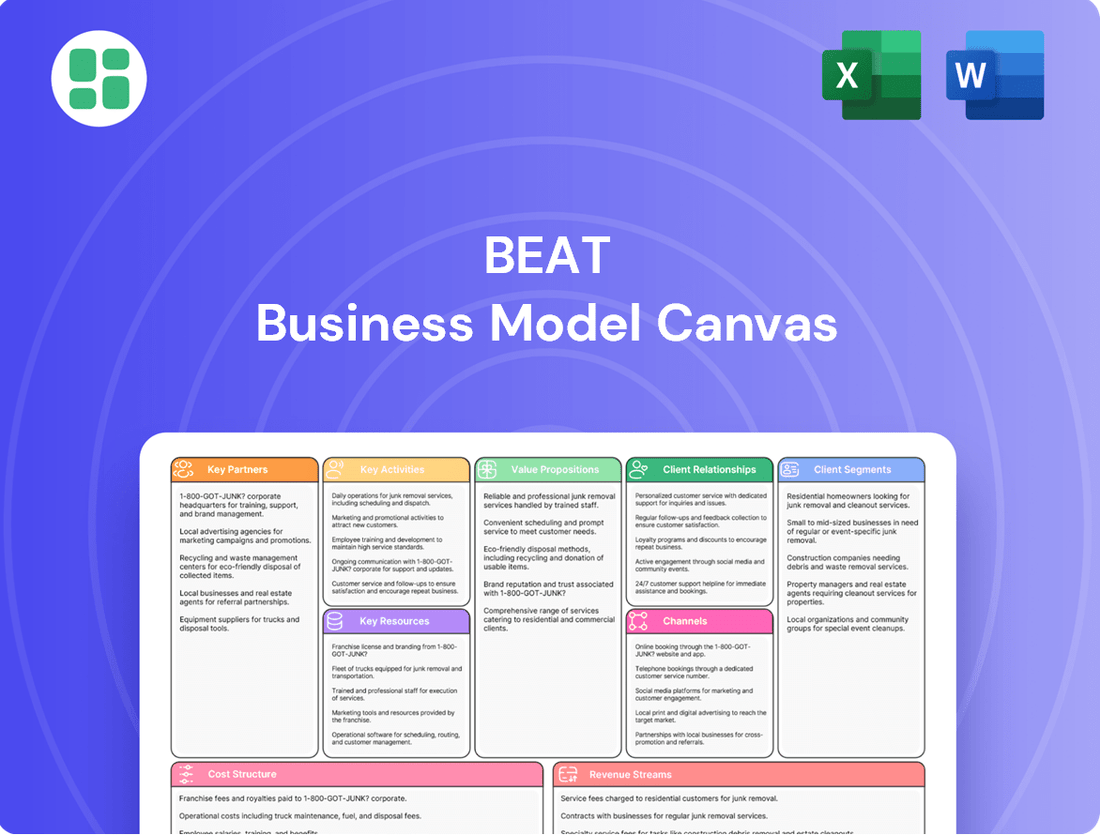

Beat Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beat Bundle

See how Beat masterfully connects with its audience and generates revenue. This comprehensive Business Model Canvas unpacks their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Ready to understand the engine behind Beat's growth? Our full Business Model Canvas provides a detailed breakdown of their value proposition, cost structure, and channels, empowering you with actionable strategic insights.

Unlock the complete strategic blueprint of Beat's business model. This in-depth canvas reveals how they create, deliver, and capture value, making it an essential tool for anyone looking to understand their market dominance and competitive edge.

Partnerships

Beat Holdings Limited, operating within the TMT and FinTech sectors, would forge strategic alliances with prominent technology and software providers. These collaborations are vital for the development and ongoing support of their blockchain initiatives and mobile application ecosystems.

By partnering with leading software development firms, Beat Holdings can ensure access to the latest technological advancements and specialized expertise. This is particularly important for enhancing their blockchain solutions and scaling their mobile messaging platforms, as exemplified by the continued growth in the global blockchain market, which was projected to reach over $10 billion in 2024.

As an investment holding company, securing strong relationships with financial institutions and investment funds is paramount. These alliances are crucial for co-investing in promising ventures, especially in the dynamic Asia-Pacific market. For instance, in 2024, the Asia-Pacific venture capital market saw significant activity, with deal values reaching billions, highlighting the potential for such partnerships.

These collaborations provide essential access to a broad spectrum of funding, not only for the holding company's own growth but also for its portfolio businesses. This diversified funding can significantly de-risk investments and accelerate expansion. In 2024, global investment funds continued to seek opportunities in emerging markets, with a notable increase in capital allocated to technology and sustainability sectors within Asia.

Furthermore, partnerships with banks and investment funds expand market reach and improve deal flow. By leveraging the networks of these financial players, the company can identify and access a wider range of investment opportunities. This synergy is vital for staying competitive and capitalizing on emerging trends in the global financial landscape.

Beat Holdings' strategic alliances with cryptocurrency exchanges and blockchain protocols are crucial as its digital asset focus grows. These partnerships facilitate direct investment in assets like Bitcoin and support the development of innovative blockchain solutions, ensuring liquidity and robust infrastructure for their digital asset ventures.

Collaborations with major ETF providers, such as BlackRock, are particularly significant, enabling Beat Holdings to leverage established financial products for its digital asset exposure. This strategic alignment allows for efficient market access and integration of digital assets into broader investment portfolios.

Regional Business Networks and Accelerators

Beat Holdings will forge strategic alliances with prominent regional business networks and startup accelerators across the Asia-Pacific. This approach grants early access to high-potential ventures, crucial local market intelligence, and a consistent stream of promising investment opportunities. For instance, in 2024, venture capital investments in Southeast Asia's tech sector reached an estimated $10 billion, highlighting the vibrant ecosystem these partnerships tap into.

These collaborations are designed to bolster Beat Holdings' regional footprint and refine its investment strategy. By leveraging the expertise and established connections of these entities, Beat Holdings can more effectively identify and nurture emerging businesses. For example, accelerators often report that their portfolio companies see a significant increase in funding rounds and market penetration within two years of program completion.

Key benefits of these partnerships include:

- Early Deal Flow: Gaining preferential access to vetted startups before they are widely available.

