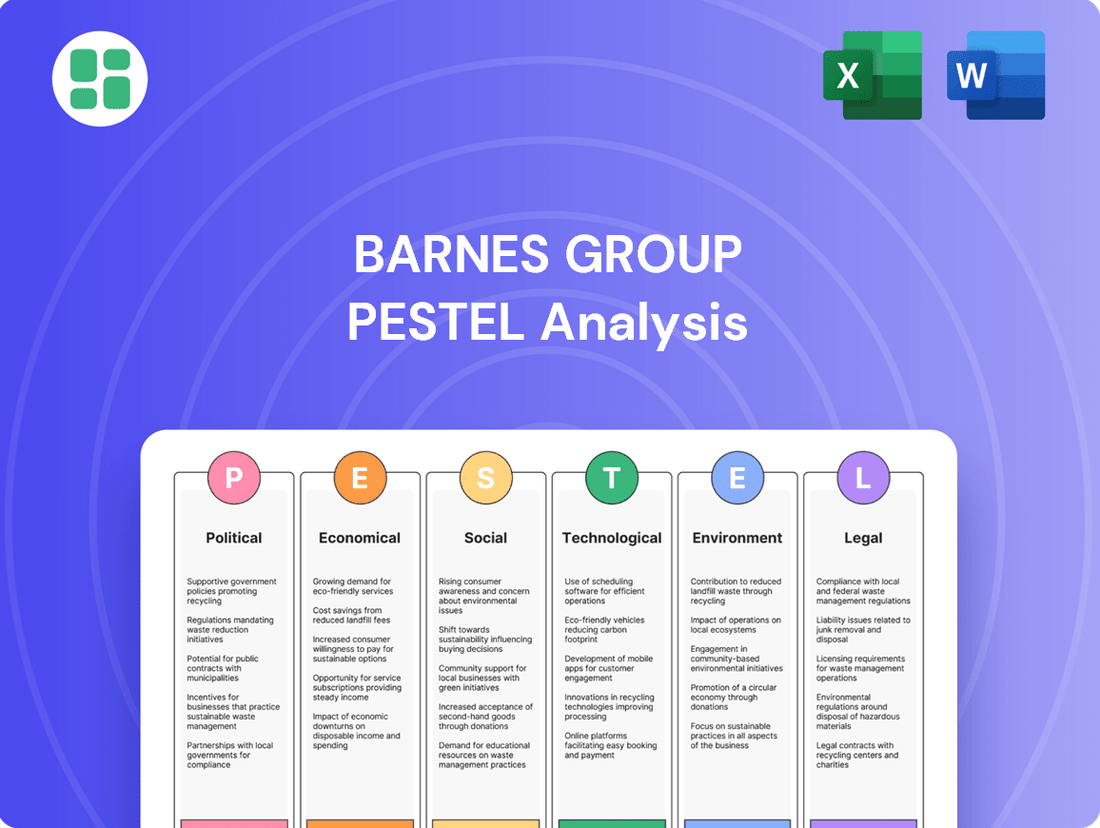

Barnes Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barnes Group Bundle

Navigate the complex external forces shaping Barnes Group's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for the company. Equip yourself with critical insights to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Barnes Group, a global manufacturing entity, navigates a complex web of federal, state, and local regulations that directly influence its aerospace and industrial operations. These mandates span critical areas like workplace safety, product quality assurance, and environmental stewardship, requiring substantial investment in compliance measures.

For instance, in 2024, the aerospace sector continued to face stringent oversight from bodies like the FAA, with ongoing reviews of manufacturing processes and supply chain integrity. Similarly, environmental regulations, such as those pertaining to emissions and waste management, are becoming increasingly rigorous, impacting production costs and necessitating advanced technological adoption.

The company's ability to adapt to evolving regulatory landscapes, including potential changes in trade policies or product certification standards anticipated in 2025, is paramount for maintaining market access and operational continuity across its diverse global footprint.

Barnes Group's extensive global footprint means that shifts in international trade policies, tariffs, and trade agreements significantly influence its cost of goods. For instance, the imposition of tariffs on critical raw materials or components could directly increase operational expenses. In 2024, ongoing trade tensions and the potential for new tariffs, particularly between major economic blocs, present a continuous challenge for supply chain management and cost optimization.

