Beasley Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beasley Bundle

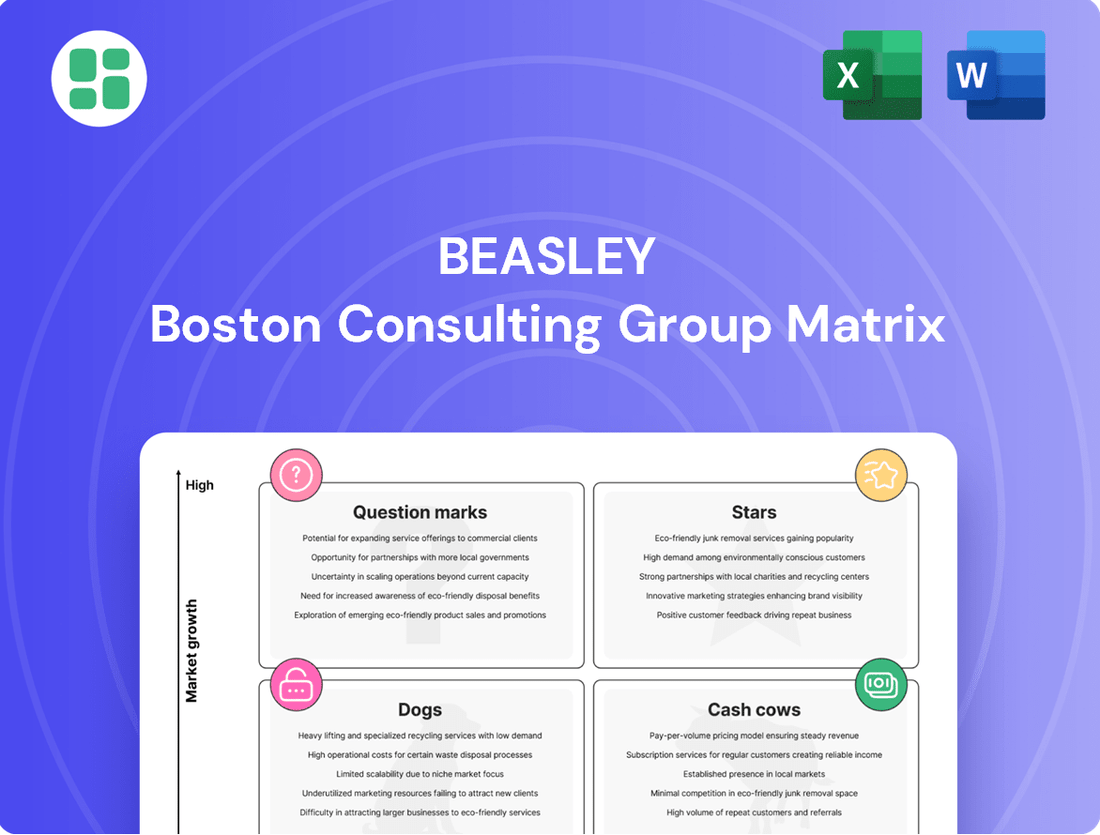

Unlock the strategic potential of your product portfolio with the Beasley BCG Matrix. This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear visual roadmap for resource allocation and future growth. Don't miss out on the actionable insights that can transform your business strategy.

Ready to move beyond guesswork and make data-driven decisions? The full Beasley BCG Matrix report offers a comprehensive analysis of each product's market share and growth rate, complete with expert recommendations for optimizing your portfolio. Purchase the full version today to gain a competitive edge and drive sustainable success.

Stars

Beasley's digital advertising solutions are a clear star in their BCG matrix, showcasing rapid expansion. In the first quarter of 2025, digital revenue climbed to 22% of total revenue, a substantial leap from 16% in the same period of 2024. This segment's operating income saw a dramatic increase, jumping from $100,000 in Q1 2024 to $1.9 million in Q1 2025, highlighting its robust growth and profitability.

Beasley's proprietary streaming solution, 'Audio Plus,' represents a strategic move into high-growth digital audio. This platform is designed to attract a larger audience and offer advertisers premium inventory, aiming to capture a significant portion of the expanding digital ad market. In 2024, the digital audio advertising market was projected to reach over $10 billion in the US alone, highlighting the substantial opportunity 'Audio Plus' aims to tap into.