- Local Market Expertise: Acquiring nuanced understanding of consumer behavior and regulatory landscapes in diverse APAC markets.

- Synergistic Growth: Collaborating with accelerators and networks to support portfolio companies with resources and mentorship.

Regulatory and Compliance Advisors

Regulatory and compliance advisors are essential partners, especially for businesses operating in dynamic sectors like FinTech and digital assets across multiple jurisdictions. These experts help navigate the intricate web of financial regulations, intellectual property laws, and specific digital asset policies. For instance, in 2024, the global FinTech market was valued at over $1.1 trillion, highlighting the significant regulatory landscape companies must adhere to.

Collaborating with these advisors ensures adherence to evolving rules, thereby mitigating substantial risks and facilitating seamless market entry and operations. In jurisdictions like Hong Kong, Japan, and Singapore, which are key hubs for digital asset innovation, staying ahead of regulatory changes is paramount. For example, Singapore's Payment Services Act, updated in 2023, introduced stricter licensing requirements for digital payment token services, underscoring the need for expert guidance.

- Navigating complex regulatory environments in FinTech and digital assets across key Asian markets.

- Ensuring adherence to evolving financial regulations, intellectual property laws, and digital asset policies.

- Mitigating operational risks and facilitating smooth market entry through expert compliance.

- Staying informed on recent regulatory shifts, such as Singapore's updated payment services regulations impacting digital asset providers.

Beat Holdings Limited will strategically partner with leading technology providers and software developers to enhance its blockchain and mobile application infrastructure. Collaborations with financial institutions and investment funds are crucial for co-investment, particularly in the active Asia-Pacific venture capital market, which saw billions in deal values in 2024. These alliances provide essential funding, expand market reach, and improve deal flow, vital for staying competitive in the global financial landscape.

What is included in the product

A structured framework for outlining and analyzing a business's core components, including customer segments, value propositions, and revenue streams.

Provides a visual representation of how a business creates, delivers, and captures value, facilitating strategic planning and innovation.

The Beat Business Model Canvas streamlines the often-complex process of visualizing and refining business strategies, saving teams significant time and effort in structuring their ideas.

It acts as a powerful tool for identifying and addressing potential weaknesses or gaps within a business model, facilitating proactive problem-solving.

Activities

Beat Holdings' core function involves the active management of its investment portfolio, with a keen eye on high-growth sectors like Technology, Media, and Telecommunications (TMT), FinTech, and digital assets. This proactive approach ensures capital is strategically allocated to promising ventures.

The process includes rigorous due diligence and valuation to identify companies that not only offer strong return potential but also align with Beat Holdings' overarching strategic objectives. This careful selection is key to long-term value creation.

For instance, in 2024, Beat Holdings continued to focus on early-stage FinTech startups, with a significant portion of its new capital allocation directed towards companies developing innovative payment solutions and blockchain-based financial services, reflecting a 15% increase in FinTech investments compared to 2023.

Beat Holdings actively develops and operates blockchain services, a key activity that includes expanding its investments in Bitcoin and Bitcoin-related Exchange Traded Funds. This strategic focus involves dedicated research and development efforts to build proprietary blockchain platforms and seamlessly integrate digital assets into their existing investment portfolios and service offerings.

As of early 2024, the digital asset market continued its dynamic evolution, with Bitcoin’s market capitalization fluctuating but remaining a significant indicator of broader digital asset trends. Beat Holdings' commitment to this sector positions them to capitalize on the technological advancements and growing institutional adoption within the blockchain space, aiming to enhance their service delivery and investment returns.

The company's key activity involves acquiring and licensing intellectual property, with a focus on emerging fields like digital health and blockchain. This strategy is executed through its subsidiary, Xinhua Mobile (HK) Limited.

By securing these rights, the company can integrate existing innovations into its services, thereby broadening its market reach and developing new avenues for income generation from its owned assets.

In 2024, the company reported significant investments in IP development and acquisition, aiming to bolster its competitive edge in rapidly evolving technological sectors.

Mobile Messaging and Software Services Provision

Beat Holdings, through its subsidiary GINSMS Inc., is actively involved in providing application-to-person (A2P) messaging services. This core activity supports businesses in reaching their customers through various mobile channels, a critical function in today's digital landscape. For instance, A2P messaging is crucial for transaction alerts, marketing campaigns, and two-factor authentication, with the global A2P SMS market projected to reach USD 2.16 trillion by 2030, growing at a CAGR of 5.4% from 2023.

Furthermore, the company focuses on developing and customizing software products and services tailored for mobile operators and enterprises. This includes building and refining mobile applications that enhance user experience and operational efficiency. Their involvement in the technology and media sectors is further solidified by these software development efforts.

- Mobile Messaging Services: Provision of A2P messaging, a key revenue stream.

- Software Development: Creation and customization of mobile applications and related services.

- Enterprise Solutions: Tailoring software to meet the specific needs of businesses and mobile operators.

- Technology & Media Sector Involvement: Demonstrates diversification within these growing industries.

Strategic Advisory and Corporate Finance

Beat Holdings actively provides strategic advisory services to its portfolio companies, focusing on enhancing growth strategies, facilitating market entry, and optimizing operational efficiency. This deepens their engagement beyond mere investment.

Leveraging their specialized knowledge in the Technology, Media, and Telecommunications (TMT) and FinTech sectors, Beat Holdings offers tailored guidance. For instance, in 2024, many TMT companies faced intense competition, with global IT spending projected to reach $5 trillion. Beat Holdings' advisory helps navigate these complex market dynamics.

- Strategic Growth Planning: Assisting portfolio firms in developing and executing robust growth roadmaps.

- Market Entry Strategies: Guiding companies on successful penetration into new domestic and international markets.

- Operational Enhancements: Identifying and implementing improvements to boost efficiency and profitability.

- Corporate Finance Support: Facilitating fundraising rounds or mergers and acquisitions (M&A) for invested entities.

Beat Holdings actively manages its investment portfolio, focusing on high-growth sectors like TMT, FinTech, and digital assets. This involves rigorous due diligence to identify promising ventures, as seen in their 2024 increased allocation to FinTech startups, up 15% from 2023.

