Bank of East Asia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of East Asia Bundle

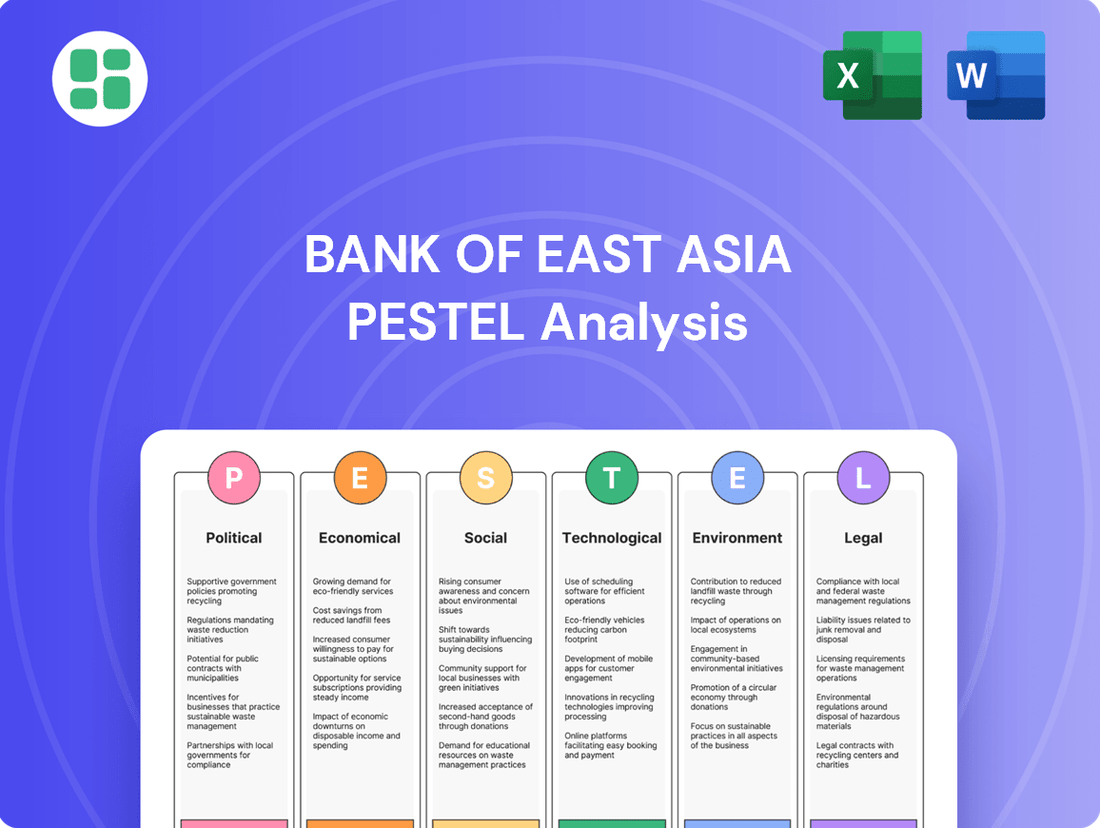

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Bank of East Asia's strategic landscape. Our meticulously researched PESTLE analysis provides actionable intelligence to navigate market complexities and anticipate future challenges. Gain a competitive edge by understanding these external forces. Download the full report now for a comprehensive strategic advantage.

Political factors

Geopolitical tensions, especially between the US and China, significantly shape Hong Kong's financial landscape and directly influence Bank of East Asia's (BEA) international operations. This dynamic impacts BEA's ability to conduct cross-border business and maintain its position as a key financial hub.

Shifts in global trade policies and tariffs can profoundly affect BEA's corporate clients, potentially altering their economic activity. This, in turn, influences the demand for loans and the volume of trade finance services the bank provides.

Navigating these intricate international relations is crucial for BEA to sustain its market presence and retain its diverse client base amidst evolving global economic conditions.

Both Hong Kong and mainland China are actively implementing policies to foster financial sector growth. Initiatives promoting FinTech, green finance, and cross-border integration, like the Greater Bay Area development, are key. For instance, Hong Kong's FinTech Week 2024 highlighted significant government support for digital innovation, with over 1,000 participating companies.

Bank of East Asia (BEA) must align its strategies with these governmental directives to capitalize on emerging opportunities and maintain regulatory adherence. The push for green finance, with China aiming for peak carbon emissions before 2030, presents a substantial area for financial institutions to support sustainable projects.

