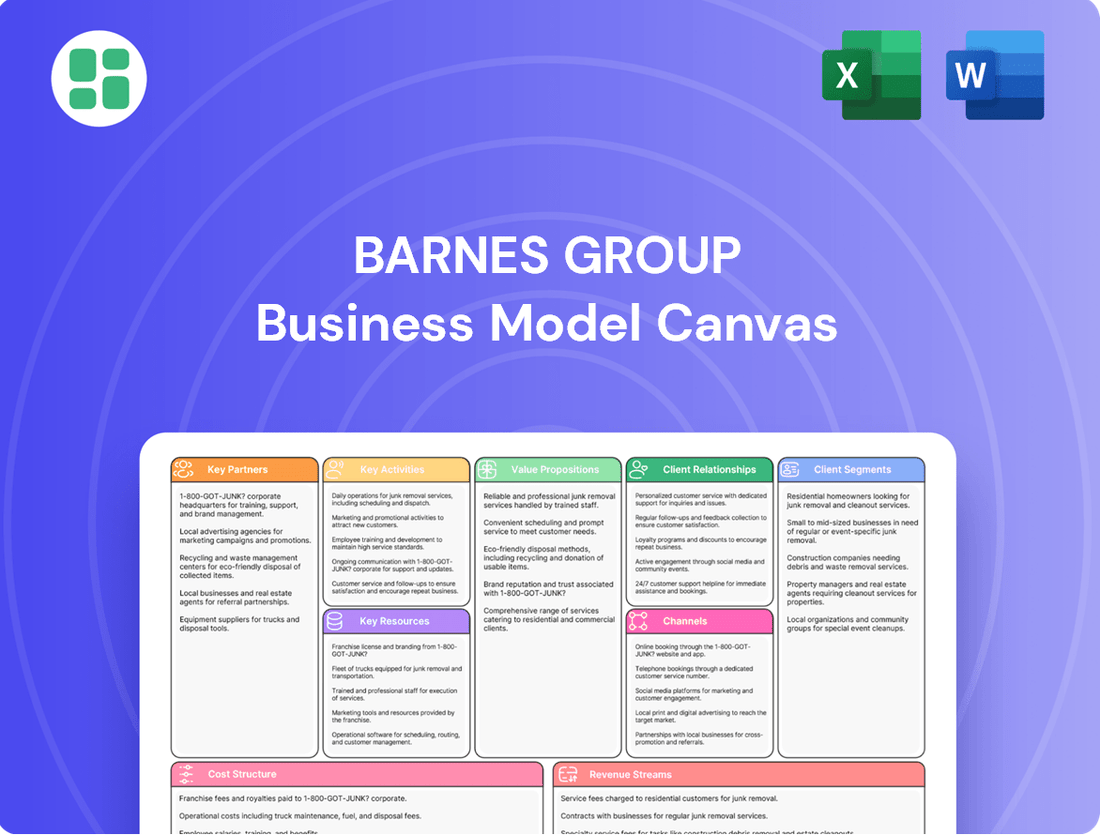

Barnes Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barnes Group Bundle

Unlock the full strategic blueprint behind Barnes Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Barnes Group Inc. has entered a definitive agreement to be acquired by Apollo Global Management, Inc. funds, with the deal expected to close in Q1 2025. This represents a crucial strategic partnership designed to accelerate Barnes' ongoing transformation and bolster its operational capabilities. Apollo's involvement is anticipated to inject significant capital and strategic direction, fostering future growth and innovation for Barnes.

Barnes Group's success hinges on its strong ties with major Original Equipment Manufacturers (OEMs) in both Aerospace and Industrial sectors. These partnerships are foundational, involving the supply of specialized, engineered components that are critical for new aircraft engines, airframes, and various industrial machinery. Securing these long-term relationships, especially within the demanding aerospace market, directly impacts Barnes Group's consistent revenue streams and its standing in the industry.

Barnes Group collaborates closely with Maintenance, Repair, and Overhaul (MRO) service providers and airlines within its Aerospace segment. These partnerships are crucial for delivering essential aftermarket services, such as component repair and overhaul, which keep aircraft flying efficiently.

The robust performance observed in the aerospace aftermarket, including Barnes' own results, underscores the value and necessity of these strong, service-focused relationships. For instance, in 2023, Barnes Group's Aerospace segment saw significant growth, driven by demand for aftermarket solutions.

Technology and Innovation Collaborators

Barnes Group actively seeks out technology and innovation collaborators to drive progress in advanced manufacturing and automation. These partnerships are crucial for developing cutting-edge solutions that meet the dynamic needs of various industries. For instance, in 2024, Barnes continued to invest in R&D, with a focus on areas like additive manufacturing and smart factory technologies, leveraging external expertise to accelerate product development and market entry.

Key collaborations often focus on specific technological domains:

- Advanced Manufacturing Processes: Partnering with research institutions and specialized firms to refine and implement next-generation manufacturing techniques, such as high-precision machining and novel material processing.

- Automation Solutions: Collaborating with robotics and AI companies to integrate intelligent automation into production lines, enhancing efficiency and creating more sophisticated industrial systems.

- Applied Technologies: Engaging with developers of specialized sensors, software, and control systems to embed advanced functionalities into Barnes' product offerings, thereby increasing their value proposition.

- Industry 4.0 Initiatives: Working with technology providers to implement digital twin technology and data analytics platforms, improving product performance monitoring and predictive maintenance capabilities.

Key Suppliers and Integrators

Barnes Group's operational success hinges on its network of key suppliers, providing essential raw materials, specialized components, and integrated systems. These partnerships are critical for maintaining the quality and efficiency of manufacturing across its Aerospace and Industrial segments.

