Beasley Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beasley Bundle

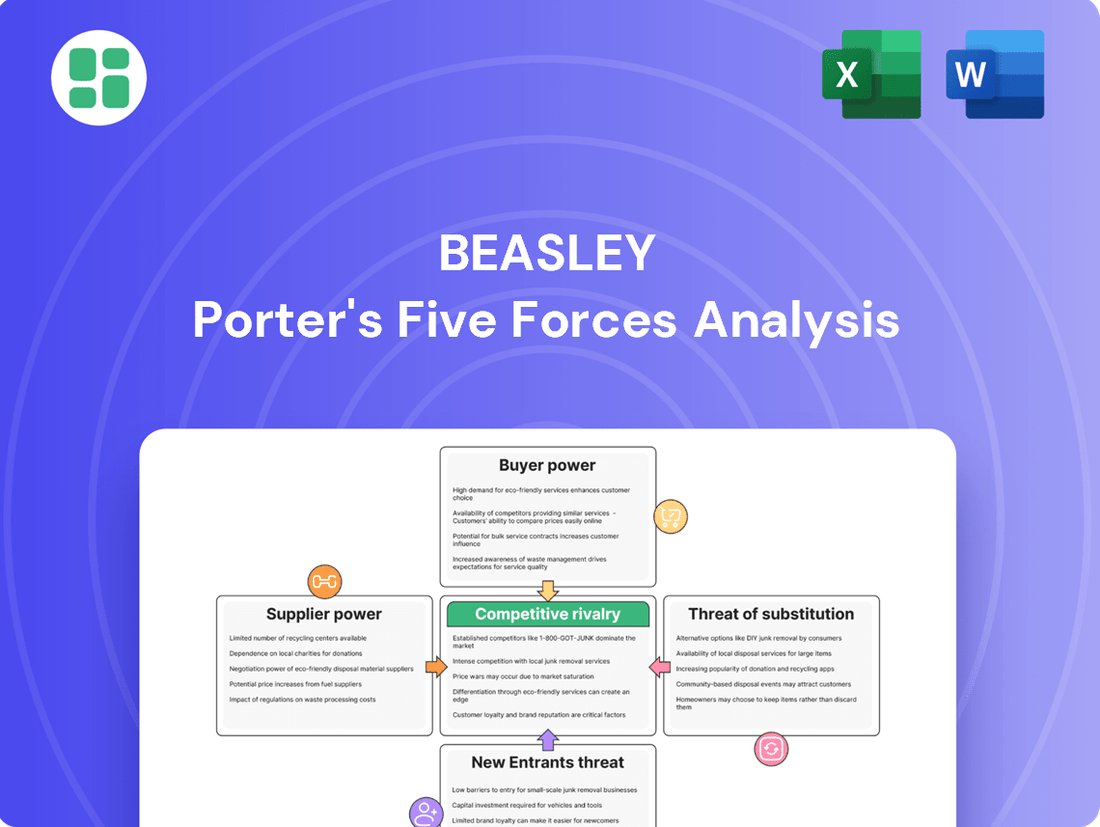

Beasley's Five Forces Analysis reveals the intricate web of competitive pressures shaping its market. Understanding the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes is crucial for strategic success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Beasley’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Beasley Media Group's reliance on popular on-air personalities and syndicated content means that talented individuals and content creators hold significant bargaining power. In 2024, the demand for unique and highly-rated talent continues to drive up compensation expectations, impacting Beasley's operating costs.

The exclusivity and brand appeal of certain content further amplify the leverage of these suppliers. For instance, securing rights to a nationally recognized syndicated show or a local personality with a substantial following can come at a premium, directly influencing Beasley's programming expenses and profitability.

Music licensing companies, such as major record labels and performance rights organizations, wield considerable bargaining power over Beasley. These entities own the copyrights to the music essential for Beasley's radio operations. The necessity of this content means Beasley has limited alternatives, strengthening the suppliers' position. Negotiations are often based on established industry rates, reflecting the suppliers' ability to dictate terms.

Broadcasting technology and equipment providers, such as those supplying specialized radio transmitters and studio gear, wield considerable bargaining power. This stems from the often niche nature and substantial cost of their products, making them critical partners for broadcasters like Beasley. For instance, acquiring a state-of-the-art digital broadcast transmitter can easily run into hundreds of thousands of dollars, representing a significant capital outlay.

