Beat Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beat Bundle

Beat's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the looming threat of new entrants disrupting the market. Understanding these dynamics is crucial for any business aiming to thrive.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Beat’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Beat Holdings, active in TMT, FinTech, and digital assets, experiences substantial supplier power due to the scarcity of specialized talent. The demand for professionals in software development, data science, AI, and cybersecurity is particularly high across Asia-Pacific. By 2025, this intense competition for skilled individuals makes talent acquisition and retention a critical challenge, directly impacting operational costs and project timelines.

Technology and infrastructure providers, especially those offering specialized blockchain capabilities and secure cloud services in the Asia-Pacific region, can hold considerable sway. For a company deeply reliant on these elements, a concentrated market of high-quality suppliers means these providers can dictate terms, potentially raising costs for essential services.

In 2024, the demand for robust cloud infrastructure supporting advanced technologies like blockchain saw a significant uptick. For instance, cloud spending in Asia-Pacific was projected to grow by over 15% in 2024, indicating a strong market for providers. This growth, coupled with the specialized nature of blockchain infrastructure, can empower these suppliers, impacting a company's operational expenses and its ability to adapt its technological offerings.

Data and analytics providers hold significant bargaining power, especially when offering unique or proprietary insights essential for investment holding companies like Beat Holdings. Access to robust financial data, market intelligence, and advanced analytics tools is paramount for informed decision-making, particularly in dynamic sectors such as TMT, FinTech, and digital assets.

Suppliers who possess exclusive datasets or sophisticated analytical capabilities can leverage this advantage to command premium pricing. For instance, in 2024, the global market for big data and business analytics was projected to reach over $300 billion, indicating the high value placed on such services. Companies that can offer differentiated insights into these rapidly evolving markets often face less price sensitivity from buyers.

Regulatory Compliance and Legal Services

The bargaining power of suppliers, particularly legal and compliance experts, is a significant factor for Beat Holdings in the FinTech and digital assets sector across Asia. The intricate and constantly changing regulatory environment in this niche demands highly specialized knowledge, which inherently strengthens the position of these service providers.

This reliance means that legal and compliance firms can command higher fees, directly impacting Beat Holdings' operational costs. For instance, the cost of regulatory advisory services in Southeast Asia's burgeoning digital asset space saw an estimated increase of 15-20% in 2024 due to increased demand and complexity.

- Specialized Expertise: The deep understanding of evolving FinTech and digital asset regulations in Asia is a scarce resource, giving these legal service providers leverage.

- Impact on Costs: High demand for compliance services in 2024 led to increased billing rates for specialized legal counsel in key Asian markets.

- Strategic Agility: Beat Holdings' ability to adapt and launch new products can be hampered if legal and compliance support is costly or slow to mobilize.

- Regulatory Complexity: Navigating diverse regulatory frameworks across countries like Singapore, Hong Kong, and Japan requires continuous, expensive legal input.

Intellectual Property (IP) Owners

Intellectual property (IP) owners wield considerable bargaining power, especially when Beat Holdings seeks to acquire or license crucial digital health and blockchain technologies. Their control over these foundational assets dictates licensing fees, usage rights, and exclusivity terms, directly influencing Beat Holdings' ability to innovate and compete.

For instance, in 2024, the market for digital health patents saw significant activity, with licensing deals often reflecting the perceived future value of the underlying IP. Companies holding patents for novel AI-driven diagnostic tools or secure blockchain-based health record systems commanded premium rates, reflecting their gatekeeper position.

- High Demand for Specialized IP: In emerging tech sectors like digital health and blockchain, unique and validated IP is scarce, increasing the leverage of its owners.

- Licensing Fee Negotiation: IP owners can dictate substantial licensing fees, impacting Beat Holdings' cost structure and profitability for products built on that IP.

- Exclusivity and Control: The ability of IP owners to grant exclusive licenses means Beat Holdings might face higher costs or be unable to secure rights if competitors offer better terms.

- Impact on Product Development: Dependence on a few key IP holders can slow down or even halt product development if licensing agreements are unfavorable or unattainable.

