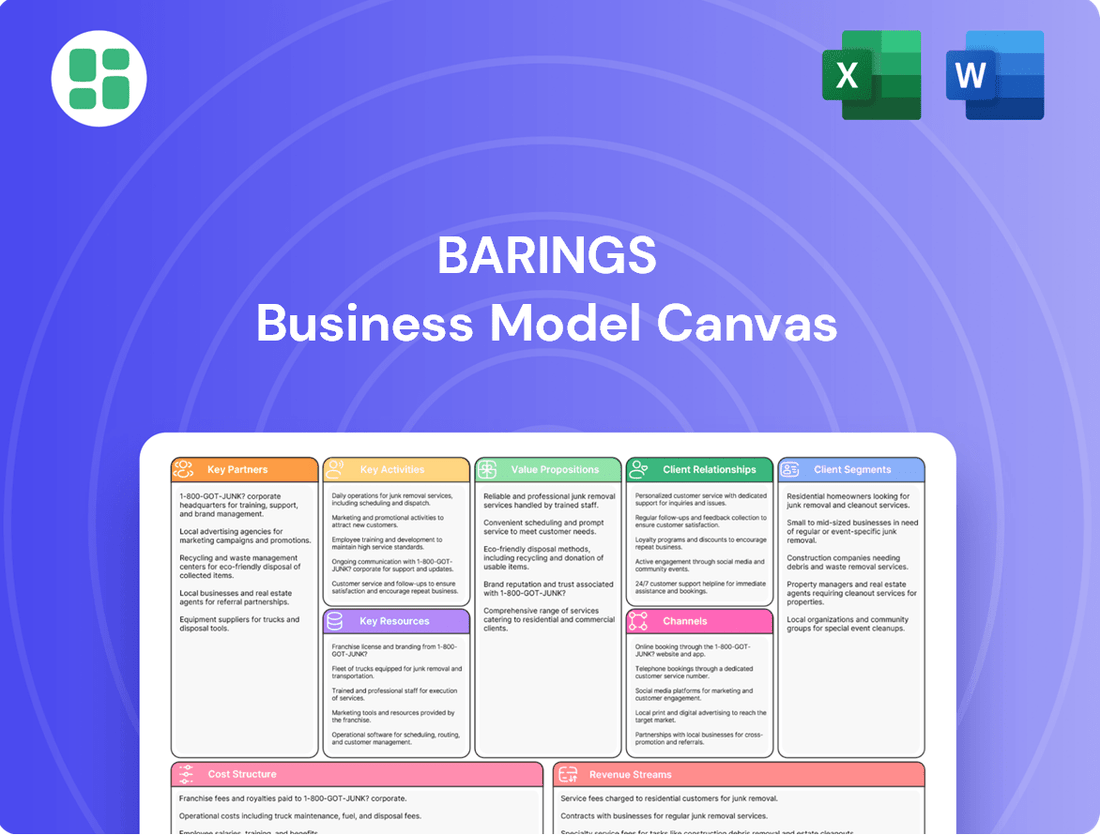

Barings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barings Bundle

Unlock the full strategic blueprint behind Barings's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Barings actively cultivates strategic alliances with a diverse array of financial institutions, such as major banks and fellow asset managers. These partnerships are crucial for broadening their distribution channels, allowing Barings' investment products to reach a wider investor base.

These collaborations also facilitate co-investment opportunities, where Barings and its partners pool resources and expertise to pursue specific investment ventures. This approach not only expands market reach but also grants access to specialized knowledge, ultimately improving the quality and breadth of services offered. For instance, in 2024, Barings announced a significant distribution agreement with a leading European bank to offer its alternative investment strategies to the bank's institutional clients.

Barings actively engages with prominent industry associations and professional bodies, a critical element for fostering thought leadership and gaining deep market insights. These collaborations are instrumental in shaping industry standards and ensuring Barings remains ahead of evolving market trends and regulatory changes.

