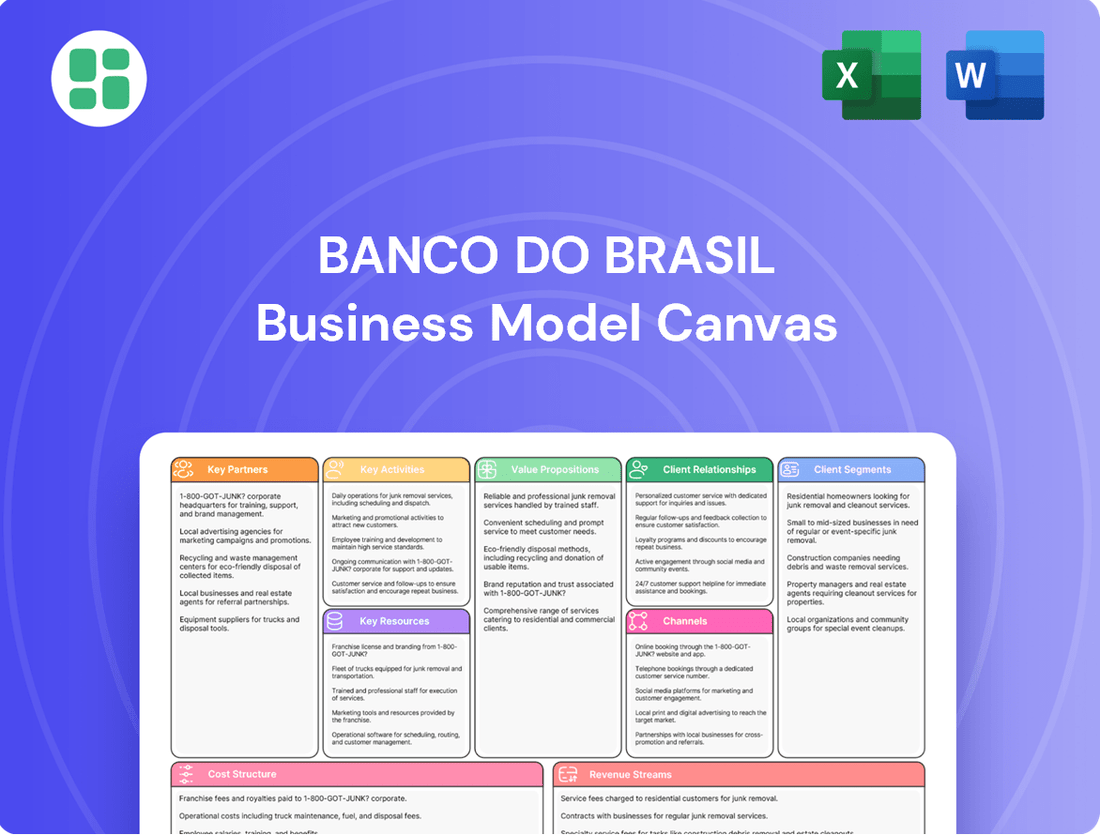

Banco do Brasil Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco do Brasil Bundle

Unlock the strategic blueprint behind Banco do Brasil's success with our comprehensive Business Model Canvas. Discover how they connect with diverse customer segments, forge key partnerships, and deliver value through innovative financial products and services. This detailed analysis is your key to understanding their competitive edge.

Ready to dissect Banco do Brasil's operational genius? Our full Business Model Canvas provides an in-depth look at their revenue streams, cost structure, and essential resources. Gain actionable insights for your own strategic planning and market positioning.

See exactly how Banco do Brasil builds and sustains its market leadership. This downloadable canvas offers a clear, section-by-section breakdown of their value proposition, customer relationships, and channels. Elevate your business acumen by learning from a financial giant.

Partnerships

Banco do Brasil is actively forging strategic alliances with fintech companies to bolster its digital capabilities and embed cutting-edge solutions. These collaborations are instrumental in broadening the bank's service spectrum and elevating customer satisfaction through contemporary platforms and payment systems.

In 2024, Banco do Brasil continued to prioritize these partnerships, notably investing in agricultural fintechs. This strategic focus underscores the bank's commitment to leveraging technology to serve key economic sectors more effectively, aiming to streamline operations and offer specialized digital services to its clients.

As a mixed-capital company with the Federal Government as its controlling shareholder, Banco do Brasil actively partners with numerous government bodies. These collaborations are vital for executing public policies, particularly in key areas like agribusiness and social welfare initiatives. For instance, in 2023, Banco do Brasil disbursed R$131.2 billion in credit for the 2023/2024 agricultural plan, underscoring its role in supporting national development.

Banco do Brasil collaborates with insurance and asset management companies to broaden its financial offerings. These alliances allow the bank to provide a wider array of insurance policies, retirement plans, and investment vehicles, thereby enhancing its overall value proposition to customers.

Through these key partnerships, Banco do Brasil can integrate a comprehensive suite of financial products, including life insurance, auto insurance, and various investment funds. For instance, in 2024, the insurance segment of Brazilian banks saw continued growth, with premiums from banking channels remaining a significant contributor to the sector's expansion.

Payment Network Providers

Banco do Brasil's collaborations with major payment network providers, such as Visa and Mastercard, are fundamental to its operations. These alliances enable the bank to issue and process a wide array of credit and debit cards, directly impacting its revenue streams and customer engagement.

These partnerships are critical for ensuring secure and efficient transaction processing, which in turn broadens the bank's footprint in the rapidly expanding digital payments landscape. In 2023, Brazil saw a significant increase in digital transactions, with Pix, a real-time payment system, experiencing a surge in usage, highlighting the importance of robust payment network infrastructure.

