Barnes Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barnes Group Bundle

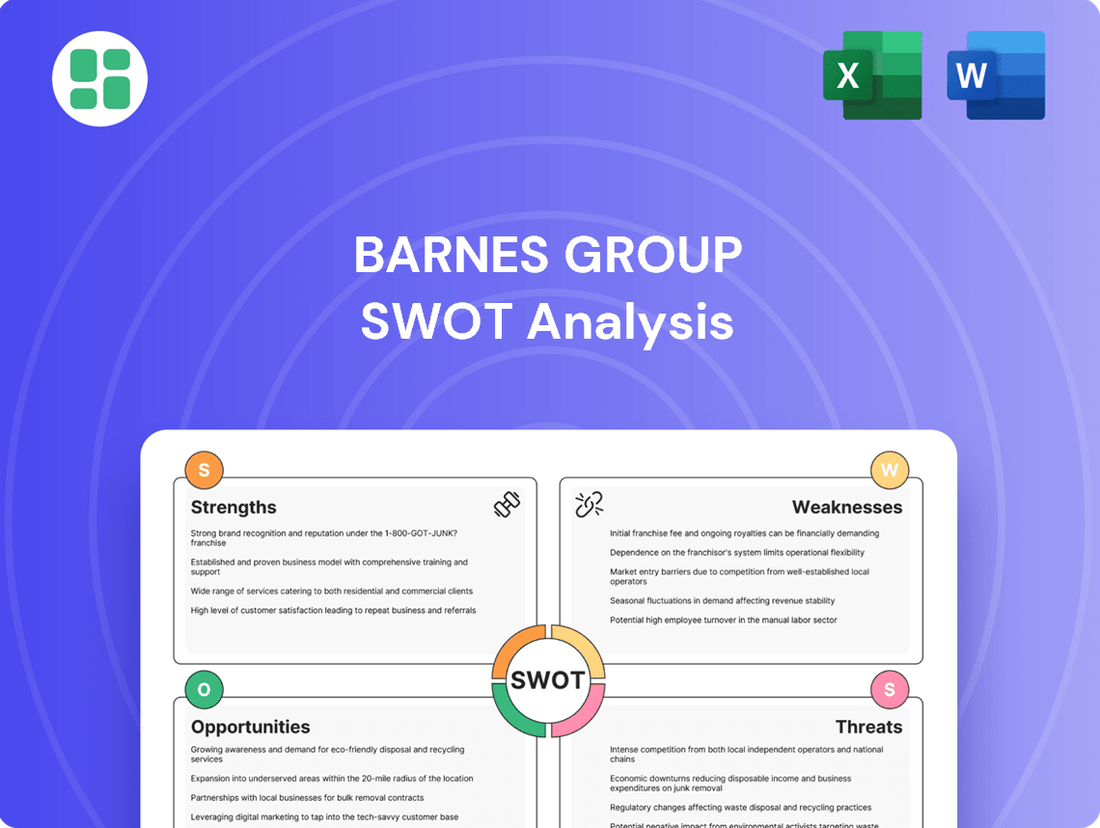

Barnes Group demonstrates robust strengths in its specialized manufacturing capabilities and established market presence, yet faces potential threats from evolving industry demands and competitive pressures. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind Barnes Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Barnes Group's diversified business segments, primarily Aerospace and Industrial, offer a significant strength by spreading revenue across different markets. This dual focus helps mitigate the impact of downturns in any single sector, fostering greater business resilience.

In 2023, Barnes Group reported approximately $1.4 billion in total revenue, with its Industrial segment contributing a substantial portion, demonstrating the benefit of this diversification. This broad exposure to end markets, including transportation and healthcare, provides a buffer against sector-specific volatility.

Barnes Group's Aerospace segment is a powerhouse, showcasing impressive growth. Sales have seen a substantial climb, bolstered by a formidable OEM backlog of $1.80 billion as of the third quarter of 2024. This segment, especially its aftermarket services, is a primary engine for both revenue and profit, highlighting robust demand for the company's essential components and maintenance, repair, and overhaul (MRO) capabilities.