Barnes Group's Aerospace segment, a key player in components for turbine engines, nacelles, and airframes for both commercial and military applications, is highly sensitive to government defense spending. Fluctuations in military budgets and the awarding of defense contracts directly shape the demand for these specialized products and services. For instance, the U.S. Department of Defense's FY2025 budget request includes significant investments in advanced aviation and defense systems, potentially boosting demand for Barnes Group's offerings.

Political Stability in Key Operating Regions

Barnes Group's global manufacturing and support presence exposes it to the risks of political instability across various regions. Geopolitical tensions, civil unrest, or shifts in government regulations in countries where Barnes operates can significantly disrupt its supply chains, production capabilities, and market demand. For instance, ongoing geopolitical shifts in Eastern Europe, a region with some manufacturing presence for industrial components, could impact raw material sourcing and logistics costs for Barnes in 2024-2025.

Barnes Group actively manages these risks through its diversified global footprint, which helps to cushion the impact of localized political disruptions. However, the company must remain vigilant and adaptable to the nuances of each local political environment. Changes in trade policies or tariffs, such as potential adjustments by the U.S. government on imported goods in 2024, could directly affect Barnes' cost of goods sold and competitive positioning in certain markets.

- Global Diversification: Barnes operates in over 20 countries, reducing reliance on any single political climate.

- Supply Chain Resilience: The company aims to secure multiple sourcing options to mitigate disruptions caused by regional instability.

- Regulatory Monitoring: Barnes continuously tracks changes in international trade agreements and domestic policies that could affect its operations.

- Market Adaptation: Strategies are in place to adjust to evolving market conditions driven by political and economic shifts in key territories.

Industrial Policies and Subsidies

Government industrial policies, particularly those favoring advanced manufacturing and key sectors like aerospace and healthcare, can significantly benefit Barnes Group. For instance, the U.S. government's CHIPS and Science Act of 2022, with its substantial investment in semiconductor manufacturing and R&D, indirectly supports industries that rely on advanced components, a market Barnes Group serves. These initiatives often include tax incentives and grants that can lower operational costs and encourage capital expenditures.

Subsidies and strategic initiatives aimed at boosting domestic production can create a more competitive landscape for Barnes Group. In 2024, many nations are focusing on reshoring critical supply chains, which could lead to increased demand for Barnes Group's engineered solutions in areas like aerospace components and industrial equipment. This trend is supported by government funding programs designed to onshore manufacturing capabilities.

- Favorable Policies: Government incentives for advanced manufacturing, such as tax credits for R&D or capital investments, can directly reduce Barnes Group's operating expenses and encourage expansion.

- Strategic Sector Support: Initiatives targeting aerospace and healthcare manufacturing, key markets for Barnes Group, can lead to increased demand and opportunities for new contracts.

- Infrastructure Investment: Government spending on infrastructure projects, especially those related to transportation and advanced technology, can create indirect demand for Barnes Group's products and services.

- Workforce Development: Policies promoting skilled labor training and development in manufacturing sectors can help Barnes Group secure a qualified workforce, crucial for its specialized operations.

Barnes Group's operations are heavily influenced by government regulations and policies, particularly in its aerospace and industrial sectors. These mandates cover safety, quality, and environmental standards, requiring ongoing investment in compliance. For example, the FAA's continued oversight in aerospace manufacturing in 2024 demands rigorous adherence to evolving process and supply chain integrity rules.

Changes in international trade policies and tariffs directly impact Barnes Group's cost of goods, as seen with ongoing trade tensions in 2024 affecting raw material imports. Furthermore, government defense spending, such as the U.S. Department of Defense's FY2025 budget, significantly shapes demand for Barnes' aerospace components.

Political stability in regions where Barnes operates is crucial, as geopolitical shifts can disrupt supply chains and production. For instance, instability in Eastern Europe in 2024 impacted raw material sourcing for industrial components.

Government support for advanced manufacturing and key sectors like aerospace, through initiatives like the CHIPS and Science Act, can create favorable conditions. Reshoring efforts in 2024 also boost demand for domestic manufacturing solutions, benefiting Barnes Group.

What is included in the product

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors impacting Barnes Group, providing a comprehensive overview of the external forces shaping its strategic landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Barnes Group's external environment to inform strategic decisions.