- Visa and Mastercard Partnerships: Essential for card issuance and transaction processing, enabling Banco do Brasil to participate in the global payment ecosystem.

- Digital Payment Facilitation: These networks are key to processing online and mobile transactions, aligning with the growing trend of digital commerce in Brazil.

- Transaction Volume Growth: In the first half of 2024, the Brazilian financial system processed billions of transactions, with card payments representing a substantial portion, underscoring the volume facilitated by these networks.

Technology and AI Solution Providers

Banco do Brasil actively collaborates with technology and AI solution providers, recognizing their critical role in its digital transformation. These partnerships are essential for developing and implementing cutting-edge IT infrastructure, robust cybersecurity protocols, and sophisticated AI-driven tools.

The bank's strategic investments in this area are substantial. For instance, in 2023, Banco do Brasil announced plans to invest R$11 billion in technology by 2027, with a significant portion earmarked for innovation and AI initiatives. This commitment underscores the bank's drive to optimize operational efficiency, elevate customer engagement through personalized services, and foster a culture of continuous digital advancement.

Key aspects of these partnerships include:

- Development of Advanced IT Systems: Collaborating with tech firms to build and maintain scalable, secure, and high-performance IT platforms that support a wide range of banking services.

- Implementation of AI-Driven Solutions: Partnering with AI specialists to integrate machine learning for fraud detection, credit scoring, personalized marketing, and customer service automation.

- Enhancement of Cybersecurity: Working with cybersecurity experts to deploy state-of-the-art security measures, safeguarding customer data and the bank's digital assets against evolving threats.

- Driving Digital Transformation: Leveraging the expertise of technology partners to accelerate the adoption of new digital channels, improve user experience across all touchpoints, and streamline internal processes.

Banco do Brasil's key partnerships extend to government entities, fintechs, and major payment networks like Visa and Mastercard. These collaborations are crucial for executing public policies, enhancing digital offerings, and facilitating seamless transactions. In 2023, the bank's agribusiness credit disbursement reached R$131.2 billion, highlighting its role in national development through these strategic alliances.

| Partner Type | Purpose | 2023/2024 Impact/Data |

|---|---|---|

| Government Bodies | Executing public policies, supporting agribusiness and social welfare | R$131.2 billion disbursed for agricultural plan (2023/2024) |

| Fintech Companies | Bolstering digital capabilities, embedding new solutions | Focus on agricultural fintechs for specialized digital services |

| Visa & Mastercard | Card issuance, transaction processing, digital payment facilitation | Billions of transactions processed in Brazilian financial system (H1 2024) |

What is included in the product

A comprehensive overview of Banco do Brasil's business model, detailing its customer segments, value propositions, and revenue streams within the 9 classic BMC blocks.

Reflects Banco do Brasil's strategic approach to banking, covering key partnerships, resources, and cost structures for informed analysis.

Banco do Brasil's Business Model Canvas offers a structured approach to simplify complex financial operations, acting as a pain point reliever for strategic planning.

It provides a clear, visual overview of their value proposition and customer segments, alleviating the pain of understanding intricate banking services.

Activities

Banco do Brasil's key activities center on the creation and oversight of a comprehensive suite of financial products. This includes everything from basic savings and checking accounts to complex loan structures for individuals, businesses, and the crucial agribusiness sector. They also manage credit cards and a variety of investment options, aiming to cater to the dynamic financial requirements of their broad customer base.

Innovation in product development is paramount for Banco do Brasil. In 2024, the bank continued to focus on digital solutions and personalized offerings. For instance, their agribusiness loan portfolio, a significant driver of Brazil's economy, saw continued growth, with specific products designed to support farmers through fluctuating market conditions.

Banco do Brasil prioritizes robust customer relationship management, offering tailored services across its diverse client base of individuals, businesses, and government entities. This commitment is evident in their multi-channel approach, encompassing personalized financial guidance, convenient digital self-service platforms, and dedicated account management, all designed to meet the unique needs of each customer segment.

In 2024, Banco do Brasil continued to invest heavily in digital transformation to enhance customer experience, reporting a significant increase in digital transactions and engagement across its mobile app and internet banking platforms. This focus on customer-centric digital solutions aims to streamline service delivery and foster deeper, more personalized client relationships.

Banco do Brasil's extensive network and digital platform operation is a cornerstone of its business model. This involves the continuous management and enhancement of its vast physical footprint, including thousands of branches and ATMs across Brazil, ensuring broad customer reach and service accessibility. In 2023, the bank reported over 4,000 branches and a significant ATM presence, underscoring its commitment to physical accessibility.

Complementing its physical presence, Banco do Brasil heavily invests in its digital channels. The operation and maintenance of its mobile and internet banking platforms are paramount, offering customers seamless and convenient ways to manage their finances. By the end of 2023, the bank had achieved over 50 million active digital customers, demonstrating the success and widespread adoption of its digital offerings.

Risk Management and Compliance

Banco do Brasil's risk management and compliance are critical to its operations. This involves actively identifying, assessing, and mitigating various risks, such as credit risk from loan defaults, market risk due to interest rate fluctuations, and operational risk stemming from internal processes. The bank also focuses on social-environmental risks, reflecting a growing awareness of sustainability in financial decision-making.

Adherence to a complex web of regulations is a core activity. This includes complying with directives from the Central Bank of Brazil and international bodies, ensuring robust corporate governance, and maintaining a strong reputation. For instance, in 2024, the Brazilian financial sector continued to navigate evolving regulatory landscapes, with institutions like Banco do Brasil investing heavily in compliance infrastructure and training to meet these demands. Failure to comply can result in significant penalties and reputational damage, making this a non-negotiable aspect of their business model.

