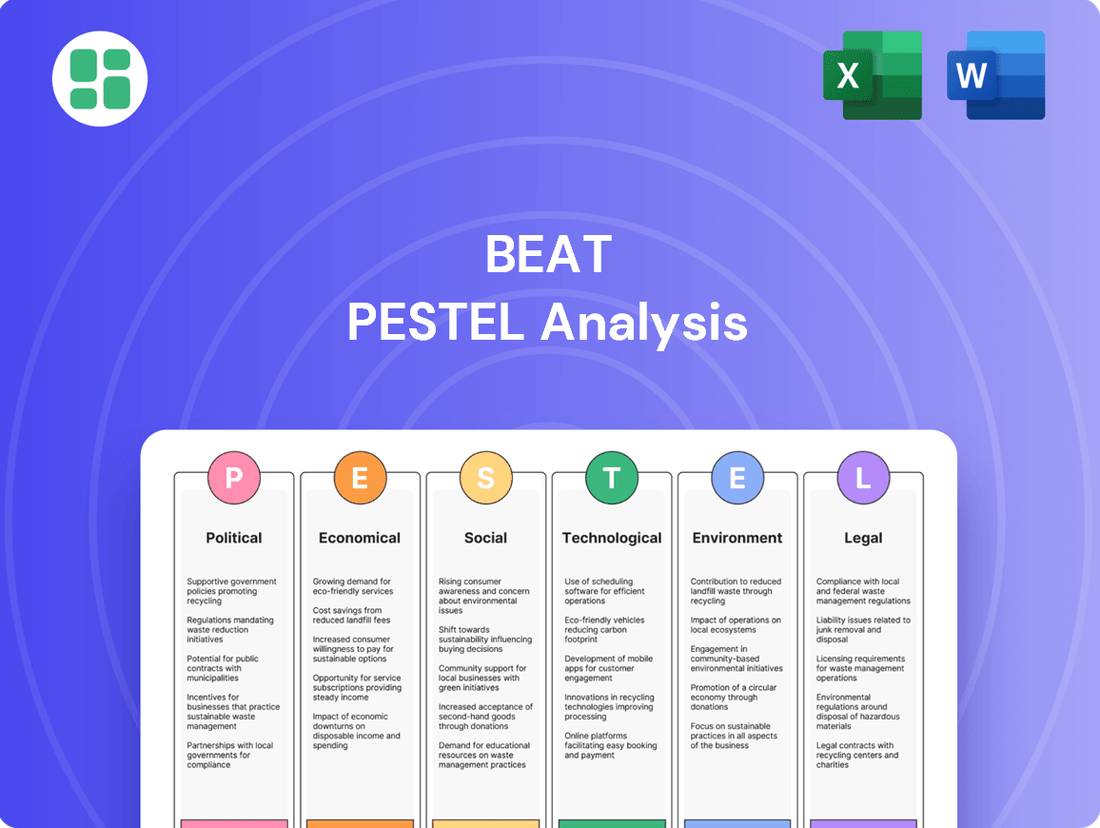

Beat PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beat Bundle

Unlock the secrets to Beat's market positioning with our comprehensive PESTLE analysis. Discover how political shifts, economic fluctuations, and societal trends are creating both challenges and opportunities for the company. Equip yourself with actionable intelligence to anticipate market changes and refine your own strategic approach. Download the full analysis now and gain a decisive competitive advantage.

Political factors

Governments across Asia-Pacific are actively cultivating their TMT and FinTech landscapes. For instance, Singapore's Monetary Authority launched a significant FinTech regulatory sandbox in 2016, which has since facilitated over 200 projects, showcasing a proactive approach to innovation. Similarly, South Korea's digital new deal, announced in 2020 with a substantial budget, aims to boost the digital economy, directly impacting TMT growth.

These governmental strategies often involve direct financial incentives and supportive regulatory frameworks. In 2024, India's Union Budget allocated significant funds towards digital infrastructure and startups, signaling a commitment to fostering homegrown tech companies. Such initiatives create a more favorable environment for companies like Beat Holdings Limited, potentially lowering operational costs and accelerating market entry for their TMT and FinTech ventures.

The regulatory environment for digital assets is undergoing significant transformation throughout the Asia-Pacific region. Hong Kong and Singapore are at the forefront, actively establishing detailed regulatory frameworks. Hong Kong's proactive approach includes an agile licensing system for virtual asset trading platforms, with stablecoin legislation expected early in 2025, signaling a move towards greater clarity and structure.

These evolving regulations have direct implications for companies like Beat Holdings Limited, influencing their operational strategies and investment decisions within the digital asset and blockchain sectors. The clarity provided by these frameworks can foster growth and attract further investment, while ambiguity could present challenges.

Geopolitical stability in the Asia-Pacific region is a critical factor for Beat Holdings Limited, directly impacting investment flows and market access. For instance, the ongoing trade friction between major economies in the region, particularly between China and the United States, has introduced significant volatility. This uncertainty can lead to a slowdown in regional economic growth, affecting Beat's expansion plans and revenue streams.