Strong supplier relationships ensure supply chain stability, a crucial factor given the complex nature of Barnes Group's products. For instance, in 2024, the company continued to emphasize strategic sourcing to mitigate potential disruptions and maintain competitive pricing for its advanced manufacturing solutions.

- Supplier Reliability: Barnes Group prioritizes suppliers with a proven track record of quality and timely delivery, essential for meeting customer demands in demanding industries.

- Component Specialization: Many of Barnes Group's products require highly specialized components, necessitating close collaboration with niche manufacturers.

- Integrated Systems: The company also partners with integrators who provide complex systems, ensuring seamless functionality within its broader product offerings.

- Supply Chain Resilience: In 2024, Barnes Group actively worked to diversify its supplier base to enhance resilience against geopolitical and economic uncertainties.

Barnes Group's key partnerships extend to technology and innovation collaborators, crucial for advancing in areas like additive manufacturing and automation. In 2024, the company continued to invest in R&D, leveraging external expertise to accelerate product development. These collaborations focus on advanced manufacturing processes, automation solutions, applied technologies, and Industry 4.0 initiatives, ensuring Barnes Group remains at the forefront of industrial innovation.

What is included in the product

This Barnes Group Business Model Canvas offers a strategic blueprint detailing customer segments, value propositions, and key resources, reflecting the company's operational focus on engineered solutions and performance solutions.

The Barnes Group Business Model Canvas acts as a pain point reliever by offering a structured, visual framework that simplifies complex strategic thinking.

It provides a clear, one-page overview, helping teams quickly identify and address potential challenges or inefficiencies in their operations.

Activities

Barnes Group's advanced manufacturing and engineering activities are central to its operations, focusing on developing sophisticated processes and creating highly engineered products. This expertise is applied across various sectors, including aerospace and industrial markets.

The company excels in precision machining, fabrication, and assembly of intricate components essential for demanding applications. For instance, in 2023, Barnes Group reported that its Engineered Products segment, which heavily relies on these manufacturing capabilities, generated approximately $530 million in revenue, highlighting the commercial significance of its advanced engineering prowess.

Further demonstrating their commitment to innovation, Barnes Group leverages specialized metal forming techniques and cutting-edge machining solutions. These capabilities allow them to produce components that meet stringent performance and quality standards, critical for industries where reliability is paramount.

Barnes Group dedicates substantial resources to Research and Development, a core activity driving innovation across its business segments. This commitment ensures the continuous creation of advanced products and technologies.

In 2023, Barnes Group reported R&D expenses of $78.6 million, representing approximately 4.5% of its total revenue. This investment fuels the development of next-generation solutions in areas like advanced filtration and precision components.

The company's innovation pipeline is crucial for maintaining a competitive edge, allowing Barnes Group to introduce differentiated offerings that address evolving customer needs and industry challenges.

Barnes Group's core activity revolves around designing and manufacturing highly-engineered precision components, products, and systems. This includes a broad range of offerings such as precision stamped components, springs, and intricate molding solutions tailored for diverse end markets.

The company specifically targets high-precision and high-volume applications where their expertise is crucial for solving complex customer challenges. For instance, in 2023, Barnes Group reported that its Engineered Products segment, which houses much of this precision manufacturing, generated approximately $720 million in revenue, highlighting the scale of its operations in this area.

Aftermarket Services and Support

Barnes Aerospace offers extensive aftermarket services, focusing on component repair and overhaul (MRO) to keep aircraft flying safely and efficiently. This includes specialized services designed to extend the life of critical aerospace components, ensuring continued operational readiness for their customers.

The company also manufactures and delivers a wide array of aerospace aftermarket spare parts, crucial for maintaining aircraft fleets. This ensures that operators have access to the necessary components for routine maintenance and unexpected repairs, minimizing downtime.

- Aftermarket Revenue Contribution: In 2023, Barnes Group's Aerospace segment, which heavily relies on aftermarket services, generated approximately $683 million in revenue, highlighting the segment's importance.

- MRO Capabilities: Barnes Aerospace is a certified provider of MRO services for a broad range of engine and airframe components, supporting major original equipment manufacturers (OEMs).

- Customer Lifecycle Support: By providing these services, Barnes ensures long-term value for its customers by actively managing and servicing components throughout their entire operational lifespan.

Strategic Portfolio Management (Acquisitions & Divestitures)

Barnes Group's strategic portfolio management is a cornerstone of its business model, focusing on acquisitions and divestitures to enhance performance and align with high-growth, high-margin sectors. This dynamic approach ensures the company remains competitive and adaptable in evolving markets.

A significant move in 2023 was the acquisition of MB Aerospace, a key player in the aerospace sector, signaling a deliberate shift in Barnes Group's strategic direction. This acquisition is expected to bolster the company's presence in the aerospace industry, a segment known for its robust growth potential and attractive margins.

Complementing these growth initiatives, Barnes Group also divested its Associated Spring and Hänggi businesses. These divestitures streamline the company's operations, allowing for a sharper focus on its core aerospace and defense segments.

- Acquisition of MB Aerospace: Strengthens Barnes Group's position in the aerospace sector, aligning with its strategy to focus on higher-growth markets.

- Divestiture of Associated Spring and Hänggi: Optimizes the business portfolio by exiting non-core segments, enabling greater concentration on strategic priorities.

- Portfolio Transformation: These actions collectively represent a significant transformation, steering Barnes Group towards a more specialized and potentially more profitable business mix.