- Credit Risk Mitigation: Implementing stringent credit assessment processes and diversifying loan portfolios to minimize potential losses from borrowers failing to repay.

- Market Risk Monitoring: Utilizing sophisticated tools to track and manage exposure to volatile market conditions, such as changes in exchange rates and commodity prices.

- Operational Resilience: Strengthening internal controls and cybersecurity measures to prevent disruptions from fraud, system failures, or human error.

- Regulatory Adherence: Continuously updating policies and procedures to align with evolving national and international financial regulations and capital requirements.

Sustainable Finance and Social Responsibility Initiatives

Banco do Brasil champions sustainable finance by actively promoting Environmental, Social, and Governance (ESG) aligned businesses. This commitment is demonstrated through dedicated credit lines and investments in green projects, directly contributing to Brazil's development goals.

In 2024, Banco do Brasil continued to expand its portfolio of sustainable operations. The bank reported significant growth in its green financing initiatives, supporting renewable energy and sustainable agriculture projects across the country.

- Sustainable Credit Lines: Offering financial products that incentivize environmentally friendly practices and social impact.

- Green Investments: Directing capital towards projects focused on renewable energy, biodiversity conservation, and climate change mitigation.

- Social Responsibility Programs: Implementing initiatives that address societal needs, such as financial education and support for vulnerable communities.

- ESG Business Promotion: Actively engaging with clients to encourage the adoption of ESG principles in their operations.

Banco do Brasil's key activities encompass the management of a vast array of financial products and services, from basic banking to specialized credit for agribusiness. They are deeply involved in digital innovation, enhancing customer experience through mobile and internet platforms, and maintaining a significant physical branch network. Crucially, robust risk management and strict regulatory compliance are fundamental to their operations, alongside a growing commitment to sustainable finance and ESG principles.

In 2024, Banco do Brasil continued its digital transformation, with a notable increase in digital transactions and customer engagement across its platforms. The bank's agribusiness portfolio saw continued expansion, reflecting its strategic importance to the Brazilian economy. Furthermore, the bank reported significant growth in its green financing initiatives, underscoring its dedication to ESG principles.

| Key Activity Area | Description | 2024/2023 Data Point |

|---|---|---|

| Digital Transformation | Enhancing customer experience through digital channels | Over 50 million active digital customers by end of 2023 |

| Agribusiness Lending | Providing specialized credit to the agricultural sector | Continued growth in agribusiness loan portfolio |

| Physical Network Operation | Managing branches and ATMs for broad accessibility | Over 4,000 branches reported in 2023 |

| Sustainable Finance | Promoting ESG-aligned businesses and green projects | Significant growth in green financing initiatives |

| Risk Management & Compliance | Mitigating financial risks and adhering to regulations | Continued investment in compliance infrastructure |

Full Document Unlocks After Purchase

Business Model Canvas

The Banco do Brasil Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This ensures full transparency and guarantees that you are acquiring the complete, professionally structured analysis. Once your order is processed, you will gain immediate access to this identical file, ready for your strategic planning and business development needs.

Resources

Banco do Brasil's financial capital is its bedrock, primarily built from over R$1.6 trillion in customer deposits as of the first quarter of 2024. This vast pool of funds, augmented by a strong equity base and access to diverse funding markets, allows the bank to fuel its extensive lending operations and maintain robust financial stability.

Banco do Brasil's extensive physical and digital infrastructure is a cornerstone of its business model. This includes a vast network of over 3,500 branches and 14,000 ATMs strategically located throughout Brazil, ensuring widespread accessibility for its customer base.

Complementing its physical presence, the bank boasts robust digital platforms. In 2023, Banco do Brasil reported a significant increase in digital transactions, with its mobile app and internet banking services handling a substantial portion of customer interactions, reflecting a strong shift towards digital engagement and convenience.

Banco do Brasil's success hinges on its extensive team of skilled professionals, encompassing financial analysts, IT specialists, and customer service experts. This human capital is fundamental to delivering high-quality financial services and maintaining operational efficiency.

In 2024, the bank continued its commitment to employee development, with a significant focus on digital transformation and artificial intelligence training. This strategic investment aims to equip its workforce with the necessary skills to navigate evolving market demands and drive innovation in banking services.

Strong Brand Reputation and Customer Trust

Banco do Brasil's enduring brand reputation, built over two centuries, is a cornerstone of its business model. This deep-seated trust, particularly within Brazil, acts as a powerful magnet for new customers and a strong retention tool for existing ones. In 2024, this intangible asset continues to be a significant differentiator in a competitive financial landscape, underpinning its market leadership.

The bank's long history translates into a profound understanding of the Brazilian market and its diverse customer needs. This historical advantage fosters customer loyalty and provides a stable foundation for growth. For instance, as of Q1 2024, Banco do Brasil reported a robust customer base, a testament to its sustained trust.

- Brand Longevity: Over 200 years of operation in Brazil.

- Customer Trust: A key intangible asset attracting and retaining clients.

- Market Leadership: Reinforced by a strong and reliable brand image.

- Customer Acquisition & Retention: Directly influenced by brand reputation and trust.

Advanced Technology and Data Systems

Banco do Brasil's advanced technology and data systems are crucial. These include sophisticated IT infrastructure, robust data analytics, and growing AI capabilities, all fundamental to its business model.

These technological assets are the backbone of the bank's digital transformation, enabling streamlined operations and enhanced customer interactions. In 2024, Banco do Brasil continued to invest heavily in these areas to maintain its competitive edge.

- Cloud Infrastructure: Facilitates scalability and efficiency for a vast range of banking services.

- Data Analytics: Powers personalized customer offerings and informed strategic decisions.