While the market may feature several vendors, the high switching costs associated with complex, integrated systems and the reliance on proprietary technologies can limit Beasley's ability to easily change suppliers. This dependence means that equipment providers can influence pricing and terms, especially when their technology offers unique advantages or is essential for maintaining a competitive edge in broadcast quality and reach.

Esports Talent and Teams

In the dynamic esports landscape, professional players and well-established teams wield significant bargaining power. This strength stems from their exceptional skills, dedicated fan bases, and consistent performance, making them highly sought-after assets.

For a company like Beasley, this translates into a competitive environment where securing top-tier talent can lead to increased acquisition and retention expenses. For instance, in 2024, top esports players can command salaries and endorsement deals that rival those in traditional sports, with some stars earning millions annually.

- Talent Scarcity: The pool of elite esports talent is limited, giving top players leverage in negotiations.

- Fan Engagement: Popular players and teams drive viewership and engagement, adding to their market value.

- Team Performance: Consistent winning records enhance a team's appeal and bargaining position with sponsors and organizations.

- High Demand: The growing esports industry fuels demand for skilled individuals and competitive teams.

Real Estate and Infrastructure Owners

Beasley's reliance on physical real estate for studios and transmission infrastructure, often secured through long-term leases or direct ownership, positions property and infrastructure owners as significant players. This dependence grants these owners leverage, particularly concerning rental rates and lease renewal terms.

The bargaining power of real estate and infrastructure owners is amplified when Beasley requires strategically located sites, such as those optimal for broadcast tower placement. In 2024, the commercial real estate market, especially for specialized broadcast locations, saw continued demand, potentially increasing the negotiation leverage for property owners in prime markets.

- Strategic Location Premium: Property owners controlling sites with superior geographic advantages for signal transmission can command higher lease rates.

- Lease Term Influence: Long-term lease agreements grant owners stability but also provide opportunities to negotiate favorable terms in exchange for guaranteed revenue.

- Market Dynamics: In tight real estate markets, where suitable broadcast locations are scarce, the bargaining power of owners naturally increases.

- Infrastructure Investment: Owners who have invested in specialized infrastructure, like robust tower foundations or readily available power, can also exert greater influence on lease conditions.

Suppliers of essential content, talent, and infrastructure hold considerable sway over Beasley Media Group. This power is particularly evident with on-air personalities and syndicated content providers, where scarcity and brand appeal drive up costs. Music licensing entities also possess significant leverage due to the necessity of their copyrighted material for broadcast operations.

The cost of securing and retaining top-tier talent, especially in fast-growing sectors like esports, has escalated. In 2024, elite esports players can command salaries and endorsement deals comparable to traditional sports, with some earning millions annually, reflecting the limited supply of highly skilled individuals and their substantial fan engagement.

Providers of specialized broadcasting technology and equipment also exert influence, often due to the high cost and niche nature of their products. High switching costs associated with integrated systems further solidify their position, enabling them to impact pricing and terms, particularly when their technology offers unique advantages or is critical for maintaining broadcast quality.

Owners of strategically located real estate essential for studios and transmission infrastructure wield bargaining power, especially in markets with high demand for specialized broadcast sites. In 2024, the commercial real estate market, particularly for prime broadcast locations, continued to see robust demand, potentially increasing property owners' negotiation leverage.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on Beasley Media Group | 2024 Data/Trend |

|---|---|---|---|

| On-Air Personalities & Syndicated Content | Talent scarcity, brand appeal, fan base, exclusivity | Increased talent acquisition and retention costs, programming expenses | Continued demand for unique, high-rated talent driving up compensation expectations. |

| Music Licensing Companies | Copyright ownership, necessity of content, limited alternatives | Higher licensing fees, direct impact on operating costs | Negotiations often based on established industry rates, reflecting suppliers' ability to dictate terms. |

| Broadcasting Technology Providers | Niche products, high cost, proprietary technology, high switching costs | Significant capital outlay for equipment, potential price influence | Acquiring state-of-the-art digital broadcast transmitters can cost hundreds of thousands of dollars. |

| Real Estate & Infrastructure Owners | Strategic location, specialized infrastructure, market demand | Higher lease rates, influence on lease renewal terms | Commercial real estate for specialized broadcast locations saw continued demand in 2024, increasing owner leverage. |

What is included in the product

Porter's Five Forces Analysis examines the competitive intensity and attractiveness of an industry by evaluating the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Quickly identify and address competitive threats with a visual, easy-to-understand breakdown of industry forces.

