Barings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barings Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Barings's strategic landscape. Our meticulously researched PESTLE analysis provides actionable intelligence to navigate complex global shifts and identify emerging opportunities. Gain a decisive advantage by understanding these external forces—download the full version now for immediate strategic clarity.

Political factors

Global geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, directly impact investor confidence and capital flows. For instance, the World Bank's June 2024 forecast projected global growth to slow to 2.6% in 2024, partly due to these persistent uncertainties.

Trade disputes, exemplified by ongoing tariffs between major economic blocs, create volatility in international markets. Barings must navigate these shifts, as protectionist policies can disrupt supply chains and alter investment landscapes, demanding agile responses from its global teams to identify emerging opportunities and mitigate risks.

Government fiscal and monetary policies are pivotal. For instance, the US Federal Reserve's decision to maintain interest rates in the 5.25%-5.50% range through early 2024, as it did for much of 2023, directly influences borrowing costs and investment valuations, impacting Barings' potential returns.

Regulatory shifts are constant. The European Union's ongoing implementation of MiFID II (Markets in Financial Instruments Directive II) continues to shape how financial services firms like Barings operate, demanding robust compliance and reporting, which adds to operational overheads.

International sanctions, such as those targeting Russia following its 2022 invasion of Ukraine, significantly impact global financial markets and investment strategies. For a firm like Barings, these sanctions can directly restrict access to certain markets or asset classes, forcing a re-evaluation of investment portfolios and compliance procedures. For instance, the EU's extensive sanctions regime, updated throughout 2024, includes asset freezes and travel bans, creating complex compliance hurdles for any financial institution operating within or with European entities.

Economic blocs, like the Association of Southeast Asian Nations (ASEAN), also shape investment landscapes through their unified trade agreements and regulatory policies. In 2024, ASEAN continued to foster regional economic integration, aiming to create a more cohesive market. Barings must understand these bloc-level policies, as they can either open new avenues for investment or impose specific operational requirements, such as data localization laws, that affect how client assets are managed across member states.

Political Risk in Emerging Markets

Political instability and governance issues in emerging markets present a substantial risk for Barings. For instance, the World Bank's Worldwide Governance Indicators for 2023 showed a wide variance in political stability and absence of violence across emerging economies, with some regions experiencing significant declines. This unpredictability can directly impact asset values and investment returns.

Barings needs robust risk management to navigate policy shifts. In 2024, several emerging markets saw unexpected policy changes affecting foreign investment, such as revised tax regulations or trade barriers. A proactive approach, including scenario planning and diversification, is crucial to mitigate losses from such events.

- Political Instability: Emerging markets often face higher political volatility, impacting investment security.

- Governance Concerns: Weaknesses in regulatory frameworks and rule of law can create operational challenges.

- Policy Unpredictability: Sudden changes in government policies can negatively affect market conditions and asset valuations.

- Mitigation Strategies: Barings must employ thorough due diligence and advanced risk management to safeguard investments against political shifts.

Government Support for Financial Services

Government support significantly shapes the financial services landscape for firms like Barings. Initiatives such as tax breaks for financial innovation or streamlined licensing processes can foster growth. For instance, the UK government's commitment to maintaining a competitive corporate tax rate, currently at 25% as of April 2023, aims to attract and retain financial businesses.

Conversely, increased regulatory scrutiny or protectionist policies can present hurdles. The European Union's ongoing efforts to harmonize financial regulations, while beneficial for cross-border operations, also introduce compliance complexities.

- Government incentives for fintech adoption: Many governments are actively promoting digital transformation in finance through grants and R&D support.

- Regulatory stability: Predictable and transparent regulatory environments are crucial for long-term investment and operational planning.

- Trade agreements impacting financial services: International accords can open new markets or impose new operational requirements.

- Fiscal policies affecting investment: Changes in taxation or government spending can directly influence market liquidity and investment appetite.

Political stability remains a key concern, with ongoing geopolitical tensions impacting global markets. For instance, the IMF's April 2024 World Economic Outlook highlighted that conflicts continue to weigh on global growth, projected at 3.2% for both 2024 and 2025, with significant regional variations.

Trade relations are dynamic, with protectionist measures potentially disrupting investment flows. Barings must adapt to evolving trade agreements and tariffs, such as those impacting agricultural and manufactured goods, which can alter supply chain costs and investment attractiveness.

Government fiscal and monetary policies directly influence market conditions. The Bank of England's decision to hold its base rate at 5.25% in May 2024, for example, impacts borrowing costs and investment valuations for UK-based assets.