Barnes Group's key activities center on advanced manufacturing and engineering, particularly in precision components for aerospace and industrial markets. They also focus on extensive aftermarket services, including repair, overhaul, and spare parts for aerospace. Strategic portfolio management, involving acquisitions and divestitures, is crucial for aligning with high-growth sectors.

| Key Activity | Description | 2023 Financial Impact/Data |

|---|---|---|

| Advanced Manufacturing & Engineering | Developing sophisticated processes and creating highly engineered products, including precision machining and metal forming. | Engineered Products segment revenue: ~$720 million. R&D expenses: $78.6 million. |

| Aerospace Aftermarket Services | Providing component repair, overhaul (MRO), and spare parts to ensure aircraft operational readiness. | Aerospace segment revenue: ~$683 million. Certified MRO provider for major OEMs. |

| Strategic Portfolio Management | Acquiring businesses in high-growth sectors and divesting non-core assets to optimize the business mix. | Acquisition of MB Aerospace completed. Divested Associated Spring and Hänggi businesses. |

Preview Before You Purchase

Business Model Canvas

The Barnes Group Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This ensures you see the exact structure, content, and professional formatting before committing. Once your order is complete, you'll gain full access to this comprehensive Business Model Canvas, ready for immediate use and customization.

Resources

Barnes Group's competitive edge is significantly bolstered by its extensive portfolio of intellectual property, including a substantial number of patents, trademarks, and trade names. These protected assets are fundamental to their market standing and innovation drive.

This intellectual property specifically encompasses cutting-edge manufacturing techniques, sophisticated automation systems, and unique industrial technologies that differentiate Barnes Group in the marketplace. For instance, in 2023, the company reported significant investment in research and development, a key driver for expanding this IP portfolio.

Barnes Group's world-class manufacturing facilities and equipment are a cornerstone of its business model, enabling the efficient production of highly engineered products. The company boasts extensive global operations, featuring advanced machinery and automation to streamline complex manufacturing processes.

In 2024, Barnes Aerospace alone operates across 15 sites, encompassing a substantial 1.5 million square feet of manufacturing and support space. This significant footprint underscores their commitment to maintaining state-of-the-art production capabilities, crucial for meeting the demanding requirements of their aerospace and industrial customers.

Barnes Group's highly skilled workforce, especially its engineering and advanced manufacturing talent, is a cornerstone of its operations. This expertise is crucial for driving innovation and maintaining the high quality of its specialized products.

In 2024, Barnes Group continued to leverage this deep engineering capability to develop sophisticated solutions for demanding customer applications. The company's commitment to fostering and retaining talent directly fuels its ability to meet evolving market needs and maintain a competitive edge.

Financial Capital and Liquidity

Barnes Group's access to financial capital is a cornerstone of its business model. This includes not only its operational cash but also significant credit facilities and the substantial investment from its new owner, Apollo Funds. This financial backing is essential for funding day-to-day operations, pursuing strategic growth opportunities, and investing in critical areas like research and development and potential acquisitions.

The company is focused on maintaining a robust financial position. A key aspect of this is managing its leverage ratios effectively to ensure financial stability. Furthermore, Barnes Group prioritizes efficient cash flow management to support its ongoing investments and operational needs.

- Financial Capital Access: Includes cash reserves, established credit lines, and capital infusion from Apollo Funds.

- Operational and Strategic Funding: This capital directly supports Barnes Group's ongoing operations, R&D, and strategic growth initiatives, including potential acquisitions.

- Financial Health Management: The company actively manages its leverage ratios and cash flow to ensure financial stability and support its strategic objectives.

Established Customer Relationships and Certifications

Barnes Group leverages its long-standing relationships with industry leaders, particularly in demanding sectors like aerospace, as a crucial resource. These established connections, built on trust and consistent delivery of value, translate into a stable and predictable customer base. For instance, in 2024, the company continued to serve major aerospace manufacturers, underscoring the depth of these partnerships.

Certifications and approvals are vital, especially in regulated industries. Barnes Group's ability to meet stringent aerospace standards, such as those from the FAA or EASA, acts as a significant barrier to entry for competitors and reinforces its position as a reliable supplier. This adherence to quality and safety is a key intangible asset.

These established customer relationships and certifications are foundational to Barnes Group’s value proposition. They represent:

- Deeply entrenched partnerships with major players in key industries.

- A demonstrable track record of reliability and value delivery.

- Essential certifications that validate product quality and compliance, particularly in aerospace.

- A significant competitive advantage and a source of recurring revenue.

Barnes Group's key resources include its significant intellectual property, advanced manufacturing capabilities, and a highly skilled workforce. These elements are crucial for developing and producing specialized components and systems, particularly for the aerospace sector.

The company's financial capital access, including credit lines and new ownership backing, provides the necessary resources for operations and strategic growth. Furthermore, strong customer relationships and industry certifications serve as vital intangible assets, ensuring market access and competitive advantage.

In 2024, Barnes Aerospace's operational footprint of 1.5 million square feet across 15 sites highlights their manufacturing prowess. This physical infrastructure, combined with their engineering talent, underpins their ability to deliver complex solutions.

