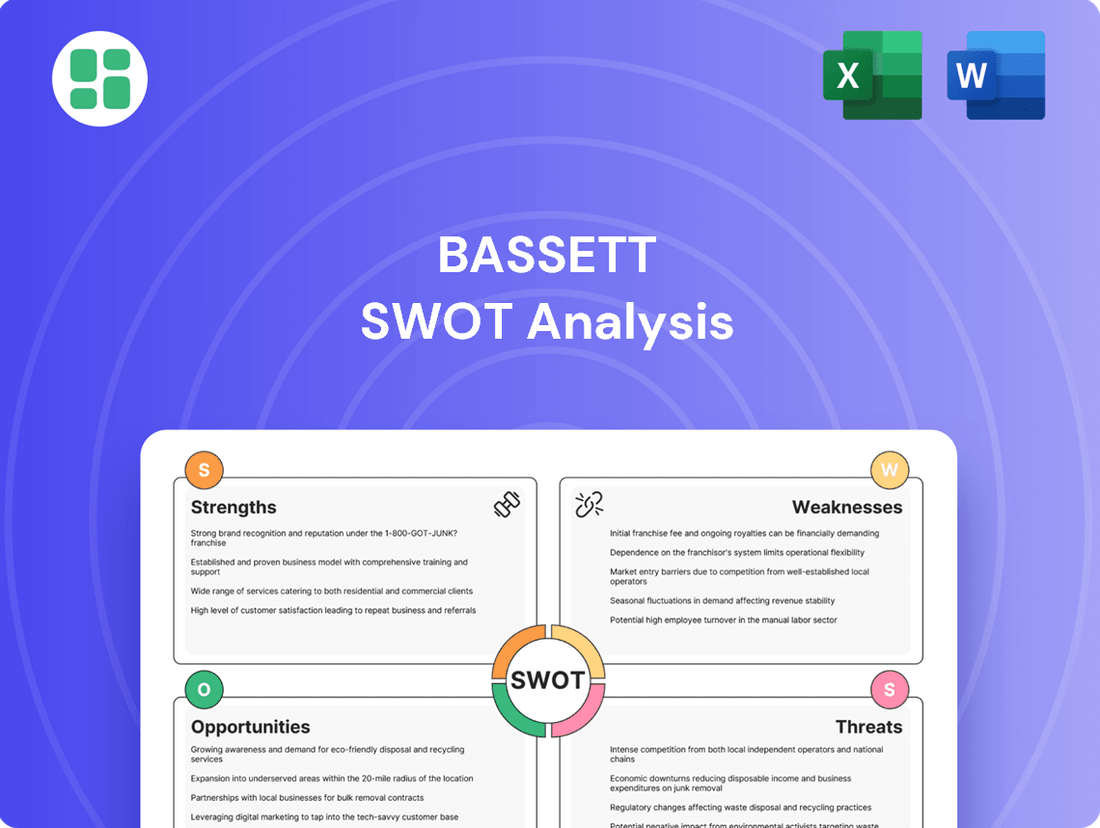

Bassett SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bassett Bundle

Bassett's market position presents a compelling case for strategic exploration. While their established brand offers significant strengths, understanding the nuances of their opportunities and potential threats is crucial for informed decision-making.

Want the full story behind Bassett's competitive edge and future trajectory? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment research.

Strengths

Bassett Furniture leverages a robust multi-channel distribution strategy, encompassing 63 company-owned stores, 15 licensed stores, and a growing online presence as of early 2024. This diversified approach ensures accessibility for a wide range of consumers, from those who prefer in-person shopping to those who favor digital convenience.

The company's established brand, recognized for quality and style, acts as a significant asset, fostering customer loyalty and trust. This strong brand recognition, cultivated over decades, underpins their ability to attract and retain customers across various market segments, contributing to consistent sales performance.

