Banco do Brasil Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco do Brasil Bundle

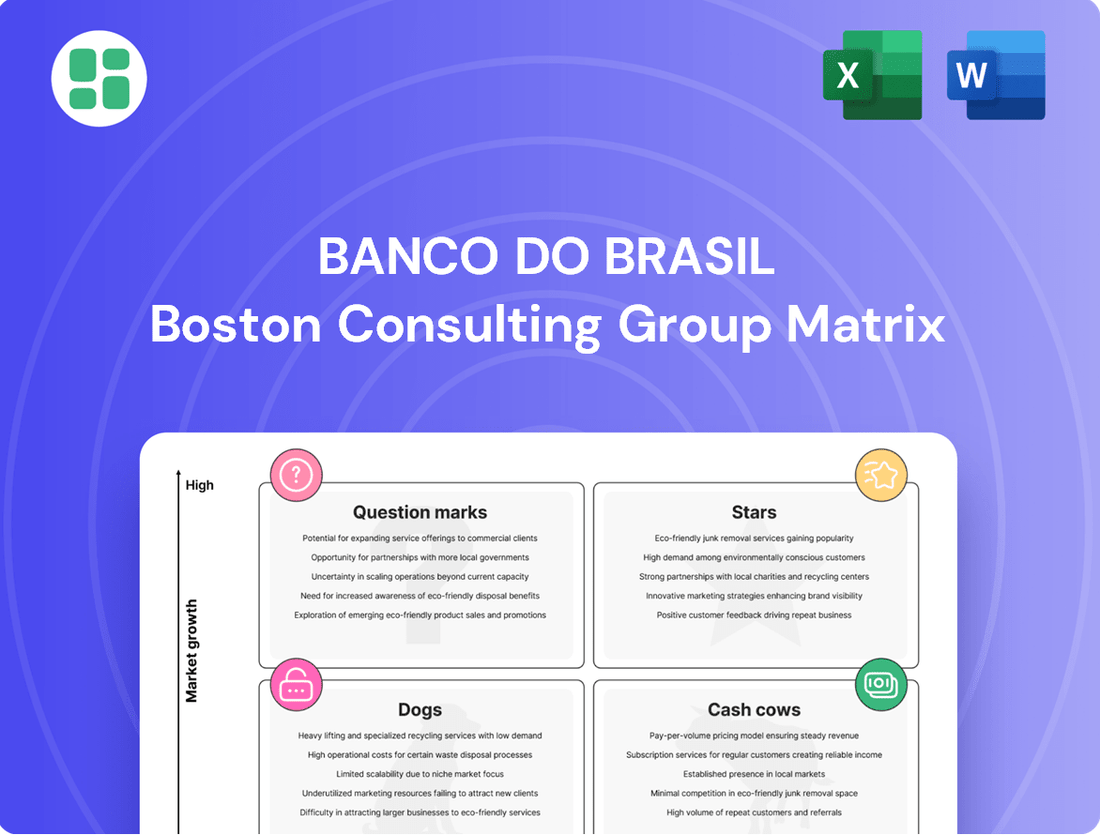

Curious about Banco do Brasil's strategic product positioning? This glimpse into their BCG Matrix reveals the potential for growth and stability within their portfolio. Understand which products are driving revenue and which might need a strategic rethink.

Ready to unlock the full picture? Purchase the complete Banco do Brasil BCG Matrix report for detailed quadrant analysis, actionable insights, and a clear roadmap to optimize your investment and product strategies.

Stars

Banco do Brasil's commitment to digital banking and AI-driven solutions positions it strongly in a high-growth sector. The bank's objective to onboard 17 million digitally mature customers by 2025 highlights its aggressive expansion strategy.

This focus on digital transformation is backed by substantial financial investment. In Q1 2025 alone, Banco do Brasil allocated R$1.8 billion to technology, a clear indicator of its dedication to enhancing customer experience and operational efficiency through innovative AI solutions.

