Bawag Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bawag Group Bundle

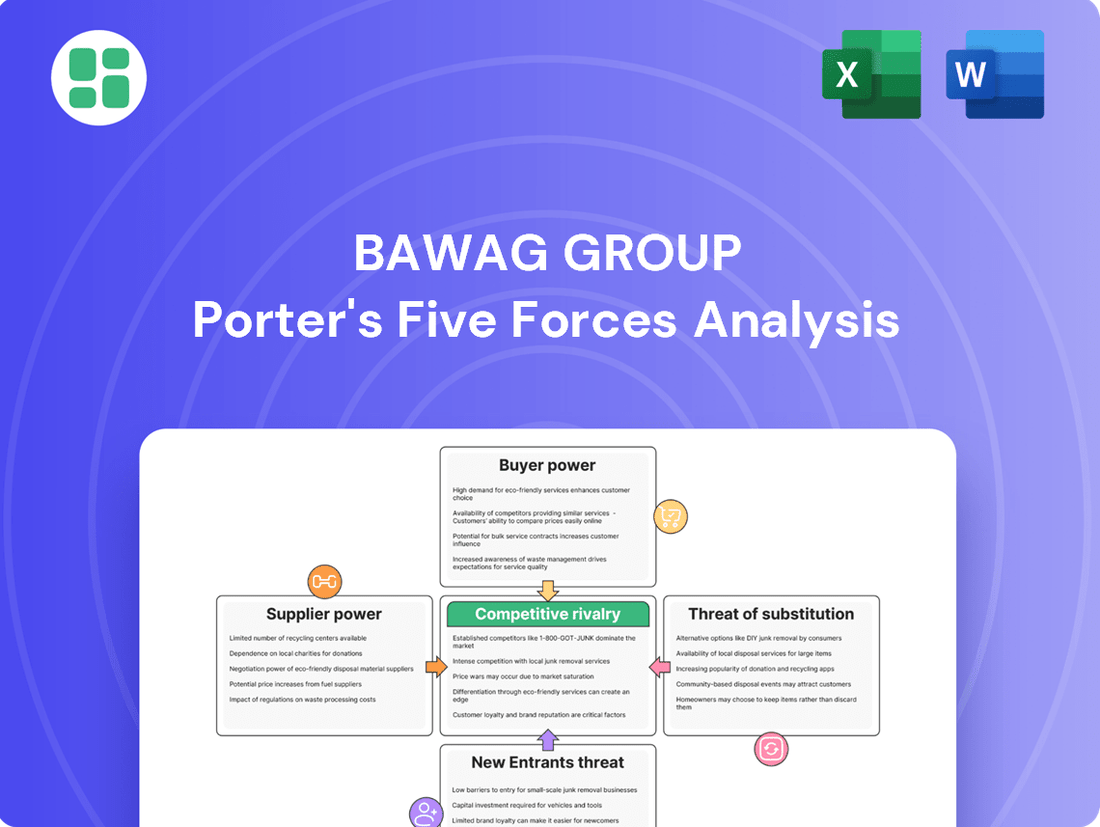

Bawag Group navigates a competitive landscape shaped by significant buyer power and the constant threat of new entrants. Understanding these forces is crucial for grasping their strategic positioning.

The full analysis reveals the strength and intensity of each market force affecting Bawag Group, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

For a bank like BAWAG Group, its suppliers are primarily its funding sources. These include customer deposits, borrowing from other banks (interbank lending), and accessing capital markets. While individual customers depositing money have little individual power, their collective deposits are a crucial funding stream, and they can easily move their money if better rates are offered elsewhere.

Wholesale funding and the terms set by central banks carry more weight. These sources are vital for a bank's liquidity and ability to expand. In 2023, for example, central bank interest rate hikes significantly influenced the cost of wholesale funding for European banks, impacting their profitability and lending capacity.

BAWAG Group, like many financial institutions, depends significantly on technology and software providers for its core banking systems and IT infrastructure. The cost and complexity of switching these critical systems can give suppliers considerable leverage, often resulting in long-term contracts where price negotiation is challenging. This dependence is amplified by the fact that banks typically opt to purchase specialized software rather than develop it in-house.

