Bassett Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bassett Bundle

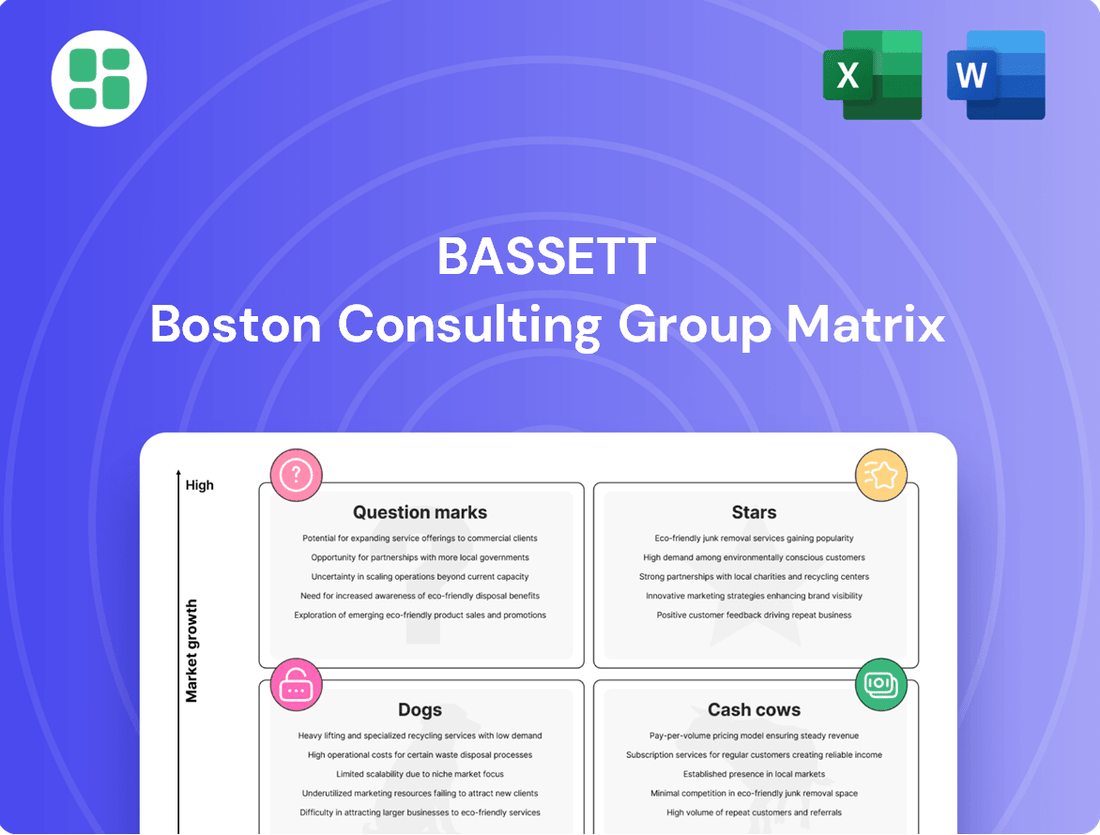

The Bassett BCG Matrix is a powerful tool for understanding your product portfolio's market position. It categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual roadmap for strategic decision-making. Ready to transform your product strategy and unlock growth? Purchase the full BCG Matrix for a comprehensive analysis and actionable insights.

Stars

Bassett's e-commerce channel is a clear star in its portfolio, experiencing impressive growth. Sales on bassettfurniture.com surged by 31% in the second quarter of 2025 and an even more substantial 36% in the first quarter of 2025. This upward trend highlights a rapidly expanding digital market presence for the company.

This strong digital performance is particularly noteworthy given broader market headwinds. Bassett is effectively capturing market share within this high-growth online segment, a success attributed to ongoing site enhancements and improved customer conversion rates.

Bassett's Custom Design Services are a shining example of a "Star" within their BCG Matrix. The company has seen impressive double-digit sales growth by focusing on these services and building stronger relationships within the interior design community.

This success is driven by Bassett's established expertise in custom manufacturing, which perfectly meets the growing consumer desire for personalized home furnishings. This segment offers a significant competitive edge and is a key driver of their current high growth.

