Banco do Brasil Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Banco do Brasil Bundle

Banco do Brasil faces moderate rivalry, with established players and a few emerging fintechs shaping the competitive landscape. Buyer power is significant due to readily available alternatives and price sensitivity, while supplier power remains relatively low for most inputs. The threat of new entrants is moderate, influenced by regulatory hurdles and capital requirements.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Banco do Brasil’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Banco do Brasil's reliance on a few specialized tech and software vendors for critical systems like core banking and cybersecurity grants these suppliers moderate bargaining power. The significant expenses and operational risks involved in switching these complex platforms, estimated to cost millions for large financial institutions, create high switching costs.

These high switching costs, coupled with the need to comply with stringent Brazilian Central Bank regulations for procurement, often lead to enduring partnerships and long-term contracts for Banco do Brasil with its technology providers.

Financial market infrastructure providers, like Visa and Mastercard, wield considerable supplier power. Their networks are indispensable for a vast array of transactions, and the high costs and regulatory hurdles to establish competing infrastructure create significant barriers to entry. For instance, in 2024, global card transaction volume continued its upward trajectory, underscoring the reliance of financial institutions on these established players.

Banco do Brasil's funding sources, primarily depositors and capital markets, wield considerable bargaining power. Large corporate clients and significant individual depositors can negotiate more favorable interest rates on their deposits, directly impacting the bank's cost of funds and, consequently, its lending margins. This leverage is particularly pronounced in a competitive deposit environment.

Furthermore, Banco do Brasil's reliance on capital markets means it is subject to investor sentiment and prevailing economic conditions. In 2024, for instance, rising global interest rates and increased market volatility could elevate the cost of borrowing for the bank, as investors demand higher yields to compensate for perceived risks. This dynamic forces the bank to carefully manage its capital structure and investor relations.

Human Capital and Specialized Talent

The banking industry, including institutions like Banco do Brasil, relies heavily on specialized human capital. Professionals skilled in digital transformation, artificial intelligence, and cybersecurity are in high demand. This creates a competitive labor market where these talented individuals can exert significant bargaining power.

This leverage directly impacts labor costs for banks and influences their capacity for innovation and maintaining a technological advantage. For instance, in 2024, reports indicated a significant shortage of cybersecurity professionals globally, driving up salaries in this critical field. Banks that cannot attract or retain this talent may find themselves lagging behind competitors in technological adoption and security protocols.

- High Demand for Digital Skills: The banking sector's focus on digital transformation means a premium is placed on employees with expertise in areas like cloud computing, data analytics, and fintech.

- Impact on Innovation: Access to and retention of specialized talent is crucial for developing new digital products and services, directly affecting a bank's competitive edge.

- Wage Pressures: A tight labor market for these in-demand skills can lead to increased salary expectations and benefits packages, raising operational costs for financial institutions.

- Cybersecurity Talent Gap: In 2023-2024, the global cybersecurity workforce gap was estimated to be millions, a challenge that directly affects banks' ability to protect sensitive customer data and systems.

Regulatory and Compliance Service Providers

In Brazil's intricate and constantly shifting regulatory environment, particularly with new rules for virtual assets, Open Finance, and Banking as a Service (BaaS), specialized legal and compliance service providers hold significant sway. Their deep knowledge in navigating these complex frameworks is essential for institutions like Banco do Brasil to ensure adherence and sidestep costly penalties. This expertise grants them moderate bargaining power, as banks depend on these providers to maintain compliance and avoid legal repercussions.

The increasing demand for specialized regulatory advice in areas like data privacy (LGPD) and financial crime prevention further amplifies the bargaining power of these service providers. For instance, the implementation of Open Finance in Brazil, which began its phased rollout in 2021, requires constant adaptation to new technical and security standards, making firms with proven track records and specialized knowledge highly sought after. This reliance on external expertise means that banks must often accept the terms and pricing offered by these niche providers.

- Specialized Expertise: Providers offering niche legal and compliance services for areas like virtual assets and BaaS possess unique knowledge, making them indispensable.

- Regulatory Complexity: Brazil's evolving financial regulations, including Open Finance, create a consistent demand for expert guidance.

- Risk Mitigation: Banks rely on these providers to ensure compliance and avoid significant fines or reputational damage.

- Supplier Dependence: The specialized nature of these services limits the number of viable alternatives for financial institutions.

