Bank of East Asia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of East Asia Bundle

The Bank of East Asia faces significant competitive pressures, with moderate rivalry among existing banks and a growing threat from digital disruptors. Buyer power is substantial, as customers can easily switch between financial institutions. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Bank of East Asia’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

For the Bank of East Asia (BEA), its primary suppliers are its capital providers. These include individual and corporate depositors who entrust their funds to the bank, as well as institutional investors who supply equity and debt capital.

In the current financial landscape of 2024, with numerous alternative investment avenues available and a general trend of rising interest rates, depositors often have significant bargaining power. They may demand higher interest rates on their deposits, directly increasing BEA's cost of funds. For instance, in early 2024, deposit rates across many markets saw upward adjustments, reflecting central bank policies.

However, BEA can mitigate this supplier power through several strategies. Cultivating strong brand loyalty among its customer base and offering a diverse range of attractive financial products and services can help retain deposits even when competitors offer slightly higher rates. This customer stickiness reduces the immediate impact of rising interest rate demands.

Technology and software vendors hold considerable bargaining power over banks like Bank of East Asia (BEA) due to the mission-critical nature of their services. BEA's reliance on advanced IT infrastructure, core banking systems, and cybersecurity solutions means that disruptions from these vendors can severely impact operations and customer trust.

The high switching costs associated with changing core banking systems or specialized fintech solutions further empower these vendors. For instance, a bank might invest millions in integrating a new system, making a pivot to a competitor a costly and time-consuming endeavor. BEA's ongoing digital transformation, including its reported partnership for CRM solutions, underscores this dependency.

The financial services industry, particularly in a dynamic global center like Hong Kong, relies heavily on professionals with specialized skills in areas like wealth management, risk assessment, data analysis, and the burgeoning field of digital banking. For the Bank of East Asia (BEA), the availability and cost of this human capital directly impacts its operational efficiency and profitability.

A scarcity of these highly qualified individuals can lead to increased salary and benefit expectations, thereby raising BEA's overall operating expenses. In 2024, the competition for top-tier financial talent remained fierce, with many institutions offering enhanced compensation packages to attract and retain essential personnel, directly influencing the bargaining power of skilled employees.

Regulatory Bodies and Central Banks

Regulatory bodies, such as the Hong Kong Monetary Authority (HKMA), and central banks act as powerful gatekeepers for banks like the Bank of East Asia (BEA). They effectively supply the essential license to operate and shape the entire banking landscape through their directives. Their influence is profound, as they set the rules of engagement, including capital adequacy ratios and operational standards, which directly affect BEA's costs and strategic maneuvering.

The increasing stringency of regulations, encompassing areas like data privacy, anti-money laundering (AML) compliance, and robust risk management frameworks, significantly amplifies the bargaining power of these institutions. For instance, in 2024, the HKMA continued to emphasize enhanced cybersecurity measures and data governance, requiring substantial investments from banks to ensure compliance. Failure to meet these evolving demands can lead to penalties or even the revocation of operating licenses, underscoring the immense leverage regulatory bodies hold over BEA.

- Regulatory Oversight: The HKMA mandates specific capital requirements, such as the Basel III framework, which directly influence BEA's financial structure and lending capacity.

- Compliance Costs: Meeting evolving AML and Know Your Customer (KYC) regulations in 2024 necessitates ongoing investment in technology and personnel, increasing operational expenses for BEA.

- Operational Flexibility: Central bank policies on interest rates and liquidity management, while not direct suppliers, profoundly impact BEA's profitability and strategic planning.

- Market Access: The ability to operate in key financial markets is contingent upon adherence to the rules set by relevant regulatory authorities, granting them significant control.

Interbank Market and Funding Sources

Banks, including the Bank of East Asia (BEA), frequently tap into the interbank market for their short-term funding needs. This market acts as a crucial liquidity reservoir, enabling banks to manage their daily cash flow. The interest rates and terms offered in this market are highly sensitive to broader economic factors and central bank policies.