Hong Kong's regulatory autonomy, while constitutionally protected under 'One Country, Two Systems', faces increasing scrutiny due to its evolving relationship with mainland China. This dynamic could impact the perception of Hong Kong as a stable financial hub, potentially influencing foreign investment and capital flows crucial for Bank of East Asia.

Stability of the Political Environment in Hong Kong

The political stability of Hong Kong is a critical determinant for business confidence and investment, directly influencing the Bank of East Asia (BEA). Social unrest or abrupt policy changes can significantly deter foreign capital, negatively impacting consumer and business sentiment, which in turn affects BEA's retail and corporate banking activities. A predictable operating environment is crucial for financial institutions like BEA.

Recent political developments, while complex, have aimed at reinforcing stability. For instance, the implementation of the National Security Law in 2020 was intended to curb dissent and promote order, although its long-term economic implications are still being assessed by market participants. BEA, like other financial entities, closely monitors these shifts to gauge their impact on the operating landscape.

- Impact on Foreign Investment: Political stability is a key factor in attracting and retaining foreign direct investment, which directly influences the demand for banking services.

- Regulatory Environment: Changes in political governance can lead to shifts in the regulatory framework, affecting banking operations and compliance requirements for BEA.

- Business Sentiment: A stable political climate fosters greater certainty for businesses, encouraging expansion and thus increasing the need for corporate banking and lending services.

- Consumer Confidence: Political stability underpins consumer confidence, influencing spending habits and the demand for retail banking products offered by BEA.

Cross-border Financial Integration Policies

Policies fostering cross-border financial integration between Hong Kong and mainland China, like the Wealth Management Connect scheme, present substantial growth avenues for Bank of East Asia (BEA). These initiatives are designed to facilitate capital flows and client engagement across the Greater Bay Area. For instance, the Wealth Management Connect scheme, which launched in October 2021, saw significant uptake, with northbound sales reaching RMB 21.4 billion (approximately USD 3 billion) by the end of 2023, demonstrating the growing appetite for cross-border investment products.

BEA must strategically adapt its service offerings and technological infrastructure to effectively leverage these integration policies. This includes enhancing digital platforms to cater to increased cross-border transactions and developing tailored financial products that meet the evolving needs of clients engaging in these markets. The bank's ability to streamline onboarding processes and offer seamless digital experiences will be crucial in capturing market share amidst growing competition.

- Wealth Management Connect: Facilitates investment product sales between Hong Kong and mainland China, with northbound sales reaching RMB 21.4 billion by end-2023.

- Digital Yuan Trials: BEA's participation in digital yuan pilots in Hong Kong could position it to benefit from the increasing adoption of central bank digital currencies for cross-border payments.

- Cross-border Capital Flows: Policies aim to increase these flows, requiring BEA to enhance its capabilities in managing foreign exchange and international trade finance.

- Client Demand: Growing demand for integrated financial services necessitates BEA's investment in technology and product development to serve a more connected client base.

Government initiatives in both Hong Kong and mainland China actively promote financial sector growth, particularly in areas like FinTech and green finance, creating opportunities for Bank of East Asia (BEA). For example, Hong Kong's FinTech Week 2024 saw over 1,000 companies participate, underscoring strong government backing for digital innovation.

Policies facilitating cross-border financial integration, such as the Wealth Management Connect scheme, are vital for BEA's expansion. By the end of 2023, northbound sales for this scheme reached RMB 21.4 billion (approximately USD 3 billion), highlighting significant client interest in these integrated services.

The political stability of Hong Kong is paramount for BEA, as it directly influences business and consumer confidence, impacting loan demand and banking activity. While the National Security Law, implemented in 2020, aims to promote order, its long-term economic effects are still under evaluation by market participants.

BEA must strategically align with these evolving political and regulatory landscapes, including adapting to potential shifts in Hong Kong's regulatory autonomy and participating in initiatives like digital yuan pilots to remain competitive.

What is included in the product

This PESTLE analysis examines the Bank of East Asia's operating environment, detailing how political stability, economic growth, social trends, technological advancements, environmental concerns, and legal frameworks influence its strategic direction and market position.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of the Bank of East Asia's external environment to streamline strategic discussions.

Economic factors

Bank of East Asia's (BEA) financial performance is intrinsically linked to the economic vitality of Hong Kong and mainland China, its core operating regions. For 2025, projections indicate a moderate economic growth trajectory for both markets, suggesting a steady, albeit not explosive, expansion in the banking sector. This forecast implies continued opportunities in areas like lending and wealth management, though the pace of growth will likely remain measured.

