Bassett Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bassett Bundle

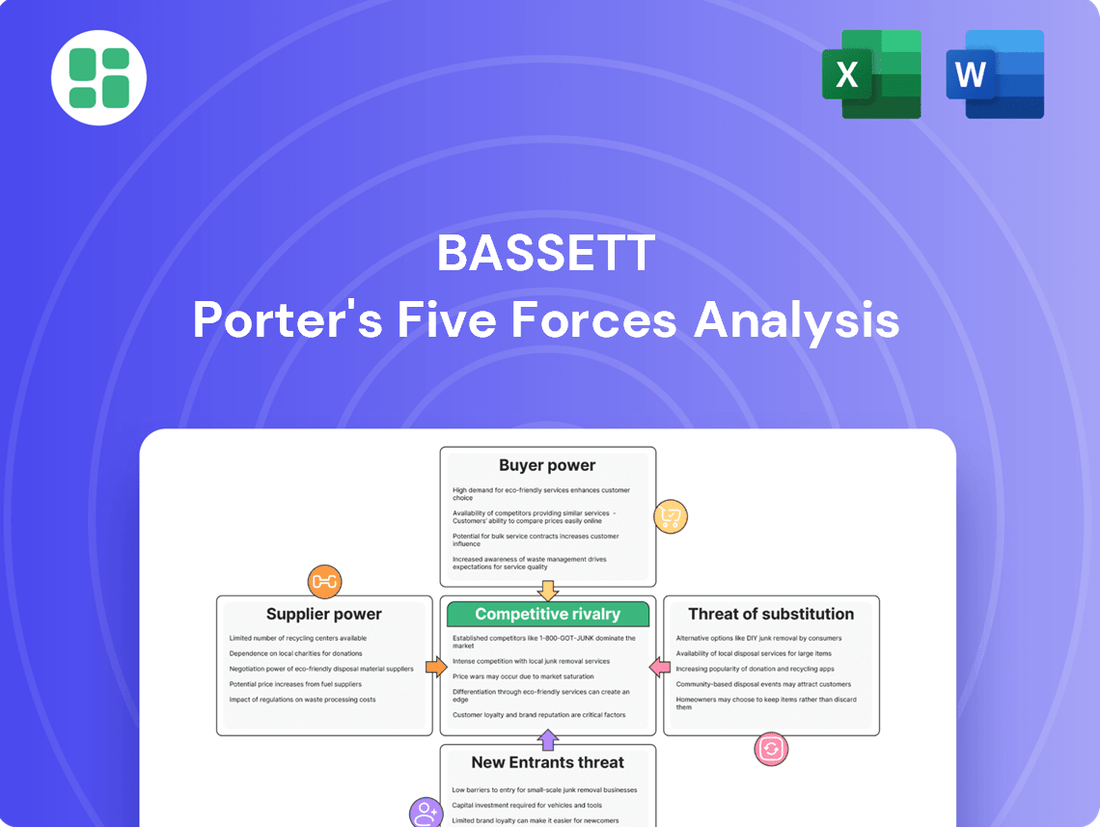

Bassett's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers and suppliers to the constant threat of new entrants and substitutes. Understanding these dynamics is crucial for any business operating in or looking to enter this market.

This brief overview only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bassett’s competitive dynamics, market pressures, and strategic advantages in detail, gaining the insights you need to thrive.

Suppliers Bargaining Power

The concentration of key suppliers for materials like lumber, textiles, and specialized hardware significantly impacts Bassett. If only a few suppliers exist for critical components, their ability to dictate prices or terms increases, potentially raising Bassett's input costs. For instance, in 2024, the global lumber market experienced price volatility due to supply chain disruptions, with some regions seeing increases of over 15% for certain wood types.

Conversely, a diverse and fragmented supplier base reduces individual supplier power. Bassett's strategy to maintain relationships with multiple vendors across different regions helps mitigate the risk of any single supplier holding excessive leverage. This diversification is crucial, especially when considering that in 2023, the furniture manufacturing sector in the US relied on imports for approximately 20% of its raw materials, highlighting the importance of supplier relationships.

