Beasley PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beasley Bundle

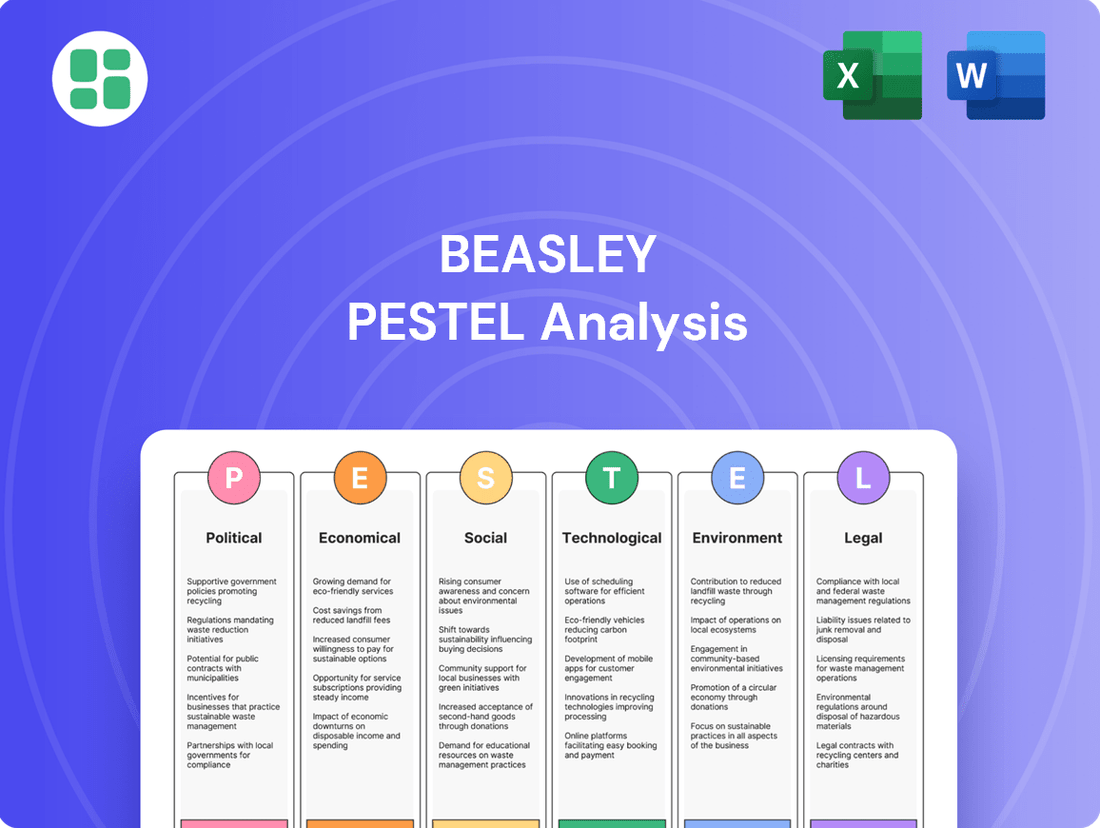

Navigate the complex external forces shaping Beasley's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities. Equip yourself with actionable intelligence to make informed strategic decisions and gain a competitive advantage. Download the full analysis now for immediate insights.

Political factors

Government regulations, particularly from the Federal Communications Commission (FCC), significantly shape Beasley Broadcast Group's operational landscape. Broadcast licensing, frequency allocation, and evolving media ownership rules directly influence how Beasley can acquire, operate, and consolidate radio stations. For instance, FCC ownership caps can limit expansion, while deregulation might create opportunities for mergers and acquisitions within the industry.

Advertising regulations significantly shape Beasley Broadcast's revenue streams. Truth in advertising standards, enforced by bodies like the Federal Trade Commission (FTC), necessitate robust internal review processes to prevent misleading claims in ads sold by Beasley, impacting client relationships and ad acceptance policies. For instance, in 2024, the FTC continued its focus on deceptive advertising in digital spaces, a trend likely to persist.

Specific rules for political advertising, particularly prominent in election years like 2024, present both opportunities and compliance challenges for Beasley. Broadcasters must adhere to stringent disclosure requirements and afford equal opportunities for candidates, impacting ad inventory management and revenue forecasting. The FCC’s political broadcasting rules are a key area of focus.

The evolving landscape of digital advertising and data usage introduces potential new regulatory hurdles. Policies concerning consumer data privacy, such as those resembling the GDPR or CCPA, could affect how Beasley targets ads and measures campaign effectiveness, potentially requiring investment in new compliance technologies and strategies to maintain ad revenue growth.

