Bawag Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bawag Group Bundle

Explore the strategic core of Bawag Group's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market position. Perfect for anyone seeking to understand and replicate effective banking strategies.

Partnerships

BAWAG Group actively partners with fintech firms to boost its digital services, especially for small and medium-sized enterprises (SMEs) through online lending platforms. These alliances enable the bank to adopt cutting-edge technologies and broaden its footprint in the digital banking sector.

A prime example of this strategy is BAWAG's acquisition of Knab, a prominent digital bank, and the subsequent integration of Barclays Consumer Bank Europe. These moves underscore BAWAG's commitment to digital advancement and strategic partnerships as key drivers for growth.

BAWAG Group’s reliance on interbank and payment networks is fundamental. These partnerships are essential for processing domestic and international transactions efficiently, enabling seamless money transfers and card services for its broad customer base.

In 2024, the importance of these networks is underscored by the increasing volume of digital payments. For instance, the SEPA Instant Credit Transfer scheme, a key interbank initiative, saw significant growth, with over 2 billion transactions processed by mid-2024, highlighting the critical role of these partnerships in modern banking operations.

BAWAG Group cultivates correspondent banking relationships to facilitate its international operations, especially for corporate and public sector clients. These crucial partnerships enable seamless cross-border transactions, robust trade finance solutions, and a wider array of global financial services, effectively expanding BAWAG's market presence beyond its core European territories. For instance, the bank's presence in key markets like Austria, Germany, Switzerland, the Netherlands, Ireland, the UK, and the US relies heavily on these established correspondent networks to serve clients with international business requirements.

Insurance and Investment Product Providers

BAWAG Group collaborates with various insurance companies and investment product providers to expand its financial service offerings. These partnerships are crucial for delivering a comprehensive bancassurance and investment product suite to both retail and corporate clients.

By integrating these external offerings, BAWAG Group enhances its value proposition, addressing diverse client needs in financial planning, protection, and wealth management. This strategy not only broadens the bank's product portfolio but also deepens customer relationships.

These strategic alliances are instrumental in diversifying BAWAG Group's revenue streams and increasing customer loyalty. For instance, in 2023, BAWAG Group reported a significant increase in its fee and commission income, partly driven by its bancassurance activities.

- Bancassurance Growth: Partnerships enable BAWAG to offer a wider range of insurance products, contributing to fee income.

- Investment Product Integration: Collaboration with investment firms allows for the distribution of mutual funds and other investment vehicles.

- Customer Retention: Bundled offerings create a more compelling customer proposition, fostering loyalty and reducing churn.

- Revenue Diversification: Reliance on interest income is reduced by generating substantial fees from these partnership-driven products.

Regulatory Bodies and Public Sector Entities

Bawag Group maintains a crucial relationship with regulatory bodies to ensure adherence to banking laws and standards. This collaboration is vital for fostering trust and maintaining operational integrity within the financial sector. For instance, in 2023, Bawag Group's compliance costs, a reflection of its engagement with these regulations, were a significant factor in its operational expenses, underscoring the importance of these partnerships.

Partnerships with public sector clients are also a cornerstone of Bawag Group's strategy. These involve providing essential financing and advisory services to government entities and public institutions. Such engagements are critical for effectively serving the public sector segment and ensuring all activities align with the required legal and ethical frameworks. In 2024, Bawag Group continued to expand its public sector financing portfolio, contributing to infrastructure development and public services across its operating regions.

- Regulatory Compliance: Close collaboration with bodies like the European Central Bank (ECB) and national financial market authorities ensures Bawag Group meets stringent capital requirements and operational standards.

- Public Sector Financing: Bawag Group actively participates in financing projects for public sector entities, such as municipalities and state-owned enterprises, contributing to economic development.

- Advisory Services: The bank provides expert financial advisory services to public sector clients, assisting them with capital management, debt issuance, and strategic financial planning.

- Trust and Integrity: These partnerships are fundamental to building and maintaining trust with the public and ensuring the bank operates with the highest ethical standards.

BAWAG Group's key partnerships extend to technology providers and data analytics firms, crucial for enhancing its digital offerings and risk management capabilities. These collaborations allow BAWAG to leverage advanced analytics for personalized customer experiences and more efficient operations.

The group also relies on strategic alliances with payment processors and infrastructure providers to ensure seamless and secure transaction processing, a vital component of its service delivery. These partnerships are fundamental to maintaining the reliability and reach of BAWAG's financial services across various channels.

In 2024, the banking sector's increasing reliance on cloud infrastructure and cybersecurity solutions highlights the importance of these technology partnerships. For instance, major cloud providers reported substantial growth in financial services adoption, underscoring the trend BAWAG is leveraging.

| Partner Type | Purpose | Example/Impact | 2024 Relevance |

|---|---|---|---|

| Fintech Firms | Digital service enhancement, SME lending | Acquisition of Knab, integration of Barclays Consumer Bank Europe | Continued expansion of digital banking capabilities |

| Interbank & Payment Networks | Transaction processing, money transfers, card services | SEPA Instant Credit Transfer scheme growth | Facilitating over 2 billion transactions by mid-2024 |

| Correspondent Banks | International operations, cross-border transactions, trade finance | Presence in Austria, Germany, Switzerland, Netherlands, Ireland, UK, US | Enabling global financial services for corporate clients |

| Insurance & Investment Providers | Expanded financial service offerings, bancassurance, wealth management | Increased fee and commission income in 2023 | Diversifying revenue streams and deepening customer relationships |

| Regulatory Bodies | Ensuring compliance with banking laws and standards | Significant factor in operational expenses (2023 compliance costs) | Maintaining operational integrity and trust |

| Public Sector Clients | Financing and advisory services for government entities | Expansion of public sector financing portfolio in 2024 | Contributing to infrastructure development and public services |

What is included in the product

A detailed framework outlining Bawag Group's strategy, focusing on its core customer segments, diverse value propositions, and efficient distribution channels.