Recent economic data supports this outlook. For instance, Hong Kong's GDP growth was estimated at 3.2% for 2024, with forecasts for 2025 hovering around 2.5-3.0%. Mainland China's economy, while larger, is also expected to see sustained but moderating growth, with official targets for 2025 likely to be in the 4.5-5.0% range. BEA must therefore develop strategies that leverage these anticipated economic conditions, focusing on efficient operations and targeted market penetration to capitalize on the available growth within these stable environments.

The interest rate environment significantly shapes Bank of East Asia's (BEA) financial performance. Global monetary policies, particularly those set by the US Federal Reserve, and local decisions from the Hong Kong Monetary Authority (HKMA) and the People's Bank of China (PBoC) dictate the direction of rates. These movements directly influence BEA's net interest margin (NIM), a key driver of profitability.

As of mid-2024, Hong Kong's interest rates have remained relatively stable, with the HKMA maintaining its base rate in line with the US Federal Reserve's policy decisions. For instance, the US Federal Reserve has signaled a cautious approach to rate cuts, which generally supports higher NIMs for banks like BEA by widening the spread between lending and deposit rates. However, prolonged higher rates could potentially slow down loan demand and hinder the recovery of the property market, a crucial sector for Hong Kong's economy and BEA's loan portfolio.

The stability of the real estate markets in Hong Kong and mainland China is a critical factor for Bank of East Asia (BEA), directly impacting its property loan portfolio and overall credit risk exposure. Challenges within mainland China's property sector, such as developer defaults and declining sales, can lead to increased non-performing loans for banks like BEA.

In 2023, Hong Kong's property market experienced a downturn, with property prices falling by approximately 5-10% year-on-year depending on the segment, which can affect collateral values for BEA's mortgage book. Furthermore, subdued local demand in Hong Kong, influenced by higher interest rates and economic uncertainty, limits opportunities for new loan growth in the real estate sector.

Inflationary Pressures and Consumer Spending

Inflationary pressures in Hong Kong have remained relatively mild, impacting consumer spending patterns. This can influence retail banking activities and the demand for wealth management products. For instance, while stable prices generally bolster economic confidence, a slowdown in private consumption could affect deposit growth and fee income for the Bank of East Asia (BEA).

Consumer spending in Hong Kong showed resilience in early 2024. For example, retail sales in the first quarter of 2024 saw a year-on-year increase of 2.3% in nominal terms. This moderate growth suggests that while consumers are not facing severe price shocks, their spending habits are evolving.

- Consumer Price Index (CPI) Growth: Hong Kong's CPI saw a modest increase of 1.7% in the first half of 2024, indicating controlled inflation.

- Retail Sales Performance: Despite inflation, retail sales for the first quarter of 2024 grew by 2.3% year-on-year, showing continued consumer engagement.

- Impact on Deposits: A sustained, albeit mild, inflationary environment could encourage consumers to seek higher-yield deposit accounts, potentially impacting BEA's net interest margin.

- Wealth Management Demand: Shifting consumer confidence, influenced by inflation and economic outlook, directly affects demand for wealth management services and products.

Global Economic Slowdown Risks

As an international financial services group, Bank of East Asia (BEA) faces significant headwinds from the risk of a global economic slowdown. This downturn can directly affect its core businesses, particularly trade finance and cross-border transactions, as global commerce contracts. The overall investment climate also deteriorates, making new market expansion and risk assessment more critical.

Several indicators point to this heightened risk. For instance, the International Monetary Fund (IMF) projected global growth to moderate to 3.2% in 2024, a slight decrease from 3.5% in 2023, signaling a cooling global economy. Furthermore, geopolitical tensions and persistent inflation in major economies continue to cast a shadow over future economic activity.

- Global Growth Forecasts: The IMF's forecast of 3.2% global growth for 2024 highlights a slowdown compared to previous years.

- Trade Finance Impact: A contraction in global trade directly reduces the volume of trade finance activities, a key revenue stream for banks like BEA.

- Investment Climate: Economic uncertainty and potential recessions in key markets can stifle foreign direct investment and reduce demand for banking services.

- Geopolitical Risks: Ongoing conflicts and trade disputes add further layers of uncertainty, potentially disrupting supply chains and dampening economic sentiment.

Economic factors are crucial for Bank of East Asia (BEA), with growth in Hong Kong and mainland China shaping its performance. For 2025, moderate GDP growth is anticipated in both regions, suggesting continued but measured expansion opportunities for BEA in lending and wealth management.

Interest rates, influenced by global and local monetary policies, directly impact BEA's net interest margin. Stable rates, as seen in mid-2024, can support margins but higher rates might temper loan demand and affect the property market.

