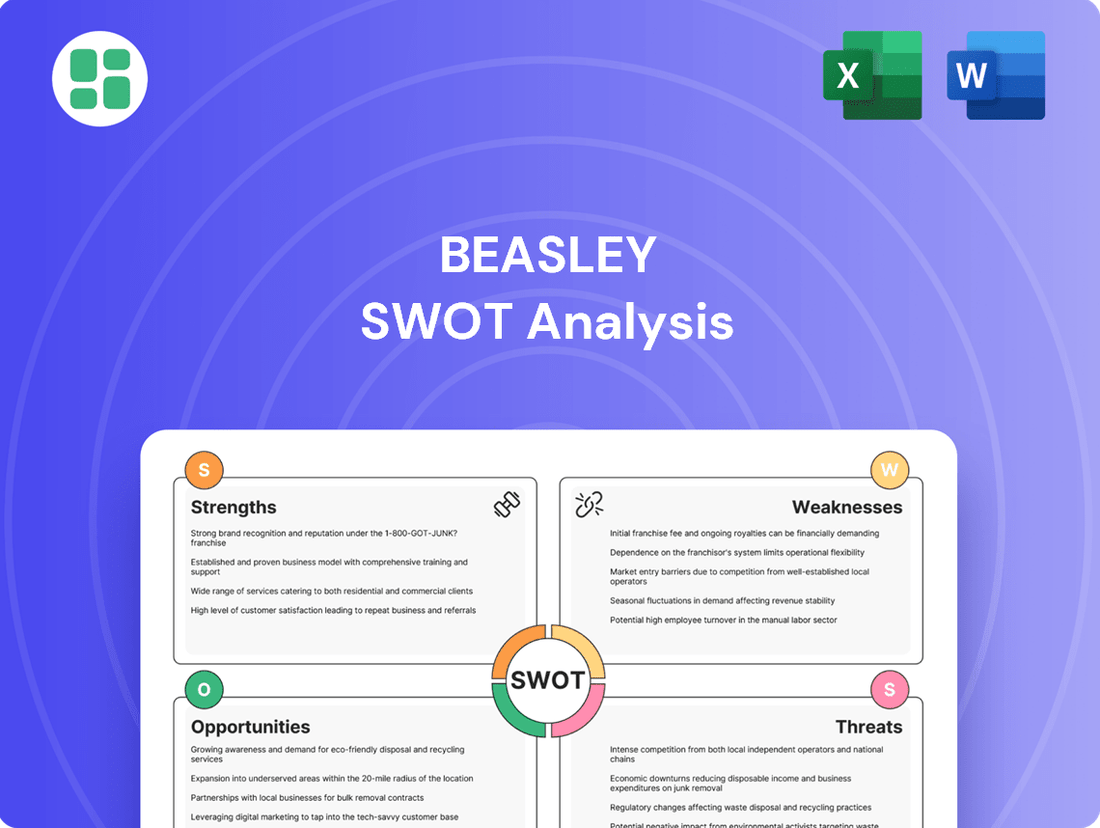

Beasley SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beasley Bundle

Beasley's current market position reveals significant strengths in its broadcast reach and established brands, but also highlights potential challenges in adapting to digital media trends. Understanding these dynamics is crucial for any strategic decision-maker.

Want the full story behind Beasley's opportunities for expansion and the threats it faces from evolving consumer habits? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Beasley Broadcast Group boasts a substantial multi-platform media presence, encompassing 57 AM and FM radio stations in vital U.S. markets. This traditional strength is amplified by a significant digital footprint, reaching approximately 17 million unique consumers weekly across over-the-air broadcasts, online streaming, and mobile applications. This broad audience engagement across various channels is a key asset for attracting advertisers and distributing content effectively.

Beasley's revenue generation shows a strong reliance on local markets, with 71% of its net revenue coming from these areas, including digital packages. This deep integration into local communities and businesses highlights its ability to adapt and thrive within specific geographic advertising landscapes.

This robust local market focus is a significant strength, allowing Beasley to effectively serve the needs of local businesses and maintain a potent presence in the local media mix. It positions the company as a resilient player, capable of capturing advertising dollars directly from the communities it serves.

Beasley's digital segment shows robust growth, with a 6% year-over-year increase in digital revenue in Q1 2025, reaching $10.8 million. This digital expansion now represents 22% of the company's total net revenue, highlighting a significant shift towards online monetization.

