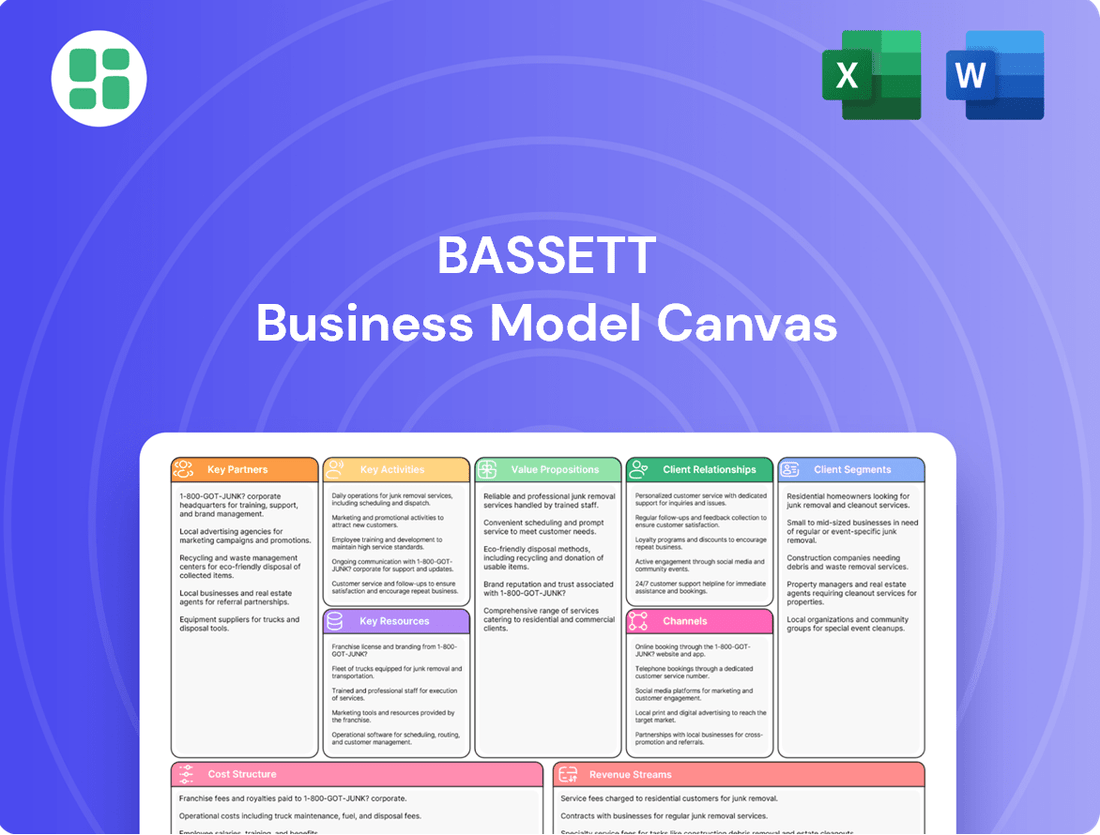

Bassett Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bassett Bundle

Discover the core components of Bassett's successful business strategy with our comprehensive Business Model Canvas. This detailed breakdown illuminates how they connect with customers, deliver value, and generate revenue. For anyone aiming to replicate or adapt such success, this is an essential tool.

Partnerships

Bassett Furniture relies on strategic alliances with key suppliers for essential raw materials like lumber, fabric, and leather. These partnerships are vital for maintaining a consistent and cost-efficient flow of components, directly impacting production schedules and quality control. For instance, in 2024, Bassett continued to navigate global supply chain fluctuations, underscoring the importance of these supplier relationships for both domestic production and imported goods.

Bassett relies heavily on third-party logistics (3PL) providers to manage its extensive distribution network. These partnerships are crucial for ensuring finished goods reach retail locations and end consumers efficiently. For instance, in 2024, Bassett likely continued to leverage these relationships to navigate supply chain complexities and maintain competitive delivery times.

Bassett's strategic licensing agreements with independent furniture retailers are a cornerstone of its expansion strategy. These partnerships allow Bassett to tap into established local markets and customer bases, significantly broadening its brand reach without the extensive capital outlay typically required for company-owned stores. In 2024, Bassett continued to leverage these relationships to place its branded Design Centers and Custom Studios within these retail locations, offering a curated Bassett experience to a wider audience.

Key Partnership 4

Bassett Furniture’s strategic alliances with interior design firms and professional designers are crucial for accessing the high-end market. These partnerships allow Bassett to showcase its custom manufacturing capabilities, offering bespoke furniture solutions tailored to specific client needs and design aesthetics.

This focus on the design trade is a significant growth driver, enabling Bassett to cater to a discerning clientele. For instance, in 2023, Bassett reported that its design trade program was a key contributor to its revenue growth, with a notable increase in orders originating from professional designers.

- Design Trade Focus: Bassett actively cultivates relationships with interior designers, positioning itself as a preferred partner for custom furniture projects.

- Market Access: These partnerships provide direct access to affluent customers seeking unique and high-quality furnishings.

- Customization Leverage: Bassett’s in-house manufacturing allows it to fulfill complex design requests, strengthening its value proposition to the trade.

- Revenue Contribution: The design trade segment has shown consistent growth, underscoring the financial impact of these key relationships.

Key Partnership 5

Bassett Furniture relies on technology and e-commerce platform providers as crucial partners in its digital transformation. These collaborations are vital for developing and maintaining Bassett's online presence, directly impacting customer engagement and sales. In 2024, the furniture industry saw continued growth in e-commerce, with online sales accounting for a significant portion of revenue for many retailers.