The real estate markets in Hong Kong and mainland China present a significant risk, with challenges in China's property sector potentially increasing BEA's non-performing loans. Hong Kong's property market has seen price declines, impacting collateral values and new loan growth opportunities.

Mild inflation in Hong Kong influences consumer spending and demand for banking products. While stable prices support confidence, a slowdown in consumption could affect deposit growth and fee income for BEA.

| Economic Indicator | Region | 2024 (Est./Actual) | 2025 (Forecast) | Impact on BEA |

|---|---|---|---|---|

| GDP Growth | Hong Kong | 3.2% | 2.5-3.0% | Steady growth opportunities |

| GDP Growth | Mainland China | ~5.0% | 4.5-5.0% | Continued expansion potential |

| Interest Rate Environment | Hong Kong | Stable (aligned with Fed) | Likely stable/cautious changes | Supports NIM, but potential for slower loan growth |

| Property Market Performance | Hong Kong | Downturn (5-10% price drop in 2023) | Mixed outlook, potential stabilization | Affects loan portfolio and collateral values |

| Consumer Price Index (CPI) Growth | Hong Kong | 1.7% (H1 2024) | Projected mild increase | Influences consumer spending and deposit behavior |

Preview the Actual Deliverable

Bank of East Asia PESTLE Analysis

The preview shown here is the exact Bank of East Asia PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank, providing actionable insights for strategic planning.

Sociological factors

Consumer banking preferences are rapidly shifting, with a pronounced demand for digital services, mobile payment solutions, and highly personalized financial advice across Hong Kong and mainland China. This trend is particularly strong among younger demographics who are digitally native and expect seamless online experiences.

Bank of East Asia (BEA) must therefore prioritize ongoing investment in its digital platforms and mobile banking capabilities to cater to these evolving expectations. For instance, by the end of 2024, mobile banking penetration in Hong Kong was over 80%, highlighting the critical need for robust digital offerings.

Hong Kong's demographic shift towards an older population, with over 20% of its residents aged 65 and above as of 2024, presents a dual-edged sword for the Bank of East Asia (BEA). This trend directly fuels a substantial demand for specialized wealth management, retirement planning, and estate or succession planning services.

BEA is well-positioned to capitalize on this evolving market by leveraging its established wealth management capabilities. The increasing need for financial security among the elderly and those approaching retirement creates a significant opportunity for BEA to offer tailored financial solutions, including investment advisory, annuity products, and trust services, thereby meeting the unique needs of this growing demographic.

High digital literacy and increasing adoption rates of FinTech services across Hong Kong and mainland China are reshaping customer expectations. In 2024, it's estimated that over 80% of Hong Kong's population uses smartphones, with a significant portion actively engaging with mobile banking and digital payment solutions. This trend is even more pronounced in mainland China, where super-apps have integrated financial services seamlessly into daily life.

Consequently, the Bank of East Asia (BEA) must prioritize the robustness, user-friendliness, and security of its digital platforms. Failure to offer a superior digital experience could lead to customer attrition, as individuals increasingly gravitate towards competitors offering more intuitive and convenient online and mobile banking services. BEA's ability to innovate and adapt its digital offerings is paramount for retaining and attracting clients in this intensely competitive digital landscape.

Demand for Sustainable and Ethical Banking

Societal expectations are shifting, with a growing emphasis on environmental, social, and governance (ESG) factors influencing consumer choices and investment decisions. This trend is directly impacting the banking sector, driving demand for sustainable finance products and ethically sound banking operations.

Bank of East Asia (BEA) has recognized this evolving landscape. For instance, in 2023, BEA announced its commitment to achieving carbon neutrality in its operations by 2030, aligning with global sustainability goals. This proactive stance on ESG initiatives, coupled with transparent reporting on its progress, is crucial for enhancing brand reputation and attracting a segment of customers and investors who prioritize socially responsible businesses.

- Growing ESG Awareness: A significant portion of consumers, particularly younger demographics, are actively seeking out financial institutions that demonstrate a commitment to sustainability.

- Impact on Investment: In 2024, sustainable investment funds are projected to continue their strong growth trajectory, with investors increasingly scrutinizing the ESG performance of banks.

- BEA's ESG Strategy: BEA's focus on areas like green financing and community engagement aims to meet this demand, potentially leading to increased customer loyalty and access to capital.

- Reputational Advantage: Banks that effectively integrate ESG principles into their core business models are likely to gain a competitive edge and build stronger relationships with stakeholders.