Suppliers of critical technology and software for Banco do Brasil, such as core banking systems and cybersecurity solutions, possess moderate bargaining power due to high switching costs and regulatory compliance needs. Financial market infrastructure providers like Visa and Mastercard also hold significant power, as their networks are essential for transactions and barriers to entry for competitors are substantial. The increasing demand for specialized talent in areas like AI and cybersecurity further empowers skilled professionals, driving up labor costs for banks.

The bargaining power of suppliers for Banco do Brasil is influenced by several factors, including the specialization of their offerings and the ease with which the bank can switch to alternatives. For instance, providers of niche regulatory compliance services in Brazil, essential for navigating complex frameworks like Open Finance, can command higher fees due to the limited availability of comparable expertise. This dependence on specialized knowledge highlights a key area where suppliers can exert influence.

| Supplier Type | Bargaining Power | Key Factors |

| Technology & Software Vendors | Moderate | High switching costs, regulatory compliance |

| Financial Market Infrastructure | High | Indispensable networks, high barriers to entry |

| Specialized Human Capital | High | Demand for digital/cybersecurity skills, talent shortages |

| Regulatory Compliance Services | Moderate | Niche expertise, evolving regulations (e.g., Open Finance) |

What is included in the product

Explores market dynamics that deter new entrants and protect incumbents like Banco do Brasil, while also highlighting the intense rivalry and buyer power within the Brazilian banking sector.

Understand the competitive landscape of Banco do Brasil with a consolidated view of all five forces, streamlining strategic planning and identifying key areas of pressure.

Customers Bargaining Power

Banco do Brasil's diverse customer base, encompassing individuals, businesses, and government entities, significantly dilutes the bargaining power of any single customer segment. This broad reach means the bank isn't overly dependent on a few large clients, reducing their leverage.

While individual retail customers have limited power, their sheer volume means collective actions or widespread dissatisfaction can still influence the bank. For instance, a significant shift in customer preference towards digital-only banking could pressure Banco do Brasil to invest more in its online platforms.

For individual consumers, particularly with the rise of digital banking and Open Finance initiatives in Brazil, switching banks has become increasingly easier, reducing loyalty to traditional institutions. This ease of transition means customers can readily explore offerings from competitors without significant hurdles.

The widespread adoption of Pix, a free and instant payment system, further lowers the friction of moving funds between different financial service providers. In 2023, Pix transactions in Brazil surpassed 16 billion, demonstrating its integral role in daily financial activities and facilitating customer mobility between banks.

Customers, particularly in Brazil's competitive retail banking sector, are showing heightened price sensitivity. They are actively looking for reduced fees and more favorable interest rates. For instance, in early 2024, the average interest rate on personal loans in Brazil hovered around 7.5% per month, a figure that many consumers actively seek to negotiate down or find better alternatives for.

The implementation of Open Finance regulations in Brazil is a significant factor amplifying this. This regulatory shift has dramatically increased transparency, providing customers with readily accessible information on a wide array of banking products and services. This ease of comparison empowers them to find the best deals, thereby increasing their bargaining power against institutions like Banco do Brasil.

Corporate and Government Client Influence

While individual customers typically have limited leverage, Banco do Brasil's large corporate and government clients wield considerable bargaining power. This is driven by the substantial volume and intricate nature of the financial services they procure. These major clients can effectively negotiate for more advantageous terms, such as reduced service fees and bespoke financial solutions, directly reflecting the significant revenue they generate for the institution.

For instance, in 2024, large corporate clients accounted for a significant portion of Banco do Brasil's loan portfolio, enabling them to demand competitive pricing and specialized products. The bank's ability to retain these key accounts often hinges on its flexibility in offering tailored packages and favorable interest rates, directly impacting the bank's profitability on these relationships.

- Significant Revenue Contribution: Large corporate and government clients represent a substantial revenue stream for Banco do Brasil, granting them leverage in negotiations.

- Volume and Complexity of Services: The scale and specialized nature of services required by these clients empower them to seek better terms.

- Negotiation for Favorable Terms: Clients can negotiate lower fees, customized solutions, and preferential interest rates due to their market importance.

- Impact on Profitability: Banco do Brasil's willingness to accommodate these demands directly influences its profit margins derived from these high-value relationships.