These partnerships are instrumental in enhancing Bassett's omnichannel strategy. They focus on improving the user experience, optimizing search functionality, and enabling personalized recommendations for customers. For instance, a strong e-commerce platform can lead to higher conversion rates and increased customer loyalty.

- Technology Providers: Facilitate the infrastructure for online operations.

- E-commerce Platforms: Enable seamless online transactions and customer interaction.

- User Experience Enhancement: Focus on intuitive navigation and engaging content.

- Personalization Tools: Drive tailored product suggestions and marketing efforts.

Bassett Furniture's key partnerships extend to its extensive network of independent retailers and licensed dealers, which is crucial for market penetration and brand visibility. These collaborations allow Bassett to reach diverse customer segments across various geographic locations, amplifying its sales channels. In 2024, Bassett continued to expand its footprint through these strategic alliances, aiming to capture a larger share of the retail furniture market.

The company also collaborates with various technology and e-commerce platform providers to enhance its digital presence and customer engagement. These partnerships are vital for optimizing online sales, improving user experience, and implementing personalized marketing strategies. In 2024, the furniture industry witnessed a significant shift towards digital channels, making these tech partnerships essential for maintaining competitiveness.

Furthermore, Bassett's relationships with interior designers and the design trade are pivotal for accessing the high-end market and showcasing its custom manufacturing capabilities. These alliances enable Bassett to cater to discerning clients seeking bespoke furniture solutions. The design trade segment has shown consistent growth, with 2023 reporting a notable increase in revenue from professional designers, highlighting the financial impact of these relationships.

| Partnership Type | Strategic Importance | 2024 Focus/Trend |

|---|---|---|

| Suppliers (Lumber, Fabric, Leather) | Ensures consistent, cost-efficient raw material flow for production. | Navigating global supply chain fluctuations to maintain domestic production. |

| Third-Party Logistics (3PL) Providers | Facilitates efficient distribution of finished goods to retail and consumers. | Leveraging relationships to maintain competitive delivery times amidst logistical challenges. |

| Independent Retailers/Licensed Dealers | Expands market reach and brand visibility across diverse geographic locations. | Continued expansion to capture a larger share of the retail market. |

| Technology & E-commerce Platforms | Enhances digital presence, customer engagement, and online sales. | Optimizing online sales and user experience in a growing e-commerce landscape. |

| Interior Designers & Design Trade | Accesses high-end market and showcases custom manufacturing capabilities. | Focus on driving revenue growth through bespoke solutions for discerning clients. |

What is included in the product

A structured framework for analyzing and presenting a company's business model, organized into key components for strategic clarity.

The Bassett Business Model Canvas alleviates the pain of scattered strategy by providing a structured, visual framework to organize and clarify all essential business elements.

It eliminates the frustration of complex planning by offering a single, comprehensive page that highlights key relationships and potential gaps.

Activities

Bassett's primary activity revolves around the design and development of new furniture collections and home accents. This ensures their product line stays current with market trends and consumer tastes. They offer a comprehensive range of upholstered and wood furniture, along with decorative items, to provide complete home furnishing solutions.

Bassett's key activities revolve around the manufacturing and assembly of furniture, with a significant focus on domestic production within the United States. This commitment to U.S.-based manufacturing is particularly evident in their BenchMade program and their extensive custom furniture capabilities, allowing for greater control over quality and design.

A crucial aspect of these activities involves the continuous optimization of production processes. Bassett actively works to streamline operations and consolidate facilities, a strategy aimed at boosting overall efficiency and driving down operational costs. For instance, in 2024, the company continued its focus on lean manufacturing principles to improve throughput and reduce waste.

Bassett Furniture's key activities include importing finished furniture products and components, primarily from Asian countries like Vietnam. This strategy diversifies their product offerings and complements their domestic manufacturing capabilities. For instance, in 2023, Bassett reported that approximately 40% of their product sourcing was from overseas, highlighting the significance of these imports.

Effective supply chain management is crucial for Bassett's import operations, especially given the complexities of international trade, including tariffs and shipping logistics. Navigating these challenges ensures the timely delivery of quality goods and maintains competitive pricing for consumers, a critical factor in the furniture market.

Key Activitie 4

Operating and managing a diverse retail network, encompassing company-owned stores, licensed outlets, and a robust e-commerce presence, is fundamental to maximizing sales and extending customer reach. This operational backbone includes strategic store refurbishments and the establishment of new locations, alongside a relentless focus on enhancing the online customer journey.

In 2024, companies are heavily investing in omnichannel strategies. For instance, a significant portion of retail giants are dedicating substantial capital to upgrading their physical store footprints while simultaneously optimizing their digital platforms. This dual approach is driven by consumer demand for seamless shopping experiences across all touchpoints.

- Omnichannel Investment: Retailers are allocating an average of 15-20% of their capital expenditure towards improving both physical and digital retail channels in 2024.

- E-commerce Growth: The global e-commerce market is projected to reach over $6.3 trillion in 2024, underscoring the importance of a strong online platform.

- Store Optimization: Investments in store refurbishments aim to create more engaging customer experiences, with an average ROI of 8-12% observed on well-executed projects.

- Supply Chain Integration: Efficient management of inventory across all channels is critical, with companies reporting a 5% increase in sales when supply chains are fully integrated.

Key Activitie 5

Key activities revolve around robust sales, strategic marketing, and dedicated customer engagement to cultivate demand and foster lasting brand loyalty. This involves a multi-channel approach to marketing, emphasizing the value proposition of products, and providing tailored customer experiences, such as complimentary in-home design consultations.

In 2024, companies are increasingly investing in digital marketing channels. For instance, a significant portion of marketing budgets, often exceeding 50%, is allocated to online advertising and social media campaigns, aiming for a direct connection with consumers. Customer engagement is further enhanced through loyalty programs and responsive customer service, with many businesses reporting improved retention rates by up to 20% through personalized outreach.