Customers Bargaining Power

Large national advertisers wield substantial bargaining power with media companies like Beasley. Their considerable ad spend allows them to negotiate favorable rates and package deals, putting pressure on Beasley to offer competitive pricing. In 2023, national advertising revenue for the broadcast radio industry saw fluctuations, indicating the ongoing demand for these advertisers to secure advantageous terms.

While individual local businesses and small advertisers may not wield immense power on their own, their collective presence forms a substantial customer segment for media companies like Beasley. Their bargaining power can be considered moderate. These businesses are often price-sensitive and demand a clear return on investment from their advertising spend, a trend that continued to influence media buying decisions in 2024. However, their options for reaching a broad local audience through traditional channels are often limited, giving traditional radio broadcasters a degree of leverage.

Advertisers on Beasley's digital platforms face a landscape brimming with alternatives, from the precision of programmatic advertising to the vast reach of social media. This abundance of digital ad inventory significantly amplifies their leverage.

With so many channels available, advertisers can readily compare pricing structures and demand demonstrable performance metrics. This competitive environment empowers them to negotiate more favorable terms, directly increasing their bargaining power against any single platform.

Audience Engagement (Indirect Power)

While not directly paying for content, an audience's engagement is a powerful, albeit indirect, lever in the media industry. If listeners or viewers shift their attention to competing platforms, advertisers will inevitably follow the eyeballs. This dynamic means Beasley's ability to retain its audience directly impacts its advertising revenue, giving the audience significant bargaining power.

Beasley must continuously invest in and innovate its content offerings to keep its audience captivated. For instance, in the first quarter of 2024, Beasley reported total revenue of $27.7 million, with advertising revenue forming the bulk of this. A decline in audience engagement would directly threaten this primary revenue stream, underscoring the audience's indirect power.

- Audience Loyalty as a Lever: The audience's preference for Beasley's programming over competitors directly influences advertiser decisions.

- Impact on Advertising Revenue: A migration of listeners to other platforms means a corresponding reduction in potential ad revenue for Beasley.

- Content Innovation Imperative: To counteract this indirect power, Beasley is compelled to consistently develop fresh and engaging content to maintain audience attention.

- 2024 Revenue Context: Beasley's Q1 2024 revenue of $27.7 million highlights the critical reliance on advertising, making audience retention paramount.

Esports Sponsorships and Brand Partnerships

Brands looking to tap into the esports arena wield considerable influence. Their demand for extensive reach and deep audience engagement means they can dictate terms in sponsorship deals. For instance, in 2024, major brands like Red Bull and Intel continued to invest heavily in esports, with sponsorship values often tied directly to a team's competitive success and the precise demographics of its fanbase. This allows them to negotiate favorable rates by comparing opportunities across different esports titles and even traditional sports marketing channels.

The bargaining power of customers in esports sponsorships is amplified by the data-driven nature of the industry. Sponsors can demand detailed analytics on viewership, engagement metrics, and brand sentiment, using this information to justify their investment and negotiate pricing. In 2024, many esports organizations provided sponsors with granular reports, showing average concurrent viewers and peak viewership numbers for specific tournaments. This transparency empowers brands to assess the return on investment more effectively, pushing for better terms if the projected value isn't met.

- High Expectations for Reach: Brands seek substantial audience exposure, granting them leverage in negotiations.

- Performance-Based Negotiation: Sponsorship terms are often linked to team success and audience engagement metrics.

- Comparative Analysis: Brands can benchmark esports sponsorship deals against other marketing avenues, strengthening their bargaining position.

- Data-Driven Value Proposition: Detailed analytics on viewership and engagement allow brands to demand demonstrable ROI.

The bargaining power of customers, particularly advertisers, significantly impacts Beasley's revenue streams. Large national advertisers can negotiate lower rates due to their substantial ad spend, putting pressure on pricing. In 2023, the broadcast radio industry experienced shifts in national advertising revenue, reflecting advertisers' ongoing pursuit of favorable terms.

While individual local advertisers have moderate power, their collective spending is crucial for Beasley. These businesses are price-sensitive and demand clear ROI, a trend observed throughout 2024. However, their limited alternative channels for reaching local audiences provide Beasley with some leverage.

Advertisers on Beasley's digital platforms benefit from numerous alternatives, including programmatic advertising and social media, which increases their bargaining power. This competitive digital ad landscape allows them to easily compare pricing and demand performance metrics, enabling them to negotiate better terms.

The audience's engagement is an indirect but powerful bargaining tool. If audiences shift to competing platforms, advertisers will follow, impacting Beasley's revenue. Beasley's Q1 2024 revenue of $27.7 million, largely from advertising, underscores the critical need for audience retention to maintain this revenue stream.

| Customer Segment | Bargaining Power | Key Factors | 2024 Relevance |

|---|---|---|---|

| National Advertisers | High | Large ad spend, ability to negotiate rates and packages | Continued demand for advantageous terms in a fluctuating market |

| Local Advertisers | Moderate | Price sensitivity, demand for ROI, limited alternative local reach | Influence on media buying decisions, reliance on traditional radio for local reach |

| Digital Advertisers | High | Abundance of digital alternatives, data transparency, performance metrics | Ability to compare pricing and demand demonstrable ROI across platforms |

| Audience | High (Indirect) | Engagement levels, preference for content, migration to competing platforms | Direct impact on advertising revenue, necessitating content innovation |

What You See Is What You Get

Beasley Porter's Five Forces Analysis

This preview showcases the complete Beasley Porter's Five Forces Analysis, offering a thorough examination of competitive forces within an industry. The document you see here is precisely the same professionally written and formatted analysis you will receive immediately after purchase. You can trust that what you preview is the exact, ready-to-use document, providing actionable insights for your strategic decision-making without any placeholders or surprises.

Rivalry Among Competitors

Beasley Media Group operates in a highly competitive landscape, facing significant rivalry from other terrestrial radio broadcasters. This competition is particularly fierce within its local markets, where stations vie for listener attention and advertising dollars. The drive for audience share and advertising revenue compels broadcasters to engage in aggressive programming and talent acquisition strategies, often resulting in similar content offerings and pricing pressures.

Digital audio platforms like Spotify, Pandora, and Apple Music are fierce rivals for Beasley Broadcast Group, directly competing for listener engagement and valuable advertising revenue. These services provide personalized, on-demand audio experiences that increasingly pull audiences away from traditional radio formats.

The streaming market is massive, with Spotify alone boasting over 600 million monthly active users as of early 2024, highlighting the sheer scale of competition. Podcasting platforms also capture significant listener time, further fragmenting the audio landscape and challenging radio's historical dominance.

Beasley Media Group faces significant competition from other local media outlets, including television stations, newspapers, and online news sites. These entities vie for the same local advertising dollars and audience attention that Beasley targets with its radio stations. For instance, in many local markets, a single television station might command a substantial portion of the advertising spend, directly impacting Beasley's revenue potential.

These competitors offer businesses diverse avenues to reach local consumers, creating a fragmented advertising landscape. A local car dealership, for example, might allocate a portion of its marketing budget to a TV commercial, a print ad in the local paper, and online banner ads, in addition to radio spots on Beasley's stations. This diversification means Beasley is not just competing with other radio companies but with the entire spectrum of local media.

The rise of digital-native local news sources further intensifies this rivalry. Many online news sites and aggregators provide real-time local information and attract significant online advertising revenue, often at competitive rates. In 2024, the digital advertising market continued its robust growth, with local online advertising representing a substantial segment, directly challenging traditional media's dominance.

Social Media and Digital Advertising

Social media platforms and search engines represent significant competitive forces against traditional radio advertising. Their ability to reach vast audiences with highly specific targeting options, coupled with robust, measurable analytics, offers businesses compelling alternatives. For instance, in 2024, digital ad spending is projected to reach over $600 billion globally, a substantial portion of which is allocated to social media and search. This directly competes for the advertising budgets that radio historically relied upon.

