Bawag Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bawag Group Bundle

Curious about Bawag Group's strategic positioning? Our BCG Matrix preview reveals their current market standing, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete report for actionable insights and a clear roadmap to optimize their portfolio.

Stars

BAWAG Group's strategic acquisitions of Knab in the Netherlands (late 2024) and Barclays Consumer Bank Europe in Germany (February 2025) are set to significantly bolster its retail and SME operations. These moves are expected to broaden BAWAG's customer reach and geographical presence within the dynamic DACH/NL region, a key growth market.

The integration of these digital-first entities is anticipated to drive substantial future earnings growth for BAWAG. By entering these high-growth markets, the group is actively pursuing and capturing market share, particularly in areas with strong digital banking adoption.

The full integration of Knab, a Dutch digital bank acquired in late 2024, significantly bolsters BAWAG's digital banking capabilities and market presence within the Netherlands. This strategic integration is perfectly timed to capitalize on the escalating consumer demand for seamless digital banking experiences. BAWAG's enhanced digital offerings are poised to capture a larger share of this expanding market segment.

This move solidifies BAWAG's commitment to digital transformation, with a particular emphasis on non-branch originations. This strategy positions the digital banking segment as a high-growth area with the potential for substantial market share gains. For instance, by the end of 2024, digital-only banks in Europe had collectively seen a 15% year-over-year increase in customer acquisition, a trend BAWAG aims to leverage.

BAWAG Group has seen robust expansion in its consumer and SME lending portfolios. Retail loans saw a 1% increase quarter-over-quarter, while the broader consumer and SME loan segment grew by 3% in the second quarter of 2025. This performance highlights the strategic importance of this area for the group, especially in the DACH/NL markets.

The company's commitment to disciplined underwriting and a sharp focus on risk-adjusted returns within this growing market segment solidify its position as a Star in the BCG matrix. This strategic focus is expected to counterbalance slower growth observed in mortgage lending.

Strategic M&A Pipeline for Growth

BAWAG Group's strategic mergers and acquisitions (M&A) represent a core growth driver, positioning them as a 'Star' in the BCG matrix. This proactive approach is evident in their consistent pursuit of earnings-accretive deals, having successfully integrated 14 acquisitions since 2015. Recent examples like the acquisitions of Knab and Barclays Consumer Bank Europe underscore their commitment to expanding market share within their key operational regions.

This disciplined M&A strategy focuses on targets that align with BAWAG's stringent return on tangible common equity (RoTCE) benchmarks, ensuring that each acquisition contributes positively to profitability. By targeting businesses that enhance their presence in growing market segments, BAWAG is effectively fueling its overall expansion and solidifying its competitive position.

Key aspects of BAWAG's strategic M&A pipeline include:

- Consistent Deal Flow: 14 acquisitions completed since 2015, demonstrating a sustained commitment to inorganic growth.

- Focus on Accretion: Prioritizing acquisitions that are earnings-accretive and meet high RoTCE targets.

- Market Expansion: Targeting businesses that strengthen their position in core markets and growing segments.

- Recent Acquisitions: Knab and Barclays Consumer Bank Europe are prime examples of their ongoing strategic M&A activity.

Specialized Lending Platforms (e.g., Factoring, Leasing)

BAWAG Group's specialized lending platforms, such as factoring and leasing, are positioned to capture niche markets with significant growth potential. These offerings allow BAWAG to cater to specific client needs, particularly within the Small and Medium-sized Enterprise (SME) sector, which often exhibits dynamic expansion.

While the broader corporate loan portfolio experienced a modest contraction, the strategic emphasis on high-return segments like specialized lending indicates a move towards more profitable avenues. This focus on specialized products, especially those supporting SME development, could classify these as potential stars within BAWAG's BCG matrix, signifying high growth and market share.