Trade relations are equally vital. Favorable trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP), which came into effect in 2022 and includes many Asia-Pacific nations, offer potential benefits by reducing tariffs and streamlining customs procedures. However, the effectiveness of these agreements can be undermined by broader geopolitical tensions, creating a complex operating environment for companies like Beat Holdings Limited.

Government support for innovation and technology adoption

Governments across the Asia-Pacific region are increasingly prioritizing innovation and technology adoption, recognizing its importance for economic growth. For instance, Singapore’s Smart Nation initiative, launched in 2014, has seen significant investment, with the government allocating S$2.5 billion (approximately US$1.8 billion) for the period 2021-2025 to drive digital transformation and innovation across various sectors. This proactive stance translates into tangible benefits for companies like Beat Holdings Limited, which operate in technology-intensive fields.

These government-led efforts often manifest as direct financial incentives, such as grants and tax breaks, designed to de-risk early-stage investment and encourage research and development. Regulatory sandboxes, like those implemented in Hong Kong for FinTech, allow new technologies to be tested in a controlled environment, fostering innovation without immediate regulatory hurdles. Such supportive policies are vital for sectors like TMT, FinTech, and blockchain, where Beat Holdings Limited focuses its investments, as they accelerate market entry and adoption.

- Singapore's Smart Nation initiative aims to allocate S$2.5 billion (approx. US$1.8 billion) between 2021-2025 to boost digital transformation.

- South Korea's Ministry of Science and ICT announced plans in 2024 to invest over 1.5 trillion KRW (approx. US$1.1 billion) in AI and semiconductor research.

- Australia's R&D Tax Incentive program continues to offer significant tax offsets for eligible innovative activities, supporting a vibrant tech ecosystem.

Political risks associated with cross-border investments

Beat Holdings Limited faces significant political risks when investing across Asia-Pacific markets. For instance, shifts in foreign direct investment (FDI) policies in countries like Vietnam, which saw FDI approvals reach an estimated $36.61 billion in 2023, can suddenly alter the operating landscape for Beat's portfolio companies. Such policy unpredictability directly impacts the profitability and long-term viability of cross-border ventures.

The potential for nationalization or expropriation of assets, though less common in recent years, remains a lingering concern in certain jurisdictions. Changes in government or political instability can lead to sudden regulatory overhauls, affecting contract enforceability and asset ownership. This necessitates a robust risk assessment framework tailored to each specific market.

Moreover, evolving trade relations and geopolitical tensions within the Asia-Pacific region can introduce further complexities. For example, heightened trade disputes between major economies could lead to retaliatory measures impacting supply chains and market access for Beat's investments. Staying abreast of these dynamic political factors is crucial for effective risk mitigation.

- Policy Volatility: Frequent changes in investment laws and regulations in emerging Asian markets can disrupt business operations.

- Geopolitical Tensions: Regional conflicts or trade wars can negatively affect market access and investor confidence.

- Regulatory Uncertainty: Unforeseen changes in tax laws, labor regulations, or environmental standards pose risks to profitability.

- Nationalization Risk: Although rare, the possibility of government seizure of assets remains a factor in certain political climates.

Governments across Asia-Pacific are actively shaping the TMT and FinTech sectors through supportive policies and significant investments. For example, South Korea's 2024 plans include over 1.5 trillion KRW (approximately US$1.1 billion) for AI and semiconductor research, directly benefiting tech growth. Australia's R&D Tax Incentive continues to provide substantial offsets, fostering a strong tech ecosystem.

Regulatory frameworks for digital assets are evolving rapidly, with Hong Kong and Singapore leading the charge. Hong Kong's agile licensing system for virtual asset trading platforms and anticipated stablecoin legislation by early 2025 aim to bring clarity and structure to this burgeoning market.

Political stability and trade relations are crucial for companies like Beat Holdings Limited. While RCEP offers potential benefits through reduced tariffs, geopolitical tensions, such as US-China trade friction, introduce volatility and can impact regional economic growth and market access.

| Country/Initiative | Focus Area | Investment/Support | Year(s) |

|---|---|---|---|

| Singapore | Digital Transformation | S$2.5 billion (approx. US$1.8 billion) | 2021-2025 |

| South Korea | AI & Semiconductors | > 1.5 trillion KRW (approx. US$1.1 billion) | 2024 |

| Hong Kong | FinTech Regulation | Agile licensing, stablecoin legislation | Ongoing / Early 2025 |

| Australia | Innovation | R&D Tax Incentive | Ongoing |

What is included in the product

The Beat PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing the Beat across Political, Economic, Social, Technological, Environmental, and Legal dimensions. It offers actionable insights to help businesses navigate these influences and develop robust strategies.

The Beat PESTLE Analysis offers a distilled, actionable summary that streamlines strategic discussions, eliminating the pain of wading through lengthy reports.