Rise of Digital-First Alternatives

The rise of digital-first alternatives significantly bolsters the bargaining power of customers against traditional banks like Banco do Brasil. The proliferation of fintechs and digital-only banks offers consumers a wider array of choices, often with more competitive pricing and user-friendly interfaces. This intensified competition means customers can readily switch providers for better rates or services, forcing established institutions to be more responsive to customer demands.

Customers now have unprecedented access to a broad spectrum of financial services from agile new players. For instance, by the end of 2023, Brazil saw a notable increase in digital account openings, with neobanks capturing a significant share of new customers. This ease of access to diverse offerings, from payments to investments, shifts customer preferences towards convenient, often lower-cost, digital-first solutions, directly impacting Banco do Brasil's customer retention strategies.

- Increased Choice: Digital banks and fintechs provide customers with more options beyond traditional banking.

- Convenience and Cost: Digital-first solutions often offer greater convenience and lower fees, attracting price-sensitive customers.

- Switching Ease: The ability to easily open and manage accounts online reduces the friction for customers to switch banks.

- Market Share Shift: In 2023, digital banks in Brazil continued to gain market share, demonstrating a clear customer preference for these alternatives.

Banco do Brasil faces moderate bargaining power from its customers, largely influenced by increasing ease of switching and price sensitivity, especially in the retail segment. While individual retail customers have limited individual power, the collective shift towards digital banking and the widespread adoption of instant payment systems like Pix, which saw over 16 billion transactions in 2023, empower them to move funds easily. This heightened customer mobility, coupled with a growing demand for lower fees and better interest rates—with personal loan rates around 7.5% per month in early 2024—forces the bank to remain competitive.

However, large corporate and government clients represent a significant counterpoint, wielding substantial bargaining power due to the volume and complexity of services they require. These clients can negotiate for more favorable terms, influencing Banco do Brasil's profitability on these high-value relationships, as seen in their significant contribution to the loan portfolio in 2024.

| Customer Segment | Bargaining Power Factors | Impact on Banco do Brasil |

|---|---|---|

| Retail Customers | Ease of switching (Open Finance, Pix) | Pressure on fees and interest rates |

| Retail Customers | Price sensitivity | Need for competitive product offerings |

| Corporate & Government Clients | Volume and complexity of services | Ability to negotiate bespoke terms |

| Corporate & Government Clients | Significant revenue contribution | Leverage for preferential pricing and solutions |