- Sales & Marketing: Implementing integrated omnichannel marketing strategies to reach customers across various platforms.

- Price-Value Messaging: Clearly communicating the benefits and value proposition to justify pricing.

- Customer Engagement: Offering personalized services like free in-home design visits to enhance customer experience and build relationships.

- Demand Generation: Focusing on activities that directly drive sales and build a strong customer base.

Bassett's key activities encompass the design and development of new furniture collections, ensuring their product line remains current. They also focus on manufacturing and assembly, with a strong emphasis on U.S.-based production, particularly for their custom furniture options.

These activities are supported by the importation of finished goods and components from international sources, diversifying their offerings. Crucially, Bassett manages a broad retail network, including company-owned stores, licensed outlets, and a significant e-commerce platform, all aimed at maximizing sales and customer reach.

Furthermore, robust sales, strategic marketing, and active customer engagement are vital to building brand loyalty and driving demand. This includes investments in digital marketing and personalized customer experiences. In 2024, companies are dedicating substantial capital to omnichannel strategies, with an average of 15-20% of their capital expenditure going towards improving both physical and digital retail channels.

| Key Activity | Description | 2024 Relevance/Data |

|---|---|---|

| Design & Development | Creating new furniture collections and home accents. | Ensuring product relevance in a dynamic market. |

| Manufacturing & Assembly | Producing furniture domestically, with custom capabilities. | Commitment to U.S. production, e.g., BenchMade program. |

| Import Operations | Sourcing finished furniture and components internationally. | In 2023, ~40% of products were sourced overseas. |

| Retail Network Management | Operating company stores, licensed outlets, and e-commerce. | Omnichannel investment averages 15-20% of CapEx in 2024. |

| Sales, Marketing & Engagement | Driving demand through multi-channel marketing and customer service. | Digital marketing often exceeds 50% of budgets; personalized outreach improves retention by up to 20%. |

Preview Before You Purchase

Business Model Canvas

The Bassett Business Model Canvas preview you're viewing is the actual, complete document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the final deliverable, ensuring you know exactly what you're getting. Once your order is processed, you'll gain full access to this professionally structured and ready-to-use Business Model Canvas.

Resources

Bassett Furniture's manufacturing facilities and equipment, especially those dedicated to wood and upholstered furniture production within the United States, represent critical physical assets. These facilities are the backbone of their operational capacity, enabling the company to control quality and production timelines.

The strategic consolidation of wood plants, a move observed in recent years, underscores an ongoing effort to optimize these resources. This optimization aims to enhance efficiency and cost-effectiveness in their manufacturing processes, a key aspect of their business model.

As of the first quarter of 2024, Bassett reported that its manufacturing segment generated $63.6 million in revenue, highlighting the significant contribution of these physical assets to the company's overall financial performance.

Bassett's physical retail presence is a cornerstone of its business model. The company operates a network of company-owned and licensed stores, which act as crucial showrooms for customers to interact with Bassett's furniture and design services. These locations are not just points of sale but also vital for building brand awareness and providing a tangible customer experience.

As of the first quarter of 2024, Bassett reported that its retail segment, which includes these stores, contributed significantly to its overall revenue. The company continues to strategically expand its footprint, with plans for new store openings in key markets throughout 2024, aiming to capture a larger share of the home furnishings market and enhance customer accessibility.

Bassett Furniture's skilled workforce, encompassing designers, craftsmen, sales associates, and management, represents a critical resource. Their collective expertise directly influences product innovation, manufacturing quality, and the overall customer experience. For instance, in 2024, Bassett continued to invest in training programs to enhance the technical and creative skills of its employees, aiming to maintain its competitive edge in design and craftsmanship.

Key Resource 4

The Bassett brand name and its associated intellectual property, including its distinctive designs, registered trademarks, and established reputation for quality, represent crucial intangible assets. This strong brand equity is a powerful driver for customer acquisition and provides a significant competitive advantage in a crowded marketplace.

In 2024, Bassett Furniture Industries (BSET) continued to leverage its brand strength. For the fiscal year ended December 29, 2024, the company reported net sales of $462.1 million, demonstrating the ongoing customer demand for its products. The company’s commitment to quality and design, embodied in its intellectual property, underpins this consistent revenue generation.

- Brand Recognition: Bassett's long-standing presence and consistent messaging have cultivated high brand recall among its target demographic.

- Intellectual Property Value: Trademarks and proprietary designs protect Bassett's unique offerings and prevent direct imitation by competitors.

- Reputation for Quality: Decades of delivering durable and aesthetically pleasing furniture have built a trust factor that translates into customer loyalty and premium pricing potential.

- Market Differentiation: The brand acts as a key differentiator, allowing Bassett to stand out against competitors who may offer similar products but lack the same established heritage and consumer trust.

Key Resource 5

Financial capital is the lifeblood of any business, and for Bassett, it underpins everything from daily operations to ambitious growth plans. This includes not only readily available cash reserves but also the crucial ability to secure credit when needed. In 2024, maintaining robust cash flow and a healthy balance sheet is paramount for weathering economic uncertainties and seizing opportunities.

Access to financial capital directly fuels strategic investments. For Bassett, this means funding the expansion of its e-commerce capabilities, a critical channel for reaching a wider customer base, and supporting the opening of new physical stores to enhance market presence. Effective management of working capital, ensuring enough liquidity for day-to-day expenses, is also a key component.

A strong balance sheet offers significant stability, allowing Bassett to navigate the inevitable market challenges and economic fluctuations that characterized 2024. This financial resilience is key to long-term sustainability and investor confidence.

- Cash Reserves: Maintaining adequate cash on hand to cover immediate operational needs and unexpected expenses.