The strategic focus on expanding the Aerospace business is evident, with a clear objective to reach $1 billion in annual revenue by 2025. This ambitious target underscores the segment's critical role in Barnes Group's overall financial health and future growth trajectory.

Barnes Group's advanced manufacturing and engineering expertise is a significant strength, allowing them to produce highly engineered products. This capability is crucial in sectors demanding precision and reliability.

Their market-leading engineering proficiency, particularly in precision components, springs, and molding, makes them a sought-after partner for complex industrial needs. This technical depth is a key differentiator.

In 2023, Barnes Group reported strong performance in its Engineered Products segment, which heavily relies on these advanced manufacturing skills, with revenue growth underscoring the demand for their specialized solutions.

Global Presence and Established Relationships

Barnes Group boasts a significant global manufacturing and support network, enabling efficient service delivery across diverse international markets. This expansive footprint is crucial for meeting the needs of a multinational clientele and capitalizing on regional growth opportunities.

The company's strength lies in its deeply entrenched relationships with key industry players, especially within the aerospace Original Equipment Manufacturer (OEM) segment. These enduring partnerships provide a foundation for consistent revenue and drive synergistic innovation, as evidenced by their collaborations on advanced component development.

- Global Operations: Barnes Group operates in over 20 countries, facilitating localized customer support and market access.

- Aerospace OEM Partnerships: Long-standing relationships with major aerospace manufacturers contribute significantly to their backlog and technological advancements.

- Market Penetration: The international presence allows for deeper penetration into high-growth emerging markets.

Strategic Portfolio Transformation

Barnes Group is actively reshaping its business through a strategic portfolio transformation. This involves simplifying its Industrial segment while aggressively expanding its Aerospace division, a sector recognized for its higher growth potential and better profit margins.

This strategic pivot is demonstrated by divestitures, such as the sale of Associated Spring and Hänggi, which are key steps in optimizing the company's overall business mix for sustained, profitable growth. The company anticipates significant annualized savings from these ongoing restructuring efforts, aiming to boost both growth and overall profitability.

- Portfolio Simplification: Divestment of non-core industrial assets like Associated Spring.

- Aerospace Focus: Increased investment and expansion in the higher-margin Aerospace segment.

- Growth Acceleration: Restructuring programs designed to speed up growth and enhance profitability.

- Cost Savings: Planned annualized savings expected from ongoing strategic initiatives.

Barnes Group's diversified business segments, primarily Aerospace and Industrial, offer a significant strength by spreading revenue across different markets. This dual focus helps mitigate the impact of downturns in any single sector, fostering greater business resilience.

In 2023, Barnes Group reported approximately $1.4 billion in total revenue, with its Industrial segment contributing a substantial portion, demonstrating the benefit of this diversification. This broad exposure to end markets, including transportation and healthcare, provides a buffer against sector-specific volatility.

Barnes Group's Aerospace segment is a powerhouse, showcasing impressive growth. Sales have seen a substantial climb, bolstered by a formidable OEM backlog of $1.80 billion as of the third quarter of 2024. This segment, especially its aftermarket services, is a primary engine for both revenue and profit, highlighting robust demand for the company's essential components and maintenance, repair, and overhaul (MRO) capabilities.

The strategic focus on expanding the Aerospace business is evident, with a clear objective to reach $1 billion in annual revenue by 2025. This ambitious target underscores the segment's critical role in Barnes Group's overall financial health and future growth trajectory.

Barnes Group's advanced manufacturing and engineering expertise is a significant strength, allowing them to produce highly engineered products. This capability is crucial in sectors demanding precision and reliability.

Their market-leading engineering proficiency, particularly in precision components, springs, and molding, makes them a sought-after partner for complex industrial needs. This technical depth is a key differentiator.

In 2023, Barnes Group reported strong performance in its Engineered Products segment, which heavily relies on these advanced manufacturing skills, with revenue growth underscoring the demand for their specialized solutions.

Barnes Group boasts a significant global manufacturing and support network, enabling efficient service delivery across diverse international markets. This expansive footprint is crucial for meeting the needs of a multinational clientele and capitalizing on regional growth opportunities.

The company's strength lies in its deeply entrenched relationships with key industry players, especially within the aerospace Original Equipment Manufacturer (OEM) segment. These enduring partnerships provide a foundation for consistent revenue and drive synergistic innovation, as evidenced by their collaborations on advanced component development.