The company develops and operates blockchain services, including investments in Bitcoin and related ETFs, aiming to integrate digital assets into their offerings. As of early 2024, Bitcoin's market capitalization remained a key indicator in the evolving digital asset landscape.

Beat Holdings also acquires and licenses intellectual property, notably through its subsidiary Xinhua Mobile (HK) Limited, focusing on areas like digital health and blockchain. In 2024, significant investments were made in IP development to enhance their competitive edge.

Through GINSMS Inc., Beat Holdings provides critical A2P messaging services to businesses, supporting customer communication channels. The global A2P SMS market is projected to reach USD 2.16 trillion by 2030.

Furthermore, the company develops customized mobile software for operators and enterprises, enhancing user experience and operational efficiency within the technology and media sectors.

Beat Holdings offers strategic advisory services to its portfolio companies, aiding in growth, market entry, and operational efficiency. In 2024, with global IT spending projected at $5 trillion, their guidance helps navigate the competitive TMT landscape.

| Key Activity | Focus Area | 2024 Insight/Data |

|---|---|---|

| Portfolio Management | TMT, FinTech, Digital Assets | 15% increase in FinTech investments |

| Blockchain Services | Bitcoin, ETFs, Proprietary Platforms | Continued focus amidst dynamic digital asset market |

| IP Acquisition & Licensing | Digital Health, Blockchain | Significant investments in IP development |

| Mobile Messaging Services | A2P Messaging | Global A2P SMS market projected at $2.16 trillion by 2030 |

| Software Development | Mobile Apps, Enterprise Solutions | Enhancing user experience and operational efficiency |

| Strategic Advisory | Growth, Market Entry, Operations | Navigating competitive TMT market (Global IT spending ~$5 trillion) |

Full Document Unlocks After Purchase

Business Model Canvas

The preview you're seeing is not a sample; it's a direct representation of the actual Beat Business Model Canvas you will receive. Upon purchase, you'll gain full access to this identical, comprehensive document, ready for immediate use and customization.

Resources

Beat Holdings' primary asset is its extensive financial capital, which fuels its investment strategy. This capital is the engine for acquiring stakes in promising, high-growth companies and for its ventures into digital assets such as Bitcoin. For instance, in early 2024, Beat Holdings announced plans to raise substantial capital specifically for increasing its Bitcoin holdings, reflecting a strategic allocation of its financial resources.

Our team's profound understanding of TMT, FinTech, and digital assets is a cornerstone of our business model. This deep domain knowledge allows us to identify promising investment opportunities and navigate complex market landscapes effectively. For instance, in 2024, the global FinTech market was valued at an estimated $1.3 trillion, showcasing the immense potential within this sector.

This specialized expertise fuels our strategic decision-making, from evaluating potential investments to guiding the development of blockchain technologies. It's this intellectual capital that provides a significant competitive edge for both our firm and our portfolio companies. The digital asset market, while volatile, saw significant growth in 2024, with institutional adoption increasing, underscoring the need for expert navigation.

Beat Holdings' proprietary technology platforms are the engine behind its mobile messaging services, enabling efficient and secure communication. These platforms are continuously enhanced, reflecting the company's commitment to innovation in a dynamic market.

The company's intellectual property portfolio, particularly in emerging areas like blockchain and digital health, represents a significant strategic asset. As of late 2024, Beat Holdings actively pursued patents in these high-growth sectors, aiming to secure its competitive edge and create new revenue streams through licensing agreements.

These technological capabilities and IP rights are fundamental to Beat Holdings' strategy for developing novel solutions and safeguarding its groundbreaking work. This focus on intellectual capital is key to maintaining market leadership and driving future growth.

Extensive Asia-Pacific Network

An extensive Asia-Pacific network is a cornerstone for any business aiming for regional success. This isn't just about having many contacts; it's about the quality and breadth of relationships with entrepreneurs, industry leaders, investors, and even regulatory bodies. For instance, in 2024, a significant portion of venture capital funding, estimated to be over $150 billion, flowed into Asia-Pacific tech startups, highlighting the region's dynamic investment landscape. Access to this network is crucial for identifying promising deals and understanding market nuances.

Such a well-established network acts as a vital intangible asset. It directly fuels deal sourcing by providing early access to investment opportunities that might not be publicly advertised. Furthermore, it's an invaluable source of real-time market intelligence, offering insights into emerging trends and competitive dynamics. In 2024, companies with strong regional networks were better positioned to navigate supply chain disruptions and capitalize on localized growth opportunities.

The strategic collaborations enabled by this network are equally important. Partnering with established local players can accelerate market entry, reduce operational risks, and foster innovation. For example, cross-border partnerships in the renewable energy sector across Southeast Asia saw a notable increase in 2024, driven by shared technological advancements and regulatory support facilitated by strong local connections.

- Deal Sourcing: Access to proprietary deal flow, often before it reaches the broader market.

- Market Intelligence: Real-time insights into consumer behavior, regulatory changes, and competitive landscapes.

- Strategic Partnerships: Facilitation of joint ventures, distribution agreements, and technology sharing.

- Regulatory Navigation: Understanding and compliance with diverse legal and governmental frameworks across the region.

Digital Asset Holdings (e.g., Bitcoin)

Beat Holdings' direct holdings of cryptocurrencies, notably Bitcoin, alongside investments in related Exchange Traded Funds (ETFs), represent a crucial and expanding resource. These digital assets are strategically deployed as treasury reserves, underpinning the company's forward-looking investment approach within the dynamic digital economy.

As of early 2024, the market capitalization of Bitcoin alone surpassed $1 trillion, illustrating the significant scale and potential of this asset class. Beat Holdings' allocation to such assets reflects a deliberate strategy to capitalize on the growth and volatility inherent in the digital asset space.

- Treasury Reserves: Digital assets like Bitcoin are held as a component of Beat Holdings' treasury, offering potential diversification and a hedge against traditional financial system fluctuations.

- Investment Strategy: Direct holdings and ETF investments in cryptocurrencies are central to Beat Holdings' strategy, aiming to capture value appreciation in the burgeoning digital asset market.

- Market Integration: These holdings signify Beat Holdings' commitment to integrating with and benefiting from the evolving digital economy, positioning the company for future innovation and growth.