Bassett Furniture Industries faces significant bargaining power from its suppliers, largely due to high switching costs. These costs can include the expense and time involved in re-tooling manufacturing processes to accommodate new materials or establishing entirely new supply chain relationships. For example, if a key component supplier changes, Bassett might need to invest in new machinery or extensive testing to ensure compatibility and quality with an alternative source.

The financial implications of these switching costs are substantial. If it's costly or time-consuming for Bassett to move to a different supplier, current suppliers gain considerable leverage in price negotiations. This leverage is further amplified by the costs associated with rigorous quality control and the lengthy process of qualifying new suppliers, ensuring they meet Bassett's exacting standards.

Suppliers offering highly specialized, patented, or unique materials or components wield significant bargaining power. For instance, if Bassett Furniture Industries relies on proprietary design elements or exceptionally rare wood species, the suppliers of these inputs can dictate premium pricing. In 2023, companies that secured exclusive supply agreements for critical, high-demand components often saw their input costs rise by 10-15% due to this leverage.

The bargaining power of these suppliers is directly correlated with the lack of readily available substitutes. If Bassett’s product lines depend on materials or components that are not easily replicated or sourced from alternative providers, the supplier’s position strengthens considerably. Conversely, the presence of generic components or easily accessible substitute materials diminishes a supplier’s ability to extract higher prices or favorable terms.

Threat of Forward Integration by Suppliers

If suppliers possess a credible threat to integrate forward and begin manufacturing furniture themselves, their bargaining power over Bassett significantly increases. This potential for direct competition can compel Bassett to accept less favorable terms, such as higher prices or stricter payment schedules, simply to avoid facing its own suppliers as direct rivals in the marketplace. While less common in the broader furniture industry, this threat can be more pronounced for suppliers of highly specialized components or unique materials, where their expertise is critical to Bassett's product differentiation.

For instance, a supplier of high-end, sustainably sourced lumber or a specialized upholstery fabric manufacturer could, in theory, leverage their unique position. Imagine a scenario where a key lumber supplier, seeing the profitability in Bassett's finished goods, decides to invest in its own finishing and assembly operations. Such a move could directly challenge Bassett's market share. In 2023, the global furniture market was valued at approximately $737 billion, indicating the substantial revenue streams available that might incentivize such forward integration for well-positioned suppliers.

- Supplier Forward Integration Threat: Suppliers can increase their bargaining power by credibly threatening to manufacture furniture themselves, forcing Bassett to accept less favorable terms.

- Impact on Bassett: This threat can lead to higher input costs or unfavorable contract conditions for Bassett to mitigate direct competition from its own suppliers.

- Industry Specificity: While generally less common in the furniture sector, the threat is more significant for suppliers of specialized components or unique materials vital to furniture production.

- Market Context: The substantial global furniture market, valued around $737 billion in 2023, presents a potential incentive for suppliers with critical capabilities to consider forward integration.

Importance of Bassett to Suppliers

The significance of Bassett Furniture Industries to its suppliers plays a crucial role in determining the suppliers' bargaining power. If Bassett constitutes a substantial portion of a supplier's annual sales, that supplier is likely to be more accommodating with pricing and terms to retain Bassett as a key customer. For instance, if a supplier's business is heavily reliant on Bassett, they may be more inclined to offer discounts or flexible payment schedules.

Conversely, if Bassett represents a minor account for a supplier, the supplier has considerably less leverage to negotiate favorable terms. In such scenarios, the supplier has little incentive to concede on price or other contractual conditions, as their overall revenue is not significantly impacted by Bassett's business. This asymmetry in reliance directly influences the bargaining dynamic.

In 2023, for example, major furniture manufacturers often source components from specialized suppliers. The concentration of these suppliers in specific regions or their unique production capabilities can also shift bargaining power. If Bassett relies on a single supplier for a critical component, that supplier gains significant leverage, regardless of Bassett's overall size.

- Supplier Revenue Dependence: A supplier whose revenue is largely derived from Bassett will have less bargaining power, incentivizing them to offer better terms.

- Bassett's Account Size: If Bassett is a small client for a supplier, that supplier has minimal motivation to compromise on price or conditions.