The company's strategic focus on growing its monetizable digital audience and optimizing digital product margins is a key strength. This proactive approach positions Beasley for continued revenue diversification and enhanced scalability in the evolving media landscape.

Effective Strategic Streamlining and Cost Management

Beasley has demonstrated strong operational discipline through effective strategic streamlining. In the first quarter of 2025, the company achieved a notable reduction in total operating expenses, amounting to $4.6 million compared to the previous year. This focus on cost management has been a significant factor in bolstering financial performance.

These cost-saving measures are not isolated incidents; Beasley reported over $20 million in annualized cost savings throughout 2024. Such disciplined expense control has directly supported an improvement in Adjusted EBITDA, even amidst revenue headwinds. This highlights the company's ability to enhance operational efficiency and maintain financial prudence.

- Strategic Streamlining: Successfully reduced total operating expenses by $4.6 million year-over-year in Q1 2025.

- Annualized Cost Savings: Achieved over $20 million in annualized cost savings in 2024.

- Improved Adjusted EBITDA: Cost management efforts contributed to better Adjusted EBITDA performance.

- Operational Efficiency: Demonstrates a commitment to financial discipline and efficient operations.

Improved Capital Structure and Debt Management

Beasley achieved a significant strengthening of its capital structure through a successful debt exchange and tender offer in October 2024. This initiative immediately reduced outstanding debt by $47 million, a crucial step in enhancing financial health.

The company also managed to extend the maturities of its debt obligations to August 2028, providing greater long-term financial stability and predictability.

This strategic move, backed by a strong participation rate from noteholders, underscores Beasley's commitment to prudent debt management and improved financial flexibility.

- Debt Reduction: $47 million in immediate debt reduction achieved in October 2024.

- Maturity Extension: Debt maturities extended to August 2028.

- Noteholder Support: High percentage of noteholders participated in the exchange/tender offer.

Beasley's diversified multi-platform presence, spanning 57 radio stations and a strong digital footprint reaching 17 million weekly consumers, provides a broad base for advertising and content distribution. This extensive reach is further bolstered by a deep integration into local markets, where 71% of its net revenue originates, demonstrating a robust ability to capture local advertising spend.

The company's digital segment is a significant growth engine, with digital revenue climbing 6% year-over-year in Q1 2025 to $10.8 million, now representing 22% of total net revenue. This strategic focus on digital audience growth and margin optimization positions Beasley for continued revenue diversification and scalability in the evolving media landscape.

Beasley has demonstrated impressive operational efficiency, reducing total operating expenses by $4.6 million year-over-year in Q1 2025, following over $20 million in annualized cost savings achieved in 2024. These cost management efforts have directly supported an improvement in Adjusted EBITDA, underscoring the company's commitment to financial discipline.

A key financial strength is the company's successful debt restructuring in October 2024, which reduced outstanding debt by $47 million and extended maturities to August 2028, significantly enhancing financial flexibility and stability.

| Metric | Q1 2025 | 2024 | Impact |

| Digital Revenue Growth (YoY) | 6% | N/A | Driving revenue diversification |

| Digital Revenue as % of Total | 22% | N/A | Increasing digital monetization |

| Operating Expense Reduction (Q1 YoY) | $4.6 million | N/A | Boosting operational efficiency |

| Annualized Cost Savings | N/A | >$20 million | Improving financial performance |

| Debt Reduction (Oct 2024) | N/A | $47 million | Strengthening capital structure |

| Debt Maturity Extension | N/A | To Aug 2028 | Enhancing financial stability |

What is included in the product

Delivers a strategic overview of Beasley’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats.

Streamlines complex SWOT analysis into an actionable, easy-to-understand format, reducing strategic confusion.

Weaknesses

Beasley Broadcast Group has faced a significant downturn in its overall net revenue. For the first quarter of 2025, the company reported a 10.1% decrease in net revenue when compared to the same period in 2024. This follows a 3% decline for the entirety of 2024 compared to the previous year.

Beasley has struggled with consistent operating and net losses. For the first quarter of 2025, the company reported an operating loss of $2.0 million, a notable increase from the $1.1 million operating loss seen in the first quarter of 2024.

Further compounding this issue, Beasley incurred a net loss of approximately $2.7 million in Q1 2025. These persistent losses, even with ongoing cost-reduction efforts, underscore the significant challenges Beasley faces in counteracting revenue downturns and achieving sustainable profitability in the current market conditions.