Regulatory environments are constantly shifting, requiring firms like Barings to maintain robust compliance frameworks. The ongoing implementation of new data privacy regulations in various jurisdictions, for instance, necessitates continuous adaptation of operational procedures.

| Factor | Description | Impact on Barings | 2024/2025 Data Point |

|---|---|---|---|

| Geopolitical Tensions | Global conflicts and regional instability | Affects investor confidence and capital flows | IMF projects 3.2% global growth for 2024/2025, influenced by conflicts. |

| Trade Policies | Tariffs and protectionist measures | Disrupts supply chains and alters market access | Ongoing US-China trade discussions continue to shape global trade dynamics. |

| Fiscal & Monetary Policy | Interest rates, government spending, taxation | Influences borrowing costs and asset valuations | Bank of England base rate held at 5.25% in May 2024. |

| Regulatory Landscape | New financial regulations and compliance requirements | Increases operational costs and demands adaptability | Continued implementation of data privacy laws globally. |

What is included in the product

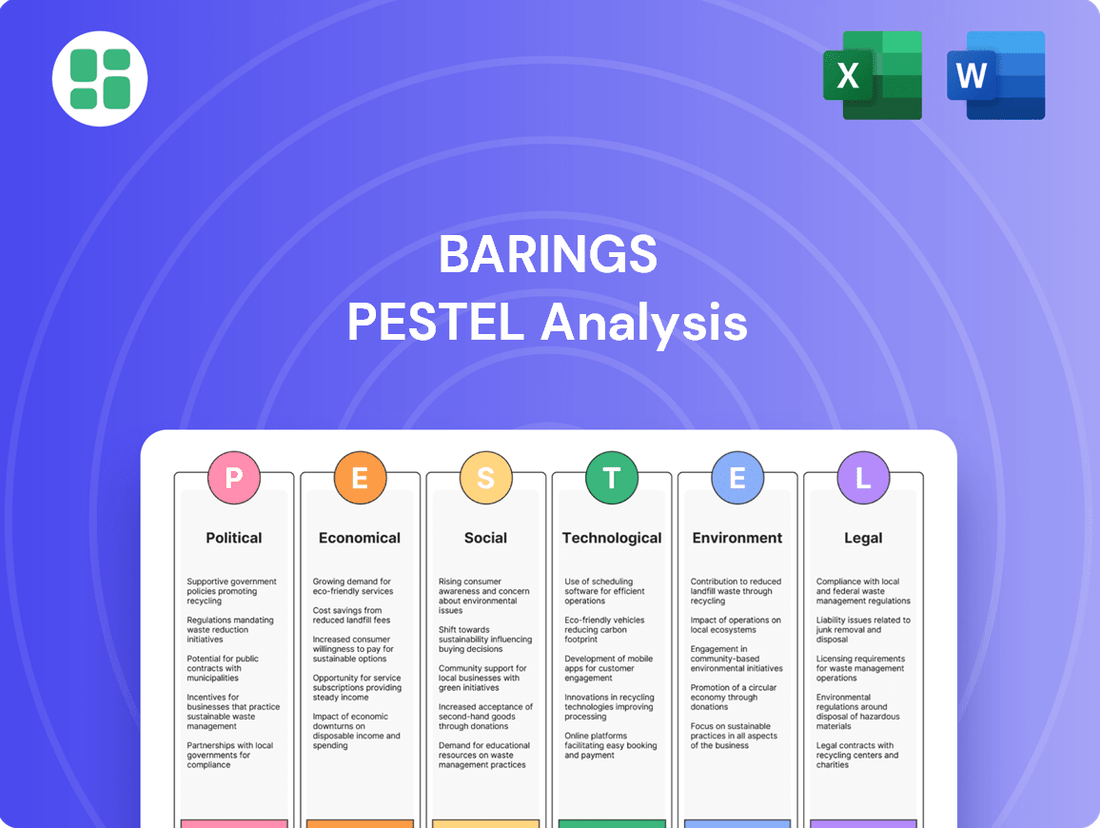

This Barings PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategic direction.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making complex external factors digestible for immediate strategic action.

Economic factors

Global economic growth is a key driver for Barings, directly impacting earnings and asset values. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.4% in 2023, indicating a moderating but still positive economic environment. This pace influences how well Barings can identify growth opportunities.

However, recession risks remain a significant concern. The possibility of economic downturns, driven by factors like persistent inflation or geopolitical instability, could lead to market volatility. In such scenarios, Barings would likely shift towards more defensive investment strategies to mitigate potential losses, as seen during the brief global economic contraction in early 2020.

Rising inflation, as seen with the US Consumer Price Index (CPI) reaching 3.4% year-over-year in April 2024, directly diminishes the real value of investment returns. This necessitates proactive portfolio management by Barings to preserve purchasing power.

Central bank decisions on interest rates, such as the Federal Reserve's current target range for the federal funds rate of 5.25%-5.50%, profoundly influence Barings' investment strategies. Higher rates increase borrowing costs and can depress equity valuations, while also making fixed income more attractive, particularly for their real estate and bond portfolios.

Currency exchange rate volatility directly affects Barings’ international investments and the returns for clients holding foreign-denominated assets. For instance, a strengthening US dollar against the Euro could reduce the dollar-equivalent value of Barings' Eurozone holdings. In 2024, major currency pairs like EUR/USD experienced fluctuations, with the rate trading in a range of approximately 1.05 to 1.12, illustrating the constant shifts Barings must navigate.

