BCE Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BCE Bundle

BCE's competitive landscape is shaped by the interplay of five key forces, impacting its profitability and strategic direction. Understanding these dynamics is crucial for navigating its market effectively.

The complete report reveals the real forces shaping BCE’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

BCE's reliance on a concentrated group of key network equipment providers, such as Nokia and Ericsson, for essential infrastructure, particularly for 5G rollouts, highlights a significant source of supplier bargaining power. These specialized, high-cost technologies create substantial switching costs for BCE, limiting its flexibility and increasing supplier leverage.

BCE's Bell Media division faces significant supplier power from major content creators and sports leagues. The exclusivity and appeal of premium content, such as live sports broadcasts or popular series, grant these suppliers substantial leverage. This can translate into higher licensing costs for BCE, impacting the profitability of its media operations.

Spectrum is a finite, government-controlled resource crucial for wireless operations. While BCE secured substantial 5G+ spectrum in 2023, the inherent scarcity and the auction system amplify the government's bargaining power as a spectrum licensor. This directly impacts BCE's costs for network expansion and future service capabilities.

Skilled Labor and Technology Vendors

BCE's reliance on highly skilled engineers, technicians, and IT professionals to maintain its intricate telecommunications and media networks underscores the bargaining power of skilled labor. In 2024, the demand for specialized telecom talent remained robust, with shortages in areas like 5G deployment and cybersecurity. This can translate to higher wage demands and increased recruitment costs for BCE.

The company’s dependence on specific software and technology vendors for its core operational systems also grants these specialized suppliers leverage. For proprietary solutions or niche expertise, vendors can command premium pricing or dictate terms, particularly if switching costs are high. For instance, a significant portion of BCE's network infrastructure may rely on specialized hardware or software from a limited number of providers, creating a potential dependency.

- Skilled Labor Demand: High demand for telecom engineers and IT professionals in 2024, especially in emerging technologies.

- Vendor Dependency: Reliance on specialized technology vendors for critical operational systems.

- Switching Costs: High costs associated with changing core technology providers can empower suppliers.

- Proprietary Solutions: Vendors offering unique or proprietary technologies hold significant bargaining power.

Infrastructure Component Costs

Suppliers of physical infrastructure components, such as fiber optic cables, cell towers, and data center hardware, hold moderate bargaining power over BCE. While the telecommunications industry often involves numerous vendors, BCE's substantial operational scale allows for significant purchasing volumes, which can shift leverage. However, the specialized nature of some advanced components can still foster a degree of dependence on specific, high-capability suppliers.

For instance, in 2024, the demand for advanced networking equipment, crucial for 5G deployment and fiber expansion, remained robust. This sustained demand, coupled with potential supply chain constraints for highly specialized chips or optical components, can empower suppliers of these niche items. BCE's reliance on these critical inputs means that price increases or delivery delays from such suppliers can directly impact project timelines and capital expenditures.

- Moderate Supplier Power: Suppliers of physical infrastructure components like fiber optic cables and data center equipment have moderate bargaining power.

- Scale Advantage: BCE's large procurement volumes can mitigate supplier power, but specialized components create some dependency.

- 2024 Market Dynamics: Robust demand for 5G and fiber expansion equipment in 2024 potentially strengthened supplier leverage for niche components.

- Impact of Dependency: Reliance on specialized suppliers for critical inputs can lead to price sensitivity and project timeline risks.

BCE faces significant supplier bargaining power from providers of essential network equipment, like Nokia and Ericsson, especially for 5G infrastructure, due to high switching costs and specialized technology. Similarly, major content creators and sports leagues leverage the exclusivity of premium content, leading to higher licensing fees for BCE's media division. The government's control over scarce radio spectrum, as seen in 2023 auctions, also represents a key supplier power, directly influencing BCE's expansion costs.

