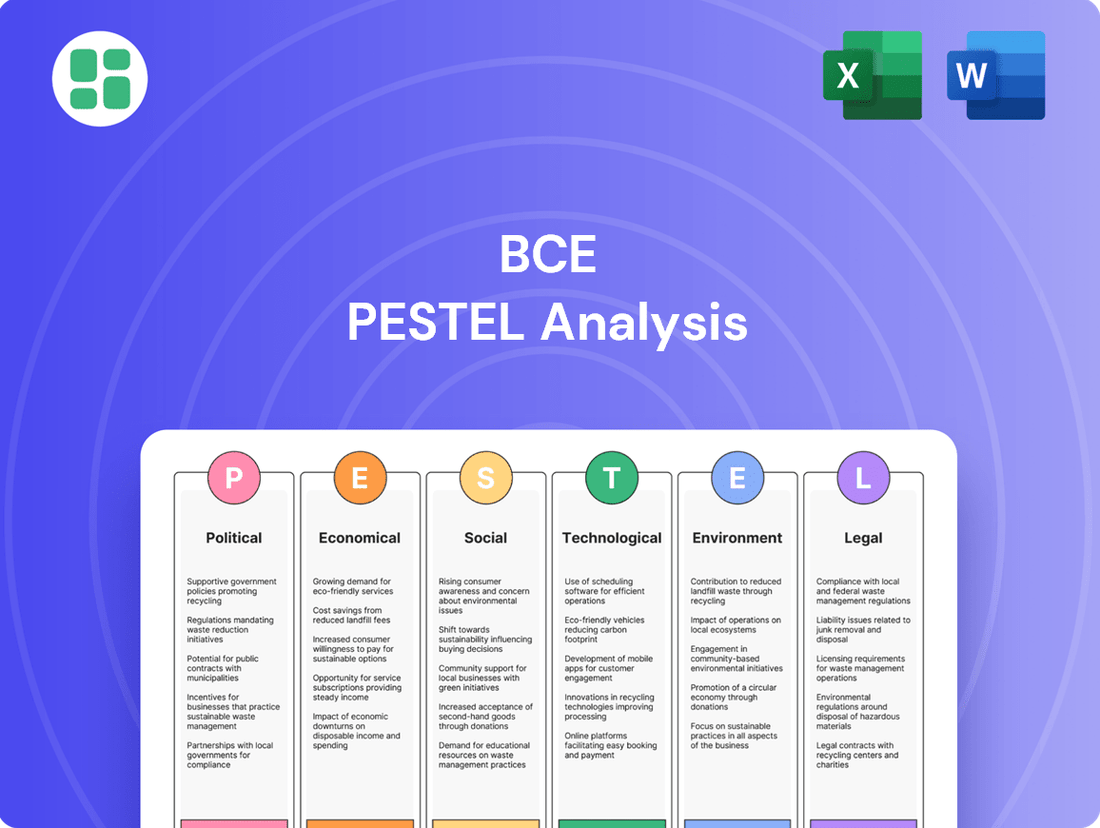

BCE PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BCE Bundle

Navigate the complex external landscape impacting BCE with our comprehensive PESTLE Analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping its future success. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full analysis now for immediate, expert insights.

Political factors

Government regulation, particularly from the CRTC, heavily shapes BCE's business. Policies on telecom pricing and competition, for instance, directly affect BCE's revenue and market dynamics. In 2024, the CRTC's ongoing review of wholesale internet rates and its focus on affordability continue to be key areas influencing BCE's strategic planning and investment in network infrastructure.

Government-led spectrum auctions are pivotal for BCE's wireless growth, especially as 5G deployment continues. The cost and availability of these crucial airwaves directly influence BCE's capacity to deliver cutting-edge services and maintain a competitive edge in the market.

For instance, in the 2023 AWS-3 spectrum auction, Canada's Innovation, Science and Economic Development (ISED) Canada generated approximately $1.9 billion, with BCE securing significant holdings. These acquisitions are fundamental to BCE's capital expenditure plans and long-term network strategy, impacting future service offerings and market positioning.

The Competition Bureau of Canada plays a significant role in overseeing BCE's operations, particularly concerning mergers and acquisitions within the telecommunications and media sectors. For instance, in 2023, the Bureau continued its active review of market practices, impacting how large players like BCE can expand or consolidate their market share.

Any significant proposed consolidation or dominant market behavior by BCE is subject to scrutiny. This oversight is designed to ensure a level playing field, preventing anti-competitive practices that could harm consumers and smaller businesses. Failure to comply can result in substantial penalties or outright prohibition of deals, as seen in past telecom merger reviews.