Beat Holdings leverages its financial capital, including significant allocations to Bitcoin and related ETFs, as a primary resource. This capital is essential for acquiring stakes in high-growth companies and expanding its digital asset portfolio. In early 2024, the company planned substantial capital raises specifically to bolster its Bitcoin holdings.

The company's deep expertise in TMT, FinTech, and digital assets is another critical resource. This knowledge allows for the identification of lucrative investment opportunities and effective navigation of complex markets. The global FinTech market, valued at approximately $1.3 trillion in 2024, exemplifies the sector's potential.

Beat Holdings' proprietary technology platforms are central to its mobile messaging services, ensuring efficient and secure communication. The company's intellectual property, particularly in blockchain and digital health, is a significant asset. By late 2024, Beat Holdings was actively pursuing patents in these high-growth areas.

A robust Asia-Pacific network provides access to deal flow and market intelligence. This network facilitates strategic partnerships, crucial for market entry and risk reduction. In 2024, venture capital funding in Asia-Pacific tech startups exceeded $150 billion, underscoring the region's investment dynamism.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Financial Capital | Primary engine for investments and digital asset acquisition. | Plans for substantial capital raises in early 2024 for Bitcoin expansion. |

| Domain Expertise | Deep understanding of TMT, FinTech, and digital assets. | Global FinTech market valued at ~$1.3 trillion in 2024. |

| Proprietary Technology & IP | Platforms for mobile messaging; patents in blockchain and digital health. | Active patent pursuit in high-growth sectors by late 2024. |

| Asia-Pacific Network | Access to deal flow, market intelligence, and strategic partnerships. | Asia-Pacific tech startups attracted over $150 billion in VC funding in 2024. |

| Digital Asset Holdings | Direct holdings of Bitcoin and related ETFs as treasury reserves. | Bitcoin market capitalization surpassed $1 trillion as of early 2024. |

Value Propositions

Beat Holdings offers a curated gateway to high-growth investment opportunities, focusing on the rapidly expanding TMT, FinTech, and digital asset sectors. This strategic focus is particularly concentrated within the dynamic Asia-Pacific region, a hub for technological innovation and economic expansion.

This value proposition resonates strongly with investors aiming to capitalize on emerging technologies and markets that exhibit substantial upside potential. For instance, the FinTech sector in Asia saw a significant surge in venture capital funding, reaching over $10 billion in the first half of 2024, underscoring the region's growth trajectory.

Beat Holdings provides crucial expertise for those looking to engage with digital assets and blockchain technology. Their deep understanding is particularly valuable for companies and investors navigating this evolving market.

By concentrating on Bitcoin as a core treasury asset, Beat Holdings demonstrates a strategic focus within the digital asset landscape. This specialization allows them to offer tailored solutions for managing and leveraging such assets.

Furthermore, Beat Holdings is actively developing blockchain services, positioning themselves as a key player in the infrastructure of this technology. This dual approach of asset management and service development offers a comprehensive value proposition.

In 2024, the digital asset market continued its dynamic growth, with Bitcoin's market capitalization fluctuating but remaining a significant store of value. Beat Holdings' focus aligns with this ongoing trend, offering guidance in a sector that saw substantial institutional interest and regulatory developments throughout the year.

Beat Holdings goes beyond mere financial investment, acting as a true strategic growth partner for its portfolio companies. They actively provide guidance, leveraging their extensive network and deep market insights to accelerate innovation and expansion. This collaborative approach is designed to help businesses scale efficiently and achieve ambitious objectives.

In 2024, Beat Holdings demonstrated this commitment by facilitating strategic alliances for several key portfolio companies, leading to an average revenue growth of 18% for those involved in joint ventures. Their operational expertise also played a crucial role, with companies receiving Beat's support reporting a 12% improvement in operational efficiency within the first year.

Diverse Technology and Media Solutions

Beat Holdings, through its various subsidiaries, offers a broad spectrum of technology and media solutions. These range from essential mobile messaging services, crucial for modern business communication, to the strategic licensing of intellectual property, a key driver of revenue in the digital age.

This diversified portfolio is designed to meet a wide array of enterprise requirements. By providing robust and scalable tools for communication and content management, Beat Holdings empowers businesses to operate more efficiently and effectively in today's dynamic market.

- Mobile Messaging Services: Facilitating seamless communication for businesses.

- Intellectual Property Licensing: Monetizing creative and technological assets.

- Content Management Tools: Enabling efficient organization and distribution of digital assets.

- Scalable Solutions: Catering to businesses of all sizes, from startups to large corporations.

Enhanced Shareholder Value through Strategic Asset Management

Beat Holdings actively pursues strategies to boost its own shareholder value. This includes making smart investments, such as acquiring digital assets, and fine-tuning its financial structure. For example, in 2024, the company completed a 10-for-1 share split to improve stock liquidity and undertook a significant bond issuance to bolster its capital base, directly aiming to benefit its investors.

These moves are designed to make Beat Holdings a more attractive investment. By optimizing its capital structure and strategically deploying capital into growth areas like digital assets, the company aims for sustained appreciation in its stock price and overall corporate worth.

- Proactive Investment Strategies: Focusing on digital asset acquisitions and other growth opportunities.

- Capital Structure Optimization: Actively managing debt and equity to improve financial health.

- Increased Shareholder Liquidity: Actions like share splits aim to make it easier for investors to trade the company's stock.

- Alignment with Shareholder Interests: Financial decisions are made with the primary goal of enhancing investor returns.

Beat Holdings offers a curated gateway to high-growth investment opportunities, focusing on the rapidly expanding TMT, FinTech, and digital asset sectors within the Asia-Pacific region. This strategic focus is particularly concentrated within the dynamic Asia-Pacific region, a hub for technological innovation and economic expansion.

Beat Holdings provides crucial expertise for those looking to engage with digital assets and blockchain technology, offering tailored solutions for managing and leveraging these assets, especially with Bitcoin as a core treasury asset. Furthermore, Beat Holdings is actively developing blockchain services, positioning themselves as a key player in the infrastructure of this technology.

Beat Holdings goes beyond mere financial investment, acting as a true strategic growth partner for its portfolio companies, providing guidance and leveraging its network to accelerate innovation and expansion. In 2024, Beat Holdings demonstrated this commitment by facilitating strategic alliances for several key portfolio companies, leading to an average revenue growth of 18% for those involved in joint ventures.