For BEA, the bargaining power of suppliers in the interbank market is directly tied to the prevailing cost of borrowing. When liquidity is scarce or interest rates are on an upward trend, the entities providing these funds gain significant leverage. For instance, in the first half of 2024, global central banks continued to navigate inflationary pressures, leading to generally higher interbank lending rates compared to previous years, thus increasing the cost of funds for banks like BEA.

- Interbank Market Reliance: BEA, like many banks, depends on the interbank market for essential short-term liquidity.

- Cost of Funding Impact: Fluctuations in interbank rates, driven by monetary policy and economic conditions, directly influence BEA's borrowing costs.

- Increased Supplier Power: During periods of tight liquidity or rising interest rates, the entities supplying funds to BEA gain greater bargaining power.

- 2024 Context: In the first half of 2024, a higher interest rate environment globally meant increased borrowing costs for banks, amplifying the bargaining power of interbank lenders.

The bargaining power of suppliers for the Bank of East Asia (BEA) is a significant factor influencing its cost structure and operational flexibility. Key suppliers include capital providers like depositors and institutional investors, technology and software vendors, skilled human capital, regulatory bodies, and participants in the interbank lending market.

In 2024, depositors and institutional investors wielded considerable power, demanding higher interest rates due to alternative investment opportunities and rising global interest rates. Technology vendors, essential for BEA's digital transformation and core banking systems, also hold strong leverage due to high switching costs. The competition for specialized financial talent in 2024 drove up salary expectations, increasing BEA's personnel costs.

Regulatory bodies like the Hong Kong Monetary Authority (HKMA) exert immense influence by setting operational standards and capital requirements, with compliance costs rising due to stricter data privacy and AML regulations. The interbank market, crucial for BEA's short-term liquidity, saw increased borrowing costs in the first half of 2024 due to a higher interest rate environment, amplifying the power of lenders.

| Supplier Type | 2024 Influence Factors | Impact on BEA | Mitigation Strategies |

|---|---|---|---|

| Depositors/Capital Providers | Rising interest rates, alternative investments | Increased cost of funds | Brand loyalty, diverse product offerings |

| Technology Vendors | Mission-critical systems, high switching costs | Dependency, potential disruption costs | Strategic partnerships, phased upgrades |

| Skilled Human Capital | Scarcity of talent, competitive compensation | Higher operating expenses | Employee development programs, attractive benefits |

| Regulatory Bodies (e.g., HKMA) | Stringent compliance (AML, data privacy), capital adequacy | Increased compliance costs, operational constraints | Proactive compliance, robust risk management |

| Interbank Market Lenders | Liquidity conditions, central bank policies | Volatile borrowing costs | Diversified funding sources, efficient treasury management |