BAWAG's commitment to investing in these platforms underscores its strategy to foster growth across the entire group. For instance, by enhancing its factoring capabilities, BAWAG can unlock working capital for businesses, thereby stimulating their growth and deepening its own market penetration.

- Factoring and Leasing: BAWAG's specialized lending products target high-growth niches within corporate lending.

- SME Focus: These offerings are particularly beneficial for SMEs, driving growth in this vital economic segment.

- Strategic Investment: BAWAG is actively investing in these platforms to ensure continued expansion and market leadership.

- Potential Star Classification: The combination of high growth potential and BAWAG's strategic focus suggests these could be 'stars' in the BCG matrix.

BAWAG Group's strategic acquisitions, particularly Knab and Barclays Consumer Bank Europe, significantly enhance its retail and SME operations, positioning these segments as Stars. These digital-first entities are expected to drive substantial future earnings growth and capture market share in high-growth digital banking markets.

The group's robust expansion in consumer and SME lending, with retail loans up 1% and the broader segment up 3% in Q2 2025, further solidifies these areas. Disciplined underwriting and a focus on risk-adjusted returns in these growing markets are key drivers for their Star classification.

BAWAG's specialized lending platforms, such as factoring and leasing, are also identified as Stars due to their potential to capture niche markets with significant growth, especially within the SME sector.

The consistent deal flow and focus on earnings-accretive acquisitions, exemplified by 14 completed since 2015, reinforce the Star status of BAWAG's inorganic growth strategy.

| Business Segment | BCG Matrix Classification | Key Drivers |

|---|---|---|

| Retail & SME Lending (incl. Knab, Barclays acquisitions) | Star | Digitalization, Market Share Growth, Digital-First Integration |

| Specialized Lending (Factoring, Leasing) | Star | Niche Market Capture, SME Support, High-Growth Potential |

| Strategic Acquisitions (Overall M&A) | Star | Earnings Accretion, RoTCE Focus, Market Expansion |