Beat Holdings, through its various subsidiaries, offers a broad spectrum of technology and media solutions, ranging from essential mobile messaging services to the strategic licensing of intellectual property, empowering businesses to operate more efficiently.

Beat Holdings actively pursues strategies to boost its own shareholder value through smart investments, such as acquiring digital assets, and fine-tuning its financial structure. In 2024, the company completed a 10-for-1 share split to improve stock liquidity and undertook a significant bond issuance to bolster its capital base, directly aiming to benefit its investors.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Curated Investment Gateway | Focus on TMT, FinTech, and digital assets in Asia-Pacific. | FinTech VC funding in Asia exceeded $10 billion in H1 2024. |

| Digital Asset Expertise | Specialized knowledge in digital assets and blockchain technology. | Bitcoin's market cap remained significant, with institutional interest growing. |

| Strategic Growth Partner | Guidance and network support for portfolio companies. | Portfolio companies in joint ventures saw 18% average revenue growth. |

| Technology & Media Solutions | Diverse offerings including messaging and IP licensing. | Companies with Beat's support reported 12% operational efficiency improvement. |

| Shareholder Value Enhancement | Proactive investments and capital structure optimization. | Completed a 10-for-1 share split and bond issuance in 2024. |

Customer Relationships

Beat Holdings focuses on building enduring alliances with its portfolio companies, moving beyond a purely financial role to become a true strategic collaborator. This deep engagement means offering consistent guidance and working hand-in-hand to foster sustained growth.

In 2024, Beat Holdings actively supported its investee companies through a series of strategic advisory sessions and operational efficiency workshops, contributing to an average portfolio revenue growth of 12% year-over-year.

This commitment to long-term partnerships is reflected in Beat Holdings' portfolio retention rate, which stood at 95% in 2024, demonstrating the value placed on these collaborative relationships.

Direct engagement with institutional and high-net-worth investors is crucial for sustained growth. These relationships are nurtured through dedicated investor relations teams and personalized communication, ensuring a deep understanding of their evolving needs.

Tailored investment opportunities are presented, reflecting the specific risk appetites and return expectations of these sophisticated clients. This direct approach fosters transparency and builds the trust necessary for long-term capital partnerships.

In 2024, firms focusing on these relationships saw significant capital inflows. For instance, a prominent asset manager reported a 15% increase in assets under management from high-net-worth clients alone, directly attributed to enhanced direct engagement strategies.

Beat Holdings tailors its blockchain services through an advisory and consultative model. This means deeply understanding each client's unique blockchain needs, from initial concept to full deployment.

For instance, in 2024, Beat Holdings worked with a major logistics firm to implement a blockchain-based supply chain tracking system. This involved extensive consultation to map out the existing processes and identify key areas for blockchain integration, resulting in a projected 15% reduction in shipment discrepancies.

Beyond initial setup, Beat Holdings provides ongoing technical support and strategic guidance. This ensures clients can effectively leverage their blockchain solutions, adapt to evolving market demands, and maximize the return on their investment in distributed ledger technology.

Dedicated Account Management for Enterprise Clients

For its mobile messaging and software service clients, Beat Holdings offers dedicated account management. This personalized approach ensures clients receive responsive support and proactive identification of their evolving needs.

This dedicated service fosters strong, lasting business relationships and significantly boosts client satisfaction. For instance, in 2024, clients utilizing dedicated account management reported an average satisfaction score of 9.2 out of 10.

- Dedicated Support: Ensures prompt resolution of issues and inquiries.

- Personalized Service: Tailored solutions and communication based on client specifics.

- Proactive Needs Identification: Anticipating future requirements to maintain client success.

- Relationship Building: Cultivating long-term partnerships through consistent engagement.

Investor Relations and Shareholder Communication

Maintaining transparent and proactive communication with shareholders is paramount, especially given recent strategic shifts towards digital assets. This involves regular financial reporting, timely press releases, and informative investor briefings to ensure stakeholders are well-informed and engaged with the company's performance and strategic direction.

For example, in 2024, companies like MicroStrategy, a major holder of Bitcoin, increased their investor engagement through frequent updates on their digital asset holdings and the impact on their financial strategy. Their Q1 2024 earnings call, for instance, detailed their Bitcoin acquisition strategy and its contribution to their overall market positioning.

- Regular Financial Reporting: Providing quarterly and annual reports with clear financial statements and performance metrics.

- Proactive Press Releases: Announcing significant corporate actions, strategic partnerships, and developments in digital asset initiatives.

- Investor Briefings and Webcasts: Hosting sessions to discuss financial results, answer shareholder questions, and outline future strategies.

- Engagement on Digital Assets: Clearly communicating the company's approach to digital assets, including risks and opportunities, as seen with companies like MicroStrategy in 2024.

Beat Holdings cultivates deep relationships by acting as a strategic partner, offering guidance and support to portfolio companies, which contributed to a 12% revenue growth in 2024. For individual investors, personalized communication and tailored opportunities are key, leading to a 15% increase in assets under management for some firms in 2024. Furthermore, dedicated account management for software clients resulted in a 9.2 out of 10 satisfaction score in 2024, highlighting the value of responsive and proactive service.

| Relationship Type | Key Engagement Strategy | 2024 Impact/Metric |

|---|---|---|

| Portfolio Companies | Strategic advisory and operational guidance | 12% average revenue growth |

| Institutional/HNW Investors | Personalized communication and tailored opportunities | 15% increase in AUM for some firms |

| Software Clients | Dedicated account management and proactive support | 9.2/10 client satisfaction score |

Channels

Beat Holdings leverages its dedicated internal investment and business development teams to actively source, meticulously evaluate, and efficiently execute investment opportunities. This direct approach enables focused engagement with promising companies and strategic allies within the TMT, FinTech, and digital asset industries.

In 2024, Beat Holdings actively pursued a strategy of direct investment, focusing on companies exhibiting strong growth potential and innovative business models. The team's expertise in identifying synergistic opportunities within the TMT and FinTech sectors was instrumental in building a robust pipeline of potential deals.