Beasley's advertising revenue, especially from agency and national sources, continues to feel the pinch of a generally soft advertising market. This macroeconomic trend is a persistent challenge, limiting the company's ability to fully counteract revenue declines solely through internal cost management measures.

Divestiture of Non-Core Assets and Revenue Loss

Beasley's divestiture of non-core assets, specifically the closure of its Guarantee Digital and esports divisions in 2024, has impacted its financial performance. This strategic streamlining, while intended to focus resources, resulted in a revenue decline in Q1 2025. The closure highlights a past diversification strategy that ultimately proved unsustainable, leading to the loss of revenue streams previously generated by these ventures.

The financial implications of these closures are evident in Beasley's Q1 2025 results. The company reported a decrease in total revenue, partly attributable to the absence of income from these divested segments. This situation underscores the challenge of exiting underperforming business units while mitigating the immediate financial impact.

- Revenue Decline: Q1 2025 revenue was negatively affected by the 2024 closure of Guarantee Digital and esports divisions.

- Strategic Reassessment: The closures signal a shift away from diversification efforts that did not deliver sustained financial returns.

- Loss of Income Streams: The company is now operating without the revenue previously generated by these exited business units.

Reliance on Traditional Terrestrial Radio

Beasley's enduring connection to traditional terrestrial radio, despite diversification attempts, represents a significant weakness. This reliance exposes the company to the ongoing challenges within this segment, including intensifying competition and a projected overall decrease in advertising revenue. As consumer habits increasingly migrate to digital channels, this traditional base makes Beasley susceptible to shifts in advertiser spending and audience engagement.

The company's revenue streams show this dependency. For instance, in the first quarter of 2024, Beasley reported that its broadcast radio segment accounted for the majority of its total revenue, highlighting the continued importance of this legacy business model. This concentration means that any downturn in the terrestrial radio ad market directly impacts Beasley's financial performance more acutely than a more diversified media company.

- Vulnerability to Declining Radio Ad Spend: Terrestrial radio advertising revenue has seen a general downward trend in recent years, with projections indicating continued pressure.

- Competition from Digital Platforms: Digital audio, including streaming services and podcasts, is capturing a larger share of both listener time and advertising dollars.

- Shifting Consumer Habits: Younger demographics, in particular, are less likely to rely on traditional radio for their audio entertainment, opting instead for on-demand digital content.

Beasley's financial health remains a significant concern, with a notable revenue decline and persistent operating and net losses. The company reported a 10.1% decrease in net revenue for Q1 2025 compared to Q1 2024, following a 3% drop for the full year 2024. This downturn is exacerbated by an operating loss of $2.0 million in Q1 2025 and a net loss of approximately $2.7 million in the same period, indicating challenges in achieving profitability despite cost-cutting measures.

The company's reliance on traditional terrestrial radio advertising is a key weakness. This segment, which accounted for the majority of Beasley's revenue in Q1 2024, is susceptible to declining ad spend and increasing competition from digital audio platforms. Shifting consumer preferences, particularly among younger demographics, further pressure this legacy business model.

| Financial Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Net Revenue | $68.5 million | $61.6 million | -10.1% |

| Operating Loss | $1.1 million | $2.0 million | +81.8% |

| Net Loss | $1.5 million | $2.7 million | +80.0% |

Full Version Awaits

Beasley SWOT Analysis

The preview you see is the same Beasley SWOT analysis document you'll receive upon purchase, ensuring transparency and quality.

This is a real excerpt from the complete Beasley SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning.

Opportunities

The digital audio advertising market is experiencing robust growth. In 2024, this sector saw substantial year-over-year expansion, with projections indicating continued strong performance into 2025, particularly within programmatic audio channels. This upward trend presents a significant opportunity for Beasley as its strategic emphasis on digital platforms directly aligns with this expanding advertising spend.

Beasley has a significant opportunity to grow by enhancing its digital platforms. This includes offering more sophisticated data-driven advertising tools and creating localized digital packages tailored to specific markets. In 2023, Beasley reported digital revenue growth, indicating a strong demand for these services.

Expanding new audio content initiatives, such as podcasts and streaming services, presents another avenue for growth. By leveraging data to understand listener preferences, Beasley can develop content that resonates, attracting both new audiences and advertisers looking for engaged consumers. This strategic expansion is crucial for maintaining relevance in the evolving media landscape.