Economic factors

Barnes Group's performance is directly influenced by global economic growth. When the world economy is expanding, demand for their engineered products and industrial technologies across sectors like aerospace, healthcare, and transportation tends to rise. For instance, the IMF projected global growth to be 3.2% in 2024, a slight slowdown from 3.4% in 2023, indicating a moderating but still positive economic environment that supports demand for Barnes Group's offerings.

Conversely, economic downturns or slowdowns can negatively impact Barnes Group's sales and profitability. A weaker global economy often translates to reduced spending on capital goods and industrial solutions, directly affecting the company's revenue streams. The projected slowdown in global growth for 2024, while still positive, signals a need for Barnes Group to remain adaptable to potential shifts in market demand.

Rising inflation presents a significant challenge for Barnes Group, as it directly escalates the costs associated with raw materials, labor, and energy. For instance, the US Producer Price Index (PPI) for finished goods saw a notable increase, reaching 1.2% in April 2024, indicating broader inflationary pressures that could squeeze profit margins for manufacturers like Barnes Group.

Fluctuations in interest rates also play a crucial role in Barnes Group's financial landscape. Higher interest rates, such as those maintained by the Federal Reserve in 2024, increase the expense of borrowing capital for essential activities like funding new projects, pursuing acquisitions, or managing outstanding debt. This sensitivity means that Barnes Group's investment decisions and overall operational strategies are closely tied to these macroeconomic trends.

Barnes Group's global operations are significantly exposed to supply chain vulnerabilities, directly impacting raw material costs and production timelines. For instance, the ongoing semiconductor shortage, a key component in many aerospace and industrial products, continued to affect manufacturing lead times throughout 2024, with some reports indicating extended delivery periods for critical electronic parts.

Geopolitical events, such as trade disputes and regional conflicts, alongside unpredictable natural disasters, can further exacerbate these issues by disrupting logistics and increasing the price of essential materials like aluminum and specialty alloys. In early 2025, the price of aluminum saw a notable increase, driven partly by energy costs and supply chain bottlenecks in key producing regions.

The company faces the persistent challenge of building supply chain resilience and implementing effective strategies to hedge against the volatility of raw material prices, a critical factor for maintaining profitability and meeting customer demand in a dynamic global market.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Barnes Group, a global enterprise operating across numerous countries. As of the first quarter of 2024, Barnes Group reported that approximately 55% of its net sales were generated outside of the United States, highlighting its substantial exposure to foreign currency movements. These shifts can directly impact the reported value of international earnings and the cost of imported components, potentially affecting Barnes Group's profitability and its pricing strategies in various regional markets.

Significant movements in the US Dollar against other major currencies, such as the Euro or the Chinese Yuan, can alter the translated value of Barnes Group's overseas revenues and expenses. For instance, a stronger US Dollar can make foreign sales less valuable when converted back into dollars, while a weaker dollar can have the opposite effect. This volatility requires careful financial management and hedging strategies to mitigate potential negative impacts on the company's consolidated financial statements.

- Global Operations: Barnes Group's presence in over 20 countries means its financial performance is inherently tied to a basket of currencies.

- Revenue Translation: Fluctuations directly affect how international sales are reported in US Dollars, impacting top-line figures.

- Cost of Goods Sold: Changes in exchange rates can also alter the cost of raw materials and components sourced internationally.

- Competitive Landscape: Currency shifts can influence the relative pricing of Barnes Group's products and those of its competitors in foreign markets.

Market Demand in Key End Markets

Barnes Group's performance is closely tied to the vitality of its major customer industries. The aerospace sector, a significant revenue driver, experienced a strong aftermarket in 2024, with demand for maintenance and repair services remaining high. However, original equipment manufacturer (OEM) sales in aerospace have been somewhat constrained by ongoing production slowdowns at major aircraft builders, impacting new aircraft deliveries.

The healthcare market continues to present steady demand for Barnes Group's engineered components and solutions, benefiting from an aging global population and increased healthcare spending. In the transportation sector, while automotive production faced some headwinds in early 2024, demand for specialized components in commercial vehicles and rail remained resilient. The general industrial segment showed mixed signals, with some areas experiencing robust activity while others navigated slower growth.

Key market demand indicators for 2024 and early 2025 include:

- Aerospace Aftermarket: Continued strength, with aftermarket services revenue for major aerospace companies often outperforming new aircraft sales. For example, some industry reports indicated aftermarket growth in the mid-to-high single digits for 2024.