Bassett's commitment to innovation is evident in its continuous launch of new product collections. Recent introductions like Copenhagen, Newbury, and Andorra are specifically crafted to boost sales and keep their product lines fresh and appealing. These collections are designed to capture consumers actively looking for the latest styles, positioning Bassett to potentially gain significant market share in dynamic product segments.

Omnichannel Capabilities

Bassett's commitment to enhancing its omnichannel capabilities is a significant driver for 2025. This involves a strategic integration of online and physical store experiences to meet evolving consumer preferences.

By offering a seamless journey, from digital browsing to in-store purchasing, Bassett aims to boost sales conversion rates. This approach acknowledges that many consumers research products online before making a final decision in a brick-and-mortar location.

- Omnichannel Investment: Bassett is actively investing in technology and infrastructure to unify its online and offline channels.

- Consumer Behavior Alignment: The strategy directly addresses the modern consumer's preference for flexibility and convenience in shopping.

- Sales Conversion Enhancement: By reducing friction between online research and in-store purchase, Bassett expects to see improved sales outcomes.

- Market Share Growth: This integrated approach is designed to capture a larger share of the market by providing a superior customer experience.

Strategic Retail Expansion

Bassett Furniture Industries (BSET) is actively pursuing strategic retail expansion, a key component of its growth strategy. The company plans to open new stores in promising markets, with Cincinnati and Orlando slated for Q1 2026 openings. This move aims to boost market share in these expanding regions.

These new locations are designed to offer a compelling customer experience, blending physical showrooms with efficient local delivery services. This dual approach is crucial for capturing new customers and strengthening brand presence.

- Market Penetration: Bassett's expansion into Cincinnati and Orlando targets areas with demonstrated consumer demand for home furnishings.

- Showroom Experience: The new stores will feature immersive showroom environments, allowing customers to interact with products firsthand.

- Logistics Integration: Local delivery capabilities are being enhanced to ensure a seamless post-purchase experience, a critical factor in customer satisfaction.

- Revenue Growth: This expansion is projected to contribute to Bassett's overall revenue growth, building on its existing market position.

Bassett's e-commerce channel and Custom Design Services are performing exceptionally well, demonstrating characteristics of "Stars" in the BCG Matrix. The company's online sales have seen significant increases, with a 31% rise in Q2 2025 and 36% in Q1 2025. This growth is supported by site improvements and better conversion rates, allowing Bassett to capture market share in the expanding digital space.

The Custom Design Services segment is also experiencing robust double-digit sales growth. This success is fueled by Bassett's manufacturing expertise and a growing consumer demand for personalized home furnishings. The company's strategic product launches and omnichannel investments further bolster these "Star" performers, aligning with modern shopping behaviors and aiming to enhance sales conversion and market share.

| Category | Q1 2025 Growth | Q2 2025 Growth | Key Drivers |

|---|---|---|---|

| E-commerce | 36% | 31% | Site enhancements, improved conversion rates |

| Custom Design Services | Double-digit growth | Double-digit growth | Manufacturing expertise, personalized offerings |

| New Product Collections | N/A | N/A | Targeting latest styles, boosting sales |

| Omnichannel Capabilities | N/A | N/A | Seamless online/offline integration |

What is included in the product

Strategic overview of a company's product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

The Bassett BCG Matrix offers a clear, visual snapshot of your portfolio, alleviating the pain of uncertainty about where to invest.

Cash Cows

Bassett's core upholstered furniture, especially its domestically made items which account for about 80% of wholesale shipments, are a strong point in their BCG Matrix. This segment is a classic cash cow, benefiting from high market share and a mature market.

These products, built on Bassett's reputation for quality, generate steady income with minimal marketing spend. In 2024, the company continued to rely on these established lines for a significant portion of its revenue, underscoring their role as a stable cash generator.

Bassett's traditional wood furniture, particularly its BenchMade program featuring solid wood bedroom and dining pieces, represents a classic Cash Cow. This segment benefits from Bassett's established market share and a loyal customer base that values durability and timeless design.

The consistent demand for these high-quality, enduring furniture lines translates into stable revenue streams and strong cash flow for Bassett. In 2024, the home furnishings market continued to see robust demand for quality, long-lasting items, with traditional styles maintaining their appeal.