What You See Is What You Get

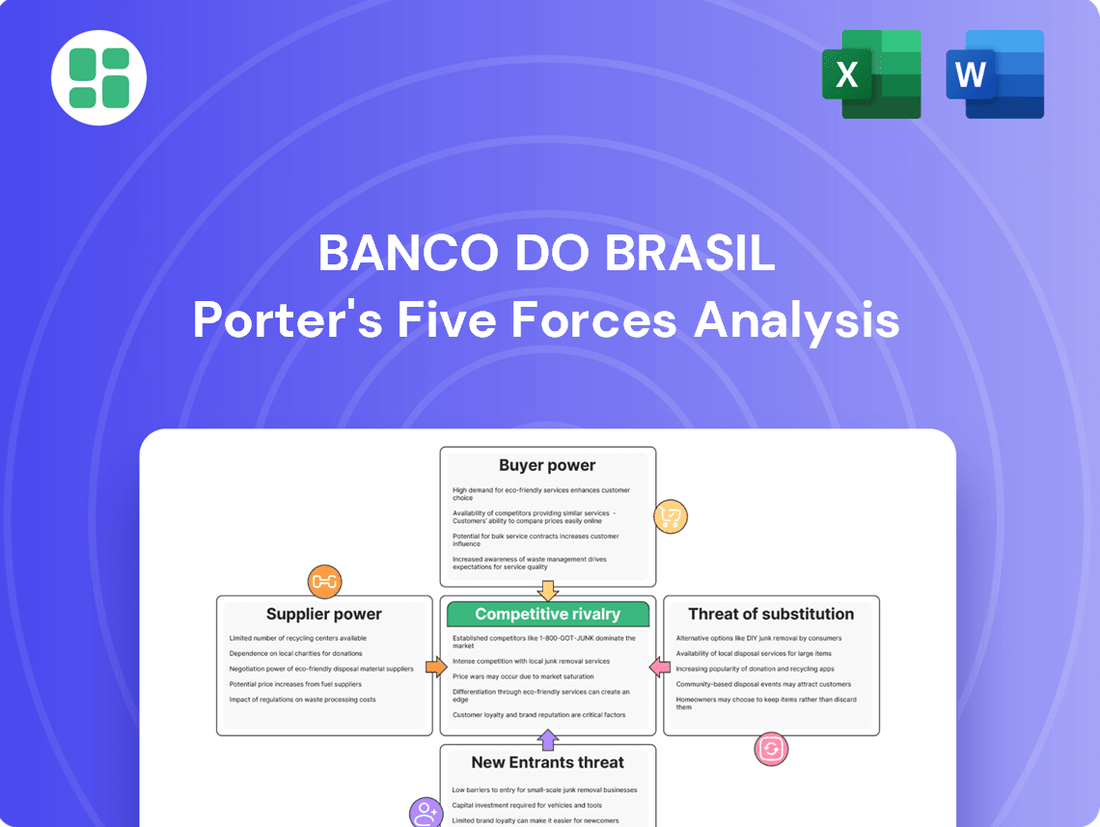

Banco do Brasil Porter's Five Forces Analysis

This preview showcases the complete Banco do Brasil Porter's Five Forces Analysis, detailing the competitive landscape for this major financial institution. You're viewing the exact document you'll receive immediately after purchase, offering a comprehensive breakdown of industry rivalry, buyer and supplier power, threat of new entrants, and the threat of substitute products. Rest assured, there are no surprises; this is the fully formatted and ready-to-use analysis you'll gain instant access to upon completing your purchase.

Rivalry Among Competitors

The Brazilian banking landscape is quite concentrated, meaning a few big players really dominate. Think of Banco do Brasil, Itaú Unibanco, Bradesco, and Santander – these established institutions have traditionally controlled a large chunk of both assets and customers. This high concentration naturally fuels fierce competition as they all vie for more market share across different banking services.

The banking sector, including Banco do Brasil, faces intense rivalry from agile fintechs and digital banks. Companies like Nubank, Banco Inter, and C6 Bank have rapidly gained market share, especially in retail, by offering streamlined, low-fee digital services. This aggressive disruption forces traditional banks to innovate and adapt their digital strategies to remain competitive.

Banco do Brasil faces intense rivalry driven by a relentless pursuit of innovation and digital transformation. Banks are heavily investing in cutting-edge technologies like artificial intelligence and cloud computing to elevate customer experiences, streamline operations, and introduce novel financial products. This technological arms race is a critical arena for securing and expanding customer bases in today's dynamic financial landscape.

Impact of Regulatory Initiatives (Pix, Open Finance)

Government and Central Bank initiatives, such as the instant payment system Pix and the broader Open Finance framework, have significantly reshaped the competitive landscape for banks like Banco do Brasil. These programs are designed to foster financial inclusion and reduce the cost of transactions for consumers and businesses alike.

Pix, launched in November 2020, has seen explosive growth, with over 1.4 billion transactions recorded in December 2023 alone, demonstrating its rapid adoption and impact on payment systems. This instant payment system lowers transaction costs and speeds up settlements, creating a more dynamic and competitive environment.

Open Finance further intensifies this rivalry by mandating greater data sharing and portability. This allows customers to more easily switch providers and enables fintechs and other new entrants to offer innovative services, putting pressure on incumbents to enhance their offerings and customer value propositions.

- Pix Adoption: By the end of 2023, Pix accounted for a substantial portion of total payment transactions in Brazil, forcing traditional banks to adapt their fee structures and service models.

- Open Finance Mandates: Regulations are pushing banks to open their APIs, facilitating third-party access to customer data (with consent), thereby spurring innovation and competition in financial services.

- Reduced Barriers to Entry: These initiatives lower the operational and technological barriers for new players, increasing the intensity of competition from fintechs and digital banks.

- Customer-Centricity: The focus shifts from proprietary systems to customer experience and value-added services, as data portability empowers consumers to seek better deals and more integrated financial solutions.

Broad Service Portfolios and Cross-Selling

Major banks like Banco do Brasil are locked in intense competition, not just on traditional banking services, but by building expansive financial ecosystems. This includes offering everything from basic checking accounts to sophisticated investment products, insurance policies, and asset management solutions. This broad service portfolio allows them to cater to a wider range of customer needs.

A key strategy to gain an edge is the effective cross-selling of these diverse services to their existing customer base. By deepening relationships and offering integrated financial solutions, banks aim to significantly increase customer lifetime value. For instance, a customer with a checking account might be offered a tailored investment plan or a home insurance policy, creating a more comprehensive banking relationship.