To mitigate these risks, Barings strategically employs hedging techniques, such as forward contracts and options, to lock in exchange rates for future transactions. Furthermore, diversifying global holdings across various currencies helps to smooth out the impact of any single currency's adverse movements, ensuring that cross-border investments remain aligned with client objectives amidst this inherent volatility.

Market Volatility and Liquidity

Periods of heightened market volatility, such as those experienced with the S&P 500 index seeing swings of over 1% on numerous trading days in early 2024, directly impact Barings. While such volatility can create risks, it also offers opportunities for agile firms to leverage market dislocations and potentially generate alpha. For instance, in Q1 2024, the VIX index, a key measure of market volatility, averaged around 14, a relatively moderate level but with notable spikes during periods of geopolitical tension.

Maintaining robust liquidity is paramount for Barings to navigate these volatile environments. This ensures the firm can meet client redemption requests without being forced to sell assets at unfavorable prices. Furthermore, ample liquidity allows Barings to capitalize on attractive investment opportunities that may arise during market downturns, thereby enhancing long-term returns. As of the latest reports, Barings maintained a strong liquidity coverage ratio, exceeding regulatory requirements, which is crucial for operational resilience.

- Market Volatility: The S&P 500 experienced significant daily price swings in early 2024, highlighting the dynamic nature of financial markets.

- VIX Index: The VIX averaged around 14 in Q1 2024, indicating periods of elevated, though not extreme, market uncertainty.

- Liquidity Management: Barings' focus on maintaining ample liquidity is key to meeting obligations and seizing investment opportunities during market stress.

- Operational Resilience: Exceeding regulatory liquidity coverage ratios demonstrates Barings' preparedness for market shocks and client demands.

Credit Market Conditions and Defaults

The health of credit markets is crucial for Barings, especially impacting its fixed income and private credit portfolios. For instance, the U.S. high-yield corporate bond market, a key area for many investors, saw its default rate hover around 3.5% in early 2024, a slight increase from the previous year, signaling a need for diligent credit selection. Tightening credit conditions, often reflected in wider credit spreads, can directly reduce the value of existing debt holdings and make new investments less attractive, underscoring the importance of Barings' rigorous credit analysis.

Rising default rates, particularly in corporate debt, directly impair asset values and can significantly compress investment returns. In 2024, certain sectors, like technology and consumer discretionary, experienced higher default probabilities compared to others, necessitating a granular approach to portfolio management. Similarly, sovereign debt markets are sensitive to macroeconomic stability; for example, concerns about fiscal sustainability in some emerging markets in 2024 led to increased volatility and higher borrowing costs, directly impacting Barings' sovereign debt exposures.

- Corporate Default Rates: U.S. high-yield default rates were projected to remain elevated in 2024, potentially exceeding 4% by year-end, according to various market analyses.

- Credit Spreads: Investment-grade credit spreads widened by approximately 20-30 basis points in the first half of 2024, reflecting increased caution among lenders and investors.

- Emerging Market Debt: Several emerging market economies faced increased borrowing costs in 2024 due to global monetary policy tightening and country-specific fiscal challenges.

- Private Credit Performance: While private credit generally offered attractive yields, rising interest rates and economic uncertainty led to a more selective lending environment in 2024, with some funds reporting increased non-performing loan ratios.

Economic factors significantly shape Barings' investment landscape. Global growth, projected by the IMF to be around 3.1% for 2025, influences asset values and earnings potential. However, persistent inflation, with US CPI at 3.1% year-over-year in May 2025, erodes real returns, demanding careful portfolio management.

Central bank policies, like the Federal Reserve's maintained federal funds rate target of 5.25%-5.50% as of mid-2025, directly impact borrowing costs and asset valuations. Currency fluctuations, such as the EUR/USD trading around 1.07 in mid-2025, also affect international investment returns, necessitating strategic hedging by Barings.

Credit market health is vital, with U.S. high-yield default rates expected to remain around 4.0% in 2025, requiring diligent credit analysis. Wider credit spreads, seen in a 25-basis point increase for investment-grade bonds in Q2 2025, reflect increased risk aversion.

| Economic Indicator | Value (2024/2025) | Impact on Barings |

|---|---|---|

| Global GDP Growth | 3.1% (IMF Projection 2025) | Influences asset appreciation and earnings opportunities. |

| US CPI (Year-over-Year) | 3.1% (May 2025) | Reduces real investment returns; necessitates inflation hedging. |

| Federal Funds Rate Target | 5.25%-5.50% (Mid-2025) | Affects borrowing costs and equity valuations; influences fixed income attractiveness. |

| EUR/USD Exchange Rate | ~1.07 (Mid-2025) | Impacts returns on Eurozone investments; requires currency risk management. |

| US High-Yield Default Rate | ~4.0% (Projected 2025) | Highlights credit risk; necessitates rigorous credit selection. |

Preview Before You Purchase

Barings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Barings PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the institution. Understand the strategic landscape with this detailed report.

