Bawag Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bawag Group Bundle

Navigate the complex external forces shaping Bawag Group's future with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends present both challenges and opportunities for the financial institution. Unlock actionable intelligence to refine your strategy and gain a competitive edge.

Our PESTLE analysis dives deep into the technological advancements and environmental considerations impacting Bawag Group's operations. Gain a clear understanding of the legal landscape and regulatory shifts that influence its strategic direction. Purchase the full report for immediate access to critical insights that will inform your investment decisions and business planning.

Political factors

The political stability within Austria and the wider European Union is a significant factor shaping the regulatory landscape and economic prospects for BAWAG Group. A stable political climate typically translates to predictable policy decisions, which is beneficial for financial institutions by creating a more certain operational environment.

Political uncertainties or significant changes in governmental priorities can introduce new regulatory requirements or modify existing ones, potentially affecting BAWAG's strategic planning and financial performance. For instance, shifts in fiscal policy or banking regulations stemming from political developments could impact capital requirements or lending practices.

As of early 2024, Austria's coalition government has maintained a focus on economic stability and gradual regulatory adjustments, offering a relatively predictable environment. However, upcoming elections in various EU member states throughout 2024 and 2025 could introduce new political dynamics and potential policy shifts that BAWAG will need to monitor closely.

The European Central Bank (ECB) and the European Banking Authority (EBA) are key architects of the regulatory environment for banks within the European Union. These bodies set the rules that all financial institutions, including BAWAG Group, must follow. For instance, as of early 2024, the finalization of Basel III reforms, often referred to as Basel IV, continues to influence capital adequacy ratios, impacting how much capital banks need to hold against their risk-weighted assets.

Upcoming regulations like CRD VI and the Digital Operational Resilience Act (DORA) are designed to bolster financial stability and ensure banks can withstand operational disruptions, particularly those stemming from digital risks. DORA, in particular, mandates stringent requirements for IT risk management and third-party service providers, which BAWAG Group must integrate into its operations by January 2025.

BAWAG Group's ability to navigate these evolving frameworks is paramount. These regulations dictate critical aspects of its business, including capital requirements, risk management strategies, and the expectations of supervisory authorities. Staying compliant and proactive in adapting to these changes is essential for maintaining operational integrity and market confidence.

Ongoing geopolitical tensions, especially those affecting global trade and stability, introduce considerable risks for the financial industry. These situations can trigger heightened market volatility, disrupt international commerce, and lead to the implementation of sanctions, impacting entities like BAWAG Group.

For BAWAG Group, with its extensive international presence, successfully navigating these intricate geopolitical landscapes is crucial. This involves meticulous adherence to restrictive measures and proactive management of potential adverse effects on its asset quality and overall profitability.

In 2024, the global financial system continues to grapple with the ripple effects of conflicts and trade disputes, leading to increased uncertainty. For instance, the ongoing tensions in Eastern Europe have already prompted significant sanctions regimes, affecting cross-border transactions and investment flows, which BAWAG Group must actively monitor and manage.

Taxation Policies

Changes in taxation policies, both within Austria and across BAWAG Group's international operations, directly impact its bottom line. For example, shifts in corporate tax rates or the introduction of new banking levies can significantly alter net earnings and influence how the group allocates its capital. Staying abreast of these fiscal developments is crucial for BAWAG to effectively manage its financial outlook.

For instance, Austria's corporate income tax rate currently stands at 25%. Any proposed increase, as has been a topic of discussion in various European countries, could reduce BAWAG's retained earnings. Similarly, international tax reforms, such as potential changes to global minimum tax rates, could affect the profitability of BAWAG's foreign subsidiaries.

- Corporate Tax Rate in Austria: 25% (as of 2024).

- Impact of Levies: Increased banking levies can directly reduce pre-tax profits.

- International Tax Environment: Global tax initiatives like the OECD's Pillar Two could influence BAWAG's effective tax rate across its multinational operations.

Government Support and Intervention

Governments, while often preferring market-driven approaches, can intervene in the banking sector, particularly during economic downturns or to steer specific national economic objectives. This intervention, though less common in stable periods, significantly impacts a bank's resilience and strategic planning. For instance, the European Central Bank's (ECB) role in overseeing major European banks, including Bawag Group, demonstrates a form of policy intervention aimed at financial stability.

Policy interventions can take various forms, such as the introduction of systemic risk buffers by financial stability boards. These measures are designed to bolster the banking sector's ability to withstand shocks. In 2024, regulatory discussions continued around capital requirements and liquidity management, reflecting ongoing government attention to banking sector health across the Eurozone.