What is included in the product

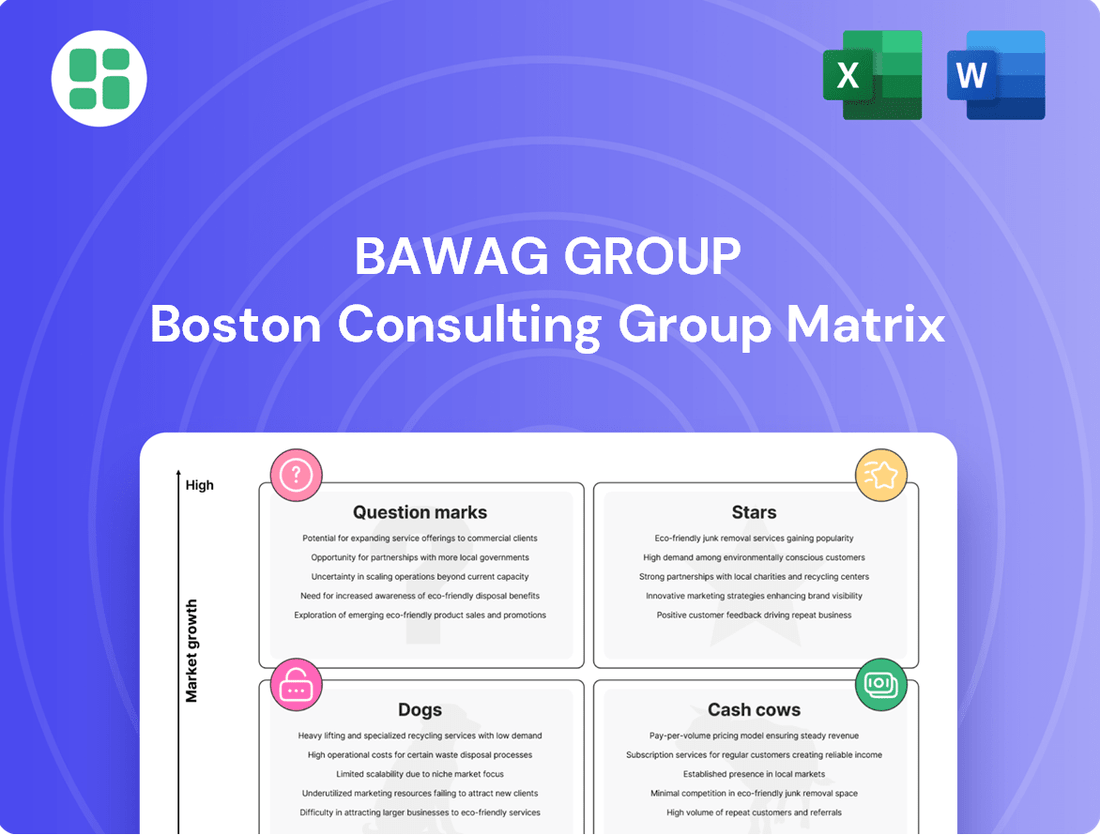

The Bawag Group BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment and divestment decisions.

A clear BCG Matrix visualizes Bawag's business units, easing the pain of strategic resource allocation.

Cash Cows

Austrian Retail Banking (Traditional) represents a significant Cash Cow for Bawag Group. Its long history and established presence have cultivated a loyal and mature customer base, ensuring consistent demand for core products like savings accounts and payment services.

This segment is characterized by strong, predictable cash flows, benefiting from a deeply entrenched market position that minimizes the need for extensive promotional spending. In 2023, Bawag Group reported a net profit of €1.4 billion, with its Austrian retail operations forming a substantial part of this strong performance.

BAWAG's mortgage loan portfolio in Austria represents a significant Cash Cow. With a substantial €27 billion in mortgages, a notable 37% benefit from state or insurance guarantees, highlighting its low-risk profile.

Despite potentially slower growth in the current market, this segment generates consistent, long-term interest income, underpinning BAWAG's profitability. The stability and security of these assets firmly place them within the Cash Cow quadrant of the BCG matrix.

BAWAG's public sector lending, especially to Austrian entities, is a cornerstone of its stability. This segment, valued at €5.8 billion, showcases a low-risk profile with predictable earnings and minimal defaults.

These loans, while not offering significant growth, hold a substantial market share in a mature, specialized area. They are crucial for BAWAG's robust asset quality, acting as a reliable source of cash flow.

Core Customer Deposits

Core customer deposits are a cornerstone of BAWAG Group's financial strength, acting as its primary refinancing source. This indicates a robust customer relationship and a dependable funding foundation.

These deposits are characterized by their low cost, offering BAWAG a consistent and stable liquidity stream crucial for its lending operations. This stability translates into healthy profit margins as it minimizes the need for substantial growth investments, positioning them as a classic Cash Cow within the BCG Matrix.

- Customer Deposits as Primary Refinancing: In 2023, customer deposits constituted a significant portion of BAWAG's total funding, underscoring their importance.

- Low-Cost Funding Advantage: The low interest rates paid on these deposits directly contribute to BAWAG's net interest margin, enhancing profitability.

- Stability and Predictability: The consistent inflow and low volatility of customer deposits provide a predictable funding base, reducing reliance on more expensive market funding.

- Contribution to Profitability: As a mature and stable source of funds, core customer deposits generate substantial profits with minimal incremental investment, aligning with the characteristics of a Cash Cow.

Treasury Operations and Capital Management

BAWAG Group's treasury operations and capital management function as a significant Cash Cow within its BCG Matrix analysis. This is driven by the bank's consistently strong capital position, evidenced by a Common Equity Tier 1 (CET1) ratio of 13.5% as of Q2 2025. The bank also holds substantial excess capital, which, coupled with disciplined capital allocation strategies, enables robust free cash flow generation.