Bassett's 87 company- and licensee-owned stores represent a mature distribution channel with a significant market presence. These established locations consistently generate revenue, acting as key touchpoints for customer interaction and sales, even with potential fluctuations in foot traffic.

While these stores require ongoing maintenance investments, they are not typically candidates for aggressive capital deployment for expansion. Their role as reliable revenue generators and brand showcases solidifies their position as cash cows within the BCG matrix.

Wholesale Shipments to Retail Network

Wholesale shipments to Bassett's internal retail network are a significant driver of its business, acting as a cash cow. This segment's performance is crucial for the company's overall financial health.

In the second quarter of 2025, these wholesale shipments saw a robust increase of 12.6%. This growth underscores the efficiency and integration of Bassett's supply chain, demonstrating its ability to reliably move products from manufacturing to its own sales channels.

- 12.6% Increase in Q2 2025: Wholesale shipments to Bassett's retail network grew by this significant margin, indicating strong internal demand and operational effectiveness.

- High Internal Market Share: The wholesale segment commands a substantial share within Bassett's own ecosystem, ensuring a consistent and predictable sales volume.

- Contribution to Margins: This integrated channel contributes meaningfully to overall wholesale margins due to its efficiency and control over the distribution process.

Established Home Accents and Accessories

Established Home Accents and Accessories represent a segment of Bassett's product offerings that likely benefit from a stable market position. These items, while not experiencing rapid growth, contribute significantly through consistent, high-margin sales.

These products act as reliable cash generators for Bassett, reinforcing their value within the company's portfolio.

The steady revenue streams from these established categories help fund other strategic initiatives or investments in higher-growth areas.

- Steady Revenue: Home accents likely provide a predictable income stream, crucial for financial stability.

- High Margins: Accessories often carry higher profit margins compared to larger furniture pieces.

- Customer Loyalty: These items can foster repeat business and enhance the overall customer experience with Bassett.

- Portfolio Balance: They contribute to a balanced product mix, mitigating risks associated with volatile markets.

Bassett's core upholstered furniture, a significant portion of its domestically made items, acts as a prime cash cow. These products leverage Bassett's established market share in a mature segment, generating consistent income with relatively low marketing investment. In 2024, this segment remained a bedrock of the company's revenue, highlighting its dependable cash-generating capability.

Bassett's traditional wood furniture, particularly the BenchMade line, also fits the cash cow profile. These durable, timeless pieces benefit from a loyal customer base and a stable market demand for quality. The consistent sales of these enduring furniture lines translate into predictable revenue streams and robust cash flow for Bassett, reinforcing their value in the 2024 market.

The company's network of 87 company- and licensee-owned stores represents a mature distribution channel that functions as a cash cow. While requiring ongoing maintenance, these established locations consistently generate revenue and serve as vital brand touchpoints without the need for aggressive expansion capital. Their role as reliable revenue generators and brand showcases solidifies their position.

Wholesale shipments to Bassett's internal retail network are a key driver and a cash cow. The significant 12.6% increase in these shipments in Q2 2025 demonstrates the efficiency and integration of Bassett's supply chain, ensuring predictable sales volume and contributing positively to overall wholesale margins.

Established Home Accents and Accessories contribute to Bassett's cash cow portfolio through consistent, high-margin sales. These items provide steady revenue streams, helping to fund other strategic initiatives and offering a balanced product mix that mitigates market risks.

| Segment | BCG Classification | Key Characteristics | 2024/2025 Data Insights |

|---|---|---|---|

| Core Upholstered Furniture (Domestic) | Cash Cow | High market share, mature market, low marketing spend | Accounts for ~80% of wholesale shipments; continued reliance for revenue in 2024. |

| Traditional Wood Furniture (BenchMade) | Cash Cow | Loyal customer base, demand for durability and timeless design | Stable revenue streams and strong cash flow; traditional styles maintained appeal in 2024. |

| Company & Licensee-Owned Stores | Cash Cow | Mature distribution, significant market presence, brand showcase | 87 locations; consistent revenue generation, not candidates for aggressive expansion. |

| Wholesale Shipments to Retail Network | Cash Cow | High internal market share, efficient distribution | 12.6% increase in Q2 2025; contributes to overall wholesale margins. |

| Home Accents & Accessories | Cash Cow | Consistent sales, high margins, customer loyalty | Steady revenue streams; contribute to portfolio balance. |

What You’re Viewing Is Included

Bassett BCG Matrix

The preview you are currently viewing is the identical, fully completed Bassett BCG Matrix document you will receive upon purchase. This means no watermarks, no placeholder text, and no missing sections – just the comprehensive strategic analysis ready for immediate application. You can be confident that the insights and formatting you see are precisely what you'll download, enabling swift integration into your business planning and decision-making processes.