Skilled labor, particularly telecom engineers and IT professionals, wield considerable power in 2024 due to high demand and shortages in specialized areas like 5G deployment. Furthermore, reliance on specific software and technology vendors for critical operational systems, where switching costs are high, allows these suppliers to dictate terms and pricing. Even suppliers of physical infrastructure components, while facing BCE's scale, can exert influence on niche, advanced components crucial for network upgrades.

| Supplier Type | Key Dependence | Bargaining Power Factor | 2024 Relevance |

|---|---|---|---|

| Network Equipment Providers (e.g., Nokia, Ericsson) | 5G infrastructure, specialized technology | High switching costs, proprietary solutions | Continued high demand for 5G deployment |

| Content Creators/Sports Leagues | Exclusive premium content (live sports, popular series) | Content appeal, exclusivity | Impacts media division profitability through licensing fees |

| Government (Spectrum Licensor) | Radio spectrum for wireless operations | Scarcity, auction system | 2023 spectrum acquisitions highlight ongoing cost impact |

| Skilled Labor (Telecom Engineers, IT Pros) | Network maintenance, deployment, cybersecurity | High demand, talent shortages | Robust demand in 2024 leads to wage pressures |

| Technology/Software Vendors | Core operational systems, proprietary solutions | High switching costs, niche expertise | Potential for premium pricing and dictated terms |

| Physical Infrastructure Suppliers | Fiber optic cables, cell towers, data center hardware | Moderate power, but amplified for niche/advanced components | Robust demand for 5G/fiber equipment in 2024 |