What is included in the product

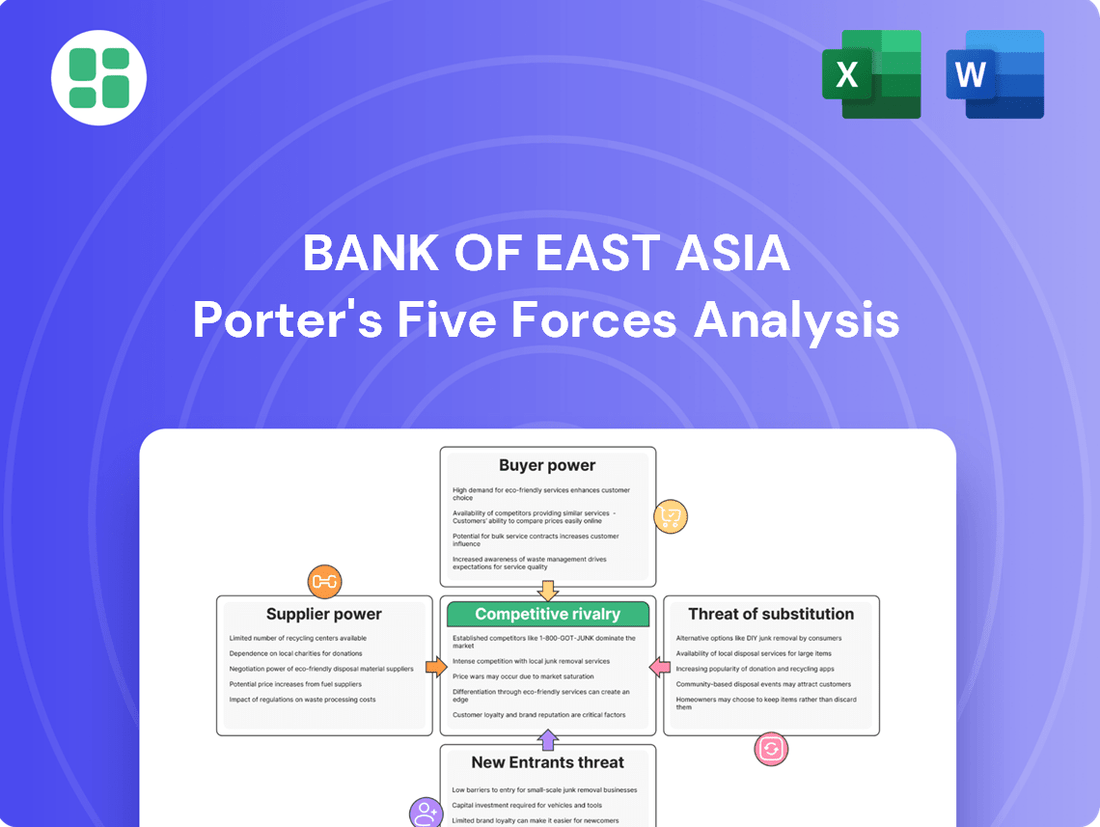

This analysis dissects the competitive landscape for the Bank of East Asia, examining the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitute products and services.

Instantly identify and mitigate competitive threats by visualizing the Bank of East Asia's Porter's Five Forces with a dynamic, interactive dashboard.

Customers Bargaining Power

For basic banking needs like savings or checking accounts, customers face minimal hurdles when switching providers. Digital tools now make opening new accounts and closing old ones incredibly straightforward. In 2024, many banks reported significant increases in digital account opening, with some seeing over 70% of new accounts initiated online, highlighting this trend.

This low-friction environment means consumers can easily shop around for the best interest rates and lowest fees. For Bank of East Asia (BEA), this translates into constant pressure to keep its pricing competitive and service levels high to retain its customer base. If BEA's offerings aren't perceived as superior or at least on par with competitors, customers are likely to move their funds elsewhere.

Customers today possess vast amounts of information thanks to online platforms, financial comparison sites, and social media. This allows them to effortlessly compare interest rates, loan conditions, and service quality from various banks, including Bank of East Asia. In 2024, the proliferation of fintech apps offering real-time rate comparisons further amplified this trend.

This heightened transparency directly boosts customer bargaining power, compelling banks like BEA to offer more competitive pricing and superior service to retain their clientele. For instance, a customer can easily find out that the average savings account interest rate in Hong Kong hovered around 0.01% in early 2024, pushing banks to differentiate through other means.

The Bank of East Asia (BEA) faces considerable bargaining power from its corporate and wealth management clients. These sophisticated customers, often managing substantial assets, can leverage their significant deposit and investment volumes to negotiate more favorable terms, including reduced fees and higher interest rates. For instance, in 2023, BEA's corporate banking segment, which includes these high-value clients, represented a significant portion of its overall revenue, making it crucial for the bank to manage these relationships effectively.

Demand for Seamless Digital Experiences

Customers today demand digital experiences that are smooth and easy to use. This means banks need to offer intuitive mobile apps and online tools where people can manage their finances without needing to visit a branch. For instance, a significant portion of banking transactions are now happening digitally. In 2024, it's estimated that over 70% of all retail banking transactions in developed markets are conducted through digital channels.