Workforce Demographics and Talent Acquisition

The banking industry, including institutions like Bank of East Asia (BEA), is grappling with significant hurdles in attracting and keeping skilled employees, especially in high-demand fields such as financial technology (FinTech), cybersecurity, and environmental, social, and governance (ESG) expertise. This talent gap is a critical concern for future expansion and innovation. For instance, a 2024 report indicated a global shortage of cybersecurity professionals, with demand projected to outpace supply by 3.5 million by the end of the year, directly impacting financial institutions' ability to protect sensitive data.

To address this, BEA must prioritize robust investment in upskilling its current workforce, equipping them with the necessary competencies for evolving digital landscapes and sustainable finance practices. Simultaneously, implementing targeted and effective recruitment strategies is paramount to securing the specialized talent essential for navigating the complexities of the modern financial sector and ensuring long-term competitiveness.

- Talent Shortage in Key Sectors: The global demand for FinTech, cybersecurity, and ESG specialists significantly outstrips supply, creating a competitive hiring environment.

- Upskilling Imperative: Investing in continuous learning and development for existing staff is crucial for adapting to technological advancements and regulatory changes.

- Strategic Recruitment: BEA needs to refine its recruitment approach to attract niche talent, potentially through partnerships with educational institutions or specialized recruitment agencies.

- Retention Strategies: Competitive compensation, career development opportunities, and a positive work culture are vital for retaining valuable employees in the face of industry-wide competition.

The increasing societal demand for ethical and sustainable business practices directly influences banking operations. Consumers, especially younger generations, are actively seeking financial institutions that align with their values, driving a need for green financing and transparent ESG reporting.

Bank of East Asia's commitment to carbon neutrality by 2030, announced in 2023, demonstrates an understanding of this trend. This focus on sustainability is crucial for building brand loyalty and attracting socially conscious investors and customers.

Technological factors

The Bank of East Asia (BEA) must prioritize digital transformation to stay competitive in the evolving financial landscape. By mid-2024, global banks were channeling significant resources into digital upgrades, with mobile banking adoption rates in key markets like Hong Kong and mainland China exceeding 70% for many institutions. This trend underscores the imperative for BEA to bolster its mobile banking platforms and online services.

Investing in digital customer journeys is crucial for BEA to streamline operations and cut costs. For instance, enhanced online account opening processes can reduce manual handling by up to 60%, directly impacting operational efficiency. Furthermore, a superior digital customer experience, characterized by intuitive interfaces and personalized services, is a key differentiator, with studies in 2024 indicating that over 85% of customers consider digital convenience a primary factor when choosing a bank.

As digital banking becomes more prevalent, Bank of East Asia (BEA) faces escalating cybersecurity threats and the critical need for robust data protection. The increasing sophistication of cyberattacks means that safeguarding customer information and financial transactions is paramount. In 2024, global financial institutions reported an average of 150 cyber incidents per organization, highlighting the pervasive nature of these risks.

To counter these threats, BEA must continuously invest in advanced cybersecurity measures and stringent data protection protocols. This proactive approach is essential not only for maintaining customer trust but also for ensuring compliance with evolving data privacy regulations, such as those impacting financial data handling in key markets.

Bank of East Asia (BEA) is increasingly integrating artificial intelligence (AI) and big data analytics to sharpen its competitive edge. These technologies are pivotal for enhancing risk management frameworks, improving the accuracy of fraud detection systems, and delivering highly personalized customer experiences. For instance, by analyzing vast datasets, BEA can better predict market trends and customer needs, leading to more targeted product offerings.

The strategic adoption of AI and big data is expected to significantly boost operational efficiency across BEA’s operations. In 2024, many financial institutions reported substantial cost savings and revenue growth through AI-driven process automation and data-driven decision-making. BEA's investment in these areas aims to replicate such successes, optimizing everything from loan processing to customer service interactions, thereby streamlining operations and reducing overheads.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) are fundamentally reshaping the financial services landscape. These innovations are particularly impactful for cross-border payments, trade finance, and the burgeoning market for digital assets. BEA's active participation in pilot programs for stablecoin transfers and its development of digital asset custody services demonstrate a clear strategy to harness these transformative technologies for enhanced operational efficiency and future expansion.

The global market for blockchain in financial services was projected to reach over $10 billion by 2024, highlighting the significant investment and adoption occurring. BEA's strategic moves position it to capitalize on this growth, potentially streamlining transaction processes and offering new digital financial products. This proactive stance is crucial for maintaining competitiveness in an increasingly digitized financial ecosystem.

- Cross-border Payments: DLT offers the potential for faster, cheaper, and more transparent international money transfers, a key area for global banks like BEA.