What is included in the product

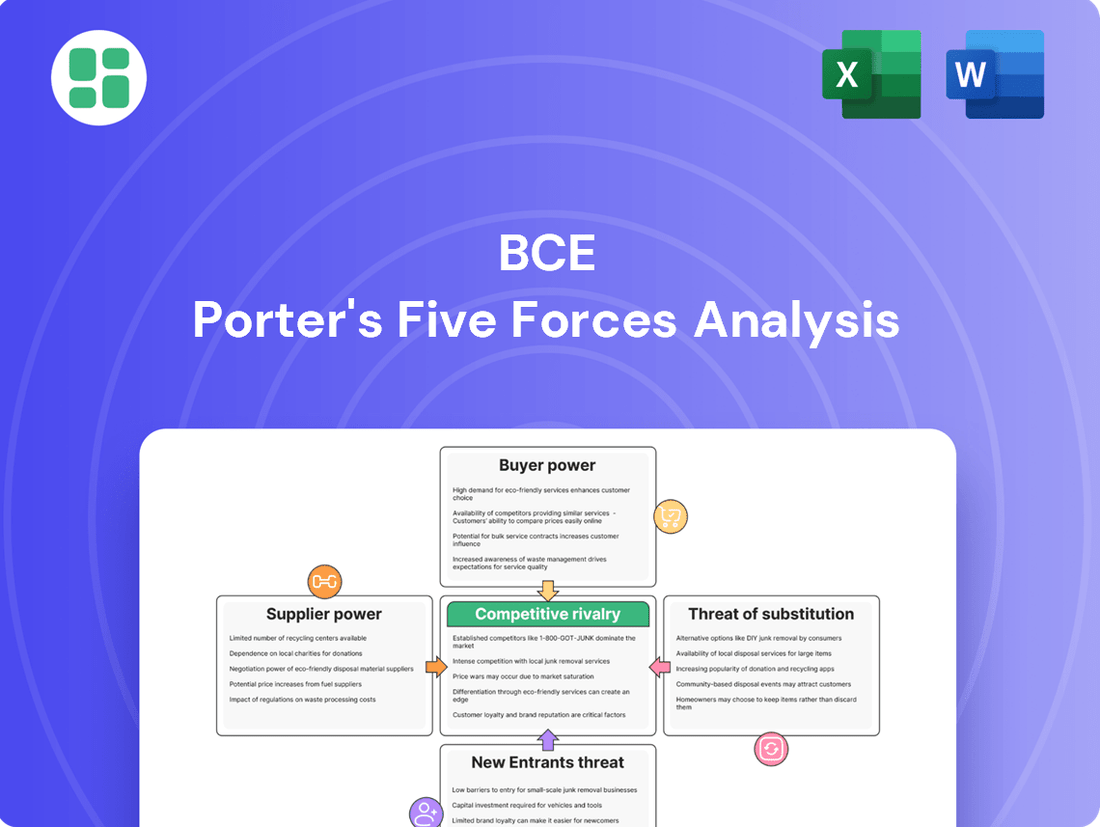

Analyzes the five competitive forces—threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitutes, and industry rivalry—to assess BCE's industry attractiveness and competitive intensity.

Quickly identify and address competitive threats, enabling proactive strategy adjustments.

Customers Bargaining Power

Residential customers, especially for wireless and internet, are highly price-sensitive in Canada's competitive telecom landscape. BCE must offer compelling pricing and promotions to win and keep these customers, directly affecting its average revenue per user.

While BCE's bundled services aim to keep customers loyal, the ease of switching individual services like mobile or internet plans, especially with recent regulatory shifts, significantly reduces customer switching costs. This freedom allows consumers to readily explore and select more attractive offers from competitors, putting pressure on BCE to remain competitive.

BCE's strategy of bundling services, including wireless, internet, TV, and home phone, significantly curtails customer bargaining power. This integrated offering creates a more compelling value proposition for consumers, making it less appealing to seek individual services elsewhere.

By packaging multiple services, BCE increases customer stickiness. For instance, in 2024, a substantial portion of BCE's residential customers subscribed to at least two services, demonstrating the effectiveness of bundling in reducing the likelihood of customers switching providers for a single service.

Regulatory Influence on Customer Power

Regulatory bodies like the Canadian Radio-television and Telecommunications Commission (CRTC) significantly shape customer bargaining power in the telecommunications sector. The CRTC's mandate to foster competition and ensure affordability directly translates into greater leverage for consumers.

For instance, the CRTC's 2024 decisions to expand wholesale access to fiber optic networks are designed to introduce more service providers and drive competitive pricing. This regulatory push for increased choice empowers customers to switch providers or negotiate better terms, thereby diminishing the bargaining power of incumbent firms like BCE.

Key regulatory actions impacting customer power include:

- CRTC Mandates: Ongoing directives promoting competition and affordability.

- Wholesale Access Expansion: Recent rulings allowing broader access to fiber networks, fostering new entrants.

- Consumer Choice Initiatives: Policies aimed at increasing the number of service providers available to Canadians.

Business and Wholesale Customer Segmentation

BCE's bargaining power of customers is significantly influenced by its business and wholesale segment. Large corporate clients and other Internet Service Providers (ISPs) represent a substantial customer base, and their sheer volume of service consumption grants them considerable leverage.

These major customers can negotiate bespoke service agreements and pricing structures, allowing them to exert more influence over BCE's offerings and terms than the average residential customer. For instance, in 2023, BCE's enterprise and wholesale revenues reached approximately $7.9 billion, highlighting the financial significance of these customer relationships.

- Significant Revenue Contribution: BCE's enterprise and wholesale segments generated around $7.9 billion in revenue in 2023, underscoring the importance of these large-volume customers.

- Negotiating Power: Due to their substantial purchasing power, these clients can negotiate customized contracts and pricing, directly impacting BCE's service delivery and profitability.

- Customized Solutions: The ability to demand tailored solutions means these customers can dictate specific service levels and features, further amplifying their influence.

- Market Influence: The collective bargaining power of these large clients can shape market dynamics and influence BCE's strategic decisions regarding product development and service expansion.