- Aerospace OEM: Production rates for new commercial aircraft, such as the Boeing 737 MAX and Airbus A320neo families, have been subject to adjustments, impacting the volume of new component orders.

- Healthcare: Consistent demand for precision-engineered medical device components, driven by innovation and an expanding patient base.

- Transportation: Moderate growth in demand for specialized parts in commercial trucking and rail, offsetting slower trends in some automotive segments.

Barnes Group's financial health is intricately linked to global economic expansion and contraction. The IMF's projection of 3.2% global growth for 2024, a slight dip from 3.4% in 2023, suggests a moderating but still supportive economic climate for engineered product demand. Conversely, inflationary pressures, evidenced by a 1.2% rise in US PPI for finished goods in April 2024, directly increase Barnes Group's operational costs for raw materials and labor, potentially impacting profit margins.

| Economic Factor | 2024 Projection/Data | Impact on Barnes Group |

|---|---|---|

| Global GDP Growth | 3.2% (IMF, 2024) | Supports demand for engineered products. |

| US Producer Price Index (PPI) | 1.2% (April 2024) | Increases cost of raw materials and labor. |

| Interest Rates (US Federal Reserve) | Maintained higher rates in 2024 | Increases borrowing costs for capital expenditures. |

| Currency Exposure (Q1 2024) | ~55% of net sales outside US | Fluctuations affect reported international earnings. |

Same Document Delivered

Barnes Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Barnes Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain actionable insights into the external forces shaping Barnes Group's strategic landscape.

Sociological factors

Barnes Group's reliance on a highly skilled workforce for its advanced manufacturing and engineering capabilities is a critical factor. The availability of this talent pool, particularly in specialized technical areas, directly influences the company's operational efficiency and innovation capacity.

Demographic shifts present significant challenges; for instance, an aging workforce could lead to a loss of institutional knowledge, while a general shortage of skilled labor in fields like advanced machining or aerospace engineering, as reported by various industry surveys throughout 2024, can hinder recruitment efforts. For example, the U.S. Bureau of Labor Statistics projected a 3% decline in manufacturing employment between 2022 and 2032, highlighting potential scarcity.

To counter these trends, Barnes Group's strategic investment in robust training and development programs is paramount. These initiatives are designed to upskill existing employees and attract new talent, ensuring a pipeline of qualified professionals ready to meet the demands of its technologically advanced sectors.

Barnes Group, operating in demanding industrial and aerospace markets, faces significant societal expectations regarding health and safety. These expectations translate into rigorous adherence to regulations designed to protect employees and ensure product integrity. For example, the Occupational Safety and Health Administration (OSHA) in the US sets strict guidelines, and non-compliance can result in substantial fines, impacting profitability.

The increasing societal focus on worker well-being and product reliability directly influences Barnes Group's operational costs. Meeting these elevated standards often requires investment in advanced safety equipment, enhanced training programs, and more robust quality control processes. This can lead to increased compliance costs, as seen in the aerospace sector where safety certifications are paramount and costly to maintain.

Societal pressure for companies to act as responsible corporate citizens is intensifying. This includes a strong focus on ethical behavior, contributing to local communities, and adopting environmentally sound practices. Barnes Group actively communicates its dedication to making a positive impact, fostering social improvement, and upholding robust governance principles, as detailed in its Environmental, Social, and Governance (ESG) reports.

For instance, in 2023, Barnes Group reported a 10% increase in employee volunteer hours dedicated to community initiatives, demonstrating a tangible commitment to social betterment. Their ESG reporting highlights a 5% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to 2022, aligning with growing expectations for sustainability.

Consumer Preferences for Sustainable Products

Consumer demand for sustainability is increasingly shaping B2B purchasing decisions. Industries like automotive and packaging, key markets for Barnes Group, are prioritizing eco-friendly materials and production methods. For instance, a 2024 report indicated that over 60% of consumers consider sustainability a key factor when purchasing vehicles, directly impacting automotive manufacturers' material choices and, consequently, their demand for advanced manufacturing solutions.

This trend translates into a growing need for Barnes Group's expertise in areas like lightweight materials and efficient molding processes, which enable their clients to meet environmental targets. The packaging sector, in particular, is seeing a surge in demand for recyclable and biodegradable options, pushing companies to invest in new technologies that Barnes Group can provide. By 2025, it's projected that the global sustainable packaging market will reach over $400 billion, highlighting the significant opportunity for suppliers like Barnes Group.