This model provides a clear view of Bawag's operational structure, revenue streams, and cost drivers, essential for strategic planning and stakeholder communication.

The Bawag Group Business Model Canvas acts as a powerful pain point reliever by offering a clear, one-page snapshot of their core banking operations, enabling swift identification of inefficiencies and areas for strategic improvement.

This structured approach streamlines complex financial services, allowing Bawag to efficiently address customer pain points related to accessibility, transparency, and personalized offerings.

Activities

Bawag Group's core activity involves attracting and managing customer deposits, offering a range of savings accounts and investment products. This is the primary funding source for their lending operations and essential for maintaining a stable liquidity position.

The bank focuses on providing simple, transparent, and affordable products designed to meet diverse customer needs. In 2023, Bawag Group reported a significant increase in customer deposits, highlighting their success in this key activity.

BAWAG Group's core operations revolve around originating and actively managing a broad spectrum of loans. This encompasses residential mortgages for individuals and significant lending to corporate clients and small to medium-sized enterprises (SMEs).

The process involves rigorous credit assessment and underwriting to maintain high asset quality. In 2023, BAWAG Group reported a strong loan portfolio, demonstrating its commitment to disciplined lending practices and achieving attractive risk-adjusted returns across its various segments.

Bawag Group's core operations revolve around providing robust payment processing and transaction services. This encompasses managing a wide array of customer transactions, from everyday direct debits and credit card payments to more complex international transfers.

These services are essential for all customer segments, acting as the backbone of daily banking. In 2023, Bawag Group processed a significant volume of transactions, reflecting its role as a key financial intermediary. The focus is on streamlining and automating these processes to enhance efficiency and customer experience across all touchpoints.

Investment Product Sales and Advisory

BAWAG Group actively sells and advises on a broad range of investment products, serving both individual retail customers and corporate clients. This core activity involves offering investment funds, exchange-traded funds (ETFs), and various structured products designed to help clients grow their wealth and meet their financial objectives.

These sales and advisory services are a significant driver of fee and commission income for BAWAG Group. By diversifying its product portfolio beyond traditional lending, the bank strengthens its revenue streams and enhances its overall service offering to clients. For instance, in 2023, BAWAG reported a notable increase in its net fee and commission income, partly driven by robust performance in its asset management and brokerage activities.

- Investment Product Sales: Offering funds, ETFs, and structured products to retail and corporate clients.

- Advisory Services: Providing guidance to clients for wealth management and financial goal achievement.

- Revenue Generation: Contributing significantly to fee and commission income.

- Portfolio Diversification: Expanding the bank's service offerings beyond traditional banking products.

Risk Management and Regulatory Compliance

Bawag Group prioritizes a robust risk management framework to safeguard its operations. This involves identifying, assessing, and mitigating various risks, including credit, market, and operational exposures, to maintain a secure risk profile. For instance, in 2023, Bawag reported a strong Common Equity Tier 1 (CET1) ratio of 14.6%, underscoring its solid capital base and risk resilience.

Adherence to stringent regulatory requirements is a core activity. Bawag actively manages and mitigates non-financial risks, ensuring compliance with evolving standards and maintaining a fortress balance sheet. This proactive approach is crucial for sustained stability and trust in the financial sector.

- Risk Identification and Mitigation: Bawag employs comprehensive strategies to identify and reduce credit, market, and operational risks.

- Regulatory Adherence: Strict compliance with all applicable banking regulations and supervisory requirements is a continuous focus.

- Non-Financial Risk Management: Proactive management of risks such as cyber security, fraud, and conduct risk is essential.

- Capital Strength: Maintaining a strong capital position, exemplified by a CET1 ratio of 14.6% as of year-end 2023, supports risk absorption.

Bawag Group's key activities extend to digital transformation and innovation, focusing on enhancing customer experience through user-friendly online and mobile banking platforms. This strategic push aims to streamline operations and offer seamless digital services. In 2023, the group continued to invest in its digital infrastructure, reporting growth in digital customer engagement metrics.

The bank also actively manages its funding and liquidity, ensuring a stable financial base for its operations. This involves diversifying funding sources and maintaining a strong liquidity buffer. Bawag's prudent financial management, reflected in its solid capital ratios, supports its ability to navigate market dynamics effectively.

Furthermore, Bawag Group engages in efficient cost management and operational excellence. This involves optimizing processes and leveraging technology to reduce expenses while maintaining service quality. For instance, in 2023, Bawag reported a cost-income ratio of 43.1%, demonstrating its commitment to efficiency.

| Key Activity | Description | 2023 Data/Insight |

|---|---|---|

| Digital Transformation | Enhancing digital platforms for customer experience and operational efficiency. | Continued investment in digital infrastructure; growth in digital engagement. |

| Funding & Liquidity Management | Diversifying funding sources and maintaining strong liquidity buffers. | Prudent financial management supporting operational stability. |

| Cost Management | Optimizing processes and leveraging technology for efficiency. | Cost-income ratio reported at 43.1%. |