The bargaining power of BCE's customers is a key factor, particularly with residential users facing price sensitivity in Canada's competitive telecom market. Large corporate clients and wholesale partners also wield significant influence due to their substantial service consumption, enabling them to negotiate tailored agreements. Regulatory actions, such as the CRTC's push for increased wholesale access, further empower consumers by fostering greater choice and competitive pricing, thereby diminishing incumbent leverage.

| Customer Segment | Influence Factor | Impact on BCE |

|---|---|---|

| Residential (Wireless/Internet) | Price Sensitivity, Ease of Switching | Pressure on ARPU, Need for competitive pricing & bundles |

| Enterprise & Wholesale | Volume, Negotiating Power | Customized contracts, pricing leverage, significant revenue source (approx. $7.9B in 2023) |

| Regulated Environment (CRTC) | Mandates for Competition & Affordability | Increased customer choice, reduced switching costs, potential for new entrants |

Preview the Actual Deliverable

BCE Porter's Five Forces Analysis

This preview showcases the complete BCE Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, fully formatted and ready for immediate application. This ensures you get the exact, professionally crafted analysis without any placeholders or modifications.

Rivalry Among Competitors

The Canadian telecommunications sector is a prime example of an oligopoly, with BCE, Rogers, and Telus holding a commanding presence. This limited number of major players means competition is fierce, as each company strives to capture a larger slice of the market across wireless, internet, and TV services. For instance, in 2024, these three companies continued to vie for dominance, often engaging in aggressive pricing strategies and bundled service offerings to attract and retain customers.

The telecommunications sector, including companies like BCE, is characterized by substantial upfront investments in network infrastructure, such as fiber optic cables and 5G technology. These high fixed costs mean that companies must operate at high utilization rates to achieve profitability.

Consequently, BCE and its rivals often engage in aggressive pricing and promotional campaigns to capture market share and keep their networks busy. This constant drive to maximize capacity utilization intensifies competition and can lead to price wars, impacting profit margins across the industry.

Competitive rivalry at BCE is intense, extending far beyond mere price competition. Companies vie for customer loyalty through superior service quality, boasting faster network speeds, particularly with ongoing 5G+ deployments. BCE's investment in network enhancements and innovative solutions, such as AI-driven customer service tools, is crucial for carving out a distinct market position.

Bundling and Loyalty Programs

BCE and its competitors heavily rely on bundling services like wireless, internet, TV, and home phone to keep customers. This strategy makes it more difficult for rivals to attract BCE's subscribers, thereby intensifying competition.

Loyalty programs further solidify customer relationships, acting as a significant barrier to switching providers. These programs are designed to reward long-term customers, making the cost or inconvenience of switching more pronounced.

- Bundling: BCE offers various bundles, such as the "SmartR" package combining internet, TV, and mobile, aiming to increase average revenue per user (ARPU) and reduce churn.

- Loyalty Programs: BCE Rewards members can earn points on eligible services, redeemable for discounts on devices, services, or travel, fostering customer stickiness.

- Competitive Impact: The widespread use of these tactics means that customer acquisition costs can be high, as companies must offer attractive bundles and rewards to lure customers away from entrenched loyalty.

Regulatory Environment and Market Share

The Canadian Radio-television and Telecommunications Commission (CRTC) significantly shapes competitive rivalry by enacting regulations that impact market access and pricing. For instance, CRTC decisions on wholesale high-speed internet access and the framework for Mobile Virtual Network Operators (MVNOs) directly influence how new and existing players can compete. BCE, as a major incumbent, navigates these regulations to protect and expand its market share, often facing intensified competition as a result of policies designed to foster a more dynamic telecom sector.

In 2024, the competitive landscape for BCE remains heavily influenced by ongoing regulatory scrutiny. The CRTC's continued focus on affordability and competition, particularly in the mobile sector, means that BCE must constantly adapt its strategies. For example, the CRTC's ongoing review of wholesale wireless service rates could lead to further pressure on BCE's margins and market positioning, potentially benefiting smaller competitors or new entrants. BCE's ability to maintain its substantial market share, which stood at approximately 25% of the Canadian wireless market in early 2024, is directly tied to its response to these evolving regulatory directives.