Payroll loans represent a star in Banco do Brasil's BCG Matrix. The bank has seen robust growth in this segment, capturing over 20% of the market by the close of 2024. This strong performance highlights its leadership in a rapidly expanding sector.

The portfolio dedicated to INSS retirees and pensioners, a key component of the payroll loan business, experienced nearly 40% growth over two years. By the first quarter of 2025, this segment was approaching a 10% market share, underscoring its high-growth potential and Banco do Brasil's increasing dominance.

Banco do Brasil's corporate lending in the large corporate segment is a significant growth driver. The portfolio saw a substantial 22.4% increase in Q1 2025, reaching R$261.5 billion. This robust expansion demonstrates the bank's effectiveness in securing a greater market share among major enterprises.

Sustainable Credit Portfolio

Banco do Brasil's Sustainable Credit Portfolio is a strong performer within its BCG matrix, reflecting its strategic focus on a rapidly expanding market. The bank has committed to a substantial R$500 billion sustainable credit portfolio by 2030, underscoring its ambition in this sector. This commitment is backed by tangible progress, with the sustainable credit portfolio reaching R$386.7 billion by the close of 2024.

The growth trajectory of this portfolio is directly influenced by global Environmental, Social, and Governance (ESG) trends, positioning Banco do Brasil favorably in a high-growth market. The bank's proactive approach is further evidenced by the issuance of its Sustainable Finance Framework in 2024, which provides a clear roadmap for its sustainable finance initiatives.

- Market Position: Banco do Brasil holds a significant market share in the burgeoning sustainable finance sector.

- Growth Driver: The global shift towards ESG principles fuels the expansion of its sustainable credit offerings.

- Financial Milestone: The sustainable credit portfolio achieved R$386.7 billion by the end of 2024.

- Strategic Commitment: A target of R$500 billion in sustainable credit by 2030 highlights the bank's long-term vision.

Rural Insurance (BB Seguridade)

BB Seguridade's rural insurance segment, leveraging Banco do Brasil's deep ties to agribusiness, presents a compelling growth narrative. This strategic focus is evident in the recent performance data.

- Growth Potential: The rural insurance sector is poised for significant expansion, amplified by Banco do Brasil's established presence in the agricultural market.

- Q2 2025 Performance: BB Seguridade reported a notable 39% year-over-year increase in credit life insurance for agricultural workers in Q2 2025, a segment directly benefiting from digital channel expansion.

- Strategic Alignment: This performance underscores the synergy between BB Seguridade's offerings and Banco do Brasil's broader objectives in financing the agricultural sector, positioning rural insurance as a key growth area.

- Market Position: Despite a generally cautious market for premium issuance, Banco do Brasil is actively strengthening its footprint in this high-potential segment.

Banco do Brasil's digital banking and AI initiatives are driving significant growth, with a target of 17 million digitally mature customers by 2025. The bank invested R$1.8 billion in technology in Q1 2025, demonstrating a strong commitment to innovation and customer experience enhancement through AI.

Payroll loans, particularly those for INSS retirees and pensioners, are a clear star. This segment saw nearly 40% growth over two years, approaching a 10% market share by Q1 2025, and captured over 20% of the overall payroll loan market by the end of 2024.

Corporate lending to large enterprises is another star, with a substantial 22.4% increase in Q1 2025, reaching R$261.5 billion. This reflects successful market share gains among major businesses.

The sustainable credit portfolio is also a star, growing to R$386.7 billion by the end of 2024, with a target of R$500 billion by 2030, driven by global ESG trends and the bank's 2024 Sustainable Finance Framework.

BB Seguridade's rural insurance, especially credit life insurance for agricultural workers, shows star potential, with a 39% year-over-year increase in Q2 2025, leveraging Banco do Brasil's agribusiness ties.

| Segment | Market Growth | Banco do Brasil Market Share | Banco do Brasil Growth (2024/Q1 2025) | BCG Classification |

|---|---|---|---|---|

| Digital Banking/AI Solutions | High | Significant | R$1.8 billion invested (Q1 2025) | Star |

| Payroll Loans (INSS Retirees) | High | >20% (overall payroll) | ~40% (2-year growth) | Star |

| Large Corporate Lending | High | Increasing | 22.4% (Q1 2025) | Star |

| Sustainable Credit | High | Growing | R$386.7 billion (end 2024) | Star |

| Rural Insurance (Credit Life) | High | Strengthening | 39% YoY (Q2 2025) | Star |

What is included in the product

This BCG Matrix overview for Banco do Brasil highlights which business units to invest in, hold, or divest based on market share and growth.