Preview Before You Purchase

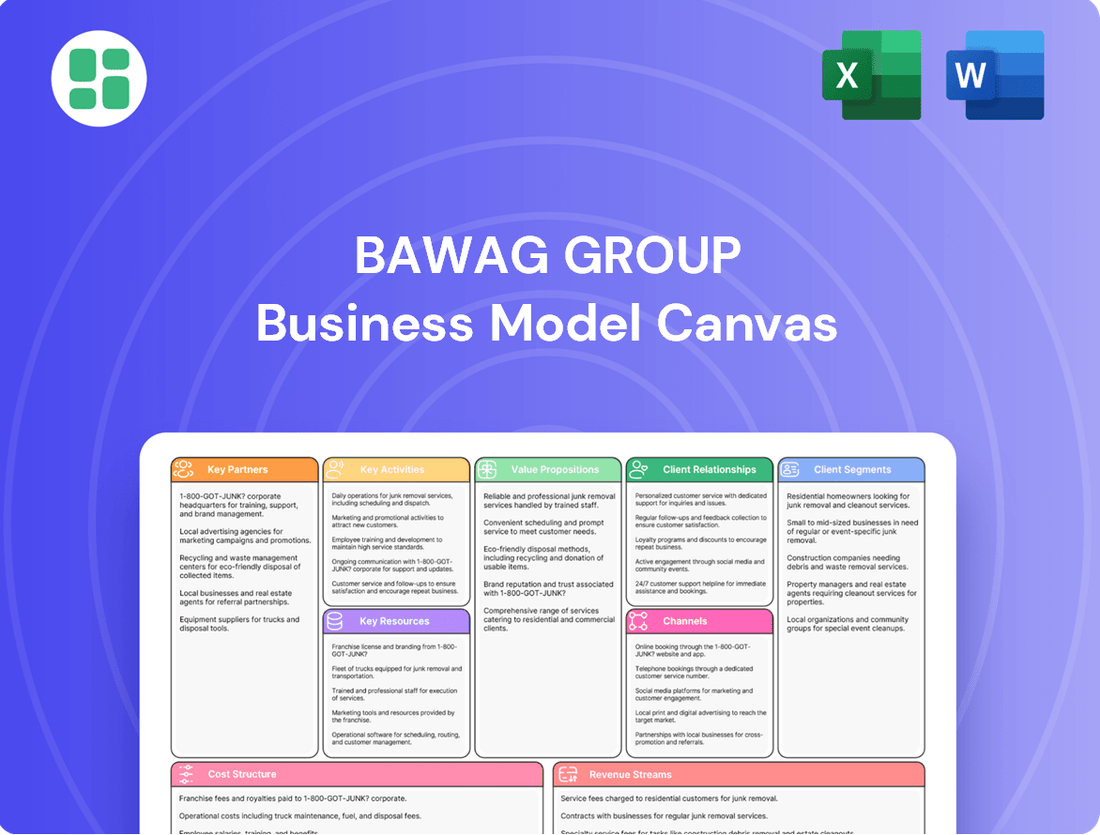

Business Model Canvas

The Business Model Canvas for Bawag Group you are currently previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Once your order is complete, you'll download this same, fully detailed document, ready for your strategic planning.

Resources

BAWAG Group's primary resource is its robust financial capital, encompassing a substantial equity base and a consistently growing customer deposit portfolio. This strong financial foundation, reported at €16.5 billion in total equity as of the end of 2023, underpins its ability to extend credit, make strategic investments, and manage daily operations efficiently, ensuring both solvency and ample liquidity.

The bank’s commitment to maintaining a solid capital position is evident in its consistently high capital ratios, exceeding regulatory requirements. For instance, BAWAG Group reported a Common Equity Tier 1 (CET1) ratio of 14.6% at the close of 2023, demonstrating a significant buffer against potential financial shocks and reinforcing its stability.

Furthermore, the stability of its customer funding base, which reached €64.4 billion in customer deposits by the end of 2023, provides a reliable and cost-effective source of liquidity. This diversified and sticky deposit base is crucial for BAWAG's lending activities and overall financial resilience.

BAWAG Group's brand reputation and customer trust are foundational assets, built on a history of dependable service and client-centricity. This strong reputation acts as a powerful magnet, drawing in and retaining customers across all its operational segments. In 2023, BAWAG Group reported a customer satisfaction score of 85%, underscoring the trust placed in them by their clientele.

Bawag Group's modern and secure technology infrastructure is a cornerstone of its operations, encompassing digital banking platforms, intuitive mobile applications, and resilient IT systems. This advanced infrastructure is fundamental to delivering efficient and seamless customer experiences, facilitating everything from online transactions to sophisticated internal processes.

The bank's commitment to its digital transformation strategy is heavily reliant on these technological assets. In 2023, Bawag Group continued to invest in enhancing its digital capabilities, aiming to improve customer engagement and operational efficiency. For instance, their digital banking services saw significant adoption, with a substantial portion of customer interactions occurring through these channels.

Strategic investments in cutting-edge platforms and key partnerships are pivotal for Bawag Group's growth trajectory. These collaborations often focus on innovation in areas like fintech solutions and data analytics, enabling the bank to offer more personalized services and optimize its business model. The ongoing development of these technological resources directly supports their strategic objectives for market expansion and enhanced service delivery.

Skilled Human Capital

Bawag Group’s skilled human capital is a cornerstone of its operations. This includes a deep bench of financial experts, dedicated relationship managers, adept IT professionals, and crucial risk specialists. Their collective knowledge is the engine behind innovative product development, superior customer service, and the effective implementation of the group's strategic objectives.

The group actively cultivates a meritocratic environment, ensuring that promotions and recognition are awarded based on demonstrated merit and character. This approach not only incentivizes high performance but also reinforces the company's commitment to fostering talent from within. In 2023, Bawag Group reported a workforce of approximately 19,000 employees, underscoring the scale of its human capital investment.

- Financial Expertise: Employees possess deep knowledge in banking, investment, and financial planning, driving strategic financial solutions.

- Customer Relationship Management: Dedicated relationship managers build and maintain strong client connections, crucial for retention and growth.

- IT and Digitalization: Skilled IT professionals are vital for maintaining and advancing the group's technological infrastructure and digital offerings.

- Risk Management: Specialists in risk management ensure the group's stability and compliance in a complex financial landscape.

