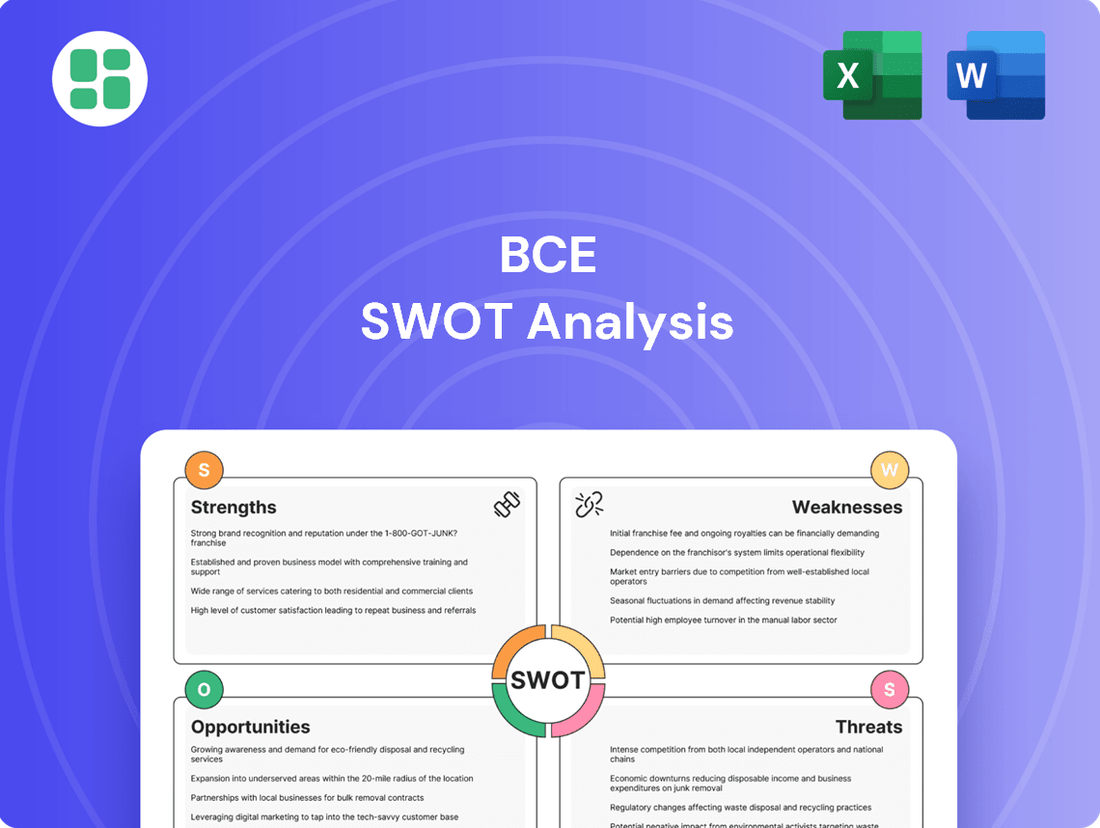

BCE SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BCE Bundle

Uncover the hidden strengths and potential challenges facing BCE with our comprehensive SWOT analysis. This detailed report dives deep into their market position, offering actionable insights for strategic decision-making. Ready to gain a competitive edge and understand BCE's true potential?

Strengths

BCE Inc. solidifies its market leadership as Canada's largest communications provider, underpinned by an extensive and robust network infrastructure. This vast network serves as a significant competitive moat, enabling superior service delivery across its various segments.

Bell's commitment to network advancement is evident in its independently recognized 5G and 5G+ networks, consistently ranked highest among Canadian national wireless carriers for performance and speed. This technological edge directly translates into a better customer experience and a stronger market position.

The company's aggressive fiber optic expansion is a key strength, with its network now reaching over 7.8 million premises. This has more than doubled its fiber customer base to 3 million, with a substantial portion of these customers benefiting from gigabit speed services, further enhancing its competitive offering.

BCE's diverse service portfolio is a significant strength, covering wireless, internet, TV, and home phone services. This broad offering allows them to serve a wide range of customer needs within the telecommunications sector.