- Global Operations: Barnes Group operates in over 20 countries, facilitating localized customer support and market access.

- Aerospace OEM Partnerships: Long-standing relationships with major aerospace manufacturers contribute significantly to their backlog and technological advancements.

- Market Penetration: The international presence allows for deeper penetration into high-growth emerging markets.

Barnes Group is actively reshaping its business through a strategic portfolio transformation. This involves simplifying its Industrial segment while aggressively expanding its Aerospace division, a sector recognized for its higher growth potential and better profit margins.

This strategic pivot is demonstrated by divestitures, such as the sale of Associated Spring and Hänggi, which are key steps in optimizing the company's overall business mix for sustained, profitable growth. The company anticipates significant annualized savings from these ongoing restructuring efforts, aiming to boost both growth and overall profitability.

- Portfolio Simplification: Divestment of non-core industrial assets like Associated Spring.

- Aerospace Focus: Increased investment and expansion in the higher-margin Aerospace segment.

- Growth Acceleration: Restructuring programs designed to speed up growth and enhance profitability.

- Cost Savings: Planned annualized savings expected from ongoing strategic initiatives.

Barnes Group's deep engineering expertise and commitment to innovation are foundational strengths, enabling the development of highly specialized components. This technical prowess is particularly evident in their Aerospace segment, where they are targeting $1 billion in annual revenue by 2025, reflecting strong market demand and their capabilities in producing critical parts.

What is included in the product

Delivers a strategic overview of Barnes Group’s internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear, actionable breakdown of Barnes Group's strategic landscape to pinpoint and address key challenges.

Weaknesses

The Industrial segment has shown significant weakness, evidenced by a substantial 24% sales decline in the third quarter of 2024. This downturn is largely attributed to strategic divestitures, but also points to underlying productivity challenges within the segment.

This underperformance stands in stark contrast to the robust growth experienced by the Aerospace segment, highlighting a clear disparity in operational success and market reception.

Barnes Group's ongoing initiatives to integrate, consolidate, and rationalize the Industrial business underscore the segment's current difficulties and the strategic efforts required to address its lagging performance.

Barnes Group's Aerospace OEM segment, while experiencing robust order backlogs, is susceptible to significant production delays stemming from aircraft manufacturers and pervasive industry-wide supply chain disruptions. These external pressures directly temper reported Aerospace OEM results and hinder the company's capacity to fulfill demand promptly.

These ongoing disruptions can lead to sales figures falling short of projections and negatively impact overall operational efficiency, as seen in the first quarter of 2024 where supply chain issues contributed to a slight miss in revenue expectations for the Aerospace segment.

Barnes Group's strategic transformation and restructuring efforts, while designed for future growth, have presented significant short-term financial headwinds. These initiatives led to a reported GAAP EPS loss of $0.32 in the third quarter of 2024, highlighting the immediate impact of these investments on the company's bottom line.

Furthermore, these transformation costs have put pressure on adjusted operating margins in certain periods, making it a delicate balancing act for management to navigate these expenses effectively while ensuring the successful implementation of their long-term strategic vision.

Negative Free Cash Flow

Barnes Group experienced negative free cash flow in the first quarter and year-to-date for the second quarter of 2024. This was driven by higher capital expenditures, increased operational cash usage, and tax payments related to divestitures. For instance, the company reported a free cash flow of -$36.7 million for Q1 2024.

While these investments are intended to fuel future growth, a sustained period of negative free cash flow can constrain the company's financial agility. This situation could potentially lead to a greater reliance on external financing to meet its obligations.

The company's stated focus on improving its leverage ratio highlights the current challenge of cash outflow. This metric is a key indicator of financial health, and a negative free cash flow directly impacts its ability to reduce debt or fund operations organically.

- Negative Free Cash Flow (Q1 2024): -$36.7 million

- Impact on Financial Flexibility: Limits ability to fund operations and debt reduction without external capital.

- Strategic Investments: Increased capital expenditures aimed at growth are a contributing factor.

- Divestiture Impact: Tax payments associated with asset sales also negatively affected cash flow.