Banks that fail to keep up with these digital expectations are at risk of losing customers. Competitors, particularly fintech companies and newer digital-only banks, often excel in providing superior user experiences and convenience. These agile players are attracting customers by focusing heavily on user-friendly interfaces and seamless integration of financial services, making it harder for traditional banks to retain market share.

- Digital Transaction Growth: Over 70% of retail banking transactions in developed markets occurred digitally in 2024.

- Customer Expectations: Demand for intuitive mobile apps and online self-service options is a primary driver of customer choice.

- Competitive Pressure: Fintechs and virtual banks are leveraging superior digital experiences to attract and retain customers.

Influence of Economic Conditions on Borrowing Demand

The bargaining power of customers is significantly influenced by prevailing economic conditions. During times of economic slowdown or uncertainty, individuals and businesses tend to become more cautious with their spending and borrowing. This reduced demand for loans and credit naturally shifts the power balance, giving borrowers more leverage to negotiate favorable lending terms with banks like the Bank of East Asia (BEA).

BEA, with its operations in key markets such as Hong Kong and mainland China, has experienced this dynamic firsthand. Subdued loan demand in these regions in recent periods has amplified the bargaining power of its customers. For instance, in Hong Kong, the aggregate loan growth for authorized institutions slowed to approximately 1.2% in the first half of 2023, indicating a cautious lending environment where customers can more readily seek better rates and terms.

- Economic Uncertainty: Periods of economic downturn lead to decreased demand for credit, empowering borrowers.

- Reduced Loan Demand: In markets like Hong Kong and mainland China, subdued loan demand gives customers more negotiation power with banks like BEA.

- Negotiating Terms: Customers can leverage lower demand to secure more favorable interest rates and loan conditions.

- BEA's Market Position: The bank must adapt its strategies to address increased customer leverage in challenging economic climates.

Customers at Bank of East Asia (BEA) wield considerable power due to low switching costs and readily available information. The ease of opening new accounts digitally, with over 70% of new accounts initiated online in 2024, means customers can quickly move to competitors offering better rates or lower fees. This forces BEA to maintain competitive pricing and high service standards to retain its client base.

The proliferation of fintech apps and comparison sites in 2024 has further amplified customer awareness of market rates, such as the average savings account interest rate in Hong Kong hovering around 0.01% in early 2024. This transparency directly pressures BEA to offer superior value to keep customers engaged.

High-value corporate and wealth management clients, managing substantial assets, can negotiate more favorable terms due to their significant deposit volumes. In 2023, corporate banking was a vital revenue stream for BEA, underscoring the importance of appeasing these powerful clients.

| Factor | Impact on BEA | 2024 Data/Trend |

|---|---|---|

| Switching Costs | Low | 70%+ of new accounts opened digitally |

| Information Availability | High | Fintech apps providing real-time rate comparisons |

| Customer Expectations | High Digital Experience | 70%+ of retail transactions are digital (developed markets) |

| Economic Conditions | Influential | 1.2% aggregate loan growth in Hong Kong (H1 2023) |

Same Document Delivered

Bank of East Asia Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for The Bank of East Asia, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You will receive this exact, professionally formatted analysis, providing actionable insights into the bank's strategic positioning within the financial services industry.

Rivalry Among Competitors

The Hong Kong banking sector is intensely competitive, featuring a significant number of licensed banks. This includes global institutions, prominent local banks, and an increasing presence of virtual banks, all vying for customers across retail, corporate, and wealth management services.

In 2024, Hong Kong continued to host over 150 licensed banks, a testament to its open financial market. This crowded environment forces established players like Bank of East Asia to constantly innovate and differentiate their offerings to capture and retain market share amidst aggressive pricing and service competition.