- CRTC's wholesale access decisions: These rulings can lower barriers to entry for competitors, increasing rivalry.

- MVNO framework: The establishment and regulation of MVNOs provide new avenues for competition, challenging incumbent market share.

- BCE's market share strategy: BCE aims to leverage its infrastructure and service offerings to defend and grow its share amidst regulatory shifts.

- Impact on competition: Regulatory actions can either intensify or moderate the competitive intensity faced by BCE and its rivals.

Competitive rivalry within the Canadian telecommunications sector, where BCE operates, is characterized by an oligopolistic structure dominated by a few key players. This intense competition forces companies to focus on customer acquisition and retention through aggressive pricing, bundled services, and loyalty programs. For instance, in early 2024, BCE held approximately 25% of the Canadian wireless market, showcasing the significant, yet still contested, market share each major player commands. The ongoing investments in 5G technology and network upgrades by BCE and its rivals further fuel this rivalry, as service quality becomes a critical differentiator.

| Key Competitors | Primary Service Offerings | 2024 Market Focus |

|---|---|---|

| BCE (Bell) | Wireless, Internet, TV, Business Solutions | 5G+ Expansion, Fibe Internet, Content Integration |

| Rogers Communications | Wireless, Internet, TV, Media | 5G Network Growth, Shaw Integration, Sports & Media Content |

| Telus Communications | Wireless, Internet, TV, Health, Business Solutions | 5G Expansion, Home Internet, Digital Health Initiatives |

SSubstitutes Threaten

The rise of Over-the-Top (OTT) streaming services presents a potent threat of substitutes for BCE's traditional media offerings. Platforms like Netflix, Disney+, and Amazon Prime Video have captured a significant share of consumer attention, offering on-demand viewing that directly competes with linear television. This shift is evident in subscriber numbers, with global OTT subscriptions projected to reach over 2.5 billion by 2025, according to Statista. The convenience and vast content libraries of these services exert considerable pressure on BCE's legacy broadcast and pay-TV revenues, as consumers increasingly opt for flexible, personalized entertainment experiences.

The rise of Voice over Internet Protocol (VoIP) and messaging apps presents a significant threat of substitutes for BCE's traditional voice services. Services like WhatsApp and FaceTime offer free or very low-cost voice and video calls, directly competing with traditional home phone and mobile voice plans. This shift has demonstrably eroded BCE's legacy voice revenue, a trend that continued into 2024 as consumers increasingly favored these digital alternatives for their global connectivity needs.

Public Wi-Fi hotspots, while not a complete replacement for home broadband, can function as a substitute for mobile data usage, especially for consumers seeking to conserve their cellular data allowances. This is particularly relevant in urban areas where free Wi-Fi is widely accessible in cafes, libraries, and public transport.

Emerging satellite internet services, such as SpaceX's Starlink, represent a more direct, albeit currently niche, substitute. As of early 2024, Starlink has expanded its service to numerous countries and continues to grow its subscriber base, offering an alternative for users in areas where traditional fixed-line broadband infrastructure is unavailable or underdeveloped, potentially impacting BCE's market share in those specific regions.

Cord-Cutting and Cord-Nevers

The ongoing trend of consumers canceling traditional cable or satellite TV subscriptions, known as cord-cutting, significantly impacts BCE's revenue from its TV segment. This shift is driven by the increasing popularity and accessibility of streaming services. For instance, by the end of 2023, approximately 30% of Canadian households had cut the cord, a figure projected to grow.

Younger demographics, referred to as cord-nevers, represent a growing segment that has never subscribed to traditional television services. These consumers are accustomed to on-demand content delivery through digital platforms. This necessitates a strategic pivot for BCE, focusing on strengthening its digital media offerings and content acquisition to appeal to these evolving consumer preferences.