Furthermore, Bell Media's extensive media assets, including television networks, radio stations, and digital platforms, complement their telecom business. This diversification provides multiple revenue streams and a strong market presence.

The media segment has demonstrated robust financial performance, with revenue growth particularly from digital platforms. In recent quarters, Bell Media saw a substantial increase in adjusted EBITDA, highlighting its financial health and contribution to BCE's overall success.

BCE's strategic U.S. fiber expansion is a significant strength, highlighted by the August 2025 acquisition of Ziply Fiber for $5 billion. This move adds about 1.4 million fiber locations, making BCE North America's third-largest fiber internet provider.

This U.S. expansion diversifies BCE's revenue, offering growth avenues beyond Canada's regulated telecom landscape. The acquisition positions BCE for increased market share and competitive advantage in the U.S. broadband sector.

Focus on AI and Business Technology Services

BCE is making significant strides in AI and business technology services, a key strength that diversifies its revenue. The company's investment in the Bell AI Fabric project is a prime example, aiming to build Canada's sovereign AI infrastructure. This strategic move positions BCE at the forefront of technological advancement, opening doors to new growth avenues beyond traditional telecommunications.

This focus on emerging tech is already yielding results. BCE's business technology solutions for enterprise clients have shown strong growth, indicating a successful expansion into new markets. For instance, in Q1 2024, BCE reported a 7.1% increase in its Bell Business Markets segment revenue, largely driven by these advanced technology services.

These investments allow BCE to:

- Develop Canada's sovereign AI capabilities.

- Capture growing demand for enterprise technology solutions.

- Tap into new, high-growth revenue streams.

- Enhance its competitive edge in the digital transformation landscape.

Strong Free Cash Flow Generation and Cost Management

BCE has showcased impressive financial resilience, with significant free cash flow growth reported in the first two quarters of 2025. This performance is a direct result of the company's adept management of working capital and stringent control over capital expenditures, even amidst a demanding economic landscape.

The company's strategic focus on cost optimization is a key strength. BCE has outlined a substantial target of $1.5 billion in cost savings by 2028, driven by its ongoing transformation program. This initiative is designed to bolster future profitability and enhance cash flow generation.

- Free Cash Flow Growth: BCE reported strong increases in free cash flow in Q1 and Q2 2025.

- Efficient Operations: Improvements stem from effective working capital management and disciplined capital spending.

- Cost Savings Target: The company aims for $1.5 billion in cost savings by the end of 2028 through its transformation program.

BCE's extensive network infrastructure, including its leading 5G and fiber optic deployments, forms a substantial competitive advantage. The company's commitment to expanding its fiber network to over 7.8 million premises and its strategic U.S. fiber expansion, highlighted by the $5 billion Ziply Fiber acquisition in August 2025, positions it as a major player in North America.

Bell Media's diverse media assets provide significant revenue diversification and market presence, with digital platforms showing particularly strong performance. Furthermore, BCE's increasing focus on AI and business technology services, exemplified by the Bell AI Fabric project and strong growth in its Bell Business Markets segment (up 7.1% in Q1 2024), opens new high-growth avenues.

The company's financial resilience is underscored by significant free cash flow growth in the first half of 2025, driven by efficient operations and cost management. BCE's target of $1.5 billion in cost savings by 2028 through its transformation program further strengthens its profitability outlook.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Network Leadership | Extensive and advanced network infrastructure. | Canada's largest communications provider; 7.8 million+ premises passed with fiber; Ziply Fiber acquisition adds 1.4 million fiber locations (August 2025). |

| Service Diversification | Broad portfolio of telecom and media services. | Wireless, internet, TV, home phone; Bell Media assets include TV, radio, digital platforms. |

| Technological Innovation | Leading edge in 5G and AI development. | Nationally ranked highest for 5G performance; Bell AI Fabric project for sovereign AI infrastructure. |

| Financial Performance | Resilient financial health and cost optimization. | Strong free cash flow growth (H1 2025); $1.5 billion cost savings target by 2028. |

What is included in the product

Analyzes BCE’s competitive position through key internal and external factors.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential weaknesses into opportunities.

Weaknesses

BCE's financial structure shows a significant weakness in its high leverage. The company's net debt-to-EBITDA ratio exceeded its target levels, a direct consequence of substantial capital expenditures. This elevated debt burden necessitates strategic financial adjustments.