The availability of skilled professionals in digital banking, cybersecurity, risk management, and financial analysis is a key supplier strength for BAWAG Group. In today's competitive job market, particularly for specialized financial talent, these individuals can negotiate for higher salaries and improved benefits, directly impacting the bank's operational expenses. For instance, in 2024, the demand for cybersecurity experts saw salary increases of up to 15% in the European financial sector, a trend BAWAG must navigate.

Regulatory Bodies and Compliance Frameworks

Regulatory bodies like the European Central Bank (ECB) and the Austrian Financial Market Authority (FMA) act as powerful, albeit non-traditional, suppliers by dictating operational parameters. Their influence is felt through capital requirements, compliance mandates, and operational rules that BAWAG Group must adhere to.

The introduction of new directives, such as CRD VI, CRR III, and the Digital Operational Resilience Act (DORA) slated for implementation from 2025, will significantly shape BAWAG's strategic direction and financial flexibility. These regulatory shifts are expected to increase operational expenses and necessitate substantial investments in compliance infrastructure.

These evolving regulations directly impact BAWAG's cost of doing business. For instance, DORA aims to bolster the digital operational resilience of the financial sector, requiring robust cybersecurity measures and incident reporting protocols, which translate into increased IT spending and risk management outlays for institutions like BAWAG.

- Regulatory Influence: ECB and FMA set capital requirements, compliance standards, and operational rules for BAWAG.

- Upcoming Directives: CRD VI, CRR III, and DORA (from 2025) will significantly impact BAWAG's operations and strategy.

- Increased Costs: Compliance with these regulations necessitates substantial investment in technology, risk management, and personnel.

- Strategic Flexibility: The need to adapt to new regulatory frameworks can limit strategic options and require significant resource allocation.

Data and Information Providers

In today's financial landscape, data and information providers wield moderate bargaining power over entities like Bawag Group. The necessity for high-quality data, analytics, and market intelligence is paramount for everything from credit scoring to strategic planning. These specialized suppliers offer critical information, fostering a degree of reliance that can translate into increased costs for comprehensive, real-time data feeds.

- Data Dependency: Banks increasingly rely on external data providers for essential functions, creating a dependency that strengthens supplier leverage.

- Specialized Offerings: Providers offering unique or proprietary data sets and analytics capabilities command higher bargaining power due to their specialized nature.

- Cost Implications: The critical and often real-time nature of financial data means that acquiring comprehensive feeds can represent a significant operational cost for financial institutions.

- Market Intelligence Value: In 2024, the demand for sophisticated market intelligence, including predictive analytics and sentiment analysis, continues to grow, enhancing the value and thus the bargaining power of providers in this niche.

BAWAG Group faces moderate bargaining power from its funding sources, especially wholesale funding and capital markets, as evidenced by the significant impact of 2023 central bank rate hikes on borrowing costs across European banks. While individual customer deposits are less impactful, their collective behavior and the ease with which they can switch to higher-yield options mean banks must remain competitive on deposit rates.

Technology and software suppliers hold considerable sway due to the critical nature and high switching costs of core banking systems, leading to long-term contracts that limit price negotiation. Furthermore, the scarcity of specialized talent in areas like cybersecurity and digital banking in 2024, with reported salary increases of up to 15% in the European financial sector, empowers these professionals to negotiate favorable terms, directly affecting BAWAG's operational expenses.

Regulatory bodies like the ECB and FMA act as powerful, non-traditional suppliers, dictating operational parameters through capital requirements and compliance mandates. Upcoming directives such as DORA, effective from 2025, will necessitate substantial investments in compliance and cybersecurity, increasing operational costs and potentially limiting strategic flexibility for BAWAG.