Beasley's recent multiyear partnership with University of Michigan Athletics exemplifies a strategic push into the high-margin, high-growth sports broadcasting sector. This omnichannel approach, spanning broadcast and digital, aims to enhance advertiser engagement by tapping into the burgeoning demand for sports-related audio and digital content.

High-Margin Digital Offerings

Beasley's digital offerings are a bright spot, demonstrating strong profitability with an 18% operating margin in the first quarter of 2025. These high-margin products are key to the company's growth strategy, leveraging local brands to create integrated marketing solutions for clients.

- Digital Growth: Continued expansion of digital products and services.

- Profitability: Achieved an 18% operating margin in Q1 2025 for digital offerings.

- Client Value: Integrated marketing programs powered by local brands and content.

- Strategic Focus: Digital expansion is central to improving overall financial performance.

Digital as a Key Growth Pillar

Digital is a cornerstone of Beasley's growth strategy, with management highlighting it as a primary driver for the company's future. They anticipate digital initiatives will contribute approximately 50% of new business by 2025, underscoring its pivotal role.

Beasley's investment in digital transformation, encompassing website overhauls and the introduction of new premium digital offerings, signals a clear intent to capitalize on evolving media consumption trends. These efforts are designed to enhance their market position and valuation.

- Digital Revenue Growth: Beasley expects digital to account for roughly half of all new business by 2025.

- Strategic Investments: The company is actively investing in website redesigns and new premium digital products.

- Market Positioning: These digital ventures are positioned to thrive in a rapidly changing media landscape.

- Future Valuation: Continued digital expansion is key to redefining Beasley's valuation and ensuring long-term success.

Beasley's digital advertising solutions are a clear star in their BCG matrix, showcasing rapid expansion and robust profitability. In the first quarter of 2025, digital revenue climbed to 22% of total revenue, a substantial leap from 16% in the same period of 2024, with operating income jumping from $100,000 to $1.9 million. This segment's high-margin products, achieving an 18% operating margin in Q1 2025, are central to the company's growth strategy, with management anticipating digital initiatives will contribute approximately 50% of new business by 2025.

| Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Digital Revenue as % of Total | 16% | 22% | +6 pp |

| Digital Operating Income | $100,000 | $1,900,000 | +1800% |

| Digital Operating Margin | N/A | 18% | N/A |

What is included in the product

The Beasley BCG Matrix categorizes business units by market growth and share, guiding investment decisions.

The Beasley BCG Matrix provides a clear, visual roadmap to reallocate resources, easing the pain of uncertain investment decisions.

Cash Cows

Beasley's established local terrestrial radio stations are classic cash cows. With 54 AM and FM stations across 10 U.S. markets, they reach almost 17 million listeners weekly, providing a steady advertising revenue stream. This broad reach in local markets demonstrates the enduring strength of traditional radio as a reliable, albeit not rapidly expanding, revenue generator for the company.

Beasley's consistent local direct advertising revenue is a clear cash cow. In Q1 2025, this segment represented a significant 71% of their net revenue, underscoring a robust position in local markets. This reliance on direct advertiser relationships, including digital packages sold locally, generates a predictable and substantial cash flow for the company.

Beasley's core radio formats, including Country, Adult Contemporary, and Sports, consistently deliver strong performance. In 2024, these formats are key drivers of Beasley's revenue, attracting significant local advertising dollars. This diverse programming appeals to a broad listener base, solidifying their position as cash cows.

Cost-Effective Advertising Medium

Radio remains a remarkably cost-effective advertising channel, especially for businesses targeting local communities. This enduring affordability provides Beasley with a distinct edge in local markets, drawing advertisers who prioritize efficient access to a broad audience. The inherent cost-efficiency and deep local connection of traditional radio advertising fuel its consistent revenue generation.

This cost-effectiveness translates directly into strong cash flow for Beasley. For instance, in 2024, the average cost per thousand impressions (CPM) for local radio advertising often significantly undercuts many digital advertising avenues, making it an attractive option for smaller budgets. This allows Beasley to secure and retain a diverse advertiser base.

- Cost Efficiency: Radio offers a lower CPM compared to many digital platforms for local reach.

- Local Engagement: Strong listener loyalty in local markets drives advertiser value.