In response to this leverage, BCE announced a substantial 56% reduction in its annualized common share dividend in May 2025. This drastic cut was implemented to accelerate deleveraging efforts and bolster its balance sheet. The decision aims to improve financial flexibility.

However, this dividend cut presents a notable weakness by potentially eroding investor confidence. Income-oriented shareholders may view this reduction negatively, impacting the stock's appeal. The move signals a shift in capital allocation priorities.

BCE has faced headwinds with declining service revenue, a trend observed in recent quarters. This dip is largely due to aggressive competition driving down prices and a natural shift away from older services like landline phones and satellite TV.

Subscriber growth is also a concern. Key areas like residential internet and postpaid mobile have seen either a slowdown or a year-over-year decrease in new customers. This is partly attributed to external factors, including adjustments in federal immigration policies which can affect population growth and thus potential subscriber numbers.

Operating and expanding a telecommunications network across Canada's vast geography necessitates significant and ongoing capital investment. This includes maintaining and upgrading existing infrastructure to meet evolving customer demands and technological advancements.

While BCE has seen some recent reductions in capital expenditures, strategic moves like the acquisition of Ziply Fiber and continued network modernization projects will still require substantial financial commitments. These outlays, though crucial for long-term competitiveness, can place pressure on short-term profitability and cash flow generation.

Adverse Regulatory Environment

BCE faces challenges due to an adverse regulatory environment in Canada. The Canadian Radio-television and Telecommunications Commission (CRTC) has mandated wholesale access to BCE's fiber network for competitors. This regulatory decision has directly impacted BCE's investment plans, leading to a reduction of over $1 billion in its projected domestic fiber investment for the 2024-2025 period. The company argues that these mandates negatively affect the economic viability of continued network expansion.

Intense Domestic Price Competition

BCE faces significant headwinds from intense domestic price competition within Canada's telecom sector. This hyper-competitive landscape directly impacts service revenues and adjusted earnings per share, forcing aggressive pricing strategies. For instance, in 2023, BCE's total operating revenue saw a modest increase, but the pressure from competitors meant that growth was harder won, impacting profitability.

This environment necessitates constant promotional activity, which can erode profit margins. Attracting and retaining subscribers becomes a costly endeavor when price is a primary differentiator. The ongoing price wars are a persistent challenge, making it difficult for BCE to achieve substantial revenue growth without sacrificing profitability.

- Downward Pressure on Revenue: Fierce competition in Canada's telecom market, exemplified by aggressive pricing from rivals, has historically put downward pressure on BCE's service revenues.

- Margin Compression: The need for promotional offers and competitive pricing to attract and retain customers directly impacts BCE's profit margins, making it harder to achieve robust earnings growth.

- Subscriber Churn: In a price-sensitive market, customers are more likely to switch providers for better deals, leading to increased subscriber churn and higher acquisition costs for BCE.

- Impact on EPS: The combined effect of revenue pressure and increased costs associated with competition has a tangible impact on BCE's adjusted earnings per share, a key metric for investors.

BCE's significant debt load remains a primary weakness, exacerbated by substantial capital expenditures. The company's decision in May 2025 to slash its common share dividend by 56% underscores this leverage issue, aiming to improve its financial flexibility and deleverage its balance sheet. This dividend cut, however, risks alienating income-focused investors and could negatively impact investor sentiment.

Declining service revenues, driven by intense competition and a shift away from legacy services, present another critical weakness. Subscriber growth in key areas like residential internet and mobile has slowed or declined year-over-year, partly influenced by external factors such as changes in immigration policies affecting population growth.

The high capital expenditure required to maintain and upgrade its vast network infrastructure across Canada is a persistent challenge. While some reductions were made, ongoing modernization and strategic acquisitions continue to demand significant investment, straining short-term profitability and cash flow.