Suppliers hold significant bargaining power when their offerings are critical, unique, or when the supplier market is concentrated. For Beat Holdings, this is evident in specialized technology components and skilled labor markets. When few suppliers can meet specific technical demands, or when talent is scarce, these suppliers can dictate terms, impacting costs and operational flexibility.

The market for advanced AI and cybersecurity talent in Asia-Pacific, for example, saw continued high demand throughout 2024. This scarcity directly translates to higher salaries and recruitment costs for Beat Holdings, as attracting and retaining these professionals becomes a competitive challenge. Similarly, providers of specialized blockchain infrastructure experienced robust demand, allowing them to command premium pricing for their services in 2024.

| Supplier Type | Key Factor of Power | Impact on Beat Holdings | 2024 Data/Trend |

|---|---|---|---|

| Specialized Tech Talent (AI, Cybersecurity) | Scarcity of skills | Increased labor costs, recruitment challenges | Asia-Pacific tech talent demand up 20% |

| Blockchain Infrastructure Providers | Concentrated market, unique offerings | Higher service fees, potential vendor lock-in | Cloud spending in APAC grew >15% |

| Data & Analytics Providers | Proprietary data, advanced analytics | Premium pricing for essential insights | Global big data market >$300 billion |

| Legal & Compliance Experts (FinTech/Digital Assets) | Regulatory complexity, specialized knowledge | Elevated advisory fees, slower compliance | Regulatory advisory costs up 15-20% in SEA |

| IP Owners (Digital Health, Blockchain) | Control over essential technologies | High licensing fees, restricted access | Significant patent licensing activity in digital health |