- Trade Finance: Blockchain can digitize and automate complex trade finance processes, reducing paperwork and risk for all parties involved.

- Digital Assets: BEA's involvement in stablecoins and digital asset custody suggests an anticipation of increased institutional demand for managing and transacting digital currencies and tokenized assets.

Competition from FinTech Startups

The financial services landscape is increasingly shaped by agile FinTech startups and established tech giants entering the market. These players often offer innovative, user-friendly digital solutions that challenge traditional banking models. For Bank of East Asia (BEA), this means a constant need to adapt and enhance its digital offerings to remain competitive.

BEA's strategy must involve both internal innovation and strategic partnerships with FinTech companies. By collaborating, BEA can leverage new technologies and business models to develop compelling products and services. This approach is crucial for meeting the evolving expectations of customers who are increasingly drawn to seamless digital experiences and personalized financial solutions.

- FinTech investment in Asia-Pacific reached $11.7 billion in the first half of 2024, indicating intense competition.

- Digital-only banks in the region are gaining traction, with some reporting significant customer growth in 2024.

- BEA's digital transformation initiatives aim to streamline customer onboarding and transaction processes, mirroring FinTech efficiency.

- Partnerships with FinTechs can provide BEA with access to specialized technologies like AI-driven credit scoring or blockchain-based payment systems.

Technological advancements are fundamentally reshaping banking, pushing institutions like Bank of East Asia (BEA) towards digital-first strategies. By mid-2024, mobile banking adoption rates in key Asian markets surpassed 70%, underscoring the need for BEA to enhance its digital platforms. This digital imperative extends to streamlining customer onboarding, a process that can be made up to 60% more efficient through online solutions.

The integration of AI and big data analytics is critical for competitive advantage, enabling better risk management and personalized customer experiences. Financial institutions globally reported significant cost savings and revenue growth in 2024 through AI-driven automation. BEA's strategic adoption of these technologies aims to optimize operations, from loan processing to customer service.

Blockchain and DLT are revolutionizing financial services, particularly in cross-border payments and trade finance. The global market for blockchain in finance was projected to exceed $10 billion by 2024. BEA's engagement with stablecoins and digital asset custody positions it to capitalize on this growth, enhancing transaction efficiency and offering new digital products.

The rise of FinTechs necessitates continuous innovation and strategic partnerships for BEA. FinTech investment in Asia-Pacific reached $11.7 billion in the first half of 2024, highlighting intense competition. Collaborating with FinTechs allows BEA to access specialized technologies and develop compelling digital offerings that meet evolving customer expectations.

| Technology Area | Impact on BEA | 2024 Data/Projections |

|---|---|---|

| Digital Transformation | Enhanced customer experience, operational efficiency | 70%+ mobile banking adoption in key markets; 60% potential reduction in manual onboarding |

| AI & Big Data | Improved risk management, personalized services, cost savings | Global financial institutions reported significant revenue growth via AI in 2024 |

| Blockchain & DLT | Faster cross-border payments, streamlined trade finance, digital asset services | Global blockchain in finance market projected >$10 billion in 2024 |

| FinTech Competition | Need for innovation and partnerships | $11.7 billion FinTech investment in APAC H1 2024; rising digital-only bank traction |

Legal factors

The Hong Kong Monetary Authority (HKMA) governs the banking sector with a strong emphasis on capital adequacy, liquidity, and operational resilience. For The Bank of East Asia (BEA), staying compliant with these dynamic HKMA guidelines is crucial for maintaining its banking license and overall operational stability.

In 2024, the HKMA continued to refine its supervisory approach, particularly concerning climate-related financial risks and digital banking. BEA's adherence to these updated directives, including stress testing scenarios and enhanced cybersecurity measures, directly impacts its ability to operate and grow within the Hong Kong market.

Bank of East Asia (BEA) navigates a complex web of regulations operating across Hong Kong, mainland China, and international markets. Compliance with differing financial regulations, anti-money laundering laws, and data privacy requirements in each jurisdiction is paramount to avoid significant penalties and maintain operational integrity. For instance, China's evolving data localization rules require careful management of cross-border data flows, impacting how BEA handles customer information and transactions.

Bank of East Asia (BEA) operates under increasingly rigorous Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws, which are constantly evolving globally and locally. For instance, in 2024, regulatory bodies worldwide continued to enhance scrutiny, with significant updates to beneficial ownership reporting and transaction monitoring requirements. Failure to comply can lead to substantial fines, with penalties in the financial sector often reaching millions of dollars for non-adherence.