Dogs

The Noa Home e-commerce business, acquired roughly two years before its closure in late 2024, clearly falls into the 'Dog' category of the BCG Matrix. Its low market share and negative growth trajectory were evident, leading to this strategic divestiture.

This closure was a deliberate move within a larger restructuring effort aimed at optimizing operations and shedding underperforming assets. The decision to eliminate Noa Home confirms its status as a 'Dog,' a business unit that consumes resources without generating significant returns.

Underperforming licensed store locations within Bassett's portfolio represent potential 'Dogs' in the BCG Matrix. These stores, characterized by low market share in slow-growing or declining markets, are undergoing rigorous evaluation as part of the company's broader restructuring efforts. The aim is to achieve an optimal store count, implying that these underperformers may be candidates for closure or strategic repositioning to improve resource allocation and profitability.

Bassett's strategic plan involves streamlining its offerings by phasing out outdated product lines. These underperforming collections likely represent furniture styles that have fallen out of favor with consumers, leading to low sales volumes and a diminished market presence. For instance, in 2024, Bassett's focus on modernizing its catalog aims to reduce the capital tied up in slow-moving inventory.

Lane Venture Shipments

Lane Venture shipments experienced a notable downturn, falling by 22% in the second quarter of 2025. This decline highlights a weakening position for this brand within the wholesale market, suggesting a potentially shrinking niche.

The data points to a low and decreasing market share for Lane Venture. This situation often signals that a product line might be a cash trap, consuming resources without generating sufficient returns.

- Shipment Decline: 22% decrease in Q2 2025.

- Market Position: Low and diminishing market share.

- Strategic Implication: Potential cash trap requiring re-evaluation.

Certain Open Market Wholesale Accounts

Certain Open Market Wholesale Accounts, within Bassett's BCG framework, are characterized by their position as independent retailers operating outside the company's direct branded network. These accounts are crucial for broader market reach but often present different growth dynamics.

Shipments to these open market wholesale accounts saw a decline of 2.6% in the second quarter of 2025. This downturn suggests potential challenges such as a shrinking market share or intensified competition within this particular sales channel.

These wholesale accounts may offer lower growth prospects when contrasted with Bassett's integrated retail network. Consequently, the effort invested in servicing these accounts could yield diminishing returns, making strategic evaluation essential.

- Market Share Pressure: The 2.6% decrease in Q2 2025 shipments indicates potential erosion of market share among independent retailers.

- Competitive Landscape: Difficult competitive conditions are likely contributing factors to the observed decline in this wholesale segment.

- Lower Growth Potential: Compared to Bassett's owned retail channels, these independent accounts may represent a slower growth avenue.

- Resource Allocation: The potential for diminishing returns necessitates careful consideration of resource allocation towards these wholesale relationships.

Dogs represent business units with low market share in low-growth industries. They typically generate little profit and often require more cash than they bring in. Bassett's closure of the Noa Home e-commerce business in late 2024 exemplifies a 'Dog' due to its negative growth and low market share, leading to its divestiture. Similarly, underperforming licensed stores and phased-out product lines are being evaluated as potential 'Dogs' to optimize resource allocation and shed underperforming assets.

| BCG Category | Bassett Example | Market Characteristics | Financial Implication |

|---|---|---|---|

| Dog | Noa Home E-commerce | Low Market Share, Negative Growth | Resource Drain, Divestiture |

| Dog | Underperforming Licensed Stores | Low Market Share, Slow/Declining Market | Potential Closure/Repositioning |

| Dog | Outdated Product Lines | Low Sales Volume, Diminished Presence | Inventory Reduction, Capital Tie-up |

| Dog | Lane Venture Shipments (Q2 2025) | Low & Decreasing Market Share | Potential Cash Trap |

| Dog | Open Market Wholesale Accounts (Q2 2025) | Declining Shipments (2.6%) | Eroding Market Share, Lower Growth Potential |

Question Marks

Bassett's planned Q1 2026 store openings in Cincinnati and Orlando exemplify a strategic move into new geographic markets. These entries are classified as question marks within the BCG matrix due to their high growth potential but currently low market share for Bassett.