| Supplier Category | Bargaining Power | Key Factors | Impact on BAWAG | Relevant Data/Trend |

| Funding Sources (Wholesale) | Moderate to High | Central bank policies, Interbank lending rates, Capital market conditions | Influences cost of funds, liquidity management | 2023 ECB rate hikes significantly increased wholesale funding costs for European banks. |

| Technology & Software Providers | High | Switching costs, critical system dependency, proprietary solutions | Drives IT expenditure, contract negotiation challenges | Banks typically purchase specialized software, increasing reliance on vendors. |

| Skilled Professionals (IT, Risk, etc.) | Moderate to High | Demand-supply imbalance, specialized skill sets | Impacts personnel costs, talent acquisition | 2024 saw up to 15% salary increases for cybersecurity experts in European finance. |

| Regulatory Bodies (ECB, FMA) | Very High (Non-traditional) | Capital requirements, compliance mandates, operational rules | Dictates operational framework, compliance costs | DORA implementation from 2025 will require significant investment in digital resilience. |

| Data & Information Providers | Moderate | Data criticality, specialized analytics, real-time needs | Increases operational costs for data acquisition | Growing demand for predictive analytics and sentiment analysis in 2024 enhances provider leverage. |

What is included in the product

This analysis details the competitive forces impacting Bawag Group, examining the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the availability of substitutes.

Bawag Group's Porter's Five Forces analysis offers a clear, actionable framework to identify and mitigate competitive pressures, transforming strategic planning from a guessing game into a data-driven process.

Customers Bargaining Power

Retail banking customers, encompassing individuals and small businesses, typically wield moderate bargaining power. This is largely due to the abundance of banking providers and the ease with which they can switch basic services, such as savings accounts and transaction processing, with minimal friction. In 2024, the continued growth of digital banking and open banking regulations further amplified this by enhancing transparency and simplifying product comparisons.

While switching costs for core services remain low, customer loyalty can be influenced by deeper relationships, bundled product offerings like mortgages and investment portfolios, and the perceived quality of customer service. For instance, Bawag Group's focus on digital transformation and personalized customer experiences aims to strengthen these bonds, thereby mitigating some of the inherent bargaining power of its retail clientele.

Corporate and public sector clients hold considerable sway over BAWAG Group due to the sheer scale of their business. These large entities often require bespoke financial products and services, giving them leverage to negotiate favorable terms. For instance, a major corporation seeking substantial credit facilities or complex treasury management solutions can command better pricing and service levels.

BAWAG Group's ability to attract and retain these high-value clients is directly impacted by this bargaining power. Competition among banks for these lucrative relationships means BAWAG must be prepared to offer competitive rates and customized solutions to secure their business. In 2023, large corporate lending in the Eurozone saw continued demand, with banks like BAWAG actively competing for market share in this segment, often through tailored offerings.

Customers today expect more than just basic banking; they want digital convenience and tailored advice. This means BAWAG Group, like other banks, must invest heavily in technology to keep up. For instance, in 2024, digital banking adoption continued to climb across Europe, with many customers preferring mobile apps for daily transactions. This shift directly increases their power to switch providers if their digital needs aren't met.

The demand for personalized financial guidance, powered by data analytics and AI, is also a significant factor. Customers are more informed and expect banks to understand their individual needs. Banks that can offer these customized digital solutions are better positioned to retain customers, while those that lag risk losing market share. This trend was evident in 2024 as many financial institutions rolled out enhanced AI chatbots and personalized investment recommendations.

Price Sensitivity and Interest Rates

Customer bargaining power is significantly amplified in environments where interest rates are high or volatile. This is particularly true for loan products such as mortgages and consumer financing. When interest rates are stable or competition is fierce, customers have more leverage to seek out the best available terms, directly impacting BAWAG's net interest income and pricing power.

The Austrian market has recently experienced shifts in demand across different loan categories. For instance, in 2024, the demand for mortgages saw a notable slowdown due to higher borrowing costs. This reduced demand inherently strengthens the bargaining position of potential borrowers, forcing banks like BAWAG to offer more competitive rates to secure business.

- Price Sensitivity: Customers are more sensitive to pricing when interest rates rise, actively comparing offers from different financial institutions.

- Loan Demand Shifts: In 2024, Austrian mortgage demand declined by approximately 15% compared to the previous year, indicating a stronger customer position in negotiations.

- Net Interest Margin Pressure: Increased competition and customer shopping for better rates can compress BAWAG's net interest margins on its loan portfolio.