What is included in the product

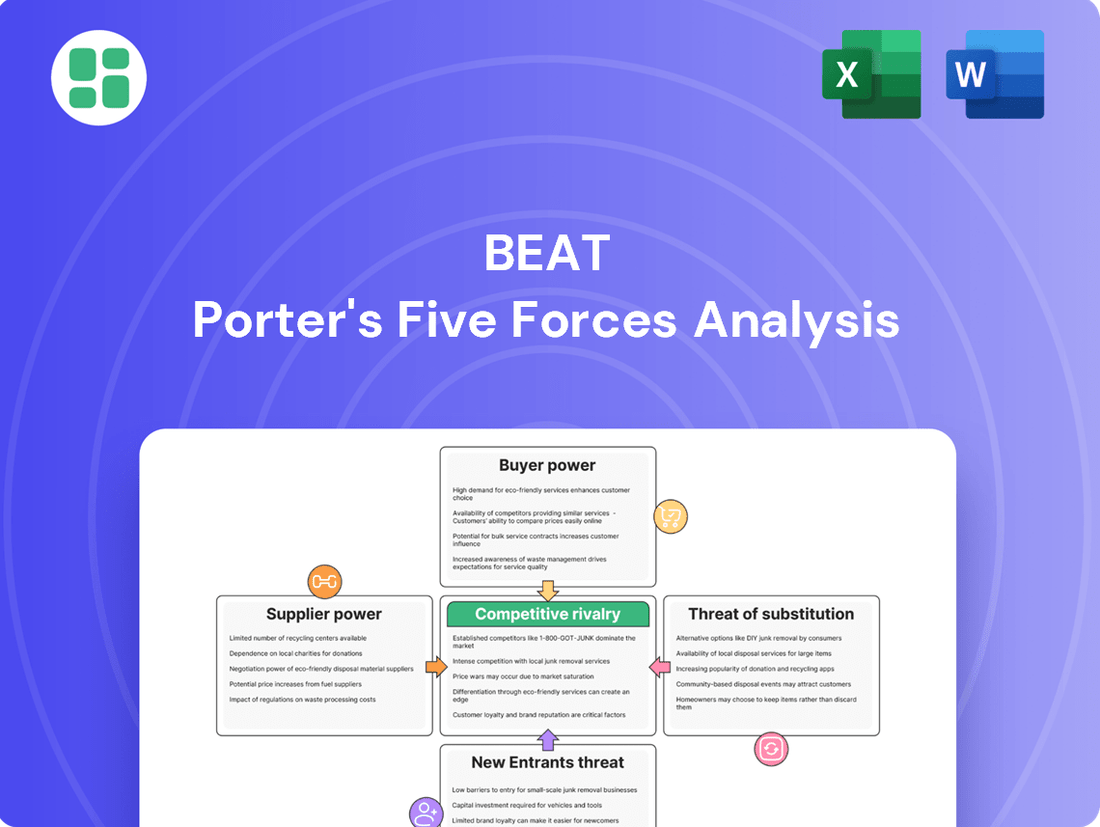

Analyzes the five competitive forces—threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitutes, and rivalry among existing competitors—to assess the attractiveness and profitability of the music streaming market for Beat.

Quickly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Companies seeking investment from Beat Holdings, especially those in fast-growing sectors like technology, media, and telecommunications (TMT), FinTech, and digital assets, often possess moderate bargaining power. This is because they can explore various funding avenues beyond Beat Holdings, such as other venture capital firms, private equity, and even debt financing options.

The venture capital landscape in the Asia-Pacific region, a key focus for many investment-seeking companies, is quite dynamic. In 2024, venture capital funding in Asia saw significant activity, with deals in the TMT and FinTech sectors remaining robust, indicating that startups have choices when it comes to securing capital and can therefore negotiate more favorable investment terms.

For Beat Holdings, shareholders and institutional investors are key 'customers' supplying crucial capital. Their influence is significant; for example, in 2024, shareholder activism saw proposals pushing for strategic shifts, such as exploring digital asset investments. This power is amplified by their ability to withdraw funding, impacting liquidity and valuation if performance or corporate governance falters.

When there are few options for selling a company, like during a tech slowdown or a dip in mergers and acquisitions in regions like Asia-Pacific, customers gain more leverage. This is especially true for companies like Beat Holdings. For instance, if M&A activity in the Asia-Pacific region, which saw significant venture capital investment in previous years, experiences a downturn, potential buyers or public market investors might have fewer choices. This limited pool of buyers can drive down the prices Beat Holdings can get for its portfolio companies, impacting its overall financial performance and making it less appealing to its own investors.

Demand for Specific Investment Themes

The demand for specific investment themes significantly shapes the bargaining power of customers in the investment landscape. Investors and potential portfolio companies are increasingly prioritizing areas like artificial intelligence (AI), environmental, social, and governance (ESG) principles, and broader sustainability initiatives. This trend gives these 'customers' – both capital providers and the companies seeking funding – considerable leverage.

Beat Holdings' capacity to draw in capital or identify promising ventures is directly tied to its alignment with these prevailing investment priorities. For instance, in 2024, global sustainable investment assets reached an estimated $37.7 trillion, according to Morningstar, highlighting the substantial capital flowing into ESG-focused strategies. This means that if Beat Holdings doesn' investment thesis doesn't resonate with these thematic demands, its ability to secure favorable terms or attract top-tier deal flow diminishes.

- Growing Investor Preference for Thematic Investing: A 2024 survey by Cerulli Associates found that 62% of financial advisors reported an increase in client demand for thematic investment solutions over the past year.

- Capital Allocation to AI: Venture capital funding for AI startups globally in the first half of 2024, according to PitchBook data, exceeded $50 billion, demonstrating a strong investor appetite for AI-centric businesses.

- ESG Integration Driving Valuations: Companies with strong ESG ratings are increasingly showing a valuation premium. S&P Global's analysis in early 2024 indicated that companies in the top quartile for ESG performance often trade at a higher multiple than their peers.

- Startup Demand for Thematic Alignment: Startups seeking funding are actively tailoring their pitches and business models to align with investor interest in AI, sustainability, and other trending themes to enhance their attractiveness and secure capital on more favorable terms.

Alternative Investment Vehicles

Investors looking to gain exposure to sectors like Technology, Media, and Telecommunications (TMT), FinTech, and digital assets have a growing array of choices beyond investing directly in a specific holding company. This abundance of options significantly bolsters their bargaining power.