- Supplier Market Share: The broader market position of a supplier can influence their ability to dictate terms, even to larger customers like Bassett.

- Component Criticality: Reliance on a sole supplier for essential parts grants that supplier enhanced bargaining power over Bassett.

The bargaining power of suppliers significantly impacts Bassett Furniture Industries by influencing input costs and operational flexibility. High switching costs, reliance on specialized materials, and the threat of supplier forward integration all contribute to this power. For instance, in 2024, the cost of key raw materials like lumber and textiles saw fluctuations, with some components experiencing price increases of up to 15% due to supply chain pressures.

Bassett's strategy to diversify its supplier base and maintain strong relationships helps mitigate these pressures. However, the dependence on suppliers for unique or patented components, where substitutes are scarce, inherently grants those suppliers leverage. This was evident in 2023, when exclusive supply agreements for high-demand components often led to 10-15% cost hikes for manufacturers.

Furthermore, if Bassett represents a significant portion of a supplier's business, the supplier may be more accommodating. Conversely, if Bassett is a minor client, the supplier's leverage increases. The global furniture market's substantial value, estimated at around $737 billion in 2023, also presents opportunities for suppliers to consider forward integration, potentially increasing their bargaining power.

| Factor | Impact on Bassett | 2023/2024 Data Point |

|---|---|---|

| Supplier Concentration | Higher prices, limited options | Lumber prices up 15% in some regions (2024) |

| Switching Costs | Reduced flexibility, higher costs to change suppliers | Investment in new machinery/testing required |

| Specialized Materials | Premium pricing, dependence on few sources | Exclusive component costs up 10-15% (2023) |

| Supplier Forward Integration Threat | Potential for direct competition, less favorable terms | $737 billion global furniture market (2023) incentivizes integration |

| Bassett's Account Size for Supplier | Supplier accommodation vs. limited negotiation | Supplier reliance varies significantly |

What is included in the product

Bassett's Five Forces Analysis dissects the competitive intensity and profitability potential of the furniture industry, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and existing rivalry.

Quickly identify and mitigate competitive threats with a visual breakdown of all five forces, making strategic planning less daunting.

Customers Bargaining Power

Customers in the home furnishings market, especially for items not considered essential luxury goods, often exhibit significant price sensitivity. This is largely because these purchases are discretionary, and consumers have a wide array of competing brands and products to choose from. For instance, a 2024 report indicated that consumer spending on furniture and home furnishings saw a notable slowdown compared to previous years, reflecting this heightened sensitivity to economic conditions and personal budgets.

Bassett's strategy of operating through multiple channels, from traditional showrooms to online platforms, allows them to address a spectrum of price points. However, the overall economic climate and the level of disposable income available to consumers are critical factors that directly impact how price-sensitive customers will be. When disposable income tightens, as seen in some sectors during early 2024 with inflation concerns, customers become more focused on value and price, thereby amplifying their bargaining power.

The furniture market in 2024 is characterized by a vast number of sellers, from online giants like Wayfair and Amazon to established retailers such as IKEA and Ashley Furniture, alongside countless smaller boutiques. This sheer volume of choices means customers have significant leverage. For instance, Wayfair reported net sales of $12.2 billion in 2023, highlighting the scale of online competition alone.

Customers can readily compare prices, styles, and quality across a multitude of channels, including brick-and-mortar stores and direct-to-consumer (DTC) brands. This ease of comparison, amplified by readily available product reviews and comparison websites, empowers consumers to seek out the best value. The rise of the resale market and the popularity of DIY furniture projects further dilute a single retailer's pricing power.

Customers today possess a remarkable advantage due to the vast amount of information readily available online. They can effortlessly research Bassett's offerings against those of its competitors, scrutinizing features, quality, and pricing to make well-informed purchasing decisions. This heightened transparency significantly diminishes information asymmetry, placing greater power in the hands of the buyer.

Low Switching Costs for Customers

For most furniture purchases, the cost or effort for a customer to switch from considering Bassett to another retailer is relatively low. There are no long-term contracts or significant investments tied to a specific brand, making it easy for customers to walk away if unsatisfied with the offering or price. This ease of switching increases customer leverage.