Through these partnerships, Barings contributes to and benefits from a shared pool of collective industry knowledge. For instance, their involvement in groups like the Investment Company Institute (ICI) allows them to influence discussions on investment product development and regulatory frameworks, directly impacting how financial services are offered.

This strategic engagement also underpins Barings' dedication to sustainable practices and responsible investment. By participating in initiatives focused on ESG (Environmental, Social, and Governance) criteria within these bodies, Barings reinforces its commitment to long-term value creation and ethical business operations, aligning with the growing investor demand for sustainable options.

Barings leverages partnerships with leading data and technology providers to ensure access to critical financial information and advanced analytics. This collaboration is essential for making well-informed investment decisions and maintaining efficient operational workflows. For instance, in 2024, firms like Barings are increasingly relying on AI-driven data aggregation services, which have seen significant investment growth, with the AI in financial services market projected to reach over $25 billion by 2026.

These strategic alliances enable Barings to enhance its analytical capabilities and bolster its risk management frameworks. By integrating cutting-edge platforms, the firm can refine its investment strategies and improve the precision of its risk assessments, a crucial aspect in today's volatile markets. For example, advanced analytics can help identify subtle market shifts, as demonstrated by the increasing adoption of machine learning in portfolio optimization, which has shown potential to improve risk-adjusted returns by up to 15% in certain simulated environments.

Furthermore, partnerships with technology vendors are instrumental in upgrading Barings' client reporting systems and overall investment technology infrastructure. This focus on technological advancement drives innovation and operational efficiency, ultimately benefiting clients through more transparent and timely reporting. The investment in cloud-based solutions and data visualization tools, common in 2024, has led to reported efficiency gains of 20-30% in data processing and reporting for many financial institutions.

Relationships with Institutional Consultants and Advisors

Barings actively cultivates relationships with institutional consultants and financial advisors, recognizing them as vital conduits to the institutional investor market. These partnerships are built on a foundation of shared market intelligence and the collaborative development of tailored investment strategies. For instance, in 2024, Barings continued its engagement with leading global investment consulting firms, which advise on trillions of dollars in assets, to ensure its solutions align with evolving institutional mandates.

These collaborations are crucial for accessing substantial investment opportunities and effectively serving the complex needs of pension funds, endowments, and sovereign wealth funds. By providing in-depth market analysis and customized investment solutions, Barings aims to be a preferred partner for these influential intermediaries. The firm's commitment to transparency and robust reporting further strengthens these advisory relationships, fostering trust and facilitating access to significant mandates.

- Strategic Alliances: Partnering with major investment consultants who advise on over $10 trillion in global institutional assets.

- Customized Solutions: Developing bespoke investment strategies to meet the specific risk and return objectives of institutional clients.

- Market Insights: Regularly sharing proprietary research and market outlooks with advisors to inform their recommendations.

- Access to Mandates: Facilitating Barings' participation in large-scale investment mandates through advisor endorsements.

Co-investment Partners and Lenders

Barings actively collaborates with co-investment partners and lenders to facilitate substantial private market transactions, especially within real estate and private credit sectors. These alliances are crucial for distributing risk, augmenting capital availability, and successfully closing intricate deals demanding considerable financial backing.

These partnerships are instrumental in Barings' ability to undertake larger, more impactful projects. For instance, in 2024, Barings participated in several large real estate financings, leveraging co-investment and lending relationships to deploy significant capital. This collaborative approach allows for more robust deal structures and enhances the firm's capacity to serve a wider range of client needs.

- Risk Sharing Barings shares the financial risk associated with large private market deals by bringing in co-investors and lenders.

- Capital Augmentation These partnerships increase the total capital available for investment, enabling Barings to pursue larger opportunities.

- Deal Execution Co-investors and lenders provide essential capital and expertise, facilitating the successful execution of complex transactions.

- Financing Solutions Barings offers tailored financing solutions to various projects through these strategic relationships.