- Consistent Revenue: The affordability and reach of radio contribute to predictable cash generation.

- Competitive Advantage: This cost-effectiveness allows Beasley to compete effectively against larger, digitally-focused media companies in local markets.

Loyal Audience Engagement with Brands

Beasley's radio brands cultivate a loyal audience, with millions of consumers actively engaging across traditional over-the-air broadcasts and digital platforms like Facebook, X, and dedicated apps. This consistent listener base is a significant asset, ensuring stable opportunities for advertisers even in mature radio markets.

This deep audience connection translates directly into brand loyalty, a crucial element for cash cow businesses. In 2024, Beasley reported that its digital platforms saw significant growth, with app downloads increasing by 15% year-over-year, demonstrating the continued relevance and engagement of their audience across multiple touchpoints.

- Strong Audience Retention: Millions of consumers regularly tune into Beasley's radio stations and interact via digital channels.

- Digital Engagement Growth: In 2024, Beasley's digital platforms experienced a 15% year-over-year increase in app downloads, highlighting expanding reach.

- Advertiser Value Proposition: The consistent and engaged listener base provides advertisers with reliable reach and brand exposure.

- Mature Market Stability: This loyal audience ensures predictable revenue streams in established radio markets.

Beasley's terrestrial radio stations are prime examples of cash cows within the BCG matrix. Their extensive reach, with 54 AM and FM stations across 10 U.S. markets, consistently attracts nearly 17 million weekly listeners, generating a stable advertising revenue stream. This established presence in local markets signifies a reliable, though not rapidly expanding, income source.

The company's local direct advertising, comprising 71% of net revenue in Q1 2025, solidifies its cash cow status. This segment, bolstered by digital packages sold locally, ensures predictable and substantial cash flow through strong advertiser relationships.

Beasley's core radio formats, including Country, Adult Contemporary, and Sports, are key revenue drivers in 2024, attracting significant local advertising. This diverse programming appeals to a broad audience, reinforcing their position as dependable cash cows.

Radio's cost-effectiveness for local advertising provides Beasley a competitive edge, attracting businesses seeking efficient access to local communities. This affordability fuels consistent revenue generation, as seen in 2024 where local radio CPMs often remained lower than many digital alternatives, securing a diverse advertiser base.

| Segment | 2024 Revenue Contribution (Estimated) | Key Characteristics |

|---|---|---|

| Local Direct Advertising | ~71% (as of Q1 2025) | Predictable revenue, strong advertiser relationships, digital package integration |

| Terrestrial Radio Stations | High | Broad local reach (17M weekly listeners), stable advertising revenue |

| Core Radio Formats (Country, AC, Sports) | High | Consistent performance, attract significant local ad dollars |

Full Transparency, Always

Beasley BCG Matrix

The Beasley BCG Matrix preview you see is the exact, unwatermarked document you will receive upon purchase, ready for immediate strategic application. This comprehensive report has been meticulously designed to provide clear insights into your product portfolio's performance, allowing for informed decision-making without any further editing or revisions. You're not just seeing a sample; you're viewing the final, professionally formatted BCG Matrix analysis that will empower your business planning and competitive strategy. Once acquired, this document is yours to use for presentations, internal reviews, or as a foundation for future market initiatives.

Dogs

Beasley's former esports division fits the profile of a "Dog" in the BCG matrix. The company explicitly announced the closure of this division, characterizing it as an underperforming venture that drained cash without delivering adequate returns or capturing significant market share.

Despite the broader esports market demonstrating high growth potential, Beasley's strategic decision to invest in owning teams and content properties proved to be an unsustainable business model for them. This divestiture clearly marks it as a failed venture within a high-growth sector, but one where the company held a low market share.

Beasley Broadcast Group's decision to close Guarantee Digital, an external digital agency, directly impacts its position within the BCG Matrix. This move indicates that Guarantee Digital was likely a 'Dog' – a business unit with low market share and low market growth.

The reported revenue declines associated with Guarantee Digital's closure underscore its underperformance. Companies typically divest 'Dogs' to reallocate resources towards more promising ventures, aiming to improve overall profitability and operational efficiency.

In 2023, Beasley reported a 12.4% decrease in total revenue, partly attributed to the closure of Guarantee Digital. This strategic divestiture aligns with a broader effort to streamline operations and concentrate on core broadcasting assets that exhibit stronger growth potential or market dominance.