These alternatives include direct investments in promising startups, participation in other venture capital or private equity funds that specialize in these high-growth areas, or even investing in publicly traded companies with similar strategic focuses. For instance, as of early 2024, venture capital funding in the FinTech sector globally saw substantial activity, with significant capital allocated to companies innovating in areas like blockchain and digital payments, providing investors with numerous avenues to deploy capital.

The availability of these diverse investment vehicles means that Beat Holdings, or any similar company, must offer competitive terms and demonstrate a clear value proposition to attract and retain investor capital. If returns or strategic alignment are not perceived as superior, investors can readily shift their focus to other opportunities. Consider the global digital asset market, which experienced significant growth and volatility in 2023, presenting both risks and opportunities that investors weigh when allocating funds across various digital asset-related ventures.

- Venture Capital Funding: Global VC funding in FinTech reached over $40 billion in 2023, offering investors many choices.

- Digital Asset Market: The digital asset market cap fluctuated significantly in 2023, highlighting the need for careful selection among various digital investment opportunities.

- Public Market Alternatives: Numerous publicly traded tech and digital asset-focused companies provide accessible investment alternatives.

- Investor Choice: The proliferation of investment vehicles empowers investors to negotiate terms more effectively with individual companies like Beat Holdings.

Customers, whether they are investors or companies seeking capital, wield significant bargaining power when alternatives are plentiful and demand for specific investment themes is high. This is particularly evident in dynamic sectors like TMT and FinTech, where numerous funding avenues exist. In 2024, the strong investor appetite for AI and ESG initiatives meant companies aligning with these themes could negotiate more favorable terms, as demonstrated by the $37.7 trillion in global sustainable investment assets.

When Beat Holdings or similar entities face a limited pool of buyers for their portfolio companies, perhaps due to a slowdown in M&A activity, customer bargaining power increases. This can lead to lower exit valuations, directly impacting the returns Beat Holdings can offer its own investors. The venture capital funding in Asia-Pacific, while active, also presents choices for startups, further empowering them.

| Factor | Impact on Customer Bargaining Power | Supporting Data (2024 unless noted) |

|---|---|---|

| Availability of Alternatives | Increases power; customers can choose other investment options. | Global FinTech VC funding exceeded $40 billion in 2023, offering many choices. |

| Demand for Thematic Investing | Increases power; customers prioritize specific themes like AI and ESG. | 62% of financial advisors saw increased client demand for thematic solutions. |

| Limited Exit Opportunities | Increases power; fewer buyers mean customers can negotiate lower prices. | Downturns in M&A activity in regions like Asia-Pacific can reduce buyer choices. |

| Investor Activism | Increases power; investors can push for strategic changes or withdraw capital. | Shareholder activism in 2024 included proposals for digital asset investments. |

Preview the Actual Deliverable

Beat Porter's Five Forces Analysis

This preview displays the complete Beat Porter's Five Forces Analysis, ensuring you receive the exact, professionally formatted document immediately after purchase. You can be confident that the insights and structure you see here are precisely what you'll download, ready for immediate application to your strategic planning. There are no hidden sections or placeholder content; this is the full, usable analysis.

Rivalry Among Competitors

The Asia-Pacific region's TMT, FinTech, and digital assets investment scene is a crowded marketplace. Local and global venture capital firms, private equity players, and corporate venture arms are all actively seeking opportunities, creating a highly competitive environment.

This intense rivalry means Beat Holdings must offer more than just funding to stand out. For instance, in 2024, venture capital funding in Asia's tech sector saw significant activity, with deals in FinTech and digital assets remaining robust, underscoring the need for differentiated value propositions.

Specialized niche competitors often possess a significant advantage by concentrating their resources and expertise within very specific sub-sectors, such as artificial intelligence or particular blockchain applications. This deep focus allows them to cultivate unparalleled knowledge and build strong industry networks, making them formidable rivals. For instance, in 2024, the venture capital funding landscape showed a clear trend of specialization, with AI startups alone attracting over $50 billion globally, demonstrating the intense competition for innovation within these focused areas.

The speed at which companies can access and invest capital significantly shapes competitive dynamics. In 2024, with venture capital funding showing a notable slowdown compared to previous years, the ability to deploy funds swiftly becomes even more critical for securing promising opportunities.