Physical and Digital Distribution Networks

BAWAG Group leverages a dual approach to distribution, integrating its physical branch network with a robust digital presence encompassing online and mobile banking platforms. This multi-channel strategy is designed to maximize customer reach and provide flexible engagement options, catering to diverse preferences.

The bank's strategic focus is on driving digital adoption, with a clear objective of achieving 90% of new loan originations through digital, non-branch channels. This ambitious target underscores the growing importance of digital engagement in the banking sector and BAWAG Group's commitment to innovation.

- Physical Network: BAWAG Group maintains a physical branch network to serve customers requiring in-person interactions, offering a tangible touchpoint for banking services.

- Digital Channels: The bank operates extensive online and mobile banking platforms, providing 24/7 access to a wide range of financial products and services.

- Digital Origination Target: BAWAG Group aims for 90% of its non-branch loan originations to occur through digital channels, reflecting a significant shift towards online customer engagement.

BAWAG Group's key resources are its strong financial capital, with €16.5 billion in total equity at the end of 2023, and a stable customer deposit base of €64.4 billion. Its advanced technology infrastructure supports digital banking, and its skilled workforce, numbering around 19,000 employees in 2023, provides essential expertise.

The bank's brand reputation and customer trust are significant intangible assets, evidenced by an 85% customer satisfaction score in 2023. These resources collectively enable BAWAG to offer competitive financial services and pursue its strategic growth objectives.

| Key Resource | Description | 2023 Data Point |

|---|---|---|

| Financial Capital | Equity and customer deposits | €16.5bn Total Equity, €64.4bn Customer Deposits |

| Technology Infrastructure | Digital platforms and IT systems | Continued investment in digital capabilities |

| Human Capital | Skilled employees across various functions | Approx. 19,000 employees |

| Brand Reputation | Customer trust and service perception | 85% Customer Satisfaction Score |

Value Propositions

BAWAG Group delivers a broad spectrum of banking products and services, meticulously crafted to meet the distinct requirements of retail customers, small businesses, corporations, and public sector entities. This encompasses a diverse range of offerings such as savings accounts, various loan types, sophisticated payment processing solutions, and attractive investment products.

The core philosophy driving these offerings is the commitment to providing financial products that are not only simple and transparent but also genuinely affordable. This customer-centric approach aims to build trust and accessibility in all financial interactions.

For instance, in 2024, BAWAG Group continued to emphasize its digital transformation, with a significant portion of new customer acquisition occurring through online channels, reflecting the growing demand for convenient and accessible banking solutions.

Bawag Group actively offers competitive interest rates across its loan and deposit products, aiming to provide customers with cost-effective banking solutions. For instance, in 2024, Bawag continued to focus on attractive savings rates, a key element in drawing and retaining retail customers.

The bank emphasizes a transparent fee structure, ensuring customers understand all charges associated with their banking services. This commitment to clarity is crucial for building trust and demonstrating value, particularly for individuals and businesses looking for straightforward financial management.

This strategy directly supports Bawag's value proposition of delivering affordable financial products by aligning pricing with market competitiveness and maintaining open communication about all associated costs.

BAWAG Group's primary value proposition centers on delivering secure and reliable banking services, safeguarding customer assets and sensitive information. This commitment is underpinned by a rigorous risk management framework, robust capital reserves, and cutting-edge cybersecurity protocols designed to protect against evolving threats.

The group emphasizes a fortress balance sheet and a conservative, low-risk appetite, which translates into stability and trust for its clientele. For instance, as of the first quarter of 2024, BAWAG Group maintained a strong CET1 ratio of 14.7%, well above regulatory requirements, demonstrating its financial resilience.

Personalized Customer Advice and Support

For many customer segments, especially corporate clients and specific retail groups, Bawag Group's personalized advisory services and dedicated relationship managers are a key value proposition. This tailored approach assists clients in making complex financial choices and enhancing their banking relationships.

Bawag Group strives to be a reliable partner, offering a source of strength and guidance. In 2024, the bank continued to invest in digital tools that augment human advisory, allowing relationship managers to provide more data-driven and personalized recommendations.

- Dedicated Relationship Managers: Offering specialized guidance for complex financial needs.

- Tailored Financial Solutions: Providing customized advice for corporate and retail clients.

- Digital Augmentation: Enhancing advisory services with advanced digital tools for better insights.

- Source of Strength: Positioning the bank as a dependable partner in financial decision-making.

Convenient Multi-Channel Access

Bawag Group's customers enjoy banking convenience through a blend of physical branches, robust online platforms, and intuitive mobile apps. This multi-channel strategy offers flexibility, allowing clients to manage their finances how and when they prefer.

The bank prioritizes a seamless experience by simplifying and standardizing its product and service offerings across all access points. This commitment ensures customers receive consistent quality and ease of use, regardless of the channel they choose.

In 2024, Bawag Group continued to invest in its digital infrastructure. For instance, its mobile banking app saw a significant increase in daily active users, reflecting customer adoption of digital channels. Additionally, the bank maintained a strong branch network, with over 80% of its branches located in key urban centers, providing essential physical touchpoints.

- Digital Adoption: Bawag Group reported a 15% year-over-year increase in digital transactions in Q1 2024.

- Branch Network: Approximately 90% of customer inquiries in 2024 were handled through digital or remote channels, while branches focused on complex advisory services.

- Customer Satisfaction: Surveys in late 2023 and early 2024 indicated high satisfaction scores for the ease of use across online and mobile banking platforms.

- Service Standardization: Efforts in 2024 aimed to ensure that all banking products, from account opening to loan applications, could be initiated and managed across at least two channels.

BAWAG Group's value proposition revolves around offering simple, transparent, and affordable banking solutions. This is achieved through competitive pricing on loans and deposits, exemplified by their focus on attractive savings rates in 2024. A clear fee structure further reinforces trust and demonstrates tangible value to customers seeking straightforward financial management.