This efficient management of financial resources, while not a product itself, allows BAWAG to effectively fund its growth initiatives and return capital to shareholders. The high return on tangible common equity (RoTCE) of 27.6% recorded in Q2 2025 underscores the profitability and effectiveness of these operations.

- Capital Strength: BAWAG maintains a robust capital position with a CET1 ratio of 13.5% and significant excess capital.

- Disciplined Management: The group employs disciplined capital management practices.

- High Profitability: Achieved a strong RoTCE of 27.6% in Q2 2025.

- Cash Generation: Efficient treasury and capital management generates substantial free cash flow.

BAWAG's Austrian retail banking segment is a prime example of a Cash Cow. Its established market presence and loyal customer base ensure steady revenue from core banking services.

This segment benefits from strong, predictable cash flows due to its mature market position, minimizing the need for aggressive marketing. In 2023, BAWAG's Austrian retail operations contributed significantly to its overall net profit of €1.4 billion.

The mortgage loan portfolio in Austria, with €27 billion in loans, many benefiting from state guarantees, is another key Cash Cow. This low-risk segment provides consistent, long-term interest income, reinforcing BAWAG's profitability.

Public sector lending, particularly to Austrian entities, represents a stable Cash Cow. This €5.8 billion portfolio boasts a low-risk profile and predictable earnings, solidifying BAWAG's robust asset quality.

| Segment | BCG Classification | Key Characteristics | 2023/2025 Data Points |

|---|---|---|---|

| Austrian Retail Banking | Cash Cow | Established market, loyal customers, predictable cash flow | Net Profit Contribution to €1.4B (2023) |

| Austrian Mortgage Loans | Cash Cow | Low-risk, guaranteed portfolio, consistent interest income | €27B Portfolio Value; 37% State/Insurance Guarantees |

| Public Sector Lending (Austria) | Cash Cow | Low-risk, predictable earnings, stable funding | €5.8B Portfolio Value |

| Customer Deposits | Cash Cow | Low-cost funding, stable liquidity, high profitability | Primary refinancing source; Low cost contributes to Net Interest Margin |

| Treasury & Capital Management | Cash Cow | Strong capital position, efficient management, high RoTCE | CET1 Ratio 13.5% (Q2 2025); RoTCE 27.6% (Q2 2025) |

What You’re Viewing Is Included

Bawag Group BCG Matrix

The Bawag Group BCG Matrix preview you're viewing is the identical, fully formatted report you'll receive upon purchase, ensuring no surprises and immediate usability for your strategic planning. This comprehensive analysis, created by industry experts, is ready to be integrated into your business development efforts without any additional editing or watermarks. You're getting a professional-grade document designed for clear insights into Bawag Group's business units, allowing for informed decision-making. Once purchased, this Bawag Group BCG Matrix will be instantly accessible for your team to leverage for competitive advantage and growth strategies.

Dogs

BAWAG Group, like many established financial institutions, likely grapples with legacy IT systems. These older platforms can be expensive to maintain and often lag in efficiency and innovation compared to modern digital solutions. In 2024, the ongoing costs associated with supporting and updating these systems represent a significant operational expenditure, potentially hindering investment in more agile and growth-oriented technologies.

Despite significant investments in digitalization, Bawag Group may still have a footprint of underutilized physical branches. These locations, if not effectively repurposed into advisory centers, represent a cost burden with declining transaction volumes and minimal market penetration in the digital banking era. For instance, in 2024, many traditional banks reported that a substantial portion of their branch network generated less than 10% of their total customer interactions, highlighting the inefficiency.

BAWAG Group's strategic focus remains on its core DACH and Netherlands markets, alongside targeted international expansion. However, within its broader portfolio, certain non-core market exposures outside these key regions might exist. These are typically smaller segments or portfolios where BAWAG holds a low market share and anticipates limited growth prospects.