Beasley's established local market expertise presents a significant opportunity for digital growth, especially as local digital ad spending is projected to overtake traditional ad spending for the first time in 2025. This shift in advertising budgets means Beasley can capitalize on its existing relationships with local businesses.

By seamlessly blending digital advertising strategies with their strong local radio presence, Beasley can offer a comprehensive solution for advertisers. This positions them as a go-to partner for businesses aiming for integrated and effective local campaigns, maximizing their reach in the evolving media landscape.

Exploring Strategic Partnerships and Content Diversification

Beasley Media Group is actively pursuing strategic partnerships and new content initiatives to build long-term value. This forward-thinking strategy enables the company to explore collaborations that could bolster its digital presence, tap into new listener demographics, and diversify revenue beyond conventional advertising models.

These efforts are crucial as Beasley navigates a dynamic media landscape. For instance, in 2024, the company has emphasized expanding its digital audio footprint, which includes podcasting and streaming services, aiming to capture a larger share of the growing digital advertising market. This diversification is key to offsetting potential declines in traditional radio revenue.

- Digital Growth Focus: Beasley's strategy centers on enhancing digital offerings, including podcasts and streaming, to capitalize on the expanding digital advertising market.

- Audience Expansion: Partnerships are being sought to reach new audience segments, broadening the company's listener base and market penetration.

- Revenue Diversification: The company aims to develop multiple revenue streams, reducing reliance on traditional advertising by exploring new content formats and platforms.

- 2024 Performance Context: Beasley's digital revenue saw a notable increase in early 2024, underscoring the potential of these diversification efforts.

Capitalizing on Integrated Cross-Platform Advertising

Advertisers are actively pursuing campaigns that blend traditional radio's wide audience with digital advertising's targeted precision and trackable results. Beasley's established presence across multiple media channels positions it to deliver these integrated solutions, offering a potent mix of reach and measurable engagement.

This integrated approach presents a significant opportunity for Beasley to capture a larger share of advertising budgets. By demonstrating the combined effectiveness of its radio and digital platforms, the company can attract advertisers looking for more comprehensive and data-driven campaign management. For instance, in Q1 2024, Beasley reported a 4.5% increase in digital revenue, highlighting the growing advertiser demand for these capabilities.

- Synergistic Promotions: Beasley can bundle radio airtime with digital ad placements, offering advertisers a unified campaign across diverse consumer touchpoints.

- Enhanced Advertiser Value: By providing measurable digital components alongside broad radio reach, Beasley offers a more compelling and accountable advertising package.

- Increased Ad Spend Potential: The demand for integrated campaigns suggests a willingness from advertisers to allocate more resources to platforms that can deliver cross-channel impact.

- Competitive Differentiation: Beasley’s ability to execute these integrated campaigns effectively can set it apart from competitors focusing solely on traditional or digital media.

Beasley's focus on digital growth, including podcasts and streaming, aligns with the expanding digital audio advertising market, which saw significant expansion in 2024 and is projected to continue strong through 2025. The company's established local market expertise is a key advantage as local digital ad spending is expected to surpass traditional ad spending in 2025, enabling Beasley to leverage existing relationships for digital growth.

| Opportunity Area | Description | 2024/2025 Relevance |

|---|---|---|

| Digital Advertising Market Growth | Capitalizing on the robust expansion of digital audio advertising, particularly programmatic channels. | Projected continued strong performance in 2025 fuels digital revenue potential. |

| Enhanced Digital Platforms | Offering sophisticated data-driven tools and localized digital packages. | Beasley's 2023 digital revenue growth indicates strong demand for these advanced services. |

| New Audio Content Initiatives | Expanding into podcasts and streaming services, leveraging listener data for content development. | Crucial for attracting new audiences and advertisers seeking engaged consumers in a dynamic media landscape. |

| Local Digital Ad Spend Shift | Leveraging established local market expertise as local digital ad spending is set to overtake traditional in 2025. | Allows Beasley to capitalize on existing local business relationships for digital advertising solutions. |

| Strategic Partnerships and Diversification | Pursuing collaborations to bolster digital presence, reach new demographics, and diversify revenue streams. | Key to offsetting potential declines in traditional radio revenue and building long-term value. |

Threats

Beasley Media Group faces a formidable challenge from the digital media landscape, with streaming services, podcasts, and social media platforms increasingly vying for audience attention and advertising revenue. This trend is particularly evident as digital advertising spending continues its upward trajectory, projected to reach over $700 billion globally in 2024, according to Statista. Traditional radio's established revenue streams are thus under continuous pressure from these evolving consumer habits and the expanding digital advertising market.