Bawag Group, operating within the European Union, is subject to directives and regulations set by EU bodies and national authorities. These frameworks, which can be adjusted based on economic conditions and policy priorities, directly influence operational requirements and strategic flexibility. The ongoing focus on digital banking regulation and consumer protection in 2025 highlights evolving political landscapes that financial institutions must navigate.

- Regulatory Frameworks: Bawag Group operates under the prudential supervision of the ECB and the Austrian Financial Market Authority (FMA), adhering to Basel III and CRD IV/CRR regulations.

- Capital Requirements: In 2024, the average Common Equity Tier 1 (CET1) ratio for significant institutions under ECB supervision remained robust, exceeding 15%, indicating a strong capital base influenced by regulatory mandates.

- Economic Policy Objectives: Government initiatives to support small and medium-sized enterprises (SMEs) through banking channels can create both opportunities and compliance burdens for banks like Bawag.

- Financial Stability Measures: The implementation of macroprudential policies, such as loan-to-value limits or debt-to-income ratios, directly influences lending practices and risk management strategies within the banking sector.

Political stability in Austria and the EU fosters predictable policy, benefiting BAWAG Group's operations. However, upcoming elections in 2024 and 2025 across the EU introduce potential policy shifts that require close monitoring.

Key regulations like DORA, effective January 2025, mandate stringent IT risk management, impacting BAWAG's operational framework. Continued finalization of Basel III reforms influences capital adequacy ratios, with average CET1 ratios for significant institutions exceeding 15% in 2024.

Geopolitical tensions and trade disputes in 2024 create market volatility and sanctions risks, impacting cross-border transactions. BAWAG must navigate these complexities to manage asset quality and profitability effectively.

Taxation policies, including Austria's 25% corporate tax rate, directly affect BAWAG's earnings. Global tax initiatives like OECD's Pillar Two could further influence its effective tax rate across multinational operations.

| Political Factor | Description | Impact on BAWAG Group | Relevant Data/Timeframe |

|---|---|---|---|

| Regulatory Environment | EU directives and national authorities set banking rules. | Influences operational requirements and strategic flexibility. | DORA effective Jan 2025; Basel III finalization ongoing. |

| Political Stability | Predictability of policy decisions in Austria and EU. | Creates a stable or uncertain operational environment. | Elections across EU member states in 2024-2025. |

| Geopolitical Tensions | Global conflicts and trade disputes. | Increases market volatility and sanctions risks. | Ongoing tensions affecting cross-border transactions in 2024. |

| Taxation Policies | Changes in corporate tax rates and levies. | Directly impacts net earnings and capital allocation. | Austria's corporate tax rate at 25% (2024); OECD Pillar Two. |