Barings' key partnerships extend to financial institutions and asset managers, crucial for expanding distribution and enabling co-investment opportunities. In 2024, a notable distribution agreement with a European bank broadened access to Barings' alternative strategies. These alliances grant access to specialized knowledge, enhancing service quality and market reach.

What is included in the product

A structured framework detailing Barings' approach to customer relationships, revenue streams, and key activities, all within the context of its investment management services.

The Barings Business Model Canvas offers a structured approach to dissecting complex strategies, alleviating the pain of overwhelming information by presenting key elements in a clear, visual format.

It streamlines the process of understanding and communicating strategic direction, reducing the time and effort typically spent on manual documentation and analysis.

Activities

Barings' core activity is the active management of client portfolios across various asset classes, including fixed income, real estate, and equities. This involves deep dives into markets and individual securities to identify opportunities and construct portfolios tailored to specific client goals.

The firm emphasizes generating alpha, or outperformance, through its proprietary fundamental research and disciplined approach to security selection. This focus on active management aims to deliver superior risk-adjusted returns for clients.

In 2024, Barings continued to navigate a dynamic market environment, with a particular emphasis on strategic asset allocation to balance risk and reward. Their commitment to fundamental research underpins their ability to adapt to evolving economic conditions and client needs.

Barings dedicates significant resources to conducting in-depth research across global markets, economic trends, and specific investment opportunities. This foundational activity directly informs their investment decisions, aiming to pinpoint attractive risk-adjusted returns for their clients.

In 2024, Barings' global network of professionals actively contributes to this deep market understanding. For instance, their analysis of emerging market equities in early 2024 highlighted a projected growth rate of 5.2% for the year, a key data point influencing portfolio allocations.

Barings prioritizes building and nurturing robust relationships with diverse clients, such as pension funds and high-net-worth individuals. This focus is crucial for long-term success and client loyalty.

Regular, transparent communication, including detailed performance reports and personalized investment guidance, underpins Barings' client servicing strategy. This proactive approach ensures clients remain informed and satisfied.

In 2024, Barings continued to emphasize delivering an outstanding client experience, aiming for both superior service and investment performance to foster enduring partnerships.

Product Development and Innovation

Barings' core activities center on the continuous creation and enhancement of investment products. This involves developing novel strategies and specialized funds designed to meet the dynamic requirements of clients and the ever-changing financial landscape. For instance, in 2024, Barings continued to expand its alternative investment offerings, a segment that has seen significant client interest.

The firm prioritizes delivering enduring value by fostering innovation across its diverse asset classes. This commitment is reflected in their ongoing research and development efforts, aiming to anticipate future market trends and client demands. Barings aims to be at the forefront of investment solution design.

- Developing new investment strategies: Barings actively designs and launches new funds and strategies to cater to evolving market needs.

- Refining existing solutions: The company continuously improves its current product suite to enhance performance and client outcomes.

- Focus on long-term value: Innovation is geared towards creating sustainable, long-term returns for investors.

- Specialization across asset classes: Barings develops expertise in various asset classes, offering tailored solutions for different investment objectives.

Risk Management and Compliance

Barings prioritizes risk management and compliance by implementing comprehensive frameworks to safeguard client assets and uphold its reputation. A key aspect involves disciplined origination and rigorous credit underwriting processes, ensuring investments align with the firm's risk appetite. For instance, in 2024, Barings continued to focus on enhanced due diligence for all new investments, a strategy that has historically contributed to a lower-than-industry-average default rate on its private credit portfolio.

Adherence to evolving regulatory requirements across all global investment activities is paramount. This commitment ensures operational integrity and protects the firm from potential penalties. Barings dedicates significant resources to compliance training and technology, reflecting the increasing complexity of financial regulations worldwide.

- Robust Risk Frameworks: Barings maintains stringent internal controls and risk assessment protocols for all investment strategies.

- Regulatory Adherence: Continuous monitoring and adaptation to global financial regulations are central to operations.

- Disciplined Origination: A focus on thorough credit analysis and underwriting minimizes potential investment losses.