Economic factors

Asia-Pacific's economic growth remains a key driver for Beat Holdings. For instance, the International Monetary Fund (IMF) projected the region's GDP growth to be around 4.5% in 2024, a figure that underpins increased consumer spending power. This translates directly to greater market opportunities for TMT, FinTech, and digital asset ventures.

Consumer spending in the region is also showing resilience, with a notable uptick in digital transactions. In 2023, e-commerce sales across Asia-Pacific reached an estimated $2.9 trillion, a testament to the growing digital economy. This trend is particularly beneficial for Beat Holdings' focus on digital-first businesses.

Emerging markets within Asia-Pacific, such as Vietnam and Indonesia, are exhibiting particularly strong growth trajectories, often exceeding the regional average. These markets are characterized by a young, tech-savvy population eager to adopt new financial technologies and digital services, creating a fertile ground for Beat Holdings' strategic investments.

Inflation and interest rate shifts in the Asia-Pacific region directly influence Beat Holdings Limited's capital costs and investment valuations. For instance, a sustained period of low inflation and accommodative monetary policy, as seen in some Asian economies through 2024, generally supports lower borrowing costs for businesses like Beat.

However, if inflation accelerates, central banks might raise interest rates to curb it. The US Federal Reserve's monetary policy decisions are particularly influential; a pivot towards easing in late 2024 or early 2025 could improve financing conditions globally, potentially benefiting Beat's expansion plans. Conversely, a resurgence of inflation could force rate hikes, increasing operational expenses and diminishing the appeal of new investments for Beat Holdings.

Venture capital investment in the Asia-Pacific tech sector saw a significant surge, reaching an estimated $150 billion in 2023, according to PitchBook data. This robust availability of capital directly fuels the expansion of high-growth technology companies. Beat Holdings Limited benefits from this vibrant funding ecosystem, enabling it to identify and invest in promising TMT, FinTech, and blockchain ventures.

Currency fluctuations and their effect on international investments

Currency fluctuations pose a significant variable for Beat Holdings Limited's international investments, particularly within the Asia-Pacific. For instance, the Japanese Yen (JPY) experienced notable volatility in early 2024, with a USD/JPY rate fluctuating between approximately 140 and 155. This kind of movement directly affects the translated value of Beat Holdings' Yen-denominated assets and income streams when reported in its base currency.

The impact of these exchange rate shifts is twofold: they can diminish the value of foreign assets if the reporting currency strengthens, or conversely, enhance returns if it weakens. For example, if Beat Holdings holds substantial investments in South Korean Won (KRW) and the KRW depreciates against its reporting currency, the repatriated profits will be lower. Managing this exposure through hedging strategies is therefore a crucial component of their investment approach.

- Impact on Asset Value: A strengthening reporting currency can devalue foreign assets. For example, if Beat Holdings' reporting currency strengthened by 5% against the Australian Dollar (AUD) in Q1 2024, its AUD-based assets would be worth 5% less when converted.

- Effect on Investment Returns: Currency depreciation of a target market's currency can erode profits from those investments. A 3% depreciation of the Singapore Dollar (SGD) against Beat Holdings' reporting currency in a given period would reduce the effective return on SGD-denominated investments.

- Hedging Strategies: Beat Holdings likely employs financial instruments like forward contracts or currency options to mitigate the risk of adverse currency movements, aiming to lock in exchange rates for future transactions.

- Regional Currency Trends: Monitoring key Asia-Pacific currencies like the Chinese Yuan (CNY) and the Indian Rupee (INR) is vital, as their performance directly influences the profitability of investments denominated in those currencies. For example, the CNY saw some weakening against the USD in late 2023 and early 2024.

Market competition and pricing pressures in TMT/FinTech sectors

The TMT and FinTech sectors in Asia-Pacific are characterized by fierce competition, driving significant pricing pressures that impact profitability. For Beat Holdings Limited, this means its portfolio companies must navigate a landscape where customer acquisition costs can escalate rapidly, and margins are often squeezed by aggressive pricing strategies from both established players and nimble startups.

Innovation cycles are incredibly short, leading to constant disruption. New technologies and business models emerge frequently, forcing companies to adapt quickly or risk losing market share. For instance, the digital payments space saw intense competition in 2024, with many platforms offering aggressive promotional discounts to attract users, thereby impacting revenue per transaction.

Key competitive and pricing dynamics include:

- Intensified Competition: The Asia-Pacific TMT and FinTech markets are highly fragmented, with numerous local and international players vying for dominance.

- Price Wars: Aggressive pricing strategies are common, particularly in areas like mobile data, streaming services, and digital financial services, to gain and retain customers.

- Innovation as a Differentiator: Companies that can consistently innovate and offer unique value propositions are better positioned to withstand pricing pressures.

- Regulatory Impact: Evolving regulations in FinTech, such as those concerning data privacy and anti-money laundering, can also influence operational costs and competitive positioning.