These minor exposures, often yielding low returns, do not align with the group's current strategic direction for growth and market leadership. For instance, a small, legacy portfolio in a market with declining economic activity and intense local competition would fit this description. Such segments are candidates for divestment or restructuring to reallocate capital to more promising ventures.

Highly Specific, Declining Traditional Services

Within Bawag Group's strategic analysis, the category of Highly Specific, Declining Traditional Services represents those banking functions experiencing a significant drop in customer engagement. These are often legacy services that haven't kept pace with digital innovation or evolving customer preferences. For instance, services like extensive manual check processing or in-branch foreign currency exchange for non-travelers might fall into this group. They cater to a diminishing segment of the customer base, yielding minimal revenue while demanding considerable operational resources.

These services are characterized by low market growth and high operational costs relative to their profitability. Bawag Group, like many financial institutions, faces the challenge of managing these offerings efficiently. The focus here is on minimizing resource allocation to these declining areas, potentially through automation, consolidation, or phased discontinuation, to free up capital and personnel for more promising ventures.

- Declining Demand: Services like physical passbook updates or over-the-counter bill payments for utilities are seeing reduced usage as digital alternatives become prevalent.

- Shrinking Customer Base: These offerings are typically used by an older demographic or a very niche segment of customers who are not migrating to newer platforms.

- High Operational Effort: Maintaining the infrastructure and personnel for these services can be disproportionately expensive compared to the revenue generated.

- Low Growth Potential: The market for these specific traditional services is not expected to rebound or grow significantly in the foreseeable future.

Inefficient Back-Office Processes

Inefficient back-office processes at BAWAG Group represent areas where the bank's commitment to continuous improvement and automation has not yet fully penetrated. These operations, often characterized by manual workflows and a high reliance on human input, are prime candidates for the 'Dog' quadrant in a BCG matrix analysis. Such inefficiencies can lead to increased operational expenditures and a drag on overall productivity, without offering significant contributions to market share or growth.

These 'Dog' segments within the back-office are typically characterized by:

- Manual and Labor-Intensive Workflows: Processes that require significant human intervention, increasing the risk of errors and slowing down operations.

- High Operational Costs: Due to the manual nature and potential for rework, these areas consume more resources than their output justifies.

- Lack of Competitive Advantage: Unlike automated and streamlined processes, these inefficient back-office functions do not contribute to a stronger market position or faster service delivery.

- Potential for Significant Improvement: Identifying and addressing these 'Dogs' offers substantial opportunities to enhance efficiency and reduce costs across the organization.

Within BAWAG Group's operational framework, certain legacy IT systems and underutilized physical branches likely fall into the 'Dog' category of the BCG matrix. These segments, while still requiring resources, exhibit low market share and low growth potential. For example, in 2024, many traditional banks saw their branch networks account for less than 10% of total customer interactions, indicating a shift away from these physical touchpoints.

Highly specific, declining traditional services, such as manual check processing or over-the-counter foreign currency exchange, also represent 'Dogs'. These services cater to a shrinking customer base and incur high operational costs relative to their revenue. Bawag Group's focus is on minimizing investment in these areas, aiming to reallocate capital to more promising digital initiatives.

Inefficient back-office processes characterized by manual workflows and high operational costs are prime examples of 'Dogs' within BAWAG Group. These areas lack a competitive advantage and offer significant opportunities for improvement through automation and streamlining. Addressing these inefficiencies is crucial for enhancing overall productivity and reducing expenditures.

Question Marks

The acquisition of Barclays Consumer Bank Europe, adding 1.2 million customers, positions Bawag Group's German operations as a Question Mark. While the business is currently exceeding expectations, its future success hinges on overcoming significant integration hurdles.

Critical to realizing the full potential of this acquisition is the successful migration of data, seamless system integration, and the rebranding to 'easybank Germany' by 2026. These complex tasks demand substantial investment and carry inherent execution risks.