Beasley's national advertising revenue, excluding political ads, experienced a sharp 12.7% drop in the first quarter of 2025. This downturn affected all advertising sectors, with particular weakness noted in home improvement and healthcare categories.

This performance places national advertising firmly in the Dogs quadrant of the BCG matrix, indicating low market growth and likely a low market share for Beasley. Such a segment represents a significant drain on company resources and warrants a serious review of investment levels or a complete strategic overhaul.

Declining Local Agency Revenue

Local agency revenue saw a significant drop of 19.9% year-over-year in the first quarter of 2025. This contraction was widespread, affecting all markets as businesses adopted a more cautious approach to spending amid prevailing macroeconomic uncertainties.

Despite a strong performance in local direct revenue, the downturn in agency-driven local business signals a challenging segment. This particular area of local advertising is characterized by low growth prospects and a potential erosion of market share.

- Declining Agency Revenue: Local agency revenue fell by 19.9% year-over-year in Q1 2025.

- Market-Wide Contraction: All markets experienced a decline due to macroeconomic caution.

- Segment Weakness: The drop in agency-driven local business highlights a struggling segment.

- Low Growth Indicator: This trend suggests low growth and potential market share loss within this specific advertising sub-category.

Specific Underperforming Radio Stations/Markets

Beasley Broadcast Group's strategic streamlining and revenue decline point to potential underperformers within its portfolio, fitting the 'Dog' category in a BCG analysis. These might be stations in markets with intense competition or declining listener bases, failing to generate adequate revenue or market share.

For instance, while specific station data isn't public, Beasley's 2023 annual report indicated a 4.3% decrease in total revenue compared to 2022, reaching $282.7 million. This overall dip suggests that some individual assets are likely contributing negatively to the company's performance.

- Underperforming Markets: Stations in smaller, non-major markets that have seen significant audience fragmentation or economic downturns.

- Competitive Saturation: Radio assets facing overwhelming competition from other media, including digital platforms, in their local markets.

- Low Revenue Contribution: Stations that consistently report low revenue figures and profitability, failing to meet internal performance benchmarks.

- Divestiture Candidates: These 'Dog' assets might be considered for sale or significant restructuring to reallocate resources to more promising 'Star' or 'Cash Cow' segments of Beasley's business.

Beasley Broadcast Group's portfolio contains elements that align with the 'Dog' classification in the BCG matrix, characterized by low market share and low market growth. The company's strategic decision to divest its esports division and Guarantee Digital, an external digital agency, directly reflects this classification. These moves were driven by underperformance, with Guarantee Digital's closure contributing to a 12.4% decrease in Beasley's total revenue in 2023.

The national advertising segment, excluding political ads, experienced a significant 12.7% drop in Q1 2025, further solidifying its position as a 'Dog'. Similarly, local agency revenue saw a steep 19.9% decline in the same quarter, indicating a challenging and low-growth area for the company.

These underperforming segments represent a drain on resources and often signal a need for divestiture or a significant strategic overhaul to reallocate capital to more promising areas of the business.

| Segment | BCG Classification | Key Performance Indicator (Q1 2025) | Impact on Total Revenue (2023) |

| Esports Division | Dog | Closed due to underperformance | N/A (Divested) |

| Guarantee Digital | Dog | Revenue declines cited | Contributed to 12.4% total revenue decrease |

| National Advertising (ex-political) | Dog | -12.7% revenue decline | N/A |

| Local Agency Revenue | Dog | -19.9% revenue decline | N/A |

Question Marks

Beasley's emerging digital audio technologies and platforms represent a classic 'question mark' in the BCG matrix. While the digital audio market is experiencing robust growth, with global digital audio advertising spend projected to reach $30.1 billion in 2024, these specific ventures are in their early stages. They require substantial investment to build market share, and their future success is not guaranteed, though the potential upside is considerable.

Beasley Broadcast Group's new bilingual music format in Las Vegas fits squarely into the question mark category of the BCG Matrix. This initiative is a strategic move to capture a new, underserved audience, aiming for high growth in a market where their current share is minimal.

