Bank of East Asia Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of East Asia Bundle

Curious about the Bank of East Asia's strategic positioning? Our BCG Matrix analysis reveals which of its offerings are market leaders (Stars), reliable income generators (Cash Cows), underperforming assets (Dogs), or potential growth opportunities (Question Marks). Don't just wonder – understand.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain detailed quadrant placements, data-driven insights, and actionable recommendations to guide your investment and product development decisions with confidence.

This is your opportunity to gain a competitive edge. Invest in the full Bank of East Asia BCG Matrix and receive a comprehensive breakdown, including strategic takeaways and visual mapping, to navigate the dynamic financial landscape effectively.

Stars

Bank of East Asia's digital wealth management solutions are a strong contender in its BCG matrix, reflecting significant investment in advanced digital platforms and wealth management services. This strategic focus caters to the growing demand from tech-savvy individuals and burgeoning cross-border investment opportunities, particularly between Hong Kong and mainland China.

The digital wealth segment is experiencing robust expansion, fueled by increasing digital adoption rates across key markets. BEA's commitment to providing a seamless digital client experience, coupled with a diverse array of investment products, positions this area as a pivotal growth engine. This strategic push aims to capture a greater share of the expanding affluent customer base, promising substantial future returns.

The Bank of East Asia (BEA) is strategically capitalizing on its dual presence in Hong Kong and mainland China, particularly within the Greater Bay Area (GBA). This focus allows BEA to deliver integrated cross-border financial services, a critical offering in this dynamic economic zone.

The GBA, a powerhouse of economic activity, is experiencing a surge in demand for streamlined banking, wealth management, and corporate services that bridge Hong Kong and mainland China. BEA's 'OneBank' strategy is designed to harness these opportunities, aiming to establish the bank as a premier facilitator of financial flows and services for both individuals and businesses operating across the region.

In 2024, the GBA's GDP reached approximately US$1.7 trillion, underscoring its immense economic potential and the growing need for sophisticated cross-border financial solutions. BEA's commitment to this region positions it to benefit from increased trade, investment, and personal financial management needs as the GBA continues its integration.

As the world increasingly prioritizes environmental, social, and governance (ESG) factors, Bank of East Asia (BEA) is strategically expanding its green and sustainable finance (GSF) offerings. This commitment reflects a growing market driven by both regulatory mandates and a surge in investor appetite for responsible investments.

BEA's proactive engagement in this burgeoning sector is evident in its GSF portfolio, which represented a significant 16.9% of its total wholesale banking business by the end of 2024. This early and robust development positions BEA to capture substantial growth opportunities and emerge as a key participant in the sustainable finance landscape.

Digital Corporate Banking Solutions

Bank of East Asia (BEA) is focusing on its digital corporate banking solutions, positioning them as a potential star in its BCG Matrix. This strategic push involves enhancing digital supply chain platforms and online trade finance, directly responding to the increasing demand for streamlined digital services from corporate clients, especially within the Chinese Mainland.

The bank's investment in cutting-edge digital and AI projects is designed to significantly improve both customer experience and operational efficiency. By better catering to the evolving needs of modern businesses, BEA aims to drive growth in fee income and attract low-cost deposits, solidifying its market position.

- Digital Supply Chain Platforms: Enhancing efficiency and transparency for corporate clients.

- Online Trade Finance: Streamlining cross-border transactions and reducing processing times.

- AI Integration: Improving customer service and internal operational workflows.

- Chinese Mainland Focus: Capitalizing on the growing digital adoption in this key market.

Strategic Fintech Partnerships & Innovation Hubs

Bank of East Asia (BEA) is actively pursuing strategic fintech partnerships and investing in innovation hubs to drive growth. These efforts are designed to cultivate new financial technologies and services, tapping into burgeoning market potential.

BEA's commitment to innovation is evident through initiatives such as its BEAST (BEA + Startups) program and the establishment of advanced facilities like the BEA Tower in Qianhai, Shenzhen. These centers are specifically designed to encourage co-creation and collaboration within the fintech ecosystem.

- Fostering Collaboration: BEA's innovation centers facilitate direct partnerships with fintech startups, accelerating the development of cutting-edge financial solutions.

- Capturing Emerging Markets: By investing in these hubs, BEA aims to gain early access to and capitalize on opportunities within rapidly expanding fintech sectors.