Competitive rivalry in the banking sector is intensely fueled by a relentless pursuit of digital transformation and innovation. Banks are pouring significant resources into areas like artificial intelligence, advanced mobile banking capabilities, and sophisticated digital platforms. This strategic focus aims to elevate customer experiences and streamline internal operations, creating a highly competitive landscape where technological prowess is a key differentiator.

Bank of East Asia (BEA) itself is actively participating in this digital race. Their partnership to implement a customer relationship management (CRM) solution underscores their commitment to leveraging technology for a competitive edge. This reflects the broader industry trend where staying ahead in digital capabilities is crucial for attracting and retaining customers in an increasingly tech-driven financial environment.

While regulations can create barriers, Hong Kong's Monetary Authority (HKMA) is actively promoting competition. Initiatives like licensing virtual banks and the Fintech 2025 strategy aim to spur innovation. This environment pushes traditional banks like Bank of East Asia to enhance their services to keep pace with new and existing players.

Pressure on Net Interest Margins (NIMs)

The banking landscape in Hong Kong and mainland China is currently facing significant pressure on Net Interest Margins (NIMs). This is largely driven by global interest rate fluctuations and fierce competition for both customer deposits and loan origination. For instance, in 2024, many banks saw their NIMs compressed as central banks adjusted rates, impacting the cost of funding. This environment forces institutions like the Bank of East Asia to prioritize operational efficiency and actively pursue diversification of their revenue sources beyond traditional lending.

This pressure on NIMs directly impacts profitability, compelling banks to innovate and find new ways to generate income. Key strategies include:

- Focusing on fee-based income: Expanding wealth management, investment banking, and other service offerings to reduce reliance on interest income.

- Enhancing digital capabilities: Investing in technology to streamline operations, reduce costs, and improve customer experience, which can indirectly support margin management.

- Optimizing cost structures: Implementing cost-saving measures across branches and back-office functions to maintain profitability despite lower margins.

Geopolitical and Macroeconomic Headwinds

Geopolitical and macroeconomic headwinds significantly amplify competitive rivalry for Bank of East Asia. Ongoing tensions and economic uncertainties, especially within mainland China, create a more challenging operating landscape. This environment forces banks to compete more aggressively for a potentially contracting pool of prime assets and desirable customers, thereby intensifying the struggle for market share.

The impact of these headwinds is evident in the banking sector's performance. For instance, in 2024, many Asian economies experienced slower GDP growth projections compared to previous years, directly affecting loan demand and the availability of quality investment opportunities. This scarcity naturally drives up competition as financial institutions vie for the same limited business.

- Increased Competition for Scarce Assets: Economic slowdowns reduce the number of creditworthy borrowers and attractive investment deals, forcing banks to compete more fiercely for them.

- Pressure on Margins: Heightened rivalry in a challenging environment can lead to price wars or reduced fees, squeezing profit margins for all players.

- Strategic Realignment: Banks may be forced to re-evaluate their market focus and product offerings to differentiate themselves amidst intense competition.

- Risk of Non-Performing Loans: Economic downturns increase the risk of loan defaults, making the selection of high-quality assets even more critical and competitive.

The competitive rivalry within Hong Kong's banking sector remains exceptionally high, driven by a dense ecosystem of over 150 licensed banks in 2024. This includes global giants, established local players like Bank of East Asia, and emerging virtual banks, all aggressively pursuing market share across diverse financial services.

Digital transformation is a primary battleground, with significant investments in AI and mobile banking aimed at enhancing customer experience and operational efficiency. This technological arms race means banks must continuously innovate to stand out, as seen with Bank of East Asia's strategic CRM implementation.