- Growing Consumer Demand: Over 60% of consumers consider sustainability in vehicle purchases (2024 data).

- Industry Shifts: Automotive and packaging sectors are prioritizing eco-friendly materials and processes.

- Market Growth: The global sustainable packaging market is expected to exceed $400 billion by 2025.

- Barnes Group's Role: Technologies supporting lightweighting and efficient molding are in high demand.

Changing Work Models and Automation Adoption

The increasing adoption of automation and digitalization across the manufacturing sector, a key market for Barnes Group, is fundamentally reshaping job roles. This trend demands a proactive approach to upskilling the workforce to manage and operate advanced automated systems. For instance, the International Federation of Robotics reported that global industrial robot installations reached a record 518,000 units in 2022, highlighting the scale of this shift.

Barnes Group must strategically invest in new technologies and potentially reconfigure its operational structures to capitalize on the efficiencies offered by automation. This includes not only the implementation of robotics and AI but also the development of digital infrastructure to support these advancements. The company's ability to adapt its service offerings and internal capabilities to this evolving landscape will be crucial for maintaining its competitive edge.

- Workforce Reskilling: Focus on training programs for employees to operate and maintain advanced automated machinery.

- Technology Investment: Allocate capital for the integration of robotics, AI, and digital manufacturing solutions.

- Operational Restructuring: Evaluate and adapt business processes to maximize the benefits of automation.

- Customer Adaptation: Support clients in their own automation transitions by providing relevant solutions and expertise.

Societal expectations around corporate responsibility are growing, pushing companies like Barnes Group to demonstrate ethical conduct and community engagement. Barnes Group's commitment to ESG principles, as evidenced by a 10% increase in employee volunteer hours in 2023 and a 5% reduction in emissions, reflects this trend. This focus on social impact is increasingly influencing business decisions across sectors.

Technological factors

Barnes Group is seeing significant shifts due to additive manufacturing's rapid progress. In 2024, the global 3D printing market is projected to reach over $20 billion, indicating a substantial and growing impact on manufacturing sectors. This technology allows for the creation of intricate, high-performance parts, potentially streamlining Barnes Group's production of specialized components and opening doors for innovative product designs.

These technological leaps in 3D printing offer Barnes Group the chance to develop more efficient, customized solutions, reducing lead times and material waste. For instance, in aerospace, a key market for Barnes, additive manufacturing is increasingly used for lightweight, complex engine parts, a trend that will likely accelerate through 2025, offering new product opportunities.

Barnes Group is actively integrating Industry 4.0 technologies, such as automation and the Internet of Things (IoT), into its manufacturing operations. This strategic adoption aims to boost operational efficiency and foster innovation across its diverse business segments.

The company's focus on smart factories and digital transformation is evident in its investments in advanced processes. For instance, in 2023, Barnes Group reported capital expenditures of $115.9 million, a portion of which is allocated to modernizing its manufacturing capabilities and enhancing its technological infrastructure.

Innovations in materials science are significantly shaping Barnes Group's product landscape. Developments in advanced composites and high-strength alloys are enabling the creation of lighter, more resilient components, particularly crucial for the aerospace sector where Barnes Group holds a strong presence. For instance, the increasing adoption of carbon fiber reinforced polymers in aircraft manufacturing, a trend expected to continue its strong growth trajectory through 2025, directly influences the demand for Barnes Group's precision-engineered solutions.

Digitalization of Engineering and Design Processes

The increasing digitalization of engineering, design, and simulation processes is a significant technological factor impacting Barnes Group. This trend enables much quicker product development cycles, leading to improved precision and better collaboration among teams. For Barnes Group, with its core strength in engineering, staying ahead means consistently adopting advanced digital tools and methodologies to fine-tune its design and manufacturing processes. For instance, in 2024, the global market for engineering design software was projected to reach over $10 billion, highlighting the widespread adoption and investment in these digital solutions.

Barnes Group's ability to leverage these digital advancements directly influences its competitive edge. By integrating digital twins, AI-driven design optimization, and cloud-based collaboration platforms, the company can accelerate innovation and reduce time-to-market for its specialized products. This digital transformation is not just about adopting new software; it’s about fundamentally rethinking how products are conceived, developed, and manufactured.