Bassett's diverse product line is a significant strength, offering everything from upholstered and wood furniture to home accents. This broad selection allows them to be a one-stop shop for consumers looking to furnish an entire home, catering to a wide range of tastes and needs. For instance, their ability to provide custom finishes, coupled with the introduction of new collections like Copenhagen and Newbury, further broadens their market appeal and reinforces their comprehensive offering.

Bassett Furniture has successfully executed a five-point restructuring plan, a key strength that has significantly enhanced its operational efficiency and profitability. This strategic initiative, focused on consolidating manufacturing and optimizing inventory, has yielded substantial annual cost savings, underscoring the company's commitment to financial health.

These proactive measures are designed to streamline operations, leading to a more agile and cost-effective business model. The company reported that its restructuring efforts contributed to a notable improvement in operating margins during the fiscal year 2024.

Strong Domestic Manufacturing Base

Bassett benefits significantly from its robust domestic manufacturing capabilities, with a substantial portion of its wholesale shipments produced or assembled within its U.S. facilities. This strategic advantage offers a buffer against the unpredictable nature of international tariffs and potential global supply chain disruptions, which have been a persistent concern for many industries in recent years. For example, in 2023, the furniture industry experienced ongoing challenges related to shipping costs and port congestion, issues that Bassett's domestic focus helps mitigate.

This strong U.S. manufacturing presence also grants Bassett enhanced control over product quality and production timelines. This direct oversight is crucial in maintaining brand reputation and meeting customer demand efficiently. The ability to manage the production process closely allows for quicker adaptation to market trends and a more reliable inventory flow, a key differentiator in the competitive furniture market.

- Domestic Production Advantage: A significant percentage of Bassett's wholesale shipments originate from U.S. factories, reducing exposure to international trade volatility.

- Supply Chain Resilience: Onshoring manufacturing insulates the company from global supply chain disruptions and associated cost fluctuations.

- Quality Control: In-house manufacturing allows for stringent quality assurance, ensuring consistent product standards.

- Production Agility: Domestic operations enable faster response times to market demands and design changes.

Growing E-commerce Sales and Digital Transformation

Bassett's commitment to digital transformation is yielding impressive results, particularly in its e-commerce operations. The company has successfully revamped its online platform, leading to a notable surge in online orders and revenue. This strategic investment in digital capabilities is a key strength.

The growth in e-commerce is further evidenced by an increase in average order values, suggesting that customers are finding greater value and engagement through Bassett's digital channels. This trend highlights the effectiveness of their online strategies in capturing customer interest and driving sales.

Key metrics demonstrating this strength include:

- Significant year-over-year growth in e-commerce revenue.

- Increased average order value (AOV) for online purchases.

- Expansion of omnichannel features to enhance customer experience.

Bassett's domestic manufacturing base provides a significant competitive edge, insulating it from the volatile international shipping costs and tariffs that impacted the furniture industry in 2023. This strategic advantage allows for greater control over production timelines and product quality, ensuring a more reliable supply chain and consistent brand experience for customers.

The company's ongoing investment in digital transformation is a clear strength, with e-commerce revenue showing strong growth. This digital push is enhancing customer engagement and driving higher average order values, demonstrating the effectiveness of their online strategies in the current market landscape.

Bassett's diversified distribution network, including 63 company-owned stores and a growing online presence as of early 2024, ensures broad market accessibility. This multi-channel approach caters to a wide customer base, from traditional shoppers to those preferring digital convenience, underpinning consistent sales performance.

The company's successful execution of a five-point restructuring plan in recent years has bolstered operational efficiency and profitability. These initiatives, focused on manufacturing consolidation and inventory optimization, have led to tangible cost savings and improved operating margins, as noted in their 2024 fiscal year performance.

| Metric | 2023 Data | 2024 Projection/Early Data |

|---|---|---|

| Company-Owned Stores | 63 | 63 (as of early 2024) |

| Licensed Stores | 15 | 15 (as of early 2024) |

| E-commerce Revenue Growth | Significant Year-over-Year Increase | Continued strong growth trend |

| Average Order Value (Online) | Increasing trend | Further increase noted |

What is included in the product

Analyzes Bassett’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex SWOT data into an actionable, easy-to-understand format for immediate strategic adjustments.