What is included in the product

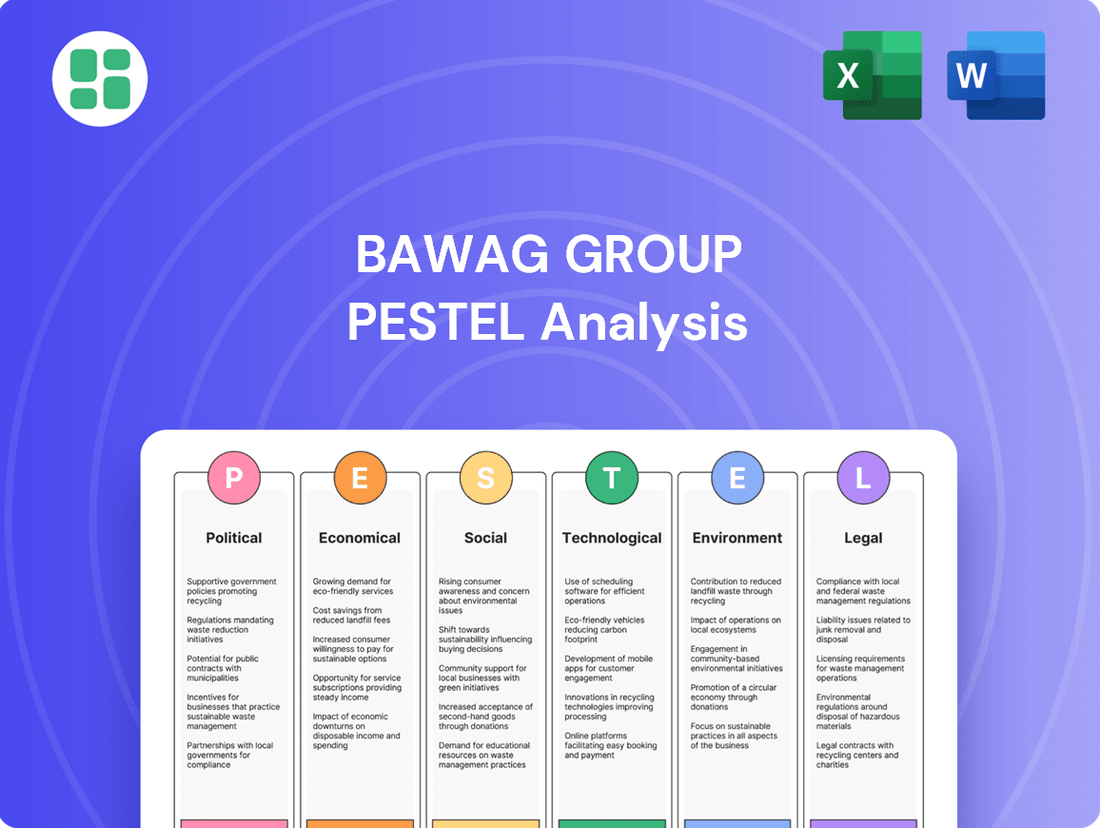

This PESTLE analysis examines the Bawag Group's operating environment by dissecting the Political, Economic, Social, Technological, Environmental, and Legal forces impacting its business.

It provides a comprehensive overview of external factors, highlighting potential threats and opportunities for strategic decision-making.

A concise Bawag Group PESTLE analysis that distills complex external factors into actionable insights, alleviating the burden of extensive research for strategic decision-making.

Economic factors

The European Central Bank's (ECB) monetary policy, especially its decisions on interest rates, significantly affects BAWAG Group's net interest income, a primary source of its profits. Higher rates in 2023 and 2024 boosted the banking sector, but anticipated rate cuts in 2025 might temper this profitability.

BAWAG's strategic management of its balance sheet and lending operations will be key to navigating the evolving interest rate environment. For instance, the ECB kept its key interest rates unchanged in its June 2024 meeting, maintaining the deposit facility rate at 3.75%, but signaled potential future cuts, a trend expected to continue into 2025.

Inflationary pressures in Austria and the wider Eurozone directly influence consumer behavior and borrowing appetite, impacting Bawag Group's operations. While inflation is projected to moderate to approximately 2.5% in 2025, Austria faced a recession in 2024.

The projected modest economic recovery for Austria in 2025 suggests continued subdued demand for corporate lending. This environment poses potential risks to asset quality, especially within vulnerable sectors such as commercial real estate, which could affect Bawag's loan portfolio.

Consumer confidence, disposable income, and savings rates are key drivers for banking products like loans and investments. In 2024, while real disposable incomes saw an increase, consumer spending remained flat. This led to a noticeable uptick in household savings rates.

This shift in consumer behavior directly influences BAWAG's retail banking operations. Stagnant spending, coupled with higher savings, can temper demand for new loans and potentially slow deposit growth as consumers prioritize accumulating cash.

Real Estate Market Dynamics

The performance of the real estate market, particularly commercial real estate (CRE), presents notable economic risks for financial institutions. While residential real estate lending has seen risk reduction through supervisory measures, the risks associated with CRE loans are escalating. This trend has prompted the implementation of additional capital buffers, expected to be introduced in mid-2025.

BAWAG Group's exposure to these real estate segments necessitates stringent risk management and continuous monitoring. The increasing concerns around CRE are reflected in market data, with some analysts projecting a potential decline in CRE values in certain European markets by up to 15% by the end of 2024, impacting loan collateral and asset quality.

- Commercial Real Estate Vulnerabilities: Intensifying risks in CRE lending due to market shifts and potential value declines.

- Regulatory Response: Introduction of additional capital buffers in mid-2025 to mitigate CRE-related risks.

- BAWAG Group Exposure: The bank's portfolio requires careful management of its real estate loan exposures.

- Market Outlook: Projections of CRE value decreases in certain European regions by up to 15% by year-end 2024.

Unemployment Rates and Labor Market

Unemployment rates are a critical economic indicator, directly influencing credit risk for financial institutions like BAWAG. When more people are out of work, the likelihood of loan defaults and the accumulation of non-performing loans (NPLs) naturally increases. This is because individuals facing job loss often struggle to meet their financial obligations.

Austria's labor market has demonstrated resilience, weathering economic headwinds effectively. However, projections suggest a modest uptick in the unemployment rate for 2025. For instance, Austria's unemployment rate stood at approximately 5.1% in the first quarter of 2024, a figure that could see a slight increase. This potential shift, even if small, warrants attention as it could subtly affect the quality of BAWAG's loan portfolio.

Conversely, a robust and stable labor market serves as a significant positive for asset quality. When employment is high and wages are steady, borrowers are better positioned to repay their loans, thereby bolstering the health of a bank's assets. BAWAG benefits from this stability, as a strong labor market generally translates to lower credit losses and a more predictable revenue stream.