Current political stances and regulatory environments significantly shape media consolidation, directly impacting Beasley's capacity for station acquisitions or divestitures. For instance, the Federal Communications Commission (FCC) in the United States has historically adjusted rules regarding station ownership limits, influencing market concentration. A more lenient approach could enable Beasley to expand its footprint through mergers, while stricter regulations might necessitate a focus on organic growth or strategic partnerships.

Shifts in these policies can either foster widespread industry consolidation, potentially leading to larger, more dominant media groups, or encourage greater local market diversity by limiting ownership. For example, a rollback of cross-ownership rules could allow companies to own more television, radio, and newspaper properties in the same market, altering the competitive landscape for Beasley. Conversely, policies promoting localism could create opportunities for smaller, independent broadcasters.

The strategic implications for Beasley's growth are substantial. If regulations ease, Beasley might pursue aggressive acquisition strategies to gain market share and achieve economies of scale, potentially enhancing its advertising revenue streams. Conversely, if policies favor diversity, Beasley might need to adapt its strategy to compete in a more fragmented market, perhaps by focusing on niche content or local community engagement to differentiate itself.

Political Climate and Advertising Spending

The broader political climate significantly impacts advertising spending. Election cycles, for instance, often lead to increased political advertising, boosting revenue for media companies like Beasley. In 2024, the US presidential election is expected to drive substantial ad spending. Government spending priorities can also influence market stability, indirectly affecting corporate advertising budgets.

Political stability or instability plays a crucial role in business confidence and, consequently, advertising investments. Periods of uncertainty can lead companies to tighten their belts, reducing marketing expenditures. Conversely, a stable political environment fosters greater business confidence, encouraging more robust advertising outlays.

- Election Year Boost: Political advertising is a key revenue driver for broadcasters. In 2024, the US presidential election is projected to see record-breaking political ad spending, estimated to reach over $10 billion across all media.

- Government Spending Impact: Shifts in government spending priorities, such as infrastructure projects or social programs, can create new advertising opportunities or alter market dynamics for media companies.

- Stability and Confidence: Political stability encourages corporate investment, including advertising. Instability can lead to cautious spending, potentially reducing overall ad budgets.

Trade Policies Affecting Media Supply Chains

International trade policies can significantly influence Beasley's operational costs. Tariffs on broadcast equipment, for instance, could increase capital expenditures for technological upgrades. The U.S. imposed tariffs on certain goods from China in recent years, which may have impacted the cost of components used in broadcast technology.

Global supply chain disruptions, exacerbated by geopolitical events, can also affect the availability and price of essential media equipment and software licenses. Changes in trade agreements, such as potential renegotiations of existing pacts, could alter import duties and create uncertainty for procurement strategies. For example, the ongoing trade tensions between major economic blocs might lead to higher costs for specialized broadcast hardware.

- Tariffs on imported broadcast technology components could raise capital expenditure for Beasley.

- Supply chain volatility may impact the availability and cost of essential media equipment.

- Shifts in trade agreements could alter import duties, affecting procurement expenses.

Government policies and regulations are pivotal for Beasley Broadcast Group. The Federal Communications Commission (FCC) dictates broadcast licensing, frequency allocation, and ownership rules, directly impacting Beasley's ability to acquire and operate stations. For instance, FCC ownership caps can limit expansion, while deregulation might present acquisition opportunities. Political advertising rules, especially in election years like 2024, require strict adherence to disclosure and equal opportunity mandates.

The political climate significantly influences advertising spending, with election cycles like the 2024 US presidential election driving substantial ad revenue, projected to exceed $10 billion across all media. Political stability also fosters business confidence, encouraging higher advertising outlays. Conversely, geopolitical events and trade policies can affect operational costs, such as tariffs on broadcast equipment, potentially increasing capital expenditures for technological upgrades.

| Regulatory Area | Impact on Beasley | 2024/2025 Relevance |

|---|---|---|

| FCC Broadcast Regulations | Licensing, frequency allocation, ownership caps | Ongoing compliance, potential for consolidation if rules ease |

| Political Advertising Rules | Disclosure, equal opportunity for candidates | Key revenue driver in election years; 2024 election spending is substantial |

| Trade Policies & Tariffs | Cost of broadcast equipment, supply chain stability | Potential for increased capital expenditure on imported technology |

What is included in the product

The Beasley PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors influencing the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Beasley PESTLE Analysis offers a structured framework to identify and mitigate external threats, providing clarity and actionable insights to navigate complex market landscapes.

Economic factors

The advertising market is undergoing a significant transformation, with a noticeable shift from traditional terrestrial radio to digital audio and, more recently, esports advertising. Digital platforms are capturing an increasing share of advertising spend, impacting revenue streams for companies like Beasley. For instance, digital advertising spending is projected to reach $335.5 billion in the US in 2024, a substantial increase from previous years, while radio advertising revenue, though still significant, faces greater competition.