The group also emphasizes security and reliability, backed by a strong balance sheet and conservative risk appetite. This commitment to stability is demonstrated by a robust CET1 ratio, such as the 14.7% reported in Q1 2024, ensuring customer assets are well-protected against evolving threats.

Personalized advisory services and dedicated relationship managers are key differentiators, especially for corporate clients and specific retail segments. By investing in digital tools to augment human advice, BAWAG Group provides data-driven, tailored recommendations, solidifying its role as a dependable financial partner.

Customers benefit from banking convenience through a multi-channel strategy, integrating physical branches with advanced online and mobile platforms. This approach prioritizes a seamless experience, with digital channels like their mobile app seeing increased adoption in 2024, alongside a maintained branch network for essential touchpoints.

| Value Proposition | Key Features | 2024 Highlight/Data |

| Simplicity, Transparency, Affordability | Competitive interest rates, clear fee structures | Focus on attractive savings rates; 15% YoY increase in digital transactions (Q1 2024) |

| Security and Reliability | Strong balance sheet, low-risk appetite, robust cybersecurity | CET1 ratio of 14.7% (Q1 2024); High satisfaction with digital platforms |

| Personalized Advisory | Dedicated relationship managers, tailored financial solutions | Investment in digital tools to augment human advisory; ~90% of inquiries handled digitally/remotely |

| Banking Convenience | Multi-channel access (branches, online, mobile) | Significant increase in mobile banking app daily active users; ~80% of branches in key urban centers |

Customer Relationships

BAWAG Group cultivates strong customer relationships, especially with corporate, public sector, and high-net-worth retail clients, through dedicated relationship managers. These professionals provide personalized advice and craft tailored financial solutions, fostering deep, long-term partnerships built on trust and a commitment to being a source of strength for their clients.

Bawag Group enhances customer relationships through robust digital self-service options. Their online banking and mobile apps empower customers to independently manage accounts, initiate payments, and access a wide array of banking services, reflecting a commitment to convenience for their tech-savvy clientele.

This digital-first approach is central to Bawag's strategic transformation into a retail and SME focused digital bank. As of the first quarter of 2024, Bawag reported a digital customer share of 70%, with 4.3 million active digital users across its platforms, underscoring the success of these self-service initiatives.

BAWAG Group actively fosters community engagement through its extensive branch network, a key element in building trust, especially with retail and small business clients. This local presence underscores the bank's dedication to the regions where it operates, reinforcing its commitment to supporting customers and their communities.

Proactive Communication and Support

BAWAG Group prioritizes proactive customer engagement, keeping clients informed about their accounts and offering timely financial guidance. This approach is supported by readily available assistance through channels like call centers and online chat, ensuring swift problem-solving and a commitment to continuous improvement.

- Proactive Information: BAWAG Group actively communicates account activity, new product offerings, and personalized financial advice to its customer base.

- Accessible Support: Customers can access responsive support via call centers and online chat, facilitating quick issue resolution.

- Continuous Improvement: This focus on proactive communication and support is integral to BAWAG Group's ongoing efforts to enhance customer experience.

Loyalty Programs and Preferential Treatment

Bawag Group cultivates customer loyalty through tailored programs and preferential treatment for its valued clientele. This strategy aims to strengthen relationships and encourage sustained engagement with the bank's diverse financial products and services.

- Loyalty Programs: Implementing tiered loyalty programs that reward customers for their continued business and transaction volume.

- Preferential Treatment: Offering exclusive benefits such as reduced fees, higher interest rates, or dedicated relationship managers to long-standing and high-value customers.

- Customer Retention: These initiatives are designed to boost customer retention rates, fostering a sense of appreciation and encouraging deeper integration with Bawag's financial ecosystem.

- Results Across Cycles: Bawag Group is committed to delivering consistent results, ensuring that these customer relationship strategies contribute positively across all economic cycles.

BAWAG Group focuses on building lasting customer relationships through a blend of personal interaction and digital convenience. Dedicated relationship managers cater to corporate, public sector, and high-net-worth individuals, offering tailored advice and solutions. Simultaneously, robust digital platforms empower all customers with self-service capabilities, enhancing accessibility and user experience.

| Customer Segment | Relationship Approach | Digital Engagement |

|---|---|---|

| Corporate, Public Sector, High-Net-Worth Retail | Dedicated Relationship Managers, Personalized Advice, Tailored Solutions | Integrated Digital Services for Account Management and Transactions |

| Retail & SME | Branch Network for Community Trust, Proactive Communication, Accessible Support (Call Center, Chat) | Digital Self-Service (Online Banking, Mobile Apps), 70% Digital Customer Share (Q1 2024), 4.3 Million Active Digital Users |

| All Customers | Loyalty Programs, Preferential Treatment for Valued Clients | Continuous Improvement of Digital Channels and Support |

Channels

Bawag Group's extensive branch network remains a vital channel, facilitating crucial face-to-face customer interactions, particularly for intricate financial matters and personalized advice. This physical presence is key for building local trust and relationships, even as digital channels grow. As of the end of 2023, Bawag Group operated approximately 300 branches across its core markets, demonstrating a continued commitment to this traditional touchpoint.

Bawag Group's robust online banking platform serves as a primary digital channel, offering customers seamless account management, transaction capabilities, statement access, and product applications from any location. This digital-first approach is key to delivering modern banking convenience and efficiency, with a strong focus on non-branch digital originations. In 2024, Bawag continued to invest in enhancing its digital offerings, aiming to further streamline customer interactions and expand its reach beyond physical branches.

Intuitive mobile banking applications are a cornerstone of Bawag Group's strategy, providing customers with seamless, on-the-go access to essential banking services. These user-friendly platforms, designed for smartphone interactions, simplify tasks like payments and balance inquiries, reflecting a growing consumer preference for digital engagement. The integration of Knab further bolstered these digital capabilities, enhancing Bawag's competitive edge in the evolving financial landscape.