In 2024, consumer spending on furniture and furnishings saw a notable increase, with the U.S. Census Bureau reporting a 4.5% rise in retail sales for furniture and home furnishings stores in the first quarter compared to the previous year. This indicates a competitive market where customers have ample choices and are less likely to be locked into a single provider.

- Low Switching Costs: Customers can easily move between furniture retailers without incurring significant penalties or investments.

- No Long-Term Commitments: Unlike services requiring contracts, furniture purchases are typically one-off transactions, allowing for greater customer flexibility.

- Price Sensitivity: The ability to switch easily makes customers more sensitive to price differences and promotions offered by competitors.

- Brand Loyalty Challenges: Retailers like Bassett must continually offer compelling value to retain customers, as brand loyalty can be fragile when switching is effortless.

Volume of Purchases by Customers

The volume of purchases by customers significantly influences their bargaining power. While individual furniture buyers typically make infrequent, low-volume purchases, limiting their individual sway, the collective impact of numerous individual decisions can shape market demand. For a company like Bassett, this means that while one customer's order is small, the aggregation of many such orders creates a substantial market force that suppliers must acknowledge.

However, large institutional buyers, such as hotel chains or property developers, often place substantial bulk orders. These significant volumes grant them considerably more leverage when negotiating prices and terms with furniture manufacturers like Bassett. For instance, a large hotel renovation project could involve thousands of furniture units, making the buyer's volume a dominant factor in the negotiation.

- Individual Consumers: Low individual purchase volume, limiting direct bargaining power.

- Institutional Buyers: High purchase volume (e.g., hotels, developers) grants significant bargaining power.

- Designer Bulk Orders: Large orders placed by designers also increase their negotiation leverage.

- Collective Market Force: The aggregation of many individual consumer decisions can create a powerful market influence.

Customers possess considerable bargaining power in the home furnishings sector due to readily available alternatives and low switching costs. In 2024, the market remains highly competitive, with numerous online and brick-and-mortar retailers offering a wide array of products. This abundance of choice allows consumers to easily compare prices and quality, driving down prices and limiting any single company's ability to dictate terms.

The ability for customers to switch between providers with minimal effort significantly amplifies their leverage. This is particularly true for non-essential, discretionary purchases like furniture, where consumers can delay buying or opt for less expensive alternatives if dissatisfied with a particular retailer's offering or pricing. Economic conditions in early 2024, marked by inflation concerns, further heightened consumer price sensitivity.

While individual consumers typically buy in low volumes, their collective purchasing decisions create a significant market force. However, large institutional buyers, such as hotel chains or property developers, wield substantial bargaining power due to their high-volume orders, often negotiating favorable terms. For instance, a major hotel renovation can involve thousands of furniture units, making the buyer's volume a dominant factor.

| Factor | Impact on Bargaining Power | 2024 Context/Example |

|---|---|---|

| Availability of Alternatives | High | Numerous online retailers (Wayfair, Amazon) and physical stores (IKEA, Ashley Furniture) offer vast choices. |

| Switching Costs | Low | No significant penalties or investments required to change furniture providers. |

| Price Sensitivity | High | Consumers readily compare prices; inflation concerns in early 2024 increased focus on value. |

| Purchase Volume | Varies | Individual consumers have low volume, but institutional buyers (e.g., hotels) have high volume, granting them significant leverage. |

Full Version Awaits

Bassett Porter's Five Forces Analysis

This preview showcases the complete Bassett Porter's Five Forces Analysis, offering a detailed examination of competitive forces within an industry. The document you see here is the exact, professionally formatted file you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently acquire this comprehensive analysis, ready for immediate application to your strategic planning needs.

Rivalry Among Competitors

The home furnishings sector is quite crowded, with a wide array of companies vying for market share. This includes giants like Ashley Furniture and IKEA, alongside nimble online retailers such as Wayfair, and even smaller, specialized shops. This sheer number and variety of players, each with different strengths and strategies, means competition is fierce across the board.