This migration towards digital channels means that while terrestrial radio remains a component, its dominance is waning. Beasley's revenue is thus increasingly influenced by its digital audio offerings and its ability to tap into newer, rapidly growing sectors like esports advertising, which itself saw significant growth in 2023 with global ad revenue estimated to be around $1.5 billion.

Economic conditions play a crucial role in advertising budgets. During economic upturns, businesses tend to increase their advertising expenditures to capitalize on consumer spending. Conversely, economic downturns often lead to budget cuts, with advertising being one of the first areas to be reduced, directly affecting media companies like Beasley.

Broader economic cycles significantly shape consumer spending and, by extension, advertising budgets. During economic downturns, consumers often reduce discretionary spending, impacting sectors like entertainment, leading businesses to scale back their advertising investments. For instance, a recessionary period might see a dip in consumer spending on non-essential goods and services, directly affecting Beasley's revenue streams from advertising.

Disposable income is a critical driver for consumer engagement with entertainment content. When households have more disposable income, they are more likely to spend on media and entertainment. In 2024, the U.S. personal saving rate, a proxy for disposable income available for spending, has shown fluctuations, but continued economic growth supports higher discretionary spending. This directly fuels advertisers' willingness to invest in reaching these engaged consumers.

Economic stability is paramount for maintaining and growing listener reach and engagement for companies like Beasley. Periods of economic stability foster consumer confidence, encouraging consistent engagement with media platforms. Conversely, economic uncertainty can lead to reduced listenership as consumers cut back on various forms of entertainment to save money, impacting the overall reach advertisers can expect.

Fluctuations in interest rates directly influence Beasley Broadcast Group's cost of capital. For instance, if the Federal Reserve maintains its target federal funds rate at the current 5.25%-5.50% range in 2024, Beasley's borrowing costs for new projects, refinancing existing debt, or pursuing acquisitions will remain elevated compared to periods of lower rates.

Higher interest rates can significantly impact Beasley's profitability by increasing the expense of servicing its debt. This also makes future expansion, especially into capital-intensive areas like the burgeoning esports sector, more expensive and potentially less attractive, impacting investment decisions and the overall cost of capital.

Inflationary Pressures on Operating Costs

Inflationary pressures directly impact Beasley's operational expenses. Rising energy costs for broadcast towers, increased talent salaries, and higher content licensing fees all contribute to a more expensive operating environment. General administrative overhead, from office supplies to technology, also sees an uptick.

Beasley may employ several strategies to mitigate these rising costs. This could include negotiating longer-term contracts for content and services, investing in energy-efficient technologies for broadcast infrastructure, and optimizing staffing models. Furthermore, exploring dynamic pricing for advertising slots could help offset increased expenditures.

The profitability of both the radio and esports divisions is susceptible to these inflationary trends. For radio, higher operating costs could squeeze margins unless advertising revenue keeps pace. In esports, the cost of acquiring and retaining top talent, as well as production expenses, could escalate, impacting the bottom line.

- Energy Costs: Broadcast operations are energy-intensive; a 10% increase in electricity prices, for instance, could add millions to annual operating expenses.

- Talent Acquisition: The competitive landscape for on-air talent and esports professionals often leads to salary inflation, particularly for high-demand individuals.

- Content Licensing: As content becomes more valuable, licensing fees for music, programming, and esports league rights are likely to rise, directly affecting content acquisition costs.

- Administrative Overhead: General inflation affects everything from rent and utilities to IT services and marketing spend, increasing the baseline cost of running the business.

Competition from Emerging Media Platforms

The economic landscape for Beasley is increasingly shaped by competition from emerging media platforms. Streaming services, podcasts, and social media are actively vying for audience attention and, consequently, advertising revenue that once primarily flowed to traditional radio. This shift exerts significant economic pressure, as these digital channels often offer more targeted advertising capabilities and can capture younger demographics. For instance, the global podcasting market was projected to reach over $30 billion by 2026, highlighting the scale of this competitive challenge.

Beasley's traditional radio operations and its newer ventures, such as esports broadcasting, are both directly impacted by this evolving media consumption. Listeners increasingly opt for on-demand audio content, fragmenting the audience that radio historically commanded. Advertisers are also reallocating budgets to platforms that promise greater reach and measurable engagement within specific niches. This necessitates strategic adaptation for Beasley to maintain its market share and revenue streams in a dynamic environment.

- Audience Fragmentation: The rise of streaming and podcasts means listeners have more choices, potentially reducing the captive audience for traditional radio.

- Advertising Revenue Diversion: Digital platforms offer advertisers precise targeting, drawing ad spend away from broader-reaching traditional media.