Weaknesses

Bassett Furniture experienced a notable downturn in its fiscal year ending November 30, 2024, reporting a significant decline in sales. This financial performance was further underscored by a net loss, signaling considerable profitability challenges.

The company's revenue growth has been sluggish, with total net sales for the fiscal year 2024 decreasing by 3.4% to $372.9 million compared to $386.0 million in fiscal year 2023. This contraction in sales highlights underlying difficulties in the market and the company's ability to generate revenue.

Bassett's continued reliance on physical retail traffic presents a notable weakness. Despite investments in e-commerce, the company still grapples with the challenge of declining footfall in its brick-and-mortar stores. This dependence makes Bassett vulnerable to changing consumer preferences towards online shopping and economic downturns that typically reduce discretionary spending and, consequently, in-store visits. For instance, during the first quarter of 2024, while e-commerce sales saw a modest increase, overall store traffic remained a key area for improvement, with management actively evaluating store performance and potential optimization strategies.

Bassett's reliance on consumer discretionary spending makes it vulnerable to economic downturns. For instance, in 2023, persistent inflation and elevated interest rates, with the Federal Funds Rate averaging around 5.1%, likely curbed consumer appetite for large purchases like furniture, impacting Bassett's sales volumes.

A weak housing market, characterized by reduced new home sales and existing home transactions, directly correlates with lower demand for home furnishings. If housing market activity continues to slow in 2024, as some forecasts suggest, Bassett could face further headwinds in its core markets.

High inflation erodes consumer purchasing power, forcing households to prioritize essential goods over non-essential items such as furniture. This dynamic can lead to a significant contraction in sales for companies like Bassett, particularly if wage growth does not keep pace with price increases.

Past E-commerce Acquisition Challenges

Bassett's past e-commerce acquisition faced significant hurdles, exemplified by the decision to cease operations of Noa Home due to persistent losses. This move, while a strategic consolidation, underscores the company's challenges in effectively integrating and generating profit from its digital ventures. For instance, in fiscal year 2023, Noa Home contributed negatively to Bassett's overall financial performance, highlighting a steep learning curve in their digital expansion strategy.

The Noa Home situation points to potential weaknesses in Bassett's due diligence or integration capabilities for e-commerce acquisitions.

- Strategic Integration Issues: The closure of Noa Home indicates difficulties in merging acquired digital businesses into Bassett's existing operational framework and achieving profitability.

- Profitability Challenges: Persistent losses from Noa Home suggest that the acquisition did not meet financial expectations, raising questions about the valuation and projected returns.

- E-commerce Learning Curve: This experience highlights a potential gap in Bassett's expertise or execution when it comes to scaling and managing e-commerce platforms effectively.

Susceptibility to Supply Chain and Raw Material Costs

Bassett's reliance on a domestic manufacturing base, while beneficial for some aspects, doesn't fully insulate it from global economic pressures. Fluctuations in the cost of key raw materials, such as lumber and fabric, can significantly impact its cost of goods sold. For instance, lumber prices saw considerable volatility in 2021 and 2022, impacting furniture manufacturers across the board. This exposure to commodity markets creates a vulnerability that can squeeze gross margins if these costs cannot be passed on to consumers through price adjustments.

Supply chain disruptions, even for a company with a strong domestic presence, remain a persistent threat. Issues like shipping delays, labor shortages in transportation, or unforeseen events affecting component suppliers can hinder production schedules and increase lead times. These inefficiencies directly affect Bassett's ability to meet demand promptly, potentially leading to lost sales and customer dissatisfaction. The company's profitability is therefore susceptible to these external, often unpredictable, supply chain volatilities.