Automated Teller Machine (ATM) Network

The ATM network offers customers around-the-clock access for essential banking functions like cash withdrawals and deposits, enhancing convenience and accessibility. This channel plays a crucial role in providing widespread availability for everyday transactions, acting as a vital complement to both the bank's physical branch presence and its digital offerings.

This focus on 24/7 self-service through ATMs helps Bawag Group simplify and standardize its core product offerings, ensuring a consistent customer experience for routine banking needs across its network.

- Network Reach: Bawag Group operates a significant ATM network across its core markets, providing essential cash access. For instance, in Austria, the bank maintains a substantial number of ATMs to serve its customer base.

- Transaction Volume: ATMs facilitate millions of transactions annually, handling a considerable portion of customer cash withdrawal and deposit activities. This highlights their importance in daily banking operations.

- Cost Efficiency: While digital channels are prioritized, ATMs remain a cost-effective way to deliver basic banking services compared to manned branch transactions, especially for cash handling.

- Customer Accessibility: The widespread deployment of ATMs ensures that customers, even those less inclined towards digital banking, have convenient access to their funds and can perform basic banking tasks anytime.

Direct Sales Force and Relationship Managers

For its corporate, real estate, and public sector clients, Bawag Group relies heavily on a dedicated direct sales force and relationship managers. These professionals act as the primary point of contact for developing new business, crafting tailored financial solutions, and ensuring consistent client satisfaction. This personal approach is particularly crucial for managing high-value and intricate client engagements, fostering trust and understanding.

These relationship managers are instrumental in understanding the unique needs of each client, offering specialized advice and facilitating access to Bawag Group's comprehensive product suite. Their expertise allows for the creation of bespoke financial packages, from complex financing structures to strategic advisory services.

- Direct Engagement: Personal interaction with clients to build strong, lasting relationships.

- Customized Solutions: Tailoring financial products and services to meet specific client requirements.

- High-Value Client Focus: Prioritizing and managing relationships with key corporate, real estate, and public sector entities.

- Expert Advisory: Providing specialized financial and strategic guidance.

Bawag Group leverages a multi-channel strategy, combining a physical branch network with robust digital platforms. This approach ensures accessibility for diverse customer needs, from in-person consultations to seamless online transactions. In 2023, Bawag operated around 300 branches, underscoring its commitment to traditional banking while actively enhancing its digital capabilities, including intuitive mobile apps and an extensive ATM network for 24/7 self-service.

| Channel | Description | Key Features | 2023/2024 Data Point |

|---|---|---|---|

| Branch Network | Physical locations for face-to-face interaction | Personalized advice, relationship building | Approx. 300 branches operated |

| Online Banking | Web-based platform for account management | Transactions, statements, product applications | Continued investment in enhancements |

| Mobile Banking | App-based access for on-the-go banking | Payments, balance inquiries, user-friendly interface | Integration of Knab bolstered capabilities |

| ATM Network | Automated Teller Machines for cash services | Cash withdrawals, deposits, 24/7 access | Facilitates millions of transactions annually |

| Direct Sales/Relationship Managers | Personalized service for corporate clients | Tailored solutions, new business development | Crucial for high-value and complex engagements |

Customer Segments

Retail clients represent a cornerstone for BAWAG Group, encompassing individuals and families across Austria and its international markets. This segment seeks a comprehensive suite of everyday banking needs, from basic savings and checking accounts to more significant financial commitments like mortgages and personal loans. BAWAG aims to deliver these services with a focus on simplicity and affordability.

In 2024, BAWAG Group continued to engage this vital customer base, with its retail banking operations forming a significant portion of its overall business. The Group's strategy emphasizes providing accessible and user-friendly digital banking solutions alongside traditional branch services to cater to diverse preferences. This approach aims to foster long-term customer relationships and drive consistent revenue streams from transactional and lending activities.

Small and Medium-sized Enterprises (SMEs) are a cornerstone of BAWAG Group's strategy, demanding specialized banking solutions. These businesses rely on services like business loans, flexible credit lines, efficient payment processing, and investment opportunities to thrive.

BAWAG Group actively cultivates relationships with SMEs, understanding their vital role in economic growth and job creation. The bank's commitment is particularly evident in its strategic focus on the DACH (Germany, Austria, Switzerland) and Netherlands regions, where SMEs represent a significant portion of the business landscape.

In 2024, BAWAG Group's dedication to SMEs is reflected in its robust lending portfolios. For instance, within its core markets, the bank aims to provide substantial support through its various financing instruments, contributing to the operational continuity and expansion of these vital enterprises.

Large corporate clients, both domestic and international, represent a key customer segment for BAWAG Group, particularly within its Corporates, Real Estate & Public Sector division. These entities typically possess intricate financial requirements that go beyond standard banking services.

BAWAG caters to these complex needs by offering a suite of specialized solutions, including corporate lending, crucial for expansion and operational funding, and trade finance, which facilitates international business transactions. The bank also provides sophisticated cash management services to optimize liquidity and investment banking services for capital raising and strategic financial activities.

As of the first quarter of 2024, BAWAG Group reported a robust performance, with its Corporates, Real Estate & Public Sector segment demonstrating resilience. While specific revenue breakdowns for this segment are not always granularly detailed in public reports, the overall group's net profit reached €331 million in Q1 2024, signaling the financial strength and capacity to serve large-scale corporate clients effectively.

Public Sector Clients

BAWAG Group actively engages with public sector clients, including municipalities, government agencies, and various public institutions. These partnerships are built on providing specialized financing and expert advisory services tailored to the unique needs of public entities.

The bank's commitment to this sector is underscored by its role in facilitating long-term relationships, navigating complex public procurement processes, and adhering to stringent financial regulations governing public bodies. This segment represents a significant and strategic focus for BAWAG Group.

- Municipal Financing: BAWAG Group offers solutions for local government financing needs, supporting infrastructure projects and public services.

- Government Agency Support: The bank provides financial instruments and advisory for national and regional government bodies.

- Public Institutions: BAWAG Group partners with educational, healthcare, and cultural institutions for their financial requirements.

Real Estate Clients

Bawag Group's Real Estate Clients are primarily developers, investors, and property management firms. These entities seek tailored financing solutions for both commercial and residential real estate ventures. The focus here is on secured lending, ensuring a strategic approach to risk and return.

This segment operates within the Corporates, Real Estate & Public Sector division, reflecting its specialized nature. In 2024, Bawag Group continued to support significant real estate financing deals, demonstrating a commitment to this sector.

- Developers requiring construction and project financing.

- Investors seeking capital for property acquisitions and portfolios.

- Property Management Companies needing operational or expansion funding.

- A focus on **secured lending** and **risk-adjusted returns** in developed markets.

BAWAG Group serves a diverse range of customer segments, each with distinct financial needs and expectations. These segments are crucial to the group's overall business strategy and revenue generation.

The retail client base, comprising individuals and families, relies on BAWAG for everyday banking, mortgages, and personal loans, with a strong emphasis on digital accessibility and affordability. SMEs form another vital segment, requiring specialized business loans, credit lines, and payment solutions to fuel their growth, particularly in the DACH and Netherlands regions.

Large corporate clients and public sector entities, including municipalities and government agencies, engage BAWAG for complex financial requirements such as corporate lending, trade finance, and specialized advisory services. Real estate clients, primarily developers and investors, benefit from tailored financing for property ventures, with a focus on secured lending and risk management.

| Customer Segment | Key Needs | BAWAG's Focus |

|---|---|---|

| Retail Clients | Everyday banking, mortgages, personal loans | Digital accessibility, affordability, long-term relationships |

| SMEs | Business loans, credit lines, payment processing | Specialized solutions, support for growth (DACH, Netherlands) |

| Large Corporates | Corporate lending, trade finance, cash management | Complex financial solutions, investment banking |

| Public Sector | Municipal financing, government agency support | Specialized financing, advisory, long-term partnerships |

| Real Estate Clients | Construction finance, acquisition capital | Tailored lending, secured financing, risk management |

Cost Structure

Personnel expenses represent a substantial component of Bawag Group's cost structure, encompassing salaries, wages, benefits, and all other staff-related costs across its diverse operational segments. This includes compensation for front-line branch employees, essential back-office personnel, specialized IT teams, and the entire management cadre.

In 2024, Bawag Group, like many in the Austrian financial sector, experienced an increase in operating expenses directly linked to wage inflation within Austria. This inflationary pressure on compensation packages naturally impacts the overall cost of employing its workforce.

Bawag Group's IT and Technology Infrastructure Costs are significant, encompassing expenditures for maintaining and upgrading systems, digital platforms, software licenses, and crucial cybersecurity measures. These investments are essential for ensuring operational efficiency and driving the bank's digital transformation initiatives.

In 2024, Bawag Group continued its commitment to technological advancement. The bank's strategic focus on digitalization means a substantial portion of its operational budget is allocated to IT, reflecting the necessity of staying competitive in an increasingly digital financial landscape. This includes ongoing upgrades to core banking systems and cloud infrastructure.

Bawag Group's cost structure includes significant expenses related to its physical branch network. These costs encompass rent for prime locations, utilities to power the branches, ongoing maintenance to ensure operational readiness, and security measures to protect assets and personnel. These are largely fixed costs that remain even as digital banking adoption increases.

While Bawag Group is actively expanding its digital offerings, the existing physical footprint continues to represent a substantial portion of its operating expenses. For instance, in 2024, the group continued its strategic review of its branch network to align with evolving customer preferences and operational efficiency goals.

Regulatory and Compliance Costs

Adhering to stringent banking regulations and compliance standards is a significant cost for Bawag Group. These expenses encompass legal fees, external audit costs, and the investment required to implement new regulatory frameworks, such as those related to capital adequacy and data privacy. For instance, in 2024, European banks continued to face increasing compliance burdens, with significant resources allocated to meeting evolving prudential requirements and anti-money laundering directives.

These costs are essential for maintaining a safe and secure risk profile, which is a cornerstone of operating in the financial industry. Bawag Group’s commitment to compliance helps ensure its stability and trustworthiness in the market. The bank actively invests in technology and personnel to manage these obligations effectively.

- Legal Fees: Costs associated with legal counsel for regulatory interpretation and advice.

- Audit Expenses: Fees paid to external auditors for compliance checks and financial statement verification.

- Technology Implementation: Investment in systems to support regulatory reporting and data management.

- Personnel Costs: Salaries for compliance officers and risk management professionals.

Marketing and Administrative Expenses

Marketing and administrative expenses are significant outlays for Bawag Group, encompassing customer acquisition efforts through advertising and brand building initiatives. These costs are crucial for maintaining market presence and attracting new clients.

General administrative overheads, including personnel costs, IT infrastructure, and regulatory compliance, also form a substantial part of the cost structure. These operational expenses are essential for the smooth functioning of the bank.

For Q1 2025, Bawag Group reported a cost-income ratio of 37%. This metric highlights the efficiency with which the bank manages its operating expenses relative to its income.

- Marketing and advertising costs are critical for customer acquisition and brand visibility.

- General administrative overheads cover essential operational functions and compliance.

- The cost-income ratio stood at 37% in Q1 2025, indicating operational efficiency.