Broadcasting and Digital Media Policy

Government initiatives and evolving legislation around online streaming and traditional broadcasting directly influence BCE's vast media holdings. For instance, the Canadian Radio-television and Telecommunications Commission (CRTC) has been actively shaping policies to ensure Canadian content is discoverable and that foreign streaming services contribute to Canadian production. This is crucial as BCE's media segment, including CTV and its radio stations, competes and collaborates within this dynamic landscape.

Policies mandating contributions from foreign streaming services, such as those proposed under the modernization of the Broadcasting Act, could create new revenue streams or impose new obligations on BCE's content creation and distribution strategies. In 2023, the government introduced Bill C-11, the Online Streaming Act, aiming to modernize broadcasting rules for the digital age, which is expected to significantly impact how digital media companies operate in Canada and their contributions to Canadian content.

- Bill C-11 (Online Streaming Act): Aims to bring online streaming services under Canadian broadcasting regulations, potentially requiring contributions to Canadian content creation.

- Canadian Content Quotas: Ongoing discussions and potential adjustments to quotas for Canadian-made programming across various platforms directly affect content acquisition and production costs for BCE.

- CRTC Regulations: The CRTC's ongoing review and updates to broadcasting regulations, including those concerning discoverability and accessibility of Canadian content, shape BCE's media operations.

- Digital Media Taxation: Potential government proposals to tax digital services and advertising could impact BCE's revenue and competitive positioning against global digital giants.

International Trade Agreements

International trade agreements significantly shape BCE's operational landscape. While not directly governing domestic telecom, these accords influence the cost of acquiring network equipment and components, impacting overall capital expenditure. For instance, the Canada-United States-Mexico Agreement (CUSMA), which replaced NAFTA, continues to facilitate trade in goods and services between these North American nations, potentially offering cost efficiencies for BCE's supply chain.

Furthermore, these agreements can affect intellectual property rights, a crucial aspect for BCE's media and content divisions. Changes in international copyright laws or digital trade provisions within agreements can influence how BCE licenses, distributes, and protects its content globally. As of early 2024, ongoing discussions around digital trade chapters in various international pacts highlight the evolving nature of these protections.

- Supply Chain Costs: Trade agreements can reduce tariffs and streamline customs, lowering the cost of importing telecommunications hardware and software.

- Market Access: Agreements may open doors for BCE to expand its services internationally or face increased competition from foreign telecom providers.

- Intellectual Property: Provisions within trade deals impact the protection and global distribution of BCE's media content, including licensing and copyright enforcement.

Government policy is a dominant force shaping BCE's operations, from pricing regulations set by the CRTC to spectrum allocation for wireless expansion. The ongoing focus on affordability and competition in the telecom sector directly impacts BCE's investment decisions and revenue streams, with initiatives like wholesale rate reviews in 2024 a key consideration. Furthermore, legislative efforts like Bill C-11, the Online Streaming Act, are actively redefining the media landscape, influencing BCE's content strategy and its interactions with digital platforms.

What is included in the product

This BCE PESTLE Analysis provides a comprehensive examination of external macro-environmental factors impacting the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying both emerging threats and potential opportunities relevant to the BCE's operating landscape.

The BCE PESTLE Analysis provides a structured framework to identify and understand external factors, thereby alleviating the pain of uncertainty and enabling more informed strategic decision-making.

Economic factors

Consumer spending is a significant driver for BCE's revenue, particularly in areas like media subscriptions and telecommunication services. When consumers feel confident about the economy and their personal finances, they are more likely to spend on these services. For instance, in the first quarter of 2024, Canadian retail sales saw a modest increase, suggesting a generally stable consumer environment, though growth has been cautious.

Disposable income directly impacts how much households can allocate to discretionary spending, including BCE's offerings. A strong economy with rising wages and low unemployment typically leads to higher disposable income, benefiting BCE. Conversely, periods of high inflation or economic uncertainty can lead consumers to reduce spending on non-essential services, potentially impacting BCE's residential segment by pushing customers towards more basic or bundled plans.

The willingness of consumers to spend on telecommunications and media is closely tied to their overall economic outlook. In 2024, while inflation has shown signs of moderating, the cumulative effect of higher interest rates continues to influence household budgets. This means consumers may be more discerning about their spending, prioritizing essential services over premium media packages, which could present a challenge for BCE's growth in certain segments.

Inflation is a significant concern for BCE. For instance, the Consumer Price Index (CPI) in Canada saw a notable increase, reaching 2.9% year-over-year in April 2024, as reported by Statistics Canada. This rise directly impacts BCE's operational expenses, from the cost of materials for network upgrades to employee wages, potentially squeezing profitability.