- Data-Driven Innovation: The integration of advanced data labs within these facilities allows for the rapid testing and refinement of new financial products and services.

- Strategic Positioning: These investments position BEA as a leader in financial innovation, prepared to adapt to and shape the future of the industry.

Bank of East Asia's digital wealth management solutions are a prime example of a 'Star' in its BCG matrix. This segment exhibits high market growth and a strong competitive position for BEA. The bank has seen significant uptake in its digital platforms, attracting a growing base of affluent customers seeking convenient and sophisticated investment tools.

The bank's investment in digital infrastructure and user experience has paid off, with digital wealth management contributing substantially to its overall growth strategy. This focus aligns with broader market trends favoring digital financial services, particularly among younger, tech-savvy demographics.

BEA's digital wealth management offerings are well-positioned to capture further market share. The bank's ability to integrate diverse investment products and provide a seamless client journey is a key differentiator in this rapidly expanding market segment.

In 2024, BEA reported a notable increase in its digital customer engagement metrics, with a significant portion of new wealth management accounts being opened through its online channels. This trend highlights the segment's 'Star' status and its potential for sustained high growth and profitability.

| Segment | Market Growth | BEA's Market Share | BCG Classification |

|---|---|---|---|

| Digital Wealth Management | High | Strong | Star |

| Green & Sustainable Finance (GSF) | High | Developing | Question Mark/Star Potential |

| Digital Corporate Banking | High | Developing | Question Mark/Star Potential |

| Greater Bay Area (GBA) Services | High | Strong | Star |

What is included in the product

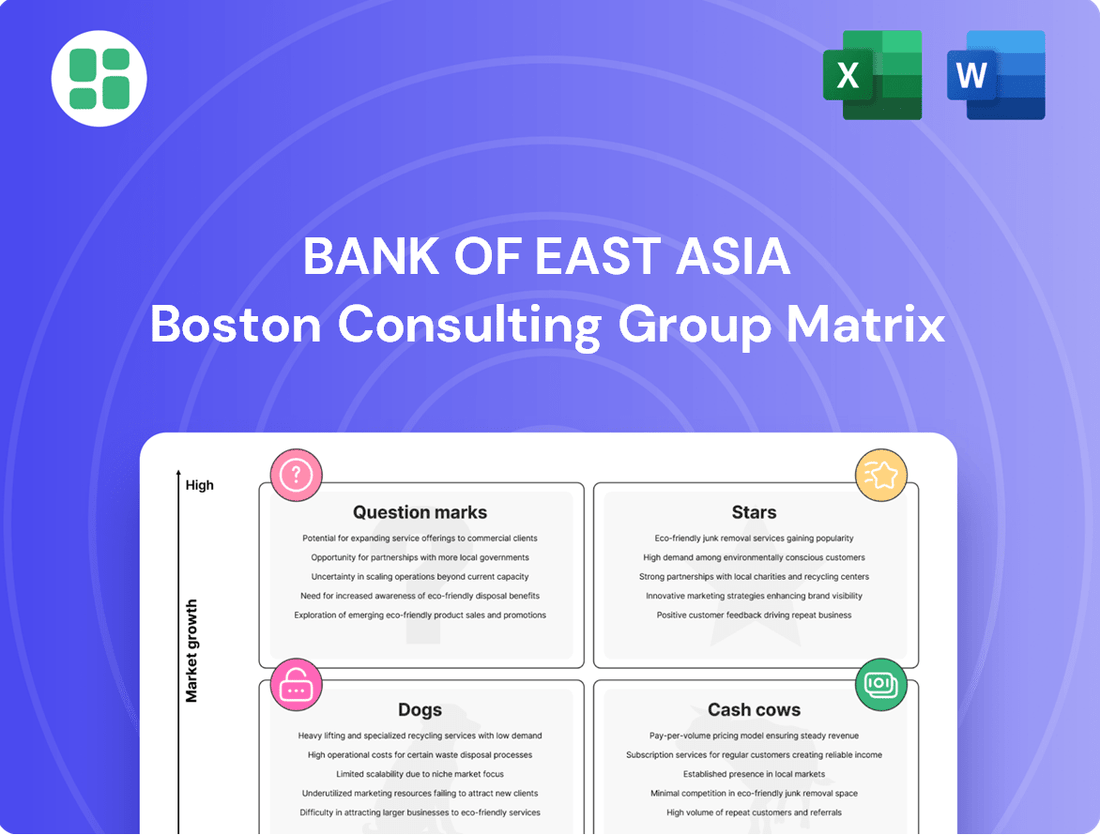

The Bank of East Asia BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

The Bank of East Asia BCG Matrix offers a clear, one-page overview placing each business unit in a quadrant, simplifying strategic decision-making.