- Reputational Safeguard: Effective risk management and compliance are crucial for maintaining client trust and market standing.

Barings' key activities revolve around actively managing client portfolios across diverse asset classes, employing proprietary research to generate alpha and deliver superior risk-adjusted returns. This includes developing innovative investment products and strategies, with a particular focus in 2024 on expanding alternative investment offerings to meet growing client demand.

The firm also prioritizes building strong client relationships through transparent communication and personalized guidance, ensuring clients remain informed and satisfied with their investment journey. This client-centric approach is fundamental to fostering long-term partnerships and loyalty.

Furthermore, Barings maintains robust risk management and compliance frameworks, emphasizing disciplined origination and rigorous credit underwriting to safeguard client assets and uphold its reputation. In 2024, this included enhanced due diligence, contributing to a historically low default rate on its private credit portfolio.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Active Portfolio Management | Managing client assets across various asset classes, seeking to outperform benchmarks. | Strategic asset allocation to balance risk and reward in a dynamic market. |

| Investment Product Development | Creating and enhancing new and existing investment strategies and funds. | Expansion of alternative investment offerings driven by client interest. |

| Client Relationship Management | Building and maintaining strong, transparent relationships with clients. | Emphasis on delivering an outstanding client experience through superior service and communication. |

| Risk Management & Compliance | Implementing comprehensive frameworks to protect assets and adhere to regulations. | Enhanced due diligence on new investments, contributing to a lower default rate on private credit. |

Full Document Unlocks After Purchase

Business Model Canvas

The Barings Business Model Canvas preview you are viewing is an authentic representation of the final document you will receive upon purchase. This means the structure, content, and formatting are identical to what you will download, ensuring no surprises. You can be confident that the full, editable version will be exactly as you see it now, ready for your strategic planning.

Resources

Barings' core strength lies in its exceptionally talented team of investment professionals. This includes seasoned managers, skilled analysts, and forward-thinking strategists, each possessing profound knowledge within their respective sectors.

Their collective expertise and commitment to an active management style are fundamental to Barings' ability to consistently deliver superior investment returns and offer valuable, in-depth market perspectives.

With a global workforce exceeding 2,000 professionals, Barings leverages a vast pool of talent to navigate complex financial landscapes and drive client success.

Barings' proprietary research and intellectual capital are foundational. This encompasses unique data sets and sophisticated analytical models, honed over years of market engagement. For instance, in 2024, the firm continued to leverage its deep dive into emerging market debt, identifying specific opportunities in countries showing robust GDP growth and stable inflation, a key differentiator.

This intellectual capital is not static; it’s a living asset that drives differentiated investment opportunities. The firm’s investment methodologies, refined through rigorous back-testing and real-world application, allow for the identification of alpha. In 2024, Barings’ proprietary analysis of supply chain resilience in the semiconductor industry, for example, informed several successful private equity investments.

Barings' global network, spanning North America, Europe, and Asia Pacific, is a cornerstone of its business model, fostering deep relationships with issuers, clients, and industry players. This extensive web of connections grants them privileged access to exclusive deal flow and crucial market intelligence. For instance, in 2023, Barings facilitated investments across a diverse range of sectors, underscoring the breadth of their reach.

These robust relationships are not merely transactional; they serve as vital conduits for Barings' distribution capabilities, enabling efficient placement of assets and capital. The firm's significant global scale and established presence are critical enablers, allowing them to navigate diverse market landscapes effectively and capitalize on opportunities worldwide.

Advanced Technology and Data Infrastructure

Barings leverages state-of-the-art technology platforms, including advanced trading systems, comprehensive portfolio management software, and sophisticated data analytics tools, as a cornerstone of its business model. This robust infrastructure is critical for enabling efficient operations across its diverse investment solutions and for conducting in-depth, sophisticated analysis.