The home furnishings industry, while experiencing some cyclical growth, can become intensely competitive when expansion slows. In 2024, the U.S. home furnishings market saw a modest growth rate, with some segments facing flat demand. This environment forces companies like Bassett Furniture Industries to fight harder for existing customers, often through price reductions and heightened promotional activity, which can squeeze profitability.

The extent to which Bassett Furniture can differentiate its products significantly influences competitive rivalry. Bassett aims to stand out through a diverse product range, focusing on design and quality. However, many furniture items, particularly at lower price points, can be perceived as commodities.

When product differentiation is strong, through unique designs, a solid brand reputation, or superior quality, it tends to lessen direct price-based competition. For instance, Bassett's ability to offer customizable options and a wide selection of fabrics can create a barrier to direct comparison with competitors.

Conversely, a lack of significant differentiation forces companies to compete more intensely on price. This dynamic can increase rivalry as businesses vie for market share by offering lower costs. In 2023, the U.S. furniture industry saw varied performance, with some segments experiencing slower growth, highlighting the importance of differentiation in a competitive landscape.

Exit Barriers

High exit barriers can significantly trap companies within an industry, even when they are struggling. For instance, specialized assets, like dedicated manufacturing plants for a specific product, can be difficult and costly to repurpose or sell. In 2024, many industries continued to grapple with the challenge of divesting underperforming divisions due to the sunk costs associated with these unique assets.

When firms find it hard to exit, they may persist in operating at a loss. This prolongs intense competition, as these companies fight to survive, often by cutting prices. This dynamic directly impacts profitability across the board, preventing the natural consolidation that could otherwise alleviate competitive pressures.

Consider the implications for Bassett: if competitors face substantial costs to leave the market, they are more likely to remain active, even if unprofitable. This can translate to continued price wars and reduced market share opportunities for Bassett. For example, industries with high capital investment in specialized machinery often see prolonged periods of intense competition due to these exit difficulties.

- Specialized Assets: Companies with unique, industry-specific equipment face high costs for disposal or repurposing.

- Long-Term Contracts: Existing commitments with suppliers or customers can obligate firms to continue operations.

- Employee Severance Costs: Significant payouts for laid-off workers represent a substantial financial hurdle to exiting.

- Government Regulations: Certain industries may have regulatory requirements that make closure or divestiture complex and expensive.

Fixed Costs and Capacity

Industries characterized by high fixed costs, such as those requiring extensive manufacturing facilities or showrooms, often foster intense competitive rivalry. Companies in these sectors are driven to operate at full capacity to spread these costs, which can lead to price wars to secure market share and maintain production levels. For instance, in 2024, the automotive manufacturing sector, which shares similarities with furniture production in its capital intensity, saw ongoing price pressures as manufacturers aimed to optimize their plant utilization.

Bassett Furniture's own manufacturing operations entail considerable fixed costs. This financial reality can compel the company and its competitors to adopt aggressive pricing tactics to ensure their production lines remain busy and overheads are covered. Such strategies become particularly pronounced during periods of economic slowdown, when demand naturally softens, increasing the pressure to maintain sales volume.

- High Fixed Costs: Industries with substantial investments in physical assets, like manufacturing plants and showrooms, create a barrier to exit and encourage capacity utilization.

- Capacity Utilization Incentive: Firms with excess capacity are often tempted to lower prices to fill their production lines, even if margins are reduced.

- Economic Sensitivity: During economic downturns, the pressure to utilize capacity intensifies, potentially leading to more aggressive competitive behavior.

- Bassett's Position: Bassett's manufacturing footprint means it faces these dynamics, potentially influencing its pricing strategies and competitive interactions.

The home furnishings sector is highly competitive, featuring numerous players from large corporations like Ashley Furniture and IKEA to online specialists such as Wayfair. This broad spectrum of companies, each with unique strategies, intensifies rivalry. In 2024, the U.S. home furnishings market experienced modest growth, with some segments facing stagnant demand, forcing companies like Bassett Furniture to compete more aggressively on price and promotions, potentially impacting profitability.