Access to Alternative Financial Providers

The growing number of FinTech firms and alternative financial providers significantly enhances customer bargaining power. These entities offer specialized services, allowing customers to pick and choose providers for specific needs, such as digital payments or investment platforms, rather than relying solely on traditional banks.

Customers can now easily disaggregate their banking requirements. For instance, they might use BAWAG for a mortgage but opt for a FinTech app for international money transfers or micro-investments. This fragmentation of services compels BAWAG to offer more competitive rates and innovative solutions to retain its customer base.

- Increased Choice: The FinTech sector's expansion provides customers with a wider array of financial service providers.

- Service Specialization: Customers can leverage FinTechs for niche services, bypassing traditional banks for those specific functions.

- Competitive Pressure: BAWAG faces pressure to innovate and offer compelling value propositions to counter the appeal of specialized financial providers.

The bargaining power of customers for Bawag Group is a significant factor, especially with the increasing digital landscape and FinTech competition. Retail customers, while numerous, have moderate power due to the ease of switching basic accounts, a trend amplified in 2024 by open banking. Corporate clients, however, wield considerable influence due to the large volumes they transact, forcing Bawag to offer tailored solutions and competitive pricing to retain their business.

The rise of FinTechs has fragmented the market, allowing customers to cherry-pick services, which pressures Bawag to innovate and maintain competitive offerings across its product suite. This increased choice means customers can easily compare rates and services, directly impacting Bawag's ability to command premium pricing, particularly in loan products where price sensitivity is high, as seen in the 2024 mortgage market slowdown.

| Customer Segment | Bargaining Power Factors | Impact on Bawag Group |

|---|---|---|

| Retail Customers (Individuals & Small Businesses) | Low switching costs for basic services, increased transparency via digital banking, FinTech alternatives | Pressure on pricing for standard products, need for enhanced digital experience and loyalty programs |

| Corporate & Public Sector Clients | Large transaction volumes, need for bespoke financial products, significant revenue potential | Leverage to negotiate favorable terms and pricing, requires customized solutions and strong relationship management |

| All Customers | Price sensitivity (especially with interest rate changes), demand for personalized digital services, FinTech disruption | Compression of net interest margins, imperative for continuous digital investment and service innovation |

Preview the Actual Deliverable

Bawag Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Bawag Group, detailing the competitive landscape and strategic implications. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the banking sector. This exact analysis will equip you with the strategic understanding needed to navigate Bawag Group's market environment effectively.

Rivalry Among Competitors

The Austrian banking landscape, BAWAG Group's home turf, presents a complex competitive scene. It’s a space populated by major established institutions, numerous regional banks, and an increasing number of nimble FinTech companies. This diversity means BAWAG faces competition from various angles, requiring a multifaceted strategy.

Despite the sheer number of players, the market isn't static; it’s undergoing a period of consolidation. BAWAG Group has actively participated in this trend, notably through its acquisition of Barclays Consumer Bank Europe and Knab. These moves demonstrate a clear strategy to bolster its market position and broaden its reach, indicating a dynamic competitive environment where scale and strategic growth are key.

Competition is particularly fierce in BAWAG Group's core segments of retail and SME banking. In these areas, products are often seen as similar, leading to a strong emphasis on price. Banks frequently compete by offering attractive interest rates on both deposits and loans, alongside efforts to enhance service quality and digital capabilities.

BAWAG's strategy directly addresses this intense rivalry by concentrating on simple, transparent, and affordable products. This approach is designed to appeal to a broad customer base and secure market share within these highly competitive banking landscapes. For instance, in 2024, the Austrian banking sector continued to see deposit rates fluctuate, with BAWAG aiming to offer competitive terms to attract and retain customers.

The digital transformation is significantly escalating competitive rivalry within the banking sector. Bawag Group, like its peers, is channeling substantial resources into technology to boost operational efficiency and enrich customer interactions. This digital arms race is a direct response to the evolving demands of consumers who now expect seamless, innovative digital banking solutions.