This technological backbone directly supports Barings' ability to manage a wide spectrum of investment strategies, from traditional fixed income to alternative assets. In 2024, the financial services industry saw significant investment in AI and machine learning for data analysis; for instance, firms reported an average of a 15% increase in operational efficiency through AI-driven automation of back-office tasks.

The data infrastructure is paramount for robust risk management, allowing Barings to identify, assess, and mitigate potential threats across its global operations. Effective data management ensures compliance with evolving regulatory landscapes and provides a competitive edge in identifying market opportunities.

Key technology resources include:

- Advanced Trading Platforms: Facilitating high-frequency and complex trade execution.

- Portfolio Management Software: Enabling real-time performance tracking and asset allocation.

- Data Analytics Tools: Supporting predictive modeling and market trend identification.

- Risk Management Systems: Ensuring compliance and safeguarding assets.

Financial Capital and Assets Under Management (AUM)

Barings' financial capital, encompassing its own resources and client assets under management (AUM), is a cornerstone of its business model. This substantial financial base is crucial for its operations and investment capabilities.

As of March 31, 2025, Barings oversees an impressive $442 billion in AUM. This significant scale allows Barings to engage in a wide array of investment strategies and maintain a strong presence in global financial markets.

The vast AUM empowers Barings to conduct diverse investment activities across numerous asset classes and geographies. This financial muscle is a key enabler for its strategic objectives and client service delivery.

- Financial Capital: Barings' own capital and client assets form its primary financial resource.

- Assets Under Management (AUM): As of March 31, 2025, Barings manages over $442 billion.

- Scale and Influence: This AUM provides significant scale, enabling broad market participation.

- Investment Diversity: The financial capital supports diverse investment opportunities across various markets.

Barings' key resources are its people, proprietary research, global network, technological infrastructure, and substantial financial capital. These elements combine to drive its investment strategies and client success.

The firm's human capital, exceeding 2,000 professionals globally, is complemented by proprietary research and sophisticated analytical models, as evidenced by its 2024 deep dives into emerging market debt and semiconductor supply chains.

A robust global network and advanced technology platforms, including AI-driven analytics, further enhance operational efficiency and risk management, supporting Barings' diverse investment strategies.

As of March 31, 2025, Barings manages $442 billion in assets under management, providing the financial scale necessary for broad market participation and diverse investment opportunities.

| Resource Category | Key Components | 2024/2025 Data Point |

|---|---|---|

| Human Capital | Investment Professionals, Analysts, Strategists | Over 2,000 global professionals |

| Intellectual Capital | Proprietary Research, Analytical Models | 2024 focus on emerging market debt and supply chain analysis |

| Network | Global presence (North America, Europe, Asia Pacific) | Facilitated diverse investments in 2023 |

| Technology | Trading Platforms, Portfolio Management Software, Data Analytics | Industry saw 15% average efficiency increase via AI automation in 2024 |

| Financial Capital | Own Capital, Client Assets (AUM) | $442 billion AUM as of March 31, 2025 |

Value Propositions

Barings provides a wide array of investment options, spanning public and private fixed income, real estate, and equity markets. This broad offering ensures clients can find strategies that align with their unique financial goals.

The firm actively manages assets across numerous market segments, demonstrating its extensive reach and capability. For instance, as of the first quarter of 2024, Barings managed approximately $347 billion in assets under management, showcasing the scale of its diversified solutions.

Barings' core value proposition centers on active management, striving to generate alpha and consistently beat market benchmarks. This is achieved through rigorous fundamental research and a disciplined approach to picking individual securities, aiming to deliver superior long-term value for clients.

The firm’s expertise lies in its deep understanding of global markets, allowing it to identify and capitalize on opportunities that others might miss. This specialized knowledge is crucial for creating alpha.

For instance, in 2024, actively managed equity funds globally saw varied performance, but those with strong fundamental research capabilities, like Barings, were often better positioned to navigate market volatility and deliver outperformance compared to passive strategies.

Barings leverages its profound knowledge of global financial markets, with a significant presence spanning North America, Europe, and Asia Pacific. This expansive reach allows for the identification and exploitation of a wide array of investment opportunities across different geographies and asset classes.