Product differentiation is a key factor in mitigating competitive rivalry. Bassett Furniture aims to distinguish itself through a wide range of designs and quality, yet many furniture items, especially at lower price points, can be perceived as interchangeable commodities. When differentiation is strong, direct price competition lessens; however, a lack of significant unique features can lead to intense price wars, as seen in the varied performance of the U.S. furniture industry in 2023, where slower growth in certain segments underscored the importance of distinct offerings.

High exit barriers, such as specialized assets or significant employee severance costs, can keep struggling companies in the market. This persistence prolongs intense competition, as firms fight to survive, often through price reductions, which negatively affects overall profitability. For example, industries with substantial investments in specialized machinery, like automotive manufacturing, often experience prolonged periods of intense competition due to these exit difficulties, a dynamic that can also affect capital-intensive sectors like furniture manufacturing.

| Factor | Description | Impact on Bassett |

|---|---|---|

| Number of Competitors | Many large and small players, including online retailers. | Intense market share battles. |

| Market Growth (2024) | Modest overall, with some flat segments. | Increased pressure for price competition and promotions. |

| Product Differentiation | Bassett focuses on design/quality; many items are seen as commodities. | Success in differentiation reduces price wars; lack thereof increases them. |

| Exit Barriers | Specialized assets, contracts, severance costs. | Competitors may remain in the market even when unprofitable, sustaining price wars. |

| Fixed Costs | High capital investment in manufacturing and showrooms. | Incentive to maintain high capacity utilization through competitive pricing. |

SSubstitutes Threaten

The availability of alternative solutions that offer a comparable value proposition at a similar or lower price point poses a significant threat to furniture retailers like Bassett Furniture. For instance, the growing popularity of furniture rental services, especially among younger demographics and those in temporary living situations, presents a direct substitute. In 2023, the global furniture rental market was valued at approximately $10 billion, with projections indicating continued growth, demonstrating a clear shift in consumer preferences away from outright ownership.

Customer willingness to switch to alternatives significantly impacts the furniture industry. If consumers readily embrace rental services, second-hand markets, or even DIY solutions, Bassett Furniture's traditional new product sales face greater pressure. For instance, the growing popularity of furniture rental platforms, which saw substantial growth in the early 2020s, indicates a segment of the market prioritizing flexibility over ownership.

Budget-consciousness is a major driver here. When economic conditions tighten, consumers are more likely to explore lower-cost alternatives to new furniture. Reports from 2024 suggest that a notable percentage of consumers are actively seeking deals and considering refurbished or pre-owned items to manage household expenses, directly impacting demand for new, higher-priced goods.

Shifting cultural norms also play a role. Trends like minimalist living, where consumers opt for fewer, more versatile items, or the rise of transient lifestyles, where individuals move more frequently, can decrease the perceived need for long-term furniture investments. This evolving consumer mindset can lead to increased adoption of modular or easily transportable solutions, acting as substitutes for traditional, stationary furniture pieces.

Consumers increasingly explore decor solutions beyond traditional furniture. Options like built-in cabinetry, custom shelving, or minimalist approaches can significantly reduce the need for new furniture purchases. For instance, the growing trend towards multi-functional spaces, where furniture serves multiple purposes, further diminishes reliance on standalone pieces.

Secondhand and Refurbished Markets

The expanding secondhand, vintage, and refurbished furniture markets present a significant threat of substitutes for companies like Bassett. Online platforms such as Facebook Marketplace and eBay, alongside specialized apps, have made it easier than ever for consumers to find pre-owned items. This trend is fueled by a desire for lower prices and unique styles, directly impacting demand for new furniture.

Consumers are increasingly drawn to these alternative markets, particularly those who are budget-conscious or environmentally aware. For instance, the resale market for furniture is projected to see continued growth, with many consumers actively seeking out more sustainable and affordable options. This can divert a substantial portion of potential sales away from traditional retailers.

- Growing Resale Market: The global secondhand market is experiencing robust growth, with furniture being a significant category.

- Price Sensitivity: Consumers can often find comparable or even higher quality furniture at a fraction of the cost of new items.

- Environmental Concerns: The appeal of sustainability encourages many buyers to opt for pre-owned furniture, reducing the demand for newly manufactured goods.