Integration Risks from Acquisitions

Barnes Group faces significant integration risks following its substantial 2023 acquisition of MB Aerospace. This deal effectively doubled the size of its aerospace segment, but the complex process of merging operations, distinct corporate cultures, and disparate IT systems presents a considerable challenge. Successfully realizing the projected synergies from this large investment is paramount to its long-term value creation.

Failure to achieve seamless integration could manifest in several ways, impacting Barnes Group's financial performance and strategic objectives:

- Operational Inefficiencies: Disruption to production lines, supply chain complexities, or duplicated functions could lead to increased costs and reduced output.

- Unrealized Synergies: The anticipated cost savings and revenue enhancements from the acquisition may not materialize if integration efforts fall short, impacting profitability targets.

- Cultural Clashes: Divergent management styles and employee expectations between Barnes Group and MB Aerospace could hinder collaboration and productivity.

Barnes Group's Industrial segment continues to be a notable weakness, with a significant 24% sales decline reported in Q3 2024, partly due to divestitures but also hinting at internal performance issues. This underperformance is a stark contrast to the Aerospace segment's growth, indicating uneven operational success.

The company is also grappling with integration risks following the substantial acquisition of MB Aerospace, which doubled the size of its aerospace division. The complexity of merging operations, cultures, and IT systems poses a considerable challenge to realizing projected synergies and could lead to operational inefficiencies or cultural clashes.

Furthermore, Barnes Group experienced negative free cash flow in Q1 and year-to-date Q2 2024, amounting to -$36.7 million in Q1. This was driven by higher capital expenditures and increased operational cash usage, impacting financial flexibility and potentially increasing reliance on external financing.

| Segment/Area | Metric | Value | Period | Impact |

|---|---|---|---|---|

| Industrial | Sales Decline | 24% | Q3 2024 | Underperformance, productivity challenges |

| Aerospace | Integration Risk | High | Post-MB Aerospace Acquisition | Operational inefficiencies, unrealized synergies |

| Cash Flow | Free Cash Flow | -$36.7 million | Q1 2024 | Reduced financial flexibility, potential need for external capital |

Full Version Awaits

Barnes Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Barnes Group's Strengths, Weaknesses, Opportunities, and Threats, ready for your strategic planning.

Opportunities

The aerospace sector is showing significant growth, fueled by the need to replace older aircraft and the anticipated rebound in both new aircraft production (OEM) and the ongoing strength in repair and maintenance services (aftermarket). This robust demand creates a substantial opportunity for Barnes Group, given its dedicated focus on this industry.

Barnes Group is well-positioned to benefit from this expanding aerospace market, which offers growth potential across both the manufacturing of new aircraft components and the critical maintenance, repair, and overhaul (MRO) segments. Projections indicate a sustained upward trend in the aerospace aftermarket through 2025 and beyond.

The pending acquisition by Apollo Funds, slated for completion in Q1 2025, offers Barnes Group a substantial opportunity. This transition to private ownership, valued at approximately $3.6 billion, could unlock enhanced capabilities and improved financial performance.

Under Apollo's stewardship, Barnes Group may gain access to crucial additional capital. This infusion of funds can fuel strategic investments, accelerate ongoing transformation initiatives, and potentially foster more agile decision-making, unburdened by the constraints of public market scrutiny.

Barnes Group can leverage its proven acquisition strategy, exemplified by the successful integration of MB Aerospace, to further expand its market reach. Beyond the Apollo acquisition, actively seeking complementary businesses in high-growth sectors like advanced manufacturing or sustainable technologies presents a significant opportunity to diversify revenue streams and enhance technological capabilities.

Technological Advancements and Automation

Barnes Group can capitalize on the growing demand for advanced manufacturing technologies. Investing in AI, machine learning, and automation can streamline operations, boost product quality, and solidify market leadership. For instance, the company's exploration of AI for risk assessments and inspections highlights a commitment to leveraging these powerful tools.

These technological integrations present a clear path to optimizing production workflows and fostering innovation in new product development. Barnes Group’s strategic focus on these areas positions it well for future growth.

- Enhanced Efficiency: Automation can reduce manual labor costs and increase throughput, potentially improving operating margins.