The firm boasts a robust network of investment professionals strategically positioned worldwide. As of early 2024, Barings employs over 700 investment professionals, underscoring its commitment to localized expertise and a truly global perspective in navigating complex market landscapes.

Tailored Client-Centric Approach

Barings prioritizes a client-centric model, deeply understanding each client's distinct financial goals. This means tailoring investment strategies to match individual risk tolerance and desired returns, whether for large institutions or affluent individuals.

Their commitment extends to building partnerships, offering flexible financing solutions designed to meet evolving needs. For example, in 2024, Barings reported a significant portion of their new business originated from existing client relationships, underscoring the success of this personalized approach.

This bespoke service ensures that every client receives dedicated attention and strategies that genuinely align with their specific circumstances.

- Personalized Strategy Development

- Alignment with Client Objectives

- Flexible Financing Solutions

- Long-Term Client Partnerships

Commitment to Sustainable and Responsible Investing

Barings deeply embeds sustainable and responsible investing (SRI) across its operations, recognizing that strong environmental, social, and governance (ESG) performance often correlates with long-term financial resilience. This dedication resonates with a growing client base actively seeking investments that align with their values, demonstrating a clear market demand for such strategies.

This commitment extends beyond client portfolios; Barings strives to positively impact its employees and the communities it serves through sustainable practices. For instance, in 2024, Barings reported a 15% reduction in its global office energy consumption compared to 2020, highlighting tangible progress in its environmental stewardship.

- Integration of ESG: Barings systematically incorporates ESG factors into its investment research and decision-making, aiming to identify risks and opportunities not always captured by traditional financial analysis.

- Client Demand: The firm caters to a significant segment of investors who prioritize ESG considerations, with data from late 2023 indicating that over 60% of institutional investors surveyed planned to increase their allocation to sustainable investments in the next two years.

- Holistic Responsibility: Barings' commitment to sustainability encompasses its corporate culture, employee well-being, and community engagement, fostering a comprehensive approach to responsible business.

- Measurable Impact: The firm actively tracks and reports on its sustainability initiatives, such as the aforementioned energy reduction, showcasing a data-driven approach to its SRI value proposition.

Barings offers a comprehensive suite of investment solutions across public and private markets, emphasizing active management to generate alpha. Their global reach, supported by over 700 investment professionals as of early 2024, allows for deep market insights and tailored client strategies.

The firm's client-centric approach focuses on understanding individual financial goals and risk tolerance, fostering long-term partnerships. This is evidenced by a significant portion of new business in 2024 originating from existing client relationships.

Furthermore, Barings integrates sustainable and responsible investing (SRI) by incorporating ESG factors into research, aligning with growing investor demand for value-aligned investments. Their commitment is demonstrated through tangible actions, such as a 15% reduction in global office energy consumption by 2024.

| Value Proposition | Description | Supporting Data/Fact |

| Diversified Investment Offerings | Broad range of public and private fixed income, real estate, and equity strategies. | Managed approximately $347 billion in assets under management as of Q1 2024. |

| Active Management & Alpha Generation | Rigorous fundamental research to outperform market benchmarks. | Actively managed equity funds in 2024 often navigated volatility better than passive strategies. |

| Global Market Expertise | Deep understanding of global financial markets across North America, Europe, and Asia Pacific. | Over 700 investment professionals employed globally as of early 2024. |

| Client-Centric Approach | Tailored investment strategies based on individual financial goals and risk tolerance. | Significant portion of 2024 new business derived from existing client relationships. |

| Sustainable & Responsible Investing (SRI) | Integration of ESG factors into investment decisions and corporate practices. | 15% reduction in global office energy consumption by 2024 (vs. 2020). |

Customer Relationships

Barings cultivates deep client loyalty through specialized service. Dedicated teams and account managers offer tailored support, ensuring every client feels valued and understood. This personalized approach is key to building lasting trust and satisfaction.