Competitors with substantial capital reserves or streamlined approval processes can gain a distinct advantage. For instance, a well-funded private equity firm with a rapid due diligence and closing capability might secure a target company before a less agile competitor, especially if the target is a startup experiencing funding challenges in the current economic climate.

Reputation and Track Record

In the investment arena, a firm's reputation and historical performance are paramount. Beat Holdings must contend with rivals who have built trust through consistent, successful investment outcomes and strategic exits. For instance, in 2024, established venture capital firms with decades of experience often boast portfolios that have delivered significant returns, making it harder for newer players like Beat Holdings to attract top-tier deals and investor capital.

A strong track record directly influences a firm's ability to secure funding from limited partners and to attract promising startups seeking capital. Competitors with a longer history of successful investments, evidenced by a higher number of IPOs or acquisitions, naturally hold an advantage. Consider that in 2024, many legacy firms continue to leverage their extensive networks and proven methodologies, which can be a significant hurdle for newer entrants aiming to establish credibility.

- Established firms often have a deeper bench of experienced professionals.

- A history of successful exits provides tangible proof of investment acumen.

- Reputation influences both the quality of deal flow and the ability to raise subsequent funds.

Regulatory Arbitrage and Market Entry

The diverse regulatory landscapes across the Asia-Pacific region present a significant challenge and opportunity for competitive rivalry. Companies can exploit differences in regulations, such as varying capital requirements or licensing procedures, to enter specific markets with lower barriers. For instance, in 2024, certain Southeast Asian nations continued to streamline financial services regulations to attract foreign investment, while others maintained more stringent oversight, creating distinct entry points.

Beat Holdings must strategically navigate these disparities to maintain a competitive advantage. This involves understanding the specific compliance burdens and potential benefits associated with each market. For example, if one country allows for a more flexible approach to data localization, a competitor might leverage this to reduce operational costs compared to a market with strict data residency laws.

- Regulatory Divergence: Asia-Pacific countries exhibit a wide range of regulatory frameworks, impacting market entry and operational costs for competitors.

- Arbitrage Opportunities: Competitors can exploit less restrictive regulations in certain markets to gain a cost or operational advantage.

- Beat Holdings' Challenge: The company must adapt its strategies to comply with diverse and sometimes conflicting regulations across its operating regions.

- Strategic Navigation: Understanding and leveraging regulatory differences is crucial for Beat Holdings to remain competitive and achieve market penetration.

Competitive rivalry in the Asia-Pacific TMT, FinTech, and digital assets space is fierce, with numerous local and global players vying for opportunities. This intense competition demands that Beat Holdings differentiate itself beyond just capital provision. For instance, in 2024, venture capital funding in Asia's tech sector remained dynamic, with FinTech and digital assets deals showing continued strength, highlighting the critical need for unique value propositions to attract both startups and investors.

SSubstitutes Threaten

For companies needing capital, traditional financing methods like bank loans, angel investors, and government grants offer viable alternatives to venture capital or private equity from firms like Beat Holdings. In 2024, the global debt financing market continued its strong growth, particularly in emerging markets across Asia, presenting a significant substitute for equity-based funding. For instance, corporate bond issuance in Asia Pacific reached record levels in early 2024, providing companies with substantial capital without diluting ownership.

Large corporations, particularly in the technology and financial sectors, are increasingly making direct investments in promising startups. For instance, in 2024, major tech giants continued their aggressive venture capital arms, injecting billions into emerging companies in areas like AI, cloud computing, and cybersecurity. This trend directly threatens investment holding companies by offering startups an alternative funding route, often coupled with strategic advantages like market access and technological integration that a passive investment might lack.

Mature startups increasingly bypass traditional venture capital by pursuing public market listings, such as Initial Public Offerings (IPOs). In 2024, the IPO market saw a resurgence, with over 200 companies going public in the US, raising more than $30 billion. This trend signifies a reduced reliance on private equity for later-stage funding.