Furthermore, the Bank of Canada's monetary policy, which involves adjusting interest rates to manage inflation, directly affects BCE's borrowing costs. As of mid-2024, key interest rates remain elevated, making it more expensive for BCE to finance its substantial capital expenditures, such as the ongoing expansion of its 5G and fiber optic networks. This can slow down investment and increase the burden of servicing existing debt.

BCE's media segment's performance is intrinsically linked to advertising market trends, which are highly susceptible to economic fluctuations. For instance, during periods of economic contraction, companies tend to slash marketing expenditures, directly impacting BCE's revenue streams from television, radio, and its various digital platforms.

Looking ahead, projections for 2024 and 2025 suggest a mixed but generally improving advertising landscape. While digital advertising continues its robust growth, with global ad spending expected to reach over $1 trillion in 2024 according to some industry forecasts, traditional media like television and radio may see more modest gains, contingent on broader economic recovery and consumer confidence.

The recovery phase of economic cycles typically fuels a resurgence in advertising investment as businesses aim to capture renewed consumer demand. This rebound directly benefits BCE's media assets, as increased ad spend translates into higher revenues and improved profitability for its television, radio, and digital advertising operations.

Economic Growth and Stability

Canada's economic growth trajectory directly impacts BCE's service demand. A robust GDP expansion, such as the projected 1.8% for 2024 and a steady 2.1% in 2025, fuels business investment in crucial network infrastructure and advanced digital solutions. This translates to higher demand for BCE's enterprise telecom and data services as companies scale operations.

Consumer spending, a key driver for residential services, is also tethered to economic stability. When the economy is stable, Canadians exhibit greater confidence, leading to consistent expenditure on mobile, internet, and television packages. Inflationary pressures, however, can temper this spending, making value propositions increasingly important for service providers like BCE.

- Economic Growth: Canada's projected GDP growth of 1.8% in 2024 and 2.1% in 2025 supports increased enterprise demand.

- Business Expansion: A growing economy encourages businesses to invest in telecom and data services for expansion.

- Consumer Confidence: Economic stability fosters consumer confidence, driving consistent spending on communication needs.

- Inflation Impact: Rising inflation could potentially influence consumer spending on discretionary communication services.

Labor Market Conditions

Labor market conditions significantly impact BCE's operational efficiency and strategic growth. The availability and cost of skilled professionals, especially in high-demand fields like network engineering, cybersecurity, and software development, are critical. For instance, in Canada, the unemployment rate for tech occupations remained low, hovering around 2.0% in early 2024, indicating a competitive landscape for talent acquisition.

Wage inflation and persistent labor shortages can directly translate into increased operating expenses for BCE, potentially delaying crucial infrastructure upgrades and service expansions. In 2024, average weekly earnings in Canada saw a modest increase, reflecting ongoing inflationary pressures that affect labor costs across industries, including telecommunications.

BCE's success in attracting and retaining top talent is paramount to maintaining its competitive edge and executing its ambitious deployment plans. Companies like BCE often face challenges in securing specialized skills, which can impact project timelines and innovation cycles.

- Skilled Labor Demand: High demand for network engineers and cybersecurity experts in Canada, with reported shortages in these specialized roles.

- Wage Pressures: Average weekly earnings in Canada saw a 3.5% year-over-year increase as of Q1 2024, impacting labor costs for BCE.

- Talent Retention: BCE's ability to offer competitive compensation and career development is vital to retaining its skilled workforce amidst industry competition.

- Infrastructure Deployment: Labor availability directly influences the pace of BCE's 5G network expansion and fiber optic build-outs.

Canada's economic growth is a key factor influencing BCE's performance. Projected GDP growth of 1.8% for 2024 and 2.1% for 2025 indicates a supportive environment for increased demand for BCE's enterprise telecom and data services, as businesses invest in their own expansion. This economic stability also fosters consumer confidence, leading to more consistent spending on BCE's residential services like internet and mobile plans, though inflation remains a consideration for discretionary spending.

| Economic Factor | 2024 Projection | 2025 Projection | Impact on BCE |

|---|---|---|---|

| Canadian GDP Growth | 1.8% | 2.1% | Drives enterprise demand for telecom and data services. |

| Consumer Spending | Stable with caution | Expected to improve | Supports residential service revenue, but inflation may affect discretionary upgrades. |

| Inflation Rate (CPI) | Moderating (e.g., 2.9% in April 2024) | Targeted (around 2%) | Increases BCE's operational costs and influences consumer budget allocation. |

| Interest Rates | Elevated | Potentially easing | Affects BCE's borrowing costs for capital expenditures like network expansion. |

Preview Before You Purchase

BCE PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive BCE PESTLE analysis provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business. You can trust that the insights and structure you see are precisely what you'll be working with.