- Broad Service Ecosystems: Banks now compete by offering a full spectrum of financial products, encompassing banking, investments, insurance, and wealth management.

- Cross-Selling as a Strategy: The ability to bundle and sell multiple services to a single customer is crucial for revenue growth and customer retention.

- Customer Lifetime Value: By providing a comprehensive suite of services, financial institutions aim to become the primary financial partner for their clients, increasing the long-term value derived from each customer relationship.

The competitive rivalry within Brazil's banking sector is exceptionally high, driven by a concentrated market dominated by a few major players like Banco do Brasil, Itaú Unibanco, Bradesco, and Santander. This intense competition is further amplified by nimble fintechs and digital banks, such as Nubank and Banco Inter, which are rapidly capturing market share with their innovative, low-fee digital offerings.

Technological innovation is a critical battleground, with banks heavily investing in AI and cloud computing to enhance customer experience and operational efficiency. Initiatives like Pix, Brazil's instant payment system, and the Open Finance framework are fundamentally reshaping the landscape, lowering transaction costs and encouraging data sharing, which in turn fuels competition and pushes incumbents to offer more value.

Banks are also competing by building extensive financial ecosystems, offering a wide array of products from basic banking to investments and insurance. Cross-selling these diverse services to existing customers is a key strategy to boost customer lifetime value and deepen relationships, making customer-centricity paramount.

| Metric | Banco do Brasil | Itaú Unibanco | Bradesco | Nubank |

| Market Share (Assets, est. 2024) | ~15% | ~20% | ~18% | ~5% (growing rapidly) |

| Customer Base (Millions, est. 2024) | ~75 | ~60 | ~55 | ~100+ |

| Digital Transactions (Pix, est. 2024) | Significant Volume | Significant Volume | Significant Volume | High Adoption Rate |

SSubstitutes Threaten

Pix, Brazil's instant payment system, presents a substantial threat of substitution for Banco do Brasil's traditional services. Launched in November 2020, Pix facilitated over 42 billion transactions in 2023, demonstrating its rapid and widespread adoption by individuals and businesses alike.

This real-time, low-cost payment method directly substitutes for bank transfers, debit card usage, and even some credit card transactions, offering a more convenient and often free alternative for everyday payments and money transfers.

The increasing preference for Pix for P2P and P2B transactions can lead to reduced transaction fee revenue for banks like Banco do Brasil and potentially diminish customer engagement with other banking products.

Fintechs and digital wallets present a significant threat by offering streamlined alternatives for payments and basic financial management. These platforms, like Nubank and PicPay in Brazil, are rapidly gaining traction, with Nubank serving over 100 million customers by early 2024, showcasing a strong migration away from traditional banking for certain services.

Capital markets present a significant threat by offering alternatives to traditional banking services for both companies and investors. Businesses can bypass banks by issuing bonds or stocks directly to raise capital, a trend that has seen robust activity. For instance, global equity issuance reached approximately $733 billion in the first half of 2024, demonstrating a strong appetite for direct funding.

High-net-worth individuals and institutional investors also find capital markets appealing, especially when benchmark interest rates are low, as they offer a wider array of investment opportunities beyond bank-managed products. The global bond market, valued in the trillions, provides diverse fixed-income instruments that compete directly with bank deposits and loans, offering potentially higher yields and greater flexibility.

Peer-to-Peer (P2P) Lending and Crowdfunding

Peer-to-peer (P2P) lending platforms and crowdfunding initiatives are emerging as significant substitutes for traditional banking services, including those offered by Banco do Brasil. These platforms offer alternative channels for both borrowers and lenders, often bypassing the established financial infrastructure.

While still a developing market, the growth of P2P lending and crowdfunding presents a credible threat. For instance, the global P2P lending market was valued at approximately USD 55.9 billion in 2022 and is projected to grow significantly. This expansion means more individuals and small businesses might opt for these platforms for financing needs, potentially reducing demand for certain loan products from established banks.

The appeal of these substitutes lies in their potential for greater flexibility and accessibility. They can cater to segments of the market that might find traditional bank lending processes more cumbersome or less accommodating. This is particularly relevant for small businesses and individuals seeking quicker or more tailored financing solutions.