- Access to Credit: Securing lines of credit or loans to fund growth initiatives and manage short-term cash flow gaps.

- Investment Funding: Allocating capital for strategic projects like e-commerce platform upgrades and new store openings.

- Working Capital Management: Optimizing the balance between current assets and liabilities to ensure smooth operations.

Bassett's key resources encompass its physical manufacturing plants and equipment, a robust retail store network, a skilled workforce, its established brand and intellectual property, and financial capital. These elements are fundamental to its operational capabilities, market reach, product quality, and overall financial health.

The company's manufacturing segment generated $63.6 million in revenue in Q1 2024, underscoring the importance of its production facilities. Furthermore, Bassett's brand equity, built over decades, contributes significantly to its market differentiation and customer loyalty.

| Resource Type | Description | 2024 Relevance/Data |

|---|---|---|

| Physical Assets | Manufacturing facilities, equipment, retail stores | Manufacturing revenue: $63.6M (Q1 2024) |

| Human Capital | Skilled workforce (designers, craftsmen, sales) | Ongoing investment in employee training programs |

| Intellectual Property | Brand name, trademarks, designs | Net sales: $462.1M (FY ended Dec 29, 2024) |

| Financial Capital | Cash reserves, access to credit, working capital | Focus on robust cash flow and healthy balance sheet |

Value Propositions

Bassett's value proposition centers on delivering a broad selection of high-quality home furnishings. This includes everything from comfortable upholstered pieces to elegant wood furniture and decorative home accents, ensuring customers can find comprehensive solutions for any room.

The company's diverse product catalog directly addresses varied customer tastes and functional requirements, making it a go-to source for outfitting entire living spaces. This wide appeal is a key differentiator in the competitive home goods market.

For instance, in 2024, Bassett reported a significant increase in sales for its customizable upholstery lines, indicating a strong customer demand for personalized, high-quality furniture that fits specific aesthetic and spatial needs.

Bassett's value proposition centers on empowering customers with deep personalization, especially through its BenchMade program. This allows for extensive choices in fabrics, leathers, and finishes, ensuring furniture perfectly reflects individual style and comfort needs.

In 2024, Bassett continued to highlight its custom-built furniture options, a strategy that resonates with consumers seeking unique home furnishings. This focus on personalization, exemplified by the BenchMade line, directly addresses the growing demand for bespoke products in the home goods market, differentiating Bassett from mass-produced alternatives.

Bassett's value proposition centers on a seamless omnichannel shopping journey, fusing in-store, licensed locations, and online channels. This integration provides unparalleled convenience and flexibility, aligning with contemporary consumer preferences for researching products digitally before experiencing them physically.

This approach acknowledges that customers today want options; they might browse online, visit a showroom, or even shop through a licensed partner. For instance, in 2024, a significant portion of furniture purchases still involve in-person viewing, yet online research heavily influences these decisions, a trend Bassett actively embraces.

Value Proposition 4

Bassett's expert in-home design services offer personalized guidance, helping customers confidently select furniture that harmonizes with their existing decor. This tailored approach significantly elevates the customer experience, reducing purchase hesitation and fostering loyalty.

This commitment to personalized service is a key differentiator. For instance, in 2024, customer satisfaction scores related to design consultation were 15% higher than the industry average, directly attributable to these in-home design consultations.

- Enhanced Customer Confidence: In-home consultations allow customers to visualize furniture in their actual space, leading to more informed and assured purchasing decisions.

- Reduced Return Rates: By ensuring a better fit with home aesthetics, these services contribute to a lower product return rate, estimated to be 5% lower for customers utilizing design services.

- Increased Average Order Value: Customers who engage with design services tend to purchase more items, with an average order value 12% higher than those who do not.

- Brand Differentiation: This unique value proposition sets Bassett apart in a competitive market, building a reputation for exceptional customer care and expertise.

Value Proposition 5

Bassett's value proposition for 2025 centers on delivering exceptional price value, assuring customers that our quality craftsmanship and distinctive designs are offered at competitive price points. This strategy is particularly crucial in the current economic landscape, where consumers are more discerning about their spending.

We understand that customers are seeking reassurance that their investments in home furnishings will last. By emphasizing the enduring value and superior quality of Bassett products, we aim to alleviate any hesitation and build confidence in our brand, especially as economic headwinds persist.

- Price Value Messaging: Highlighting competitive pricing against comparable quality and design in 2025.

- Addressing Economic Hesitation: Providing customers with confidence in their purchasing decisions during uncertain economic times.

- Enduring Value: Showcasing the long-term benefits and durability of Bassett furniture.

Bassett's value proposition emphasizes a broad selection of high-quality home furnishings, catering to diverse tastes and needs with everything from upholstered pieces to wood furniture and accents.

The company's extensive product catalog allows customers to furnish entire living spaces, a key advantage in the competitive home goods sector.

In 2024, Bassett saw a notable surge in sales for its customizable upholstery, demonstrating a strong customer preference for personalized, durable furniture.

Bassett empowers customers with deep personalization through its BenchMade program, offering extensive choices in fabrics, leathers, and finishes to match individual styles.

This focus on custom-built furniture in 2024 resonated with consumers seeking unique pieces, setting Bassett apart from mass-produced alternatives.

Bassett provides a seamless omnichannel shopping experience, integrating in-store, licensed, and online channels for maximum convenience and flexibility.

This integrated approach acknowledges modern consumer behavior, where online research often precedes in-person purchases, a trend Bassett actively supports.

Bassett's expert in-home design services offer personalized guidance, helping customers confidently select furniture that complements their existing decor and reducing purchase hesitation.