Furthermore, pressure on Net Interest Margins (NIMs) in 2024, influenced by global interest rate shifts, compels banks to diversify revenue streams into fee-based services and optimize costs. Geopolitical and macroeconomic uncertainties, particularly concerning mainland China's economic performance, further intensify competition for limited quality assets, forcing strategic adjustments.

| Metric | 2023 (Approx.) | 2024 (Projection/Trend) | Impact on Rivalry |

|---|---|---|---|

| Number of Licensed Banks in HK | 150+ | 150+ | Sustains high competition |

| Net Interest Margin (NIM) Pressure | Moderate to High | High | Drives focus on non-interest income and cost control |

| Digital Banking Investment | Significant | Accelerating | Key differentiator, intensifies competition |

| GDP Growth (Major Asian Markets) | Varied, some slowdowns | Projected slower growth in some regions | Reduces prime asset availability, increases competition |

SSubstitutes Threaten

The rise of fintech companies and digital payment platforms presents a significant threat of substitutes for Bank of East Asia (BEA). These agile firms offer specialized, often more convenient and cheaper, alternatives to traditional banking services. For instance, peer-to-peer lending platforms and digital wallets directly substitute basic banking functions like lending and payment processing, potentially eroding BEA's revenue streams, particularly in these areas.

In 2024, the global digital payments market was projected to reach over $1.5 trillion, highlighting the substantial shift towards these substitute services. Fintechs are adept at leveraging technology to provide seamless user experiences, directly challenging BEA's established customer base and its traditional revenue models, especially in areas like cross-border remittances and small personal loans where digital solutions often outperform.

The rise of virtual banks and digital-only financial services presents a substantial threat of substitution for Bank of East Asia (BEA). In Hong Kong, the Hong Kong Monetary Authority (HKMA) has licensed several virtual banks, such as ZA Bank and WeLab Bank, which offer entirely digital banking experiences. These new players often boast lower operating costs due to their lack of physical branches, allowing them to potentially offer more competitive pricing on services and attract customers seeking convenience and speed. For instance, ZA Bank reported over 800,000 customers by the end of 2023, demonstrating rapid adoption of digital-first banking models.

The rise of direct investment and wealth management platforms presents a significant threat of substitutes for traditional banking services. Customers can now bypass banks entirely, opting for online brokerages and robo-advisors to manage their investments. This trend is accelerating, with the global robo-advisor market projected to reach over $2.5 trillion in assets under management by 2027, up from an estimated $1.7 trillion in 2023.

These platforms offer lower fees and greater accessibility, directly competing with the wealth management arms of banks like Bank of East Asia (BEA). For instance, many independent robo-advisors charge annual management fees of 0.25% or less, a stark contrast to the typical 1% or more charged by traditional wealth managers. This cost advantage, coupled with user-friendly interfaces, makes them an attractive alternative for a growing segment of investors.

The impact on BEA's wealth management segment is a reduced reliance on its advisory services and product distribution channels. As more individuals gain confidence in self-directed investing or automated portfolio management, the demand for personalized, bank-led wealth management solutions may diminish. This shift necessitates that banks innovate and offer compelling value propositions to retain their client base in this evolving financial landscape.

Non-Bank Lenders and Private Credit Market

For corporate clients, non-bank financial institutions and the growing private credit market present viable alternatives to traditional bank lending. These entities often provide more tailored financing solutions and quicker decision-making processes, directly substituting for services offered by banks like Bank of East Asia (BEA).

The private credit market has seen significant expansion, offering substantial capital to businesses. For instance, global private debt fundraising reached a record high in 2023, with many firms actively deploying capital. This trend indicates a robust and growing substitute for corporate loan origination, impacting BEA's market share.

- Private Credit Market Growth: Global private debt fundraising hit an all-time high in 2023, demonstrating its increasing appeal as an alternative to bank financing.

- Flexible Terms: Non-bank lenders frequently offer more adaptable loan covenants and repayment structures compared to traditional bank loans, attracting corporate clients seeking customized solutions.

- Speed of Approval: The streamlined processes of many alternative lenders can result in faster loan approvals, a critical factor for businesses needing timely access to capital.

- Impact on BEA: This competitive landscape pressures BEA to innovate its corporate lending products and service delivery to retain market share against these agile substitutes.