Key aspects of this threat include:

- Alternative Funding Sources: P2P lending and crowdfunding provide direct access to capital from a broad base of investors, bypassing traditional bank intermediation.

- Market Growth: The increasing adoption and valuation of P2P lending platforms indicate a growing preference for these alternative financing methods.

- Niche Market Penetration: These platforms often excel at serving specific borrower segments or loan types that may be less profitable or more complex for large banks.

Cryptocurrencies and Blockchain-based Solutions

The rise of cryptocurrencies and blockchain technology poses a potential threat of substitution for traditional banking services. As Brazil moves forward with regulating virtual assets and introducing its own digital currency, Drex, these innovations could offer alternative methods for value storage, fund transfers, and accessing financial products.

For instance, stablecoins, pegged to fiat currencies, could become a direct competitor for transactional banking, while asset tokenization might disrupt traditional investment and lending platforms. By July 2025, the adoption rate and regulatory clarity surrounding these digital assets will be key indicators of their substitutive power against established financial institutions like Banco do Brasil.

- Stablecoins: Offering a digital alternative for payments and remittances, potentially bypassing traditional interbank systems.

- Asset Tokenization: Enabling fractional ownership and easier trading of real-world assets, creating new investment avenues outside of bank-managed portfolios.

- Central Bank Digital Currency (Drex): As Brazil's Drex evolves, it could streamline payment systems and offer a digital alternative for holding funds, impacting deposit bases.

- Regulatory Landscape: The evolving regulatory framework in Brazil for cryptocurrencies and digital assets will significantly shape the extent to which these technologies can substitute traditional banking functions.

The threat of substitutes for Banco do Brasil is significant, primarily driven by digital payment systems like Pix and the growing influence of fintechs. Pix, adopted by over 130 million Brazilians by early 2024, directly challenges traditional bank transfers and fee-based services, impacting revenue streams.

Fintechs, such as Nubank with its over 100 million customers, offer user-friendly alternatives for payments and basic financial management, drawing customers away from incumbent banks for everyday transactions.

Capital markets also provide substitutes, allowing companies to raise funds through direct issuance rather than bank loans, with global equity issuance remaining robust. Furthermore, P2P lending platforms and emerging digital currencies like Drex represent evolving threats, offering alternative financing and transactional methods that could reduce reliance on traditional banking infrastructure.

| Substitute | Key Impact | Adoption/Growth Indicator |

|---|---|---|

| Pix | Reduced transaction fee revenue, lower customer engagement | Over 42 billion transactions in 2023 |

| Fintechs (e.g., Nubank) | Customer migration for payments and basic services | Over 100 million customers by early 2024 |

| Capital Markets | Bypassing banks for capital raising | Global equity issuance ~$733 billion (H1 2024) |

| P2P Lending | Alternative financing for individuals and SMEs | Global P2P lending market ~$55.9 billion (2022) |

| Cryptocurrencies/Drex | Potential for alternative value storage and transfers | Ongoing regulatory developments and Drex pilot programs |

Entrants Threaten

The banking sector in Brazil faces high regulatory barriers, primarily enforced by the Central Bank of Brazil (BCB). These regulations mandate substantial capital reserves, rigorous licensing procedures, and adherence to intricate compliance frameworks, effectively deterring many new entrants.

In 2024, these stringent requirements continue to limit the emergence of new traditional banking competitors, as the cost and complexity of meeting BCB standards are exceptionally high. For instance, the minimum capital requirement for establishing a new financial institution can run into hundreds of millions of Brazilian Reais, a significant hurdle for most aspiring players.

Establishing a full-service bank, like Banco do Brasil, demands enormous initial capital. This includes setting up physical branches, robust IT systems, and meeting stringent regulatory requirements, often running into billions of dollars. For instance, in 2023, the Brazilian banking sector saw significant investments in digital transformation, with major banks allocating substantial funds to upgrade their technological infrastructure.

This high capital barrier significantly deters potential new entrants, especially smaller firms or startups lacking substantial financial backing. The sheer cost of entry makes it exceptionally challenging to compete effectively against established players such as Banco do Brasil, which already possess vast resources and economies of scale.

Banco do Brasil, as an established player, benefits immensely from economies of scale. This allows them to spread operational costs across a vast customer base, enabling competitive pricing on services like loans and deposits, a significant barrier for newcomers. For instance, in 2023, Banco do Brasil reported total assets exceeding R$1.6 trillion, a scale that is difficult for new entrants to replicate quickly.