A clear BCG Matrix visualizes Banco do Brasil's portfolio, easing strategic decision-making by highlighting areas needing investment or divestment.

Cash Cows

Agribusiness lending represents a cornerstone of Banco do Brasil's operations, firmly positioning it as a Cash Cow within its portfolio. Despite facing headwinds such as rising delinquency rates and challenges in judicial recoveries during the first quarter of 2025, the bank's dominance in this sector remains undisputed. Banco do Brasil commands an impressive market share exceeding 50% in agricultural financing.

The bank's commitment to agribusiness is underscored by significant resource allocation. For the 2024/25 harvest, Banco do Brasil provided R$260 billion, highlighting its continued dependence on this segment for substantial cash flow. This deep market penetration and established history ensure consistent revenue generation, even amidst current sector-specific pressures.

Banco do Brasil's traditional deposit accounts and branch network represent its established Cash Cow. As Brazil's oldest and largest bank, this segment offers a stable, low-cost funding base, a critical advantage. In 2024, the bank continued to leverage this extensive network, which underpins its significant market share in traditional banking services, ensuring consistent cash flow to fuel other strategic initiatives.

Brasilprev, Banco do Brasil's pension arm, is a prime example of a cash cow. By Q2 2025, it managed an impressive R$440 billion in reserves, demonstrating significant scale.

The pension market, while mature, offers stable, recurring management fees. Brasilprev's substantial market share ensures these fees translate into a consistent and reliable income stream for the bank.

This segment requires minimal new investment to maintain its position, allowing it to generate substantial cash flow. This predictable revenue supports other, more growth-oriented ventures within Banco do Brasil's portfolio.

Asset Management (BB DTVM)

BB Asset, Banco do Brasil's asset management division, manages an impressive R$1.7 trillion in assets as of the first quarter of 2025. This substantial figure highlights its dominant market share within Brazil's financial landscape.

The sheer scale of BB Asset's operations translates into consistent fee-based revenue streams, solidifying its role as a cash cow for Banco do Brasil. Its established presence ensures a steady flow of income, even as market growth rates may vary.

- Market Dominance: R$1.7 trillion in assets under management (Q1 2025).

- Revenue Generation: Consistent fee income from a large asset base.

- Stability: Established position provides a reliable cash generator for the bank.

Established Credit Card Portfolio

Banco do Brasil's established credit card portfolio is a prime example of a Cash Cow within its BCG Matrix. This segment consistently generates substantial revenue streams, primarily from interchange fees, interest accrued on customer balances, and annual cardholder fees. These predictable cash flows are vital for funding other business areas.

Despite operating in a highly competitive market, Banco do Brasil leverages its extensive customer base to maintain a significant market share within its credit card offerings. This strong position ensures continued profitability even without aggressive expansion efforts, solidifying its Cash Cow status.

- Revenue Generation: Interchange fees, interest income, and annual fees contribute to consistent cash flow.

- Market Position: A large customer base secures a high market share in a competitive credit card landscape.

- Profitability Contribution: The portfolio provides stable earnings, supporting overall bank profitability without extensive reinvestment needs.

Banco do Brasil's agribusiness lending business is a significant Cash Cow, commanding over 50% of the agricultural financing market in Brazil. The bank allocated R$260 billion for the 2024/25 harvest, demonstrating its deep commitment and reliance on this sector for consistent cash flow, despite facing some delinquency challenges in early 2025.

The bank's traditional deposit accounts and extensive branch network also function as a Cash Cow. As Brazil's oldest and largest bank, this segment provides a stable, low-cost funding base, underpinning its market share in traditional banking services and generating reliable income.