To navigate these complex legal landscapes, BEA must invest heavily in robust internal controls, sophisticated reporting systems, and comprehensive employee training to effectively combat financial crime. This proactive approach is crucial for safeguarding the bank's reputation and avoiding severe financial penalties and operational disruptions, ensuring continued trust and stability in its operations.

Data Privacy and Protection Regulations

As Bank of East Asia (BEA) expands its digital offerings, navigating increasingly strict data privacy and protection regulations is paramount. China's Data Security Law (DSL), implemented in September 2021, and the Personal Information Protection Law (PIPL), effective November 2021, set rigorous standards for data handling and cross-border transfers. BEA must meticulously adhere to these laws to safeguard customer information, thereby fostering trust and mitigating the risk of substantial penalties and reputational harm.

Compliance involves robust data governance frameworks and secure data management practices. Failure to comply can result in significant financial penalties; for instance, violations of PIPL can lead to fines of up to 50 million yuan or 5% of the previous year's annual turnover. BEA's commitment to data protection is therefore not just a legal obligation but a critical component of its business strategy in the evolving digital landscape of 2024 and beyond.

- China's Data Security Law (DSL) and Personal Information Protection Law (PIPL) impose stringent data handling requirements.

- BEA faces potential fines of up to 5% of annual turnover for PIPL violations.

- Adherence to these regulations is crucial for maintaining customer trust and avoiding reputational damage.

- The bank must invest in advanced data security measures and compliance protocols.

Consumer Protection Laws in Financial Services

Consumer protection is increasingly paramount for financial regulators globally, with a strong emphasis on fair treatment, enhanced transparency, and robust redress mechanisms for customers. The Bank of East Asia (BEA) must diligently comply with these evolving regulations across its retail banking, wealth management, and insurance offerings to safeguard consumer rights and uphold public confidence. For instance, in Hong Kong, the Securities and Futures Commission (SFC) actively enforces investor protection rules, with a reported 1,151 investor complaints handled in 2023, highlighting the critical need for compliance.

BEA's adherence to these consumer protection laws is vital for maintaining its reputation and operational integrity. This includes ensuring clear product disclosures, preventing predatory lending practices, and providing accessible channels for dispute resolution.

- Fairness in Product Suitability: Ensuring that wealth management products are aligned with client risk profiles and financial goals, as mandated by regulations like the SFC's Code of Conduct.

- Transparency in Fees and Charges: Clearly communicating all associated costs for banking services and investment products to prevent hidden charges.

- Data Privacy and Security: Complying with stringent data protection laws, such as Hong Kong's Personal Data (Privacy) Ordinance, to safeguard customer information.

- Effective Complaint Handling: Establishing efficient and transparent processes for addressing customer grievances and providing timely resolutions.

The Bank of East Asia (BEA) operates under a stringent regulatory framework in Hong Kong, overseen by the Hong Kong Monetary Authority (HKMA). In 2024, the HKMA continued to emphasize capital adequacy, with Basel III Endgame reforms progressing, requiring banks to hold more capital against riskier assets. BEA's compliance with these evolving capital requirements is essential for its financial stability and ability to lend.

Furthermore, BEA must navigate China's evolving financial regulations, including those related to cross-border data flows and anti-money laundering (AML) efforts. For instance, China's ongoing efforts to combat financial crime mean that BEA must maintain robust AML/CTF systems, with penalties for non-compliance potentially reaching significant financial thresholds, as seen in global banking fines averaging hundreds of millions of dollars for major breaches in recent years.

Consumer protection remains a key legal focus, with regulators like Hong Kong's Securities and Futures Commission (SFC) enforcing rules on product suitability and transparency. In 2023, the SFC reported handling 1,151 investor complaints, underscoring the importance for BEA to ensure clear disclosures and fair treatment of its retail and wealth management clients to avoid regulatory action and maintain customer trust.

Environmental factors

Climate change presents significant physical risks, such as extreme weather events impacting properties in BEA's loan portfolio, and transitional risks, like policy changes affecting carbon-intensive industries where the bank has exposure. For instance, a significant portion of the global economy remains reliant on fossil fuels, creating potential for stranded assets if decarbonization accelerates rapidly.

BEA must embed climate risk assessments into its core lending and investment processes, evaluating the resilience of borrowers and projects to both physical and transitional impacts. This includes stress-testing portfolios against various climate scenarios, a practice gaining traction among leading financial institutions globally.

Developing proactive strategies to mitigate these identified risks is crucial. This could involve shifting lending towards green initiatives, engaging with clients to support their transition to lower-carbon models, and divesting from sectors with unmanageable climate exposure, aligning with growing investor demand for sustainable finance.