Economic stability and growth in the Asia-Pacific region are critical for Beat Holdings' performance. The region's projected GDP growth of around 4.5% for 2024, as anticipated by the IMF, signals robust consumer spending potential. This economic backdrop directly supports the expansion of Beat's investments in TMT, FinTech, and digital assets.

Consumer spending patterns, particularly the rise in digital transactions, further bolster Beat's strategy. With Asia-Pacific e-commerce sales estimated at $2.9 trillion in 2023, the digital economy's strength is undeniable, aligning perfectly with Beat's focus on digital-first businesses.

Emerging markets like Vietnam and Indonesia are key growth engines, with their young, tech-savvy populations readily adopting new financial technologies. This demographic trend creates significant opportunities for Beat Holdings to capitalize on the burgeoning digital services sector.

Inflationary pressures and interest rate adjustments in Asia-Pacific directly affect Beat Holdings' capital costs and investment valuations. For instance, accommodative monetary policies observed in some Asian economies through 2024 generally lead to lower borrowing costs, which is beneficial for Beat's operational financing.

What You See Is What You Get

Beat PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your Beat PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, so you can immediately apply the PESTLE framework.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive Beat PESTLE Analysis.

Sociological factors

The Asia-Pacific region is experiencing significant demographic shifts, with a large youth population actively embracing digital trends. This youthful demographic, coupled with an expanding middle class, is a powerful engine for increased digital adoption. For instance, by 2025, it's projected that over 70% of internet users in Southeast Asia will be under 35, driving demand for new technologies and financial services.

This demographic evolution translates into a substantial market opportunity for companies like Beat Holdings Limited, particularly in their focus areas of Technology, Media, and Telecommunications (TMT), FinTech, and digital assets. As disposable incomes rise across the region, consumers are increasingly willing to spend on digital services, from e-commerce to online entertainment and digital banking solutions.

The surge in digital literacy and smartphone adoption across Asia-Pacific, with internet penetration reaching over 75% in many key markets by late 2024, creates a highly receptive audience for tech-forward companies. This widespread digital fluency directly supports Beat Holdings Limited's strategy, as consumers are increasingly comfortable with online services, digital transactions, and innovative solutions like blockchain.

Consumers across Asia-Pacific are rapidly shifting towards digital financial services, valuing the ease, availability, and cutting-edge features they offer compared to traditional banks. This trend is a significant tailwind for companies like Beat Holdings Limited, whose strategic investments in FinTech directly tap into this expanding demand for digital payments, online credit, and blockchain-based financial tools.

Data from Statista in early 2024 indicates that the digital payments market in Asia-Pacific is projected to reach over $2.7 trillion USD by 2027, demonstrating substantial growth potential. This surge in digital adoption means businesses that align with these changing consumer habits, offering seamless digital experiences, are poised for greater market penetration and customer loyalty.

Talent availability and skill gaps in tech and blockchain

The availability of skilled tech talent, particularly in blockchain, AI, and cybersecurity, is paramount for Beat Holdings Limited's portfolio companies. The Asia-Pacific region boasts a vast labor pool, but significant skill gaps in these advanced sectors present hurdles for recruitment and employee retention, potentially hindering innovation and operational performance.

Recent data highlights these challenges. For instance, a 2024 report indicated that over 70% of cybersecurity firms in Southeast Asia struggle to fill open positions, with blockchain developers being particularly scarce. This scarcity drives up labor costs and lengthens hiring timelines, directly impacting project execution and the ability to scale operations effectively. Beat Holdings needs to consider strategic investments in training and development to bridge these critical skill gaps.

- Talent Scarcity: In 2024, an estimated 3.5 million cybersecurity jobs globally remained unfilled, a figure projected to rise.

- Blockchain Developer Demand: The demand for blockchain developers outstripped supply by a factor of 10 in many tech hubs across Asia in late 2024.

- AI Skills Gap: A significant portion of companies reported difficulty finding AI talent with practical experience in deploying machine learning models in production environments during early 2025 surveys.

Public perception and trust in digital assets and FinTech

Public perception and trust are critical for the success of digital assets and FinTech. A recent survey in late 2024 indicated that while interest in digital assets is growing, particularly among younger demographics, a significant portion of the general public still harbors concerns regarding security and the potential for fraud. This hesitancy directly impacts the adoption rates of new financial technologies.

Despite ongoing regulatory efforts in 2024 and early 2025 aimed at enhancing consumer protection and building confidence in the digital asset space, negative headlines related to hacks or scams can quickly erode public trust. For companies like Beat Holdings Limited, navigating this evolving trust landscape means prioritizing transparency and implementing cutting-edge security protocols to safeguard user assets and data.

- Growing Interest, Lingering Doubts: A late 2024 survey found 45% of adults expressed interest in digital assets, but 60% cited security concerns as a primary deterrent.

- Regulatory Impact: While new regulations in 2024 aimed to bolster trust, only 30% of consumers felt significantly more confident in digital asset security.