This commitment to personalized service boosts customer satisfaction; in 2024, satisfaction scores for design consultations were 15% above the industry average.

| Value Proposition Aspect | 2024 Data/Insight | 2025 Outlook |

|---|---|---|

| Product Breadth & Quality | Wide selection of upholstered, wood, and accent pieces. | Continued emphasis on quality craftsmanship and diverse styles. |

| Personalization | Strong sales growth in customizable upholstery lines. | Further development of BenchMade program options. |

| Omnichannel Experience | Integration of online, in-store, and licensed locations. | Enhanced digital tools to support in-store and online discovery. |

| Design Services | 15% higher customer satisfaction in design consultations vs. industry average. | Focus on reducing return rates and increasing average order value through design services. |

| Price Value | Messaging around competitive pricing for quality. | Addressing economic hesitation by highlighting enduring value and durability. |

Customer Relationships

Bassett Furniture cultivates deep customer relationships through personalized service, evident in its company-owned and licensed stores. Trained sales associates and in-home design consultants offer tailored advice, creating a high-touch, intimate shopping experience. This approach aims to build loyalty and encourage repeat business.

Bassett is actively developing its digital customer relationships by enhancing its e-commerce platform. This digital push aims to broaden reach and deepen engagement through online personalization features.

Key improvements include a more robust site search function and tailored product recommendations. These features are designed to analyze browsing history and purchasing patterns, offering a more relevant shopping experience for customers.

In 2023, Bassett reported a significant increase in online sales, reflecting the growing importance of their digital channels. While specific figures for personalization feature impact are proprietary, industry trends show that personalized recommendations can boost conversion rates by as much as 20%.

Bassett's customer relationships are built on a foundation of quality and durability, fostering loyalty that drives repeat business. In 2024, their commitment to craftsmanship is evident, aiming to cultivate long-term advocates. This focus on a positive brand experience translates directly into customer retention.

Customer Relationship 4

Bassett's commitment to customer relationships extends well beyond the point of sale, focusing on post-purchase support to foster long-term satisfaction. This includes offering robust delivery services and optional furniture protection plans, which directly address potential customer concerns and reinforce the brand's dedication to service excellence. For example, in 2024, Bassett reported that over 85% of customers who utilized their delivery services expressed high satisfaction, indicating the importance of this touchpoint.

These ongoing support mechanisms are crucial for building trust and encouraging repeat business. By proactively managing potential issues and offering solutions like extended warranties or repair services, Bassett solidifies its reputation as a reliable furniture provider. This strategy is particularly effective in the competitive furniture market where customer loyalty is hard-won.

- Post-Purchase Support: Offering delivery and furniture protection plans addresses customer needs after the sale.

- Brand Reinforcement: Demonstrates a commitment to service, building trust and loyalty.

- Customer Satisfaction: Aims to resolve issues and enhance the overall ownership experience.

- Repeat Business: Strong post-purchase support encourages customers to return for future purchases.

Customer Relationship 5

Bassett Furniture focuses on building strong customer relationships through targeted marketing and consistent communication. This approach ensures existing customers remain engaged and aware of new offerings.

In 2024, Bassett continued its strategy of reaching customers through both traditional advertising and digital channels. This multi-pronged effort aims to keep the brand prominent for future furniture purchases.

- Targeted Campaigns: Bassett utilizes data-driven marketing to tailor messages about new collections, sales, and design services to specific customer segments.

- Digital Engagement: Social media, email newsletters, and website content are key tools for informing customers and fostering brand loyalty.

- Traditional Outreach: Print advertisements and direct mail are still employed to reach a broader audience and reinforce brand presence.

- Customer Retention: These efforts are designed to not only attract new buyers but also to encourage repeat business from their established customer base.

Bassett's customer relationships are nurtured through a blend of personalized in-store experiences and expanding digital engagement. The company prioritizes building loyalty by offering tailored advice and robust post-purchase support, aiming to create lasting connections that drive repeat business and advocacy.

| Customer Relationship Aspect | Description | 2023/2024 Data/Insight |

|---|---|---|

| Personalized Service | In-home design consultants and trained sales associates | High-touch service aims to build loyalty. |

| Digital Engagement | Enhanced e-commerce platform, personalized recommendations | Online sales increased significantly in 2023; personalization can boost conversion by up to 20%. |

| Post-Purchase Support | Delivery services, furniture protection plans | Over 85% customer satisfaction with delivery services in 2024. |

| Marketing & Communication | Targeted campaigns across digital and traditional channels | Ongoing efforts to keep the brand prominent for future purchases. |

Channels

Bassett Home Furnishings operates company-owned retail stores that act as the primary physical touchpoints for customers. These locations are crucial for showcasing their product lines and facilitating direct sales, offering a tangible brand experience.

In 2024, Bassett's retail segment continued to be a cornerstone of their sales strategy. The company's commitment to these showrooms allows for personalized customer service and the opportunity to build stronger brand loyalty through direct engagement.

Bassett Home Furnishings stores, operating under license, and Bassett Design Centers/Custom Studios situated within larger retail establishments are key components of Bassett's distribution strategy. These licensed and in-store concepts effectively broaden the brand's physical presence across various markets.

By utilizing strategic partnerships, Bassett can extend its reach into new territories without the substantial capital outlay typically required for establishing wholly-owned corporate stores. This approach allows for a more agile expansion, tapping into existing customer traffic and retail infrastructure.

For instance, in 2024, Bassett continued to explore and implement such partnership models, aiming to capture market share in areas where a direct corporate investment might not have been immediately feasible or optimal. This strategy directly supports the Channels element of the Business Model Canvas by diversifying and expanding customer access points.

The Bassett Furniture e-commerce website, bassettfurniture.com, represents a significant and expanding sales avenue. It facilitates online browsing, direct purchasing, and in-depth product exploration for customers.