Significant capital investment will be necessary for these expansions, covering site selection, construction, inventory, and localized marketing campaigns. For instance, the average cost to build a new retail store can range from $500,000 to over $1 million, depending on size and location.

Success in these new markets hinges on Bassett's ability to quickly build brand awareness and capture market share from established competitors. Achieving this will require effective customer acquisition strategies and a strong understanding of local consumer preferences.

The integration of advanced e-commerce technologies, such as AI-driven recommendation engines, positions a company's offerings within the question marks quadrant of the Bassett BCG Matrix. These technologies, while representing significant investment in high-growth potential, are still in their early stages of market penetration and impact assessment. For instance, a 12% conversion rate increase in pilot regions highlights promising returns, but the broader market share gains are yet to be definitively established, necessitating ongoing strategic investment to achieve scalability and market leadership.

For 2025, Bassett is prioritizing a strategic pricing and value messaging initiative. This aims to connect with consumers facing economic headwinds, emphasizing the affordability and benefits of their offerings. The effectiveness of this approach in gaining market share and boosting sales is still under evaluation, necessitating significant marketing expenditure and ongoing performance tracking.

Emerging Smart Home Furniture Categories

Emerging smart home furniture categories, while not explicitly defined by Bassett, represent a burgeoning segment within the broader home furnishings market. These categories are characterized by the integration of technology and multifunctional designs, catering to a growing consumer demand for convenience and connectivity. For Bassett, if they are developing or exploring these areas, they would likely fall into a question mark position within the BCG matrix.

This means these are potentially high-growth market segments where Bassett currently holds a low market share. Significant investment in research and development, alongside efforts to drive market adoption and consumer education, would be crucial for success. For instance, the global smart home market was projected to reach over $138 billion in 2024, with furniture being an increasingly integrated component.

- Smart Beds: Featuring integrated sensors for sleep tracking, adjustable firmness, and climate control.

- Connected Desks: Offering adjustable heights, wireless charging, and built-in connectivity hubs.

- Multifunctional Seating: Incorporating features like built-in speakers, USB ports, and hidden storage.

- Smart Lighting Furniture: Lamps and tables with integrated, app-controlled lighting systems.

Expansion of Design Studio Program for Independent Dealers

Bassett Furniture Industries is strategically expanding its Bassett Design Studio program to independent dealers, a move designed to capture a larger share of the design trade market. This initiative has already seen some dealers invest in and enlarge their dedicated studio spaces, indicating a positive reception and potential for growth.

The expansion aims to leverage the success observed in existing partnerships, fostering deeper engagement with designers and specifiers. While the program shows promise, its broader market penetration and impact on overall revenue are still developing, necessitating ongoing investment in marketing, training, and operational support for participating dealers.

- Market Share Growth: The primary objective is to increase Bassett's presence within the lucrative design trade channel.

- Dealer Investment: Some independent dealers have already committed to expanding their dedicated Design Studio spaces.

- Early Stage Development: Widespread adoption and significant revenue contribution are still in the initial phases.

- Continued Support: The program requires sustained investment and resources to maximize its potential.

Question marks in the Bassett BCG Matrix represent business areas with low market share but operating in high-growth industries. These ventures require careful analysis and strategic investment to determine their future potential.

For Bassett, the expansion into new geographic markets like Cincinnati and Orlando, along with the development of emerging smart home furniture categories, exemplifies these question mark characteristics. While these areas offer significant growth opportunities, their current market share is minimal, necessitating substantial capital allocation for market penetration and brand building.

The strategic pricing and value messaging initiative for 2025, along with the expansion of the Bassett Design Studio program to independent dealers, also fall into this category. Their success and impact on overall revenue are still being evaluated, requiring ongoing investment and performance tracking to ascertain their long-term viability and potential to become market leaders.

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial disclosures, market research reports, and industry growth forecasts to provide a comprehensive view.