- Esports Competition: While an emerging area for Beasley, esports also faces competition from established gaming streamers and platforms, impacting potential revenue.

- Economic Pressure: The need to invest in digital infrastructure and new content formats to compete places ongoing economic strain on traditional media companies like Beasley.

Economic cycles directly influence advertising spend, with upturns typically boosting budgets and downturns leading to cuts, impacting Beasley's revenue. Disposable income is key; higher income means more consumer spending on entertainment, making media platforms more attractive to advertisers. Economic stability fosters consistent engagement, while uncertainty can reduce listenership and advertiser confidence.

Interest rates affect Beasley's borrowing costs; for example, the Federal Reserve's target rate of 5.25%-5.50% in 2024 means elevated borrowing expenses for expansion or debt servicing. Inflation increases operational costs for energy, talent, and content licensing, potentially squeezing profit margins if advertising revenue doesn't keep pace. Beasley may counter this through contract negotiation and efficiency investments.

The media landscape is increasingly competitive, with digital platforms and streaming services diverting advertising revenue from traditional radio. This audience fragmentation necessitates strategic adaptation for Beasley to maintain its market share and revenue streams. For instance, the global podcasting market is projected to exceed $30 billion by 2026, illustrating the scale of this competitive challenge.

| Economic Factor | Impact on Beasley | Relevant Data (2024-2025) |

|---|---|---|

| Economic Cycles | Advertising budget fluctuations | US GDP growth projected at 2.1% for 2024, indicating a generally positive economic environment for advertising. |

| Disposable Income | Consumer engagement with entertainment | US Personal Saving Rate fluctuated, but overall economic growth supports discretionary spending. |

| Interest Rates | Cost of capital and debt servicing | Federal Reserve target federal funds rate maintained at 5.25%-5.50% in 2024. |

| Inflation | Operational expenses and profitability | Consumer Price Index (CPI) saw an annual increase of 3.4% in April 2024, indicating ongoing inflationary pressures. |

| Competition | Audience share and advertising revenue diversion | Digital advertising spending projected to reach $335.5 billion in the US for 2024. |

What You See Is What You Get

Beasley PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This Beasley PESTLE Analysis preview accurately reflects the comprehensive report you will download immediately after completing your purchase.

You are seeing the actual Beasley PESTLE Analysis document, ensuring that what you preview is precisely what you will obtain upon purchase, with no surprises.

Sociological factors

Beasley's radio listenership faces challenges from evolving media habits. The shift to on-demand digital platforms, like Spotify and Apple Music, along with the explosive growth of podcasting, means consumers increasingly choose personalized content over traditional broadcast schedules. In 2024, digital audio ad spending is projected to reach $13.9 billion, highlighting this trend.

Beasley is responding by investing in digital content creation and exploring new distribution channels. This includes expanding its podcast offerings and leveraging social media to engage younger demographics. Their strategy aims to capture audience attention across multiple platforms, recognizing that traditional radio is no longer the sole source of audio entertainment.

Demographic shifts significantly shape Beasley's audience. For instance, the aging population in the US, with the 65+ demographic projected to reach 73.1 million by 2030, may influence radio listenership, requiring tailored content for older demographics. Conversely, the growing urban youth population, increasingly engaged with digital platforms and esports, presents opportunities for Beasley to adapt its content and advertising strategies. In 2024, understanding the nuances of listener diversity, from age to cultural background and geographic location, is paramount for effective programming and sales.

Beasley Media Group is navigating evolving listener engagement trends, with radio audiences increasingly valuing local content and community connection. In 2024, radio's ability to provide hyper-local news, traffic, and community event coverage remains a key differentiator, fostering loyalty. For instance, Beasley's stations often feature local personalities and sponsor community events, building a strong sense of belonging that digital-only alternatives struggle to replicate.

The rise of esports also presents a unique engagement dynamic, requiring a different approach to loyalty. While not directly comparable to traditional radio, the principles of community building and personalized experiences are paramount. Beasley's efforts to integrate with local sports and entertainment scenes, including potential esports partnerships or sponsorships in the future, could tap into similar loyalty drivers by offering exclusive content and interactive opportunities.

Influence of Social Media on News and Entertainment

Social media platforms have fundamentally altered how consumers engage with news and entertainment, making them central to media consumption. Beasley, like many media companies, actively utilizes these platforms for promotion, direct audience interaction, and distributing its content. This real-time, interactive environment presents both significant opportunities for engagement and challenges in managing brand perception and information flow.

The pervasive nature of social media means that news and entertainment are no longer passively consumed but are actively curated and shared by users. For Beasley, this translates into a dynamic landscape where content virality and audience participation are key drivers of reach. For instance, by mid-2024, platforms like TikTok and Instagram continue to be dominant forces in entertainment discovery, with a significant portion of younger demographics relying on them for content recommendations.