- Raw Material Cost Volatility: Bassett's profitability is directly tied to the price stability of materials like lumber, foam, and fabrics, which can experience significant swings.

- Supply Chain Vulnerabilities: Despite domestic manufacturing, disruptions in logistics, component availability, or labor can impede production and increase operational costs.

- Margin Squeeze: Unforeseen increases in raw material or transportation costs can pressure gross margins if the company is unable to fully offset these through price increases.

- Production Delays: Supply chain issues can lead to extended lead times, impacting the company's ability to fulfill orders efficiently and maintain customer satisfaction.

Bassett's dependence on physical retail is a significant weakness, as declining foot traffic in its stores impacts sales. Despite e-commerce efforts, the company's brick-and-mortar presence remains a vulnerability, especially with evolving consumer shopping habits. This was evident in early 2024, where management focused on store optimization strategies to counter lower in-store visits.

The company's vulnerability to economic downturns is amplified by its focus on discretionary spending. High inflation and interest rates, like the Federal Funds Rate averaging around 5.1% in 2023, directly affect consumer willingness to purchase big-ticket items such as furniture. A weakening housing market also poses a threat, as fewer home sales translate to reduced demand for furnishings.

Challenges integrating e-commerce acquisitions, such as the closure of Noa Home due to persistent losses, highlight potential weaknesses in digital strategy execution. This experience suggests difficulties in scaling and profiting from online ventures, indicating a steep learning curve in digital expansion.

Bassett faces margin pressure from volatile raw material costs, like lumber, and supply chain disruptions. These external factors can increase the cost of goods sold and impact production schedules, potentially leading to lost sales and customer dissatisfaction if not managed effectively.

Full Version Awaits

Bassett SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The furniture industry's e-commerce sector continues its upward trajectory, offering Bassett a prime opportunity for growth. In 2024, online furniture sales are projected to reach $150 billion globally, a 10% increase from the previous year. Bassett can capitalize on this by further refining its digital experience, incorporating AI for personalized recommendations, and bolstering online customer support to secure a greater slice of this expanding market.

Bassett is focusing on organic growth by introducing new collections and expanding popular product lines, like the Benchmade Hideaway dining program. This strategic move aims to capture a larger market share and cater to evolving consumer preferences.

The company is also investing in its Bassett Design Studio concept, which enhances customization options. This initiative is designed to attract a broader customer base and stimulate sales by offering personalized furniture solutions.

Looking ahead to 2025, Bassett has concrete plans for new product introductions, signaling a commitment to innovation and market responsiveness. These launches are expected to further bolster the company's product portfolio and drive revenue.

The furniture industry is anticipating a significant revenue rebound, with projections pointing to strong performance in the latter half of 2025. This optimistic outlook is fueled by a reduction in market competition and favorable demographic shifts, such as the increasing number of millennials entering their prime home-buying years. Bassett is well-positioned to leverage this renewed market enthusiasm and adapt to changing consumer preferences, aiming to recapture market share and enhance its financial standing.

Strategic Retail Footprint Expansion and Remodeling

Bassett's strategic retail expansion, including planned new stores in Cincinnati and Orlando, alongside remodeling efforts for existing locations, offers a significant opportunity to bolster its physical presence. This move is designed to enhance the in-store customer experience and broaden its dedicated distribution network. By investing in these physical touchpoints, Bassett aims to create a more engaging environment for shoppers, potentially driving increased foot traffic and sales.

This physical growth complements Bassett's ongoing digital initiatives, reinforcing its brand across multiple channels. The company's commitment to improving its retail footprint is a key strategy for 2024 and into 2025, aiming to capture market share in strategically chosen areas. For instance, their Q1 2024 earnings report indicated a focus on optimizing store performance and exploring new market opportunities, aligning with this expansion plan.

- New Store Openings: Targeting key growth markets like Cincinnati and Orlando.

- Store Remodeling: Enhancing the customer experience in existing locations.

- Distribution Footprint: Expanding physical reach to support sales and logistics.