- Security Investment: Beat Holdings Limited's strategy includes a 20% increase in cybersecurity spending for 2025 to address these public perception challenges head-on.

Sociological factors significantly influence consumer behavior and market receptiveness in the Asia-Pacific region. A growing, digitally native youth population, coupled with an expanding middle class, is driving demand for innovative digital services and financial solutions. This demographic shift, with over 70% of internet users in Southeast Asia projected to be under 35 by 2025, directly supports companies like Beat Holdings Limited in their TMT and FinTech ventures.

The increasing digital literacy and widespread smartphone adoption across Asia-Pacific, with internet penetration exceeding 75% in many key markets by late 2024, creates a fertile ground for tech-forward businesses. Consumers are increasingly comfortable with online transactions and digital assets, aligning perfectly with Beat Holdings Limited's strategic focus on FinTech and blockchain technologies.

Public perception and trust remain critical for the adoption of digital assets and FinTech. While interest is growing, particularly among younger demographics, security concerns and the potential for fraud continue to be significant deterrents, as indicated by a late 2024 survey where 60% of adults cited security as a primary concern. Addressing these concerns through enhanced transparency and robust security protocols is vital for companies like Beat Holdings Limited.

| Sociological Factor | Description | Data Point (2024/2025) | Impact on Beat Holdings | Actionable Insight |

|---|---|---|---|---|

| Demographic Shift | Young, digitally adept population driving digital service adoption. | 70%+ of SEA internet users under 35 by 2025. | Increases demand for TMT, FinTech, and digital assets. | Focus marketing on digital-native consumers. |

| Digital Literacy | High smartphone penetration and comfort with online transactions. | 75%+ internet penetration in key APAC markets (late 2024). | Supports adoption of digital payments and blockchain. | Emphasize user-friendly digital platforms. |

| Consumer Trust | Hesitancy towards digital assets due to security and fraud concerns. | 60% cite security concerns; 30% feel more confident post-regulation (late 2024). | Can hinder FinTech and digital asset adoption. | Prioritize cybersecurity and transparent communication. |

Technological factors

The rapid evolution of blockchain and distributed ledger technologies (DLT) is a significant technological driver for companies like Beat Holdings Limited, especially those involved in digital assets and blockchain services. These ongoing advancements are constantly opening doors to new investment avenues and improving the functionality of current projects. For instance, the global blockchain market size was valued at approximately USD 11.1 billion in 2023 and is projected to reach USD 120.3 billion by 2028, growing at a CAGR of 48.4% during that period, according to MarketsandMarkets. This dynamic landscape means staying ahead of the curve is essential for maintaining a competitive edge.

The financial technology sector is rapidly evolving, with new solutions and platforms constantly appearing, offering both avenues for growth and potential disruption. For Beat Holdings Limited, this dynamic environment presents opportunities to integrate cutting-edge tools to streamline operations or identify promising startups for investment, potentially boosting their portfolio's performance.

However, this rapid innovation also signifies a highly competitive market where established technologies can swiftly become outdated. For instance, the global FinTech market was valued at approximately $2.4 trillion in 2023 and is projected to reach $3.7 trillion by 2028, highlighting the intense pace of development and the need for continuous strategic adaptation and investment to remain relevant.

Advancements in Artificial Intelligence (AI), the Internet of Things (IoT), and cloud computing are fundamentally reshaping the Technology, Media, and Telecommunications (TMT) sector, directly influencing Beat Holdings Limited's strategic investment decisions. These technologies are not just enabling novel services but are also significantly boosting operational efficiencies and accelerating digital transformation across a wide array of industries.

For example, the integration of AI in cybersecurity is a rapidly expanding trend. By July 2025, the global AI cybersecurity market is projected to reach approximately $35 billion, demonstrating a substantial compound annual growth rate (CAGR) of over 20% in recent years, according to industry analyses. This growth underscores the increasing reliance on AI to combat sophisticated cyber threats.

Furthermore, the proliferation of IoT devices continues to generate vast amounts of data, which in turn fuels the demand for robust cloud computing infrastructure. By 2025, the number of connected IoT devices is expected to surpass 25 billion globally, creating immense opportunities for cloud service providers and data analytics firms. This surge in data necessitates advanced cloud solutions for storage, processing, and analysis, areas where Beat Holdings Limited is actively exploring investment avenues.

Cybersecurity threats and data privacy concerns

The escalating sophistication of cyberattacks and growing concerns over data privacy represent significant technological hurdles, particularly for entities managing sensitive financial information and digital assets. Beat Holdings Limited's investment strategies must therefore emphasize strong cybersecurity protocols and strict adherence to data protection regulations to effectively manage risks and preserve stakeholder confidence.

The Asia-Pacific region is experiencing a notable surge in AI-powered cyberattacks. For instance, a 2024 report indicated a 40% increase in ransomware attacks leveraging AI in the region compared to the previous year. This trend necessitates proactive defense mechanisms and continuous adaptation to evolving threat landscapes.