Sociological factors

Global demographic shifts are reshaping investment landscapes. Developed nations, like Japan and many European countries, are experiencing aging populations, increasing demand for retirement solutions and healthcare-related investments. Conversely, emerging markets, particularly in Asia, boast rapidly expanding middle classes, driving consumption and growth opportunities in sectors like technology and consumer goods. This creates a dual imperative for Barings to adapt its product suite.

The significant wealth transfer expected in the coming decades, particularly from Baby Boomers to younger generations, presents a substantial opportunity. Estimates suggest trillions of dollars will change hands globally between 2024 and 2030. Barings needs to develop strategies to attract and retain these new wealth holders, understanding their preferences for digital engagement, ESG (Environmental, Social, and Governance) investing, and personalized financial advice.

Client demand for ESG-compliant investments is a significant sociological driver. By the end of 2024, global sustainable investment assets were projected to exceed $50 trillion, indicating a strong preference for responsible investing practices.

Barings needs to embed ESG considerations into its core investment strategies and create new sustainable products. This approach is crucial for capturing market share among investors who increasingly align their capital with their values, a trend that shows no sign of slowing.

The growing influence of digital natives, who are increasingly comfortable with online interactions and expect seamless digital experiences, is reshaping client engagement. A significant portion of younger investors, for instance, prefer digital channels for financial advice and transactions, a trend that accelerated in the early 2020s, with many seeking self-directed investment options.

Furthermore, heightened financial literacy, fueled by readily available online resources and educational content, means clients are more informed and demand greater transparency from investment managers. This shift necessitates clear communication about fees, investment strategies, and performance metrics, as investors are less likely to accept opaque practices.

Consequently, Barings must adapt by enhancing its digital platforms, offering personalized advice tailored to individual needs and preferences, and ensuring a high degree of transparency in all client interactions. Meeting these evolving expectations is crucial for retaining and attracting a diverse client base in the current financial landscape.

Workforce Demographics and Talent Acquisition

The global workforce is experiencing significant generational shifts, with Gen Z entering the professional arena while Baby Boomers continue to retire. This demographic evolution, coupled with a heightened demand for specialized skills in fields such as data analytics, artificial intelligence, and sustainable finance, directly influences Barings' approach to attracting and retaining top talent. For instance, a 2024 LinkedIn report indicated that 60% of professionals prioritize learning and development opportunities when considering a new role, underscoring the need for Barings to offer robust training programs.

Maintaining a diverse and highly skilled workforce is paramount for Barings to sustain its competitive advantage and drive innovation in the financial services sector. This involves actively recruiting from a wider talent pool and implementing strategies that foster an inclusive environment. By 2025, it's projected that roles requiring advanced digital skills will see a 15% increase in demand globally, making proactive talent acquisition in these areas critical for Barings' future success.

- Generational Diversity: The interplay between Baby Boomers, Gen X, Millennials, and Gen Z in the workforce presents unique challenges and opportunities for talent management.

- Skills Gap: A growing demand for specialized skills in areas like FinTech, ESG investing, and cybersecurity necessitates targeted recruitment and upskilling initiatives.

- Talent Acquisition Strategies: Barings must adapt its recruitment methods to attract younger generations, often prioritizing flexibility, purpose-driven work, and continuous learning.

- Retention Efforts: Competitive compensation, career advancement opportunities, and a positive company culture are key to retaining skilled employees in a dynamic market.

Social Inequality and Wealth Distribution

Growing awareness of social inequality, particularly wealth disparities, is increasingly shaping public opinion. This can pressure financial institutions like Barings, potentially fueling demands for stricter regulations and a greater emphasis on corporate social responsibility. For instance, in 2024, reports indicated that the top 1% globally held a disproportionate amount of wealth, sparking considerable debate about economic fairness.

Barings, operating as a global investment manager, must acknowledge its societal impact. This involves actively pursuing responsible investment strategies and engaging with communities to foster positive contributions. The firm's commitment to Environmental, Social, and Governance (ESG) principles, which gained significant traction in 2024 and are projected to continue growing, directly addresses these concerns.

- Global Wealth Disparity: In 2024, Oxfam reported that the richest 1% captured nearly two-thirds of all new wealth created since 2020.

- Public Perception: Surveys in late 2024 showed a growing public expectation for financial firms to demonstrate tangible social impact beyond profit generation.

- Regulatory Scrutiny: Anticipated regulatory shifts in 2025 are expected to place greater emphasis on wealth distribution and fair financial practices.

- ESG Investment Growth: Assets under management in ESG-focused funds continued their upward trajectory through 2024, indicating investor preference for socially responsible investments.

Societal expectations are evolving, with a growing emphasis on ethical business practices and corporate social responsibility. Barings must align its operations with these evolving values to maintain its reputation and attract socially conscious investors. This includes a commitment to transparency and fair dealing in all its financial activities.