Cryptocurrencies and Decentralized Finance (DeFi)

The rise of cryptocurrencies and decentralized finance (DeFi) presents a growing substitute threat to traditional banking services. These digital assets and platforms offer alternative methods for value storage, fund transfers, and even lending and borrowing, bypassing conventional financial institutions. While still characterized by volatility, their potential to disrupt the established banking model is significant.

By mid-2024, the total market capitalization of cryptocurrencies reached over $2.5 trillion, illustrating a substantial shift in digital asset adoption. DeFi applications, in particular, have seen rapid growth, with total value locked (TVL) in DeFi protocols exceeding $100 billion in early 2024, demonstrating increasing user engagement with these non-traditional financial avenues.

- Alternative Value Storage: Cryptocurrencies like Bitcoin offer a digital store of value, independent of traditional fiat currencies and banking systems.

- Decentralized Transactions: DeFi platforms facilitate peer-to-peer lending, borrowing, and trading without intermediaries, potentially reducing reliance on banks for these services.

- Growing Market Share: The increasing market capitalization and TVL in DeFi indicate a growing segment of financial activity moving outside traditional banking channels.

- Systemic Disruption Potential: The long-term impact could involve a significant portion of banking revenue streams, such as transaction fees and interest income, being eroded by these emerging technologies.

The threat of substitutes for Bank of East Asia (BEA) is multifaceted, stemming from fintech innovations, virtual banks, direct investment platforms, alternative lenders, and the burgeoning world of cryptocurrencies and DeFi. These substitutes often offer greater convenience, lower costs, and more specialized services, directly challenging BEA's traditional offerings and revenue streams.

The increasing adoption of digital payment platforms and virtual banks in markets like Hong Kong, where virtual banks have rapidly acquired hundreds of thousands of customers, signifies a clear shift away from traditional banking. Similarly, the growth in robo-advisory services, managing trillions in assets, and the expansion of private credit markets, which saw record fundraising in 2023, highlight how businesses and individuals are finding alternatives to bank-provided financial solutions.

The total market capitalization of cryptocurrencies exceeding $2.5 trillion by mid-2024 and the significant total value locked in DeFi protocols underscore the growing appeal of decentralized finance. These alternatives bypass traditional intermediaries, potentially eroding bank revenues from transactions and lending, forcing institutions like BEA to adapt and innovate to remain competitive.

Entrants Threaten

The banking sector, including institutions like Bank of East Asia, faces a significant threat from new entrants due to high capital requirements and extensive regulatory barriers. For instance, establishing a new bank typically necessitates substantial upfront capital for licensing, robust IT infrastructure, and compliance with evolving financial regulations. In 2024, the Hong Kong Monetary Authority (HKMA) continues to enforce strict capital adequacy ratios and operational standards, making it exceptionally costly and complex for new players to enter the market and compete effectively.

Established brand loyalty and trust represent a significant barrier for new entrants looking to challenge incumbents like the Bank of East Asia (BEA). Decades of consistent service and community presence have cultivated deep customer relationships. For instance, in 2023, BEA reported a strong customer base, indicating the stickiness of its existing relationships. Replicating this level of trust and recognition is a formidable and expensive undertaking for any new financial institution.

Existing banks like Bank of East Asia leverage significant economies of scale, benefiting from lower per-unit costs in technology, operations, and marketing due to their vast customer bases and established infrastructure. For instance, a large bank can spread the cost of a sophisticated digital banking platform across millions of users, making it far more cost-effective than a startup building a similar system from scratch.

Network effects also create a formidable barrier. The more customers a bank has, the more valuable its services become, particularly for payment systems and interbank transfers. This established network makes it challenging for new entrants to attract a critical mass of users quickly, as they lack the immediate connectivity and convenience that incumbents offer.

Virtual Bank Licensing as a Controlled Entry Point

The Hong Kong Monetary Authority (HKMA) has strategically managed virtual bank licensing, creating a controlled entry point rather than an open floodgate. While this fosters innovation, the limited number of licenses issued, such as the eight granted by the end of 2020, signifies a deliberate approach to market development. New entrants, even with a license, still navigate substantial regulatory hurdles and the demanding path to profitability, as evidenced by the ongoing operational adjustments and capital injections required by many of these digital-first institutions.