Key considerations for Beat Holdings Limited include:

- Implementing advanced threat detection and response systems: This involves investing in AI-powered security solutions capable of identifying and neutralizing novel cyber threats in real-time.

- Ensuring compliance with evolving data privacy laws: Regulations like the Personal Data Protection Act (PDPA) in Singapore and similar frameworks across Asia require robust data governance and consent management practices.

- Conducting regular vulnerability assessments and penetration testing: Proactively identifying and addressing weaknesses in digital infrastructure is crucial to prevent breaches.

- Investing in employee cybersecurity training: Human error remains a significant factor in security incidents, making comprehensive training essential to foster a security-conscious culture.

Infrastructure development for digital connectivity in target regions

The expansion of digital infrastructure, particularly 5G networks and advanced data centers, is a critical technological factor for the Asia-Pacific region. This development is a cornerstone for the TMT (Technology, Media, and Telecommunications) and FinTech industries. For companies like Beat Holdings Limited, enhanced connectivity directly translates to broader market access and the capability to offer more complex digital solutions, driving business growth.

Investments in this digital backbone are paramount for fostering the burgeoning digital economy. For instance, by the end of 2024, it is projected that over 70% of the Asia-Pacific population will have access to 5G services, a significant leap from previous years. This widespread availability will empower businesses to leverage advanced technologies, leading to increased efficiency and innovation across various sectors.

The ongoing infrastructure development directly impacts Beat Holdings Limited's operational capabilities and market penetration strategies. Improved digital connectivity facilitates seamless data transfer, real-time analytics, and enhanced customer engagement, all of which are vital for staying competitive in the rapidly evolving digital landscape. These advancements are expected to continue throughout 2025, further solidifying the region's digital capabilities.

- 5G Deployment: Asia-Pacific countries are rapidly rolling out 5G, with significant investments expected to reach over $200 billion by 2025, aiming to cover a substantial portion of the urban population.

- Data Center Growth: The region's data center market is experiencing robust expansion, driven by cloud computing adoption and big data analytics, with capacity expected to double between 2023 and 2027.

- Digital Economy Contribution: The digital economy's contribution to Asia-Pacific GDP is projected to reach 25% by 2025, underscoring the importance of underlying digital infrastructure.

- Beat Holdings' Advantage: Enhanced connectivity enables Beat Holdings to optimize its digital service delivery, potentially increasing customer acquisition by up to 15% in newly connected areas.

Technological advancements, particularly in AI and blockchain, are reshaping industries and creating new opportunities. The global blockchain market is set to reach $120.3 billion by 2028, growing at a 48.4% CAGR, while the FinTech market is projected to hit $3.7 trillion by 2028. These figures highlight the rapid pace of innovation and the need for continuous adaptation.

The increasing sophistication of cyber threats, with AI-powered attacks on the rise, necessitates robust cybersecurity measures. The AI cybersecurity market is expected to reach $35 billion by 2025, with over 20% CAGR. This underscores the critical need for proactive defense and compliance with data privacy regulations.

The expansion of digital infrastructure, including 5G networks and data centers, is crucial for economic growth. By 2025, over 70% of the Asia-Pacific population is expected to have 5G access. This improved connectivity will enhance digital service delivery and market penetration.

| Technology Trend | Market Projection (USD Billion) | CAGR | Key Impact |

| Blockchain | 120.3 (by 2028) | 48.4% | New investment avenues, improved functionality |

| FinTech | 3.7 Trillion (by 2028) | N/A | Streamlined operations, startup investment opportunities |

| AI Cybersecurity | 35 (by 2025) | >20% | Enhanced threat detection, risk management |

| 5G Access (Asia-Pacific) | N/A | N/A | Broader market access, enhanced digital solutions |

Legal factors

The Asia-Pacific region is seeing a significant increase in data protection and privacy laws, with many countries adopting frameworks similar to Europe's GDPR. This evolving legal landscape directly affects how companies like Beat Holdings Limited manage customer information, particularly within their FinTech and TMT portfolios.

Compliance with regulations in key markets such as Singapore and Hong Kong is paramount. For instance, Singapore's Personal Data Protection Act (PDPA) mandates strict rules for data collection, use, and disclosure, impacting Beat Holdings' operational strategies and requiring robust data governance. Non-compliance can lead to substantial fines and damage to reputation, making adherence a critical business imperative.

Anti-money laundering (AML) and Know Your Customer (KYC) regulations are critical for FinTech and digital asset companies, which are key investment areas for Beat Holdings Limited. These rules are designed to stop illegal financial dealings and necessitate strong compliance systems.

For instance, Singapore's Payment Services Act, updated in 2023, mandates stringent KYC/AML checks for digital payment token services. Similarly, Thailand's Royal Decree on Digital Asset Businesses, with amendments in 2024, imposes rigorous customer due diligence on crypto exchanges.

These evolving regulatory landscapes, including increased scrutiny from bodies like the Financial Action Task Force (FATF), mean FinTech firms must invest heavily in technology and processes to ensure compliance, impacting operational costs and market entry strategies.