Furthermore, the banking sector is characterized by powerful network effects. The more customers a bank has, the more attractive it becomes to potential new customers due to enhanced service offerings, wider ATM access, and greater interoperability. This creates a substantial challenge for new entrants aiming to build a comparable customer base and service network from scratch.

Customer Loyalty and Brand Recognition

Established financial institutions like Banco do Brasil often possess a significant advantage through deeply ingrained customer loyalty and robust brand recognition. This is particularly true in Brazil, where trust and familiarity play crucial roles in banking relationships.

Banco do Brasil, with its extensive history, has cultivated a substantial and loyal customer base. This makes it considerably more difficult for new entrants to attract and retain customers, as they must first overcome the established bank's reputation and existing relationships. For instance, as of early 2024, Banco do Brasil reported a significant portion of its customer base being long-term, underscoring the challenge for newcomers.

- Customer Loyalty: Banco do Brasil benefits from decades of operation, fostering deep-seated trust and loyalty among its clientele.

- Brand Recognition: Its name is synonymous with banking in Brazil, providing a powerful barrier to entry for less-known competitors.

- Acquisition Costs: New entrants face high customer acquisition costs due to the need to build brand awareness and trust from scratch.

Fintech Entry and Regulatory Facilitation

The threat of new entrants for Banco do Brasil is evolving. While traditional banking requires substantial capital and licenses, regulatory shifts are creating new avenues for competition. Initiatives like Open Finance and Banking as a Service (BaaS) are particularly impactful, allowing fintechs and specialized providers to enter the market without the full overhead of a traditional bank.

These changes specifically lower barriers in niche areas. For instance, BaaS regulations permit non-financial companies to offer financial services, segmenting the market and potentially siphoning off specific customer transactions or product lines. This means that while a full-scale bank might still face high entry costs, a fintech offering a specialized digital payment solution or a niche lending product can now enter with significantly less friction.

In 2024, the Brazilian fintech landscape continued its dynamic growth. According to reports, the number of fintechs operating in Brazil reached over 1,000, with a significant portion focusing on payments, credit, and investment services. These agile players, unburdened by legacy systems, can leverage new regulations to offer competitive, digitally-native alternatives, directly challenging established institutions like Banco do Brasil in specific service areas.

- Regulatory Facilitation: Open Finance and BaaS regulations in Brazil are key drivers reducing entry barriers for fintechs.

- Niche Competition: New entrants can offer specialized financial services, bypassing the need for full banking licenses.

- Fintech Growth in Brazil: Over 1,000 fintechs were operating in Brazil in 2024, focusing on payments, credit, and investments.

- Agility Advantage: Fintechs' lack of legacy systems allows them to quickly adapt to new regulations and market demands.

The threat of new entrants for Banco do Brasil remains moderate, largely due to high capital requirements and stringent regulations from the Central Bank of Brazil, which demand substantial initial investment and adherence to complex compliance frameworks. These barriers are significant, with minimum capital requirements for new financial institutions often reaching hundreds of millions of Brazilian Reais.

However, the rise of fintechs, facilitated by Open Finance and Banking as a Service (BaaS) initiatives, is creating new competitive avenues. These agile players can enter specific market niches with lower overheads, bypassing the need for full banking licenses and challenging incumbents like Banco do Brasil in areas such as payments and digital lending.

The Brazilian fintech sector saw over 1,000 operational entities in 2024, many focusing on these specialized services, indicating a shift in competitive dynamics. This trend suggests that while traditional banking entry is difficult, specialized digital financial services present a growing challenge.

| Factor | Impact on New Entrants | Relevance to Banco do Brasil |

|---|---|---|

| Regulatory Barriers | High (Capital reserves, licensing) | Significant deterrent for traditional banks |

| Capital Requirements | Extremely High (Millions of BRL) | Major hurdle for startups |

| Economies of Scale | Difficult to replicate | Banco do Brasil's advantage (R$1.6T+ assets in 2023) |

| Network Effects | Challenging to build | Strengthens established players |

| Fintech Innovation (Open Finance, BaaS) | Lowered barriers in niche areas | Emerging competitive threat |

| Fintech Growth (2024) | Over 1,000 entities | Increased competition in specific services |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Banco do Brasil leverages data from official company filings, including annual reports and investor presentations, alongside industry-specific research from reputable financial data providers and market analysis firms.