The rise of Security Token Offerings (STOs) and Initial Coin Offerings (ICOs) presents another significant substitute. These digital asset fundraising methods offer startups alternative avenues for capital, potentially at lower costs and with greater accessibility. Regulatory clarity in 2024 has bolstered the legitimacy of STOs, making them a more viable option for established firms seeking to tokenize equity.

Internal Innovation and Development

Companies increasingly prioritize internal innovation, leveraging retained earnings to fund research and development rather than seeking external capital. This self-sufficiency in innovation directly challenges the role of firms like Beat Holdings as capital providers. For instance, in 2024, the global R&D spending by the top 2,500 companies reached an estimated $1.1 trillion, a significant portion of which is internally generated.

This internal development acts as a powerful substitute for external investment. Companies can develop proprietary technologies and solutions, reducing their reliance on outside funding for growth and competitive advantage. This trend is evident in the tech sector, where many established players reinvest substantial profits into internal R&D to stay ahead of market shifts.

- Internal R&D Investment: Companies are allocating more resources to internal research and development, aiming to create unique solutions.

- Retained Earnings as Funding: A growing number of firms are opting to self-fund innovation using profits, bypassing the need for external capital injections.

- Technological Self-Sufficiency: Developing in-house technologies provides a competitive edge and reduces dependence on external partnerships or investments.

- Impact on Capital Providers: This shift can diminish the influence and necessity of external investors or financial institutions for companies focused on organic growth.

Alternative Investment Products for Investors

Investors seeking exposure to digital assets can bypass general investment holding companies like Beat Holdings by directly investing in regulated Bitcoin ETFs, which saw significant inflows in early 2024. For instance, the iShares Bitcoin Trust (IBIT) accumulated over $10 billion in assets under management within its first few months of trading in 2024, demonstrating a clear alternative path for capital.

Furthermore, specialized blockchain funds and venture capital firms focusing on the digital asset space offer another avenue for investors to gain exposure to this rapidly evolving sector, acting as substitutes for broader investment vehicles. These funds often provide curated portfolios of digital assets and related technologies, appealing to those seeking targeted growth in this area.

The availability of diverse asset classes, from traditional equities and bonds to alternative investments like private equity and real estate, also presents substitutes. Investors can allocate capital to these established markets if they perceive Beat Holdings' strategy as less attractive or more risky compared to diversification across a wider range of investment opportunities.

Key substitute investment options include:

- Regulated Digital Asset ETFs: Offering direct, accessible exposure to cryptocurrencies like Bitcoin.

- Specialized Blockchain Funds: Providing curated investments in blockchain technology and related companies.

- Other Alternative Investments: Such as private equity, venture capital, and real estate, offering diversification away from traditional markets.

- Direct Investment in Digital Assets: Allowing investors to hold cryptocurrencies directly, bypassing intermediaries.

The threat of substitutes arises when alternative products or services can fulfill the same customer need, potentially drawing business away from an industry. For investment firms, this means investors have numerous other places to put their money besides traditional equity or debt instruments. In 2024, the landscape for capital allocation became even more diverse, with new avenues emerging that directly compete for investor attention.

For instance, the burgeoning market for regulated digital asset ETFs, like those tracking Bitcoin, offered investors a direct and accessible way to gain exposure to cryptocurrencies. The iShares Bitcoin Trust, a prominent example, amassed over $10 billion in assets under management within its initial months of trading in 2024, showcasing a significant alternative for capital that might otherwise flow into traditional investment vehicles. This trend highlights how readily available, specialized investment products can serve as powerful substitutes, diverting funds from broader investment strategies.

Entrants Threaten

While capital is undeniably crucial for investment holding companies and venture capital firms, the barrier to entry isn't always insurmountable. The proliferation of diverse funding sources, including crowdfunding platforms and the increasing prevalence of smaller, specialized funds, has somewhat lowered the initial capital hurdle. For instance, in 2024, many emerging venture capital funds successfully launched with initial capital commitments ranging from $50 million to $200 million, demonstrating that substantial, though not astronomical, capital can be raised.

The threat of new entrants in the FinTech and digital asset space in Asia-Pacific is significantly dampened by formidable regulatory hurdles. Navigating this complex and constantly evolving landscape requires substantial investment in legal counsel and compliance infrastructure.