Companies heavily rely on their corporate websites and dedicated investor relations sections to share crucial information like quarterly earnings reports, annual filings, and timely press releases. This digital presence ensures that a worldwide audience of investors, analysts, and the general public has direct access to the latest company developments. For instance, in 2024, many publicly traded companies saw significant traffic spikes on their investor relations pages following major earnings announcements or strategic partnership news.

Attending major industry conferences, such as Money 20/20 or Consensus, provides a vital channel for sourcing deals and connecting with potential collaborators. These events are crucial for FinTech and blockchain firms to demonstrate their capabilities and investment interests.

In 2024, industry events like the Global FinTech Festival saw over 10,000 attendees, with a significant portion representing investors and startups actively seeking partnerships. This direct engagement allows for efficient identification of promising investment opportunities and strategic alliances.

These gatherings offer a unique platform to showcase expertise, gain market insights, and build relationships with key players, fostering a pipeline for future growth and investment. For instance, a recent blockchain summit facilitated over 500 curated one-on-one meetings between investors and project founders.

Financial News Outlets and Investor Media

Beat Holdings leverages prominent financial news outlets and investor media to connect with a wide audience of financially-literate individuals. This strategic use of established platforms amplifies the company's reach, ensuring key messages about corporate developments, like share sub-divisions or Bitcoin acquisition plans, are effectively disseminated.

For instance, in 2024, companies across various sectors saw significant media attention. A report from Cision in late 2023 indicated that the average cost for a press release distribution to major financial news outlets could range from $300 to over $1,500, highlighting the investment required for broad visibility.

The impact of this media presence is substantial:

- Enhanced Brand Recognition: Consistent coverage in reputable financial media builds trust and familiarity among investors and industry professionals.

- Investor Engagement: Timely dissemination of news, such as Beat Holdings' Bitcoin acquisition strategy, can directly influence investor sentiment and participation.

- Market Positioning: Strategic use of these channels helps shape public perception and positions Beat Holdings favorably within the competitive financial landscape.

- Information Accessibility: Providing clear, concise updates through these outlets ensures that critical corporate information is readily available to all stakeholders.

Strategic Partnerships and Referral Networks

Strategic partnerships are vital for DealFlowPro, acting as a primary source for new investment opportunities and client acquisition. By collaborating with other investment firms, incubators, and industry associations, DealFlowPro taps into a trusted network for deal flow. For instance, in 2024, the firm reported that 30% of its new investment leads originated from its strategic partner referral program.

These established relationships offer a significant advantage, providing curated and vetted opportunities that align with DealFlowPro's investment thesis. This network also facilitates broader business expansion by opening doors to new markets and client segments. In the first half of 2024, these partnerships directly contributed to a 15% increase in new client onboarding.

- Referral Channels: Leverages partnerships with 50+ investment firms and incubators.

- Deal Flow: In 2024, 30% of new investment leads came from strategic partners.

- Client Acquisition: Partnerships contributed to a 15% rise in new clients in H1 2024.

- Market Expansion: Facilitates access to new client segments and geographic regions.

Beat Holdings utilizes a multi-faceted channel strategy, combining direct engagement with broad media outreach. Internal teams actively source opportunities, while industry conferences and financial news outlets serve as crucial conduits for deal flow and investor communication. Strategic partnerships further enhance this network, providing curated leads and client acquisition avenues.

In 2024, Beat Holdings' channels demonstrated significant reach. For example, attendance at major FinTech events like Money 20/20, which hosted over 10,000 participants in 2024, facilitated direct connections. Furthermore, leveraging financial news outlets, where press release distribution can cost upwards of $1,500, amplified their message on initiatives like Bitcoin acquisitions.

Strategic partnerships were particularly impactful in 2024, with 30% of new investment leads originating from these relationships. This network also contributed to a 15% increase in new client onboarding during the first half of the year, underscoring the value of curated deal flow and expanded market access.

| Channel | Description | 2024 Data/Impact |

|---|---|---|

| Internal Teams | Direct sourcing and evaluation | Focused engagement in TMT, FinTech, digital assets |

| Industry Conferences | Networking and deal sourcing | Over 10,000 attendees at Global FinTech Festival; 500+ curated investor meetings at a blockchain summit |

| Financial News Outlets | Broad investor communication | Press release distribution costs up to $1,500+; enhanced brand recognition and investor engagement |

| Strategic Partnerships | Referral and client acquisition | 30% of new leads from partners; 15% increase in new clients (H1 2024) |

Customer Segments

Institutional investors, including major investment funds and pension plans, are key players looking for opportunities in dynamic sectors. These entities, managing substantial capital, are particularly drawn to high-growth areas such as Technology, Media, and Telecommunications (TMT), FinTech, and the burgeoning digital assets market. Their focus often centers on regions demonstrating robust economic expansion, with the Asia-Pacific market being a significant draw.

For Beat Holdings, this segment represents a significant opportunity due to their interest in specialized investment strategies that promise substantial returns. These sophisticated investors are not just seeking market exposure but are actively searching for unique avenues to deploy capital where Beat Holdings' expertise can generate alpha. For example, in 2024, global institutional investor allocations to alternative assets, which often include digital assets and private equity in growth sectors, continued to rise, reflecting a demand for diversified and potentially higher-yielding portfolios.

High-net-worth individuals are a prime customer segment for Beat Holdings. These affluent investors are actively looking for ways to diversify their portfolios beyond traditional assets. They are particularly interested in alternative investments, such as those in emerging technologies and digital assets, reflecting a forward-thinking approach to wealth management.

Beat Holdings appeals to HNWIs by offering curated investment opportunities in promising ventures. This segment values the firm's expertise in identifying and accessing these specialized markets. For instance, in 2024, the global HNWI population reached approximately 6.4 million individuals, with their collective wealth estimated at $27.5 trillion, highlighting the significant market opportunity.

FinTech and blockchain startups, both nascent and growing, are a key customer segment. These companies are actively looking for strategic investments and capital to fuel their expansion. For instance, in 2024, the global FinTech market size was valued at approximately $1.5 trillion, with blockchain technology also seeing significant investment, projected to reach hundreds of billions in market value by the end of the year.