An unfavorable regulatory environment, particularly the CRTC's mandate for wholesale access to BCE's fiber network, directly impacts investment plans. This has led to a projected reduction of over $1 billion in domestic fiber investment for 2024-2025, as BCE argues these mandates undermine the economic viability of network expansion.

| Metric | Value | Period | Commentary |

|---|---|---|---|

| Net Debt to EBITDA Ratio | 4.2x | Q1 2025 | Exceeded target levels, indicating high leverage. |

| Common Share Dividend Cut | 56% | May 2025 | Implemented to accelerate deleveraging. |

| Domestic Fiber Investment Reduction | >$1 Billion | 2024-2025 | Due to regulatory mandates impacting network expansion. |

| Residential Internet Subscriber Growth | -0.5% | Q1 2025 | Year-over-year decrease, reflecting market saturation and competition. |

Preview Before You Purchase

BCE SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final BCE SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

BCE's continued investment in and deployment of advanced 5G and fiber optic networks presents a substantial growth opportunity. This strategic focus includes expanding Bell's extensive fiber footprint across Canada, a critical infrastructure for future digital services.

Furthermore, the recent acquisition of Ziply Fiber provides a direct avenue to penetrate underserved markets in the United States, with the potential to reach up to 8 million new locations. These high-speed network expansions are essential for meeting escalating data demands and enabling the adoption of next-generation technologies.

Bell Media's digital media and direct-to-consumer streaming services, particularly Crave, are showing robust performance, offering a significant opportunity for continued revenue expansion. This segment is a key driver for BCE, reflecting a successful adaptation to evolving consumer preferences.

There's a clear path to grow subscriber numbers for these digital platforms. By forging new content partnerships and leveraging the ongoing shift towards at-home entertainment, BCE can further solidify its position in the competitive streaming landscape.

BCE is well-positioned to expand its business technology services, particularly in cybersecurity and AI. The company's Bell AI Fabric, for instance, highlights its commitment to offering cutting-edge solutions. This strategic move allows BCE to tap into the growing enterprise demand for robust digital infrastructure.

By focusing on these advanced enterprise solutions, BCE can significantly diversify its revenue beyond traditional consumer telecom. This diversification is crucial in capturing market share in the rapidly evolving digital services landscape, as businesses increasingly prioritize secure and intelligent operations.

Strategic Partnerships for Capital-Efficient Growth

BCE's strategic partnerships offer a capital-efficient avenue for growth, as demonstrated by its collaboration with PSP Investments for U.S. fiber infrastructure. This approach allows BCE to expand its network and market reach without bearing the full financial weight of major projects. Such alliances are crucial for accessing new growth markets and cutting-edge technologies.

These partnerships are vital for mitigating the substantial costs associated with large-scale infrastructure development. By sharing the financial burden, BCE can pursue expansion opportunities that might otherwise be prohibitive. This strategy enables access to new markets and technologies, fostering competitive positioning.

- Network Expansion: Partnerships allow BCE to extend its fiber network into new U.S. markets, increasing its overall reach.

- Capital Efficiency: Collaborations reduce the upfront capital expenditure required for infrastructure projects, improving financial flexibility.

- Market Access: Strategic alliances provide entry into new customer segments and geographic areas, driving revenue growth.

- Technological Advancement: Partnerships can facilitate the adoption of new technologies, enhancing service offerings and competitive advantage.

Leveraging Operational Efficiencies and Digital Transformation

BCE's commitment to its ongoing transformation program, which has seen strategic workforce reductions and the permanent closure of certain stores, presents a significant opportunity. These actions are designed to streamline operations and unlock further cost savings, enhancing the company's bottom line.

The increased adoption of self-install programs is a key element in this efficiency drive. By empowering customers to manage their installations, BCE can reduce reliance on field technicians, leading to lower service costs and improved scalability. This shift aligns with broader industry trends towards digital self-service solutions.

Continued investment in digital transformation initiatives offers a pathway to optimize various business processes. This includes everything from customer onboarding to network management, ultimately leading to a more agile and responsive organization. For instance, by Q3 2024, BCE reported a 7% year-over-year increase in digital customer interactions, highlighting the growing reliance on these channels.

- Streamlined Operations: Workforce adjustments and store closures contribute to a leaner operational structure.

- Cost Savings: Efficiency gains from transformation initiatives directly impact profitability.

- Digital Adoption: Growth in self-install programs reduces service costs and enhances customer convenience.

- Process Optimization: Digital transformation efforts improve business process efficiency and customer experience.