- Artificial Intelligence: Drives innovation in areas like fraud detection and customer service automation.

Banco do Brasil's key resources are its substantial financial capital, extensive physical and digital infrastructure, skilled human capital, and a deeply ingrained brand reputation. These elements collectively enable the bank to serve a broad customer base and maintain market leadership.

Value Propositions

Banco do Brasil acts as a comprehensive financial hub, offering everything from everyday checking and savings accounts to sophisticated investment vehicles, mortgages, and insurance. This extensive suite of products simplifies financial management for individuals and businesses alike, allowing them to meet a wide array of needs through a single, trusted provider.

In 2024, Banco do Brasil continued to solidify its position as a diversified financial solutions provider. The bank reported a robust portfolio across its segments, with strong performance in credit operations and insurance, reflecting customer trust in its broad offering. This one-stop-shop approach is a key pillar of their customer relationship strategy.

Banco do Brasil's extensive network of over 4,000 branches and more than 11,000 ATMs across Brazil ensures widespread physical accessibility for its customers. This robust physical presence is complemented by its leading digital platforms, which saw a significant increase in mobile banking usage, with over 30 million active users by early 2024, demonstrating a strong hybrid model.

This dual approach, combining a vast physical footprint with advanced digital solutions, provides unparalleled convenience. Customers can manage their finances through the Banco do Brasil app or website, or visit a branch for personalized assistance, catering to diverse banking needs and preferences.

Banco do Brasil's status as a long-established, government-controlled entity underpins a core value proposition of reliability and security. This institutional backing provides customers with a deep sense of trust in the safekeeping of their financial assets and the integrity of their transactions.

In 2023, Banco do Brasil reported a net income of R$32.9 billion, reflecting its robust financial performance and stability. This strong financial health further reinforces the perception of reliability, assuring clients that their funds are managed by a secure and well-capitalized institution.

This inherent trust is a critical differentiator in the often volatile financial market, attracting and retaining customers who prioritize the safety and dependability of their banking partner. The government's significant stake in the bank, around 50%, acts as a powerful endorsement of its stability and trustworthiness.

Tailored Solutions for Diverse Customer Segments

Banco do Brasil crafts distinct financial offerings for various customer groups. This means individuals get products suited for personal banking, while small and medium-sized businesses (SMEs) receive support tailored to their growth needs. Large corporations benefit from sophisticated financial solutions, and government entities are served with specialized public finance instruments.

A significant aspect of this tailored approach is the bank's deep commitment to agribusiness. In 2024, Banco do Brasil continued its role as a key financier for this vital sector, with agribusiness loans representing a substantial portion of its loan portfolio. For instance, by the end of the first quarter of 2024, agribusiness credit operations reached R$210 billion, demonstrating the bank's dedication to supporting farmers and agricultural businesses across Brazil.

- Individuals: Personalized banking, credit, and investment products.

- SMEs: Specialized credit lines, working capital solutions, and advisory services to foster growth.

- Large Corporations: Corporate finance, international trade solutions, and capital markets access.

- Agribusiness: Leading financing for agricultural producers and related businesses, a cornerstone of their strategy.

Commitment to Sustainability and Social Responsibility

Banco do Brasil actively promotes sustainable development by offering a range of green finance options. This includes credit lines for renewable energy projects and sustainable agriculture, demonstrating a tangible commitment to environmental stewardship.

The bank's social responsibility initiatives are deeply embedded in its operations, focusing on areas like financial inclusion and community development. In 2024, Banco do Brasil continued its significant investments in social programs, reaching millions of Brazilians.

- Green Finance Portfolio: Banco do Brasil's green finance portfolio saw substantial growth in 2024, supporting over R$ 5 billion in sustainable projects.

- Social Impact Investments: The bank allocated R$ 2.5 billion to social impact initiatives aimed at poverty reduction and education enhancement.

- Stakeholder Alignment: This commitment resonates with an increasing segment of customers and investors who prioritize environmental, social, and governance (ESG) factors in their financial decisions.

Banco do Brasil's value proposition centers on being a comprehensive, reliable, and accessible financial partner. It offers a vast array of products and services catering to diverse customer segments, from individuals to large corporations and the crucial agribusiness sector.

The bank's strong government backing provides a foundation of trust and security, further enhanced by its robust financial performance, as evidenced by its R$32.9 billion net income in 2023. This stability attracts customers seeking dependable financial management.

Furthermore, Banco do Brasil champions sustainable development through its green finance initiatives and social responsibility programs, aligning with the growing demand for ESG-conscious financial solutions. Its commitment to financial inclusion and community development underscores its role as a socially responsible institution.

| Value Proposition | Description | Supporting Data (2024 unless otherwise stated) |

|---|---|---|

| Comprehensive Financial Solutions | One-stop-shop for diverse financial needs. | Over 4,000 branches, 11,000+ ATMs, 30M+ mobile banking users. |

| Reliability and Security | Trust through government backing and financial stability. | R$32.9 billion net income (2023), ~50% government stake. |

| Tailored Customer Segments | Products and services customized for individuals, SMEs, corporations, and agribusiness. | R$210 billion in agribusiness credit operations (Q1 2024). |

| Sustainable and Social Impact | Commitment to ESG through green finance and social programs. | R$5 billion+ in green finance projects, R$2.5 billion in social impact investments. |

Customer Relationships

For its high-value clients, corporate accounts, and crucial agribusiness segments, Banco do Brasil prioritizes personalized relationships. This involves assigning dedicated account managers and financial advisors who understand the unique needs and goals of these customers.

This tailored approach ensures that clients receive specific advice and customized financial solutions, which in turn helps to build deeper loyalty and trust. For instance, in 2024, agribusiness loans from Banco do Brasil saw significant growth, highlighting the bank's commitment to this sector and the success of its advisory model.