- Faster Product Development: Digital tools shorten design-to-production timelines.

- Enhanced Precision: Simulation and digital modeling reduce errors and improve accuracy.

- Improved Collaboration: Cloud-based platforms facilitate seamless teamwork across geographies.

- Optimized Workflows: Digital integration streamlines manufacturing and operational efficiency.

Innovation in Precision Components and Molding Solutions

Barnes Group's foundation rests on precision components and molding solutions, necessitating ongoing innovation to satisfy dynamic customer demands and industry benchmarks. The company's commitment to R&D, evidenced by its substantial $48 million investment in 2024, fuels the development of advanced technologies aimed at enhancing product performance and streamlining manufacturing processes.

This focus on technological advancement is critical for maintaining a competitive edge in sectors like aerospace and medical, where precision and reliability are paramount. Barnes Group's strategic investments are designed to drive the next generation of high-performance components and sophisticated molding techniques.

Key technological drivers for Barnes Group include:

- Advancements in material science for lighter, stronger, and more durable components.

- Development of advanced manufacturing processes such as additive manufacturing (3D printing) for complex geometries.

- Integration of digital technologies, including AI and IoT, for enhanced quality control and operational efficiency.

- Continued investment in R&D to anticipate and meet future market needs in specialized industries.

Technological advancements, particularly in additive manufacturing and digitalization, are reshaping Barnes Group's operational landscape. The global 3D printing market's projected growth to over $20 billion in 2024 underscores the potential for Barnes to leverage this for intricate, custom parts, especially in aerospace. Furthermore, Barnes' 2023 capital expenditures of $115.9 million reflect a commitment to integrating Industry 4.0 technologies like automation and IoT for improved efficiency and innovation.

Innovations in materials science are also critical, with advanced composites enabling lighter, stronger components essential for aerospace, a key market for Barnes. The company's $48 million R&D investment in 2024 highlights its dedication to developing next-generation high-performance solutions and sophisticated molding techniques to meet evolving industry demands.

| Technology Area | 2024/2025 Projection/Investment | Impact on Barnes Group |

|---|---|---|

| Additive Manufacturing (3D Printing) | Global market projected over $20 billion (2024) | Enables complex, customized parts; streamlines production; reduces waste. |

| Industry 4.0 (Automation, IoT) | Capital Expenditures: $115.9 million (2023) allocated to modernization | Boosts operational efficiency; fosters innovation; enhances quality control. |

| Materials Science (Composites, Alloys) | Strong growth in aerospace adoption of advanced materials through 2025 | Development of lighter, stronger, more resilient components; meets aerospace demands. |

| Digitalization (AI, Digital Twins) | Global engineering design software market over $10 billion (2024) | Accelerates product development; improves precision; enhances collaboration. |

| Research & Development | $48 million investment (2024) | Drives development of advanced technologies; anticipates future market needs. |

Legal factors

Barnes Group, as a global manufacturer of engineered components, faces stringent product liability laws across its operating regions. These regulations mandate that its precision parts, springs, and molding solutions adhere to high safety and performance benchmarks to prevent potential lawsuits and safeguard its reputation. For instance, in 2023, the U.S. Consumer Product Safety Commission (CPSC) reported over 1.5 million product-related injuries requiring medical attention, highlighting the critical importance of compliance for companies like Barnes Group.

Barnes Group places significant emphasis on safeguarding its intellectual property, particularly its patents covering unique industrial technologies and forward-thinking solutions. This protection is fundamental to maintaining its edge in the market.

The company's strategy involves the diligent management of its patent assets and readiness to take action against any infringements, thereby securing its technological advancements and R&D investments.

Barnes Group, operating across numerous countries, navigates a complex web of labor laws. These regulations, covering everything from minimum wage to workplace safety, significantly influence HR strategies and operational expenses. For instance, in 2024, the average minimum wage in the EU varied considerably, with Luxembourg at €2,570.93 per month and Bulgaria at €398.83, highlighting the diverse compliance landscape Barnes Group must manage.

Changes in employment regulations, such as new mandates on employee benefits or union negotiation frameworks, can directly impact Barnes Group's cost structure and talent acquisition. For example, the increasing focus on remote work policies and associated legal implications in 2024-2025 across North America and Europe requires continuous adaptation of HR practices to ensure compliance and maintain competitive advantage in attracting skilled labor.