Brasilprev, Banco do Brasil's pension fund arm, managed R$440 billion in reserves by Q2 2025, solidifying its Cash Cow status. The mature pension market provides stable, recurring management fees, translating into a consistent income stream with minimal need for new investment.

BB Asset, the asset management division, oversees R$1.7 trillion in assets as of Q1 2025, making it another key Cash Cow. Its dominant market share generates consistent fee-based revenue, ensuring a steady income flow for the bank.

Banco do Brasil's credit card portfolio is a strong Cash Cow, generating consistent revenue from interchange fees, interest, and annual fees. Its large customer base secures a high market share, ensuring profitability without extensive reinvestment.

| Business Segment | BCG Category | Key Financial Metric (as of latest available data) | Market Position | Revenue Driver |

| Agribusiness Lending | Cash Cow | R$260 billion (2024/25 harvest allocation) | >50% Market Share | Interest income from loans |

| Traditional Deposits & Branch Network | Cash Cow | N/A (Focus on stable funding) | Largest in Brazil | Net interest margin, fees |

| Brasilprev (Pension Arm) | Cash Cow | R$440 billion (Assets under management, Q2 2025) | Significant Market Share | Management fees |

| BB Asset (Asset Management) | Cash Cow | R$1.7 trillion (Assets under management, Q1 2025) | Dominant Market Share | Management and performance fees |

| Credit Card Portfolio | Cash Cow | N/A (Focus on fee generation) | High Market Share | Interchange fees, interest, annual fees |

Delivered as Shown

Banco do Brasil BCG Matrix

The Banco do Brasil BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, designed for strategic insight, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis of Banco do Brasil's business units.

Dogs

Banco do Brasil's older physical branch services, especially those in areas with less foot traffic, are likely facing challenges. The rapid move to digital banking means some services that haven't been updated to work online might be holding back growth and losing market share. For instance, in 2024, while digital transactions surged, a significant portion of the population still uses branches, but the nature of those transactions is shifting away from basic services.

Banco do Brasil, with its extensive history, may retain certain niche legacy products. These offerings, often untouched by modernization, likely command a very small market share and exhibit negligible growth. For instance, older savings account structures or specific types of long-term, fixed-rate loans might fall into this category, representing a small fraction of the bank's overall portfolio.

Some of Banco do Brasil's international operations might be classified as Dogs. These are typically smaller ventures or those in less developed markets where the bank has a low market share and faces limited growth prospects. For instance, in 2024, while Banco do Brasil reported significant international revenue, specific subsidiaries in regions with slower economic expansion may not have contributed proportionally to overall profitability.

These underperforming units can act as cash traps, consuming resources without generating substantial returns. Their limited competitive advantage in their local markets means they often require continuous investment to maintain even a modest presence, diverting capital from more promising domestic or international opportunities. The bank's strategy likely involves a careful review of these Dog segments, potentially leading to divestment or restructuring to improve capital allocation.

Less Adopted Digital Channels (e.g., specific legacy apps)

Banco do Brasil, despite its robust digital transformation efforts, may find certain legacy applications or less intuitive digital channels lagging in customer adoption. These might represent a challenge if they fail to capture a significant portion of the digitally active customer base or generate substantial engagement. For instance, a specific older mobile banking app, despite ongoing maintenance, could be seeing declining active users compared to newer, more streamlined platforms.

These underperforming digital assets could be categorized as Dogs within the BCG Matrix if their market share is low and their growth prospects are minimal. For example, if a particular customer service portal, introduced several years ago, has consistently shown less than 5% of digital customer interaction compared to the main banking app, it might fit this description.

- Low Adoption: Certain legacy apps may only be used by a small, specific segment of the customer base, perhaps those less inclined to adopt newer technologies.

- Limited Market Share: These channels often possess a negligible share of the overall digital customer interactions compared to the bank's flagship digital offerings.

- Minimal Engagement: Usage statistics might reveal low session durations or infrequent user activity, indicating a lack of perceived value or utility.