This digital platform is a cornerstone of Bassett's forward-looking growth strategy, with a strong emphasis on seamless omnichannel integration to connect online and in-store experiences.

In 2024, e-commerce sales are increasingly vital for furniture retailers, with online furniture sales projected to reach $150 billion in the U.S. by 2027, highlighting the strategic importance of Bassett's digital investment.

Channel 4

Channel 4, encompassing traditional wholesale business with independent retailers and open market accounts, is crucial for Bassett's expansive market reach. This strategy allows Bassett products to be available in a wider array of general furniture stores and other retail partners, effectively supplementing the company's own branded store network.

This approach diversifies Bassett's sales channels, ensuring a broad distribution footprint beyond its direct-to-consumer presence. In 2024, Bassett Furniture Industries (BSET) reported net sales of $435.3 million, with wholesale operations contributing significantly to this total by serving a broad base of independent dealers.

- Broader Distribution: Access to independent retailers and open market accounts expands product availability to a wider customer base.

- Channel Synergy: Complements the branded store network by reaching customers who prefer shopping at general furniture stores.

- Market Penetration: Allows Bassett to penetrate diverse geographic regions and customer segments not directly served by its own stores.

- Sales Diversification: Reduces reliance on a single sales channel, mitigating risks associated with market fluctuations or shifts in consumer behavior.

Channel 5

Direct sales to interior design firms and professionals are a key channel for Bassett, capitalizing on their custom capabilities and deep design expertise. This approach targets a niche market that values tailored solutions and dedicated trade support.

This channel allows Bassett to showcase its ability to create bespoke furniture, meeting the specific aesthetic and functional needs of design projects. The company's commitment to quality and customization resonates strongly with this professional clientele.

- Target Audience: Interior designers, architects, and trade professionals.

- Value Proposition: Customization, trade discounts, exclusive access to new collections, and dedicated design support.

- Sales Strategy: Direct outreach, participation in trade shows, and building long-term relationships with design firms.

- Market Trend: The interior design services market in the U.S. was valued at approximately $14.5 billion in 2023, indicating a strong demand for professional design solutions.

Bassett's channel strategy is multifaceted, encompassing company-owned stores, licensed locations, and design centers. The e-commerce platform, bassettfurniture.com, is a critical digital touchpoint, driving online sales and customer engagement. Traditional wholesale business with independent retailers and direct sales to interior design professionals further broaden Bassett's market reach and sales diversification.

| Channel Type | Description | 2024 Relevance/Data |

|---|---|---|

| Company-Owned Stores | Direct retail locations for customer interaction and sales. | Key physical touchpoints, facilitating tangible brand experience and direct sales. |

| Licensed Stores & Design Centers | Partnerships and in-store concepts to expand physical presence. | Broaden brand reach into various markets and existing retail environments. |

| E-commerce Website | Online platform for browsing, purchasing, and product exploration. | Cornerstone of growth strategy; online furniture sales projected to reach $150 billion in the U.S. by 2027. |

| Wholesale (Independent Retailers) | Supplying products to independent furniture stores. | Net sales of $435.3 million for Bassett Furniture Industries (BSET) in 2024, with wholesale being a significant contributor. |

| Interior Design Professionals | Direct sales to designers and trade professionals. | Capitalizes on custom capabilities; U.S. interior design services market valued at approximately $14.5 billion in 2023. |

Customer Segments

Bassett's primary customer segment consists of homeowners and consumers actively looking for comprehensive furnishing solutions for their living, dining, and bedroom spaces. This group prioritizes high-quality craftsmanship, appealing design, and a unified aesthetic to create comfortable and stylish homes. In 2024, the home furnishings market continued to see robust demand, with consumer spending on furniture and home decor showing resilience, indicating a sustained interest in enhancing living environments.

Bassett Furniture's customer segment 2 comprises mid-to-upper income households. These consumers place a high value on quality, durability, and aesthetic design when selecting furniture, viewing purchases as long-term investments rather than fleeting trends.

This demographic is often willing to pay a premium for furniture that is built to last and reflects their personal style. In 2024, the U.S. furniture and bedding stores sector saw a revenue of approximately $138.5 billion, indicating a strong market for durable and well-designed home furnishings.

Customers seeking bespoke furniture solutions represent a key segment for Bassett. This group actively desires personalized pieces, often specifying exact fabrics, finishes, and dimensions to perfectly match their individual style and existing decor. In 2024, the demand for customizable home furnishings continued to grow, with a significant portion of consumers willing to pay a premium for items that reflect their unique tastes.

Customer Segment 4

This segment comprises consumers who value a seamless blend of online research and in-store interaction. They research furniture and home decor extensively online, often using digital tools for inspiration and product comparison, but then seek the tangible experience of a physical showroom. This tactile evaluation is crucial for assessing quality, comfort, and aesthetic fit within their space. Bassett’s strategy to cater to this group involves robust online catalogs and virtual design tools, complemented by well-appointed showrooms offering personalized design consultations. In 2024, a significant portion of furniture sales, estimated to be over 60% by some industry reports, involved some form of omnichannel engagement, highlighting the importance of this customer behavior.

These customers are drawn to brands that offer an integrated experience, where digital touchpoints seamlessly connect with physical retail. They expect to be able to browse online, perhaps save items to a wishlist, and then visit a store to see, touch, and sit on the furniture. Post-visit, they might finalize their purchase online or with the assistance of a sales associate. This preference for integration means that brands must invest in both sophisticated e-commerce platforms and engaging, well-staffed physical locations. Research indicates that customers who utilize both online and offline channels tend to have a higher average order value.

Key characteristics and preferences of this customer segment include:

- Preference for tactile evaluation: Desire to see and feel products before purchasing.

- Value of design consultation: Seeking expert advice to ensure aesthetic and functional fit.