- Cord-Cutting Impact: Consumers cancelling traditional TV subscriptions for streaming services directly erodes BCE's legacy TV revenue streams.

- Cord-Nevers Trend: Younger generations, who bypass traditional TV altogether, represent a crucial future market that BCE must engage through digital-first strategies.

- Strategic Imperative: BCE must invest heavily in digital platforms and exclusive content to compete effectively against a growing array of streaming alternatives.

Self-Service and Digital Alternatives for Business

The threat of substitutes for BCE's traditional business communication services is significant, particularly from self-service and digital alternatives. For business customers, cloud-based communication tools, Software-as-a-Service (SaaS) solutions, and digital collaboration platforms offer flexible and often more cost-effective options. For instance, the global collaboration software market was projected to reach over $60 billion in 2024, indicating a strong preference for these digital substitutes.

These readily available digital alternatives can fulfill many of the communication and collaboration needs previously met by traditional telco providers. This trend necessitates that BCE adapt its offerings, moving beyond basic connectivity to provide integrated technology services that incorporate these digital capabilities. Companies are increasingly looking for unified platforms that streamline operations, making standalone communication services less appealing.

- Cloud-based communication platforms offer scalable solutions that bypass traditional infrastructure.

- SaaS collaboration tools provide integrated functionalities for project management and team interaction.

- Digital alternatives often present lower upfront costs and greater flexibility for businesses.

- The growing adoption of these substitutes pressures companies like BCE to innovate their service portfolios.

The threat of substitutes for BCE's traditional media and telecommunications services is substantial, driven by evolving consumer preferences and technological advancements. Digital platforms offer convenience and cost-effectiveness, directly challenging legacy revenue streams.

In 2024, the subscription video-on-demand (SVOD) market continued its robust growth, with global revenue projected to exceed $150 billion, underscoring the shift away from traditional cable. Similarly, over-the-top (OTT) voice and messaging services have significantly eroded BCE's traditional voice revenues, with many consumers opting for free or low-cost alternatives for international communication.

| Service Category | Key Substitutes | Impact on BCE |

|---|---|---|

| Television Services | Netflix, Disney+, Amazon Prime Video, YouTube TV | Decreased cable/satellite subscriptions (cord-cutting), reduced advertising revenue. |

| Voice Services | WhatsApp, FaceTime, Zoom, Skype | Erosion of traditional landline and mobile voice revenue. |

| Internet Services | Public Wi-Fi, Satellite Internet (e.g., Starlink) | Potential reduction in mobile data usage, alternative for underserved areas. |

Entrants Threaten

The threat of new entrants in the telecommunications sector, particularly for a company like BCE, is significantly mitigated by the sheer scale of capital expenditure required. Building and maintaining advanced telecommunications infrastructure, such as extensive fiber optic networks and the latest 5G wireless capabilities, demands billions of dollars in investment. For instance, in 2024, major telecommunications companies continued to invest heavily in 5G deployment, with global capital expenditures in this area projected to reach hundreds of billions of dollars annually.

This immense capital requirement acts as a substantial barrier to entry. New companies would need to secure vast amounts of funding to even begin competing on infrastructure alone, let alone marketing and customer acquisition. BCE's established and extensive network scale, built over decades, provides a significant cost advantage. A newcomer would struggle to achieve comparable economies of scale, making it incredibly difficult to match BCE's pricing or service reach without incurring prohibitively high per-unit costs.

The threat of new entrants for BCE is significantly mitigated by intense regulatory hurdles. Canada's telecommunications and media industries are overseen by the Canadian Radio-television and Telecommunications Commission (CRTC), which imposes rigorous licensing requirements, ongoing compliance obligations, and adherence to specific broadcasting and telecommunications policies. For instance, in 2023, the CRTC continued to emphasize its commitment to fostering competition while ensuring consumer protection and Canadian content, making the initial investment and operational setup a complex and costly undertaking for any aspiring competitor.