- Austria's unemployment rate averaged around 5.1% in early 2024.

- Projections indicate a potential slight rise in unemployment for 2025.

- Higher unemployment directly correlates with increased credit risk and NPLs.

- A strong labor market is a key factor supporting asset quality for banks.

The economic landscape for BAWAG Group in 2024-2025 is shaped by evolving monetary policy and inflation trends. While the European Central Bank's (ECB) interest rate decisions directly impact net interest income, with potential rate cuts anticipated in 2025 after rate hikes in 2023-2024, inflation moderation to around 2.5% in Austria is expected. However, Austria's recession in 2024 and a projected modest economic recovery in 2025 suggest subdued demand for corporate lending and potential risks to asset quality, particularly in commercial real estate.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on BAWAG |

|---|---|---|---|

| ECB Key Interest Rate | Maintained at 3.75% (June 2024), signaling potential cuts | Anticipated cuts | Could temper net interest income post-rate hikes |

| Austrian Inflation | Moderating | Projected around 2.5% | Influences consumer spending and borrowing appetite |

| Austrian Economic Growth | Recession in 2024 | Modest recovery | Subdued demand for corporate lending, asset quality risks |

| Austrian Unemployment Rate | Approx. 5.1% (Q1 2024) | Slight projected increase | Potential increase in credit risk and non-performing loans |

| Commercial Real Estate Values | Potential decline up to 15% in some European markets (2024) | Continued market shifts | Escalating risks for CRE loans, necessitating capital buffers |

Preview the Actual Deliverable

Bawag Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bawag Group PESTLE analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing valuable strategic insights.

Sociological factors

Customers now demand intuitive digital banking, expecting everything from online account opening to sophisticated mobile apps and instant digital payments. This shift is a major sociological trend impacting the entire financial sector.

BAWAG Group's strategic imperative is to accelerate its digital transformation to keep pace with these evolving customer expectations. Failing to do so risks losing ground to agile fintech challengers and impacting customer loyalty.

In 2023, for instance, a significant majority of banking interactions across Europe were already conducted digitally, with mobile banking apps seeing a substantial rise in active users, highlighting the urgency for banks like BAWAG to maintain robust digital offerings.

Austria's demographic landscape is characterized by a steadily aging population, a trend that significantly impacts the banking sector. By 2024, projections indicate a continued increase in the proportion of individuals over 65, directly influencing demand for retirement planning services and wealth management solutions. BAWAG Group must adapt its product portfolio to address the growing need for specialized loan products catering to seniors and those planning for retirement.

BAWAG Group's success is influenced by the financial literacy of its target markets. In Austria, for example, while a significant portion of the population engages with banking services, understanding of more complex investment products can vary. Initiatives aimed at improving financial literacy, such as those promoted by the Austrian Financial Market Authority (FMA), can lead to greater adoption of BAWAG's offerings and a stronger customer base.

Public Trust and Reputation

Public trust in financial institutions like BAWAG Group is a cornerstone of its success, heavily shaped by historical events, ethical practices, and a commitment to transparency. Recent surveys in 2024 indicate that while trust in European banks has seen some recovery post-pandemic, a significant portion of the public still prioritizes institutions demonstrating strong ethical governance and clear communication. BAWAG's efforts to maintain a reputation for reliability and customer focus are therefore paramount for client acquisition and retention in the increasingly competitive banking landscape.

A strong public image directly impacts customer loyalty and the ability to attract new business. For instance, in 2023, BAWAG reported continued growth in its customer base, partly attributed to its consistent focus on customer satisfaction and digital accessibility. Negative publicity or perceived ethical lapses can erode this trust rapidly, impacting market share and profitability.

- Customer Trust Metrics: BAWAG's internal surveys in early 2024 show a 78% customer satisfaction rate, a key indicator of public trust.

- Reputation Management: The group actively monitors public sentiment through media analysis and customer feedback channels to address any emerging concerns promptly.

- Ethical Conduct: Adherence to stringent regulatory frameworks and a clear code of conduct are foundational to building and sustaining public confidence.

- Transparency Initiatives: BAWAG's commitment to transparent reporting, including detailed annual reports, aims to foster an informed and trusting customer base.

Workforce Dynamics and Talent Attraction

The availability of skilled talent, especially in tech, cybersecurity, and ESG, is paramount for BAWAG Group's expansion and innovation efforts. In 2024, the competition for these specialized roles intensified, with reports indicating a significant skills gap in European tech sectors. For instance, a 2024 study by the European Commission highlighted that over 60% of businesses struggle to find employees with adequate digital skills.

Changing work preferences, such as the widespread adoption of hybrid work models, directly impact talent attraction and retention. BAWAG Group, like many financial institutions, is adapting its strategies to accommodate these shifts. A survey in early 2025 revealed that over 75% of job seekers in the financial services industry prioritize flexible work arrangements. This necessitates a re-evaluation of traditional office-centric policies to remain competitive in the talent market.

The demand for diverse and inclusive workplaces is also a key sociological factor influencing BAWAG Group's human capital strategies. Companies that demonstrate a strong commitment to diversity and inclusion often see higher employee engagement and better talent acquisition outcomes. By mid-2025, BAWAG Group continued to focus on initiatives aimed at fostering a more inclusive environment, recognizing its importance in attracting and retaining a broad range of skilled professionals.

- Talent Demand: High demand for tech, cybersecurity, and ESG professionals in 2024/2025.

- Skills Gap: Over 60% of European businesses faced digital skills shortages in 2024.

- Work Preferences: 75% of financial services job seekers prioritize flexible work in early 2025.

- Inclusion Focus: BAWAG Group's ongoing commitment to diversity and inclusion for talent attraction.

Societal attitudes towards digital banking continue to shape BAWAG Group's operational focus, with a clear preference for intuitive online platforms and mobile applications. By 2024, a significant majority of banking transactions across Europe were digital, underscoring the need for BAWAG to maintain and enhance its digital offerings to meet customer expectations and compete with fintechs.

Austria's aging demographic presents both challenges and opportunities for BAWAG Group, necessitating a tailored approach to financial products and services. Projections for 2024 indicated a continued rise in the over-65 population, driving demand for retirement planning and specialized senior loan products.

Public trust remains a critical asset for BAWAG Group, influenced by ethical practices and transparency, with 2024 surveys showing a public prioritization of reliable financial institutions. BAWAG's commitment to robust governance and clear communication is essential for retaining and growing its customer base in a competitive market.

The financial literacy of BAWAG's customer base directly impacts product adoption, with initiatives to improve understanding of complex financial instruments being key. Efforts to boost financial literacy, supported by regulatory bodies, are expected to strengthen customer relationships and expand market reach.

Technological factors

The banking industry is rapidly embracing digital transformation, with automation becoming a cornerstone for operations like loan processing, payments, and customer support. BAWAG Group's commitment to digitalization is critical for boosting efficiency, cutting costs, and improving customer interactions across its various business areas.

In 2023, BAWAG reported a digital onboarding rate of 76% for new customers, highlighting significant progress in digitizing customer acquisition. The group's ongoing investment in technology aims to streamline internal processes, enhance data analytics capabilities, and deliver more personalized digital services, which is crucial for staying competitive in the evolving financial landscape.

The fintech landscape is rapidly evolving, presenting both significant challenges and avenues for growth for established financial institutions like BAWAG Group. These agile newcomers often leverage technology to deliver specialized services, potentially disrupting traditional banking models. For instance, in 2024, fintech investment globally continued to show resilience, with significant funding rounds in areas like digital payments and embedded finance, indicating ongoing innovation that BAWAG must address.

To stay competitive, BAWAG Group is actively pursuing a multi-pronged strategy. This includes fostering internal innovation to develop its own digital offerings and exploring strategic acquisitions or partnerships. A prime example of this approach was BAWAG's acquisition of Knab, a move designed to bolster its digital capabilities and expand its customer reach within the digital banking space. This proactive engagement with fintech is crucial for BAWAG to enhance its service portfolio and maintain its market position in the face of increasing competition.

As Bawag Group's operations continue to digitize, the threat landscape from cyberattacks and data breaches intensifies. Protecting sensitive customer information and ensuring uninterrupted service are critical, making advanced cybersecurity defenses non-negotiable. For instance, in 2023, the global average cost of a data breach reached $4.45 million, highlighting the significant financial and reputational risks involved.

Robust cybersecurity is essential for maintaining customer trust and operational resilience in the face of evolving threats. Regulatory mandates, such as the Digital Operational Resilience Act (DORA) in the EU, are pushing financial institutions like Bawag to bolster their Information and Communication Technology (ICT) risk management frameworks and incident reporting capabilities. DORA's implementation, expected to be fully in effect by early 2025, will further underscore the need for proactive and comprehensive cybersecurity strategies.

Artificial Intelligence (AI) and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are fundamentally reshaping the financial services landscape. These technologies are instrumental in elevating customer interactions through personalized advice and streamlined processes, while also bolstering operational resilience by enhancing risk assessment and fraud detection capabilities. For instance, in 2024, it's estimated that AI in banking could save the industry billions annually through improved efficiency and reduced losses from fraud.

BAWAG Group is well-positioned to harness the power of AI and ML to drive significant improvements across its operations. By integrating these advanced analytics, the group can refine its credit scoring models for more accurate risk evaluation, automate routine customer service inquiries to free up human resources for complex tasks, and unlock deeper, actionable insights from its extensive data repositories. This strategic adoption is crucial for maintaining a competitive edge and fostering smarter, more data-driven decision-making.

- Enhanced Customer Experience: AI-powered chatbots and personalized financial advice platforms are becoming standard, with projections suggesting AI will handle over 90% of customer service interactions in leading banks by 2025.

- Improved Risk Management: Machine learning algorithms are proving highly effective in identifying subtle patterns indicative of credit risk or fraudulent activity, potentially reducing loan default rates by up to 20% in some applications.

- Operational Efficiency: Automation of tasks like data entry, document analysis, and compliance checks through AI can lead to substantial cost savings and faster processing times, with some institutions reporting a 30% increase in operational efficiency post-AI implementation.

- Data-Driven Insights: AI and ML enable the analysis of vast datasets to identify market trends, customer behavior patterns, and potential new product opportunities, leading to more informed strategic planning.

Cloud Computing Adoption

Cloud computing adoption is a significant technological factor for BAWAG Group. Migrating to the cloud offers substantial advantages like improved scalability, cost savings, and better data management. This move helps BAWAG handle increasing data and support its digital offerings, making its IT infrastructure more adaptable.

The global cloud computing market is projected to reach over $1.3 trillion by 2025, highlighting its widespread adoption across industries, including finance. For BAWAG, this means leveraging advanced technologies to streamline operations and enhance customer experiences.

- Scalability: Cloud solutions allow BAWAG to easily adjust its IT resources up or down based on demand, ensuring efficient operations.

- Cost Efficiency: Moving to the cloud can reduce capital expenditure on hardware and IT maintenance, leading to significant operational savings.

- Data Management: Enhanced data storage and processing capabilities in the cloud support BAWAG's growing data needs and analytics efforts.

The banking sector's technological evolution is accelerating, with BAWAG Group actively integrating advanced solutions. Digital onboarding reached 76% in 2023, underscoring a commitment to efficient customer acquisition. Continued investment in technology is vital for streamlining processes and enhancing data analytics.

The rise of fintech presents both opportunities and challenges, with global fintech investment remaining robust in 2024, particularly in payments and embedded finance. BAWAG's strategy includes internal innovation and strategic partnerships, such as the acquisition of Knab, to bolster digital capabilities.

Cybersecurity is paramount, especially with increasing digitalization. The global average cost of a data breach in 2023 was $4.45 million, emphasizing the need for robust defenses. EU regulations like DORA, effective by early 2025, mandate stronger ICT risk management and incident reporting.

AI and ML are transforming banking, improving customer service and risk management. Projections suggest AI could save the industry billions annually by 2024 through efficiency gains. BAWAG can leverage these technologies for better credit scoring, automated customer service, and data-driven insights.

| Technological Factor | BAWAG Group's Strategy/Impact | Relevant Data/Projections |

| Digitalization & Automation | Improving efficiency, cost reduction, enhanced customer interaction. | 76% digital onboarding rate (2023). |

| Fintech Integration | Responding to agile competitors, expanding digital offerings. | Continued strong global fintech investment (2024). |

| Cybersecurity | Protecting data, ensuring operational resilience, meeting regulatory demands. | $4.45M average data breach cost (2023); DORA implementation by early 2025. |

| AI & Machine Learning | Personalized services, improved risk management, operational efficiency. | AI in banking could save billions annually (2024 projection). |

Legal factors

BAWAG Group operates under the stringent EU Banking Package, encompassing the Capital Requirements Regulation (CRR) and Capital Requirements Directive (CRD). This regulatory framework dictates the capital buffers and risk management practices essential for its operations.

The forthcoming implementation of CRR III and CRD VI is set to introduce substantial adjustments to capital requirements and supervisory oversight, particularly for third-country branches. These revisions are designed to bolster the resilience of the European banking sector amidst evolving economic conditions.

Adherence to these dynamic regulatory shifts is paramount for BAWAG Group to sustain its financial stability and retain its operational licenses within the European Union. The group must proactively adapt its strategies to meet these updated capital and supervisory demands.

BAWAG Group's operations are significantly shaped by stringent data privacy regulations, most notably the General Data Protection Regulation (GDPR) within the European Union. These laws mandate careful handling of customer information, impacting data collection, processing, and storage practices.

Non-compliance with GDPR can lead to substantial financial penalties, with fines potentially reaching up to 4% of annual global turnover or €20 million, whichever is greater. For instance, in 2023, various companies faced significant GDPR fines, underscoring the regulatory risk.

Adherence to these privacy mandates is not just about avoiding fines; it's fundamental to maintaining customer trust and safeguarding BAWAG Group's reputation in an increasingly data-sensitive market.

Financial institutions like BAWAG Group are under constant scrutiny to adhere to stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. These laws are designed to prevent the financial system from being exploited for illicit purposes.

The European Banking Authority (EBA) has been instrumental in developing new AML/CFT frameworks and guidelines, aiming to establish uniform compliance standards across the European Union, particularly concerning restrictive measures. This harmonization ensures a more consistent approach to combating financial crime.

To meet these evolving legal demands, BAWAG Group must allocate significant resources towards advanced technological systems and comprehensive employee training. These investments are crucial for effectively identifying, preventing, and reporting suspicious financial activities, thereby safeguarding the integrity of its operations and the broader financial ecosystem.

Consumer Protection Laws

Consumer protection laws, such as those governing credit agreements and fair banking practices, significantly shape BAWAG Group's product development and marketing strategies. Adherence to these regulations is crucial for ensuring equitable customer treatment, deterring predatory lending, and minimizing legal and reputational damage. For instance, in 2024, the European Banking Authority continued to emphasize robust consumer protection frameworks across the EU, influencing how banks like BAWAG structure their loan offerings and disclosure requirements.

BAWAG Group must navigate a complex web of consumer protection legislation that mandates transparency in financial dealings and prohibits unfair or deceptive practices. This includes regulations on data privacy, complaint handling, and the clear communication of terms and conditions for all financial products. Failure to comply can result in substantial fines and a loss of customer trust, impacting market share and profitability.

- Regulatory Scrutiny: BAWAG Group faces ongoing oversight from bodies like the Austrian Financial Market Authority (FMA) and European regulators regarding consumer protection standards.

- Product Design Impact: Laws dictate how loan products, deposit accounts, and investment services are presented, ensuring clarity on fees, interest rates, and risks.

- Risk Mitigation: Robust compliance programs help BAWAG avoid litigation and reputational damage stemming from consumer complaints or alleged misconduct.

- Market Trust: Demonstrating a commitment to consumer protection fosters trust, which is vital for customer retention and attracting new business in the competitive banking sector.

Digital Operational Resilience Act (DORA) and MiCA

The European Union's Digital Operational Resilience Act (DORA) and Markets in Crypto-Assets Regulation (MiCA) are fundamentally reshaping the financial landscape. DORA mandates enhanced cybersecurity and operational resilience across financial entities, requiring robust risk management frameworks and incident reporting. MiCA, on the other hand, establishes a comprehensive regulatory regime for crypto-assets, covering issuance, trading, and service providers.

BAWAG Group is actively adapting to these pivotal regulations. For DORA, the focus is on strengthening internal processes to meet heightened cybersecurity demands and ensure business continuity. Regarding MiCA, BAWAG is evaluating its involvement in the crypto-asset ecosystem to ensure full compliance with new rules governing digital assets and related services.

- DORA Compliance: BAWAG is investing in advanced cybersecurity measures and operational resilience testing to meet DORA's stringent requirements, aiming to minimize digital operational risks.

- MiCA Adaptation: The group is assessing potential impacts and opportunities presented by MiCA, particularly concerning any future engagement with regulated crypto-asset activities.

- Operational Optimization: BAWAG is streamlining its operational frameworks to efficiently integrate the compliance obligations stemming from both DORA and MiCA, ensuring seamless integration into existing business models.

BAWAG Group must navigate evolving EU banking regulations, with CRR III and CRD VI set to increase capital requirements and supervisory oversight, impacting third-country branches. Compliance with these dynamic rules is vital for maintaining financial stability and operational licenses.

The group faces significant legal obligations under GDPR, requiring careful handling of customer data and carrying substantial penalties for non-compliance, with fines potentially reaching 4% of global turnover. Adherence to these privacy mandates is crucial for customer trust and reputation.

Stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations, reinforced by EBA guidelines, necessitate ongoing investment in technology and training to combat financial crime effectively.

Consumer protection laws, emphasized by the EBA in 2024, dictate transparency in financial dealings and prohibit unfair practices, impacting product design and marketing to ensure equitable customer treatment and mitigate legal risks.

Environmental factors

BAWAG Group actively integrates Environmental, Social, and Governance (ESG) factors into its core business strategy, viewing them as fundamental to sustainable value creation. This approach ensures that ESG considerations are central to all decision-making processes, fostering long-term success for the bank and its stakeholders. For instance, in 2023, BAWAG reported a 12% increase in its sustainable finance portfolio, reaching €25.5 billion, demonstrating a tangible commitment to environmentally and socially responsible lending.

Financial institutions like BAWAG Group face growing exposure to climate change. This includes physical risks, such as extreme weather events damaging assets used as collateral for loans, and transition risks, stemming from policy changes that favor a low-carbon economy and could impact carbon-intensive sectors in BAWAG's portfolio. For instance, the European Central Bank's 2024 climate risk stress test indicated that a significant portion of the banking sector's real estate collateral could be exposed to physical climate risks.

To ensure long-term stability, BAWAG must proactively assess and integrate these climate-related risks into its core operations. This means embedding climate considerations into lending decisions, refining risk assessment models to account for climate impacts, and enhancing transparency through robust disclosures. By doing so, BAWAG can better manage potential financial headwinds and capitalize on opportunities within the evolving green economy.

There's a clear upward trend in demand for green financial products, including green mortgages and sustainable loans. This is mirrored by increasing regulatory mandates pushing for more sustainable lending practices across the financial sector.

BAWAG Group is actively responding to this by setting specific targets for its green lending initiatives. For instance, the bank aims to significantly grow new business in this segment, a move directly aimed at mitigating long-term climate-related risks and actively supporting the shift to a low-carbon economy.

Regulatory Pressure for ESG Disclosure

Regulatory bodies globally, including those in Europe, are intensifying their scrutiny of Environmental, Social, and Governance (ESG) performance and risk management. This heightened focus translates into mandates for greater transparency and integrity in ESG ratings and the burgeoning field of sustainable investments. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD) is a significant driver, requiring extensive ESG disclosures.

BAWAG Group is actively responding to these evolving demands. The group is reporting in accordance with the European Sustainability Reporting Standards (ESRS), a comprehensive framework designed to standardize sustainability disclosures. Furthermore, BAWAG Group has disclosed its environmental data to CDP (formerly the Carbon Disclosure Project), a global non-profit that runs the world’s environmental disclosure system for companies, cities, states, and regions. This dual approach demonstrates a commitment to robust ESG reporting and adherence to increasingly stringent regulatory requirements.

- Increased Regulatory Scrutiny: Global regulators are prioritizing ESG disclosure and risk management, demanding more transparent and reliable ESG ratings and sustainable investment practices.

- ESRS Reporting: BAWAG Group is aligned with the European Sustainability Reporting Standards (ESRS), ensuring comprehensive and standardized ESG data.

- CDP Disclosure: The group's disclosure to CDP highlights its commitment to transparent environmental reporting and engagement with key sustainability initiatives.

Reputational Risks and Stakeholder Expectations

Failure to effectively manage environmental concerns and showcase robust Environmental, Social, and Governance (ESG) performance can severely damage a company's reputation and erode trust among key stakeholders, including investors, customers, and employees. This can translate into tangible financial consequences.

BAWAG Group's strategic focus on reducing its CO2 emissions and increasing the representation of women in leadership roles demonstrates a clear understanding of these evolving stakeholder expectations. This proactive stance on social and environmental responsibility is crucial for maintaining a positive brand image and attracting investment.

- BAWAG Group aims to reduce financed emissions intensity by 40% by 2030 compared to 2019 levels.

- The group has set a target to increase the share of women in management positions to at least 35% by 2025.

- In 2023, BAWAG Group reported that 31% of its management positions were held by women.

- Investor demand for ESG-compliant investments continues to grow, with global sustainable fund assets projected to reach $50 trillion by 2025.

Environmental factors significantly influence BAWAG Group's operations, particularly concerning climate-related risks and the increasing demand for sustainable finance. The bank must navigate physical and transition risks associated with climate change, as highlighted by the European Central Bank's 2024 stress tests on real estate collateral. BAWAG's commitment to growing its sustainable finance portfolio, which reached €25.5 billion in 2023, reflects its strategy to mitigate these risks and capitalize on the green economy.

| Environmental Aspect | BAWAG Group's Response/Data | Year/Target |

|---|---|---|

| Sustainable Finance Portfolio Growth | €25.5 billion | 2023 |

| Financed Emissions Intensity Reduction Target | 40% | By 2030 (vs. 2019) |

| Climate Risk Assessment | Incorporating into lending and risk models | Ongoing |

| Regulatory Alignment | ESRS Reporting, CDP Disclosure | Ongoing |

PESTLE Analysis Data Sources

Our Bawag Group PESTLE Analysis is built on a comprehensive review of data from reputable financial institutions, regulatory bodies, and leading market research firms. We draw insights from economic reports, legislative updates, technological advancements, and socio-demographic trends to provide a holistic view.