- High Maintenance Costs: Despite low usage, these legacy systems can still incur significant costs for maintenance and security updates, impacting profitability.

Small, Non-Strategic Corporate Loan Segments

Within Banco do Brasil's corporate lending, small, non-strategic segments can be viewed as potential Cash Cows or even Dogs, depending on their specific characteristics. While the broader corporate lending area might be a Star, these niche areas could exhibit low growth and a small market share, making them less attractive for further investment. For instance, certain specialized equipment financing for industries outside the bank's core focus might fall into this category.

These segments often struggle to generate significant returns due to their limited scale and potentially higher operational costs per unit of lending. Banco do Brasil's strategic focus in 2024 might be on consolidating its core strengths, leading to a re-evaluation of these smaller, less impactful corporate loan portfolios. The bank's overall corporate loan portfolio, as of Q1 2024, reached R$ 350 billion, but the performance of these smaller segments may not be contributing proportionally to this total.

- Low Market Share: These segments typically represent a minor portion of Banco do Brasil's overall corporate loan book, potentially less than 1% each.

- Stagnant Growth: In 2023, the growth rate for these niche corporate loan areas averaged around 1-2%, significantly lower than the 8-10% seen in strategic corporate segments.

- Capital Allocation Inefficiency: Resources allocated to these segments might yield lower returns on equity compared to more strategic areas, impacting overall profitability.

Banco do Brasil's "Dogs" represent business units or products with low market share and low growth potential. These often include legacy physical branches in declining areas or older, less adopted digital services that require ongoing maintenance but yield minimal returns. For instance, specific international subsidiaries in economically stagnant regions or niche corporate loan portfolios outside the bank's core focus may fall into this category, consuming resources without contributing significantly to overall growth.

These underperforming segments can act as cash traps, diverting capital from more promising ventures. Their limited competitive advantage necessitates continuous investment to maintain even a modest presence, impacting the bank's overall capital allocation efficiency. Banco do Brasil's strategy likely involves a careful review of these Dog segments, potentially leading to divestment or restructuring to optimize resource deployment.

In 2024, while digital transactions saw substantial growth, certain legacy digital channels within Banco do Brasil might exhibit low customer adoption and minimal engagement. For example, a specific older mobile banking app, despite ongoing maintenance, could be seeing declining active users compared to newer, more streamlined platforms. Such segments, characterized by low market share and negligible growth prospects, are prime candidates for the Dog classification.

These underperforming digital assets, if they consistently show less than 5% of digital customer interaction compared to flagship offerings, could be categorized as Dogs. They often incur significant maintenance costs despite low usage, impacting overall profitability and making capital allocation decisions crucial for the bank's strategic direction.

| Category | Market Share | Growth Rate | Profitability | Strategic Implication |

| Dogs (e.g., Legacy Branches, Niche International Operations) | Low | Low | Low/Negative | Divestment or Restructuring |

| Dogs (e.g., Underperforming Digital Assets) | Low | Low | Low/Negative | Sunset or Integration into Core Platforms |

Question Marks

Banco do Brasil is aggressively pursuing advanced AI and generative AI, recognizing their transformative potential. The bank has committed substantial investment, with reports indicating significant allocations towards AI development and employee upskilling in these areas throughout 2024. This focus positions these technologies as key growth drivers, aiming for enhanced operational efficiency and a superior customer experience.

While the investment and development are robust, the full market impact and profitability of these advanced AI implementations are still in their nascent stages. Consequently, in a BCG matrix context, these initiatives represent a Stars category, characterized by high growth potential but currently holding a relatively low, though rapidly expanding, market share in terms of fully realized value and market penetration.

Banco do Brasil's strategic focus on agricultural fintech, exemplified by its investment in Traive, positions these ventures as potential Stars within its BCG Matrix. These innovative segments are experiencing robust growth, but initially, they command a modest market share and require substantial capital to expand.