- Audience Engagement: Social media allows Beasley to foster direct conversations with its audience, gathering feedback and building community around its programming.

- Content Dissemination: Platforms serve as crucial channels for promoting new shows, sharing clips, and driving traffic to Beasley’s owned and operated media properties.

- Real-time Trends: The speed of social media necessitates agility in content creation and response, allowing Beasley to capitalize on trending topics and cultural moments.

- Brand Reputation Management: The interactive nature requires constant monitoring and a strategic approach to address public sentiment and potential crises swiftly.

Community Involvement and Local Content Demand

Beasley's radio stations play a crucial role in fostering community involvement by delivering local news, information, and engagement. This focus on hyper-local content and community-centric initiatives remains a significant strength for traditional radio in an increasingly fragmented media landscape.

The demand for content that resonates with local audiences, covering everything from school board meetings to community events, continues to be a cornerstone of traditional radio's appeal. Beasley reinforces its position as a vital local media hub by actively participating in and supporting community events, thereby maintaining strong audience connections and relevance.

- Hyper-local content demand: Studies consistently show that local news and information are highly valued by radio listeners, driving engagement.

- Community engagement initiatives: Beasley's involvement in local events and sponsorships strengthens its brand as a community partner.

- Audience loyalty: A strong connection to local issues and personalities fosters listener loyalty, a key differentiator for traditional radio.

- Digital integration: While traditional, Beasley also leverages digital platforms to extend its local reach and community engagement.

Sociological factors significantly influence Beasley's audience and content strategy. Shifting demographics, such as an aging population and the growing urban youth segment, necessitate tailored programming. By mid-2024, the increasing reliance on social media for entertainment discovery, particularly among younger demographics, highlights the need for Beasley to adapt its engagement models. This dynamic requires a keen understanding of diverse listener preferences and cultural trends to maintain relevance and reach.

Technological factors

Beasley Media Group is navigating the shift towards digital audio broadcasting, including HD Radio, aiming to enhance sound fidelity and offer more content. This technological evolution allows for multiple audio streams on a single frequency, potentially increasing programming diversity and listener engagement. The company's investments in these areas are crucial for staying competitive in a rapidly changing media landscape.

The adoption of HD Radio, for instance, provides a clearer signal and additional channels, such as HD2 and HD3, which Beasley can utilize for niche programming or specialized content. This upgrade represents a significant capital expenditure but promises improved audio quality and expanded reach, aligning with listener expectations for modern broadcasting. As of early 2024, the penetration of HD Radio receivers continues to grow, creating a larger addressable audience for these enhanced services.

Technological advancements have fueled the explosive growth of streaming platforms and podcasting, fundamentally altering how audiences consume audio content. Beasley is actively adapting to this shift by developing its own digital platforms and podcasts, aiming to complement its traditional terrestrial radio offerings and reach a wider, digitally-native audience. For instance, Beasley Media Group launched its own podcast network, featuring original content and leveraging its existing talent pool.

The company's digital strategy involves investing in the technological infrastructure necessary for scalable content delivery, ensuring a seamless experience for listeners across various devices. This includes robust content management systems and streaming capabilities. Beasley's commitment to digital expansion is evident in its continued investment in digital advertising solutions and audience engagement tools, which are crucial for monetization in the evolving media landscape.

Beasley is actively integrating advanced ad-tech solutions, particularly in programmatic advertising, to enhance its offerings. This shift allows for more efficient and precisely targeted ad placements, moving beyond traditional broadcast methods. For instance, the company's investment in data analytics platforms aims to provide advertisers with deeper insights into audience behavior, optimizing campaign performance and demonstrating clear ROI. This focus on data-driven strategies is crucial for maximizing advertising revenue in the evolving media landscape.

Mobile Technology and App Development for Content Delivery

Mobile technology is absolutely central to how Beasley Media Group reaches its audience. Their apps are the primary gateway for listeners to tune into live radio streams, catch up on their favorite podcasts, and even follow esports content. This constant evolution of their mobile presence is key to staying connected.

Beasley consistently invests in improving its mobile applications. This includes updates for smoother user experience and the addition of new features, ensuring listeners can easily access a diverse range of content, from traditional radio to on-demand podcasts and live esports broadcasts. This focus on app development directly translates to better user engagement.

The widespread adoption of smartphones means mobile platforms significantly boost accessibility for Beasley's content. In 2024, smartphone penetration in the US is well over 85%, meaning a vast majority of potential listeners are already equipped to use Beasley's apps. This ubiquity allows for greater reach and more frequent user interaction.

- Mobile App Reach: Beasley's apps provide a direct channel to millions of listeners, enhancing content accessibility beyond traditional broadcast signals.

- Podcast Integration: The seamless integration of podcast content within mobile apps caters to the growing demand for on-demand audio experiences.

- Esports Engagement: Mobile platforms are crucial for delivering live esports content, tapping into a younger, tech-savvy demographic.

- User Experience Focus: Continuous app development prioritizes user experience, driving higher engagement and retention rates for Beasley's digital offerings.

Evolution of Esports Technology and Streaming

The esports landscape is fundamentally shaped by rapid technological evolution, directly impacting Beasley's media and esports ventures. High-performance gaming hardware, from advanced graphics cards to ultra-low latency peripherals, is crucial for competitive integrity and immersive viewer experiences. The continued growth of streaming platforms like Twitch and YouTube Gaming, which saw millions of concurrent viewers for major 2024 tournaments, provides the essential infrastructure for content distribution and audience engagement. Beasley's ability to leverage these technologies for content creation and live event broadcasting is paramount.

Innovation in esports technology is relentless, directly influencing how content is produced and consumed. Emerging technologies such as virtual reality (VR) and augmented reality (AR) are beginning to offer new dimensions for spectator interaction and player performance analysis, though their widespread adoption in competitive play is still developing. The increasing sophistication of game engines and broadcasting software also allows for more dynamic and engaging visual presentations, a key factor for attracting and retaining audiences in a competitive media environment.

- Hardware Advancements: Continued improvements in CPUs, GPUs, and network infrastructure are essential for smooth gameplay and high-fidelity streaming, supporting the demands of professional esports.

- Streaming Platform Dominance: Twitch and YouTube Gaming remain the primary conduits for esports content, with Twitch alone reporting over 1.8 billion hours watched in Q1 2024, highlighting their critical role.

- Emerging Technologies: VR and AR applications are exploring new ways to enhance viewer immersion and data visualization, though widespread integration into professional play is still nascent.

- Content Creation Tools: Sophisticated editing software, real-time data overlays, and advanced camera systems enable richer storytelling and analysis for esports broadcasts.

Technological advancements are reshaping the audio landscape, pushing Beasley Media Group towards digital innovation. The company's engagement with HD Radio, offering enhanced sound and multiple streams, taps into a growing market for improved audio experiences. As of early 2024, HD Radio receiver penetration continues to climb, expanding the potential audience for these upgraded services.

The rise of streaming and podcasting presents both challenges and opportunities. Beasley is actively expanding its digital footprint through original podcast networks and robust streaming capabilities, aiming to capture a digitally-native audience. This strategic pivot is essential for maintaining relevance and reaching listeners across diverse platforms.

Beasley's integration of advanced ad-tech, particularly in programmatic advertising, allows for more targeted and efficient ad delivery. By leveraging data analytics, the company aims to provide advertisers with deeper audience insights, optimizing campaign performance and demonstrating clear ROI. This data-driven approach is critical for revenue generation in the evolving media market.

Legal factors

Beasley Broadcast Group must navigate a complex web of Federal Communications Commission (FCC) regulations to operate its radio stations. Obtaining and maintaining broadcast licenses involves meeting strict technical standards, fulfilling public interest obligations, and adhering to content rules, including those for political advertising and indecency. Failure to comply can result in significant fines, license revocation, and challenges during the license renewal process, which occurs every eight years for AM and FM stations.

Beasley navigates a complex legal environment concerning music rights and content licensing across its broadcast and digital platforms. This includes adhering to copyright laws and managing agreements with performance rights organizations like ASCAP, BMI, and SESAC, which are crucial for royalty payments to artists and publishers.

The company's engagement in digital media and emerging areas like esports also necessitates careful consideration of intellectual property. Ensuring proper licensing for streamed content and managing rights for user-generated content, particularly in competitive gaming, are ongoing legal challenges. For instance, in 2024, the music industry continued to see evolving digital licensing models, impacting how broadcasters like Beasley utilize copyrighted material online.

Beasley Broadcast Group must navigate increasingly stringent data privacy regulations, such as the California Consumer Privacy Act (CCPA) and the emerging potential for federal legislation. These laws significantly impact how Beasley collects, stores, and utilizes listener and advertiser data across its digital platforms.

Compliance demands rigorous adherence to data security protocols, obtaining explicit consent for data usage, and maintaining transparency with users about how their information is handled. This directly affects Beasley's ability to offer targeted advertising and personalized content, which are crucial revenue streams.

Failure to comply can result in substantial fines; for instance, the CCPA allows for penalties of up to $7,500 per intentional violation. This legal landscape necessitates ongoing investment in data governance and privacy-enhancing technologies to ensure continued operational integrity and maintain advertiser confidence.