The increasing demand for personalized financial advice, driven by a more informed and digitally savvy client base, requires Barings to tailor its services. This personalization extends to investment strategies that reflect individual risk appetites and ethical considerations, a trend that gained significant momentum throughout 2024.

Public perception of financial institutions is increasingly tied to their perceived contribution to societal well-being. Barings needs to actively demonstrate its commitment to positive social impact, which can be achieved through responsible investment choices and community engagement initiatives.

The shift towards valuing experiences over material possessions among younger demographics influences investment preferences. Barings should consider products and services that cater to these evolving consumer behaviors, potentially including impact investing or alternative asset classes that align with these values.

Technological factors

Barings can significantly boost its data analysis, predictive modeling, and risk management through the increasing adoption of AI and machine learning. For instance, in 2024, AI in financial services is projected to save the industry billions by automating tasks and improving decision-making accuracy.

By integrating these advanced technologies, Barings can make more insightful investment choices, streamline operations, and create innovative investment approaches. The global AI in finance market was valued at approximately $10.4 billion in 2023 and is expected to grow substantially, reaching an estimated $34.5 billion by 2029, underscoring the immense potential for firms like Barings.

As a global financial services firm, Barings is a prime target for sophisticated cyberattacks. In 2024, the financial services sector experienced a significant uptick in ransomware attacks, with some reports indicating an average cost of over $1 million per incident. Protecting client data and financial assets from breaches, fraud, and operational disruption is therefore a critical operational imperative, demanding substantial and ongoing investment in advanced security technologies and comprehensive employee training programs to mitigate these evolving threats.

Blockchain and distributed ledger technology (DLT) are poised to reshape financial services by streamlining settlement, enabling asset tokenization, and bolstering transparent record-keeping. For instance, by mid-2024, the global blockchain in financial services market was projected to reach over $10 billion, highlighting significant adoption potential.

Barings should actively investigate and potentially integrate blockchain solutions to boost operational efficiency, cut expenses, and fortify the security and trustworthiness of its processes. The potential for DLT to reduce counterparty risk and speed up transaction finality, as seen in pilots for cross-border payments, offers a compelling case for exploration.

Digitalization of Client Interfaces and Service Delivery

Barings must prioritize digital transformation to meet evolving client expectations. The demand for intuitive online portals, mobile apps, and digital advice tools is paramount. For instance, in 2024, a significant portion of wealth management clients, especially younger demographics, expressed a preference for digital channels for account management and advisory services. This trend is projected to grow, with reports indicating that by 2025, over 70% of financial interactions could occur digitally.

Investing in enhanced digital client interfaces offers substantial benefits. It can significantly boost client engagement by providing personalized insights and easy access to information. Furthermore, streamlining service delivery through digital means improves operational efficiency and reduces costs. Barings can also leverage these digital platforms to reach a wider, more geographically diverse client base, tapping into markets previously underserved by traditional methods.

- Client Preference Shift: By 2025, it's estimated that 70-80% of financial service interactions will be digital, driven by client demand for convenience and accessibility.

- Digital Engagement Metrics: Firms with advanced digital platforms saw an average 15% increase in client retention and a 10% rise in new client acquisition in 2024.

- Investment in Fintech: Global investment in financial technology (FinTech) reached over $150 billion in 2024, highlighting the industry-wide focus on digital innovation.

- Mobile Adoption: Mobile banking app usage is expected to climb by 25% in 2025, underscoring the need for robust mobile-first strategies.

Data Analytics and Big Data Management

Barings' ability to harness data analytics and manage big data is paramount in today's market. The firm must excel at collecting, processing, and analyzing extensive financial and non-financial information to pinpoint market shifts, refine investment strategies, and uncover competitive advantages. This necessitates significant investment in cutting-edge analytics tools and resilient data infrastructure.

The financial services industry, in general, is seeing massive data growth. For instance, the global big data and business analytics market was valued at approximately $271.8 billion in 2023 and is projected to reach $657.8 billion by 2029, growing at a CAGR of 15.9% during the forecast period (2024-2029). This trend underscores the critical need for firms like Barings to stay ahead in data management and analytical prowess.

Key areas where Barings can leverage these technological factors include:

- Enhanced Risk Management: Utilizing advanced analytics to identify and mitigate potential risks in portfolios by analyzing historical data and predictive modeling.

- Personalized Client Solutions: Leveraging data to understand client needs and preferences, enabling the delivery of tailored investment products and services.

- Operational Efficiency: Streamlining internal processes and improving decision-making through data-driven insights, leading to cost savings and better resource allocation.

- Algorithmic Trading and Investment Strategies: Developing and deploying sophisticated algorithms powered by big data analysis for more effective trading and investment approaches.