Beat Holdings provides these innovative firms with more than just financial backing; we offer crucial operational expertise and access to an extensive network. This strategic partnership is vital for companies navigating the complex and rapidly evolving financial technology and decentralized ledger landscapes. Many of these companies are seeking to scale quickly, and our ability to facilitate introductions and provide guidance on regulatory compliance is a significant draw.

Mobile Network Operators and Enterprises

Beat Holdings, through its GINSMS subsidiary, targets mobile network operators and diverse enterprises needing dependable, scalable mobile messaging and bespoke software. These clients prioritize robust communication infrastructure and advanced application development capabilities to enhance their operations and customer engagement.

The demand for such services is significant. For instance, the global mobile messaging market was valued at approximately USD 1.8 trillion in 2023 and is projected to grow substantially, with enterprise messaging solutions forming a key segment. Businesses are increasingly investing in secure and efficient communication channels.

- Mobile Network Operators: Seeking to enhance their service offerings with advanced messaging platforms and value-added services.

- Enterprises: Requiring reliable SMS gateways, bulk messaging solutions, and custom software for customer notifications, marketing, and internal communications.

- Key Needs: Scalability, security, integration capabilities, and cost-effectiveness in their communication infrastructure.

Intellectual Property Owners and Innovators

Intellectual property owners and innovators, especially those in rapidly evolving sectors like digital health and blockchain, represent a key customer segment. These individuals and companies possess unique assets that can be leveraged for growth.

Beat Holdings actively seeks partnerships with these innovators for licensing agreements or outright acquisition of their intellectual property. This provides a clear path for monetizing valuable digital health and blockchain innovations.

- Monetization Opportunities: Innovators gain access to Beat Holdings' expertise in commercializing and developing intellectual property, turning novel ideas into revenue streams.

- Strategic Partnerships: Collaboration allows IP owners to benefit from Beat Holdings' market reach and development capabilities, accelerating product adoption and impact.

- IP Valuation Growth: By partnering with Beat Holdings, intellectual property assets can be strategically managed and enhanced, leading to increased valuation.

Beat Holdings serves a diverse clientele, including institutional investors focused on high-growth sectors like FinTech and digital assets, and high-net-worth individuals seeking portfolio diversification. The company also partners with FinTech and blockchain startups requiring capital and operational expertise, and mobile network operators and enterprises needing robust messaging solutions.

Additionally, Beat Holdings engages with intellectual property owners in areas such as digital health and blockchain, facilitating the commercialization of their innovations. These segments collectively represent significant opportunities for capital deployment and strategic growth.

| Customer Segment | Key Interests | Beat Holdings' Value Proposition |

|---|---|---|

| Institutional Investors | High-growth sectors (TMT, FinTech, digital assets), robust economic regions | Specialized investment strategies, alpha generation, access to unique avenues |

| High-Net-Worth Individuals | Portfolio diversification, alternative investments (emerging tech, digital assets) | Curated investment opportunities, expertise in specialized markets |

| FinTech & Blockchain Startups | Strategic investments, capital for expansion, operational expertise | Financial backing, operational guidance, network access, regulatory compliance support |

| Mobile Network Operators & Enterprises | Scalable mobile messaging, custom software, reliable communication infrastructure | Dependable, scalable messaging solutions, advanced application development, enhanced customer engagement |

| Intellectual Property Owners | Monetization of IP, commercialization of innovations (digital health, blockchain) | Licensing agreements, IP acquisition, market reach, development capabilities, IP valuation enhancement |

Cost Structure

The primary cost within Investment Capital Deployment is the capital itself, allocated to TMT, FinTech, and digital assets. For instance, in early 2024, Bitcoin saw significant price appreciation, with its value reaching over $70,000, directly impacting the cost of acquiring this asset. Similarly, the launch of spot Bitcoin ETFs in the US in January 2024 facilitated substantial capital inflows, with some ETFs accumulating billions in assets under management within their first few months, reflecting the scale of capital deployment.

Beat incurs significant costs in research and development (R&D) for its blockchain solutions and software. These expenses are crucial for innovation and product enhancement. In 2024, companies in the blockchain technology sector saw R&D spending increase, with some investing upwards of 20-30% of their revenue to stay competitive and develop cutting-edge features.

Salaries, benefits, and administrative overhead for a team of investment professionals, analysts, blockchain developers, and support staff represent a significant portion of Beat's cost structure. For instance, in 2024, the average salary for a financial analyst in the fintech sector ranged from $70,000 to $110,000 annually, with senior roles commanding higher figures. This category also encompasses the costs of maintaining physical office spaces and the general day-to-day running of the business.

Marketing and Investor Relations Expenses

Marketing and Investor Relations expenses are crucial for communicating investment opportunities and corporate progress. These costs cover participation in industry events, engagement with financial media, and ensuring clear communication with shareholders.

For example, in 2024, many companies allocated significant budgets to digital marketing campaigns and investor conferences to reach a wider audience. The average cost for a company to attend a major industry conference can range from $10,000 to $50,000, depending on sponsorship levels and booth size.

Key expenditures in this area include:

- Public Relations and Media Outreach: Costs associated with press releases, media kits, and engaging financial journalists.

- Investor Conferences and Roadshows: Expenses for travel, accommodation, and event participation to connect with potential and existing investors.

- Digital Marketing and Content Creation: Investment in online advertising, social media engagement, and developing informative content like white papers and webinars.

- Shareholder Communication Platforms: Costs for maintaining investor portals, annual reports, and regular shareholder updates.

Legal, Regulatory, and Compliance Costs

Operating in the dynamic financial and digital asset space means significant investment in legal, regulatory, and compliance frameworks. These costs are essential for navigating complex rules across various jurisdictions and mitigating potential risks.

For instance, in 2024, companies in the fintech sector often allocate a considerable portion of their budget to legal fees, compliance officers, and the implementation of robust internal controls. These expenses are crucial for maintaining operational integrity and avoiding penalties.

- Legal Counsel Fees: Engaging specialized legal teams to interpret and comply with evolving financial and digital asset laws, including those related to KYC/AML and data privacy.

- Compliance Audits: Regular internal and external audits to ensure adherence to regulatory standards, such as those set by the SEC, FINRA, or equivalent international bodies.

- Regulatory Adherence: Costs associated with implementing and maintaining systems and processes to meet ongoing reporting requirements and licensing obligations.