Cash Cows

Bank of East Asia's (BEA) traditional Hong Kong retail banking is a classic Cash Cow. Its extensive history in the region has cemented a substantial market share and a loyal customer base, providing a stable foundation for consistent revenue generation.

Despite the low growth in Hong Kong's saturated banking market, these operations are profit engines, fueled by deposits, lending, and an established branch network. In 2024, BEA continued to leverage this segment, focusing on operational efficiency and customer retention to maintain its strong profit margins.

Established corporate lending in Hong Kong is a significant Cash Cow for the Bank of East Asia (BEA). This segment consistently generates stable income through traditional lending to a robust base of corporate clients, reflecting BEA's deep market penetration and long-standing relationships.

The bank's strong historical presence in Hong Kong allows it to maintain a profitable and low-risk revenue stream from this established sector. In 2023, BEA reported a net interest income of HKD 11.4 billion, with corporate banking playing a crucial role in this performance, demonstrating the continued strength of its lending activities.

The Bank of East Asia's mortgage lending portfolio in Hong Kong represents a classic Cash Cow. Despite market shifts, this segment consistently provides a reliable source of interest income, underpinning the bank's financial stability.

As of the first half of 2024, BEA reported a robust mortgage loan book, contributing significantly to its net interest income. The bank's strategic focus on controlled growth in this area ensures a steady, predictable revenue stream, even amidst the Hong Kong property market's typical cycles of consolidation.

Trade Finance Business

Bank of East Asia's trade finance business, especially in Hong Kong and the Chinese Mainland, acts as a significant cash cow. This segment consistently generates fee income and attracts low-cost deposits, underpinning the bank's financial stability.

This mature yet vital service is crucial for companies involved in international trade. BEA leverages its extensive network and deep expertise to maintain a strong competitive edge in this area.

- Stable Income Source: Trade finance provides a reliable stream of fee income for BEA.

- Low-Cost Deposits: The business attracts stable, low-cost funding crucial for banking operations.

- Competitive Advantage: BEA's established network and expertise give it a strong position in this market.

- Mature Market: While offering stability, growth prospects are generally moderate, characteristic of a cash cow.

Core Deposit Base

Bank of East Asia's core deposit base in Hong Kong and mainland China represents a significant Cash Cow. This stable, low-cost funding source is vital for the bank's operations, contributing substantially to its net interest margin. While not a high-growth area, its reliability as a funding pillar is paramount.

The bank's ability to maintain this large deposit base relies more on consistent customer service than aggressive marketing, making it a predictable and consistent revenue generator. As of the first half of 2024, Bank of East Asia reported total customer deposits of HKD 728.3 billion, highlighting the scale of this core asset.

- Stable Funding: The core deposit base provides a reliable and low-cost funding mechanism.

- Net Interest Margin Support: This mature product significantly bolsters the bank's profitability through its net interest margin.

- Operational Efficiency: Maintaining this base requires less intensive marketing spend compared to growth-focused products.

- Scale of Operations: With HKD 728.3 billion in customer deposits as of H1 2024, it underpins the bank's extensive financial activities.

Bank of East Asia's (BEA) wealth management services in Hong Kong, particularly its established customer relationships, function as a cash cow. This segment benefits from a mature market and a loyal clientele, generating consistent fee income through advisory and investment products.

While growth may be moderate, the stability and profitability derived from these services are significant. BEA's focus remains on deepening client relationships and offering tailored solutions to maintain its strong position. In 2023, BEA's fee and commission income was HKD 4.3 billion, with wealth management being a key contributor.

BEA's credit card business in Hong Kong also operates as a cash cow. It provides a steady stream of transaction fees and interest income from a large, established customer base. This segment leverages existing customer relationships for cross-selling opportunities.