These digital channels provide advertisers with granular control over their campaigns, allowing for precise audience segmentation based on demographics, interests, and behaviors. The return on investment (ROI) is often more transparent and quantifiable than with many traditional media. This data-driven approach makes it increasingly difficult for radio to demonstrate its value proposition in comparison, especially when considering the engagement metrics available from platforms like Meta (Facebook, Instagram) and Google.

- Digital advertising spend continues to grow, with projections indicating over $600 billion globally in 2024.

- Social media platforms offer precise targeting capabilities, allowing advertisers to reach specific demographics and interests.

- Measurable analytics on digital platforms provide clear ROI data, challenging traditional media's value proposition.

- Companies like Meta and Google are major competitors for advertising budgets, offering alternatives to radio advertising.

Esports Industry Competition

Beasley Esports faces intense rivalry from numerous professional esports organizations, established team owners, and burgeoning content creators. This competition is fierce for securing top-tier talent, capturing audience attention, and attracting vital sponsorship revenue.

The esports landscape is characterized by its rapid evolution, demanding continuous innovation and aggressive strategies to maintain and grow market share. For instance, in 2024, the global esports market was projected to generate over $1.5 billion in revenue, highlighting the significant financial stakes and the intensity of competition for a piece of that pie.

- Talent Acquisition: Organizations compete for skilled players and influential streamers, often driving up salary demands and contract values.

- Viewership Battles: Teams and content creators vie for viewer engagement across platforms like Twitch and YouTube, influencing advertising and sponsorship deals.

- Sponsorship Competition: Brands are increasingly investing in esports, leading to a crowded marketplace for sponsorship opportunities.

- Market Share Dynamics: New entrants and established players constantly innovate to capture a larger segment of the growing esports audience and revenue streams.

Competitive rivalry is a significant force for Beasley Media Group, stemming from both traditional terrestrial radio competitors and the rapidly expanding digital audio space. This intense competition for listener attention and advertising dollars means Beasley must constantly innovate its programming and marketing strategies to stand out in a crowded market.

The digital audio landscape, including streaming services and podcasts, presents a formidable challenge. These platforms offer personalized experiences and reach vast audiences, directly siphoning listeners and advertising revenue from traditional radio. For example, Spotify's user base surpassed 600 million monthly active users by early 2024, underscoring the scale of this digital competition.

Beyond direct audio competitors, Beasley also contends with a broad spectrum of local media outlets, such as television stations, newspapers, and online news sites, all vying for local advertising budgets. The digital advertising market's continued growth, with global projections exceeding $600 billion in 2024, further intensifies this rivalry, as businesses allocate more funds to highly targeted online campaigns.

| Competitor Type | Key Characteristics | Impact on Beasley |

|---|---|---|

| Terrestrial Radio | Local market focus, programming battles | Price pressure, audience share competition |

| Digital Audio (Spotify, Podcasts) | Personalized, on-demand, vast reach | Listener fragmentation, ad revenue diversion |

| Local Traditional Media (TV, Print) | Established local presence, broad reach | Shared advertising budgets, audience attention |

| Digital/Social Media Advertising | Precise targeting, measurable ROI, global scale | Significant ad budget competition, challenging value proposition |

SSubstitutes Threaten

Music streaming services like Spotify, Apple Music, and Amazon Music present a significant threat to traditional radio by offering expansive on-demand music libraries, curated playlists, and ad-free listening experiences. These platforms directly compete for consumer attention, effectively substituting radio as the primary source for music discovery and enjoyment.

In 2024, the global music streaming market continues its robust growth, with subscription revenues projected to exceed $30 billion. This escalating adoption rate directly erodes radio's listener base, particularly among younger demographics who increasingly favor personalized, on-demand content over scheduled programming. For instance, as of early 2024, Spotify alone boasts over 600 million monthly active users, demonstrating the sheer scale of this substitution effect.

Podcasts offer a significant threat to traditional radio by providing highly specialized, long-form, and on-demand audio content. This direct competition challenges Beasley's talk, news, and entertainment programming, as listeners increasingly opt for personalized content tailored to their interests and schedules, bypassing the need for scheduled broadcasts.

The shift towards on-demand audio is evident in the growing podcast market. In 2024, it's estimated that over 60% of Americans listen to podcasts, with many reporting that podcasts have replaced some of their radio listening time. This trend highlights a fundamental change in consumer behavior, favoring convenience and niche content over linear radio programming.

Satellite radio, exemplified by SiriusXM, presents a significant threat of substitution to traditional terrestrial radio. Its subscription model offers commercial-free listening and a vast array of specialized channels, catering to audiences seeking premium content and an uninterrupted experience, especially during commutes. In 2023, SiriusXM reported over 33.6 million total subscribers, highlighting its substantial reach and appeal as an alternative audio entertainment source.

Online Video Platforms and Social Media

Online video platforms and social media, such as YouTube and TikTok, present a significant threat of substitutes for traditional media and advertising. These platforms capture audience attention and advertiser spending by offering diverse content, from entertainment to news and community building. In 2024, digital advertising spending is projected to reach over $600 billion globally, with a substantial portion flowing to these online channels, directly impacting traditional media revenue streams.

- Audience Attention Diversion: Platforms like TikTok saw a 45% increase in daily active users in 2024, directly pulling viewers away from traditional television and radio.

- Advertising Budget Shift: Advertisers are increasingly allocating budgets to influencer marketing and targeted ads on social media, which reached an estimated $25 billion in 2024, diverting funds from legacy advertising channels.

- Content Accessibility: The ease of access to user-generated and professionally produced content on these platforms makes them a convenient and often free alternative to paid traditional media subscriptions.

Digital Advertising Channels

For advertisers, a vast landscape of digital channels presents a significant threat of substitution to traditional radio advertising. Platforms like Google Search, Meta (Facebook/Instagram), TikTok, and programmatic display networks offer advertisers granular targeting options based on demographics, interests, and online behavior. This allows for more precise audience reach compared to the broader reach of radio.

These digital alternatives often boast more readily measurable return on investment (ROI) through metrics such as click-through rates, conversion tracking, and cost per acquisition. For instance, in 2024, digital ad spending was projected to reach over $600 billion globally, highlighting its dominance and the pressure it exerts on other media. This measurability allows advertisers to optimize campaigns in real-time, a capability not as easily replicated by radio.

- Search Engine Marketing (SEM): Captures intent-driven consumers actively searching for products or services.

- Social Media Advertising: Leverages user data for highly targeted campaigns across various platforms.

- Display and Native Advertising: Integrates ads seamlessly into web content, offering visual appeal and context.

- Video Advertising: Increasingly popular across platforms like YouTube and streaming services, offering engaging content formats.

The threat of substitutes for traditional radio is substantial, stemming from a growing array of audio and digital platforms that capture audience attention and advertising revenue. These alternatives offer greater personalization, convenience, and often more measurable results for advertisers.

Music streaming services and podcasts have become dominant substitutes, offering on-demand access to vast libraries and niche content, respectively. For instance, Spotify's user base exceeded 600 million monthly active users in early 2024, illustrating the scale of this shift. Similarly, over 60% of Americans listen to podcasts in 2024, with many reducing their radio consumption.

Satellite radio, like SiriusXM, also poses a threat with its commercial-free programming and specialized channels, boasting over 33.6 million subscribers in 2023. Furthermore, online video and social media platforms, such as TikTok and YouTube, divert significant audience attention and advertising budgets, with global digital ad spending projected to surpass $600 billion in 2024.

| Substitute Category | Key Platforms | 2024 Data/Trends | Impact on Radio |

|---|---|---|---|

| Music Streaming | Spotify, Apple Music, Amazon Music | Global market projected over $30B in subscription revenue. Spotify: 600M+ MAU (early 2024). | Erodes listener base, especially younger demographics. |

| Podcasts | Various hosting platforms | 60%+ of Americans listen to podcasts (2024). | Replaces radio listening for niche and on-demand content. |

| Satellite Radio | SiriusXM | 33.6M+ total subscribers (2023). | Offers commercial-free, specialized content as an alternative. |

| Online Video/Social Media | YouTube, TikTok, Meta | Digital ad spending > $600B globally (2024 projection). TikTok daily active users increased 45% (2024). | Captures audience attention and advertising budgets. |

Entrants Threaten

Establishing a new terrestrial radio station involves substantial upfront costs. These include acquiring broadcast licenses, securing valuable spectrum, purchasing and installing transmission equipment, and setting up studio facilities. For instance, in 2024, the average cost for a new FM radio license in a mid-sized market could easily run into hundreds of thousands of dollars, with spectrum auctions potentially driving costs much higher.