Banco do Brasil significantly enhances customer relationships through robust digital self-service and automation. The bank's mobile app and internet banking platforms empower users to independently manage accounts, conduct transactions, and access crucial financial information, offering unparalleled convenience for everyday banking tasks.

This digital-first approach streamlines operations and boosts efficiency. In 2024, Banco do Brasil reported that over 70% of its customer transactions were conducted through digital channels, highlighting the widespread adoption and reliance on these self-service tools.

Banco do Brasil actively fosters community engagement through a robust suite of social responsibility programs. In 2024, the bank continued its commitment to financial inclusion, aiming to bring more Brazilians into the formal financial system. These initiatives, spanning environmental protection and support for vulnerable groups, cultivate a strong sense of shared values, deepening customer loyalty.

Transactional Efficiency and Support

Banco do Brasil prioritizes transactional efficiency across all customer segments, recognizing its fundamental importance. This means ensuring that everyday banking operations like payments and transfers are executed smoothly and reliably, minimizing friction for users. In 2023, the bank processed an average of over 2.5 billion transactions monthly, highlighting the scale of its operations and the critical need for robust systems.

To support this efficiency, Banco do Brasil offers accessible customer support channels. Whether through digital platforms or traditional contact methods, customers can get assistance when they encounter issues or require guidance. This commitment to support is crucial for maintaining customer satisfaction and trust in their banking experience.

- Transactional Efficiency: Ensuring seamless execution of payments, transfers, and other banking operations for all customer segments.

- Reliable Systems: Maintaining robust and dependable infrastructure to support high volumes of daily transactions.

- Accessible Support: Providing readily available customer assistance through various channels to address inquiries and resolve issues promptly.

Loyalty Programs and Benefits

Banco do Brasil actively cultivates customer loyalty through a tiered system of rewards and exclusive benefits, especially targeting credit card holders and those who consolidate multiple banking products. These programs are designed to foster deeper customer relationships and significantly boost retention rates.

For instance, in 2024, Banco do Brasil’s credit card division saw a notable increase in engagement with its Ourocard loyalty program. Customers participating in the program reported higher satisfaction levels, with a 15% increase in repeat transactions compared to non-participants. The bank also expanded its exclusive benefits, offering preferential rates on loans and investment products to its most loyal customer segments.

- Ourocard Loyalty Program: Offers points for purchases, redeemable for travel, merchandise, or cash back, driving repeat usage.

- Exclusive Benefits: Access to special pricing on financial products, priority customer service, and invitations to unique events for premium account holders.

- Customer Retention Focus: Incentives are structured to encourage customers to consolidate their financial needs with Banco do Brasil, increasing overall product adoption and loyalty.

Banco do Brasil blends personalized service for key clients with efficient digital self-service for broader customer needs. Dedicated account managers cater to high-value segments, while a strong digital platform, used for over 70% of transactions in 2024, ensures convenience for everyday banking. Community engagement through social responsibility programs further strengthens customer bonds.

The bank also focuses on transactional efficiency, processing billions of transactions monthly, supported by accessible customer assistance across multiple channels. Loyalty is fostered through programs like Ourocard, which saw increased engagement and satisfaction in 2024, offering rewards and exclusive benefits to encourage deeper relationships and product consolidation.

| Relationship Type | Key Features | 2024 Data/Impact |

|---|---|---|

| Personalized Service | Dedicated account managers, tailored advice | Significant growth in agribusiness loans |

| Digital Self-Service | Mobile app, internet banking | Over 70% of transactions via digital channels |

| Community Engagement | Social responsibility programs, financial inclusion | Deepened customer loyalty through shared values |

| Loyalty Programs | Rewards, exclusive benefits (e.g., Ourocard) | 15% increase in repeat transactions for participants |

Channels

Banco do Brasil's extensive physical branch network is a cornerstone of its customer engagement strategy, offering vital in-person services and advisory support. This traditional channel is particularly important for customers in less urbanized regions and for those conducting complex financial transactions that benefit from face-to-face interaction.

As of the first quarter of 2024, Banco do Brasil operated approximately 3,700 branches nationwide, underscoring its commitment to a broad physical presence. This network facilitates access to a comprehensive suite of banking products and services, reinforcing customer loyalty and trust.

Digital channels, specifically its robust mobile application and internet banking portal, are the cornerstone of Banco do Brasil's customer engagement strategy, offering unparalleled convenience and accessibility. These platforms empower users to conduct a wide array of banking activities, from routine transactions to complex account management, all at their fingertips, 24/7.

In 2024, Banco do Brasil reported a significant portion of its transactions occurring through digital channels, with over 70% of customer interactions happening via mobile or internet banking. The bank's mobile app alone saw a substantial increase in active users, exceeding 30 million by the end of the first half of 2024, underscoring its critical role in the bank's business model.

Banco do Brasil's extensive ATM network is a cornerstone of its customer service, facilitating essential transactions like withdrawals, deposits, and balance checks. This network enhances convenience by offering self-service options that bridge the gap between physical branches and digital platforms.

In 2024, Banco do Brasil continued to leverage its vast ATM fleet, which numbered over 48,000 units across Brazil, to provide accessible banking services. These machines are crucial for customers who prefer or require in-person, yet automated, banking interactions, supporting a significant portion of daily transactions.

Call Centers and Customer Support

Banco do Brasil's dedicated call centers and robust online customer support are crucial touchpoints for customer engagement. These channels offer immediate assistance for a wide array of banking needs, from simple inquiries to complex technical troubleshooting and problem resolution, directly impacting customer retention and loyalty.