The bank continues to optimize its credit card offerings to ensure profitability and customer loyalty. As of the first half of 2024, BEA reported continued growth in its credit card spending, reflecting its enduring appeal in the market.

| Segment | BCG Category | Key Characteristics | 2023/H1 2024 Data Point |

|---|---|---|---|

| Hong Kong Retail Banking | Cash Cow | Stable revenue, high market share, low growth | Net interest income HKD 11.4 billion (2023) |

| Corporate Lending (HK) | Cash Cow | Consistent income, established client base | Significant contributor to net interest income |

| Mortgage Lending (HK) | Cash Cow | Reliable interest income, stable loan book | Robust mortgage loan book (H1 2024) |

| Trade Finance | Cash Cow | Fee income, low-cost deposits, established network | Vital service for international trade |

| Core Deposit Base | Cash Cow | Low-cost funding, stable margins, large scale | Total customer deposits HKD 728.3 billion (H1 2024) |

| Wealth Management (HK) | Cash Cow | Fee income, loyal clientele, moderate growth | Fee and commission income HKD 4.3 billion (2023) |

| Credit Card Business (HK) | Cash Cow | Transaction fees, interest income, customer loyalty | Continued growth in credit card spending (H1 2024) |

Full Transparency, Always

Bank of East Asia BCG Matrix

The Bank of East Asia BCG Matrix you are previewing is the identical, fully-formatted document you will receive upon purchase. This comprehensive report, meticulously crafted with strategic insights, contains no watermarks or demo content, ensuring you get a polished, ready-to-use analysis for informed decision-making.

Dogs

Legacy branch operations in declining areas often represent the Dogs in the Bank of East Asia's BCG Matrix. These are typically older, less strategically positioned physical locations, especially in areas experiencing demographic shifts or a rapid increase in digital banking adoption. Their market share is often low, and the growth prospects are minimal, if not negative.

These branches can become cash traps because they tend to consume more resources, such as rent and staffing costs, than the revenue they generate. For instance, a report from late 2023 indicated that the average cost to operate a physical bank branch in urban areas could range from $15,000 to $30,000 per month, excluding staffing. In declining areas, the revenue generated by these branches might not even cover these operational expenses.

While these branches might still serve a segment of the customer base, particularly older demographics less inclined towards digital platforms, their overall contribution to the bank's growth is negligible. Consequently, they become prime candidates for strategic review, optimization efforts like reducing operating hours or staff, or outright closure to reallocate capital to more promising ventures.

Outdated traditional payment services, like paper checks or certain legacy wire transfer systems, often find themselves in the Dogs quadrant of the BCG Matrix. While some customers still rely on them, their usage is declining, reflecting low market growth. For instance, check usage in the U.S. has been steadily decreasing, with the Federal Reserve reporting a significant drop in check volume over the past decade, a trend expected to continue through 2024 and beyond.

These services typically exhibit low market share as newer, more efficient digital payment solutions gain prominence. Banks like Bank of East Asia, while needing to support existing customers, find that investing heavily in these older systems offers minimal returns. The focus shifts towards modernizing payment infrastructure to capture growth in areas like mobile payments and real-time transfers, making outdated services candidates for divestment or minimal operational support.

Non-performing loan portfolios within specific segments, particularly those exposed to mainland China's commercial real estate sector, represent a potential 'Dog' category for the Bank of East Asia (BEA) in its BCG Matrix. These segments are characterized by persistent asset quality issues and low returns, consuming significant capital and management resources without commensurate profitability.

For instance, as of the first half of 2024, while BEA has been actively managing its credit risk, the ongoing challenges in certain property markets mean that some loan books may continue to exhibit elevated non-performing loan ratios. These problematic assets not only drag down overall portfolio performance but also necessitate increased provisioning, impacting the bank's profitability and capital allocation efficiency.

Undifferentiated Niche Overseas Operations

Undifferentiated Niche Overseas Operations represent segments of Bank of East Asia's (BEA) business that are small, lack unique market positioning, and operate in international markets characterized by intense competition or sluggish growth. These operations often struggle to achieve substantial market share, making it difficult for them to contribute significantly to BEA's overall profitability. They might consume considerable resources simply to maintain a presence, without yielding proportionate returns or strategic benefits.