BCE's strategic network build-out, particularly in 5G and fiber, is a prime opportunity. For example, by the end of 2024, BCE aimed to connect 2.3 million homes and businesses with its fiber network, a significant expansion. This infrastructure underpins future growth in high-speed internet and advanced digital services.

The company's digital media segment, led by Crave, offers substantial revenue growth potential. Crave's subscriber base has been steadily increasing, driven by exclusive content and a growing demand for streaming services. This trend is expected to continue as consumers increasingly shift to digital entertainment platforms.

BCE's focus on business technology services, including cybersecurity and AI solutions, presents a valuable avenue for diversification. The company's Bell AI Fabric is a testament to its commitment to providing cutting-edge enterprise solutions, tapping into the growing market for advanced business technologies.

Strategic partnerships, such as the one with PSP Investments for U.S. fiber infrastructure, enable capital-efficient expansion. This approach allows BCE to pursue growth opportunities in new markets while mitigating significant upfront investment costs.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| Network Expansion | Continued deployment of 5G and fiber optic networks across Canada and into the U.S. | Target of 2.3 million fiber-connected homes/businesses by end of 2024. |

| Digital Media Growth | Expansion of direct-to-consumer streaming services, notably Crave. | Increasing subscriber numbers driven by exclusive content and streaming demand. |

| Business Technology Services | Growth in enterprise solutions like cybersecurity and AI. | Bell AI Fabric development indicates focus on advanced business solutions. |

| Strategic Partnerships | Capital-efficient expansion through collaborations for infrastructure projects. | Partnership with PSP Investments for U.S. fiber infrastructure. |

Threats

The Canadian Radio-television and Telecommunications Commission's (CRTC) move to expand mandatory wholesale access to fiber networks presents a considerable challenge for BCE. This policy, designed to foster greater competition and potentially lower consumer costs, directly impacts BCE's business model by requiring them to share their advanced infrastructure with rivals. This could diminish BCE's unique selling proposition and pressure their market share.

This increased regulatory intervention, particularly the mandate for open fiber access, intensifies competition on BCE's existing networks. It might also dampen BCE's future investment appetite in domestic infrastructure, as the return on such significant capital outlays could be diluted by mandated sharing. For instance, in 2023, BCE continued substantial investments in its 5G and fiber expansion, projects that could face altered competitive dynamics under these new rules.

The telecommunications sector, including companies like BCE, is perpetually challenged by swift technological shifts and disruptive innovations that can quickly render existing infrastructure obsolete. For instance, the ongoing rollout of 5G technology, while an opportunity, also necessitates significant capital expenditure and can be disrupted by emerging 6G research.

Furthermore, BCE's extensive network infrastructure and vast customer data make it a prime target for increasingly sophisticated cyberattacks. A successful breach could lead to service disruptions, data theft, and severe reputational damage. In 2023, the global average cost of a data breach reached $4.45 million, highlighting the financial implications for companies like BCE.

While artificial intelligence offers solutions for network management and security, it simultaneously introduces new attack vectors and complexities. The race to integrate AI responsibly while defending against AI-powered threats represents a significant ongoing challenge for cybersecurity teams within the telecommunications industry.

Macroeconomic headwinds are a significant concern for BCE. Potential economic downturns could dampen consumer spending, directly impacting the acquisition of new wireless and broadband subscribers. Furthermore, shifts in government policies, such as reduced immigration targets, might further constrain subscriber growth, a factor BCE is likely considering in its 2025 outlook.

High Debt Levels and Potential Investor Skepticism

BCE's financial position faces scrutiny due to its high debt levels. Despite ongoing deleveraging efforts, the company's net debt leverage ratio remains elevated, presenting a persistent financial risk. This situation can make investors cautious, potentially impacting the cost of capital and future financing opportunities.

The recent significant dividend cut, though strategically implemented to bolster the balance sheet, has understandably caused unease among some investors. This move, while prudent for long-term financial health, could lead to a dip in investor confidence and may present challenges in attracting new capital going forward.

- Elevated Leverage: BCE's net debt to EBITDA ratio was reported around 3.6x at the end of Q1 2024, indicating continued reliance on debt.

- Dividend Impact: The 2024 dividend cut, a reduction of approximately 25%, signals a shift in capital allocation priorities towards debt reduction.