The HKMA has explicitly stated that the current cohort of virtual banks is considered optimal, indicating a reluctance to approve further licenses without a compelling market need. This stance suggests that the threat of new entrants, in terms of sheer numbers, is currently mitigated by regulatory policy. For instance, as of early 2024, no new virtual bank licenses have been issued since the initial wave, reinforcing the controlled nature of this entry point.

- Controlled Licensing: The HKMA's issuance of a limited number of virtual bank licenses, with eight granted by the end of 2020, restricts the influx of new competitors.

- Regulatory Scrutiny: All virtual banks face rigorous oversight from the HKMA, imposing significant compliance costs and operational complexities on new entrants.

- Profitability Challenges: Achieving profitability remains a significant hurdle for virtual banks, with many still working towards sustainable business models in 2024, deterring less capitalized entrants.

- HKMA's Stance: The HKMA's view that the current number of virtual banks is optimal signals a low likelihood of new licenses being granted in the near future, thus dampening the threat.

Talent Acquisition and Infrastructure Investment

New entrants into the banking sector, particularly those aiming to compete with established players like Bank of East Asia, face considerable challenges in talent acquisition and infrastructure development. The need to attract highly skilled financial professionals and cutting-edge technologists, coupled with the massive investment required for robust IT systems and advanced cybersecurity, presents a significant barrier to entry.

For instance, building a secure and compliant digital banking platform in 2024 demands millions in upfront capital. This includes not only software development but also the ongoing costs of data management, cloud hosting, and sophisticated fraud detection systems. The ability to attract top-tier cybersecurity experts is also paramount, as breaches can lead to catastrophic financial losses and reputational damage. In 2023, the average cost of a data breach in the financial sector globally was reported to be around $5.9 million, highlighting the critical importance of this investment.

- Talent Acquisition Costs: Attracting specialized financial analysts, risk managers, and IT security professionals often requires competitive salaries and comprehensive benefits packages, driving up initial operational expenses.

- Infrastructure Investment: Establishing a secure, scalable, and compliant IT infrastructure, including core banking systems, data analytics platforms, and cybersecurity defenses, represents a substantial capital outlay.

- Regulatory Compliance: New entrants must also invest heavily in understanding and implementing complex regulatory frameworks, adding another layer of cost and complexity to market entry.

- Cybersecurity Expenditure: The escalating threat landscape necessitates significant ongoing investment in cybersecurity measures to protect customer data and financial assets, a cost that can easily run into millions annually.

The threat of new entrants for Bank of East Asia is currently moderate, primarily due to the high capital requirements and stringent regulatory environment in Hong Kong. While virtual banks have entered the market, their numbers are controlled, and they still face significant hurdles in achieving profitability and building customer trust, which are key advantages for established institutions like BEA.

New entrants must overcome substantial barriers, including the need for significant capital, robust IT infrastructure, and adherence to strict regulations set by the HKMA. For example, the HKMA's capital adequacy ratios mean new banks need substantial reserves to operate. Furthermore, replicating the established brand loyalty and economies of scale enjoyed by BEA presents a formidable and costly challenge for any newcomer.

The HKMA's controlled approach to virtual bank licensing, with a limited number of licenses issued, acts as a significant deterrent to widespread new entry. As of early 2024, the HKMA has not issued new virtual bank licenses since the initial wave, indicating a deliberate strategy to manage market competition and ensure stability. This regulatory stance effectively dampens the threat of new entrants by limiting their numbers and imposing rigorous oversight.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for the Bank of East Asia is built upon a foundation of reliable data, including the bank's annual reports, investor presentations, and official regulatory filings. We also incorporate insights from reputable financial news outlets and industry-specific market research reports to provide a comprehensive view of the competitive landscape.