Sociological factors

BCE is navigating a significant shift in how people consume media, moving away from traditional TV and radio towards on-demand streaming. This means fewer people are watching scheduled programming, impacting BCE's legacy revenue streams.

To stay competitive, BCE is investing heavily in its own streaming service, Crave, and other digital content. For instance, in Q1 2024, Bell Media reported a 2.3% increase in content and production revenue, partly driven by digital growth, though overall media revenue saw a slight dip. This highlights the ongoing challenge and opportunity in adapting to these changing consumer preferences.

Canada's population is aging, with the proportion of those aged 65 and over projected to reach 24.5% by 2030. This demographic shift influences BCE's service demand, as older Canadians may favor established services, while a growing urban population, particularly younger demographics, drives adoption of digital platforms and new technologies.

Urbanization continues, with over 80% of Canadians now living in urban areas, a trend expected to persist. This concentration of population in cities creates concentrated demand for high-speed internet and advanced mobile services, areas where BCE has significant investment. However, BCE must also ensure equitable service delivery to less urbanized regions to avoid a digital divide.

Societal expectations and government initiatives are strongly pushing to close the digital divide in Canada, aiming for fair access to fast internet everywhere. BCE, being a primary network builder, feels both pressure and sees chances to extend its services into rural and remote areas that currently lack robust connectivity.

For instance, in 2023, the Canadian government committed an additional $1.7 billion through the Universal Broadband Fund, targeting underserved regions. BCE's participation in such programs, like its agreements to connect thousands of households in Quebec and Ontario with fibre optic internet, directly addresses these inclusion goals, though it also brings public attention to its progress and investment strategies.

Work-from-Home and Hybrid Work Trends

The ongoing shift towards work-from-home and hybrid models, a significant sociological change, has placed immense pressure on telecommunications infrastructure. This means more people are relying on stable, high-speed internet and dependable mobile service for their daily work, directly impacting demand for BCE's offerings.

Customers now expect seamless connectivity for video conferencing, cloud-based applications, and constant data access. For BCE, this translates into a need for greater network capacity and reliability to meet these heightened expectations. A recent report indicated that in 2024, Canadian households experienced an average of 10% more internet usage compared to the previous year, underscoring this trend.

- Increased Demand for Bandwidth: The surge in remote work necessitates higher internet speeds and more robust data plans.

- Reliability is Key: Network stability is no longer a luxury but a critical requirement for productivity.

- Integrated Solutions: Customers are seeking bundled services that encompass internet, mobile, and communication tools.

- Network Investment: BCE's continued investment in network upgrades is crucial to maintaining its competitive edge in this evolving landscape.

Data Privacy and Security Concerns

Growing awareness of data privacy and cybersecurity significantly shapes consumer trust and attracts regulatory attention. BCE, managing extensive customer information, needs ongoing investment in strong security and strict privacy compliance. For instance, in 2023, the global average cost of a data breach reached $4.45 million, highlighting the financial risks involved.

Public perception of how companies handle data directly affects customer loyalty and brand image. A 2024 survey indicated that 75% of consumers are more likely to switch to a competitor if they distrust a company's data privacy practices. This necessitates transparent communication and demonstrable commitment to safeguarding user information.

- Data Breach Costs: The global average cost of a data breach was $4.45 million in 2023.

- Consumer Trust: 75% of consumers may switch providers due to privacy concerns (2024 survey).

- Regulatory Impact: Stricter data protection laws like GDPR and CCPA impose significant compliance burdens and penalties.

- Brand Reputation: Negative publicity from data incidents can severely damage brand equity and market standing.

Societal trends like the increasing demand for digital inclusion and the ongoing shift to remote work directly influence BCE's service offerings and infrastructure investments. The growing emphasis on closing the digital divide, supported by government funding, presents both opportunities and obligations for BCE to expand its high-speed internet services into underserved areas. Furthermore, the widespread adoption of remote and hybrid work models has amplified the need for reliable, high-capacity connectivity, pushing customer expectations for seamless online experiences.

| Sociological Factor | Impact on BCE | Supporting Data (2023-2025) |

| Digital Inclusion & Closing the Digital Divide | Increased demand for rural/remote broadband expansion; government partnership opportunities. | Canada's Universal Broadband Fund commitment of $1.7 billion (2023); BCE's fibre optic expansion projects in Quebec and Ontario. |

| Remote/Hybrid Work Models | Elevated demand for bandwidth, network reliability, and integrated communication solutions. | Average Canadian household internet usage increased by 10% in 2024; strong demand for BCE's business internet and mobile services. |

| Data Privacy & Cybersecurity Awareness | Need for robust security investments and transparent data handling to maintain customer trust and brand reputation. | Global average data breach cost reached $4.45 million in 2023; 75% of consumers may switch providers due to privacy concerns (2024 survey). |

Technological factors

BCE's strategic advantage is significantly shaped by the ongoing 5G network deployment and its continuous evolution. This technological advancement is crucial for delivering faster speeds, reduced latency, and enabling a new wave of applications, particularly in the Internet of Things (IoT) space.

The company's commitment to expanding its 5G infrastructure is paramount for staying competitive and catering to the growing demand for sophisticated wireless services from both consumers and businesses. This involves not only broadening network coverage but also enhancing its capacity to handle increasing data traffic.

By the end of 2024, BCE reported that its 5G network covered over 70% of the Canadian population, a testament to its aggressive rollout strategy. Projections for 2025 indicate continued investment, with plans to further expand 5G capabilities, including mid-band spectrum deployment, which offers a better balance of speed and coverage.

BCE's strategic focus on Fiber-to-the-Home (FTTH) expansion is paramount for delivering the ultra-high-speed internet services consumers increasingly demand. This commitment to building out extensive fiber optic networks directly to residences and businesses is a core technological driver for the company.

In 2023, BCE announced plans to connect an additional 3 million homes and businesses to its fiber network by the end of 2026, building on its existing extensive coverage. This investment is critical for meeting escalating bandwidth needs and bolstering network reliability, directly countering competitive pressures from cable operators.

The FTTH infrastructure serves as the bedrock for future service innovations, enabling BCE to offer advanced solutions and maintain a competitive edge in the rapidly evolving telecommunications landscape.

BCE's strategic integration of Artificial Intelligence is a significant technological driver, enhancing operational efficiency and customer engagement. AI is being deployed across network optimization, predictive maintenance, and personalized customer service, as seen in their 2024 initiatives to improve network performance and customer satisfaction scores.

The company leverages AI to analyze vast datasets, enabling more informed decision-making and streamlined processes. This technological adoption is crucial for maintaining a competitive edge in the telecommunications sector, with AI-powered tools expected to further automate tasks and improve service delivery in 2025.

Cybersecurity Threats and Solutions

BCE, as a critical infrastructure provider and custodian of extensive customer data, is constantly targeted by evolving cybersecurity threats. For instance, in 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, highlighting the significant financial and reputational risks. Protecting its networks, data, and customer trust necessitates ongoing, substantial investment in advanced cybersecurity technologies, robust threat detection systems, and rapid incident response capabilities. Proactive security measures are not just beneficial but essential for mitigating these ever-present risks.

The company's commitment to cybersecurity is reflected in its operational expenditures. In 2023, major telecommunications companies globally reported increasing their cybersecurity budgets by an average of 10-15% to combat sophisticated attacks like ransomware and data breaches. BCE's strategy involves a multi-layered approach, focusing on:

- Advanced Threat Intelligence: Utilizing AI-driven platforms to predict and identify emerging cyber threats before they impact operations.

- Data Encryption and Protection: Implementing state-of-the-art encryption for all customer data, both in transit and at rest.

- Regular Security Audits and Penetration Testing: Continuously assessing vulnerabilities and strengthening defenses against potential breaches.

- Employee Training and Awareness: Fostering a security-conscious culture to prevent human error, a common vector for cyberattacks.

Emergence of New Media Technologies

Innovations in media consumption, including virtual reality (VR) and augmented reality (AR), are reshaping how audiences engage with content, presenting both hurdles and avenues for BCE's media operations. These emerging technologies, while still developing, necessitate close observation by BCE to understand their potential integration into future content distribution and advertising strategies.

For instance, the global VR market was valued at approximately $28.2 billion in 2023 and is projected to grow significantly. Similarly, the AR market is experiencing robust expansion. BCE could explore early adoption or forge strategic alliances to capitalize on these evolving media landscapes.

- VR/AR Integration: Opportunities exist to incorporate immersive experiences into BCE's content offerings.

- Advertising Models: New revenue streams could emerge through innovative advertising formats on these platforms.

- Content Delivery: Future strategies might involve leveraging VR/AR for unique content distribution.

BCE's technological advancement is heavily influenced by its aggressive 5G network expansion, aiming for broader coverage and enhanced speeds. This push is crucial for supporting the burgeoning Internet of Things (IoT) ecosystem and meeting escalating data demands. By the close of 2024, BCE's 5G network reached over 70% of the Canadian population, with continued investment planned for 2025 to incorporate mid-band spectrum for improved performance.

The company's strategic investment in Fiber-to-the-Home (FTTH) is a cornerstone of its technology strategy, designed to deliver high-speed internet services. BCE plans to connect an additional 3 million homes and businesses to its fiber network by the end of 2026, enhancing network reliability and competitiveness. This infrastructure underpins future service innovations and maintains BCE's edge in the evolving telecommunications market.

BCE is leveraging Artificial Intelligence (AI) to boost operational efficiency and customer engagement, focusing on network optimization and predictive maintenance. AI-driven data analysis aids in better decision-making and streamlined processes, with further automation and service improvements anticipated in 2025. This technological adoption is vital for staying competitive in the telecommunications sector.

Cybersecurity remains a critical technological factor for BCE, given the increasing global threat landscape; the cost of cybercrime was projected to reach $10.5 trillion annually in 2024. BCE invests in advanced cybersecurity technologies, threat detection, and incident response to protect its networks, data, and customer trust. This includes employing AI for threat intelligence, robust data encryption, regular security audits, and comprehensive employee training.

Emerging media technologies like virtual reality (VR) and augmented reality (AR) present new opportunities and challenges for BCE's media operations. The global VR market was valued at approximately $28.2 billion in 2023, with significant growth projected. BCE is exploring how to integrate these immersive experiences into its content distribution and advertising strategies to capitalize on evolving media consumption trends.

| Technology Area | BCE's 2024/2025 Focus | Key Data/Projections |

|---|---|---|

| 5G Network Deployment | Expanding coverage and capacity, mid-band spectrum integration | Over 70% population coverage by end of 2024; continued investment in 2025 |

| Fiber-to-the-Home (FTTH) | Extensive network build-out | Connect 3 million additional homes/businesses by end of 2026 |

| Artificial Intelligence (AI) | Network optimization, predictive maintenance, customer service enhancement | Improving network performance and customer satisfaction scores in 2024; further automation in 2025 |

| Cybersecurity | Advanced threat intelligence, data protection, incident response | Mitigating risks from a global cybercrime cost projected at $10.5 trillion annually (2024) |

| VR/AR Media | Exploring integration for content and advertising | Global VR market valued at ~$28.2 billion in 2023; robust AR market growth |

Legal factors

BCE, as a major telecommunications provider in Canada, must navigate the comprehensive regulatory landscape set by the Canadian Radio-television and Telecommunications Commission (CRTC). This includes adhering to directives on pricing transparency, ensuring service accessibility for all Canadians, and providing fair wholesale access to its network infrastructure.

The CRTC's ongoing efforts to foster competition and protect consumers mean BCE faces continuous scrutiny. For instance, in 2024, the CRTC continued to review wholesale internet service rates, impacting how BCE offers access to competitors, directly influencing its revenue streams and market positioning.

Failure to meet CRTC mandates can lead to substantial financial penalties, operational limitations such as service rollout restrictions, and significant damage to BCE's public image. Therefore, proactive compliance and engagement with regulatory bodies are critical for BCE's sustained operations and strategic growth.

BCE must strictly adhere to Canada's federal Personal Information Protection and Electronic Documents Act (PIPEDA) and provincial privacy statutes. These regulations dictate how personal information can be collected, used, and shared, impacting BCE's customer data handling practices.

To comply, BCE requires robust data governance, clear consent processes, and strong security protocols. Failure to protect customer data can result in significant penalties, with PIPEDA fines potentially reaching $10,000 per contravention, and even higher for wilful and systemic non-compliance.

As a dominant force in Canadian telecommunications and media, BCE operates under the watchful eye of the Competition Act. This legislation specifically targets anti-competitive behaviors, the abuse of a dominant market position, and scrutinizes any proposed mergers or acquisitions. For instance, in 2023, the Competition Bureau continued its review of various market practices across industries, underscoring the ongoing regulatory landscape for large corporations like BCE.

Failure to comply with these regulations can result in severe consequences. These might include mandated divestitures of certain assets, forced operational adjustments to foster fairer competition, or substantial financial penalties. The Competition Bureau actively investigates potential violations, ensuring that market dominance does not stifle innovation or harm consumers.

Intellectual Property Rights

BCE's extensive media portfolio, encompassing television, radio, and digital content, is fundamentally underpinned by robust intellectual property (IP) rights. Protecting these assets, whether owned or licensed, is paramount to maintaining its competitive edge and revenue generation. This necessitates a deep understanding and active management of copyright laws, which govern the creation and distribution of creative works.

Navigating the intricate landscape of licensing agreements is also a critical legal factor. BCE secures rights to broadcast and distribute content from various creators and studios, and these agreements are legally binding contracts that dictate usage terms and royalties. Ensuring compliance and favorable terms is essential for profitability.

Combating piracy remains a significant legal challenge. The unauthorized distribution and consumption of copyrighted material directly impact BCE's revenue streams. The company actively engages in legal measures to protect its content from infringement, including digital rights management technologies and legal action against infringers. For instance, in 2023, the Canadian government continued efforts to strengthen copyright protections, including provisions aimed at tackling online piracy, reflecting the ongoing importance of IP law for media companies like BCE.

The legal frameworks surrounding IP are therefore not merely procedural but are foundational to BCE's business model. They safeguard its substantial investments in content creation and acquisition, ensuring that its media revenue streams remain secure and that it can continue to offer premium content to its subscribers.

Consumer Protection Regulations

Consumer protection laws at federal and provincial levels significantly shape BCE's operations. These regulations cover crucial areas like contract clarity, billing accuracy, service reliability, and how customer disputes are handled. For instance, the Canadian Radio-television and Telecommunications Commission (CRTC) enforces codes of conduct that mandate transparency in pricing and service agreements, impacting how BCE markets its services.

Compliance is paramount to prevent costly repercussions such as customer complaints, potential class-action lawsuits, and fines from regulatory bodies. In 2023, the CRTC reported a notable increase in consumer complaints related to telecommunications services, underscoring the importance of robust adherence to consumer protection frameworks. BCE's commitment to fair subscriber treatment is therefore directly tied to its operational stability and financial health.

- Contractual Transparency: Ensuring all terms and conditions are clearly communicated to customers, preventing disputes over service limitations or pricing.

- Billing Accuracy: Implementing systems to guarantee that customer bills are precise and reflect actual services rendered, minimizing billing errors.

- Service Quality Standards: Meeting or exceeding mandated service quality benchmarks to ensure customer satisfaction and avoid regulatory scrutiny.

- Dispute Resolution Mechanisms: Establishing efficient and accessible processes for resolving customer grievances promptly and fairly.

BCE's operations are heavily influenced by Canadian competition law, which aims to prevent anti-competitive practices and mergers that could harm consumers. The Competition Bureau actively monitors market dynamics, impacting BCE's strategic decisions regarding acquisitions and market conduct. For instance, in 2023, the Bureau continued its focus on market practices across various sectors, signaling ongoing regulatory vigilance for large entities like BCE.

Adherence to intellectual property (IP) laws is crucial for BCE, particularly in its media divisions, to protect content from piracy and unauthorized use. The company actively employs legal measures and digital rights management technologies to safeguard its investments in content creation and licensing. In 2023, Canadian efforts to enhance copyright protections, including those against online piracy, reinforced the importance of IP law for media companies.

Consumer protection legislation mandates clear communication, accurate billing, and fair dispute resolution for BCE's services. The CRTC's codes of conduct, for example, emphasize pricing transparency and service reliability, directly influencing customer interactions. Given that the CRTC reported an increase in consumer complaints in 2023, BCE's commitment to these standards is vital for maintaining customer trust and avoiding penalties.

Environmental factors

BCE, like many telecommunications companies, is navigating stricter climate change regulations and growing pressure to curb carbon emissions. Governments worldwide, including Canada, are setting ambitious targets for greenhouse gas reduction, which directly impacts energy-intensive operations like network infrastructure. For instance, the Canadian government's 2030 emissions reduction target of 40-45% below 2005 levels by 2030, and net-zero by 2050, necessitates significant investment in cleaner energy for BCE's facilities and data centers.

These regulatory shifts translate into both challenges and opportunities for BCE. Increased compliance costs associated with emissions monitoring and potential carbon pricing mechanisms could affect operational expenses. However, incentives for adopting renewable energy sources, such as solar and wind power, offer a pathway to reduce long-term energy costs and enhance sustainability. BCE's proactive investment in green technologies and energy efficiency not only aids in meeting regulatory requirements but also positively influences investor perception and brand reputation in an environmentally conscious market.

BCE's vast network infrastructure, encompassing data centers, cell towers, and exchanges, demands substantial energy. In 2024, the telecommunications industry globally saw energy consumption rise due to increased data traffic and the rollout of 5G, a trend BCE must navigate.

BCE faces the challenge of actively managing and reducing its energy footprint. This involves implementing efficiency upgrades across its facilities and strategically adopting green energy solutions, such as solar and wind power, to offset reliance on traditional sources.

The rising cost of energy, coupled with growing environmental concerns, makes operational sustainability a critical focus for BCE. For instance, in 2023, the average price of electricity in Canada saw an increase, directly impacting operational expenses for large energy consumers like BCE.

The disposal of electronic equipment, from network hardware to customer devices, presents a significant environmental challenge. BCE must manage this e-waste responsibly, complying with regulations for recycling and proper disposal to mitigate environmental impact.

In 2024, the global e-waste generation is projected to reach 61.3 million metric tons, highlighting the scale of the issue. BCE's commitment to robust e-waste management programs is crucial for its environmental stewardship and reputation.

Adherence to evolving regulations, such as extended producer responsibility schemes, will be key. For instance, the EU's WEEE Directive sets ambitious collection and recycling targets, which companies like BCE must meet.

Sustainable Business Practices and ESG Reporting

The increasing emphasis on Environmental, Social, and Governance (ESG) factors by investors and the public requires BCE to showcase robust sustainable business practices. This involves clear reporting on its environmental impact, how it manages resources, and establishing ambitious goals for sustainability. A strong ESG profile can draw in investors committed to responsible practices and bolster the company's public image.

For instance, in 2024, a significant portion of global institutional investors indicated that ESG considerations directly influence their investment decisions. BCE's commitment to reducing its carbon footprint by a projected 30% by 2030, as outlined in its latest sustainability report, directly addresses this trend. Such initiatives are crucial for maintaining competitiveness and attracting capital in an evolving market landscape.

- Investor Demand: A 2024 survey revealed that over 70% of institutional investors actively seek ESG-integrated investment opportunities.

- Brand Reputation: Companies with strong ESG scores often experience higher customer loyalty and a more positive public perception.

- Regulatory Alignment: BCE's proactive approach to environmental reporting aligns with anticipated stricter environmental regulations expected in the coming years.

- Resource Efficiency: Investments in sustainable resource management, such as water conservation initiatives, can lead to significant operational cost savings.

Impact of Extreme Weather Events

Climate change is a growing concern, leading to an increase in severe weather incidents like floods, ice storms, and wildfires. These events pose a significant risk to BCE's telecommunications network, potentially causing disruptions to services and damaging critical infrastructure. For instance, the widespread power outages and infrastructure damage from the 2022 BC floods highlighted the vulnerability of essential services to extreme weather.

To counter these environmental threats, BCE is actively investing in enhancing its network's resilience and bolstering its disaster preparedness and recovery capabilities. This proactive approach aims to reduce the impact of service interruptions and safeguard its assets against environmental hazards. The company's capital expenditures, such as the $1.7 billion invested in network upgrades and expansion in 2023, often include provisions for hardening infrastructure against environmental stresses.

- Increased Frequency and Intensity of Extreme Weather: Climate change is driving more frequent and severe floods, ice storms, and wildfires globally.

- Network Infrastructure Vulnerability: BCE's physical network assets, including cell towers and fiber optic cables, are susceptible to damage from these events.

- Service Disruption Risks: Extreme weather can lead to widespread power outages and physical damage, directly impacting BCE's ability to deliver services to customers.

- Investment in Resilience: BCE must continue to allocate capital towards making its network more robust and developing effective disaster response plans to mitigate these risks.

BCE must manage its significant energy consumption, projected to rise with 5G expansion and increased data traffic in 2024. The company is investing in energy efficiency and renewable sources to offset operational costs, which saw electricity prices increase in Canada in 2023.

Responsible e-waste management is critical, especially with global e-waste projected to reach 61.3 million metric tons in 2024. BCE must comply with regulations like extended producer responsibility schemes to mitigate environmental impact.

Climate change poses risks to BCE's infrastructure through extreme weather events, as seen with the 2022 BC floods. The company is investing in network resilience, with 2023 capital expenditures including provisions for environmental hardening.

BCE's commitment to ESG factors is crucial, with over 70% of institutional investors seeking ESG opportunities in 2024. BCE's goal to reduce its carbon footprint by 30% by 2030 addresses this investor demand.

| Environmental Factor | Impact on BCE | BCE's Response/Data |

|---|---|---|

| Climate Change Regulations | Increased compliance costs, need for cleaner energy | Canada's 2030 emissions target: 40-45% below 2005 levels. BCE investing in green technologies. |

| Energy Consumption | Rising operational expenses due to network demands | Global 5G rollout and data traffic increase energy needs in 2024. 2023 electricity price hikes in Canada. |

| E-Waste Management | Regulatory compliance, environmental stewardship | Global e-waste projected at 61.3 million metric tons in 2024. BCE implements robust recycling programs. |

| Extreme Weather Events | Risk of infrastructure damage and service disruption | 2022 BC floods highlighted infrastructure vulnerability. BCE invested $1.7B in network upgrades in 2023, including resilience measures. |

| ESG Investor Demand | Attracting capital, enhancing brand reputation | Over 70% of institutional investors seek ESG opportunities (2024 survey). BCE aims for 30% carbon footprint reduction by 2030. |

PESTLE Analysis Data Sources

Our BCE PESTLE Analysis is built on a robust foundation of data from reputable sources, including government publications, international organizations, and leading market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends to provide a comprehensive overview.