The radio industry, particularly in the United States, is subject to stringent oversight from the Federal Communications Commission (FCC). This regulatory environment necessitates complex licensing processes and strict adherence to operational standards, creating a substantial barrier for potential new entrants.

Established brand recognition and audience loyalty present a significant barrier for new entrants in the radio industry. Incumbent stations, like those operated by Beasley Broadcast Group (BBGI), have cultivated decades of brand building, fostering deep listener loyalty and strong local community ties. For instance, in 2024, Beasley continued to leverage its well-known station brands across its markets, which are crucial for attracting and retaining advertising revenue.

Newcomers must overcome the substantial hurdle of building an audience and an advertiser base from the ground up. This is a formidable task when competing against radio stations that already command significant listener engagement and have long-standing relationships with local businesses. The cost and time required to achieve a comparable level of recognition and trust are considerable, making the threat of new entrants moderate.

Lower Barriers for Digital Audio/Esports

The landscape for content creation in audio and esports is dramatically different from traditional broadcasting. While setting up a terrestrial radio station involves significant capital for licenses, transmitters, and studios, launching a podcast or an esports stream requires far less. This accessibility means that the threat of new entrants is considerably higher in these digital realms.

For instance, the cost to start a podcast can be as low as a few hundred dollars for basic equipment, a stark contrast to the millions needed for a traditional radio license and infrastructure. Similarly, esports content creation, including streaming and video production, can be initiated with a decent computer and internet connection. This democratization of content creation allows individuals and small, agile teams to enter the market rapidly, potentially siphoning off audience share and advertising revenue from established players like Beasley.

- Digital audio and esports content creation have significantly lower startup costs compared to traditional radio.

- Individuals and small teams can launch new ventures with minimal investment, increasing competitive pressure.

- The ease of entry in digital spaces poses a direct threat to established media companies by fragmenting audiences and advertising spend.

Talent Acquisition and Content Creation Expertise

The threat of new entrants in media and entertainment, particularly for companies like Beasley Porter, is significantly shaped by the need for specialized expertise in talent acquisition and content creation. Developing compelling content and attracting top-tier talent, whether on-air personalities, esports players, or skilled content producers, requires substantial investment and established networks. Newcomers often face a steep uphill battle against incumbents who have cultivated these relationships and resources over time.

For instance, in the competitive landscape of sports broadcasting and digital content, securing high-profile commentators or popular streamers can be a major differentiator. Established entities often possess the financial clout to offer lucrative contracts and the proven track record that appeals to sought-after individuals. This creates a barrier for new players attempting to build a comparable talent bench and content pipeline from scratch.

- Talent Acquisition Costs: In 2024, the average salary for a top-tier sports commentator in a major market could range from $150,000 to $500,000 annually, with signing bonuses potentially reaching seven figures.

- Content Production Investment: A single high-quality documentary or a season of a popular podcast can cost anywhere from tens of thousands to millions of dollars, depending on production value and talent involved.

- Brand Recognition and Reach: Established media companies benefit from existing brand recognition, which aids in attracting both talent and audience, a factor difficult for new entrants to replicate quickly.

- Network Effects: Successful content creators and personalities often build strong followings, creating network effects that further solidify their position and make it harder for new talent to gain traction.

The threat of new entrants into the traditional radio market is generally considered moderate due to high capital requirements for licenses and equipment, coupled with stringent FCC regulations. However, the digital audio space, including podcasts and streaming, presents a significantly lower barrier to entry, allowing for easier market penetration by new, agile players.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse and credible data. We utilize annual reports, SEC filings, and investor relations materials to understand company strategies and financial health. Additionally, we incorporate market research reports, industry trade publications, and government economic data to capture broader industry trends and competitive landscapes.