New players must contend with a patchwork of diverse licensing requirements across different jurisdictions, alongside strict adherence to Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) regulations. For instance, in 2024, Singapore's Monetary Authority (MAS) continued to refine its digital payment token framework, demanding robust risk management and consumer protection measures from applicants, a process that can easily run into hundreds of thousands of dollars in upfront costs and ongoing operational expenses.

Furthermore, stringent data protection laws, such as those in Hong Kong and South Korea, add another layer of complexity and cost. These regulations necessitate significant investment in secure data storage, privacy protocols, and regular audits, creating a high barrier to entry for smaller, less capitalized firms aiming to compete with established players.

Established firms like Beat Holdings possess a significant advantage through their deep-rooted networks and privileged access to deal flow. This often translates into a consistent pipeline of promising investment opportunities that new entrants struggle to replicate.

Newcomers must invest considerable time and resources to cultivate similar relationships and gain market intelligence, a process that can take years to build trust and identify high-growth ventures. For instance, in 2024, the average time for a venture capital firm to close its first significant deal after establishment was reported to be around 18-24 months, highlighting the substantial lead time required.

Talent Acquisition and Retention

Attracting and retaining top-tier talent in the Technology, Media, and Telecommunications (TMT), FinTech, and digital assets sectors presents a significant threat to new entrants. These industries face persistent skill shortages and fierce competition for experienced professionals, making it difficult for newcomers to build a strong team.

New entrants often find it challenging to match the compensation packages, benefits, and career advancement opportunities offered by established companies. This disparity can hinder their ability to attract the experienced personnel necessary to effectively develop products, execute strategies, and compete in the market.

For instance, in 2024, the demand for AI and machine learning engineers remained exceptionally high, with average salaries in the US for senior roles often exceeding $200,000 annually. New companies may struggle to offer such competitive remuneration, impacting their capacity to innovate and scale.

- Talent Scarcity: Key roles in areas like cybersecurity, data science, and blockchain development are in high demand across multiple sectors.

- Compensation Wars: Established firms can leverage greater financial resources to offer higher salaries and more attractive stock options, outbidding new entrants.

- Limited Brand Recognition: New companies may lack the employer brand appeal of industry leaders, making it harder to attract top candidates.

- Retention Challenges: Even if acquired, new entrants may face difficulties retaining talent if they cannot offer a compelling long-term vision or competitive growth prospects.

Reputation and Brand Building

In the investment industry, reputation and trust are absolutely critical. New entrants face a significant hurdle because they simply don't have the years of proven success or the well-known brand names that established firms possess. This makes it a real challenge to attract both investors looking for safe havens and promising companies seeking capital, particularly when the market sentiment is a bit wary.

Building a strong reputation takes time and consistent performance. Consider that in 2023, the average time for a new investment firm to gain significant market traction can be upwards of five years, assuming consistent positive returns. Without this established credibility, new players struggle to compete for investor attention and capital.

- Brand Recognition: Established firms benefit from years of marketing and successful track records, creating immediate trust.

- Track Record: New entrants lack the audited performance history that reassures sophisticated investors.

- Investor Confidence: In uncertain economic climates, investors often gravitate towards well-known, reputable institutions.

- Talent Acquisition: Attracting top portfolio managers and analysts is harder for new firms without a proven name.

The threat of new entrants is significantly mitigated by high capital requirements and the need for specialized expertise, particularly in regulated sectors like FinTech. Established networks and a proven track record also create substantial barriers, making it difficult for newcomers to gain market access and trust.

In 2024, the cost of regulatory compliance alone, as seen with Singapore's digital payment token framework, can run into hundreds of thousands of dollars. Furthermore, attracting top talent in high-demand fields like AI engineering, where senior roles command over $200,000 annually in the US, presents a considerable challenge for new firms lacking established compensation structures and brand appeal.

Porter's Five Forces Analysis Data Sources

Our analysis leverages a robust combination of industry-specific market research reports, company financial statements, and expert interviews to capture the nuances of competitive intensity and market dynamics.