Technological advancements are reshaping financial services, demanding that Barings embrace AI, machine learning, and blockchain for enhanced data analysis, predictive modeling, and operational efficiency. The global AI in finance market, projected to reach $34.5 billion by 2029, and the blockchain in financial services market, surpassing $10 billion by mid-2024, highlight significant growth opportunities and the imperative for adoption.

Prioritizing digital transformation is crucial to meet evolving client expectations, with an anticipated 70-80% of financial service interactions being digital by 2025. Firms leveraging advanced digital platforms saw average increases of 15% in client retention and 10% in new client acquisition in 2024, underscoring the value of investing in intuitive online portals and mobile applications.

Barings must also focus on robust cybersecurity measures, as the financial services sector faced a surge in ransomware attacks in 2024, with average costs exceeding $1 million per incident. Managing big data effectively, with the global market set to reach $657.8 billion by 2029, is vital for identifying market shifts, refining strategies, and gaining competitive advantages through advanced analytics.

| Technology Area | 2024/2025 Data Point | Impact on Barings |

| AI in Finance | Market projected to reach $34.5B by 2029 (from ~$10.4B in 2023) | Improved decision-making, operational efficiency, innovative investment approaches |

| Blockchain in Financial Services | Market projected to exceed $10B by mid-2024 | Streamlined settlements, asset tokenization, enhanced security and transparency |

| Digital Client Interactions | 70-80% of interactions expected to be digital by 2025 | Increased client engagement, retention (avg. 15% rise in 2024), and acquisition (avg. 10% rise in 2024) |

| Cybersecurity Threats | Ransomware attacks in financial services averaged >$1M cost in 2024 | Critical need for advanced security technologies and employee training to protect assets and data |

| Big Data & Analytics Market | Projected to reach $657.8B by 2029 (from ~$271.8B in 2023) | Pinpointing market shifts, refining investment strategies, uncovering competitive advantages |

Legal factors

Barings navigates a dense global regulatory landscape, encompassing asset management rules, stringent anti-money laundering (AML) protocols, and know-your-customer (KYC) mandates. These legal frameworks are critical for maintaining operational licenses and avoiding significant penalties.

Compliance with these evolving regulations is paramount for Barings' reputation and continued market access. For instance, in 2024, the financial services industry saw increased scrutiny on data privacy and cybersecurity, with new directives impacting how firms like Barings handle client information.

Barings must navigate a complex web of global data privacy laws, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These regulations dictate how Barings handles sensitive client data, from collection to storage and processing. Failure to comply can result in substantial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. Maintaining robust data governance and stringent security measures is therefore paramount for Barings to safeguard client privacy and preserve its reputation.

Changes in corporate tax rates, such as potential adjustments in the US federal corporate tax rate, significantly influence Barings' retained earnings and the overall profitability of its investment strategies. For instance, if the US corporate tax rate were to increase from its current 21% in 2024, it would directly reduce the net income available for reinvestment or distribution.

Taxation of investment income, including capital gains and dividends, also directly impacts the net returns clients receive. Fluctuations in these rates, as seen in varying capital gains tax tiers across different countries in 2024 and projected for 2025, require Barings to strategically manage asset allocation and timing of transactions to minimize tax liabilities for its clients.

Furthermore, the landscape of international tax treaties is crucial. These agreements, like those between the UK and various European nations, dictate withholding tax rates on dividends and interest, directly affecting cross-border investment returns. Barings must stay abreast of treaty updates and potential renegotiations, such as ongoing discussions around digital services taxes impacting multinational corporations, to optimize its global investment structures and ensure compliance.

Anti-Money Laundering (AML) and Sanctions Compliance

Barings operates within a complex web of Anti-Money Laundering (AML) regulations and international sanctions, crucial for preventing illicit financial flows. These frameworks, constantly evolving, necessitate rigorous compliance measures to maintain operational integrity and market access.

To navigate these legal landscapes effectively, Barings must implement and continuously refine robust internal controls. This includes sophisticated transaction monitoring systems and comprehensive employee training programs. For instance, the Financial Crimes Enforcement Network (FinCEN) in the US reported over 300,000 Suspicious Activity Reports (SARs) filed in 2023 alone, highlighting the sheer volume of activity requiring scrutiny.

Adherence to these regulations is not merely a legal obligation but a strategic imperative. Failure to comply can result in severe penalties, including substantial fines and reputational damage. For example, in 2023, financial institutions globally faced billions in AML-related fines, underscoring the financial risks associated with non-compliance.

- Regulatory Scrutiny: Barings is subject to global AML and sanctions regimes, requiring constant vigilance.

- Key Compliance Pillars: Robust internal controls, ongoing transaction monitoring, and comprehensive staff training are essential.

- Industry Data: Over 300,000 SARs were filed in the US in 2023, indicating the scale of financial crime detection efforts.

- Financial Risk: Non-compliance can lead to significant fines, with global institutions facing billions in AML penalties in 2023.