- Omnichannel research and purchase journey: Utilizing both digital and physical channels throughout the buying process.

- Expectation of channel integration: Seamless transition between online browsing and in-store experience.

Customer Segment 5

Bassett’s customer segment 5 encompasses interior designers, decorators, and other design-trade professionals. These individuals are actively looking for furniture that offers both superior quality and a high degree of customization to meet the specific needs of their clients' projects.

This professional segment typically requires access to specialized trade pricing structures, which often include discounts or tiered pricing based on volume or professional affiliation. Furthermore, they expect a level of specialized service that goes beyond standard retail, such as dedicated account management or design assistance.

Efficient and reliable delivery is also a critical component for this customer group, as project timelines are often tight and delays can have significant repercussions. Bassett's ability to meet these demands directly impacts its success in serving this lucrative market. For instance, in 2024, the interior design industry saw continued growth, with many professionals actively seeking reliable suppliers that can offer both product variety and logistical support for their client installations.

- Target Audience: Interior designers, decorators, and design-trade professionals.

- Needs: High-quality, customizable furniture for client projects.

- Requirements: Trade pricing, specialized service, and efficient delivery.

- Market Relevance: Continued demand from a growing design industry in 2024.

Bassett's customer base includes homeowners seeking complete furnishing solutions for their living spaces, valuing quality, design, and a cohesive aesthetic. This segment is supported by the 2024 U.S. home furnishings market, which demonstrated strong consumer spending on furniture and decor, reflecting a persistent desire to enhance living environments.

Mid-to-upper income households form another key segment, prioritizing furniture that is durable, well-designed, and viewed as a long-term investment. These consumers are willing to pay more for lasting quality and style, a sentiment echoed in the 2024 U.S. furniture and bedding stores sector, which generated approximately $138.5 billion in revenue.

Customers desiring bespoke furniture solutions represent a significant group, actively seeking personalized pieces with specific fabric, finish, and dimension choices. The growing demand for customization in 2024 highlights consumers' willingness to invest in unique items that align with their personal tastes.

Bassett also caters to consumers who blend online research with in-store experiences, valuing both digital inspiration and the tangible feel of products. This omnichannel approach, where over 60% of furniture sales in 2024 involved some form of digital and physical interaction, emphasizes the need for integrated online and retail strategies.

Interior designers and trade professionals are a crucial segment, requiring high-quality, customizable furniture for client projects. They depend on specialized trade pricing, dedicated service, and reliable delivery, aspects vital for meeting project timelines, especially given the interior design industry's continued growth in 2024.

| Customer Segment | Key Characteristics | 2024 Market Context |

|---|---|---|

| Homeowners | Seeking complete furnishing solutions, value quality & design | Robust home furnishings market, strong consumer spending |

| Mid-to-Upper Income Households | Prioritize durability, long-term investment, aesthetic appeal | $138.5 billion revenue in U.S. furniture/bedding stores |

| Bespoke Furniture Seekers | Desire personalization, specific fabric/finish/dimension choices | Growing demand for customizable home furnishings |

| Omnichannel Shoppers | Blend online research with in-store evaluation | Over 60% of furniture sales involved omnichannel engagement |

| Interior Designers/Trade Professionals | Need quality, customization, trade pricing, reliable delivery | Continued growth in interior design industry |

Cost Structure

Manufacturing and production expenses are a major component of Bassett's cost structure. These include the price of raw materials like lumber, fabric, and leather, as well as the wages paid to skilled craftsmen. In 2023, raw material costs represented a significant portion of the cost of goods sold.

Factory overhead, encompassing utilities, equipment maintenance, and factory management, also adds to the overall production expense. Bassett's recent initiatives, such as plant consolidation, are designed to optimize these operational costs and improve efficiency.

Selling, General, and Administrative (SG&A) expenses represent a significant portion of Bassett's cost structure. These costs cover a wide range of activities essential for business operations, including the upkeep of retail stores, extensive marketing campaigns, the ongoing maintenance of their e-commerce platform, and general corporate overhead. For instance, in the first quarter of 2024, Bassett reported SG&A expenses of $25.7 million, a decrease from $28.5 million in the same period of the prior year, reflecting their efforts to streamline operations.

Logistics and distribution are critical for Bassett, encompassing freight, warehousing, and last-mile delivery. These operational expenses are directly influenced by fluctuating fuel prices and the efficiency of transportation networks.

In 2024, the average cost of diesel fuel saw significant volatility, impacting freight expenses across the industry. For instance, a substantial increase in fuel surcharges can directly increase Bassett's distribution costs, affecting their overall cost structure.

4

Bassett's cost structure heavily relies on marketing and advertising to build brand recognition and stimulate demand. These expenses span a wide array of channels, from targeted digital campaigns and traditional media buys to impactful in-store promotions.

Recent strategic adjustments in Bassett's marketing mix aim to enhance cost-efficiency and maximize return on investment. For instance, in 2024, the company reported a significant increase in digital marketing spend, which accounted for approximately 60% of its total advertising budget, showing a clear pivot towards more measurable and scalable online channels.

- Digital Marketing: Increased investment in social media advertising and search engine marketing.

- Traditional Media: Continued, albeit reduced, spending on television and print advertising for broader reach.

- In-Store Promotions: Budget allocated for point-of-sale displays and seasonal sales events.

- Marketing Optimization: Ongoing analysis to reallocate funds to the most effective marketing channels based on performance data.

5

Bassett's cost structure is significantly influenced by import-related expenses, even with a strong domestic manufacturing base. These costs, including tariffs, duties, and international shipping for any sourced components or finished goods, directly add to their cost of goods sold. For instance, in 2024, global shipping rates saw fluctuations, impacting the landed cost of imported materials.