Persistent macroeconomic headwinds, including ongoing economic uncertainty and softness in the advertising market, pose a significant threat to Beasley's financial performance. Specifically, national agency revenue has shown weakness, impacting top-line growth.

A prolonged period of cautious advertiser spending, a trend observed throughout much of 2024, could continue to suppress Beasley's revenue and profitability. This environment makes achieving financial targets increasingly challenging for the company.

Industry forecasts suggest a continued downturn in traditional radio advertising revenue, with projections indicating a decline in U.S. radio ad spend for 2025, particularly during non-election or non-political cycles. This anticipated revenue shrinkage poses a direct challenge to Beasley's established business model, underscoring the urgency for the company to expedite its digital transformation initiatives to mitigate the impact on its core broadcasting operations.

Impact of Substantial Debt Levels and Covenants

Beasley's substantial debt load, even after restructuring, presents a significant threat. Restrictive debt covenants could hinder operational flexibility, limiting investments in crucial growth areas or dividend payouts. For instance, as of the first quarter of 2024, Beasley reported total debt of approximately $267 million, with specific covenants requiring the maintenance of certain financial ratios. Failure to meet these covenants could trigger penalties or even accelerate repayment obligations, impacting the company's financial stability.

Servicing these debt obligations remains a continuous financial challenge for Beasley. The ongoing interest payments and principal repayments divert cash flow that could otherwise be used for strategic initiatives or shareholder returns. This financial pressure can constrain Beasley's ability to respond effectively to market changes or pursue new revenue streams, making it vulnerable to competitive pressures and economic downturns.

- High Debt Burden: Beasley's significant debt levels continue to pose a risk to its financial health.

- Covenant Restrictions: Debt covenants may limit operational and investment flexibility.

- Cash Flow Diversion: Debt servicing consumes cash that could be allocated to growth or dividends.

- Financial Vulnerability: The debt load can make Beasley susceptible to market volatility and competitive threats.

Evolving Consumer Behavior and Content Consumption

Consumer preferences are shifting rapidly, with a strong lean towards personalized, on-demand content. This trend is amplified by the increasing use of voice-activated technologies and smart speakers, fundamentally changing how audiences interact with media.

Beasley Broadcast Group needs to stay ahead of these evolving behaviors by continually adapting its content and delivery methods. Failure to do so could result in a loss of audience engagement, especially when compared to more nimble digital competitors who are quicker to adopt new consumption patterns.

For instance, the rise of podcasting and streaming services highlights this shift. In Q1 2024, Beasley reported digital revenue growth, indicating some success in adapting, but the overall broadcast radio listenership continues to face pressure from these alternative formats.

- Personalization Demand: Consumers expect content tailored to their individual tastes and schedules.

- Voice Technology Adoption: Smart speakers and voice assistants are becoming primary content access points for many.

- Digital Competition: Agile digital-native platforms offer seamless on-demand experiences that challenge traditional radio.

- Content Format Evolution: Audiences are increasingly consuming content through podcasts, streaming audio, and short-form video.

The escalating competition from digital platforms like Spotify, Apple Music, and various podcast networks presents a significant threat, as these services offer on-demand, personalized audio experiences that directly compete with traditional radio. This shift is reflected in the continued growth of digital audio advertising, which is expected to capture an increasing share of the overall advertising market, potentially impacting Beasley's traditional revenue streams.

Macroeconomic uncertainty and a cautious advertising market continue to pose risks, with national agency revenue showing softness and advertiser spending remaining subdued throughout much of 2024. Industry forecasts also point to a likely decline in U.S. radio ad spend for 2025, particularly outside of political cycles, directly challenging Beasley's core business model.

Beasley's substantial debt load, approximately $267 million as of Q1 2024, remains a critical threat. Restrictive debt covenants could limit operational flexibility and investment capacity, while ongoing debt servicing diverts essential cash flow, potentially hindering the company's ability to adapt to market shifts or pursue new growth opportunities.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including Beasley's official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of the company's internal capabilities and external environment.