For instance, consider BEA's presence in certain smaller European markets as of early 2024. These operations might be facing established local banks with deep customer relationships and specialized product offerings. Without a clear differentiator, BEA's niche overseas units could find themselves in a constant battle for market share, potentially leading to lower margins and limited growth prospects. In 2023, BEA reported that its international operations contributed a smaller portion to its overall revenue compared to its core Hong Kong business, underscoring the challenges in these less differentiated markets.

- Low Market Share: These operations typically hold a minimal percentage of the market in their respective international territories.

- Intense Competition: They operate in environments where numerous competitors vie for the same customer base, often with established brand loyalty.

- Slow Growth Markets: The overall economic or banking sector growth in these regions is often subdued, limiting organic expansion opportunities.

- Resource Drain: Maintaining these operations can require significant investment in staff, technology, and marketing without a clear path to substantial returns.

Certain Legacy IT Systems and Infrastructure

Certain legacy IT systems and infrastructure at Bank of East Asia can be categorized as Dogs within the BCG Matrix. These older systems are often inefficient, expensive to maintain, and struggle with scalability and integration, hindering competitive advantage and revenue growth.

These legacy systems represent a significant operational cost. For instance, many financial institutions in 2024 continue to spend a substantial portion of their IT budgets, sometimes exceeding 70%, on maintaining existing infrastructure rather than on innovation. This drains resources that could otherwise be invested in digital transformation initiatives.

- Costly Maintenance: Legacy systems incur high operational expenses due to outdated hardware, specialized skill requirements for upkeep, and frequent patching.

- Limited Scalability: These systems often cannot adapt to increased transaction volumes or new service demands, impacting the bank's agility.

- Integration Challenges: Integrating legacy IT with modern platforms is complex and expensive, creating data silos and operational inefficiencies.

- Divestment/Replacement Candidates: Such systems are prime candidates for divestment or replacement to streamline operations and reduce long-term costs.

Certain legacy IT systems and infrastructure at Bank of East Asia can be categorized as Dogs within the BCG Matrix. These older systems are often inefficient, expensive to maintain, and struggle with scalability and integration, hindering competitive advantage and revenue growth.

These legacy systems represent a significant operational cost. For instance, many financial institutions in 2024 continue to spend a substantial portion of their IT budgets, sometimes exceeding 70%, on maintaining existing infrastructure rather than on innovation. This drains resources that could otherwise be invested in digital transformation initiatives.

Legacy systems incur high operational expenses due to outdated hardware, specialized skill requirements for upkeep, and frequent patching. They often cannot adapt to increased transaction volumes or new service demands, impacting the bank's agility. Integrating legacy IT with modern platforms is complex and expensive, creating data silos and operational inefficiencies, making them prime candidates for divestment or replacement.

| Category | Description | BCG Quadrant | Key Characteristics | Strategic Implication |

| Legacy IT Systems | Outdated and inefficient technology infrastructure | Dog | High maintenance costs, low scalability, poor integration capabilities | Divestment or replacement for efficiency and innovation |

| Declining Branch Network | Physical branches in areas with low customer traffic and digital adoption | Dog | Low market share, minimal growth prospects, high operating expenses | Optimization (reduced hours/staff) or closure to reallocate capital |

| Underperforming Niche Overseas Operations | Small, undifferentiated operations in competitive or slow-growth foreign markets | Dog | Low market share, intense competition, limited growth potential, resource drain | Strategic review, potential divestment or restructuring |

| Legacy Payment Services | Traditional payment methods with declining usage | Dog | Low market share, decreasing customer reliance, minimal return on investment | Minimal support, focus on modernizing payment infrastructure |

Question Marks

Emerging FinTech-driven consumer lending, featuring AI-powered personalized loans and embedded finance, is a rapidly expanding sector. These innovative platforms offer significant growth potential as they cater to evolving consumer demands for speed and convenience. The global digital lending market was valued at approximately $11.5 billion in 2023 and is projected to grow significantly in the coming years, driven by fintech advancements.

Bank of East Asia (BEA) might currently hold a modest position in this dynamic and competitive landscape. Capturing substantial market share in these nascent areas requires considerable strategic investment to compete effectively against established fintech giants and agile new entrants. Failure to invest adequately could relegate these initiatives to the 'Dog' category within the BCG matrix.