Increasing regulatory and stakeholder pressure is driving demand for comprehensive ESG reporting. Bank of East Asia (BEA) is expected to provide transparent information on its environmental footprint, social impact, and governance practices.

Aligning with international standards like the International Sustainability Standards Board (ISSB) is crucial for meeting market expectations and attracting sustainable investments. For instance, as of early 2024, many global financial institutions are enhancing their climate-related disclosures, with a significant portion aiming for ISSB compliance by 2025.

The global movement towards a low-carbon economy is significantly boosting the demand for green finance products, such as green loans and bonds. The Bank of East Asia (BEA) is well-positioned to capitalize on this trend by expanding its green and sustainable finance offerings. This expansion not only supports clients in their transition to more sustainable operations but also opens up new avenues for revenue generation.

Operational Environmental Footprint

Bank of East Asia (BEA) is actively working to reduce its own operational environmental footprint, focusing on areas like energy consumption and waste generation as part of its broader sustainability commitment. This proactive approach demonstrates responsible corporate citizenship.

BEA has set ambitious targets to achieve net-zero operations by 2030. For instance, in 2023, the bank reported a 15% reduction in its Scope 1 and Scope 2 greenhouse gas emissions compared to its 2020 baseline, showcasing tangible progress towards this goal. This focus on efficiency can also unlock significant cost savings.

- Energy Efficiency Initiatives: BEA has invested in upgrading its branches and offices with energy-efficient lighting and HVAC systems, contributing to a 10% decrease in overall electricity consumption across its Hong Kong operations in the past year.

- Waste Reduction Programs: The bank implemented a comprehensive paperless initiative, resulting in a 25% reduction in paper usage in 2023, alongside enhanced recycling programs for electronic waste and general office materials.

- Sustainable Procurement: BEA is increasingly prioritizing suppliers with strong environmental credentials, ensuring that its procurement practices align with its sustainability objectives.

- Water Conservation: Efforts are underway to monitor and reduce water usage in its facilities, with pilot programs showing a potential for 5% water savings in targeted branches.

Reputational Risks from Environmental Incidents

Bank of East Asia (BEA) faces significant reputational risks if it fails to adequately address environmental concerns or participates in projects with substantial negative environmental consequences. Public perception and the trust of stakeholders, including customers and investors, are directly tied to a bank's commitment to environmental stewardship and responsible financing practices.

For instance, a major oil spill linked to a project financed by BEA could lead to widespread public outcry and boycotts, impacting its customer base and market value. In 2024, a significant portion of consumers, particularly younger demographics, indicated they would actively choose financial institutions with demonstrable environmental commitments, with some reports suggesting as high as 60% of millennials consider ESG factors in their banking choices.

BEA's proactive engagement in sustainable finance and green initiatives is therefore not just a matter of corporate social responsibility but a critical element for maintaining its brand integrity and competitive edge. This includes transparent reporting on its financed emissions and setting ambitious targets for reducing the environmental footprint of its loan portfolios.

Environmental factors are increasingly shaping the banking landscape, with climate change posing both risks and opportunities for institutions like Bank of East Asia (BEA). Growing regulatory scrutiny and investor demand for Environmental, Social, and Governance (ESG) performance mean that banks must proactively manage their environmental impact and financing activities.

BEA is actively pursuing net-zero operations by 2030, having already achieved a 15% reduction in Scope 1 and 2 emissions in 2023 against a 2020 baseline. The bank is also enhancing its green finance offerings to meet the rising demand for sustainable investment products.

Reputational risk is a significant concern, as demonstrated by consumer preferences in 2024, where up to 60% of millennials consider ESG factors in their banking choices. BEA's commitment to environmental stewardship is therefore crucial for maintaining brand integrity and market competitiveness.

| Metric | 2023 Data | Target | Notes |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 15% (vs. 2020 baseline) | Net-Zero by 2030 | Tangible progress towards operational sustainability. |

| Paper Usage Reduction | 25% | Ongoing | Result of paperless initiatives. |

| Electricity Consumption Reduction (HK Operations) | 10% | Ongoing | Driven by energy-efficient upgrades. |

| Green Finance Offerings | Expanding | Growth Area | Capitalizing on market demand. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bank of East Asia is built on a comprehensive review of official financial reports, regulatory updates from Hong Kong and mainland China, and economic forecasts from reputable institutions like the IMF and World Bank. We also incorporate market research on technological advancements and demographic shifts impacting the banking sector.