FinTech firms are a potent force, introducing disruptive business models and product offerings that directly challenge established banks. For instance, by mid-2024, FinTech adoption rates continued to climb, with many consumers increasingly favoring digital-first financial services for everyday transactions and lending. This forces traditional institutions like Bawag to accelerate their own digital development to remain competitive and retain market share.

Regulatory Landscape and Capital Buffers

Strict banking regulations and capital requirements significantly shape competitive rivalry. For instance, Austria's introduction of a sectoral systemic risk buffer for commercial real estate loans in 2024, as part of broader Basel III endgame implementation, directly impacts lending practices and profitability.

These heightened regulatory demands, including increased capital adequacy ratios, translate to higher compliance costs. This can create a barrier to entry and expansion for smaller financial institutions or new market participants.

Consequently, larger, well-established banks with robust capital bases, such as BAWAG Group, are often better positioned to absorb these costs and navigate the complex regulatory environment. This can lead to an uneven competitive landscape.

- Increased Compliance Costs: Banks face higher operational expenses due to stringent regulatory adherence.

- Capital Adequacy Requirements: Regulations like Basel III endgame necessitate stronger capital buffers, impacting lending capacity.

- Market Consolidation: Compliance burdens may encourage consolidation, favoring larger players.

- Impact on Smaller Competitors: Smaller banks and new entrants may find it more challenging to compete due to resource constraints for regulatory compliance.

Economic Environment and Loan Demand

Austria's economic landscape in 2024 presents a mixed picture, with subdued GDP growth impacting overall loan demand. This environment intensifies rivalry among banks as they vie for a shrinking pool of high-quality lending opportunities.

The challenges within the commercial real estate market, a key sector for lending, further exacerbate competitive pressures. Banks are increasingly focused on risk management and maintaining asset quality amidst these economic headwinds.

- Subdued GDP Growth: Austria's GDP growth is projected to remain modest in 2024, affecting corporate and consumer borrowing appetite.

- Commercial Real Estate Challenges: This sector faces headwinds, potentially leading to increased non-performing loans and reduced lending activity.

- Intensified Competition: Banks are competing more fiercely for fewer profitable lending opportunities, potentially compressing net interest margins.

- Focus on Risk Management: The current economic climate necessitates a heightened emphasis on prudent lending practices and robust risk assessment.

Competitive rivalry within the Austrian banking sector is intense, driven by a mix of established players, regional banks, and agile FinTechs, all vying for market share. BAWAG Group's strategic acquisitions, like that of Barclays Consumer Bank Europe, highlight its proactive approach to consolidating its position amidst this dynamic environment. The competition is particularly sharp in retail and SME banking, where product differentiation is often minimal, leading to a strong focus on pricing and digital service enhancements.

FinTech disruption and the ongoing digital transformation are further escalating competitive pressures, forcing traditional banks like BAWAG to invest heavily in technology to meet evolving customer expectations for seamless digital experiences. In 2024, FinTech adoption continued its upward trend, making it imperative for incumbent banks to innovate rapidly to retain relevance and customer loyalty.

Stringent banking regulations, including capital adequacy requirements, create a more challenging landscape, especially for smaller institutions. These compliance costs can act as a barrier to entry, potentially favoring larger, well-capitalized entities like BAWAG Group. Austria's economic conditions in 2024, marked by subdued GDP growth and challenges in sectors like commercial real estate, intensify the competition for profitable lending opportunities, pushing banks to prioritize risk management and asset quality.

| Key Competitor Aspects | Description | Impact on BAWAG Group | 2024 Data/Context |

| Market Structure | Fragmented with large banks, regional players, and FinTechs. | Requires diverse strategies to capture different customer segments. | Ongoing consolidation trends. |

| Pricing & Digitalization | Price sensitivity in retail/SME banking; digital capabilities are key differentiators. | Necessitates competitive pricing and continuous investment in digital channels. | High FinTech adoption rates in 2024. |

| Regulatory Environment | Increased compliance costs and capital requirements. | Favors larger banks with stronger capital bases; can be a barrier for smaller competitors. | Basel III endgame implementation impacting capital ratios. |

| Economic Headwinds | Subdued GDP growth and sector-specific challenges (e.g., CRE). | Intensifies competition for lending; focus on risk management. | Modest GDP growth projections for Austria in 2024. |

SSubstitutes Threaten

FinTech companies and neo-banks represent a substantial threat of substitutes for BAWAG Group. These nimble, digitally focused players often provide specialized banking services with greater efficiency and lower costs. For instance, digital payment platforms directly challenge traditional payment processing, while robo-advisors offer automated investment management, a substitute for wealth management services.