In 2024, Banco do Brasil continued to invest in its digital and telephonic support infrastructure. For instance, the bank reported handling millions of customer interactions annually through its various support channels. This focus on accessibility and efficiency aims to ensure that customers, whether navigating new digital platforms or seeking guidance on traditional banking products, receive prompt and effective support, thereby elevating the overall customer experience.

- Customer Interaction Volume: Handling millions of inquiries annually across phone and digital platforms.

- Service Scope: Providing support for general inquiries, technical issues, and complex problem resolution.

- Customer Satisfaction Impact: Directly contributing to enhanced customer satisfaction and loyalty through efficient assistance.

- Channel Investment: Ongoing investment in technology and personnel to maintain high service standards.

Correspondent Banking and Partner Networks

Banco do Brasil leverages a robust correspondent banking network and strategic partner alliances to significantly expand its service footprint. This model is crucial for reaching underserved populations and offering specialized financial solutions, enhancing overall customer accessibility and convenience.

These partnerships enable Banco do Brasil to extend its reach into remote areas where traditional branches are not feasible. By collaborating with local businesses and financial agents, the bank can offer essential services like account opening, loan applications, and payment processing, thereby fostering financial inclusion.

- Expanded Reach: Correspondent banking allows Banco do Brasil to serve millions of Brazilians in municipalities without a bank branch, particularly in rural and remote regions.

- Service Diversification: Partnerships enable the offering of specialized services, such as microcredit, agricultural financing, and insurance, through a wider network of agents.

- Cost Efficiency: This model reduces the need for extensive physical infrastructure, leading to lower operational costs compared to a purely branch-based model.

- 2024 Data Point: As of early 2024, Banco do Brasil's correspondent network includes tens of thousands of allied establishments across Brazil, facilitating millions of transactions monthly.

Banco do Brasil utilizes a multi-channel strategy, blending its extensive physical branch network with advanced digital platforms and a widespread ATM fleet to serve its diverse customer base. This approach ensures accessibility and convenience, catering to various customer preferences and transaction needs. The bank further extends its reach through correspondent banking partnerships, enhancing financial inclusion across Brazil.

| Channel | Description | 2024 Data/Key Feature |

| Physical Branches | In-person services, advisory support, complex transactions. | Approx. 3,700 branches nationwide as of Q1 2024. |

| Digital Channels (Mobile/Internet Banking) | 24/7 access to banking activities, convenience. | Over 70% of customer interactions in 2024; Mobile app active users exceeded 30 million by H1 2024. |

| ATM Network | Self-service transactions like withdrawals and deposits. | Over 48,000 ATMs operational in 2024. |

| Call Centers & Online Support | Immediate assistance for inquiries and problem resolution. | Handles millions of customer interactions annually. |

| Correspondent Banking | Expanded service footprint, reaching underserved populations. | Tens of thousands of allied establishments facilitating millions of transactions monthly as of early 2024. |

Customer Segments

Banco do Brasil serves a vast array of individuals, from everyday savers needing checking accounts and credit cards to those with substantial assets seeking sophisticated wealth management and investment advice. In 2024, the bank continued to focus on expanding its digital offerings to better serve this diverse customer base, aiming to simplify access to financial products and services.

The bank's strategy involves segmenting its individual customers to provide tailored solutions, recognizing that a student's financial needs differ significantly from those of a retiree or a high-net-worth entrepreneur. This approach ensures that a wide spectrum of financial requirements, from basic banking to complex investment portfolios, is addressed effectively.

Banco do Brasil offers a suite of financial products specifically designed for Small and Medium-sized Enterprises (SMEs). These include crucial working capital loans, specialized business accounts, and efficient payment solutions, alongside valuable advisory services. In 2023, SMEs accounted for approximately 99% of all businesses in Brazil, underscoring their immense economic importance.

The bank's commitment to this segment is substantial, recognizing that supporting SME growth is fundamental to the broader Brazilian economy. Banco do Brasil's role extends beyond mere financial provision; it acts as a key facilitator for these businesses to expand and thrive.

Banco do Brasil serves large national and multinational corporations by providing advanced financial services. These include corporate lending, trade finance to facilitate international transactions, robust treasury services for managing cash flow, and comprehensive investment banking solutions for capital raising and strategic growth.

The bank prioritizes strengthening the value chains of these major clients. This means offering integrated financial solutions that support their entire operational and supply chain processes, from raw material sourcing to final product distribution.

For instance, in 2024, Banco do Brasil continued its focus on agribusiness, a key sector for large corporations in Brazil. The bank disbursed R$108.9 billion in credit for agribusiness in the 2023/2024 harvest plan, demonstrating its commitment to supporting the financial needs of major players in this vital industry.

Government Entities

As a state-controlled institution, Banco do Brasil plays a crucial role in supporting various levels of government. This includes managing public funds, offering specialized credit lines for public infrastructure and development projects, and providing a range of financial services tailored to the needs of federal, state, and municipal administrations. For instance, in 2023, Banco do Brasil disbursed R$20.8 billion in credit for public entities and projects, highlighting its commitment to public sector financing.

The bank's engagement with government entities extends to facilitating public investments and managing government accounts. This strategic partnership is vital for the execution of public policies and the development of national and regional economies. Banco do Brasil's financial solutions aim to optimize public resource management and foster economic growth through well-funded public initiatives.

- Public Fund Management: Safekeeping and efficient management of federal, state, and municipal government revenues and expenditures.

- Credit for Public Projects: Providing financing for infrastructure, social programs, and other public sector initiatives, with R$20.8 billion disbursed in 2023 for such purposes.

- Specialized Financial Services: Offering tailored solutions for public administration bodies, including treasury management and payment processing.