Environmental Regulations and Compliance

Barnes Group's manufacturing processes are heavily influenced by environmental regulations. These laws govern everything from air emissions and wastewater discharge to the proper disposal of waste materials and the efficient use of resources. Staying compliant with these evolving standards, particularly those addressing climate change and the handling of hazardous substances, is a critical operational imperative for the company.

The company is committed to minimizing its environmental impact. This commitment is reflected in its ongoing efforts to reduce its carbon footprint and manage its operations sustainably. For example, in 2023, Barnes Group reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions by 15% compared to its 2019 baseline, demonstrating tangible progress in its environmental stewardship.

- Emissions Control: Adherence to air quality standards for manufacturing facilities.

- Waste Management: Compliance with regulations for hazardous and non-hazardous waste disposal.

- Resource Efficiency: Implementing strategies to reduce water and energy consumption.

- Climate Change Initiatives: Actions taken to mitigate greenhouse gas emissions and adapt to climate-related risks.

International Trade Laws and Anti-corruption Compliance

Barnes Group's global footprint necessitates rigorous adherence to international trade laws and export control regulations. Failure to comply can result in significant fines and operational disruptions, impacting supply chains and market access. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) actively enforces export controls on advanced technologies, which could affect Barnes Group's aerospace and defense segments.

Anti-corruption compliance, particularly concerning legislation like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, is paramount. These laws govern business dealings with foreign officials and entities. In 2023, the U.S. Department of Justice reported significant enforcement actions against companies for FCPA violations, underscoring the substantial penalties, including multi-million dollar fines, that can be imposed.

- International Trade Laws: Compliance with export/import regulations and sanctions lists is critical for Barnes Group's global operations.

- Export Controls: Adherence to regulations on technology transfer, especially in defense and aerospace, prevents legal repercussions.

- Anti-corruption Legislation: Strict adherence to FCPA and similar global anti-bribery laws is essential to avoid severe penalties and reputational harm.

- Enforcement Trends: Increased global scrutiny and enforcement actions in 2023-2024 highlight the growing risks associated with non-compliance.

Barnes Group must navigate a complex landscape of product liability laws, ensuring its engineered components meet stringent safety standards to avoid costly litigation. For example, in 2023, the U.S. Consumer Product Safety Commission documented over 1.5 million product-related injuries, underscoring the critical need for compliance.

The company's intellectual property, particularly its patents on industrial technologies, requires robust legal protection to maintain its competitive edge, with active management and enforcement against infringements being key strategies.

Global operations expose Barnes Group to diverse labor laws, impacting HR and operational costs; for instance, minimum wages vary significantly across regions, as seen with the EU's range in 2024 from Luxembourg's €2,570.93 to Bulgaria's €398.83.

Compliance with international trade laws and export controls, such as those enforced by the U.S. Bureau of Industry and Security, is vital to prevent fines and supply chain disruptions, especially for its aerospace and defense segments.

Furthermore, strict adherence to anti-corruption legislation like the FCPA and UK Bribery Act is paramount; the U.S. Department of Justice's 2023 enforcement actions against FCPA violations demonstrate the severe penalties, including multi-million dollar fines, that non-compliance can incur.

Environmental factors

Barnes Group's commitment to sustainability is evident in its proactive efforts to slash global emissions and minimize waste. This focus directly addresses the increasing consumer and industry demand for environmentally conscious products.

Their molding solutions, for instance, play a crucial role in helping customers reduce their carbon footprints. By enabling more efficient product design and manufacturing, Barnes Group is aligning its offerings with the global push for greener alternatives, a trend that saw the sustainable products market reach an estimated $150 billion in 2024.

Barnes Group is actively pursuing ambitious net-zero targets, with a strong focus on slashing its Scope 1 and 2 greenhouse gas emissions. This commitment is underscored by their participation in critical initiatives like the Climate Disclosure Project (CDP) and adherence to frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD), showcasing a dedicated approach to climate action.

Barnes Group is committed to reducing its environmental footprint through robust waste management and recycling initiatives. In 2023, the company reported a significant decrease in industrial process waste, diverting over 75% of its manufacturing byproducts from landfills through recycling and reuse programs.

Further strengthening its circular economy approach, Barnes Group actively collaborates with clients to integrate recycled materials into shipping and packaging solutions. This partnership-driven strategy not only minimizes landfill contributions but also fosters a more sustainable supply chain, aligning with growing global demands for eco-friendly business practices.