- Online Accessibility: Digital platforms have democratized the secondhand market, making it a convenient and accessible alternative for a wide range of consumers.

Do-It-Yourself (DIY) Furniture and Upcycling

The growing popularity of DIY furniture projects and upcycling old pieces presents a threat of substitutes for companies like Bassett. Consumers are increasingly drawn to personalizing their spaces, saving money, or engaging in creative hobbies by building their own furniture or repurposing existing items. This trend, while perhaps not impacting large furniture purchases significantly, does siphon off demand for smaller, more customizable items or specific functional needs that might otherwise be met by traditional retailers.

For instance, platforms like Etsy and Pinterest have seen a surge in DIY furniture tutorials and upcycling ideas. In 2023, searches for DIY furniture on Google Trends increased by approximately 15% year-over-year. This indicates a tangible shift in consumer behavior, where a segment prioritizes unique, cost-effective, or handmade solutions over mass-produced items. This can be particularly relevant for Bassett's lower-priced or more modular product lines.

- DIY Trend Growth: Online searches for DIY furniture projects saw a notable increase in 2023.

- Consumer Motivations: Personalization, cost savings, and creative expression drive consumers towards DIY.

- Impact on Retailers: This trend diverts demand, particularly for smaller or customizable furniture items.

The threat of substitutes for furniture retailers like Bassett is significant and multifaceted. Consumers are increasingly turning to rental services, the burgeoning secondhand market, and even DIY projects as viable alternatives to purchasing new furniture. These substitutes often appeal due to cost savings, flexibility, or unique customization options, directly impacting traditional sales channels.

The rise of furniture rental, especially for those seeking temporary solutions or frequent style changes, offers a direct substitute. In 2023, the global furniture rental market was valued at around $10 billion, indicating a substantial shift in consumer preference away from outright ownership for certain segments. This trend is projected to continue its upward trajectory, presenting a clear challenge to new furniture sales.

The secondhand and refurbished furniture markets are also growing rapidly, driven by price sensitivity and a desire for sustainability. Online platforms have made these alternatives more accessible than ever. For example, in 2024, a significant portion of consumers actively sought deals and considered pre-owned items to manage household budgets, directly competing with new furniture purchases.

DIY furniture projects and upcycling are further eroding demand for new items, particularly for smaller or customizable pieces. In 2023, Google searches for DIY furniture increased by approximately 15% year-over-year, highlighting a growing consumer interest in personalized, cost-effective, and creative solutions that bypass traditional retail.

| Substitute Category | Key Drivers | 2023 Market Data/Trends |

|---|---|---|

| Furniture Rental | Flexibility, temporary living, style changes | Global market valued at ~$10 billion, with continued growth |

| Secondhand/Refurbished | Cost savings, sustainability, unique styles | Robust growth, increased online accessibility |

| DIY/Upcycling | Cost savings, personalization, creative hobbies | ~15% YoY increase in Google searches for DIY furniture (2023) |

Entrants Threaten

The home furnishings industry, especially for businesses with manufacturing and broad retail footprints like Bassett Furniture Industries, demands considerable capital. Think about the costs associated with setting up factories, acquiring and maintaining machinery, stocking a diverse inventory, and creating appealing retail showrooms. For instance, in 2023, Bassett reported capital expenditures of $23.5 million, highlighting the ongoing investment needed to maintain and grow its operations.

These substantial upfront financial commitments create a significant hurdle for any new company looking to enter the market and compete effectively. It’s not just about having a good idea; it's about having the millions of dollars needed to build the infrastructure from the ground up. This barrier naturally limits the number of new entrants capable of entering the market at a scale that could meaningfully challenge established players like Bassett.

Economies of scale present a significant barrier for new entrants into the furniture industry. Established players, such as Bassett Furniture Industries (BSET), leverage their substantial production volumes to achieve lower per-unit costs in manufacturing, raw material sourcing, and logistics. For instance, in 2023, Bassett reported a gross profit margin of 32.1%, reflecting some of these efficiencies.

Newcomers would find it incredibly challenging to match these cost advantages from the outset. Without the established volume and operational expertise, they would likely face higher production costs, making it difficult to compete on price with Bassett and other large manufacturers. Building up the necessary scale to achieve comparable cost efficiencies can take years and significant capital investment.

Existing furniture giants like Bassett Furniture Industries have cultivated deep brand loyalty over decades, a significant barrier for newcomers. Their established reputation for quality and design, bolstered by consistent marketing efforts, means new entrants must invest heavily to even begin to capture consumer attention. For example, in 2024, the furniture industry saw continued consumer preference for brands with a proven track record, making it challenging for unproven entities to gain market share without substantial promotional spending.

Access to Distribution Channels

Bassett Furniture Industries (BSET) benefits from established distribution channels, including company-owned retail stores, licensed locations, and robust online platforms. This existing infrastructure presents a significant barrier for new entrants aiming to compete in the furniture market.

New competitors would face the considerable challenge of replicating Bassett's multi-channel distribution network. This involves substantial investment in physical retail space, forging partnerships with online marketplaces, or developing effective direct-to-consumer (DTC) strategies. For instance, establishing a national retail footprint similar to Bassett's approximately 100 stores requires millions in capital expenditure and years of development.

Securing prime shelf space in physical stores or achieving visibility on crowded online platforms is another major hurdle. In 2024, the retail landscape continues to be dominated by established brands with strong customer loyalty and marketing budgets. New entrants must overcome the inertia of consumer purchasing habits and the cost associated with acquiring new customers, making market penetration a slow and expensive process.

- Established Distribution Network: Bassett's blend of company-owned stores, licensed partners, and online presence offers immediate market access.

- High Entry Costs: New entrants must invest heavily in building their own retail infrastructure or securing online distribution agreements.

- Competitive Visibility: Gaining traction against established players like Bassett requires significant marketing spend and strategic placement.

- Time to Market: Developing a comparable distribution and sales network can take years, delaying profitability for newcomers.

Experience and Learning Curve

The furniture industry demands significant expertise in areas like supply chain logistics, design innovation, and customer relations. Newcomers often struggle to match the operational efficiency and market understanding developed by established companies over years of experience.

Bassett Furniture, for instance, benefits from decades of accumulated knowledge in sourcing materials, managing production, and understanding consumer preferences. This deep learning curve means new entrants may face higher initial costs and a greater risk of operational missteps.

- Operational Complexity: Navigating a furniture business involves intricate supply chains, quality control, and retail operations, which take time to master.

- Learning Curve Disadvantage: New entrants lack the institutional knowledge and experience that established players like Bassett have built over many years.

- Market Missteps: Inexperience can lead to errors in product design, marketing, or distribution, hindering a new company's ability to gain traction.

- Cost of Inefficiency: Without established processes, new entrants may incur higher costs for production, logistics, and customer service, impacting profitability.

The threat of new entrants into the home furnishings sector, particularly for companies like Bassett Furniture Industries, is significantly mitigated by high capital requirements and established economies of scale. New players need substantial investment to match production volumes and achieve cost efficiencies, a challenge highlighted by Bassett's 2023 capital expenditures of $23.5 million.

Furthermore, strong brand loyalty and extensive distribution networks, like Bassett's approximately 100 stores and online presence, act as formidable barriers. New entrants must overcome consumer inertia and the costs of building comparable market access, a process that often takes years and considerable financial backing.

| Barrier Type | Description | Impact on New Entrants | Example (Bassett) |

|---|---|---|---|

| Capital Requirements | High upfront investment for manufacturing, inventory, and retail. | Limits the number of well-funded competitors. | $23.5 million in capital expenditures (2023). |

| Economies of Scale | Lower per-unit costs due to high production volumes. | Makes it difficult for new entrants to compete on price. | 32.1% gross profit margin (2023) suggests efficiency. |

| Brand Loyalty | Established reputation and customer trust. | Requires significant marketing to gain consumer attention. | Continued consumer preference for proven brands (2024 trend). |

| Distribution Network | Existing physical stores, licensed locations, and online platforms. | High cost and time to replicate market access. | Network of ~100 stores and online sales channels. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of publicly available data, including company annual reports, SEC filings, and industry-specific market research reports to provide a comprehensive view of the competitive landscape.