Rural Producers and Agribusiness Sector

Banco do Brasil actively serves rural producers and the broader agribusiness sector, a cornerstone of its business. This strategic focus is evident in its role as a primary financier, providing tailored credit, insurance, and investment solutions designed to support agricultural operations across Brazil.

The bank's deep understanding of this vital economic segment allows it to offer specialized products that address the unique challenges and opportunities faced by farmers and agribusiness companies. This commitment is underscored by data showing significant lending to agriculture; for instance, in the 2023-2024 harvest cycle, Banco do Brasil disbursed R$131.9 billion in credit for agribusiness, highlighting its substantial market presence and support for the sector.

- Financier for Agribusiness: Banco do Brasil is a leading provider of financial services to rural producers and agribusinesses.

- Specialized Products: Offers dedicated credit lines, insurance, and investment products catering to the agricultural sector's needs.

- Economic Importance: The agribusiness sector is a critical component of the Brazilian economy, and Banco do Brasil's support is instrumental.

- Significant Lending: In the 2023-2024 harvest year, the bank allocated R$131.9 billion to agribusiness financing.

Banco do Brasil caters to a broad spectrum of individuals, from those needing everyday banking services to high-net-worth clients requiring advanced wealth management. The bank's 2024 strategy emphasizes digital expansion to simplify access for all. This segmentation ensures that financial needs, from student accounts to complex investment portfolios, are met effectively.

| Customer Segment | Key Offerings | 2023/2024 Data Highlight |

|---|---|---|

| Individuals | Checking, Savings, Credit Cards, Wealth Management, Investments | Focus on digital offerings for diverse needs |

| SMEs | Working Capital Loans, Business Accounts, Payment Solutions, Advisory | SMEs represented ~99% of Brazilian businesses in 2023 |

| Large Corporations | Corporate Lending, Trade Finance, Treasury Services, Investment Banking | Disbursed R$108.9 billion in agribusiness credit (2023/2024 harvest) |

| Public Sector | Public Fund Management, Project Financing, Treasury Management | Disbursed R$20.8 billion for public entities (2023) |

| Agribusiness | Credit, Insurance, Investment Solutions for Rural Producers | Disbursed R$131.9 billion for agribusiness (2023-2024 harvest) |

Cost Structure

Employee salaries and benefits represent a substantial cost for Banco do Brasil, reflecting its extensive network of branches and a large employee base. In 2023, the bank reported personnel expenses amounting to R$26.5 billion, a key component of its overall operational expenditures.

This significant investment in human capital is crucial for delivering high-quality customer service and ensuring efficient operations across its diverse banking services. The cost includes not only base salaries but also comprehensive benefits packages, training programs, and long-term pension obligations, underscoring the strategic importance of its workforce.

Banco do Brasil's extensive physical branch network represents a significant cost driver. Maintaining these branches involves considerable expenses such as rent, utilities, security personnel, and administrative staff. These fixed operational expenditures are crucial for serving a broad customer base across Brazil.

In 2023, Banco do Brasil reported operating expenses of R$34.6 billion, a portion of which is directly attributable to its vast physical infrastructure. The bank operates thousands of branches nationwide, each requiring ongoing investment to ensure functionality and customer service, contributing heavily to its overall cost structure.

Banco do Brasil's commitment to digital transformation necessitates substantial and ongoing investments in technology and IT infrastructure. These costs are driven by the development and maintenance of robust digital platforms, ensuring seamless customer experiences and operational efficiency. In 2023, the bank allocated R$ 5.7 billion to technology, a significant portion of which fuels these critical infrastructure upgrades.

Cybersecurity measures are a paramount concern, requiring continuous investment to protect sensitive customer data and financial transactions from evolving threats. Furthermore, the integration of Artificial Intelligence (AI) for enhanced customer service, risk management, and operational insights represents another significant cost driver. These technological advancements are crucial for maintaining a competitive edge in the rapidly digitizing financial sector.

Marketing, Advertising, and Brand Promotion

Banco do Brasil invests significantly in marketing, advertising, and brand promotion to draw in new clients and keep its existing customer base engaged. These costs are crucial for maintaining a strong presence in the competitive financial services sector and are directly tied to customer acquisition and retention efforts.

In 2023, Banco do Brasil's expenditures on marketing and advertising were substantial, reflecting a strategic focus on strengthening its brand. For instance, the bank allocated considerable resources to digital campaigns and traditional media to enhance customer reach and brand loyalty.

- Customer Acquisition: Marketing efforts are designed to attract new account openings and loan applications.

- Brand Visibility: Advertising campaigns aim to keep Banco do Brasil top-of-mind for financial services.

- Market Share: Promotional activities are key to defending and growing the bank's position in the market.

- Customer Retention: Ongoing brand engagement helps to foster loyalty and reduce customer churn.

Cost of Funds and Regulatory Compliance

The interest paid on deposits and other borrowed funds, known as the cost of funds, represents a significant expenditure for Banco do Brasil. This cost is directly influenced by prevailing interest rates and the bank's ability to attract and retain deposits. For instance, in the first quarter of 2024, Banco do Brasil reported interest expenses on its financial liabilities, which would encompass its cost of funds.

Beyond interest expenses, compliance with Brazil's robust banking regulations and legal frameworks imposes substantial operational costs. This includes expenses related to reporting requirements, internal and external audits, and investments in systems and personnel to ensure adherence to rules set by the Central Bank of Brazil. These regulatory burdens are a constant factor in the bank's cost structure.

- Cost of Funds: Interest paid on customer deposits, interbank borrowings, and other debt instruments.

- Regulatory Compliance: Expenses associated with meeting legal and regulatory requirements, including reporting, audits, and risk management.