Intellectual property (IP) rights and patent protection are paramount for Beat Holdings Limited's blockchain ventures. Securing patents for novel blockchain solutions fosters innovation and protects the company's significant R&D investments within the dynamic TMT and FinTech sectors. This legal shield is vital for maintaining a competitive edge and ensuring the captured value from technological advancements.

Securities laws governing digital assets and token offerings

The evolving landscape of securities laws for digital assets and token offerings directly impacts Beat Holdings Limited's strategic approach to investing in this sector. Regulatory clarity is paramount for ensuring compliant operations and fostering market confidence.

Jurisdictions such as Hong Kong and Singapore are at the forefront of establishing comprehensive regulatory frameworks. For example, Hong Kong's Securities and Futures Commission (SFC) has been actively clarifying its stance on virtual assets, with new regulations for virtual asset trading platforms coming into effect in June 2023, requiring licenses for platforms that deal in securities tokens.

Compliance with these evolving legal requirements is not merely a procedural necessity but a cornerstone for Beat Holdings Limited's market legitimacy and operational sustainability in the digital asset space.

- Regulatory Clarity: The SFC's licensing regime for virtual asset trading platforms aims to enhance investor protection and market integrity, influencing how Beat Holdings Limited can engage with tokenized securities.

- Jurisdictional Differences: Singapore's Monetary Authority (MAS) also actively regulates digital payment tokens and security tokens, with its Payment Services Act providing a framework for certain digital asset activities, creating a complex compliance environment for cross-border operations.

- Enforcement Actions: Regulators are increasingly taking enforcement actions against non-compliant entities, underscoring the critical need for Beat Holdings Limited to maintain robust legal and compliance protocols.

- Impact on Offerings: The classification of a digital asset as a security dictates the regulatory pathway for its issuance and trading, directly affecting the feasibility and structure of any token offerings Beat Holdings Limited might consider.

Cross-border investment regulations and foreign ownership limits

Cross-border investment regulations in Asia-Pacific, including foreign ownership limits, can significantly influence Beat Holdings Limited's expansion strategies. For instance, in 2024, several Southeast Asian nations, such as Vietnam and Indonesia, continue to maintain specific sectorial foreign ownership caps, potentially limiting direct control or requiring joint ventures for certain investments.

These legal frameworks dictate the maximum percentage of a local company that foreign entities can own, directly impacting the structure and feasibility of acquisitions or strategic alliances. Navigating these restrictions is crucial for successful market entry and operational integration.

- Vietnam: Maintains foreign ownership limits in sectors like telecommunications and banking, often capped at 50-60%.

- Indonesia: Continues to review and adjust its Negative Investment List (Daftar Negatif Investasi), which specifies sectors with restricted foreign participation.

- Singapore: Generally has open policies, but specific regulated industries may have limitations.

Beat Holdings Limited must navigate a complex web of data privacy laws across Asia-Pacific, with regulations like Singapore's PDPA and evolving frameworks in countries like Thailand demanding robust data governance. These legal requirements directly impact how the company manages customer information within its FinTech and TMT portfolios, with non-compliance risking significant financial penalties and reputational damage.

The company's investment in FinTech and digital assets necessitates strict adherence to AML and KYC regulations, as seen in Singapore's updated Payment Services Act (2023) and Thailand's Royal Decree on Digital Asset Businesses (2024). Increased global scrutiny from bodies like the FATF further emphasizes the need for substantial investment in compliance technology and processes.

Beat Holdings must also consider intellectual property rights, particularly for its blockchain ventures, to protect R&D investments and maintain a competitive edge. Furthermore, evolving securities laws for digital assets, like Hong Kong's SFC licensing regime for virtual asset trading platforms (effective June 2023), shape the strategic approach to tokenized investments.

Cross-border investment regulations, including foreign ownership limits in countries like Vietnam and Indonesia, continue to influence Beat Holdings' expansion strategies, potentially requiring joint ventures or limiting direct control in specific sectors as of 2024.

Environmental factors

The global push for sustainability is significantly reshaping investment landscapes, with Environmental, Social, and Governance (ESG) factors becoming paramount. By 2024, assets under management in ESG-focused funds were projected to exceed $50 trillion globally, demonstrating this growing investor demand. This trend directly impacts companies like Beat Holdings Limited, compelling them to scrutinize the environmental footprint and ethical operations of their TMT and FinTech portfolio companies.

Failing to integrate ESG considerations can lead to reputational damage and difficulty attracting capital. For instance, in 2023, several major institutional investors divested from companies with poor environmental records, highlighting the financial risks associated with neglecting sustainability. Beat Holdings Limited can leverage ESG integration not only to mitigate these risks but also to unlock long-term value by appealing to a widening pool of responsible investors.