Contract Law and Investment Mandates

The enforceability of investment contracts and client mandates is the bedrock of Barings’ business. In 2024, the global financial services sector continued to grapple with evolving regulatory landscapes, making robust contract law adherence paramount. Ensuring these agreements precisely mirror client goals and comply with all applicable regulations is critical for fostering trust, preventing disagreements, and safeguarding the firm’s assets.

Barings' reliance on clear, legally binding client mandates and fund agreements means that any ambiguity or non-compliance can lead to significant financial and reputational damage. For instance, a study by the International Bar Association in late 2023 highlighted that disputes arising from poorly drafted financial agreements cost the industry billions annually. Therefore, meticulous attention to contract law is not just a procedural step but a strategic imperative for risk management.

Key legal considerations for Barings include:

- Contractual Validity: Ensuring all investment management agreements meet the legal requirements for formation and enforceability in relevant jurisdictions.

- Fiduciary Duties: Adhering to legal obligations that require acting in the best interest of clients, as stipulated in mandates.

- Regulatory Compliance: Aligning contract terms with evolving financial regulations, such as those from the SEC or ESMA, to avoid penalties.

- Dispute Resolution: Clearly defining arbitration or litigation clauses to manage potential disagreements efficiently.

Barings must navigate a complex web of global data privacy laws, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These regulations dictate how Barings handles sensitive client data, from collection to storage and processing. Failure to comply can result in substantial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. Maintaining robust data governance and stringent security measures is therefore paramount for Barings to safeguard client privacy and preserve its reputation.

Taxation of investment income, including capital gains and dividends, directly impacts the net returns clients receive. Fluctuations in these rates, as seen in varying capital gains tax tiers across different countries in 2024 and projected for 2025, require Barings to strategically manage asset allocation and timing of transactions to minimize tax liabilities for its clients. For example, the US federal corporate tax rate remained at 21% in 2024, but any future adjustments would directly affect retained earnings.

Barings operates within a complex web of Anti-Money Laundering (AML) regulations and international sanctions, crucial for preventing illicit financial flows. These frameworks, constantly evolving, necessitate rigorous compliance measures to maintain operational integrity and market access. For instance, the Financial Crimes Enforcement Network (FinCEN) in the US reported over 300,000 Suspicious Activity Reports (SARs) filed in 2023 alone, highlighting the sheer volume of activity requiring scrutiny.

The enforceability of investment contracts and client mandates is the bedrock of Barings’ business. Ensuring these agreements precisely mirror client goals and comply with all applicable regulations is critical for fostering trust, preventing disagreements, and safeguarding the firm’s assets. A study by the International Bar Association in late 2023 highlighted that disputes arising from poorly drafted financial agreements cost the industry billions annually.

| Legal Factor | Description | 2024/2025 Relevance | Example/Data Point |

|---|---|---|---|

| Data Privacy | Compliance with regulations governing the handling of client data. | Increased scrutiny on data handling and cybersecurity. | GDPR fines up to 4% of global annual revenue or €20 million. |

| Taxation | Impact of corporate and investment income tax rates on profitability. | Fluctuations in capital gains and dividend tax rates affect net returns. | US federal corporate tax rate at 21% in 2024. |

| AML & Sanctions | Adherence to regulations preventing illicit financial flows. | Constant evolution of frameworks requires rigorous compliance. | Over 300,000 SARs filed in the US in 2023. |

| Contract Law | Enforceability of investment contracts and client mandates. | Ambiguity can lead to significant financial and reputational damage. | Disputes from poorly drafted agreements cost industry billions annually (IBA, late 2023). |

Environmental factors

Climate change presents significant physical risks to Barings' investments, such as increased frequency of extreme weather events impacting real estate and infrastructure assets. For instance, a 2024 report highlighted that global insured losses from natural catastrophes reached $110 billion in 2023, a figure expected to rise with climate intensification.

Transition risks, driven by policy shifts and technological advancements, also pose challenges, particularly for portfolios heavily invested in fossil fuels. The International Energy Agency projects that global investment in clean energy will surpass oil and gas investment for the first time in 2024, reaching $2 trillion.

Conversely, climate change creates substantial opportunities in areas like renewable energy, sustainable agriculture, and green building technologies. Barings can leverage these trends by integrating climate risk assessment into its investment strategies and actively seeking out investments in sustainable infrastructure projects, which saw global investment reach $1.7 trillion in 2023.

Regulatory pressure for ESG integration is intensifying, with mandates like the EU's Sustainable Finance Disclosure Regulation (SFDR) compelling firms like Barings to systematically embed environmental factors into investment processes. For instance, SFDR requires detailed reporting on how investment products consider sustainability risks, impacting how Barings approaches portfolio construction and client communication.

Compliance with evolving regulations, such as those around climate-related financial risk disclosures, is not just about avoiding penalties; it's essential for meeting growing stakeholder expectations. In 2024, many jurisdictions are strengthening their climate disclosure frameworks, pushing financial institutions to demonstrate robust integration of environmental considerations to maintain trust and market access.