BAWAG's strategic focus on its core DACH and Netherlands markets is complemented by a forward-looking expansion into Western Europe and the United States. These new geographical ventures, characterized by low initial market share but high growth potential, would be classified as Question Marks in the BCG matrix. For instance, BAWAG's entry into the US market, a vast and competitive landscape, requires substantial investment to build brand recognition and a customer base.

Emerging digital payment solutions represent a significant opportunity for BAWAG Group, fitting squarely into the Question Mark category of the BCG matrix. The fintech sector is experiencing explosive growth, with global digital payment transaction values projected to reach over $15 trillion by 2027. BAWAG's current market share in this dynamic space might be nascent, necessitating strategic investments in advanced payment processing technologies or key partnerships to gain a competitive foothold.

To transition these digital payment ventures from Question Marks to Stars, BAWAG must focus on driving substantial user adoption and market penetration. The success of these initiatives hinges on effective marketing campaigns and seamless user experiences to capture a meaningful share of the rapidly expanding digital payments market. For instance, companies like Stripe, which facilitates online payment processing, saw its valuation surge significantly in recent years, highlighting the potential rewards for successful players in this arena.

New Investment Products (e.g., ESG-focused)

New investment products, especially those aligned with Environmental, Social, and Governance (ESG) principles, are a key growth area as investor demand escalates. BAWAG's engagement in developing and marketing these specialized offerings, where its market position may still be emerging, positions them as Stars or Question Marks within a BCG Matrix framework. Continued investment is crucial to capture assets and establish a stronger market footprint.

The ESG market is experiencing significant expansion. For instance, global sustainable investment assets reached an estimated $35.3 trillion in early 2024, according to the Global Sustainable Investment Alliance. BAWAG's strategic focus on these products reflects a proactive approach to a rapidly evolving financial landscape.

- ESG Market Growth: The global sustainable investment market continues its upward trajectory, driven by increasing investor awareness and regulatory support.

- BAWAG's Strategic Position: BAWAG's development of ESG-focused products places it in a dynamic segment requiring strategic investment to build market share.

- Investment Rationale: Capital allocation towards these new offerings is essential for attracting investor capital and solidifying BAWAG's presence in this high-potential market.

- Competitive Landscape: While the ESG market is growing, it is also becoming increasingly competitive, necessitating a strong value proposition and effective marketing.

Advanced Data Analytics and AI Initiatives

BAWAG Group's commitment to innovation is clearly demonstrated through its investments in advanced data analytics and AI initiatives. These projects are designed to create more personalized customer experiences, bolster risk management capabilities, and enhance overall operational efficiency.

These cutting-edge endeavors are characterized by their high growth potential, but also by the inherent uncertainty of immediate returns and their initial limited market impact. This positions them squarely in the question mark category of the BCG matrix, representing potential future stars if their implementation proves successful.

- Investment Focus: BAWAG is channeling resources into AI and advanced analytics for improved customer journeys and risk mitigation.

- Growth Potential: These initiatives target high-growth areas within the financial services sector.

- Market Position: Currently, they exhibit low market share and low market growth, typical of question marks.

- Future Outlook: Successful execution could transform these into stars, driving significant future growth and market dominance.

Bawag Group's expansion into new markets, such as the US, and its ventures into emerging areas like digital payments and ESG-focused products, represent significant Question Marks. These initiatives offer high growth potential but currently hold a low market share, requiring substantial investment and facing considerable execution risk.

The success of these Question Marks hinges on strategic execution, including effective integration of acquisitions like Barclays Consumer Bank, robust marketing for new digital offerings, and capturing market share in the rapidly growing ESG investment space.

Bawag's investments in AI and advanced data analytics also fall into the Question Mark category, promising future efficiency and personalized customer experiences, but with uncertain immediate returns and market impact.

To convert these Question Marks into Stars, Bawag must drive user adoption, achieve seamless integration, and establish a strong competitive position in these dynamic, high-potential segments.

BCG Matrix Data Sources

Our Bawag Group BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.