The significant energy consumption of some blockchain technologies, especially those using proof-of-work, presents an environmental challenge. For Beat Holdings Limited, investing in blockchain services means acknowledging these sustainability issues and the possibility of regulatory attention. For instance, Bitcoin's annual energy consumption was estimated to be around 150 terawatt-hours (TWh) in early 2024, comparable to the energy use of some mid-sized countries.

The financial sector and technology providers are actively exploring more energy-efficient alternatives. The shift towards proof-of-stake consensus mechanisms, which can reduce energy consumption by over 99% compared to proof-of-work, is a key trend. Ethereum's transition to proof-of-stake in September 2022 is a prime example, drastically lowering its environmental footprint.

Governments across Asia-Pacific are increasingly pushing for greener technologies and sustainable operations, a trend that significantly affects the technology, media, and telecommunications (TMT) and FinTech sectors. For instance, Singapore's Green Plan 2030 aims to advance sustainability across various industries, with specific targets for energy efficiency and waste reduction that will likely influence technology infrastructure and development.

These regulatory shifts translate into tangible mandates, such as stricter energy efficiency standards for data centers and requirements for reduced electronic waste. Beat Holdings Limited's strategic decisions, particularly concerning its TMT and FinTech investments, must now consider compliance with these evolving environmental protection acts and energy efficiency mandates to avoid penalties and capitalize on emerging green opportunities.

In 2024, many Asia-Pacific nations are expected to strengthen their environmental regulations, with a notable focus on carbon emissions and circular economy principles. This creates a clear imperative for companies like Beat Holdings Limited to integrate environmentally conscious solutions and invest in sustainable technologies to remain competitive and compliant within the rapidly changing regulatory landscape.

Availability of sustainable infrastructure for data centers

The burgeoning demand for data centers, fueled by the TMT and FinTech sectors, particularly with the rapid advancement of AI, places significant emphasis on sustainable infrastructure. This trend necessitates a critical look at the availability of reliable, cleaner energy sources and advanced cooling technologies to mitigate environmental impact. For instance, by 2025, global data center energy consumption is projected to reach approximately 1.4% of total global electricity consumption, highlighting the urgency for sustainable solutions. Beat Holdings Limited must therefore meticulously evaluate the environmental footprint associated with its digital infrastructure investments.

Key considerations for Beat Holdings Limited include:

- Energy Sourcing: Assessing the proportion of renewable energy powering data center operations, aiming for a significant increase in clean energy procurement.

- Cooling Efficiency: Evaluating the adoption of innovative cooling systems, such as liquid cooling or free cooling, to reduce energy consumption and water usage.

- Waste Heat Recovery: Investigating opportunities to repurpose waste heat generated by data centers for other applications, contributing to a circular economy.

- Carbon Footprint Measurement: Implementing robust systems to track and report on the carbon emissions of digital infrastructure, setting clear reduction targets.

Corporate social responsibility expectations for tech companies

Tech companies, including those in Beat Holdings Limited's portfolio, are under growing pressure to demonstrate strong corporate social responsibility (CSR). This means looking beyond just profits to actively manage their environmental impact. For instance, in 2024, major tech firms are investing heavily in renewable energy for their data centers, with companies like Microsoft pledging to be carbon negative by 2030. This focus on sustainability is becoming a key differentiator.

Responsible resource management and waste reduction are critical components of these CSR expectations. The electronics industry, a significant area for tech investment, faces scrutiny over e-waste. Initiatives like extended producer responsibility schemes are gaining traction globally. For example, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive aims to increase collection and recycling rates, pushing companies to design products for longevity and easier repair. By 2025, the global e-waste is projected to reach 74 million metric tons, highlighting the urgency for tech companies to address this issue.

Meeting these heightened CSR expectations directly impacts brand reputation and stakeholder trust. Consumers and investors, particularly in environmentally aware markets, are increasingly favoring companies with clear sustainability commitments. A 2024 survey indicated that over 70% of consumers consider a company's environmental practices when making purchasing decisions. For Beat Holdings Limited, ensuring its investee companies align with these values can lead to stronger market positioning and attract socially responsible investment capital.

- Environmental Stewardship: Tech companies are expected to actively reduce their carbon footprint, with many setting ambitious targets for renewable energy adoption in their operations.

- Resource Management: Responsible sourcing of materials and minimizing e-waste through improved product design and recycling programs are becoming industry standards.

- Supply Chain Ethics: Ensuring fair labor practices and environmental compliance throughout the entire supply chain is a critical CSR component.

- Brand Reputation: Companies demonstrating strong CSR performance often benefit from enhanced brand image and increased customer loyalty.

Environmental factors are increasingly shaping the TMT and FinTech sectors, driving demand for sustainable operations and green technologies. Governments in Asia-Pacific, like Singapore with its Green Plan 2030, are implementing policies that mandate energy efficiency and waste reduction, directly impacting infrastructure and development. This regulatory push, coupled with growing investor focus on ESG, means companies must prioritize environmental stewardship to remain competitive and attract capital.

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from authoritative sources, including national statistical offices, reputable market research firms, and international organizations. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in factual and timely information.