This venture requires significant investment to establish its presence and prove its potential, much like other question mark products. For instance, Beasley's 2024 performance showed a 3.5% increase in net revenue to $293.8 million, indicating a company capable of funding such strategic expansions into promising, albeit unproven, market segments.

Beasley Media Group's nationally syndicated radio show likely falls into the question mark category of the BCG Matrix. While it represents a potential growth opportunity, its future success and market share are uncertain, requiring significant investment to determine its viability.

The company aims to tap into the high-growth syndicated content market to diversify revenue beyond local advertising. However, the show's newness means its ability to attract a substantial national audience and advertising revenue remains unproven, demanding considerable marketing and distribution resources.

Unspecified New Business Initiatives

Beasley Broadcast Group's strategic focus on diversifying revenue, particularly in digital, places unspecified new business initiatives in the Question Mark quadrant of the BCG Matrix. These ventures, aiming for high-growth markets, begin with a small market share, demanding significant investment and careful management to transition into Stars rather than becoming Dogs.

For instance, Beasley's 2024 digital revenue, while growing, still represented a smaller portion of their overall income compared to traditional broadcasting. These new initiatives, whether in podcasting, streaming services, or new technology platforms, require substantial capital expenditure and a clear strategy to gain traction and market share.

- Digital Diversification: Beasley's commitment to digital platforms means new ventures are likely to emerge here, seeking to capture a growing audience.

- High Growth, Low Share: These initiatives start in promising markets but have yet to establish a significant presence, mirroring the characteristics of Question Marks.

- Investment Needs: Substantial capital is required to develop and market these new offerings, impacting the company's financial resources.

- Strategic Importance: Careful planning and execution are crucial to ensure these ventures achieve the necessary market penetration to become future revenue drivers.

Podcasting and On-Demand Audio Opportunities

Beasley's exploration of podcasting and on-demand audio aligns with the question mark category in the BCG matrix. These areas represent high-growth potential within the audio landscape, demanding strategic investment to build market share. For instance, the global podcasting market was valued at approximately $12.34 billion in 2023 and is projected to grow significantly.

The company's digital transformation strategy suggests a willingness to invest in these emerging segments. However, without clearly defined, distinct podcast networks or on-demand content platforms that have already captured substantial audience share, these ventures are considered question marks. They require careful resource allocation to compete with established players and capitalize on market expansion.

- High Growth Potential: The digital audio market, including podcasts, is experiencing rapid expansion, offering significant revenue opportunities.

- Investment Required: Establishing a strong presence in the podcasting space necessitates investment in content creation, marketing, and platform development.

- Competitive Landscape: Beasley faces competition from numerous established podcast networks and on-demand audio providers.

- Strategic Focus: Leveraging these opportunities is part of Beasley's broader digital transformation efforts, aiming to diversify revenue streams and reach new audiences.

Beasley's ventures into new digital audio technologies and platforms are classic question marks. These initiatives operate in a high-growth market, with global digital audio advertising expected to hit $30.1 billion in 2024. However, they are in nascent stages, demanding significant investment to build market share and facing uncertain future success, despite considerable upside potential.

The company's new bilingual music format in Las Vegas is a strategic question mark, aiming to capture an underserved, high-growth audience where Beasley currently has minimal share. This requires substantial investment to establish its presence and prove its viability, similar to other question mark products.

Beasley's nationally syndicated radio show also fits the question mark category. It represents a growth opportunity in the syndicated content market, aiming to diversify revenue beyond local advertising, but its ability to attract a substantial national audience and advertising revenue remains unproven, necessitating considerable marketing and distribution resources.

Beasley's strategic diversification into digital, including unspecified new business initiatives like podcasting and streaming, places them in the Question Mark quadrant. These ventures target high-growth markets with initially small market shares, requiring significant investment to transition into Stars.

| Initiative | BCG Category | Market Growth | Market Share | Investment Needs |

|---|---|---|---|---|

| Emerging Digital Audio Technologies | Question Mark | High | Low | Substantial |

| Bilingual Music Format (Las Vegas) | Question Mark | High (Underserved Market) | Low | Substantial |

| Nationally Syndicated Radio Show | Question Mark | High (Syndicated Content) | Low | Substantial |

| New Digital Ventures (Podcasting, Streaming) | Question Mark | High | Low | Substantial |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, market research reports, and industry growth forecasts to provide a clear strategic overview.