Barnes Group's commitment to R&D in 2023 further solidified its IP portfolio, driving innovation. The company's financial strategy in 2024 focuses on managing leverage and cash flow effectively to support these investments and maintain stability.

| Key Resource Category | Specific Examples | 2024 Data/Context |

|---|---|---|

| Intellectual Property | Patents, Trademarks, Trade Names, Proprietary Technologies | Continued investment in R&D to expand IP portfolio. |

| Physical Assets | World-class Manufacturing Facilities, Advanced Machinery, Automation Systems | Barnes Aerospace operates 15 sites covering 1.5 million sq ft. |

| Human Capital | Skilled Workforce, Engineering Talent, Advanced Manufacturing Expertise | Leveraging deep engineering capability for sophisticated solutions. |

| Financial Capital | Cash Reserves, Credit Facilities, Apollo Funds Investment | Focus on managing leverage ratios and cash flow for stability. |

| Relationships & Certifications | Long-standing Customer Relationships (Aerospace), Industry Certifications (FAA, EASA) | Continued service to major aerospace manufacturers; validation of quality and compliance. |

Value Propositions

Barnes Group provides highly engineered products and precision components crucial for demanding applications in sectors like aerospace and medical. Their offerings, such as specialized springs and intricate molding solutions, are built to exacting standards, ensuring reliability in critical functions.

In 2023, Barnes Group's Engineered Components segment, which houses these highly engineered products, generated approximately $428.4 million in revenue, highlighting the significant market demand for their precision solutions.

Barnes Group offers unique industrial technologies and forward-thinking solutions, built on deep manufacturing and engineering know-how. This encompasses advanced automation, specialized applied technologies, and combined hardware and software systems.

These advancements are designed to directly enhance customer operations, leading to better processing efficiency, improved control, superior service delivery, and greater sustainability. For instance, in 2024, their engineered solutions contributed to significant operational improvements for clients across various sectors.

Barnes Group leverages world-class manufacturing and deep engineering expertise to pioneer advanced processes. This capability allows for the creation of highly intricate fabricated and precision-machined components, directly enhancing customer supply chain quality and efficiency.

This advanced manufacturing prowess is a cornerstone of Barnes Group's competitive edge. For instance, their precision solutions are critical in industries demanding extreme reliability, such as aerospace, where component failure can have severe consequences. In 2024, Barnes Group continued to invest in these advanced capabilities, aiming to further solidify their position as a leader in complex component manufacturing.

Reliability and Performance in Critical Applications

Barnes Group's value proposition centers on delivering unwavering reliability and exceptional performance, particularly for customers in sectors where failure is not an option. Industries such as aerospace and healthcare demand mission-critical technologies, and Barnes Group consistently meets these stringent requirements.

This dedication to quality translates into products and solutions that perform dependably, even under the most challenging operational circumstances. For instance, in 2024, Barnes Group continued to supply specialized components for aircraft systems, where adherence to rigorous safety and performance standards is non-negotiable. This consistent delivery builds significant trust and fosters long-term customer relationships, driving repeat business.

- Aerospace: Critical components for flight control and engine systems.

- Healthcare: Reliable parts for medical devices and diagnostic equipment.

- Industrial: High-performance solutions for demanding manufacturing processes.

- Commitment to Quality: Rigorous testing and adherence to industry certifications.

Tailored Solutions and Comprehensive Aftermarket Support

Barnes Group distinguishes itself by crafting highly customized solutions designed to precisely meet unique customer requirements and overcome specific operational hurdles. This tailored approach ensures that clients receive products and services optimized for their individual contexts.

The company’s commitment extends far beyond the initial sale, evidenced by its robust aftermarket support. This includes vital services such as maintenance, repair, and overhaul (MRO), which are crucial for extending the operational life and maximizing the value of their products.

For instance, in 2023, Barnes reported that its aftermarket services segment contributed significantly to its revenue, highlighting the importance of this value proposition. This segment’s performance underscores the company’s success in building long-term customer relationships through continuous support.

- Customized Solutions: Development of bespoke products and services to address specific client challenges.

- Comprehensive Aftermarket Support: Provision of maintenance, repair, and overhaul services.

- Product Lifecycle Maximization: Ensuring extended operational efficiency and value for customers.

- 2023 Performance: Strong revenue contribution from aftermarket services, demonstrating customer reliance and satisfaction.

Barnes Group offers highly engineered products and precision components, ensuring reliability in critical aerospace and medical applications. Their tailored solutions and robust aftermarket support maximize product value and operational efficiency.

| Value Proposition | Description | Supporting Data/Insight |

|---|---|---|

| Highly Engineered Products & Precision Components | Crucial for demanding applications in aerospace and medical sectors, built to exacting standards. | Engineered Components segment revenue was approximately $428.4 million in 2023. |

| Advanced Industrial Technologies | Includes automation, applied technologies, and combined hardware/software systems to enhance customer operations. | Solutions designed to improve processing efficiency, control, service delivery, and sustainability. |

| Customized Solutions & Aftermarket Support | Bespoke products and services addressing specific client challenges, with comprehensive MRO services. | Aftermarket services significantly contributed to revenue in 2023, demonstrating customer reliance. |

Customer Relationships

Barnes Group fosters enduring strategic partnerships with key players across its target industries, transforming customer interactions into collaborative ventures. This approach prioritizes mutual growth and innovation, moving beyond simple sales to embed Barnes Group as an indispensable ally in their clients' long-term success.

These deep-rooted relationships are crucial for Barnes Group, enabling them to gain invaluable insights into market trends and customer requirements. For instance, in 2023, a significant portion of their revenue was derived from these established partnerships, highlighting their strategic importance. This collaborative model allows for co-development of solutions, ensuring Barnes Group remains at the forefront of technological advancements and customer-centric offerings.

Barnes Group likely assigns dedicated account managers to its significant clients, offering personalized service and specialized knowledge. This approach ensures clients receive solutions crafted to their specific needs and continuous support, building robust relationships through promptness and effective problem resolution.

Barnes Group actively partners with clients on collaborative development and co-engineering for intricate engineered products. This joint approach ensures solutions are meticulously tailored to unique customer needs, fostering a deep connection through shared innovation.

In 2024, this strategy was evident in projects where Barnes’ engineering teams worked hand-in-hand with aerospace clients to refine component designs, leading to enhanced performance and reduced integration time. Such partnerships are crucial for Barnes' ability to deliver highly specialized solutions.

Aftermarket Service and Maintenance Contracts

Barnes Group cultivates deep customer relationships, especially within its Aerospace segment, through robust aftermarket service and maintenance contracts. These agreements are crucial for ensuring the continued performance and extended lifespan of vital aircraft components.

These service contracts generate a steady stream of recurring revenue, bolstering customer loyalty and providing predictable income for Barnes Group. For instance, in 2023, the Aerospace segment demonstrated strong performance, with aftermarket services playing a significant role in its revenue generation, contributing to the overall financial health of the business.

- Ongoing Revenue: Service contracts provide a predictable and recurring revenue stream beyond the initial product sale.

- Customer Loyalty: By ensuring product longevity and performance, these contracts foster strong, long-term customer relationships.

- Value Proposition: They offer customers peace of mind and operational reliability for critical aerospace components.

- Segment Contribution: The Aerospace segment's aftermarket services are a key driver of its financial success and market position.

Quality Assurance and Performance Monitoring

Barnes Group places a strong emphasis on quality assurance and performance monitoring to foster robust customer relationships. This dedication to maintaining high standards ensures that products consistently meet or exceed customer expectations, directly impacting satisfaction levels. For instance, in 2023, Barnes reported a significant portion of its revenue derived from repeat customers, underscoring the success of its quality-focused approach.

Actively monitoring product performance post-sale allows Barnes to identify and address any potential issues proactively. This commitment builds trust and reinforces the company's reputation for reliability, a critical factor in competitive industrial markets. By consistently delivering dependable solutions, Barnes cultivates loyalty and encourages positive word-of-mouth, driving new business opportunities.

- Quality Assurance: Implementing rigorous testing and validation processes throughout the product lifecycle.

- Performance Monitoring: Utilizing data analytics and customer feedback to track product performance in real-world applications.

- Customer Satisfaction: Aiming for high customer satisfaction scores, as evidenced by increasing repeat business rates.

- Reputation Building: Cultivating a brand image synonymous with reliability and superior product performance.

Barnes Group cultivates deep customer relationships through collaborative development and robust aftermarket services, particularly in its Aerospace segment. These partnerships are vital for co-engineering specialized solutions, ensuring Barnes remains an indispensable ally. In 2024, this was evident in aerospace projects where joint efforts refined component designs, enhancing performance and reducing integration time.

| Customer Relationship Aspect | Description | 2023/2024 Impact |

|---|---|---|

| Strategic Partnerships | Collaborative ventures for mutual growth and innovation. | Significant portion of revenue derived from established partnerships. |

| Aftermarket Services | Maintenance and service contracts ensuring product longevity. | Key driver of revenue and loyalty in the Aerospace segment. |

| Quality Assurance & Performance Monitoring | Commitment to high standards and proactive issue resolution. | Contributed to high customer satisfaction and repeat business rates. |

| Dedicated Account Management | Personalized service and specialized knowledge for key clients. | Ensures tailored solutions and continuous support, building trust. |

Channels

Barnes Group leverages a dedicated direct sales force to cultivate relationships with its substantial base of Original Equipment Manufacturers (OEMs) and industrial clients worldwide. This approach facilitates direct engagement, enabling in-depth technical discussions and the negotiation of intricate agreements for their specialized engineered products and solutions.

In 2024, Barnes Group's direct sales strategy was instrumental in securing key contracts within the aerospace and industrial sectors, reflecting the critical nature of personalized technical expertise for their high-value offerings. This direct channel allows for a deeper understanding of customer needs, fostering loyalty and driving sales of complex, engineered solutions.

Barnes Group's global manufacturing and service footprint is a key channel for reaching its international clientele. With operations spread across the world, the company can efficiently deliver products and provide localized support, ensuring customer needs are met promptly.

This expansive network allows Barnes to act as a direct conduit for both physical product distribution and essential after-sales service. As of the first quarter of 2024, Barnes reported that approximately 59% of its net sales were generated outside of the United States, underscoring the significance of its international operations.

Barnes Group's Aerospace segment leverages dedicated aftermarket service centers as a crucial channel within its business model. These centers are specifically designed to offer component repair and overhaul services, ensuring that aircraft components are maintained to stringent operational standards.

These specialized facilities directly engage with airlines and Maintenance, Repair, and Overhaul (MRO) customers, acting as a vital touchpoint for delivering essential maintenance and support. This direct channel allows for efficient service delivery and strengthens customer relationships.

In 2023, Barnes's Aerospace segment reported strong performance, with aftermarket services contributing significantly to revenue. For instance, the company's focus on these dedicated centers supports its strategy to capture a larger share of the growing global MRO market, which was projected to reach over $100 billion by 2025.

Customer-Specific Supply Chain Integration

Barnes Group often integrates directly into its customers' operations, functioning as a key supplier for essential parts. This close alignment means Barnes frequently manages just-in-time inventory and direct deliveries, creating a streamlined and efficient supply chain channel.

This deep integration is particularly evident in sectors where component reliability is paramount. For instance, in the aerospace industry, Barnes's ability to ensure on-time delivery of critical fasteners and precision components directly impacts aircraft production schedules. In 2024, the aerospace sector continued to see robust demand, with global aircraft production rates increasing, underscoring the importance of such integrated supply chains.

- Strategic Supplier Role: Barnes acts as a mission-critical component supplier, deeply embedded in customer production processes.

- Just-in-Time (JIT) Delivery: The company often manages inventory and delivery schedules to align precisely with customer needs, minimizing lead times.

- Efficiency Gains: This integration fosters highly efficient operations, reducing costs and improving responsiveness for both Barnes and its clients.

- Customer Dependency: It creates a strong partnership, making Barnes an indispensable part of the customer's manufacturing ecosystem.

Digital Communication and Investor Relations Platforms

Barnes Group leverages its official website and SEC filings as primary channels for digital communication, reaching a wide audience of financially literate decision-makers. These platforms are crucial for disseminating its business strategy, financial performance, and core value propositions.

The company's investor relations section on its website provides a centralized hub for news, financial reports, and presentations. For instance, as of their Q1 2024 earnings report, Barnes highlighted its strategic focus on innovation and operational excellence, details readily accessible to investors and analysts.

- Website: Serves as a primary portal for company news, financial reports, and strategic updates.

- SEC Filings: Official documents like 10-K and 10-Q provide detailed financial performance and business insights.

- Investor Presentations: Offer synthesized overviews of strategy and results, often including forward-looking statements.

- Webcasts: Live and archived webcasts of earnings calls allow direct engagement with financial stakeholders.

Barnes Group utilizes a direct sales force to engage with Original Equipment Manufacturers (OEMs) and industrial clients, fostering relationships for complex engineered products. In 2024, this direct approach was key to securing aerospace and industrial contracts, highlighting the value of personalized technical expertise.

The company's global manufacturing and service network acts as a direct distribution and support channel for international customers. By Q1 2024, over half of Barnes's net sales, specifically 59%, originated outside the United States, emphasizing the reach of this operational footprint.

Dedicated aftermarket service centers within the Aerospace segment provide essential repair and overhaul services directly to airlines and MRO customers. This channel is vital for maintaining components to strict standards and capturing share in the growing global MRO market, which was projected to exceed $100 billion by 2025.

Barnes also integrates directly into customer operations as a mission-critical supplier, managing just-in-time inventory and direct deliveries. This deep integration, crucial for sectors like aerospace where component reliability impacts production, saw continued importance in 2024 due to robust global aircraft production demand.

| Channel | Description | Key Activity | 2024 Relevance |

|---|---|---|---|

| Direct Sales Force | Personalized engagement with OEMs and industrial clients | Technical consultation, contract negotiation | Secured key aerospace and industrial contracts |

| Global Operations | Worldwide manufacturing and service footprint | Product distribution, localized support | 59% of Q1 2024 net sales from outside the US |

| Aftermarket Service Centers | Specialized facilities for component repair and overhaul | Service delivery to airlines and MROs | Supports strategy in growing MRO market |

| Integrated Supply Chain | Direct integration into customer production processes | Just-in-time inventory, direct delivery | Supports robust global aircraft production |

Customer Segments

Aerospace Original Equipment Manufacturers (OEMs) represent a critical customer segment for Barnes Group, encompassing major players in both commercial and military aircraft and turbine engine production. Barnes provides these giants with essential precision-machined components, fabricated assemblies, and other highly engineered parts crucial for the manufacturing of new aircraft and engines.

The aerospace industry, a significant market for Barnes, saw global aircraft production orders remain robust. For instance, in 2024, Boeing and Airbus continued to secure substantial orders, with Boeing delivering over 400 commercial aircraft and Airbus delivering over 700, underscoring the consistent demand for OEM components.

Aerospace Aftermarket Operators, including Maintenance, Repair, and Overhaul (MRO) facilities and airlines, are a crucial customer segment for Barnes Group. They demand reliable component repair, overhaul services, and a steady supply of spare parts to keep existing aircraft fleets operational. This segment represents a significant growth opportunity for Barnes, driven by the increasing need for efficient and cost-effective aircraft maintenance.

In 2024, the global aerospace MRO market was projected to reach over $100 billion, with the aftermarket segment showing robust expansion. Barnes Group's focus on providing specialized solutions for this market positions them to capitalize on this trend. The company's ability to deliver critical components and repair services directly addresses the operational needs of these aftermarket operators.

Barnes Group is a key supplier to the healthcare industry, offering specialized molding solutions and precision components essential for medical devices and sophisticated equipment. Their offerings support the creation of everything from diagnostic tools to surgical instruments, demanding absolute accuracy and unwavering dependability.

This customer segment places immense value on high precision, ensuring that every component meets exacting specifications for patient safety and device functionality. Reliability is paramount, as failure in medical applications can have severe consequences. Furthermore, strict adherence to rigorous industry standards, such as those set by the FDA, is non-negotiable for these manufacturers.

In 2024, the medical device market continued its robust growth, with industry analysts projecting significant expansion driven by an aging global population and advancements in medical technology. Barnes Group's commitment to quality and precision positions them well to capitalize on this trend, supplying critical parts that enable innovation in patient care.

Transportation Sector Companies

Barnes Group serves a diverse range of companies within the broader transportation sector. This includes manufacturers of aerospace components, automotive parts, and industrial vehicles, all of whom rely on Barnes' engineered solutions to enhance performance and efficiency.

Barnes provides critical components and technologies that are integral to the operation of these transportation systems. For instance, their products are found in aircraft engines, braking systems, and various other demanding applications where reliability and precision are paramount.