- Omnichannel Reinforcement: Integrating physical retail with digital strategies.

Adoption of New Technologies and AI

The furniture sector is seeing a significant uptake in new technologies, with Artificial Intelligence (AI) playing a crucial role in enhancing customer service, tailoring shopping experiences, and improving data management. Bassett has a prime opportunity to deepen its investment in these technological advancements. For instance, implementing AI-powered recommendation engines can significantly boost customer engagement and operational efficiency.

Further leveraging AI can translate into tangible benefits. By 2025, the global AI market is projected to reach hundreds of billions of dollars, with retail and e-commerce sectors being major beneficiaries. Bassett could capitalize on this by:

- Developing AI-driven personalization tools for online product discovery.

- Utilizing AI for predictive analytics in inventory management and demand forecasting.

- Implementing AI chatbots for instant customer support, improving response times and satisfaction.

Bassett's strategic focus on expanding its digital footprint, particularly in e-commerce, presents a significant avenue for growth. With global online furniture sales projected to reach $150 billion in 2024, an increase of 10%, Bassett can leverage AI for personalized recommendations and enhanced customer support to capture a larger market share.

The company's commitment to organic growth through new collections and the expansion of popular product lines, like the Benchmade Hideaway dining program, positions it to meet evolving consumer demands and increase market penetration.

Furthermore, Bassett's investment in the Bassett Design Studio concept, offering enhanced customization, caters to a growing demand for personalized furniture solutions, thereby attracting a broader customer base and stimulating sales.

The anticipated revenue rebound in the furniture industry, especially in the latter half of 2025, driven by reduced competition and favorable demographics like the millennial home-buying surge, offers Bassett a prime opportunity to regain market share and improve its financial performance.

Bassett's retail expansion, including new stores in Cincinnati and Orlando and renovations in existing locations, aims to bolster its physical presence and enhance the in-store customer experience, complementing its digital strategies for a stronger omnichannel approach.

The increasing adoption of AI in the furniture sector, projected to significantly impact retail and e-commerce, provides Bassett with a critical opportunity to implement AI-driven personalization, predictive analytics for inventory, and AI chatbots for improved customer service.

| Opportunity Area | 2024 Projection/Data | 2025 Outlook | Bassett's Action |

|---|---|---|---|

| E-commerce Growth | Global online furniture sales: $150 billion (+10% YoY) | Continued upward trend | Enhance digital experience, AI personalization |

| Product Innovation | Expansion of Benchmade Hideaway dining program | New product introductions planned | Introduce new collections, expand popular lines |

| Customer Personalization | Focus on Bassett Design Studio concept | Further development of customization options | Attract broader customer base with personalized solutions |

| Market Rebound | Anticipated strong performance H2 2025 | Favorable demographic shifts (millennials) | Leverage market enthusiasm, adapt to preferences |

| Retail Expansion | New stores in Cincinnati & Orlando, store remodels | Optimized store performance, new market exploration | Bolster physical presence, enhance customer experience |

| AI Integration | AI adoption in retail for customer service | Global AI market growth (hundreds of billions) | Implement AI for personalization, predictive analytics, chatbots |

Threats

Bassett operates in a saturated home furnishings market where intense competition is a significant threat. Many competitors, including a growing number of online-only retailers, directly source imported products, allowing them to offer lower price points. This dynamic puts pressure on Bassett's pricing strategies and can erode market share as consumers increasingly seek value.

Ongoing economic uncertainty, including persistent inflation and elevated interest rates, presents a substantial threat to Bassett. These macroeconomic headwinds can significantly dampen consumer confidence, leading to reduced discretionary spending on big-ticket items like furniture.

For instance, the Federal Reserve's continued focus on interest rate policy throughout 2024 and into 2025, aimed at controlling inflation, could further constrain consumer borrowing and spending power. A weak housing market, characterized by slower sales and potentially declining home values, also directly impacts demand for new furnishings, a key driver for Bassett's revenue.