- Improved Quality Control: AI and machine learning can identify defects with greater precision than traditional methods, leading to higher product reliability.

- New Revenue Streams: Developing and offering advanced automation solutions to other industries could create new business opportunities.

- Competitive Edge: Early adoption and effective implementation of these technologies can create a significant advantage over competitors.

Further Optimization of Industrial Portfolio

Barnes Group's ongoing strategic review of its Industrial segment presents a significant opportunity to refine its portfolio. This process can involve streamlining operations and divesting underperforming or non-core assets, which could unlock greater efficiency and profitability. For instance, by focusing on higher-margin industrial product lines, Barnes can bolster the segment's financial contribution. This strategic pruning also allows for a more concentrated allocation of resources, potentially accelerating growth in key areas or facilitating a greater strategic pivot towards the aerospace sector.

The optimization efforts aim to enhance the performance of the remaining industrial businesses. By shedding less profitable ventures, Barnes can concentrate its capital and management attention on areas with stronger growth potential and better margins. This strategic repositioning is crucial for maximizing shareholder value and ensuring the long-term health of the company. For example, the company reported that in Q1 2024, its Industrial segment revenue was $184.3 million, and further optimization could improve its operating margin.

- Streamlining Operations: Reducing complexity and improving efficiency within the existing industrial footprint.

- Divestment of Non-Core Assets: Selling off businesses that do not align with the company's strategic focus or profitability goals.

- Focus on High-Margin Products: Shifting resources towards industrial product lines that generate better profitability.

- Strategic Portfolio Shift: Potentially increasing the weighting of the aerospace segment within the overall business mix.

Barnes Group's strategic pivot towards aerospace, bolstered by the pending acquisition by Apollo Funds in Q1 2025, presents a significant growth avenue. This transition, valued at $3.6 billion, is expected to provide capital for accelerated transformation and strategic investments. The company's proven acquisition strategy, as seen with MB Aerospace, offers further opportunities for expansion into high-growth sectors.

Leveraging advanced manufacturing technologies like AI and automation is another key opportunity, promising enhanced efficiency, improved quality control, and a stronger competitive edge. Barnes Group's focus on optimizing its Industrial segment, potentially through divestitures of non-core assets and a concentration on high-margin products, also positions it for increased profitability and a more focused strategic direction.

| Opportunity Area | Key Benefit | Supporting Data/Context |

|---|---|---|

| Aerospace Sector Growth | Increased demand for OEM and aftermarket services | Strong rebound in new aircraft production and ongoing strength in MRO services through 2025. |

| Apollo Funds Acquisition | Access to capital for strategic investments and agility | $3.6 billion valuation; potential for accelerated transformation initiatives. |

| Advanced Manufacturing Technologies | Enhanced efficiency, quality, and competitive advantage | AI for risk assessments and inspections; streamlining production workflows. |

| Industrial Segment Optimization | Improved profitability and strategic focus | Focus on high-margin industrial product lines; Q1 2024 Industrial segment revenue was $184.3 million. |

Threats

Barnes Group faces a significant threat from economic downturns and market volatility, directly impacting demand across its key aerospace and industrial segments. For instance, a projected slowdown in global manufacturing output for 2024, estimated by some analysts to be around 1-2%, could translate into reduced orders for Barnes' industrial technologies.

This economic uncertainty directly affects customer spending habits and, consequently, the company's order volumes and overall profitability. Lingering inflation concerns and the potential for recessionary pressures in major economies in 2024-2025 represent substantial risks to Barnes Group's financial performance, potentially squeezing margins and hindering growth initiatives.

Barnes Group operates in the aerospace and industrial sectors, both of which are characterized by a high degree of competition from a multitude of domestic and international companies. This crowded marketplace means Barnes Group faces rivals who compete fiercely on product quality, pricing strategies, technological innovation, and customer service levels. For instance, in the aerospace components market, major players alongside Barnes Group include companies like Eaton and Safran, each with significant market presence and diverse product portfolios.