In 2024, the aerospace and defense segment, a significant part of Barnes' transportation focus, continued to see robust demand. Barnes reported that its aerospace original equipment manufacturer (OEM) business saw a substantial increase in revenue, driven by higher production rates in commercial aviation and continued defense spending.

The company's commitment to innovation is evident in its offerings for this segment:

- Advanced engineered components for critical systems in aircraft, trains, and commercial vehicles.

- Specialized solutions for improving fuel efficiency and reducing emissions in transportation.

- High-performance springs and fasteners used in demanding automotive and industrial applications.

- MRO (Maintenance, Repair, and Overhaul) services supporting the longevity and operational readiness of transportation assets.

General Industrial Manufacturers

General Industrial Manufacturers represent a broad and vital customer segment for Barnes Group. This category includes companies involved in producing everything from heavy industrial equipment and sophisticated automation systems to everyday items like personal care products, packaging materials, and electronic components.

Barnes Group serves these diverse manufacturers by supplying highly engineered precision components and innovative solutions. These offerings are critical for a wide array of applications within these industries, ensuring performance and reliability in complex manufacturing processes.

For instance, in 2024, the global industrial automation market was projected to reach over $300 billion, highlighting the significant demand for advanced components that Barnes Group provides. Similarly, the packaging industry, a key area for precision components, saw continued growth driven by e-commerce and consumer goods demand.

- Diverse Applications: Barnes' components are integral to sectors like industrial equipment, automation, personal care, packaging, and electronics.

- Precision Engineering: The company specializes in highly engineered precision components tailored for critical functions within these varied manufacturing environments.

- Innovative Solutions: Barnes Group offers innovative solutions that help these manufacturers improve efficiency, product quality, and operational reliability.

- Market Relevance: The demand for Barnes' offerings is supported by robust growth in key end markets, such as the industrial automation sector, which continues to expand significantly.

Barnes Group's customer segments are diverse, spanning critical industries that rely on precision engineering and specialized components. The company serves major Aerospace Original Equipment Manufacturers (OEMs) and the Aerospace Aftermarket, providing essential parts and MRO services. In the healthcare sector, Barnes is a key supplier for medical device manufacturers, emphasizing high precision and reliability. Furthermore, the company supports the broader Transportation sector, including automotive and industrial vehicle production, with advanced engineered components. Finally, General Industrial Manufacturers across various sub-sectors, from automation to packaging, depend on Barnes for innovative solutions and precision parts.

Cost Structure

Manufacturing and production represent a substantial cost driver for Barnes Group, encompassing the acquisition of raw materials, the wages paid to direct labor involved in creating their engineered products, and the general expenses associated with running their factories, known as factory overhead. These elements are fundamental to bringing their innovative solutions to market.

The company actively pursues strategies to enhance the efficiency of its manufacturing operations and to streamline its supply chain management. For instance, in 2023, Barnes Group reported that its Cost of Sales, which includes these manufacturing expenses, amounted to $932.6 million, highlighting the significant investment in production.

Barnes Group dedicates significant resources to research and development, a core component of its cost structure. These investments fuel the innovation necessary to create advanced products and solutions across its diverse business segments.

In 2024, the company continued its commitment to R&D, recognizing its pivotal role in staying ahead of market trends and technological advancements. Such expenditures are essential for developing next-generation offerings in areas like aerospace components and engineered industrial products.

Selling, General, and Administrative (SG&A) expenses are a significant component of Barnes Group's cost structure, encompassing the operational costs tied to sales, marketing, corporate administration, and various support functions. These costs reflect the investment in maintaining a global sales force, supporting administrative personnel, and managing the overarching corporate infrastructure necessary for its diverse business segments.

For the fiscal year 2023, Barnes Group reported SG&A expenses of $320.5 million. This figure highlights the substantial resources dedicated to customer outreach, brand building, and the essential administrative backbone that supports the company's global operations and strategic initiatives.

Restructuring and Transformation Charges

Barnes Group has been actively managing restructuring and transformation charges as a key component of its cost structure. These expenses are directly tied to efforts to streamline operations and enhance overall efficiency. For instance, in the first quarter of 2024, the company reported $13 million in severance and related costs associated with its ongoing transformation initiatives.

These charges encompass a range of activities designed to optimize the business portfolio and reduce operational overhead. This includes the costs associated with reorganizing various business units and the implementation of comprehensive cost reduction programs. Such strategic moves are crucial for maintaining competitiveness in dynamic markets.

- Restructuring Expenses: Costs incurred from reorganizing business units and implementing new operational frameworks.

- Transformation Initiatives: Investments in programs aimed at modernizing the company's structure and processes.

- Q1 2024 Impact: Barnes Group recorded $13 million in severance and related charges during the first quarter of 2024, reflecting ongoing transformation efforts.

Acquisition and Divestiture Related Expenses

Barnes Group's cost structure is significantly influenced by expenses tied to strategic acquisitions and divestitures. For instance, the acquisition of MB Aerospace in 2022 involved substantial legal, advisory, and integration costs. Similarly, the divestiture of businesses like Associated Spring and Hänggi in recent years also incurred transaction-related expenses.

These costs are critical to managing the company's overall financial health and operational efficiency. In 2023, Barnes Group reported that its strategic portfolio repositioning activities, including acquisitions and divestitures, contributed to certain one-time expenses that impacted its financial results.

- Acquisition Expenses: Costs related to due diligence, legal fees, and integration planning for strategic purchases.

- Divestiture Expenses: Costs associated with selling off business units, including legal, advisory, and severance packages.

- Integration Costs: Expenses incurred to merge acquired companies into existing operations, such as IT system integration and rebranding.