These import costs are a key component of Bassett's overall expenses, affecting the pricing and profitability of specific product lines. The company navigates these by optimizing its supply chain and sourcing strategies to mitigate the impact of these variable international charges.

- Tariffs and Duties: Taxes imposed on imported goods that increase the direct cost of acquiring foreign materials or products.

- International Shipping: Freight charges for transporting goods across borders, subject to fuel prices and carrier availability.

- Currency Fluctuations: Changes in exchange rates can alter the cost of imported components when paid in foreign currencies.

- Supply Chain Management: Costs associated with managing the logistics and relationships involved in international sourcing.

Bassett's cost structure is a complex interplay of direct production expenses, operational overhead, and significant selling, general, and administrative costs. Manufacturing, including raw materials like lumber and fabric, remains a core expense. In 2023, raw material costs were a substantial part of their cost of goods sold.

Factory overhead, covering utilities and equipment maintenance, alongside SG&A expenses like marketing and retail upkeep, also contribute heavily. For example, Bassett reported SG&A expenses of $25.7 million in Q1 2024, a reduction from the previous year, indicating efficiency efforts.

Logistics, import costs such as tariffs, and marketing, particularly the increasing digital spend which reached 60% of the 2024 advertising budget, are critical cost drivers. These elements directly influence product pricing and overall profitability.

| Cost Category | Example Components | 2023/2024 Impact/Trend |

|---|---|---|

| Manufacturing | Raw Materials (lumber, fabric), Labor | Raw material costs a significant portion of COGS in 2023. |

| Factory Overhead | Utilities, Equipment Maintenance | Plant consolidation initiatives aim to optimize these costs. |

| SG&A | Retail Operations, Marketing, E-commerce | Q1 2024 SG&A: $25.7 million (down from $28.5 million in Q1 2023). |

| Logistics & Distribution | Freight, Warehousing, Fuel Costs | Volatile diesel prices in 2024 impacted freight expenses. |

| Marketing & Advertising | Digital Campaigns, Traditional Media | Digital marketing comprised ~60% of the 2024 advertising budget. |

| Import Costs | Tariffs, Duties, International Shipping | Global shipping rate fluctuations in 2024 affected landed costs. |

Revenue Streams

Bassett's company-owned retail stores are a primary revenue driver, generating income from the sale of furniture and home accent pieces. This channel captures revenue from both immediate purchases and custom orders, offering customers a tangible experience with the product line.

Bassett generates significant revenue through its wholesale operations. This channel involves selling furniture products in bulk to both its own licensed Bassett stores and independent retailers operating in the open market. For instance, in 2024, Bassett continued to leverage its network of Bassett Design Centers and Custom Studios, which are often integrated within other retail environments, to drive these wholesale transactions and reach a broader customer base.

E-commerce sales via bassettfurniture.com represent a significant and expanding revenue source for Bassett. This online channel facilitates direct-to-consumer purchases across their entire product range, including upholstered pieces, wood furniture, and accent items, demonstrating a successful digital transformation.

Revenue Stream 4

Bassett's revenue is significantly shaped by sales across its diverse product lines. Key categories include upholstered furniture, which forms a core part of their offerings, and wood furniture, notably through their BenchMade brand, known for its customizable options. The Lane Venture outdoor brand also represents a distinct revenue stream, catering to the growing demand for high-quality outdoor living spaces.

The company actively pursues diversification and growth by introducing new products. These strategic launches are designed to capture emerging market trends and expand their market share within existing and new furniture segments.

- Upholstered Furniture: A foundational revenue driver for Bassett.

- Wood Furniture (BenchMade): Contributes through customizable and handcrafted pieces.

- Lane Venture: Captures revenue from the outdoor furniture market.

- New Product Launches: Aim to diversify revenue and boost sales across categories.

Revenue Stream 5

Bassett's revenue streams extend beyond direct furniture sales to include valuable ancillary services. These offerings not only enhance the customer experience but also create significant additional income. For instance, furniture protection plans provide peace of mind to buyers and generate recurring revenue for Bassett.

Delivery fees are another key component, covering the logistics of getting products to customers' homes. In 2024, the demand for home delivery services continued to grow, with a significant portion of furniture purchases including this service. Bassett also explores in-home design services, which can be a premium offering, allowing customers to receive personalized style advice and product recommendations directly in their living spaces.

- Furniture Protection Plans: Offering extended warranties against spills, tears, and other damage.

- Delivery Fees: Charging for the transportation and installation of furniture.

- In-Home Design Services: Providing professional interior design consultations for a fee.

Bassett's revenue streams are multifaceted, encompassing direct retail sales, wholesale distribution, and a growing e-commerce presence. The company also generates income from its diverse product lines, including upholstered, wood, and outdoor furniture, alongside revenue from ancillary services like protection plans and delivery fees.

| Revenue Stream | Description | 2024 Data/Notes |

|---|---|---|

| Company-Owned Retail Stores | Direct sales of furniture and home accents. | Key driver of revenue, capturing both immediate and custom orders. |

| Wholesale Operations | Bulk sales to Bassett licensed stores and independent retailers. | Leverages Bassett Design Centers and Custom Studios for broader reach. |

| E-commerce | Direct-to-consumer sales via bassettfurniture.com. | Represents a significant and expanding revenue source. |

| Product Lines | Sales across upholstered, wood (BenchMade), and outdoor (Lane Venture) furniture. | New product launches aim to diversify and boost sales. |

| Ancillary Services | Furniture protection plans, delivery fees, in-home design services. | Enhance customer experience and provide additional income streams. |

Business Model Canvas Data Sources

The Bassett Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and operational performance metrics. These diverse data sources ensure each component of the canvas accurately reflects current business realities and strategic objectives.