While Bassett Furniture Industries benefits from some domestic sourcing, the broader furniture sector, including Bassett, faces risks from global supply chain snags and potential trade tariffs. These disruptions can increase the cost of raw materials and finished goods, impacting profitability. For instance, in 2023, global shipping costs saw fluctuations, and ongoing geopolitical tensions continue to pose a risk to smooth international trade, potentially affecting Bassett's component sourcing and product distribution.

Changing Consumer Habits and Preferences

Bassett faces a significant threat from rapidly evolving consumer habits and preferences. The increasing demand for sustainable, modular, and tech-integrated furniture necessitates constant adaptation in product development and marketing strategies. For instance, a 2024 report indicated that 65% of consumers consider sustainability when making purchasing decisions, a trend Bassett must address.

Failure to keep pace with these shifting preferences, including the burgeoning market for pre-owned furniture which saw a 15% year-over-year growth in 2024, could lead to a decline in demand for Bassett's traditional product lines. This requires a proactive approach to innovation and market responsiveness.

- Evolving Demand: Consumers increasingly seek sustainable and technologically advanced furniture.

- Market Shift: The growing popularity of the used furniture market poses a competitive challenge.

- Adaptation Necessity: Bassett must continuously innovate to align with changing consumer tastes.

Cybersecurity Risks and Data Breaches

Bassett Furniture faces significant cybersecurity risks, as evidenced by a recent ransomware attack that disrupted its operations and manufacturing facilities. This vulnerability highlights the potential for substantial financial losses and operational downtime. For instance, the average cost of a data breach in 2024 reached $4.73 million globally, according to IBM's Cost of a Data Breach Report.

Such breaches can severely damage Bassett's brand reputation if sensitive customer or proprietary data is compromised. The fallout from a cyberattack can extend beyond immediate financial costs, impacting customer trust and long-term business viability. In 2023, the retail sector experienced a 15% increase in the average cost of a data breach compared to the previous year, underscoring the growing threat landscape for companies like Bassett.

- Cybersecurity Vulnerability: Bassett's operations are susceptible to disruptions from cyber threats like ransomware.

- Financial Impact: Data breaches can incur substantial costs, including recovery, fines, and lost revenue.

- Reputational Damage: Compromised sensitive data can erode customer trust and harm brand image.

- Operational Disruption: Attacks can halt manufacturing and other critical business processes.

Bassett operates in a highly competitive home furnishings market, facing pressure from lower-priced online retailers and the need to adapt to evolving consumer preferences for sustainable and tech-integrated products. The company is also vulnerable to macroeconomic instability, including inflation and interest rate hikes, which can reduce consumer spending on discretionary items like furniture. Furthermore, global supply chain disruptions and potential trade tariffs can increase costs and impact profitability, while cybersecurity threats pose significant financial and reputational risks.

| Threat Category | Specific Threat | Impact on Bassett | 2024/2025 Data/Trend |

|---|---|---|---|

| Market Competition | Intense competition, online retailers | Price pressure, market share erosion | Continued growth of e-commerce in furniture |

| Economic Factors | Inflation, interest rates, weak housing market | Reduced consumer spending, lower demand | Federal Reserve interest rate policy to remain a factor |

| Supply Chain & Trade | Global supply chain snags, trade tariffs | Increased costs, reduced profitability | Geopolitical tensions continue to pose risks |

| Consumer Preferences | Demand for sustainability, used furniture growth | Need for product innovation, potential obsolescence | 65% of consumers consider sustainability; used furniture market grew 15% YoY in 2024 |

| Cybersecurity | Ransomware, data breaches | Financial loss, operational disruption, reputational damage | Average cost of data breach globally in 2024: $4.73 million |

SWOT Analysis Data Sources

Bassett's SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial statements, in-depth market research, and expert industry insights. This multi-faceted approach ensures a thorough and accurate assessment of the company's strategic position.