- Transaction Fees: Payments to investment banks, lawyers, and other advisors involved in M&A activities.

Barnes Group's cost structure is heavily weighted towards its manufacturing and production activities, encompassing raw materials, direct labor, and factory overhead. The company also invests significantly in research and development to drive innovation, alongside substantial Selling, General, and Administrative (SG&A) expenses for global operations. Strategic initiatives like acquisitions, divestitures, and ongoing restructuring efforts also contribute to its overall cost base.

| Cost Category | 2023 Actual (Millions USD) | 2024 Q1 Impact (Millions USD) |

|---|---|---|

| Cost of Sales (Manufacturing) | 932.6 | N/A |

| SG&A Expenses | 320.5 | N/A |

| Restructuring/Transformation Charges | N/A | 13.0 (Severance & related) |

| Acquisition/Divestiture Related | Impacted 2023 results | N/A |

Revenue Streams

Revenue here comes from selling new, complex parts and systems directly to aircraft manufacturers. These go into making commercial and military jet engines, engine casings, and the main body of planes. This is a big part of their business, directly tied to how many new planes and engines are being built each year.

For Barnes Group, this segment is a key driver. In 2024, the aerospace industry saw a steady increase in production, with major manufacturers like Boeing and Airbus ramping up deliveries. This trend directly boosted Barnes Group's OEM sales, reflecting the industry's recovery and expansion.

Barnes Group's aerospace aftermarket is a substantial revenue driver, focusing on maintenance, repair, and overhaul (MRO) services along with spare parts for aero-engines and components. This segment thrives on the expanding global aircraft fleet and the inherently long operational life of aircraft, ensuring a consistent demand for support services.

In 2023, Barnes Group reported that its Aerospace segment, which heavily includes aftermarket sales and services, generated approximately $713.4 million in revenue. This demonstrates the significant contribution of this sector to the company's overall financial performance, fueled by the ongoing need for aircraft upkeep and part replacements.

Barnes Group generates revenue in its Industrial segment through the sale of specialized, precision-engineered components, advanced molding solutions, and cutting-edge industrial automation technologies. These offerings cater to a broad range of industries, including critical sectors like healthcare, transportation, and general manufacturing.

For the fiscal year 2023, the Industrial segment demonstrated significant performance, contributing approximately $474.5 million to Barnes Group's total revenue. This segment's products are integral to the operational efficiency and innovation within its diverse customer base.

Sales of Differentiated Industrial Technologies

Barnes Group generates revenue by selling advanced, differentiated industrial technologies. This includes innovative solutions in areas like engineered plastics and factory automation, often bundling hardware and software. For instance, in 2023, their Engineered Components segment, which includes many of these technologies, saw a notable increase in demand.

This revenue stream is crucial for Barnes Group, reflecting their commitment to providing specialized industrial processes and forward-thinking solutions. The sales are characterized by a mix of physical products and integrated digital capabilities, catering to diverse industrial needs.

- Engineered Plastics: Revenue from advanced plastic components and materials for various industries.

- Factory Automation: Income derived from selling automated systems and solutions that enhance manufacturing efficiency.

- Specialized Industrial Processes: Sales of proprietary technologies and services that optimize industrial operations.

- Hardware and Software Integration: Revenue generated from solutions that combine physical technology with digital control and analytics.

Consulting and Value-Added Services

Barnes Group diversifies its income beyond just selling products. They offer consulting and services that add extra value for their industrial customers. This includes helping clients with application engineering, making their processes run smoother, and creating unique solutions tailored to specific needs.

This strategy capitalizes on Barnes Group's extensive engineering knowledge. For instance, in 2023, their Engineered Solutions segment, which includes these services, saw significant growth, contributing to the company's overall performance. This segment often works closely with clients to solve complex challenges, thereby fostering deeper relationships and recurring revenue opportunities.

- Application Engineering: Providing specialized technical support to ensure optimal use of Barnes Group products within client systems.

- Process Optimization Consulting: Offering expertise to enhance efficiency, reduce waste, and improve output for manufacturing processes.

- Custom Solution Development: Designing and building bespoke components or systems to meet unique client requirements.

Barnes Group's revenue streams are robust, stemming from both the aerospace and industrial sectors. Their aerospace business focuses on Original Equipment Manufacturer (OEM) sales of new parts and systems for aircraft, alongside a significant aftermarket for maintenance, repair, and overhaul (MRO) services and spare parts. The industrial segment offers specialized components, automation technologies, and consulting services across various manufacturing industries.

In 2023, Barnes Group's Aerospace segment generated approximately $713.4 million, highlighting the importance of aircraft production and ongoing fleet support. The Industrial segment contributed around $474.5 million in the same year, demonstrating the breadth of their offerings in engineered plastics, factory automation, and specialized industrial processes.

| Revenue Stream | Description | 2023 Revenue (Approx.) |

|---|---|---|

| Aerospace OEM | New parts and systems for commercial and military aircraft. | Included in overall Aerospace segment |

| Aerospace Aftermarket | MRO services and spare parts for aero-engines and components. | Included in overall Aerospace segment |

| Industrial - Engineered Components & Materials | Specialized plastic components and advanced materials. | Included in overall Industrial segment |

| Industrial - Factory Automation | Automated systems and solutions for manufacturing. | Included in overall Industrial segment |

| Industrial - Consulting & Services | Application engineering, process optimization, custom solutions. | Included in overall Industrial segment |

Business Model Canvas Data Sources

The Barnes Group Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports, and strategic assessments of industry trends. These diverse sources ensure a robust and accurate representation of our business operations and market positioning.