While the long-term success of these agricultural fintech partnerships remains subject to market adoption and competitive pressures, their high-growth potential is undeniable. For instance, the Brazilian agritech market itself saw significant investment activity in 2023, with venture capital flowing into innovative solutions aimed at increasing efficiency and sustainability in agriculture.

Emerging ESG-focused investment funds within Banco do Brasil's portfolio might be considered question marks. While the bank has a robust sustainable finance framework, these newer, specialized funds are likely in their nascent stages of asset accumulation. For instance, as of early 2024, many new ESG funds globally are still building their track records and investor bases, often with assets under management in the tens to hundreds of millions, rather than billions, highlighting their early-stage growth potential.

Hyper-personalized Digital Financial Services

Banco do Brasil is heavily investing in hyper-personalized digital financial services, leveraging vast customer data to tailor product offerings and enhance user experience. This strategic focus acknowledges the growing demand for customized financial solutions, particularly within the digital realm.

This initiative falls into the Question Mark category of the BCG Matrix due to its high-growth potential in the digital financial services sector, coupled with the significant challenges in achieving broad market penetration and profitability. The complexity and capital requirements for developing and scaling these sophisticated personalized platforms are substantial.

- High Growth Potential: The digital financial services market is expanding rapidly, with a significant portion of this growth driven by personalized offerings that cater to individual customer needs and preferences.

- Capital Intensive: Developing advanced data analytics capabilities, AI-driven personalization engines, and robust digital infrastructure requires considerable financial investment.

- Market Penetration Challenges: Gaining widespread adoption for hyper-personalized services necessitates overcoming customer trust barriers, data privacy concerns, and the need for continuous innovation to stay ahead of competitors.

- Uncertain Future Success: While the potential is high, the ultimate market share and profitability of these personalized services remain uncertain, making it a classic Question Mark requiring careful management and strategic decision-making.

Expansion of Digitally Mature Customer Base

Banco do Brasil's ambition to cultivate 17 million digitally mature customers by 2025 highlights a substantial ongoing internal shift. This focus on expanding its digitally savvy clientele positions this initiative as a Stars category within the BCG framework, characterized by high growth potential in terms of digital engagement. The bank is actively investing in converting its existing customer base, a process that demands continuous strategic effort and resources, with the immediate returns on these conversion efforts remaining somewhat uncertain.

The bank's strategy involves significant investment in digital channels and customer education to drive this transformation. For instance, by the end of 2023, Banco do Brasil reported a notable increase in digital transactions, with over 60% of its customer base actively using digital channels for their banking needs. This upward trend indicates progress, but the journey to full digital maturity for all customers is ongoing.

- Growth in Digital Adoption: The target of 17 million digitally mature customers by 2025 signifies a significant expansion from its current digitally active base, indicating a high-growth internal market.

- Investment & Uncertain Returns: This is a strategic investment in customer transformation, where the immediate profitability of converting traditional users to highly engaged digital ones is not guaranteed, aligning with Star characteristics.

- Market Share of Digital Users: Banco do Brasil is effectively increasing its 'market share' of digitally engaged customers, a key indicator of success in this growth phase.

- Ongoing Transformation: The initiative requires sustained strategic focus and resource allocation to nurture digital maturity across its broad customer spectrum.

Banco do Brasil's exploration into new, specialized financial products, such as certain niche investment funds or emerging digital payment solutions, can be categorized as Question Marks. These ventures are in their early stages, operating in high-growth potential markets but currently hold a small market share and require significant investment to gain traction.

The bank's ongoing efforts to develop and integrate advanced AI for hyper-personalized customer experiences represent a classic Question Mark. While the potential for increased customer loyalty and revenue is substantial, the high costs associated with AI development and the uncertainty of widespread market adoption and profitability place these initiatives firmly in this category.

These initiatives are characterized by substantial investment needs and uncertain future returns, making them prime candidates for careful strategic evaluation and potential divestment or increased investment to move them towards becoming Stars.

BCG Matrix Data Sources

Our Banco do Brasil BCG Matrix is built on verified market intelligence, combining financial data from the bank's official reports and regulatory filings, alongside industry research and growth forecasts.