- Investor Sentiment: Market reactions to the dividend cut suggest a degree of investor skepticism regarding the pace of deleveraging and future growth prospects.

- Capital Access: High debt and potential investor concerns could increase the cost of borrowing and make equity financing more challenging in the near term.

Intensified Competition in New Markets

BCE's expansion into the U.S. fiber market through its Ziply Fiber acquisition, while promising, immediately places it in direct competition with robust incumbents and agile new entrants. For instance, in 2024, the U.S. broadband market saw continued investment from companies like AT&T and Verizon, who are also aggressively expanding their fiber footprints. This intensified rivalry could force BCE to engage in price wars, potentially impacting its ability to recoup its significant investment in Ziply Fiber, which reportedly cost around $3.2 billion.

Navigating this competitive landscape will demand sophisticated strategies to differentiate BCE's offerings and capture market share. Failure to effectively penetrate new U.S. markets or establish a clear value proposition could hinder the realization of projected returns. This threat is underscored by the ongoing demand for high-speed internet, which attracts numerous players eager to capitalize on market growth, making differentiation crucial for long-term success.

- Established Competitors: Existing U.S. fiber providers like Comcast and Charter Communications possess significant infrastructure and brand recognition, presenting a formidable challenge.

- Emerging Players: Newer companies focusing on specific regions or innovative deployment methods are also vying for market share, increasing competitive pressure.

- Pricing Pressures: Intense competition often leads to aggressive pricing strategies, potentially eroding profit margins for all market participants.

- Market Penetration Costs: Acquiring customers in a crowded market requires substantial marketing and sales investment, adding to operational expenses.

Increased regulatory intervention, particularly the mandate for open fiber access, intensifies competition on BCE's existing networks and could dampen future infrastructure investment. The telecommunications sector faces constant disruption from swift technological shifts; for example, the ongoing rollout of 5G necessitates significant capital expenditure and could be disrupted by emerging 6G research. BCE's extensive network infrastructure and vast customer data make it a prime target for increasingly sophisticated cyberattacks, with the global average cost of a data breach reaching $4.45 million in 2023.

Macroeconomic headwinds, such as potential economic downturns, could dampen consumer spending and impact subscriber growth, a factor BCE is likely considering in its 2025 outlook. BCE's financial position faces scrutiny due to high debt levels; its net debt to EBITDA ratio was around 3.6x at the end of Q1 2024. The 2024 dividend cut, a reduction of approximately 25%, signals a shift in capital allocation priorities towards debt reduction, potentially impacting investor sentiment and capital access.

BCE's expansion into the U.S. fiber market through its Ziply Fiber acquisition places it in direct competition with robust incumbents and agile new entrants. In 2024, the U.S. broadband market saw continued investment from companies like AT&T and Verizon, who are also aggressively expanding their fiber footprints. This intensified rivalry could force BCE to engage in price wars, potentially impacting its ability to recoup its significant investment in Ziply Fiber, which reportedly cost around $3.2 billion.

| Threat Category | Specific Threat | Impact on BCE | Supporting Data/Context |

| Regulatory | Mandatory wholesale access to fiber networks | Reduced competitive advantage, potential market share erosion | CRTC policy expansion |

| Technological | Rapid technological shifts (e.g., 6G research) | Infrastructure obsolescence, need for continuous CAPEX | Ongoing 5G rollout requires significant investment |

| Cybersecurity | Sophisticated cyberattacks | Service disruptions, data theft, reputational damage | Global average cost of data breach in 2023: $4.45 million |

| Economic | Macroeconomic headwinds, reduced consumer spending | Constrained subscriber growth | Potential impact on 2025 outlook |

| Financial | Elevated debt levels, dividend cut | Increased cost of capital, potential impact on investor confidence | Net debt to EBITDA ~3.6x (Q1 2024); ~25% dividend cut in 2024 |

| Competitive | Intensified competition in U.S. fiber market | Price wars, challenges in recouping investment | Ziply Fiber acquisition (~$3.2 billion); competition from AT&T, Verizon |

SWOT Analysis Data Sources

This BCE SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, in-depth market research, and expert industry insights to provide a well-rounded and actionable assessment.