Established brand loyalty and network effects present a significant barrier for new entrants looking to challenge incumbents like BCE. BCE, for instance, benefits from decades of brand recognition and a deeply entrenched customer base, making it difficult for newcomers to gain traction. In 2023, BCE reported over 13 million total mobile subscribers, a testament to its established market presence and the loyalty it commands.

Limited Access to Scarce Resources (Spectrum)

The availability of wireless spectrum, a finite resource managed by governments, presents a significant barrier for new entrants wanting to offer mobile services. Acquiring these essential licenses through auctions is a high-stakes, expensive endeavor, often demanding billions of dollars. For instance, the U.S. Federal Communications Commission's Auction 110 in 2021 generated over $81 billion for mid-band spectrum, highlighting the immense capital required.

This scarcity and cost make it exceedingly difficult for newcomers to secure the necessary spectrum rights to build a competitive wireless network. Without adequate spectrum, a new provider cannot offer the data speeds and capacity consumers expect, effectively limiting their ability to challenge established players.

- Spectrum Scarcity: Wireless spectrum is a limited, government-controlled asset vital for mobile operations.

- High Auction Costs: Spectrum auctions are intensely competitive and require substantial financial investment, as demonstrated by the $81 billion raised in the U.S. FCC Auction 110 in 2021.

- Barrier to Entry: The cost and difficulty of acquiring spectrum licenses prevent many new companies from entering the market with a viable service offering.

- Competitive Disadvantage: Insufficient spectrum allocation handicaps new entrants, hindering their ability to match the network performance of existing mobile operators.

Integration of Services and Bundling

BCE's strategy of integrating wireless, internet, TV, and media services creates a significant barrier for new entrants. This bundled offering fosters customer loyalty and necessitates substantial investment in diverse infrastructure and content. For example, in 2024, BCE continued to expand its fiber-to-the-home network, reaching over 3.7 million premises, a testament to the capital required for such integrated services.

A new competitor would struggle to match BCE's comprehensive service portfolio. They would either need to invest heavily to replicate this complexity or target a specific niche, potentially facing intense price competition from BCE's bundled advantages. This integration makes it difficult for smaller, less diversified players to gain significant market share.

- Bundled Advantages: BCE's integrated services offer convenience and potential cost savings for customers, making it harder for new entrants to attract them away.

- Capital Intensity: Replicating BCE's vast infrastructure, including its extensive wireless and fiber networks, requires immense capital investment, a significant deterrent for new players.

- Customer Stickiness: The integrated nature of BCE's offerings increases customer switching costs, reinforcing its market position.

- Regulatory Hurdles: Navigating the complex regulatory landscape for telecommunications and media services in Canada adds another layer of difficulty for potential new entrants.

The threat of new entrants for BCE is significantly diminished by the immense capital investment required to build and maintain telecommunications infrastructure, coupled with stringent regulatory requirements and the scarcity of wireless spectrum. These factors create substantial barriers, making it exceptionally difficult and costly for new companies to establish a competitive presence.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|---|

| Capital Intensity | Building advanced networks (5G, fiber) requires billions. | Prohibitive initial investment. | Global 5G capex projected in hundreds of billions annually (2024). |

| Regulatory Hurdles | CRTC licensing, compliance, and policy adherence. | Complex and costly setup process. | CRTC focus on competition and consumer protection (2023). |

| Spectrum Scarcity | Limited wireless spectrum, high auction costs. | Difficulty obtaining licenses for mobile services. | US FCC Auction 110 raised over $81 billion (2021). |

| Brand Loyalty & Scale | Established customer base and network effects. | Challenges in customer acquisition and retention. | BCE had over 13 million mobile subscribers (2023). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including detailed company financial statements, industry-specific market research reports, and publicly available regulatory filings. This blend ensures a comprehensive understanding of competitive intensity, supplier and buyer leverage, and the threat of new entrants and substitutes.