Labor Laws and Employment Regulations

Beasley Broadcast Group operates within a complex legal landscape shaped by federal and state labor laws. Compliance with wage and hour regulations, such as the Fair Labor Standards Act (FLSA), directly affects payroll expenses, requiring adherence to minimum wage and overtime pay standards. For instance, in 2024, the federal minimum wage remains $7.25 per hour, though many states and cities have higher rates, impacting Beasley's overall labor costs across its various markets.

Workplace safety is another critical legal consideration, governed by the Occupational Safety and Health Administration (OSHA). While the media industry might not present the same physical hazards as manufacturing, ensuring a safe working environment for on-air talent, production staff, and administrative personnel is paramount. Anti-discrimination laws, including Title VII of the Civil Rights Act, prohibit bias based on race, color, religion, sex, or national origin, necessitating robust HR policies and training to prevent legal challenges and maintain a fair workplace.

Union relations also play a significant role, particularly within broadcast journalism and technical roles. Beasley must navigate collective bargaining agreements and labor relations laws, which can influence hiring practices, compensation, and work rules. For example, in 2023, the National Labor Relations Board (NLRB) continued to oversee union elections and unfair labor practice charges, impacting how companies like Beasley manage their workforce dynamics and potential labor disputes.

- Wage and Hour Laws: Beasley must comply with federal and state minimum wage and overtime requirements, impacting direct labor costs.

- Workplace Safety: Adherence to OSHA standards is necessary to ensure a safe environment for all employees, mitigating risks and potential liabilities.

- Anti-Discrimination: Compliance with federal and state anti-discrimination statutes is crucial for fair employment practices and avoiding legal repercussions.

- Union Relations: Managing relationships with labor unions through collective bargaining agreements and labor laws affects operational flexibility and employee compensation structures.

Antitrust Laws and Media Mergers

Antitrust laws significantly constrain media mergers, acquisitions, and joint ventures by scrutinizing deals that could lead to monopolies or stifle competition. For Beasley, this means any strategic growth or market expansion involving consolidation would face rigorous review by regulatory bodies like the Federal Communications Commission (FCC) and the Department of Justice. For instance, the FCC's media ownership rules, last updated significantly in 2000 and subject to ongoing review, aim to ensure a diversity of voices and prevent undue concentration of media power. These regulations can limit the number of stations a single entity can own in a market or nationally, directly impacting Beasley's ability to grow through acquisition.

The potential for increased regulatory scrutiny on media consolidation is a key legal factor for Beasley. As the media landscape continues to evolve, particularly with the rise of digital platforms, regulators are increasingly focused on how traditional media mergers affect the broader information ecosystem. Beasley's strategic initiatives, such as expanding its radio market presence or exploring new media ventures, must be carefully planned to navigate these legal boundaries. Failure to comply with antitrust regulations can result in blocked deals, hefty fines, or mandated divestitures, all of which would severely impact financial performance and strategic objectives.

- Regulatory Scrutiny: Antitrust laws, enforced by agencies like the FCC and DOJ, examine media mergers to prevent monopolies.

- Market Concentration Limits: Regulations may restrict the number of media outlets a company can own within a specific market or nationally.

- Impact on Growth: Beasley's expansion plans through mergers or acquisitions are directly influenced by these legal constraints.

- Compliance Costs: Navigating antitrust reviews can involve significant legal fees and potential divestiture requirements, impacting financial resources.

Beasley Broadcast Group must adhere to evolving advertising regulations, including truth-in-advertising standards enforced by the Federal Trade Commission (FTC) and specific rules for broadcast advertising. This includes regulations around political advertising disclosures, which require stations to maintain public files with details on advertisers and ad content. For instance, during the 2024 election cycle, the FCC continued to emphasize transparency in political ad buying.

The company also faces legal considerations related to sweepstakes, contests, and promotional activities, which are subject to state and federal laws designed to prevent deceptive practices. Ensuring clear terms and conditions and proper prize fulfillment is critical to avoid legal challenges and maintain consumer trust. In 2024, the FTC reported an increase in enforcement actions related to deceptive online advertising, a trend that extends to broadcast media.

Beasley's digital operations are also subject to consumer protection laws, particularly concerning online advertising and data usage. Compliance with regulations like the CAN-SPAM Act for email marketing and guidelines on influencer marketing is essential. The company must ensure all promotional content, whether on-air or online, is accurate and transparent to avoid penalties.

Environmental factors

Beasley Broadcast Group's operations, like many in the media industry, have an environmental footprint tied to energy consumption. This includes powering transmission towers, studios, and the data centers that manage digital content. The ongoing demand for constant broadcasting means significant electricity usage, directly impacting operational costs and carbon emissions.