Resource Scarcity and Efficient Material Use

Barnes Group recognizes that potential resource scarcity is a significant environmental factor. This awareness pushes the company towards optimizing material usage and refining its manufacturing to conserve vital resources.

The company is actively working to reduce its environmental footprint by focusing on energy conservation and minimizing water usage across its production facilities. These initiatives are key to maintaining operational sustainability in the face of growing environmental pressures.

- Energy Efficiency: Barnes Group aims to reduce energy consumption per unit produced, aligning with global trends toward lower carbon footprints. For instance, in 2023, the company reported progress in its sustainability initiatives, including energy reduction efforts at its manufacturing sites.

- Water Conservation: Efforts are underway to decrease water intake and improve wastewater management, reflecting a commitment to responsible resource stewardship.

- Material Optimization: Barnes Group continuously seeks ways to use materials more efficiently, reducing waste and the need for virgin resources.

- Circular Economy Principles: The company is exploring the integration of circular economy principles to enhance material reuse and recycling within its operations.

Climate Change Impact on Supply Chains and Operations

Climate change presents significant environmental challenges for Barnes Group, with extreme weather events and changing resource availability directly impacting its global supply chains and operational continuity. For instance, the increasing frequency of hurricanes and floods in key manufacturing regions can disrupt production and logistics, as seen in the supply chain disruptions experienced globally in 2024 due to severe weather patterns.

Barnes Group acknowledges these long-term environmental shifts and adopts a precautionary principle to manage potential risks. This involves proactive measures to build resilience, such as diversifying supplier bases and investing in more robust infrastructure to withstand environmental shocks. The company's commitment to sustainability is reflected in its efforts to reduce its carbon footprint, aligning with global trends and regulatory pressures that are becoming increasingly stringent.

- Supply Chain Vulnerability: Extreme weather events in 2024, such as widespread flooding in Southeast Asia and heatwaves impacting agricultural yields, have highlighted the fragility of global supply chains, potentially affecting Barnes Group's access to raw materials and components.

- Operational Continuity: The company must consider the risk of disruptions to its manufacturing facilities and distribution networks due to climate-related events, which could lead to increased operational costs and delays in product delivery.

- Resource Availability: Shifts in water availability and agricultural output due to climate change could impact the sourcing of certain materials used in Barnes Group's diverse product lines.

- Precautionary Approach: Barnes Group's strategy to mitigate these risks includes investing in climate-resilient infrastructure and exploring alternative sourcing locations to ensure business continuity.

Barnes Group's environmental strategy is deeply integrated with global sustainability trends, focusing on emission reduction and waste minimization to meet growing market demand for eco-friendly solutions. Their efforts in developing efficient molding solutions directly contribute to customer carbon footprint reduction, aligning with the sustainable products market projected to reach $150 billion in 2024.

The company is actively pursuing net-zero targets by reducing Scope 1 and 2 emissions, demonstrating this commitment through participation in CDP and adherence to TCFD frameworks. Furthermore, Barnes Group prioritizes waste reduction, with over 75% of manufacturing byproducts diverted from landfills in 2023 through recycling and reuse.

Barnes Group is proactively addressing climate change impacts on its supply chains and operations, recognizing the potential for disruptions from extreme weather events. Their strategy includes building resilience through diversified sourcing and robust infrastructure, a crucial approach given the global supply chain challenges observed in 2024 due to severe weather.

| Environmental Focus | Barnes Group's Action | Data/Context (2023-2024) |

|---|---|---|

| Emissions Reduction | Pursuing net-zero targets, reducing Scope 1 & 2 emissions | Active participation in CDP, adherence to TCFD |

| Waste Management | Diverting manufacturing byproducts from landfills | Over 75% diverted in 2023 via recycling/reuse |

| Sustainable Products | Developing solutions for customer carbon footprint reduction | Aligns with $150 billion sustainable products market (est. 2024) |

| Climate Resilience | Diversifying suppliers, investing in robust infrastructure | Mitigates risks from 2024 global supply chain disruptions |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Barnes Group is meticulously constructed using a blend of official government publications, reports from international organizations like the IMF and World Bank, and reputable industry-specific market research. This comprehensive approach ensures that every identified trend and factor is grounded in verifiable, current data.