The competitive landscape is further intensified by peer-to-peer lending platforms and specialized online lenders, which offer alternative avenues for credit, directly impacting BAWAG's loan business. These alternatives leverage technology to reduce overhead and streamline operations, making them attractive to customers seeking faster, more convenient, and often cheaper financial solutions. For example, the global FinTech market was projected to reach over $300 billion by 2024, indicating significant customer adoption of these substitute services.

Customers are increasingly turning to direct online brokerage platforms and wealth management apps to manage their investments, bypassing traditional banks like BAWAG. These digital alternatives often boast lower fees and provide users with more direct control over their portfolios, a significant draw for financially savvy individuals. For instance, the European market for robo-advisors and online investment platforms saw substantial growth in 2024, with assets under management reaching new highs, directly impacting BAWAG's commission-based revenue streams.

Alternative lending and funding sources present a significant threat to BAWAG Group. Beyond traditional bank loans, businesses and individuals can now tap into crowdfunding platforms, venture capital firms, and private debt markets for capital, lessening their dependence on established financial institutions.

For larger corporations, options like internal financing or direct access to capital markets via bond issuance can effectively substitute for conventional corporate banking services. This growing diversity in funding avenues poses a long-term challenge to the stability and growth of BAWAG's core lending business.

For instance, the global crowdfunding market alone was projected to reach over $130 billion by 2025, demonstrating a substantial shift in capital accessibility. This trend directly impacts the demand for traditional bank loans, a key revenue stream for BAWAG.

Cryptocurrencies and Blockchain-based Services

The rise of cryptocurrencies and blockchain technology presents a growing threat of substitutes to traditional banking services. These innovations offer alternative methods for value transfer, payments, and even lending, potentially bypassing established financial institutions.

Decentralized finance (DeFi) specifically represents a significant long-term substitute threat. By enabling peer-to-peer transactions and financial operations without intermediaries, DeFi platforms could fundamentally alter how banking services are consumed. For instance, in 2024, the total value locked (TVL) in DeFi protocols, a key metric for the size of the DeFi ecosystem, reached hundreds of billions of dollars, indicating substantial user adoption and capital allocation away from traditional channels.

- Decentralized Finance (DeFi) Growth: DeFi TVL in 2024 has demonstrated a significant increase, with some projections indicating continued expansion as the technology matures and regulatory clarity emerges.

- Alternative Payment Systems: Cryptocurrencies offer a parallel payment infrastructure, potentially reducing reliance on bank-operated payment networks for certain transactions.

- New Lending Models: Blockchain-based lending platforms provide alternative avenues for borrowing and lending, challenging traditional credit facilities.

Internal Corporate Finance Capabilities

Large corporate clients are increasingly building robust internal finance departments. These sophisticated teams can manage treasury functions, optimize cash flow, and even handle some lending activities, thereby reducing their reliance on external banking partners like BAWAG Group. This trend of 'self-supply' directly impacts the demand for traditional corporate banking products.

For instance, as of 2024, many multinational corporations have dedicated treasury units with advanced capabilities in foreign exchange management and intercompany lending. This internal expertise allows them to bypass certain fee-based services previously offered by banks. The ability of these large clients to generate their own financial solutions represents a significant substitute threat.

- Internal Treasury Management: Large corporations can manage their own cash, liquidity, and debt issuance.

- In-house Lending/Financing: Some firms can finance their operations or even offer loans to subsidiaries internally.

- Reduced Dependence on Banks: This self-sufficiency directly lowers the need for external corporate banking services.

- Impact on BAWAG's Product Demand: BAWAG may see reduced demand for services like syndicated loans or complex treasury solutions from these clients.

The threat of substitutes for BAWAG Group is significant, driven by FinTech, neo-banks, and alternative lending platforms. These entities offer specialized, often cheaper, and more convenient financial services, directly challenging BAWAG's core offerings in payments, investments, and lending. For example, the global FinTech market's projected growth to over $300 billion by 2024 highlights customer adoption of these alternatives.

Digital investment platforms and robo-advisors are also gaining traction, with substantial growth in assets under management in the European market during 2024, impacting BAWAG's fee-based revenue. Furthermore, crowdfunding and private debt markets provide alternative capital sources, reducing reliance on traditional bank loans, a key revenue stream for BAWAG. The global crowdfunding market's projected reach of over $130 billion by 2025 underscores this shift.

Cryptocurrencies and Decentralized Finance (DeFi) represent emerging substitutes, offering alternative payment and lending mechanisms. The hundreds of billions of dollars in total value locked (TVL) in DeFi protocols in 2024 indicates substantial capital moving away from traditional financial channels. Additionally, large corporations increasingly manage their own treasury functions and financing, reducing their need for BAWAG's corporate banking services.

| Substitute Area | Key Players/Examples | 2024/2025 Data Point | Impact on BAWAG |

| FinTech & Neo-banks | Digital Payment Platforms, Robo-advisors | Global FinTech Market projected >$300B by 2024 | Challenges payment processing and wealth management revenue |

| Alternative Lending | Crowdfunding, P2P Lending, Private Debt | Global Crowdfunding Market projected >$130B by 2025 | Reduces demand for traditional loans |

| Digital Investments | Online Brokerages, Wealth Management Apps | Significant growth in European robo-advisor AUM in 2024 | Impacts commission-based revenue |

| Digital Currencies & DeFi | Cryptocurrencies, DeFi Protocols | DeFi TVL reached hundreds of billions in 2024 | Offers alternative payment and lending, bypassing banks |

| Corporate Self-Sufficiency | In-house Treasury, Internal Financing | Multinational corps' advanced treasury units in 2024 | Decreases demand for corporate banking services |

Entrants Threaten

The banking sector, including institutions like Bawag Group, faces substantial threats from new entrants due to high regulatory and capital requirements. New banks must navigate a complex web of rules, demanding significant upfront investment and ongoing compliance efforts. This creates a formidable barrier, protecting established players.

Meeting stringent capital adequacy ratios, such as the Common Equity Tier 1 (CET1) requirement, is a critical hurdle. For instance, as of early 2024, many European banks, including those operating under the ECB's supervision like Bawag, maintain CET1 ratios well above the regulatory minimums, often in the 13-15% range, to ensure stability and absorb potential losses. Acquiring the necessary licenses and adhering to frameworks like Basel IV and anti-money laundering (AML) regulations further escalate the financial and operational demands.

Existing financial institutions, including BAWAG Group, possess significant economies of scale. These scale advantages in areas like technology infrastructure, operational efficiency, and risk management create a cost advantage that new entrants struggle to match. For instance, in 2023, BAWAG Group reported a cost-income ratio of 44.3%, reflecting their operational efficiency, a benchmark difficult for a new, smaller player to achieve immediately.

Building customer trust and brand loyalty in the banking sector is a lengthy and resource-intensive process. Consumers typically gravitate towards established, reputable banks for their perceived security and reliability, especially for managing their finances. This inherent preference for stability presents a formidable hurdle for any new entity seeking to gain market share.

Established financial institutions like Bawag Group benefit from deeply entrenched distribution channels, including extensive branch networks and mature digital platforms, which grant them significant market reach. For instance, in 2024, Bawag continued to optimize its branch footprint while investing heavily in its digital offerings, aiming to serve its broad customer base effectively. This established infrastructure makes it difficult for newcomers to replicate the same level of accessibility and customer engagement.

New entrants, particularly FinTechs, often face substantial hurdles in building comparable distribution networks and accumulating the vast customer data that incumbents already possess. While digital-first strategies offer agility, achieving widespread customer adoption and trust against established players remains a formidable challenge in 2024. Gaining access to critical customer data for personalized services is also a significant barrier for these newer entities.