The intense competition directly impacts Barnes Group's ability to maintain its market share and profitability. Competitors' aggressive pricing can force Barnes Group to lower its own prices, potentially squeezing profit margins. Furthermore, the need to constantly innovate and offer superior technical capabilities requires significant investment, adding to operational costs. In 2023, the industrial sector, a key market for Barnes Group, saw continued price pressures due to global supply chain dynamics and increased manufacturing output from various regions, impacting margins across the industry.

Ongoing global supply chain risks, including persistent shipping delays and labor shortages, continue to threaten Barnes Group's manufacturing operations and the timely delivery of its products. For instance, the Suez Canal blockage in early 2021, while resolved, highlighted the fragility of global trade routes, impacting various industries including aerospace and industrial sectors where Barnes operates.

Geopolitical tensions, such as those arising from trade disputes or regional conflicts, can further compound these supply chain challenges. These tensions can lead to increased raw material costs, unexpected production halts, and a general reduction in operational efficiency, directly impacting Barnes' bottom line and market responsiveness.

Barnes Group's reliance on a complex, interconnected global supply chain inherently makes it vulnerable to these external disruptions. A disruption at any critical node, from component suppliers to logistics providers, can have a cascading effect, hindering production schedules and potentially affecting customer satisfaction.

Integration Risks Post-Acquisition by Apollo

The acquisition by Apollo Funds, while offering strategic advantages, introduces significant integration risks. A key challenge lies in the transition from a public to a private company structure, which can impact operational workflows and strategic decision-making. Successfully managing this shift requires careful attention to maintaining business continuity and employee engagement throughout the process.

Potential disruptions during the integration phase could negatively affect Barnes Group's performance. For instance, changes in management or operational strategies under new ownership might lead to unexpected challenges. The company's ability to navigate these changes smoothly will be crucial for realizing the full benefits of the acquisition and avoiding adverse impacts on its market position.

- Post-acquisition integration complexity: Merging operations and cultures of a publicly traded entity into a privately held structure presents inherent challenges.

- Employee morale and retention: Uncertainty following an acquisition can impact employee morale, potentially leading to talent drain if not managed proactively.

- Strategic alignment under new ownership: Apollo's strategic priorities may differ from previous public market expectations, requiring careful management to ensure continued business success.

Fluctuations in Raw Material Costs and Energy Prices

Barnes Group's manufacturing processes are inherently susceptible to the unpredictable swings in the cost of essential raw materials, such as various metals, and the volatile prices of energy. These fluctuations can significantly impact the company's bottom line. For instance, a sharp rise in steel prices, a key component for many of Barnes Group's products, could directly increase production expenses.

When these increased input costs cannot be fully transferred to customers through higher product prices, it directly squeezes profit margins. This is a recurring challenge for manufacturers across industries.

Managing these external economic forces is absolutely vital for Barnes Group to sustain its profitability and financial health.

- Metal price volatility: For example, LME Nickel prices saw significant fluctuations in early 2024, impacting manufacturers reliant on this metal.

- Energy cost impact: Global energy prices, influenced by geopolitical events, can directly affect operating expenses for Barnes Group's production facilities.

- Margin pressure: Inability to pass on 100% of increased raw material and energy costs can reduce operating margins, as seen in industry reports for Q4 2023 and Q1 2024.

The company faces intense competition from established players like Eaton and Safran in the aerospace sector, necessitating continuous innovation and potentially impacting pricing power. For instance, in 2023, the industrial sector experienced ongoing price pressures, which could affect Barnes' margins.

Global economic slowdowns and market volatility pose a significant threat, potentially reducing demand for Barnes' products. Analysts projected a 1-2% slowdown in global manufacturing output for 2024, a direct risk to industrial segment orders.

Supply chain disruptions, including shipping delays and geopolitical tensions, remain a persistent risk, impacting production schedules and operational efficiency. The fragility of global trade routes was underscored by events like the Suez Canal blockage, highlighting vulnerabilities for companies like Barnes.

The acquisition by Apollo Funds introduces integration risks, impacting operational workflows and strategic alignment. Employee morale and retention are also key concerns during this transition period.

SWOT Analysis Data Sources

This Barnes Group SWOT analysis is built upon a foundation of credible data, drawing from the company's official financial filings, comprehensive market research reports, and expert industry commentary to provide a well-informed strategic perspective.