Developing digital-only banking for new segments like Gen Z or digital nomads offers significant growth potential. Bank of East Asia (BEA) faces a challenge here, as its established model gives it a low market share in these emerging digital niches.

These ventures demand substantial investment in technology, marketing, and customer acquisition to achieve scale. Without this, BEA's digital-only initiatives risk not gaining enough momentum to succeed in these competitive spaces.

Bank of East Asia's (BEA) strategic push into new Southeast Asian markets positions it as a potential "Question Mark" in the BCG matrix. These markets, characterized by rapidly developing economies and a growing middle class, present significant long-term growth opportunities, with some economies like Vietnam and the Philippines projected to grow at over 6% annually in the coming years.

However, BEA's entry into these nascent markets would likely begin with a relatively low market share, facing established local banks and other international competitors. This necessitates substantial investment in infrastructure, technology, and tailored product offerings to gain traction.

Specialized ESG Advisory Services for Corporates

Specialized ESG advisory services for corporates represent a burgeoning sector as businesses prioritize sustainability. For Bank of East Asia (BEA), this area could be positioned as a potential 'Question Mark' within the BCG Matrix. While the demand for ESG reporting and strategy guidance is escalating, with the global ESG consulting market projected to reach USD 10.7 billion by 2027, BEA might currently hold a modest market share against established, specialized consulting firms.

Investing in building deep expertise and a strong reputation in ESG advisory is crucial for BEA to capitalize on this high-growth opportunity. This strategic move, however, necessitates significant upfront investment in talent and market development, with success contingent on gaining market acceptance and demonstrating tangible value to corporate clients.

- Market Growth: The ESG consulting market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of 15% from 2022 to 2027.

- Potential for BEA: BEA could leverage its existing corporate relationships to offer these specialized services, potentially transforming a low-share, high-growth area into a future 'Star'.

- Investment Requirement: Significant investment in ESG subject matter experts and the development of proprietary ESG frameworks will be necessary for BEA to compete effectively.

- Competitive Landscape: Specialized firms like McKinsey & Company, PwC, and EY already have established ESG practices, presenting a competitive challenge for new entrants.

Blockchain and Distributed Ledger Technology (DLT) Applications

Bank of East Asia (BEA) is exploring and implementing blockchain and Distributed Ledger Technology (DLT) for areas like cross-border payments and digital assets. These are high-growth technological frontiers, indicating a potential for significant future expansion. BEA is likely in the early stages of adoption within these emerging tech-driven markets, meaning its current market share is relatively low.

The adoption of blockchain and DLT requires substantial investment in research, development, and navigating complex regulatory landscapes. While the outcomes are uncertain, the potential for transformative impact on banking processes is considerable. For instance, by 2024, the global blockchain in banking market was projected to reach billions, highlighting the significant growth trajectory.

- Cross-border Payments: Streamlining international transactions with faster settlement times and reduced fees.

- Trade Finance: Enhancing transparency and efficiency in supply chain financing and letter of credit processes.

- Digital Assets: Exploring the issuance and management of tokenized securities and other digital forms of value.

Bank of East Asia's ventures into new Southeast Asian markets represent a strategic "Question Mark." These regions offer substantial long-term growth potential due to their developing economies and expanding middle class, with countries like Vietnam and the Philippines expected to see over 6% annual growth in the coming years. However, BEA's market share in these areas is likely low, requiring significant investment to compete with established local and international players.

Similarly, BEA's exploration of blockchain and DLT for areas like cross-border payments and digital assets places it in a "Question Mark" category. These are high-growth technological frontiers, but BEA is likely in the early stages of adoption, meaning its current market share is minimal. Substantial investment in R&D and regulatory navigation is necessary, with the global blockchain in banking market projected to reach billions by 2024.

The bank's move into specialized ESG advisory services also fits the "Question Mark" profile. The global ESG consulting market is projected to reach USD 10.7 billion by 2027, but BEA may have a modest market share against specialized firms. Significant investment in talent and frameworks is needed for BEA to establish itself in this high-growth, albeit competitive, sector.

These initiatives, while holding promise, are characterized by high growth potential but low current market share for BEA. They require substantial investment and strategic execution to transition into successful "Stars" rather than remaining "Question Marks" or declining into "Dogs."

BCG Matrix Data Sources

Our Bank of East Asia BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.