BCE Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BCE Bundle

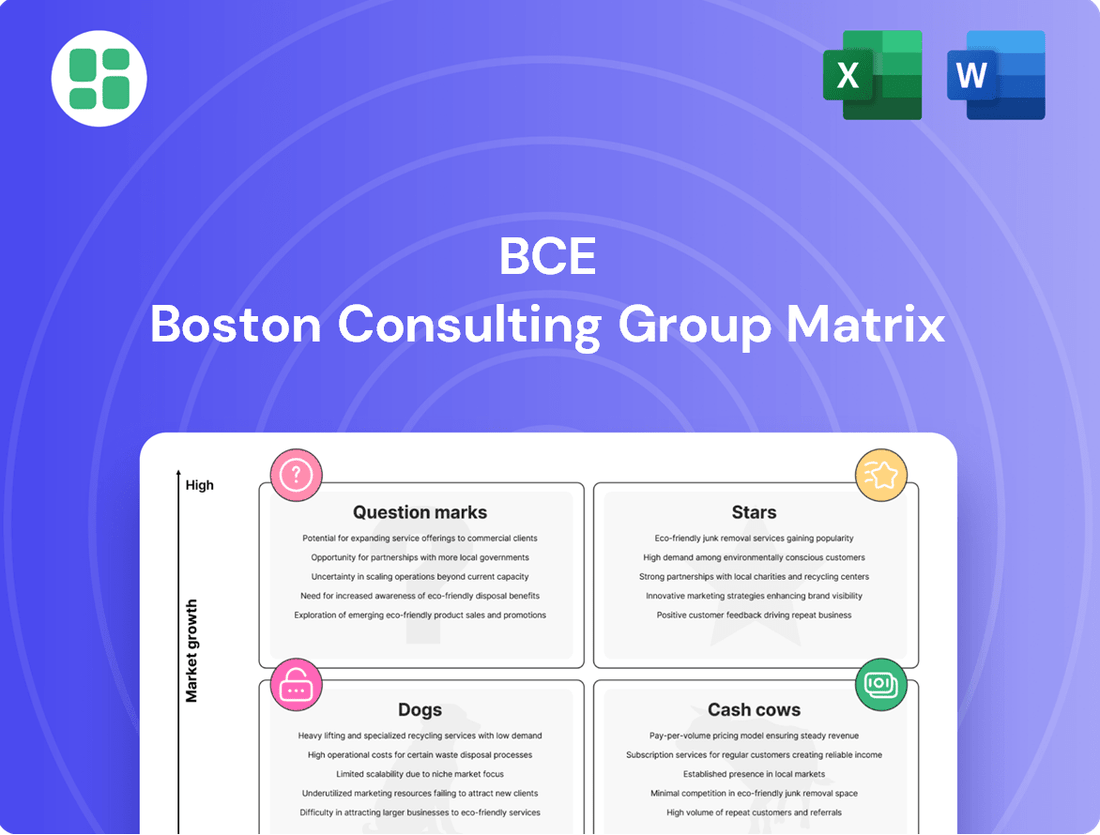

The BCG Matrix is a powerful tool for analyzing a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share. Understanding these placements is crucial for informed resource allocation and strategic planning.

This preview offers a glimpse into the strategic positioning of key products, but the full BCG Matrix report unlocks a complete, data-driven roadmap. Gain actionable insights into optimizing your portfolio and driving sustainable growth by purchasing the full version today.

Stars

BCE's 5G and 5G+ networks are recognized as top-performing in Canada, suggesting a significant market share in this rapidly growing sector. The company's ongoing investment in expanding its 5G coverage directly supports the anticipated rise in 5G service subscriptions across the country.

This robust position within a burgeoning market points to sustained leadership and promising future profitability for BCE's wireless services.

Bell's Fibre-to-the-Home (FTTH) internet service is a standout performer, often lauded for its superior speed and reliability. This has translated into a steadily growing customer base, solidifying its position as a market leader in the high-speed internet sector.

Despite some regulatory hurdles that have influenced the speed of its nationwide rollout, BCE has successfully built out a significant and growing FTTH network. This expansion has been accompanied by robust revenue growth, underscoring the financial viability of this investment.

Customer demand for fibre optic technology continues to climb, with many consumers prioritizing its enhanced capabilities. This strong preference positions BCE's FTTH segment as a crucial engine for increasing market share in the competitive high-speed internet landscape.

Bell Business Markets and Enterprise Solutions represent a significant growth engine for BCE, demonstrating robust revenue expansion in business technology services. In the first quarter of 2024, BCE reported that its Bell Business Markets segment saw its revenue increase by 4.7% year-over-year.

This segment capitalizes on BCE's extensive network infrastructure to deliver sophisticated solutions, including cloud, security, and managed services, to enterprise clients. The company is strategically positioning itself as a leader in tech services, tapping into the high demand driven by digital transformation initiatives across various industries.

Digital Media and Streaming (Crave)

Bell Media's digital media and streaming segment, notably its Crave service, is a significant growth engine for BCE. This sector is characterized by robust revenue and EBITDA expansion, reflecting strong subscriber acquisition and increased digital advertising spend.

Digital revenues now represent a considerable portion of Bell Media's overall income, primarily fueled by the expanding direct-to-consumer streaming subscriber base. For instance, in the first quarter of 2024, BCE reported that its Bell Media segment saw a 2% increase in revenue, with digital contributing significantly to this growth.

- Digital Revenue Growth: Bell Media's digital platforms, including Crave, are showing sustained revenue increases.

- Subscriber Momentum: Direct-to-consumer streaming services are attracting more subscribers, boosting digital revenue.

- Market Expansion: BCE is actively investing in compelling content and digital advertising to capture a larger share of this high-growth market.

- EBITDA Performance: The digital media and streaming operations are also demonstrating strong EBITDA growth, indicating healthy profitability.

Mobile Connected Devices and IoT Services

BCE's mobile connected devices and IoT services are showing robust expansion. This segment, encompassing connected car subscriptions and other Internet of Things (IoT) offerings, has experienced significant net activation growth. This performance suggests BCE holds a substantial market share within the rapidly expanding IoT sector of telecommunications.

The increasing customer adoption of these connected services highlights a dynamic, high-growth market. BCE is strategically positioned to capitalize on this trend, aiming to further broaden its service portfolio and increase its subscriber numbers.

- Strong Net Activation Growth: BCE reported substantial increases in net activations for mobile connected devices and IoT services.

- High Market Share in IoT: This growth indicates a leading position for BCE within the burgeoning telecommunications IoT market.

- Expanding Service Adoption: The rising uptake of connected car subscriptions and other IoT services demonstrates a strong market demand.

- Future Growth Potential: BCE is well-placed to leverage this high-growth environment for further expansion of its offerings and customer base.

Stars in the BCG Matrix represent high-growth, high-market-share business units. For BCE, its 5G and 5G+ networks clearly fit this description, demonstrating strong performance and significant investment in a rapidly expanding sector. Similarly, Bell's Fibre-to-the-Home (FTTH) internet service is a market leader with growing demand, positioning it as a Star. Bell Business Markets and Bell Media's digital operations, including Crave, also exhibit robust revenue growth and strong market potential, further solidifying their Star status within BCE's portfolio.

| BCE Business Segment | Market Growth | Market Share | BCE Performance Indicator |

|---|---|---|---|

| 5G and 5G+ Networks | High | High | Top-performing in Canada, ongoing expansion |

| Fibre-to-the-Home (FTTH) | High | High | Superior speed and reliability, growing customer base |

| Bell Business Markets | High | High | 4.7% revenue increase (Q1 2024), strong expansion |

| Bell Media (Digital/Streaming) | High | High | 2% revenue increase (Q1 2024), strong EBITDA growth |

| Mobile Connected Devices/IoT | High | High | Substantial net activation growth, expanding service adoption |

What is included in the product

The BCG Matrix categorizes business units by market share and growth, guiding strategic decisions on investment and resource allocation.

Provides a clear, visual roadmap for resource allocation, easing the pain of uncertain investment decisions.

Cash Cows

BCE's postpaid mobile services are a prime example of a Cash Cow within its portfolio. These services hold a significant market share in a mature, albeit competitive, telecommunications landscape.

Despite some pressure on average revenue per user (ARPU) due to market competition, the sheer volume of its established subscriber base ensures a consistent and robust cash flow generation. In 2023, BCE reported its postpaid wireless subscriber base grew to over 11 million, highlighting the scale of this segment.

The strength of BCE's extensive network infrastructure and strong brand recognition contribute to this stability, requiring comparatively lower investment in marketing and customer acquisition compared to services in high-growth phases.

BCE's traditional wireline internet services represent a significant Cash Cow. Despite the ongoing shift to fibre, this segment continues to generate substantial revenue and robust cash flow for the company.

In 2024, BCE reported that its wireline services, encompassing both legacy and fibre, served millions of customers, highlighting the enduring demand for its internet offerings. The mature nature of the traditional wireline market, coupled with BCE's strong market share, enables the company to maintain healthy profit margins on these services.

BCE's traditional television services, encompassing IPTV and satellite TV, operate within a mature market characterized by a declining subscriber base. This trend is largely driven by evolving consumer preferences and the rise of streaming alternatives, with many households opting for more flexible viewing options.

Despite the subscriber erosion, these legacy services remain significant cash cows for BCE. In 2023, BCE reported that its Bell Media segment, which includes television services, generated approximately $3.3 billion in revenue, showcasing the substantial cash flow still derived from its established customer base. The strategy here is to maximize profitability through operational efficiency and careful cost management, rather than pursuing aggressive expansion.

Established Media Broadcast Assets (TV/Radio)

Bell Media's traditional TV and radio assets, while operating in a mature market with declining ad revenue, represent significant cash cows for BCE. These established platforms benefit from extensive existing infrastructure and a wide audience reach, ensuring stable, predictable cash flows. For instance, in 2024, BCE continued to leverage its extensive broadcast network, which includes numerous television stations and radio frequencies across Canada, to generate consistent revenue streams despite industry headwinds.

These assets are characterized by their low growth but high market share, fitting the description of cash cows within the BCG matrix. Their established nature means lower investment requirements for maintenance and operations, allowing them to convert a substantial portion of their revenue into free cash flow. This stability is crucial for funding other, more growth-oriented ventures within BCE's portfolio.

Key characteristics of these cash cow assets include:

- Established Market Presence: Significant market share in traditional media sectors.

- Stable Cash Flows: Predictable revenue generation despite industry maturity.

- Low Investment Needs: Reduced capital expenditure requirements due to existing infrastructure.

- Contribution to Overall Profitability: Provide a consistent source of cash to support other business units.

Extensive Legacy Network Infrastructure

BCE's extensive legacy network infrastructure, encompassing its mature wireline and wireless assets, functions as a classic cash cow. This established network, a result of significant historical investment, provides a robust and reliable foundation for its diverse service offerings, generating predictable and substantial cash flows.

The ongoing capital expenditure for maintaining this infrastructure is generally lower than that required for deploying entirely new network technologies, further enhancing its cash-generating capabilities. For example, in 2023, BCE reported capital expenditures of $4.7 billion, a portion of which supported the ongoing maintenance and evolution of this established network.

- Stable Cash Flow Generation: The legacy network reliably generates consistent cash flow, underpinning BCE's financial stability.

- Lower Maintenance Capex: Compared to building new infrastructure, maintaining the existing network requires comparatively less capital, boosting profitability.

- Foundation for Services: This infrastructure serves as the backbone for numerous BCE services, ensuring high capacity and reliability for customers.

- Mature Asset Value: The long-term investment in this network represents a significant, depreciated asset that continues to yield returns.

Cash Cows within BCE's portfolio are business segments with high market share in mature industries. These segments generate more cash than they consume, requiring minimal investment to maintain their position. BCE's postpaid mobile services and traditional wireline internet are prime examples, consistently delivering strong revenue and profit.

These established services benefit from BCE's extensive infrastructure and brand loyalty, allowing for efficient operations and predictable cash generation. For instance, BCE's postpaid wireless subscriber base exceeded 11 million in 2023, underscoring the scale of this cash cow. Similarly, wireline services continued to serve millions of customers in 2024, demonstrating enduring demand.

While traditional television and media assets face market maturity and declining subscriber trends, they still function as significant cash cows. BCE's Bell Media segment, for example, generated approximately $3.3 billion in revenue in 2023. The strategy for these segments focuses on maximizing profitability through cost management rather than aggressive growth.

BCE's legacy network infrastructure, a result of substantial historical investment, acts as a core cash cow. This established network requires lower maintenance capital expenditures compared to new technology deployment, enhancing its cash-generating capacity. In 2023, BCE's capital expenditures were $4.7 billion, part of which supported this vital infrastructure.

| Segment | Market Share | Growth Rate | Cash Flow Generation | Investment Need |

|---|---|---|---|---|

| Postpaid Mobile Services | High | Low | High | Low |

| Wireline Internet Services | High | Low | High | Low |

| Traditional TV/Radio Assets | High | Declining | Moderate | Very Low |

What You See Is What You Get

BCE BCG Matrix

The BCG Matrix document you are currently previewing is precisely the same comprehensive report you will receive upon purchase, offering a clear and actionable framework for strategic business analysis. This means no watermarks, no placeholder content, and no surprises – just the complete, professionally formatted BCG Matrix ready for your immediate use. You can confidently use this preview to understand the depth of insight and strategic clarity the full document provides. Once purchased, this exact file will be yours to download, edit, and integrate into your business planning, competitive analysis, or investor presentations without any further modifications needed.

Dogs

Legacy Voice Services, representing BCE's traditional landline offerings, are firmly positioned as a 'Dog' within the BCG matrix. This segment is characterized by its declining revenue, with significant year-over-year decreases reported, reflecting a shrinking customer base.

The market for landline services exhibits very low growth, if any, and continues to lose market share to wireless and Voice over Internet Protocol (VoIP) alternatives. In 2023, BCE's wireline network revenue, which includes legacy voice, saw a continued downward trend, although specific landline-only figures are often embedded within broader reporting categories.

These services typically generate minimal profits or are cash-neutral, offering little strategic advantage. Consequently, BCE's approach to this segment is focused on managed decline, aiming to minimize cash outflow and potentially exploring divestiture opportunities in the future.

Legacy Data Services, much like older telephone lines, represent a segment of BCE's business that is seeing a steady decline. These are the wireline data offerings that haven't been upgraded to newer fiber optic technology or modern broadband standards. Their demand is simply not there anymore, and as a result, their slice of the market continues to shrink, adding very little to the company's overall growth picture.

BCE is actively moving its focus and its investment dollars away from these older, less relevant services. This strategic pivot means that resources are being directed towards more promising and future-proof areas of the business, ensuring the company stays competitive in the evolving telecommunications landscape. For instance, in 2024, BCE's capital expenditures are heavily weighted towards network modernization and 5G deployment, with a reduced allocation for maintaining legacy infrastructure.

Prepaid mobile phone services from certain BCE brands are positioned as Dogs in the BCG matrix. BCE has experienced a decline in its prepaid customer base, even ceasing new plan sales for some brands. This signifies a low market share within a segment that is either contracting or intensely competitive, leading to reduced profitability.

These services are being de-emphasized, with BCE phasing them out. For instance, in 2023, the prepaid mobile market saw increased competition from flanker brands and MVNOs, putting pressure on established players like BCE. This strategic shift reflects a focus on more profitable segments of the telecommunications market.

Divested Retail Stores (The Source)

The permanent closures of The Source stores, a part of BCE's strategic shift, represent a divestment from a retail segment characterized by low growth and potentially constrained profitability. This move, solidified by a distribution partnership with Best Buy Canada, signals a reorientation away from physical retail assets that no longer fit BCE's primary growth objectives.

- Divestment Rationale: The Source's retail footprint was deemed a low-growth area, prompting BCE to exit this segment.

- Strategic Shift: Partnerships, like the one with Best Buy Canada, are prioritized over direct retail operations for distribution.

- Financial Implications: While specific 2024 profitability figures for The Source are not publicly broken out by BCE, the decision to close stores indicates a strategic reallocation of resources from underperforming or low-potential assets.

Outdated Satellite Services

Outdated Satellite Services, categorized as Dogs in BCE's BCG Matrix, represent a segment with a low growth rate and a declining market share. This is primarily due to customers increasingly shifting towards IPTV and streaming alternatives.

As of the latest available data, satellite television subscriptions continue to face headwinds. For instance, in 2024, the trend of cord-cutting, which significantly impacts traditional pay-TV services including satellite, persisted as consumers favored more flexible and cost-effective digital options.

- Declining Subscriber Base: Satellite TV services are seeing a steady decrease in customer numbers as viewers opt for IPTV and streaming platforms.

- Low Market Growth: The satellite TV market itself is characterized by minimal to negative growth, reflecting its diminishing relevance.

- Strategic Focus on Management: BCE's strategy for this segment likely involves efficiently managing the existing subscriber base and minimizing costs rather than pursuing expansion.

- Reduced Revenue Contribution: The contribution of satellite services to BCE's overall revenue is expected to continue shrinking in the coming years.

Dogs in BCE's portfolio represent business units with low market share in slow-growing industries. These segments typically generate low profits and require significant investment to maintain, making them candidates for divestment or managed decline. BCE's strategy often involves minimizing cash outflow from these areas while focusing resources on more promising growth opportunities.

For example, legacy voice services and outdated satellite offerings are prime examples of BCE's 'Dogs'. These segments are experiencing declining revenues and customer bases as newer technologies like fiber optics and streaming services gain traction. BCE is actively de-emphasizing these areas, as seen in their reduced capital expenditure on legacy infrastructure in 2024, prioritizing network modernization and 5G deployment instead.

The closure of The Source stores is another instance of BCE exiting a low-growth retail segment. This strategic move, coupled with partnerships like the one with Best Buy Canada, highlights BCE's focus on reallocating resources from underperforming assets to more strategic growth areas. Prepaid mobile services also fall into this category, with BCE experiencing a decline in this segment due to intense competition.

| BCE Business Segment | BCG Category | Market Trend | BCE Strategy |

|---|---|---|---|

| Legacy Voice Services | Dog | Declining, low growth | Managed decline, minimize cash outflow |

| Outdated Satellite Services | Dog | Declining, low growth | Efficient management, cost minimization |

| Prepaid Mobile Services | Dog | Contracting or intensely competitive | De-emphasizing, phasing out |

| The Source Retail Stores | Dog | Low growth | Divestment, strategic exit |

Question Marks

Bell AI Fabric, a major BCE initiative to build Canada's largest AI compute capacity, signifies a strategic push into a high-growth, emerging sector. This venture, involving partnerships with firms like Cohere, positions BCE to capture a slice of the burgeoning AI infrastructure market.

While the market for AI infrastructure is expanding rapidly, BCE's current market share within this specific segment is relatively small. This presents a classic question mark scenario in the BCG matrix, demanding significant capital investment to develop its capabilities and potentially achieve market leadership.

Ziply Fiber's U.S. expansion, driven by BCE's acquisition, positions it as a potential 'Question Mark' within the BCG matrix. The Pacific Northwest offers substantial growth prospects in the fiber internet sector, a market BCE is entering with a nascent market share.

Significant capital will be necessary to rapidly expand Ziply's fiber network and capture market share in this competitive, albeit high-growth, U.S. territory. BCE's investment in Ziply Fiber reflects a strategic move into a new, unregulated market, aiming to leverage its expertise to build a strong position.

BCE's new digital advertising and data monetization platforms, leveraging its Bell marketing platform and partnerships with entities like Trade Desk, are strategically positioned to tap into the burgeoning digital ad market. This move aims to offer advertisers direct access to BCE's first-party data, a significant asset in today's privacy-focused environment.

This initiative is a clear play for the high-growth digital advertising and data monetization sector. While specific market share figures for BCE's new platforms are still emerging, the broader Canadian digital advertising market saw significant growth, with projections indicating continued expansion in the coming years, driven by increased online activity and the demand for targeted advertising solutions.

Advanced Smart Home and IoT Ecosystem Development

BCE's strategic focus on advanced smart home and IoT ecosystem development positions it within the "Question Mark" category of the BCG Matrix. While the broader connected home market is expanding, BCE's investment in sophisticated, integrated IoT solutions signifies a high-potential, yet unproven, growth avenue.

This segment requires substantial investment in research and development, along with significant efforts in consumer education to drive adoption of these complex offerings. For instance, the global smart home market was valued at approximately $103.2 billion in 2023 and is projected to reach $278.2 billion by 2030, demonstrating a compound annual growth rate of 15.1%.

- High Growth Potential: Advanced IoT ecosystems offer significant future revenue streams as consumers increasingly seek integrated home automation and security.

- Nascent Market Adoption: Widespread consumer understanding and uptake of complex IoT solutions are still developing, presenting a challenge for market penetration.

- Investment Needs: BCE must allocate considerable capital towards innovation, platform development, and marketing to establish a strong foothold in this emerging sector.

- Market Education Imperative: Success hinges on educating consumers about the benefits and ease of use of these advanced smart home capabilities.

Specialized B2B Cloud Solutions and Cybersecurity Services

BCE's strategic move into specialized B2B cloud network solutions and cybersecurity services, including its Security-as-a-Service, positions it within a high-growth sector. These enterprise segments offer substantial future potential, reflecting a broader industry trend towards digital transformation and enhanced security. For instance, the global cybersecurity market was projected to reach $231.7 billion in 2024, according to Gartner.

However, within these specialized technology solution areas, BCE's market share is likely modest when contrasted with its established dominance in core telecom services. This places these new ventures in the "Question Marks" category of the BCG Matrix, requiring significant investment to capture a larger portion of these competitive, niche markets.

- High Growth Potential: The B2B cloud and cybersecurity markets are experiencing rapid expansion, driven by enterprise demand for scalable infrastructure and robust data protection.

- Niche and Competitive Landscape: BCE faces established players and agile innovators in these specialized technology segments, necessitating strategic differentiation.

- Investment Requirement: To convert these "Question Marks" into market leaders, substantial capital allocation will be crucial for product development, sales, and marketing efforts.

- Market Share Dynamics: While BCE has a strong foundation in its traditional services, its penetration in these newer, specialized B2B offerings is still developing.

Question Marks represent business units or products in high-growth markets where the company has a low market share. These ventures require substantial investment to improve their competitive position and potentially become future Stars. BCE's ventures in AI compute capacity, Ziply Fiber expansion, digital advertising platforms, advanced smart home ecosystems, and specialized B2B cloud/cybersecurity services all fit this profile.

These areas demand significant capital for development, marketing, and market penetration to achieve economies of scale and build brand recognition. The success of these "Question Marks" is critical for BCE's future growth and diversification beyond its traditional telecom services.

The key challenge is to strategically invest in these high-potential but currently low-share segments, with the goal of transforming them into market leaders. This requires careful resource allocation and a clear understanding of the competitive landscape.

| BCE Initiative | Market Characteristic | BCG Category | Investment Need | Potential Outcome |

|---|---|---|---|---|

| Bell AI Fabric | High-growth AI compute market | Question Mark | High | Future Star |

| Ziply Fiber Expansion | Growing U.S. fiber market | Question Mark | High | Future Star |

| Digital Advertising Platforms | Expanding digital ad market | Question Mark | Moderate to High | Future Star |

| Smart Home & IoT Ecosystems | High-growth connected home market | Question Mark | High | Future Star |

| B2B Cloud & Cybersecurity | High-growth enterprise tech market | Question Mark | High | Future Star |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitive landscape analysis, to accurately position each business unit.