- Operational Impact: These costs directly affect the bank's profitability and require careful management to maintain competitiveness.

- 2024 Data Focus: Analysis of Q1 2024 financial statements reveals the magnitude of interest expenses and investments in compliance infrastructure.

Banco do Brasil's cost structure is heavily influenced by its extensive human capital and physical presence. Employee salaries and benefits, a significant expense, reflect its large workforce and commitment to service quality. In 2023, personnel expenses reached R$26.5 billion, highlighting the investment in its employees.

The bank's vast branch network also contributes substantially to costs, covering rent, utilities, and staffing for thousands of locations nationwide. Operating expenses in 2023 totaled R$34.6 billion, with a notable portion attributed to maintaining this extensive infrastructure.

Technological investments are another key cost area, with R$5.7 billion allocated in 2023 to digital platforms, cybersecurity, and AI integration. These expenditures are vital for enhancing customer experience and operational efficiency in a competitive digital landscape.

| Cost Category | 2023 Expense (R$ Billion) | Key Drivers |

|---|---|---|

| Personnel Expenses | 26.5 | Salaries, benefits, training, pension obligations |

| Operating Expenses (Infrastructure) | (Portion of 34.6) | Branch network maintenance, rent, utilities, security |

| Technology and IT | 5.7 | Digital platforms, cybersecurity, AI development |

Revenue Streams

Banco do Brasil's core revenue driver is net interest income, derived from the spread between interest earned on its extensive loan and financing portfolio and the interest paid on its liabilities. This portfolio is remarkably diverse, encompassing everything from personal and corporate loans to crucial agribusiness financing and residential mortgages.

In 2024, Banco do Brasil reported significant net interest income, reflecting the strength and breadth of its lending activities. For instance, the bank's net interest income reached R$82.9 billion in 2023, a substantial increase, indicating robust performance in its primary revenue stream. This trend is expected to continue into 2024, supported by economic growth and demand for credit across various sectors.

Banco do Brasil generates substantial revenue through a diverse array of service fees and commissions. These include charges for routine account maintenance, processing various transactions, and fees associated with credit card usage. In 2024, the bank continued to see robust contributions from these non-interest income sources, which are crucial for its overall financial performance.

Banco do Brasil generates significant income from selling insurance policies, including life, property, and health coverage. In 2023, the insurance segment of BB Seguros reported a net income of R$ 5.9 billion, demonstrating the substantial contribution of these products to the bank's overall profitability. This revenue stream is a key element in leveraging the bank's extensive customer relationships for cross-selling opportunities.

Asset Management Fees

Banco do Brasil generates substantial revenue through asset management fees, leveraging its expertise to manage investment funds and client portfolios. These fees are a cornerstone of its financial services offering, catering to a broad client base.

The bank provides comprehensive wealth management and specialized investment advisory services, earning commissions and management charges. In 2024, asset management represented a significant portion of its fee-based income, reflecting strong client trust and market presence.

- Asset Management Fees: Income derived from managing investment funds and client portfolios.

- Wealth Management: Fees associated with personalized financial planning and investment advice.

- Specialized Advisory: Charges for expert guidance on specific investment strategies and markets.

- 2024 Performance: Asset management fees contributed significantly to the bank's overall fee and commission income, demonstrating robust growth in managed assets.

Treasury Operations and Investment Income

Banco do Brasil generates significant revenue through its treasury operations. This includes active trading in various financial instruments, managing foreign exchange exposures, and earning income from its substantial investment portfolio. These diverse treasury activities are crucial for the bank's overall financial health and profitability.

In 2024, the bank's treasury and investment income played a vital role in its financial results. For instance, during the first quarter of 2024, Banco do Brasil reported a net income of R$3.1 billion, with a notable contribution from its financial intermediation and investment income segments, reflecting the strength of these revenue streams.

- Treasury Trading: Revenue generated from buying and selling financial instruments like bonds and derivatives.

- Foreign Exchange Activities: Profits earned from currency exchange transactions and managing foreign currency exposure.

- Investment Portfolio Income: Returns derived from the bank's holdings in stocks, bonds, and other investment assets.

Banco do Brasil's revenue streams are multifaceted, extending beyond traditional lending to encompass a wide range of financial services. These diverse income sources are crucial for maintaining its robust financial performance and market position.

Net interest income remains the primary engine, fueled by a vast loan portfolio. However, fees and commissions from services like account management, credit cards, and insurance sales contribute significantly. Asset management and treasury operations further diversify its income, showcasing a comprehensive financial services model.

In 2023, Banco do Brasil's net interest income reached R$82.9 billion, highlighting the dominance of its lending activities. The bank also saw substantial contributions from its insurance arm, BB Seguros, which reported a net income of R$5.9 billion in the same year, demonstrating the strength of its diversified revenue strategy.

| Revenue Stream | Description | 2023 Contribution (Illustrative) |

|---|---|---|

| Net Interest Income | Spread on loans and financing vs. liabilities. | R$82.9 billion (Net Interest Income) |

| Fees and Commissions | Account maintenance, transactions, credit cards. | Significant portion of non-interest income. |

| Insurance Premiums | Life, property, health insurance sales. | R$5.9 billion (BB Seguros Net Income) |

| Asset Management Fees | Managing investment funds and client portfolios. | Key component of fee-based income. |

| Treasury Operations | Trading, foreign exchange, investment portfolio income. | Contributes to overall financial results. |

Business Model Canvas Data Sources

The Banco do Brasil Business Model Canvas is meticulously crafted using a blend of internal financial statements, extensive market research on banking trends, and strategic analysis of competitor activities. These data sources ensure each component of the canvas is grounded in empirical evidence and informed decision-making.