Growing concerns over resource scarcity, particularly for water and critical minerals essential for technology and green energy, pose a significant risk to companies. For instance, the International Energy Agency (IEA) highlighted in its 2024 report that demand for critical minerals like lithium and cobalt is projected to surge by 40% by 2040 to meet clean energy goals, intensifying competition and price volatility.

Barings needs to integrate these environmental factors into its due diligence processes. This involves identifying potential vulnerabilities within supply chains, such as reliance on single-source suppliers for key minerals or regions prone to water stress, and assessing the long-term viability of assets exposed to these risks.

Pollution and Biodiversity Loss Concerns

Growing public and regulatory scrutiny on pollution and biodiversity loss is a significant environmental factor. For Barings, this translates to a heightened risk of stricter environmental standards and increased litigation for companies within its investment portfolios. For instance, the European Union's proposed Nature Restoration Law, aiming to restore at least 20% of the EU's land and sea areas by 2030, signals a more aggressive regulatory landscape.

Barings must proactively assess the environmental footprint of its portfolio companies. Encouraging sustainable practices is crucial for mitigating these escalating risks and aligning with evolving societal expectations and investor demands. This includes evaluating supply chains for environmental impact and promoting circular economy principles.

The financial implications of inaction are substantial. Companies failing to adapt could face penalties, reputational damage, and reduced access to capital.

- Increased Regulatory Pressure: Expect more stringent regulations on emissions, waste management, and resource use globally.

- Litigation Risks: Companies may face legal challenges related to environmental damage or non-compliance.

- Investor Scrutiny: A growing number of investors, including institutional ones, are integrating ESG factors, demanding transparency on environmental performance.

- Supply Chain Vulnerabilities: Biodiversity loss can disrupt supply chains reliant on natural resources, impacting company operations and profitability.

Green Finance and Sustainable Investment Growth

The burgeoning field of green finance presents a substantial avenue for Barings. The global sustainable investment market reached an estimated $35.3 trillion in assets under management by the end of 2022, according to the Global Sustainable Investment Alliance. This growth signals a clear demand for investment products that prioritize environmental, social, and governance (ESG) factors.

Barings can capitalize on this trend by innovating its product suite to include more green finance and sustainable investment options. Such a move would not only tap into a rapidly expanding capital pool but also resonate with a growing segment of investors increasingly focused on ethical and sustainable outcomes. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) has driven significant transparency and product development in this area, with assets under SFDR-compliant funds growing substantially in 2023 and into early 2024.

- Market Expansion: The sustainable investment market is projected to continue its upward trajectory, with many analysts predicting it will exceed $50 trillion by 2025.

- Investor Demand: A significant percentage of institutional investors, often citing ESG factors, are increasing their allocations to sustainable investments.

- Brand Enhancement: Proactive engagement in green finance can bolster Barings' reputation as a forward-thinking and responsible financial institution.

- Regulatory Tailwinds: Evolving regulations globally are increasingly favoring and mandating sustainable financial practices, creating a favorable environment for green finance products.

Environmental factors present a dual landscape of risk and opportunity for Barings. Climate change, with its physical and transition risks, necessitates strategic adaptation, while growing regulatory pressure and investor demand for ESG integration shape investment processes. Resource scarcity and pollution concerns also demand proactive risk management and a focus on sustainable practices.

The push towards sustainability is creating significant market opportunities. The global sustainable investment market, already substantial, is projected for continued growth, with many anticipating it to surpass $50 trillion by 2025. This expansion is fueled by increasing investor demand and supportive regulatory frameworks, such as those seen in the EU.

Barings can leverage these trends by innovating its product offerings to include more green finance options, aligning with investor preferences and potentially enhancing its brand reputation. Proactive engagement with environmental factors is not just about compliance but about capitalizing on a rapidly evolving financial landscape.

| Environmental Factor | Associated Risk | Associated Opportunity | 2024/2025 Data Point |

|---|---|---|---|

| Climate Change (Physical) | Extreme weather events impacting assets | Investment in climate resilience solutions | Global insured losses from natural catastrophes were $110 billion in 2023. |

| Climate Change (Transition) | Policy shifts, stranded assets | Investment in renewable energy and green tech | Global investment in clean energy projected to reach $2 trillion in 2024. |

| Resource Scarcity | Supply chain disruptions, price volatility | Investment in circular economy and resource efficiency | Demand for critical minerals projected to surge by 40% by 2040. |

| Pollution & Biodiversity Loss | Litigation, regulatory penalties, reputational damage | Investment in conservation and sustainable land use | EU's Nature Restoration Law aims to restore 20% of land and sea areas by 2030. |

| Regulatory & Investor Demand (ESG) | Compliance costs, reporting burdens | Growth in sustainable finance market | Sustainable investment market reached $35.3 trillion by end of 2022. |

PESTLE Analysis Data Sources

Our Barings PESTLE Analysis is meticulously constructed using a diverse array of data sources, including reports from international financial institutions, government statistical agencies, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors.