Banco do Brasil PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco do Brasil Bundle

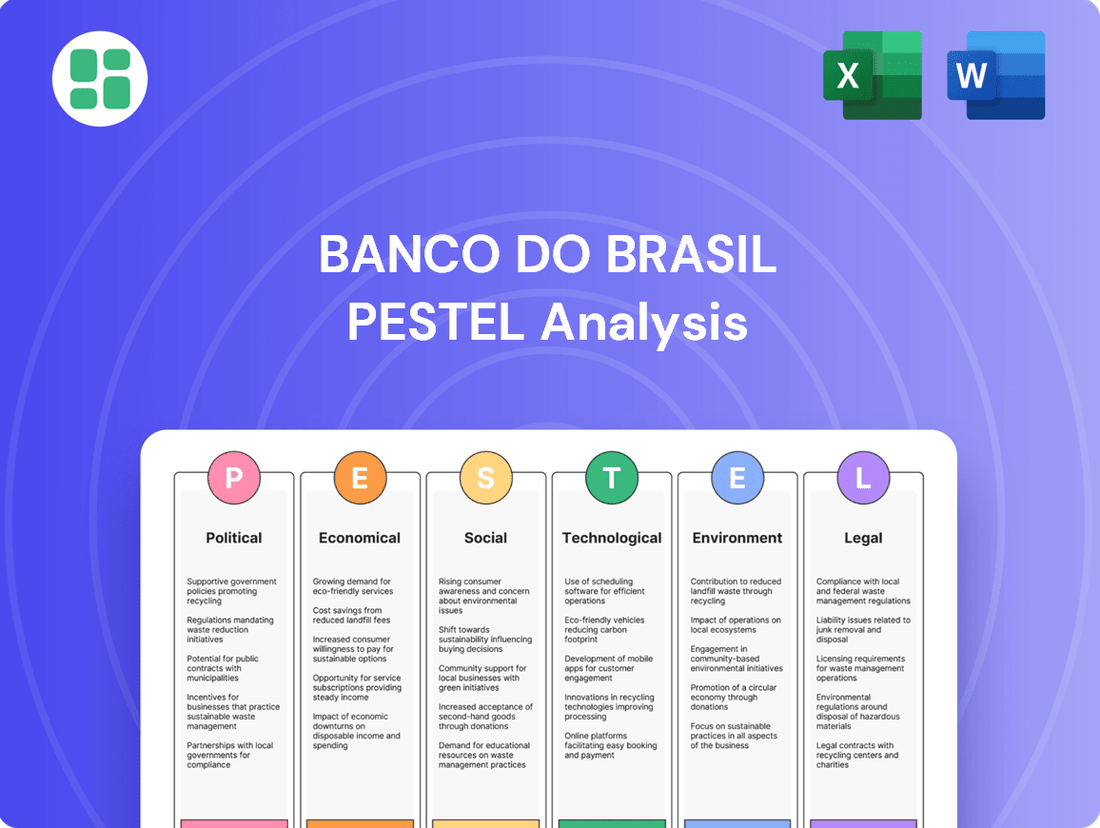

Unlock critical insights into Banco do Brasil's operating environment with our comprehensive PESTLE analysis. Understand the intricate interplay of Political, Economic, Social, Technological, Legal, and Environmental factors that are shaping its strategic trajectory. This analysis is your key to anticipating challenges and capitalizing on opportunities within the Brazilian financial sector.

Political factors

As a state-controlled entity, Banco do Brasil's strategic direction is heavily influenced by government policies and priorities. For instance, in 2024, the Brazilian government's focus on economic growth and social inclusion directly shaped the bank's lending targets, particularly in sectors like agriculture and infrastructure. This government oversight can influence operational autonomy and profitability, as seen in past instances where directives for specific lending programs impacted the bank's risk profile and return on equity.

The stability of Brazil's political landscape directly impacts Banco do Brasil's operational environment by influencing the predictability of banking regulations and financial market reforms. A stable political climate, as seen in the relatively consistent policy direction observed through much of 2024, generally fosters greater investor confidence. This predictability is crucial for long-term strategic planning, allowing the bank to anticipate and adapt to evolving financial sector requirements without the disruption of sudden policy shifts.

Government fiscal policies, such as public spending and taxation, alongside the Central Bank's monetary policies, including interest rate adjustments, significantly shape the economic landscape for Banco do Brasil. For instance, Brazil's central bank, the Banco Central do Brasil (BCB), maintained its Selic rate at 10.50% as of June 2024, a decision influenced by inflation expectations and fiscal concerns. This policy directly impacts borrowing costs and investment returns.

These governmental decisions directly influence loan demand, credit risk profiles, and the overall cost of capital for the bank. Higher interest rates, like the Selic rate, can dampen credit demand while potentially increasing the risk of defaults. Conversely, lower rates might stimulate borrowing but compress net interest margins.

For example, Brazil's government announced a fiscal deficit target of 2.5% of GDP for 2024, which could necessitate either increased borrowing or reduced spending, both having implications for the financial sector. Banco do Brasil's financial performance is thus intrinsically linked to the government's ability to manage its budget and the Central Bank's effectiveness in controlling inflation.

International Relations and Trade Agreements

Brazil's political stance on international trade and foreign relations significantly influences Banco do Brasil's global operations. Favorable trade agreements, such as those within Mercosur, can bolster cross-border financial services and open new markets. Conversely, strained international relations could introduce operational hurdles and increase financial risks for its foreign presence.

Geopolitical stability is a key determinant for foreign investment inflows into Brazil. For instance, in 2023, Brazil attracted approximately USD 67 billion in foreign direct investment, a figure that can be sensitive to shifts in global political climates and Brazil's international standing. Banco do Brasil, as a major financial institution, is directly impacted by these investment flows.

- Trade Dynamics: Brazil's participation in agreements like Mercosur facilitates easier financial transactions and market access for Banco do Brasil in neighboring countries.

- Investment Climate: Political stability and Brazil's foreign policy directly influence the volume of foreign direct investment, impacting the bank's international business opportunities.

- Risk Management: Strained international relations can lead to increased compliance burdens or restrictions on capital flows, requiring robust risk management strategies from Banco do Brasil.

Anti-Corruption and Governance Initiatives

Political efforts to combat corruption and bolster corporate governance directly impact Banco do Brasil's operational integrity and public image. For instance, in 2023, Brazil's Federal Court of Accounts (TCU) continued its oversight of state-owned enterprises, including banks, focusing on transparency and efficiency. Increased scrutiny can lead to more rigorous compliance demands, potentially requiring significant investment in governance frameworks and internal controls.

Adherence to these anti-corruption and governance initiatives is crucial for maintaining investor confidence and securing regulatory approval. Banco do Brasil, as a significant state-controlled financial institution, is subject to evolving legal and ethical standards. These efforts aim to ensure responsible management and safeguard public funds, which in turn supports the bank's long-term stability and reputation in the market.

- Enhanced Transparency: Initiatives often mandate greater disclosure of financial dealings and decision-making processes.

- Stricter Compliance: New regulations may impose more stringent rules on internal audits, risk management, and ethical conduct.

- Governance Investments: Banks may need to allocate resources to upgrade IT systems, training, and compliance personnel to meet new standards.

- Reputational Impact: Demonstrating strong governance can attract foreign investment and improve credit ratings.

Government directives significantly shape Banco do Brasil's strategic lending, with 2024 seeing a focus on agriculture and infrastructure to drive economic growth and social inclusion. Political stability in Brazil, as observed through consistent policy in 2024, enhances investor confidence and aids the bank's long-term planning by ensuring regulatory predictability.

Fiscal and monetary policies are pivotal; Brazil's Selic rate remained at 10.50% as of June 2024, impacting borrowing costs and returns. The government's 2024 fiscal deficit target of 2.5% of GDP also influences the financial sector's cost of capital and credit risk. Brazil's international trade stance, exemplified by Mercosur participation, affects cross-border operations, while geopolitical stability, which saw USD 67 billion in FDI in 2023, impacts foreign investment inflows.

| Factor | 2023/2024 Impact | Banco do Brasil Implication |

|---|---|---|

| Government Lending Priorities | Focus on agriculture & infrastructure (2024) | Shapes loan portfolio and risk |

| Political Stability | Consistent policy direction (2024) | Boosts investor confidence, aids planning |

| Monetary Policy (Selic Rate) | 10.50% (June 2024) | Affects borrowing costs and net interest margins |

| Fiscal Policy | 2.5% GDP deficit target (2024) | Influences cost of capital and credit risk |

| Foreign Direct Investment | USD 67 billion (2023) | Impacts international business opportunities |

What is included in the product

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors impacting Banco do Brasil, offering insights into market dynamics and regulatory landscapes.

It provides a strategic framework for identifying opportunities and threats, enabling proactive decision-making for Banco do Brasil's growth and stability.

A Banco do Brasil PESTLE analysis offers a clear, summarized version of external factors, relieving the pain of sifting through complex data for strategic decision-making.

This analysis provides a concise, easily shareable format, ideal for quick alignment across teams and departments when addressing external risks and market positioning.

Economic factors

The prevailing Selic rate, set by the Central Bank of Brazil, directly influences Banco do Brasil's net interest margin. As of early 2024, the Selic rate has been undergoing a downward trend, moving from 13.75% in early 2024 towards 10.50% by mid-2024, impacting both lending income and funding costs.

This dynamic environment means that while lower rates can spur credit demand, they also compress the bank's margins on loans. Conversely, a higher rate environment would boost interest income but simultaneously increase funding expenses and potentially heighten borrower default risks.

Banco do Brasil's profitability is therefore closely tied to its ability to manage these interest rate fluctuations, balancing the benefits of increased lending with the costs of capital and the credit quality of its portfolio.

Inflation significantly impacts consumer purchasing power and business operating expenses, directly influencing loan demand and the creditworthiness of borrowers for Banco do Brasil. In early 2024, Brazil's inflation rate hovered around 4.62% (IPCA), a notable decrease from previous years, which could bolster consumer confidence and spending.

Brazil's economic growth, tracked by its Gross Domestic Product (GDP), has a direct bearing on the demand for banking services. For instance, the Brazilian economy expanded by an estimated 2.9% in 2023, and projections for 2024 suggest continued, albeit potentially slower, growth, which generally translates into increased demand for loans, investment products, and financial advisory services for Banco do Brasil.

A strong economic performance, characterized by consistent GDP expansion, typically translates into higher profitability for financial institutions like Banco do Brasil. This is due to increased transaction volumes, a larger loan portfolio, and improved asset quality, all stemming from a healthier economic environment.

Banco do Brasil's profitability is directly influenced by the volatility of the Brazilian Real. For instance, a significant depreciation of the Real against the US Dollar can increase the value of dollar-denominated assets held by the bank, but conversely, it can also make foreign currency-denominated liabilities more expensive to service. This dynamic impacts the bank's net interest margin and the overall valuation of its international financial activities.

The bank's exposure to international trade finance means that exchange rate shifts directly affect the cost and profitability of import and export operations it facilitates. For example, if the Real weakens substantially, the cost for Brazilian companies importing goods financed by Banco do Brasil will rise, potentially dampening demand for these services.

In 2024, the Brazilian Real experienced periods of significant fluctuation, trading within a range that presented both opportunities and risks for financial institutions like Banco do Brasil. For instance, during certain months, the Real depreciated by over 5% against the US Dollar, impacting the bank's foreign exchange gains and losses on its international portfolio.

Unemployment Rates and Income Levels

High unemployment rates and stagnant income levels can significantly impact Banco do Brasil's performance. For instance, Brazil's unemployment rate hovered around 7.8% in early 2024, and while showing a downward trend, it still represents a considerable portion of the workforce. This situation can lead to increased credit defaults as individuals struggle to meet their financial obligations, consequently reducing demand for new loans and financial products.

Conversely, an improving labor market and rising disposable income directly benefit the bank. When more people are employed and earning higher wages, their capacity to service existing debt improves, and they are more likely to seek new financial services, such as mortgages, car loans, or investment products. This scenario boosts both the retail and corporate segments of Banco do Brasil.

- Unemployment Impact: Brazil's unemployment rate was approximately 7.8% in early 2024, indicating a segment of the population with potentially reduced purchasing power and increased risk of loan defaults.

- Income Growth: Real income growth in Brazil has shown fluctuations, with some periods of modest increases, which directly correlates with increased consumer spending and demand for financial products.

- Credit Risk: Higher unemployment and lower income levels heighten credit risk for banks like Banco do Brasil, potentially leading to higher provisions for bad debts.

- Demand for Services: Economic recovery with job creation and income growth stimulates demand for a wider range of banking services, from basic accounts to more complex credit and investment solutions.

Credit Market Conditions and Competition

The Brazilian credit market is robust and highly competitive, impacting Banco do Brasil's ability to maintain its market share and pricing power. As of early 2024, Brazil's banking sector is characterized by a significant number of players, including large private banks, smaller regional institutions, and a growing number of fintechs. This competitive landscape means that credit availability is generally good, but it also puts pressure on margins for all participants.

Intense competition from established private banks and agile fintech companies forces Banco do Brasil to continually innovate. This pressure is evident in the need for enhanced digital services and competitive interest rates. For instance, the Central Bank of Brazil's Pix instant payment system, launched in late 2020, has reshaped transaction dynamics and encouraged digital offerings across the board, a trend that continues to evolve in 2024 and 2025.

- Credit Market Health: Brazil's credit market remains dynamic, with lending growth showing resilience in early 2024, though subject to monetary policy adjustments.

- Competitive Intensity: The presence of over 100 financial institutions, including major private banks and a rapidly expanding fintech sector, intensifies competition for Banco do Brasil.

- Margin Pressure: Fierce competition necessitates competitive pricing, potentially compressing net interest margins for traditional banks like Banco do Brasil.

- Innovation Imperative: The need to match or exceed the digital offerings of fintechs drives continuous investment in new products and services, such as digital account management and personalized loan products.

The Brazilian economy's performance, as indicated by its GDP growth, directly influences the demand for banking services. Projections for 2024 suggested continued economic expansion, albeit at a potentially moderated pace compared to 2023's estimated 2.9% growth. This economic backdrop generally supports increased lending and investment activities, benefiting institutions like Banco do Brasil.

Inflationary pressures, with the IPCA rate around 4.62% in early 2024, affect consumer spending and borrower creditworthiness. While this rate represented a decrease from prior periods, it still influences the real value of income and the cost of goods, impacting loan demand and repayment capacity.

The Central Bank of Brazil's monetary policy, reflected in the Selic rate, is a critical factor. The downward trend of the Selic rate from 13.75% in early 2024 towards 10.50% by mid-2024 impacts Banco do Brasil's net interest margins by altering both lending income and funding costs.

| Economic Indicator | Value/Trend (Early-Mid 2024) | Impact on Banco do Brasil |

|---|---|---|

| GDP Growth | Projected continued expansion (following 2.9% in 2023) | Increased demand for loans and financial services |

| Inflation (IPCA) | Around 4.62% | Influences consumer spending and credit risk |

| Selic Rate | Downward trend (13.75% to 10.50%) | Compresses net interest margins, potentially spurs credit demand |

Same Document Delivered

Banco do Brasil PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Banco do Brasil PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the institution. You'll gain a clear understanding of the external forces shaping its operations and strategic decisions.

Sociological factors

Brazil's demographic landscape is undergoing significant shifts. The population is aging, with projections indicating a growing proportion of individuals over 60 in the coming years, creating a greater need for retirement planning and wealth management services. This trend directly impacts Banco do Brasil's product development, requiring a focus on long-term investment and pension solutions.

Concurrently, Brazil continues to experience substantial urbanization. As more people move to cities, demand for financial products supporting urban living, such as mortgage loans for housing and accessible digital banking platforms, is expected to rise. Banco do Brasil needs to ensure its digital infrastructure and lending products are well-positioned to capture this urban growth, potentially seeing increased demand for consumer credit and digital payment solutions.

Banco do Brasil's growth is closely tied to Brazil's financial inclusion and literacy rates. In 2023, approximately 70% of Brazilians were considered banked, a figure that has been steadily increasing, yet a significant portion still faces challenges with financial literacy. This gap means that while more people have access to basic banking, the adoption of more complex financial products like investments or specialized insurance remains limited.

The bank's vast physical and digital presence is crucial for reaching underserved populations. However, low financial literacy, a persistent issue in Brazil, can be a barrier to customers fully utilizing sophisticated financial tools. For instance, in 2024, surveys indicated that a substantial percentage of the population struggled with understanding basic investment concepts, directly impacting the market for such products offered by Banco do Brasil.

Investing in financial education initiatives is therefore key for Banco do Brasil. By improving the population's understanding of financial concepts, the bank can unlock new market segments and drive demand for its broader product suite. This strategy is essential for long-term customer engagement and for expanding the bank's reach into higher-value financial services.

Consumer behavior is rapidly evolving, with a pronounced shift towards digital channels for banking. Banco do Brasil is seeing this trend firsthand, as customers increasingly demand convenience, speed, and mobile accessibility. This necessitates substantial investment in digital platforms to meet these changing preferences and retain customers, especially younger demographics who are early adopters of new technologies.

In 2024, a significant portion of banking transactions are expected to be conducted digitally. For instance, mobile banking usage continues to surge globally, with projections indicating that by the end of 2025, over 80% of banking interactions for many institutions could occur via mobile devices. Banco do Brasil's ability to offer a seamless and intuitive digital experience is therefore critical for its competitive edge and future growth.

Income Inequality and Social Programs

Brazil's significant income inequality shapes the demand for financial services across various socioeconomic strata. Banco do Brasil's role in government social programs, such as those aimed at financial inclusion and poverty reduction, directly influences its lending activities and the associated risks. For instance, in 2023, Brazil's Gini coefficient remained high, indicating persistent wealth disparities, which necessitates tailored product offerings from institutions like Banco do Brasil to serve both affluent and lower-income segments.

These social programs, often designed to address inequality, can impact Banco do Brasil's portfolio by channeling credit towards specific development goals or vulnerable populations. The bank's involvement in initiatives like the Bolsa Família program, which provides financial aid to low-income families, demonstrates this connection. Maintaining a strong social license to operate hinges on effectively navigating and responding to these societal disparities, ensuring that the bank's operations contribute positively to social development goals.

- Persistent Inequality: Brazil's Gini coefficient, a measure of income inequality, remained elevated in 2023, highlighting the need for diversified financial products catering to different income levels.

- Social Program Integration: Banco do Brasil's participation in government initiatives like Bolsa Família directly influences its lending portfolio and risk assessment by supporting lower-income households.

- Social License to Operate: Addressing income disparities is crucial for Banco do Brasil's reputation and its ability to maintain public trust and regulatory support.

Trust in Financial Institutions

Public trust in financial institutions is a cornerstone for customer loyalty and growth. Following periods of economic instability or corporate misconduct, this trust can be fragile. For Banco do Brasil, upholding a reputation for dependability, openness, and ethical practices is paramount to securing the confidence of its broad customer spectrum.

A significant factor influencing trust is the perception of fairness and the handling of past financial crises. For instance, in Brazil, the aftermath of economic downturns often leads to increased scrutiny of banking practices. Maintaining robust compliance and transparent communication are key strategies Banco do Brasil employs to counter potential trust erosion.

The 2023 Edelman Trust Barometer reported that trust in financial services globally remains a critical concern, with institutions needing to demonstrate consistent ethical behavior and deliver on promises. For Banco do Brasil, this translates to a continuous effort to reinforce its commitment to customer well-being and operational integrity, especially as digital channels become more prevalent, requiring enhanced security and transparency.

- Reputational Resilience: Banco do Brasil's ability to maintain public trust is directly linked to its consistent delivery of reliable financial services and adherence to ethical standards.

- Impact of Past Events: Historical financial crises and scandals can leave lasting impressions, necessitating proactive measures by institutions like Banco do Brasil to rebuild and sustain confidence.

- Transparency as a Driver: Open communication regarding fees, policies, and security measures is crucial for fostering a strong, trusting relationship with customers.

- Customer Acquisition & Retention: A high level of trust directly correlates with a bank's capacity to attract new clients and retain existing ones, underpinning long-term financial stability.

Brazil's aging population, with projections showing a rise in those over 60, creates a growing demand for retirement planning and wealth management services, directly influencing Banco do Brasil's product development towards long-term investments.

The ongoing urbanization trend in Brazil fuels the need for financial products supporting city living, such as mortgages and accessible digital banking, requiring Banco do Brasil to enhance its digital infrastructure and lending options.

Financial literacy remains a challenge in Brazil, despite increasing banking access, with many consumers still struggling to understand complex financial products, impacting Banco do Brasil's ability to expand its offerings beyond basic services.

Technological factors

Digital transformation is fundamentally altering banking, pushing Banco do Brasil to prioritize investments in sophisticated mobile apps and online services. By the end of 2024, it's estimated that over 80% of banking interactions for major Brazilian banks will occur through digital channels, underscoring the need for seamless customer experiences and robust digital infrastructure.

Banco do Brasil is responding by enhancing its digital platforms to offer a comprehensive suite of services, from routine transactions to personalized customer support, directly through its mobile and online channels. This focus on convenience and accessibility is crucial, as customer adoption of digital banking solutions in Brazil saw a significant surge, with mobile banking users increasing by approximately 15% year-over-year through early 2025.

Cybersecurity is a major concern for Banco do Brasil, especially with more financial activities happening online. In 2023, the global cost of cybercrime was estimated to reach $10.5 trillion annually by 2025, highlighting the significant financial risks involved. Protecting customer data and ensuring system integrity through advanced encryption and fraud detection is therefore crucial for maintaining trust and operational stability.

Banco do Brasil must invest heavily in robust cybersecurity measures. This includes implementing sophisticated fraud detection systems and providing comprehensive training for employees to combat evolving threats. The bank's commitment to data protection is also vital, especially with regulations like Brazil's LGPD (Lei Geral de Proteção de Dados) in effect, which imposes strict requirements on how personal data is handled.

Banco do Brasil is actively integrating Artificial Intelligence (AI) and Machine Learning (ML) to boost efficiency and customer service. For instance, AI-powered chatbots handled over 30 million customer interactions in 2023, significantly reducing wait times and freeing up human agents for more complex issues. This adoption allows for more personalized banking experiences, from tailored product recommendations to proactive financial advice.

The bank is also employing predictive analytics for more accurate credit scoring and enhanced fraud detection. In 2024, their ML models for credit risk assessment are projected to reduce non-performing loans by an estimated 5%, a crucial factor in a dynamic economic climate. These advancements in AI and ML are key to optimizing decision-making and maintaining a competitive edge in the financial sector.

Fintech Competition and Collaboration

The burgeoning fintech sector presents a dual challenge and opportunity for Banco do Brasil. Fintech firms, with their nimble operations and cutting-edge tech, are pushing traditional banks to accelerate their own innovation cycles. This competitive pressure is a significant technological factor shaping the banking landscape.

Strategic alliances and acquisitions with fintechs offer Banco do Brasil a pathway to quickly adopt new technologies and broaden its service portfolio. For instance, by integrating specialized payment solutions or digital lending platforms from fintech partners, the bank can enhance customer experience and reach new market segments. This approach was evident in 2023 when the Brazilian fintech market saw significant investment, with Nubank, a major player, reporting over 90 million customers globally by the end of the year, highlighting the scale of digital adoption.

- Competitive Pressure: Fintechs challenge established banks with agile, tech-driven solutions in areas like payments, lending, and wealth management.

- Collaboration Opportunities: Partnerships or acquisitions allow banks to integrate innovative technologies and expand service offerings efficiently.

- Market Dynamics: The rapid growth of fintechs, exemplified by companies reaching tens of millions of customers, necessitates adaptation from traditional institutions.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) offer transformative potential for banking, impacting areas like cross-border payments and trade finance. Banco do Brasil is actively exploring these innovations to enhance operational efficiency and security. For instance, the global DLT market was projected to reach $23.3 billion by 2023, indicating significant investment and development in this space.

The bank must continue to pilot and assess DLT applications for functions such as identity verification and streamlining complex financial processes. These technologies promise greater transparency and reduced transaction costs, critical for maintaining a competitive edge. By mid-2024, several major financial institutions were reporting successful DLT pilot programs for interbank settlements, demonstrating tangible benefits.

Key areas for Banco do Brasil to consider include:

- Improving cross-border payment efficiency: DLT can reduce settlement times and costs compared to traditional correspondent banking networks.

- Enhancing trade finance security: Blockchain can provide a secure, immutable record of trade documents, reducing fraud and disputes.

- Streamlining identity verification: DLT-based digital identities can offer a more secure and efficient Know Your Customer (KYC) process.

Banco do Brasil's technological advancements are centered on digital transformation, aiming to meet evolving customer expectations. By early 2025, over 80% of banking interactions in Brazil are expected to be digital, driving the bank's investment in user-friendly mobile and online platforms. The bank's focus on enhancing these digital channels is crucial, as mobile banking users in Brazil saw a 15% year-over-year increase through early 2025.

AI and ML integration are key to Banco do Brasil's strategy for efficiency and personalized service. AI-powered chatbots handled over 30 million customer interactions in 2023, demonstrating their capacity to manage routine queries. Predictive analytics are also being employed to refine credit scoring and fraud detection, with ML models projected to reduce non-performing loans by 5% in 2024.

The rise of fintechs presents both competition and opportunities for innovation. These agile companies are pushing traditional banks to adopt new technologies rapidly. Banco do Brasil is exploring strategic partnerships and acquisitions to integrate fintech solutions, enhancing its service offerings and customer reach, much like major fintech players who already serve tens of millions of customers.

Blockchain and DLT are being explored for their potential to revolutionize areas like cross-border payments and trade finance. The global DLT market was projected to reach $23.3 billion by 2023, signaling significant industry interest. Banco do Brasil's continued assessment of DLT applications for identity verification and process streamlining aims to improve transparency and reduce transaction costs, building on successful pilot programs in interbank settlements reported by mid-2024.

| Technology Area | Banco do Brasil Focus | Industry Trend/Impact | Key Data Point (2023-2025) |

|---|---|---|---|

| Digital Transformation | Mobile & Online Services Enhancement | 80% of banking interactions digital by end of 2024 | 15% YoY growth in mobile banking users (early 2025) |

| AI & Machine Learning | Chatbots, Predictive Analytics | Improved efficiency, personalized services, risk reduction | 30M+ chatbot interactions (2023); 5% reduction in NPLs projected (2024) |

| Fintech Integration | Partnerships & Acquisitions | Competitive pressure, service expansion | Significant investment in Brazilian fintech market (2023) |

| Blockchain & DLT | Cross-border Payments, Trade Finance | Enhanced efficiency, security, transparency | Global DLT market projected $23.3B (2023) |

Legal factors

Banco do Brasil navigates a landscape shaped by the Central Bank of Brazil's (BACEN) stringent banking regulations. These rules dictate crucial aspects like capital adequacy, with Basel III norms continuing to influence requirements, and liquidity ratios, ensuring the bank can meet its short-term obligations. For instance, BACEN's ongoing efforts to strengthen the financial system through updated prudential guidelines directly affect Banco do Brasil's risk management strategies and operational capacity.

Brazil's Lei Geral de Proteção de Dados (LGPD) significantly impacts Banco do Brasil, mandating strict protocols for customer data handling. Failure to comply, which could involve hefty fines, necessitates continuous investment in data security and consent management systems.

Banco do Brasil operates under stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws, a critical legal factor impacting its operations. These regulations mandate robust Know Your Customer (KYC) protocols, sophisticated transaction monitoring, and the timely reporting of suspicious activities to Brazil's Financial Intelligence Unit (COAF). Failure to comply can result in significant fines and reputational damage, underscoring the importance of maintaining up-to-date compliance frameworks.

Consumer Protection and Financial Services Laws

Consumer protection laws are paramount for Banco do Brasil, shaping every client interaction. These regulations mandate fair lending, clear product disclosures, and robust dispute resolution, ensuring ethical practices. For instance, the Brazilian Central Bank's directives, updated in late 2024, emphasize enhanced transparency in digital banking services, directly impacting how Banco do Brasil communicates with its customers about fees and terms.

Non-compliance with these consumer protection statutes can lead to severe penalties, including substantial fines and reputational damage, as seen in the R$ 5 million fine levied against a competitor in early 2025 for misleading advertising. Maintaining strong adherence is crucial for fostering customer loyalty and trust. Changes in these legal frameworks, such as potential new data privacy requirements for financial institutions anticipated in 2025, will necessitate adjustments in product development and marketing approaches.

Key legal factors influencing Banco do Brasil include:

- Fair Lending Practices: Adherence to regulations preventing discriminatory lending based on race, gender, or other protected characteristics.

- Transparency in Disclosure: Mandates for clear and comprehensive information on financial products, including fees, interest rates, and risks.

- Dispute Resolution Mechanisms: Requirements for accessible and effective channels for customers to resolve grievances.

- Data Privacy and Security: Evolving regulations governing the collection, use, and protection of customer financial data.

Labor Laws and Employment Regulations

Brazilian labor laws are known for their complexity and comprehensiveness, directly impacting Banco do Brasil's human resources strategies. These regulations govern everything from hiring and compensation to benefits and termination, requiring strict adherence to mitigate risks of labor disputes and legal penalties.

Compliance with these intricate labor laws is paramount for Banco do Brasil to maintain smooth operations and avoid costly legal entanglements. For instance, the Consolidação das Leis do Trabalho (CLT) outlines detailed rules for employment contracts, working hours, and employee rights, which the bank must meticulously follow.

Potential shifts in labor legislation present ongoing challenges and opportunities for Banco do Brasil. For example, discussions around labor reform in Brazil, which have been ongoing, could influence operational expenses and necessitate adjustments in workforce management approaches. In 2024, the focus remains on adapting to evolving labor market dynamics while ensuring legal compliance.

- Complex Regulatory Environment: Banco do Brasil must navigate Brazil's detailed labor laws, including those related to minimum wage, working hours, and employee benefits, to ensure compliance.

- Risk of Litigation: Non-compliance with labor regulations can lead to significant fines and legal disputes, impacting the bank's financial performance and reputation.

- Adaptability to Reforms: The bank needs to remain agile to adapt to potential changes in labor legislation, which could affect its operational costs and human capital strategies.

- Workforce Management Impact: Labor laws directly influence hiring practices, compensation structures, and termination procedures, requiring strategic HR planning.

Banco do Brasil must adhere to Brazil's robust consumer protection laws, which mandate fair lending, transparent product disclosures, and effective dispute resolution mechanisms. Recent updates from the Brazilian Central Bank in late 2024, particularly concerning digital banking, emphasize enhanced transparency in fees and terms. Non-compliance can result in significant penalties; for instance, a competitor faced a R$ 5 million fine in early 2025 for misleading advertising, highlighting the critical need for adherence to foster customer trust.

The bank's operations are significantly influenced by Brazil's complex labor laws, governing aspects from hiring to termination. Strict compliance with regulations like the Consolidação das Leis do Trabalho (CLT) is essential to avoid legal disputes and penalties. Ongoing discussions around labor reforms in Brazil could impact operational costs and workforce management strategies, requiring continuous adaptation to evolving legal frameworks.

Banco do Brasil operates under stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) laws, necessitating robust Know Your Customer (KYC) protocols and transaction monitoring. Failure to comply can lead to substantial fines and reputational damage, underscoring the importance of maintaining up-to-date compliance frameworks with Brazil's Financial Intelligence Unit (COAF).

Navigating Brazil's General Data Protection Law (LGPD) is crucial for Banco do Brasil, requiring strict protocols for customer data handling and robust data security measures to avoid hefty fines.

Environmental factors

Climate change presents significant challenges for Banco do Brasil, manifesting as physical risks like damage to agricultural collateral from extreme weather events, impacting its loan portfolio. Transition risks also loom, driven by policy shifts pushing for a low-carbon economy.

In response, the bank faces growing pressure to embed climate risk assessments into its operations and bolster green financing. This includes expanding support for renewable energy projects and sustainable agriculture, aligning with global sustainability goals.

By mid-2024, Banco do Brasil had already allocated R$15 billion towards its 2024-2027 climate action plan, emphasizing its commitment to green finance and climate risk mitigation.