Disruptive Potential of FinTechs with Niche Focus

While establishing a full-service bank remains a significant hurdle due to capital requirements and extensive regulation, the threat of new entrants for Bawag Group is amplified by specialized FinTech companies. These firms often concentrate on specific, high-margin segments of the financial services industry, such as digital payments or peer-to-peer lending. Their ability to enter with less capital by focusing on a single service, coupled with technological advancements, allows them to offer compelling user experiences and competitive pricing.

This focused approach can bypass some of the traditional barriers to entry. For instance, in Austria, regulatory sandboxes provide a pathway for FinTechs to test novel business models and technologies. This can lead to a gradual erosion of market share in profitable niches, even without a full banking license.

- Targeted Niche Dominance: FinTechs can capture significant market share in areas like cross-border payments or digital wealth management, areas where incumbents might be slower to innovate.

- Lower Overhead Costs: By avoiding the extensive infrastructure of traditional banking, FinTechs operate with significantly lower cost bases, enabling aggressive pricing strategies.

- Regulatory Facilitation: Austrian regulatory sandboxes, like those overseen by the FMA, allow for the testing of innovative financial products and services, potentially lowering the barrier for entry for specialized FinTechs.

- Customer Experience Focus: Many FinTechs prioritize user-friendly interfaces and seamless digital experiences, attracting customers who are dissatisfied with traditional banking platforms.

Acquisition Strategy of Incumbents

BAWAG Group actively counters the threat of new entrants through strategic acquisitions. By integrating innovative FinTech companies or smaller financial institutions, BAWAG absorbs potential disruptive forces and enhances its own capabilities. This approach allows the group to gain access to new technologies and customer segments, thereby solidifying its market position.

Notable examples include BAWAG's acquisition of Knab, a digital-first bank, and Barclays Consumer Bank Europe. These moves not only expand BAWAG's geographical reach and customer base but also incorporate cutting-edge digital solutions, effectively neutralizing emerging competitive threats before they gain significant traction. This proactive strategy is crucial in a rapidly evolving financial landscape.

The rationale behind such acquisitions is to achieve economies of scale and scope, while simultaneously fostering innovation internally. By bringing these entities under its umbrella, BAWAG can leverage their agility and technological advancements to improve its service offerings and operational efficiency. This integration process is key to maintaining a competitive edge against both new and existing players in the banking sector.

- Acquisition of Knab: Strengthened BAWAG's digital banking capabilities and expanded its presence in key European markets.

- Acquisition of Barclays Consumer Bank Europe: Significantly boosted BAWAG's scale and diversified its product portfolio, particularly in consumer finance.

- Market Consolidation: BAWAG's acquisition strategy contributes to industry consolidation, reducing the number of potential new, agile competitors.

- Innovation Integration: The acquired entities bring new technologies and customer-centric approaches, which BAWAG integrates to enhance its overall service delivery.

While traditional banking entry remains difficult due to high capital and regulatory barriers, the threat to Bawag Group is primarily from specialized FinTechs. These agile firms focus on profitable niches, leveraging technology to offer superior customer experiences and competitive pricing, thereby eroding market share in specific segments. For example, in 2024, FinTechs continued to gain traction in areas like digital payments and wealth management, often operating with lower overheads.

Bawag Group proactively mitigates this threat through strategic acquisitions, integrating innovative FinTechs to absorb competitive forces and enhance its own capabilities. The acquisition of entities like Knab and Barclays Consumer Bank Europe in recent years exemplifies this strategy, bolstering digital offerings and expanding market reach. This approach allows Bawag to maintain a competitive edge by incorporating new technologies and customer-centric models.

These acquisitions not only integrate new technologies but also contribute to market consolidation, effectively reducing the number of potential agile competitors. By bringing these entities under its umbrella, Bawag can leverage their agility and technological advancements to improve its service offerings and operational efficiency, a crucial step in navigating the evolving financial landscape.

Porter's Five Forces Analysis Data Sources

Our Bawag Group Porter's Five Forces analysis is built upon a foundation of publicly available financial statements, annual reports, and investor presentations. We also incorporate insights from reputable industry analysis firms and macroeconomic data providers to ensure a comprehensive understanding of the competitive landscape.