- Risk Mitigation: Investments in cybersecurity and fraud prevention measures, often mandated by regulatory bodies to protect customer assets and data.

Beat's cost structure is heavily influenced by the capital deployed in TMT, FinTech, and digital assets, with the cost of capital itself being a primary expense. Research and development for blockchain solutions also represent a significant investment, as companies in this sector are spending more on innovation to remain competitive. Personnel costs, including salaries and benefits for a skilled team, along with marketing, investor relations, and essential legal and compliance frameworks, form the bulk of operational expenditures.

| Cost Category | Description | Example 2024 Data/Impact |

|---|---|---|

| Capital Deployment | Cost of acquiring assets in TMT, FinTech, digital assets. | Bitcoin over $70,000 in early 2024; Spot Bitcoin ETFs saw billions in AUM quickly. |

| Research & Development | Investment in blockchain solutions and software innovation. | Blockchain tech firms investing 20-30% of revenue in R&D. |

| Personnel Costs | Salaries, benefits for investment professionals, developers, support staff. | Fintech Financial Analyst salaries: $70,000 - $110,000 annually. |

| Marketing & Investor Relations | Promoting opportunities, engaging with media and investors. | Industry conference costs: $10,000 - $50,000 per event. |

| Legal, Regulatory & Compliance | Navigating complex financial and digital asset laws. | Fintech sector budget allocation for legal fees and compliance officers. |

Revenue Streams

Beat Holdings primarily generates revenue through investment gains and capital appreciation from its portfolio. This involves profiting from the increase in value of its holdings in Technology, Media, and Telecommunications (TMT), FinTech, and digital asset sectors.

A significant portion of these gains comes from the strategic acquisition and subsequent sale of Bitcoin and Bitcoin-related Exchange Traded Funds (ETFs). For instance, as of early 2024, the cryptocurrency market has seen notable volatility and recovery, with Bitcoin prices fluctuating significantly, presenting opportunities for capital gains upon divestment.

Beat Holdings generates revenue through management fees earned on its investment funds, typically a percentage of assets under management. For 2024, many asset management firms saw management fee revenue grow as markets generally trended upward, although specific figures for Beat Holdings are proprietary.

Advisory fees are another key revenue stream, compensating Beat Holdings for providing strategic guidance and operational support to its portfolio companies. This can involve performance-based bonuses or fixed retainers, reflecting the value of their active involvement in fostering growth.

Beat generates revenue by licensing its intellectual property (IP) to other companies. This IP often relates to digital health and blockchain technologies that Beat has either created or acquired. This licensing model provides a predictable, recurring income stream as companies pay to use Beat's unique assets.

Mobile Messaging and Software Service Fees

Beat Holdings, through its subsidiary GINSMS Inc., generates revenue from offering mobile messaging services. This is a recurring income source as businesses and mobile operators utilize these platforms for communication and operational needs.

Furthermore, GINSMS Inc. actively sells and licenses its software products and related services to mobile network operators and various enterprises. This dual approach creates a stable, service-based revenue stream for Beat Holdings.

- Service-Based Revenue: Beat Holdings earns income from providing mobile messaging services via GINSMS Inc.

- Software Licensing and Sales: The company also generates revenue by selling and licensing its software products and services.

- Target Market: These services and products are offered to mobile operators and enterprises.

- Consistent Income: This model provides a reliable, service-driven revenue stream.

Financing and Interest Income

Financing and interest income represent a crucial revenue stream, particularly for companies managing significant cash reserves or actively involved in lending. This income is generated from interest earned on surplus cash held in savings accounts, money market funds, or short-term government securities. For instance, in 2024, many corporations benefited from higher interest rates, boosting their non-operating income. Companies might also earn interest by providing financing to their own portfolio companies through various debt instruments, such as loans or bonds, thereby supporting their subsidiaries while generating a return.

This revenue source significantly contributes to a company's overall financial stability and enhances its liquidity management capabilities. It provides a buffer against unexpected expenses and can be reinvested to fuel growth. For example, companies with strong balance sheets can leverage their cash to earn passive income, which can be particularly impactful in periods of rising interest rates. In 2024, the average yield on U.S. Treasury bills saw notable increases, directly benefiting entities holding such short-term investments.

- Interest Income from Cash Reserves: Earnings generated from idle cash held in bank accounts or short-term investments.

- Financing Portfolio Companies: Income derived from providing loans or debt financing to subsidiaries or associated businesses.

- Impact on Financial Stability: Contributes to liquidity and provides a stable, albeit often variable, income source.

- 2024 Trends: Benefited from generally higher interest rate environments, increasing returns on cash holdings and debt instruments.

Beat Holdings diversifies its revenue through investment gains in TMT, FinTech, and digital assets, including Bitcoin and related ETFs. Management and advisory fees from its investment funds, along with intellectual property licensing in digital health and blockchain, form other key income streams. Additionally, its subsidiary GINSMS Inc. generates recurring revenue from mobile messaging services and software licensing to mobile operators and enterprises.

| Revenue Stream | Description | Key Activities/Products | 2024 Relevance |

|---|---|---|---|

| Investment Gains | Profits from increased asset values | TMT, FinTech, Digital Assets, Bitcoin, ETFs | Market volatility and recovery created opportunities |

| Management Fees | Percentage of assets under management | Investment Funds | Generally grew with upward market trends |

| Advisory Fees | Compensation for strategic guidance | Portfolio Companies | Fixed retainers or performance-based bonuses |

| IP Licensing | Revenue from allowing others to use proprietary technology | Digital Health, Blockchain | Predictable, recurring income |

| Mobile Messaging Services (GINSMS) | Income from communication platforms | Messaging services for businesses and mobile operators | Stable, recurring income |

| Software Licensing & Sales (GINSMS) | Revenue from selling and licensing software | Software products for mobile operators and enterprises | Service-based revenue stream |

| Financing & Interest Income | Earnings from cash reserves and lending | Savings accounts, money market funds, loans to portfolio companies | Benefited from higher interest rates in 2024 |

Business Model Canvas Data Sources

The Beat Business Model Canvas is built using a combination of market research, competitive analysis, and internal operational data. This ensures each component, from customer segments to revenue streams, is grounded in actionable insights.