR) of 16.8% through 2030.

- Exploring emerging TMT technologies: Investing in the metaverse or advanced AI applications within media content creation presents new avenues for growth. The global metaverse market size was valued at $131.7 billion in 2023 and is expected to expand at a CAGR of 37.1% from 2024 to 2030.

- Adopting varied business models: Moving beyond traditional software-as-a-service (SaaS) to explore subscription-based hardware or data-as-a-service (DaaS) models can create a more resilient portfolio.

Beat Holdings can leverage the burgeoning digital asset market by diversifying its investment portfolio. The company can strategically invest in a wider array of cryptocurrencies and related financial products like ETFs, capitalizing on the market's substantial growth. For example, the global cryptocurrency market capitalization hovered around $2.5 trillion in early 2024, presenting ample opportunities.

Strategic partnerships and acquisitions within the TMT, FinTech, and blockchain sectors offer a pathway to integrate new technologies and services. This proactive approach strengthens Beat's overall value proposition, with potential collaborations in areas like cybersecurity or acquiring niche FinTech firms to unlock new revenue streams.

The increasing institutional adoption of digital assets, evidenced by the early 2024 launch of spot Bitcoin ETFs which saw over $12 billion in inflows within their first month, validates digital assets as a strategic component of treasury management. This trend enhances market stability and liquidity for Beat Holdings' digital asset holdings.

Beat Holdings can further diversify within TMT and FinTech by targeting emerging sub-sectors and innovative business models. Exploring areas like AI-driven cybersecurity or decentralized finance (DeFi) platforms, alongside niche FinTech solutions such as RegTech (projected to reach $10.7 billion in 2024) and emerging TMT technologies like the metaverse (valued at $131.7 billion in 2023), presents significant growth potential.

Threats

Beat Holdings faces significant risks from market volatility, particularly in the TMT, FinTech, and digital asset sectors where it invests. These industries are known for their rapid fluctuations, meaning the value of Beat's holdings can change dramatically and quickly. This inherent instability directly impacts the company's investment valuations and overall financial health.

Economic downturns or substantial market corrections present a serious threat, potentially leading to considerable losses across Beat's portfolio. For instance, a broad market sell-off could devalue many of its assets simultaneously. The company's reported negative net income for the period ending December 31, 2023, which stood at -$1.9 million, and a sales decline to $1.7 million in the same period, underscore its vulnerability to prevailing economic conditions and market sentiment.

The technology, media, and telecommunications (TMT), FinTech, and digital asset sectors are experiencing significant investor interest, drawing in major venture capital firms, private equity funds, and other investment entities. This heightened competition is a significant threat to Beat Holdings.

This intense competition is driving up the valuations of promising companies in these high-growth areas. For instance, venture capital funding in the global FinTech sector reached an estimated $100 billion in 2023, a substantial increase from previous years, making it harder for Beat Holdings to secure deals at favorable terms.

Consequently, Beat Holdings faces increased difficulty in identifying and acquiring attractive investment opportunities that align with its return expectations. The elevated entry costs due to aggressive bidding by competitors can compress potential future returns, posing a direct challenge to the firm's investment strategy.

Adverse regulatory changes pose a significant threat to Beat Holdings, especially given its substantial investment in Bitcoin. Governments worldwide are still defining the rules for digital assets and FinTech, and stricter regulations, new taxes, or even outright bans could directly impact Beat's profitability and future growth. For instance, a hypothetical 2025 regulation imposing a 40% capital gains tax on crypto assets held for less than a year could drastically reduce returns on Beat's existing Bitcoin holdings.

Technological Obsolescence and Disruption

Beat Holdings faces the significant threat of technological obsolescence. As technology evolves at an unprecedented pace, investments in current platforms or solutions risk becoming outdated quickly. For instance, the semiconductor industry, a key area for many tech investments, saw the average lifespan of a technology generation shrink considerably in the early 2020s, with new architectures emerging every 18-24 months. This necessitates aggressive reinvestment and constant evaluation of emerging technologies to avoid holding depreciating assets.

To mitigate this, Beat Holdings must proactively monitor technological trends and invest in companies that demonstrate a commitment to innovation and adaptability. The company's strategy should prioritize identifying disruptive technologies before they become mainstream. For example, companies that invested heavily in AI-driven automation in the late 2020s were better positioned to weather the subsequent shifts in various industries compared to those relying on older, less efficient methods. This proactive stance is crucial for maintaining a competitive edge and ensuring the long-term viability of its investment portfolio.

The challenge is amplified by the increasing speed of disruption. What was cutting-edge yesterday can be surpassed tomorrow. Consider the rapid rise of generative AI models, which have fundamentally altered content creation and software development workflows in just a few years, impacting companies that hadn't anticipated such advancements. Beat Holdings needs to foster a culture of continuous learning and agility, enabling swift pivots when new technological paradigms emerge.

Key considerations for Beat Holdings include:

- Continuous R&D Investment: Supporting portfolio companies in their research and development efforts to stay ahead of technological curves.

- Strategic Partnerships: Collaborating with innovative startups and research institutions to gain early access to emerging technologies.

- Agile Portfolio Management: Regularly reviewing and rebalancing the investment portfolio to divest from assets at risk of obsolescence and allocate capital to promising new technologies.

- Talent Acquisition and Development: Ensuring the workforce possesses the skills to understand and leverage new technological advancements.

Shareholder Proposals and Internal Governance Challenges

Recent shareholder proposals concerning substantial funding and Bitcoin acquisition strategies highlight potential internal governance hurdles and divergent stakeholder perspectives. For instance, in early 2024, activist investor proposals pushed for strategic reviews, some of which were narrowly defeated, indicating a divided shareholder base on capital allocation priorities.

Such ongoing disagreements or frequent strategic pivots driven by shareholder activism can introduce instability, potentially disrupting long-term planning and operational execution. For example, a significant shift in a company's core business strategy due to a shareholder vote could lead to increased implementation costs and a loss of market focus.

- Shareholder Activism: Increased proposals in 2024 focused on capital allocation, including potential large-scale digital asset investments.

- Governance Strain: A notable percentage of proposals in the 2024 proxy season narrowly failed, signaling internal governance friction.

- Strategic Volatility: Frequent changes in strategic direction due to shareholder influence can negatively impact operational efficiency and long-term growth projections.

Beat Holdings is susceptible to the rapid pace of technological advancement, where current investments risk becoming obsolete. The shrinking product cycles in sectors like semiconductors, with new architectures appearing every 18-24 months as of the early 2020s, necessitate continuous innovation and adaptation to avoid holding depreciating assets.

The company also faces significant competition in its target sectors, with venture capital funding in FinTech alone reaching an estimated $100 billion in 2023. This intense competition drives up valuations, making it harder for Beat Holdings to secure deals at favorable terms and potentially compressing future returns.

Regulatory uncertainty, particularly concerning digital assets and FinTech, presents another substantial threat. New regulations, taxes, or bans could directly impact Beat's profitability, as illustrated by the hypothetical impact of a 40% capital gains tax on crypto assets in 2025.

Internal governance challenges and shareholder activism also pose risks. Shareholder proposals in early 2024, focusing on capital allocation and digital asset strategies, indicated divided stakeholder perspectives, potentially leading to strategic volatility and impacting long-term planning.

SWOT Analysis Data Sources

This Beat SWOT analysis is built upon a foundation of robust data, incorporating internal financial reports, comprehensive market research, and expert industry commentary to ensure a well-rounded and accurate assessment.