Banco do Brasil faces increasing pressure from investors, regulators, and the public to showcase robust ESG performance. For instance, as of early 2024, global sustainable investment assets were projected to exceed $50 trillion, highlighting a significant market shift.

The bank must navigate evolving ESG reporting standards, meticulously disclosing its environmental footprint and embedding sustainable practices throughout its operations. This includes tracking metrics like Scope 1, 2, and 3 emissions.

Demonstrating strong ESG credentials is vital for enhancing Banco do Brasil's reputation, attracting responsible capital, and bolstering its risk management frameworks. In 2023, companies with strong ESG ratings often saw lower borrowing costs.

Banco do Brasil's lending and investment strategies are under growing pressure to account for their environmental footprint. This means the bank must develop and implement robust policies to identify and manage environmental risks in the projects it supports, favoring investments in businesses with strong environmental credentials.

By embracing sustainable finance principles, Banco do Brasil can effectively reduce reputational risks and demonstrate alignment with international sustainability objectives. For instance, as of early 2024, the bank has committed to increasing its portfolio in renewable energy and sustainable agriculture, aiming for a significant portion of its new credit lines to meet stringent environmental criteria.

Resource Management and Operational Footprint

Banco do Brasil is increasingly focused on its operational environmental footprint, addressing energy consumption, water usage, and waste generation across its vast network of branches and data centers. In 2023, the bank reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions by 15.7% compared to its 2019 baseline, demonstrating progress in its sustainability efforts.

Implementing efficient resource management strategies, such as reducing emissions and promoting recycling, directly impacts the bank's environmental performance and offers tangible cost savings. For instance, initiatives to optimize energy use in its facilities contributed to a 5% decrease in electricity consumption per square meter in 2023.

- Energy Efficiency: Banco do Brasil is investing in energy-efficient technologies for its branches and data centers, aiming to further reduce its carbon footprint.

- Water Conservation: Water usage is being monitored and managed, with efforts to implement water-saving technologies in its facilities.

- Waste Reduction and Recycling: The bank actively promotes recycling programs and waste reduction initiatives across its operations, contributing to a circular economy approach.

Regulatory Pressure for Environmental Compliance

Brazilian environmental regulations are increasingly strict, compelling companies, including financial institutions like Banco do Brasil, to meet diverse environmental standards. This means Banco do Brasil needs to ensure its own operational activities and the various projects it funds are in line with environmental licensing, pollution control mandates, and conservation legislation.

Failure to comply with these regulations can result in significant consequences. These include legal repercussions, substantial fines, and a negative impact on the bank's reputation and public perception. For instance, in 2024, Brazil's National Environment Council (CONAMA) continued to refine regulations concerning environmental impact assessments for infrastructure projects, directly affecting the financing sector.

- Increased Scrutiny: Banco do Brasil faces heightened scrutiny over its financed projects' environmental impact.

- Compliance Costs: Adhering to new environmental standards may increase operational and due diligence costs.

- Reputational Risk: Non-compliance can lead to significant damage to the bank's brand and investor confidence.

- Financing Restrictions: Projects failing environmental assessments may be ineligible for Banco do Brasil's funding.

Banco do Brasil is actively integrating environmental considerations into its business model, driven by climate change impacts and increasing regulatory demands. The bank's commitment to green finance is evident in its substantial allocation towards climate action, aiming to mitigate both physical and transition risks associated with a changing climate.

The bank's operational efficiency is also a focus, with reported reductions in greenhouse gas emissions and energy consumption. These efforts not only bolster its environmental performance but also contribute to cost savings, demonstrating a dual benefit of sustainability initiatives.

Navigating Brazil's evolving environmental regulations is crucial for Banco do Brasil, as non-compliance carries significant financial and reputational risks. The bank is therefore prioritizing robust environmental due diligence for its financed projects.

| Environmental Factor | Banco do Brasil's Action/Impact | Data/Example |

|---|---|---|

| Climate Change Risks | Mitigating physical and transition risks in loan portfolio. | R$15 billion allocated to 2024-2027 climate action plan. |

| Green Financing | Expanding support for renewable energy and sustainable agriculture. | Commitment to increase portfolio in renewable energy and sustainable agriculture. |

| Operational Footprint | Reducing energy consumption, water usage, and waste. | 15.7% reduction in Scope 1 & 2 GHG emissions (2023 vs. 2019 baseline). |

| Regulatory Compliance | Adhering to strict Brazilian environmental standards. | Increased scrutiny on financed projects' environmental impact. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Banco do Brasil is built on a robust foundation of data from official Brazilian government agencies, international financial institutions like the IMF and World Bank, and leading economic and market research firms. This ensures comprehensive coverage of political stability, economic trends, social demographics, technological advancements, environmental regulations, and legal frameworks impacting the bank.