In 2023, the broadcast industry continued to face scrutiny over its energy usage. While specific 2024 data for Beasley's energy consumption isn't publicly detailed, the industry trend points towards increased focus on efficiency. Companies are exploring upgrades to more energy-efficient transmission equipment and optimizing data center cooling systems to mitigate these environmental impacts and control rising utility expenses.

Beasley's commitment to sustainability, as evidenced by industry-wide initiatives, likely involves evaluating renewable energy sourcing options and implementing energy-saving technologies within its facilities. Reducing the carbon footprint associated with energy use is not only an environmental imperative but also a strategic move to manage operational expenditures in a fluctuating energy market.

Beasley's environmental footprint includes waste from office operations, electronic equipment, and events. The company must consider responsible disposal of broadcast equipment, which can contain hazardous materials.

While specific 2024/2025 Beasley initiatives aren't publicly detailed, the industry trend, exemplified by companies like Sinclair Broadcast Group which reported a 15% reduction in landfill waste in 2023 through enhanced recycling programs, suggests a growing focus on waste reduction. Beasley likely engages in similar efforts to minimize waste and promote recycling across its facilities.

Beasley Media Group has been actively engaging in sustainability initiatives, with a notable focus on reducing its environmental footprint. In 2023, the company continued its efforts to promote energy efficiency across its broadcast facilities and explore greener operational practices.

While specific public reporting on environmental metrics for 2024 is still emerging, Beasley's commitment to corporate social responsibility often includes community engagement and support for local causes, which indirectly contributes to a positive environmental impact through volunteerism and awareness campaigns.

A strong CSR profile can significantly bolster Beasley's brand reputation among listeners and advertisers alike. This enhanced image can foster stronger stakeholder relations, potentially leading to increased listener loyalty and a more attractive proposition for businesses seeking to align with socially conscious media outlets.

Climate Change Impact on Infrastructure

Climate change presents significant long-term environmental risks to Beasley's physical infrastructure. The increasing frequency and intensity of severe weather events, such as hurricanes and extreme heatwaves, could directly impact broadcast towers, studios, and other facilities. For instance, in 2024, the National Oceanic and Atmospheric Administration (NOAA) reported a notable increase in the number of billion-dollar weather disasters across the United States, impacting various sectors.

Beasley's geographical spread of assets means exposure to diverse climate-related threats. Regions prone to coastal flooding or high winds require robust preparedness measures. Adapting infrastructure to withstand these events, such as reinforcing towers or relocating critical equipment to higher ground, is crucial for mitigating operational disruptions and substantial repair costs. Investing in resilient infrastructure can prevent revenue loss and maintain service continuity.

- Increased Storm Severity: Beasley's broadcast towers in coastal areas are vulnerable to stronger winds and storm surges, potentially leading to outages.

- Extreme Heat Impacts: Higher temperatures can strain cooling systems in data centers and studios, risking equipment failure and increased energy consumption.

- Flood Risk: Facilities located in flood plains face damage from rising water levels, necessitating flood defenses and potential relocation of sensitive equipment.

- Wildfire Threats: In drier regions, wildfires pose a risk to transmission infrastructure, requiring fire-resistant landscaping and emergency response plans.

Public Perception of Environmental Efforts

Public and investor perception of Beasley's environmental initiatives significantly shapes its brand image and the trust stakeholders place in the company. A positive environmental stance can attract socially conscious consumers and investors, while negative perceptions can lead to boycotts or divestment.

The increasing focus on Environmental, Social, and Governance (ESG) factors is a critical driver in investment decisions. For instance, in 2024, a significant portion of institutional investors are actively integrating ESG criteria into their portfolio selection, with many explicitly stating their commitment to companies demonstrating strong environmental stewardship.

Beasley's transparent communication about its environmental performance is paramount to building and maintaining stakeholder confidence. This includes reporting on emissions, waste reduction, and sustainable resource management. Companies that proactively share their environmental data often see improved investor relations and a stronger brand reputation.

- Brand Image: Positive environmental perception enhances brand loyalty and market appeal.

- Investor Trust: Strong ESG performance, particularly environmental metrics, is increasingly crucial for attracting investment capital.

- Stakeholder Engagement: Open communication about environmental efforts fosters trust with customers, employees, and the wider community.

- Regulatory Compliance: Public scrutiny of environmental practices can influence regulatory attention and compliance requirements.

Beasley's environmental considerations center on energy consumption for broadcasting operations and waste management. The industry is seeing a push towards energy efficiency, with companies exploring upgrades to equipment and data center cooling. Minimizing waste, particularly from electronic equipment, is also a key focus, with enhanced recycling programs becoming standard practice.

PESTLE Analysis Data Sources

Our PESTLE Analysis is informed by a comprehensive blend of data, including reports from international organizations like the UN and WTO, as well as national economic surveys and industry-specific market research. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental landscapes.