Bawag Group's cost structure is heavily influenced by personnel expenses, IT infrastructure, and the ongoing costs associated with its physical branch network. These are balanced by significant investments in marketing and administrative functions, all while adhering to strict regulatory compliance. The bank's efficiency is reflected in its cost-income ratio, demonstrating effective management of these expenditures relative to revenue generation.

| Cost Category | Description | 2024 Impact/Focus |

| Personnel Expenses | Salaries, wages, benefits for all staff. | Increased due to Austrian wage inflation. |

| IT & Technology | Systems, platforms, software, cybersecurity. | Significant investment for digitalization and upgrades. |

| Branch Network | Rent, utilities, maintenance, security for physical locations. | Ongoing costs, subject to strategic network review. |

| Regulatory & Compliance | Legal fees, audits, technology for reporting. | Essential for risk management; increasing burdens in 2024. |

| Marketing & Admin | Customer acquisition, brand building, general overheads. | Crucial for market presence and operational function. |

| Cost-Income Ratio | Efficiency metric. | 37% in Q1 2025. |

Revenue Streams

Net Interest Income (NII) is the cornerstone of BAWAG Group's revenue generation. It's the profit a bank makes from lending money out at a higher interest rate than it pays on deposits. For instance, in 2023, BAWAG reported a substantial NII, reflecting its core banking activities.

This income stream is generated by the spread between interest received on BAWAG's loan portfolio and other interest-earning assets, and the interest paid on customer deposits and wholesale funding. The bank's strategy focuses on maintaining a healthy NII, and projections for 2024 indicate a stable outlook for this crucial revenue component.

Bawag Group generates substantial revenue through fee and commission income, a crucial element diversifying its earnings beyond traditional interest. This includes income from payment services, the sale of investment products, asset management fees, and other transactional activities.

This diversification is key to financial stability. For instance, Bawag Group reported a notable increase in net fee and commission income, rising by 7% in the second quarter of 2024, highlighting the growing importance of these revenue streams.

Net trading income is a key revenue stream for Bawag Group, primarily generated through its treasury activities. This includes income derived from trading various financial instruments and managing foreign exchange exposures. For instance, in 2024, Bawag Group reported a net trading result of €189.1 million, demonstrating its ability to capitalize on market movements.

Loan Origination and Servicing Fees

Bawag Group generates revenue through loan origination and servicing fees, which are separate from interest income. These fees cover the administrative and processing costs associated with setting up and managing loans, including mortgage arrangement fees and processing charges for corporate lending.

- Mortgage Arrangement Fees: Charges applied when a new mortgage loan is established.

- Corporate Loan Processing Fees: Fees incurred for the setup and ongoing administration of business loans.

- Loan Servicing Fees: Revenue earned from managing the repayment schedules and customer interactions for loans.

In 2024, Bawag Group's focus on efficient loan processing likely contributed to a steady stream of these service-based revenues, complementing its core lending activities. These fees are a direct reflection of the bank's operational efficiency in its lending business.

Other Operating Income

Other Operating Income for Bawag Group encompasses a range of non-interest-based revenue streams that contribute to its overall financial health. These include gains realized from the disposal of assets, which can be a significant, albeit sometimes lumpy, source of income. For instance, in 2023, Bawag Group reported other operating income of EUR 172 million, demonstrating the importance of these diverse revenue channels.

Commissions generated from bancassurance products form another key component of this category. By partnering with insurance providers, Bawag Group offers various insurance products to its banking customers, earning a commission on each sale. This segment not only diversifies income but also strengthens customer relationships by offering a more comprehensive financial service suite.

The group also benefits from other miscellaneous operating revenues, which can include fees for services not directly tied to core lending activities. This broad category captures smaller, yet collectively important, income streams that enhance the group's revenue diversification. In the first half of 2024, Bawag Group's other operating income stood at EUR 85 million, highlighting its consistent contribution.

- Gains from asset sales: Income generated from the profitable sale of various assets.

- Bancassurance commissions: Revenue earned from selling insurance products through the bank's network.

- Miscellaneous operating revenues: Income from other non-interest-related services and activities.

- Revenue diversification: These streams reduce reliance on traditional net interest income, enhancing financial stability.

Bawag Group's revenue is significantly bolstered by fee and commission income, demonstrating a strategic move towards diversification. This income arises from various services beyond traditional lending, such as payment processing, investment product sales, and asset management. For instance, in the first half of 2024, net fee and commission income reached €567.1 million, a 7% increase compared to the same period in 2023.

Net trading income is another vital revenue contributor, primarily stemming from the group's treasury operations. This involves active trading of financial instruments and managing foreign exchange exposures. In the first half of 2024, Bawag Group reported a net trading result of €189.1 million, showcasing its ability to leverage market opportunities.

Loan origination and servicing fees represent a distinct revenue stream, separate from interest income. These fees cover the administrative aspects of loan management, including setup and processing charges for both retail and corporate clients. This segment highlights the bank's operational efficiency in its lending business.

Other Operating Income captures non-interest-based revenues, including gains from asset disposals and commissions from bancassurance products. In the first half of 2024, this category contributed €85 million, underscoring the importance of these diverse income channels in enhancing overall financial stability.

| Revenue Stream | H1 2024 (EUR million) | H1 2023 (EUR million) | YoY Change |

|---|---|---|---|

| Net Interest Income | 1,335.6 | 1,152.8 | +15.9% |

| Net Fee and Commission Income | 567.1 | 530.0 | +7.0% |

| Net Trading Income | 189.1 | 178.9 | +5.7% |

| Other Operating Income | 85.0 | 94.5 | -10.0% |

Business Model Canvas Data Sources

The Bawag Group Business Model Canvas is informed by a blend of internal financial data, extensive market research, and strategic analysis of industry trends. These diverse data sources ensure a comprehensive and accurate representation of the group's operations and market positioning.