Proactive engagement is central to Barings' customer relationship strategy. Regular communication, prompt responses to inquiries, and forward-thinking advice are standard practice. This commitment aims to consistently exceed client expectations and enhance their investment journey.

Barings cultivates client relationships through a deeply consultative and advisory approach. They actively engage with clients to grasp their changing requirements, offering strategic guidance based on thorough financial objective analysis, risk tolerance assessments, and market trend evaluations. This personalized strategy fosters enduring partnerships.

Barings actively cultivates client understanding by offering a wealth of educational resources. This includes insightful market commentaries and forward-thinking thought leadership pieces distributed across multiple platforms, such as their website and client portals.

By providing access to this content, Barings not only deepens client knowledge but also showcases its own profound expertise. For instance, their 2024 market outlook reports detailed significant shifts in fixed income strategies, directly informing client investment decisions and reinforcing trust in the firm's guidance.

Performance Reporting and Transparency

Barings prioritizes transparency in performance reporting to foster strong client relationships. This commitment means clients receive regular, clear, and comprehensive updates on their investments and the firm's operations. For instance, in 2024, Barings continued to emphasize detailed reporting, ensuring clients understand their portfolio's progress and the underlying strategies.

Maintaining high levels of transparency builds and sustains client confidence, a cornerstone of Barings' approach. This involves clear communication regarding financial results and all portfolio activities. Clients expect and receive an open dialogue about how their capital is managed and performing.

- Clear Communication: Barings provides detailed reports outlining investment performance, fees, and portfolio changes.

- Regular Updates: Clients receive timely information, typically on a monthly or quarterly basis, keeping them informed.

- Operational Transparency: Beyond performance, Barings aims to be open about its operational processes and investment decision-making.

- Client Trust: This dedication to transparency is key to building long-term, trusting relationships with a diverse investor base.

Long-Term Partnership Building

Barings prioritizes building lasting relationships, striving to be a trusted long-term partner for its clients. This commitment is demonstrated through consistent investment performance and reliable service delivery, adapting to evolving client requirements. For instance, in 2024, Barings continued to emphasize its client-centric approach across its diverse asset management offerings.

The firm's strategy centers on becoming a dependable ally for investors, fostering loyalty through transparency and a deep understanding of their financial objectives. This dedication to partnership is a cornerstone of their business model, aiming for mutual growth and success over extended periods.

- Client Retention Focus: Barings aims to maintain high client retention rates by consistently meeting and exceeding expectations.

- Adaptive Service Model: They continuously adapt their services to align with the changing needs and market conditions faced by their clients.

- Trusted Advisor Role: The firm actively positions itself as a trusted advisor, offering strategic guidance beyond mere investment management.

- Long-Term Performance Commitment: Barings underscores its dedication to delivering sustained long-term investment performance as a key element of partnership.

Barings fosters enduring client relationships through proactive engagement and a consultative approach, aiming to be a trusted long-term partner. Their commitment to transparency in reporting, evident in their 2024 detailed performance updates, builds crucial client confidence. This client-centric strategy, focused on understanding evolving needs and delivering consistent value, underpins their high client retention goals.

| Relationship Aspect | Barings' Approach | Example (2024 Focus) |

|---|---|---|

| Personalized Support | Dedicated account managers and specialized teams offer tailored advice. | Ensuring individual client needs are met with bespoke solutions. |

| Proactive Communication | Regular updates, prompt responses, and forward-thinking market insights. | Distributing 2024 market outlook reports to guide investment strategies. |

| Transparency | Clear and comprehensive reporting on performance, fees, and operations. | Detailed portfolio progress reports provided consistently throughout 2024. |

| Long-Term Partnership | Focus on client retention and adapting services to evolving requirements. | Maintaining a client-centric approach across diverse asset management offerings. |

Channels

Barings leverages a direct sales force and dedicated relationship managers to cultivate deep connections with institutional clients, insurance companies, and high-net-worth individuals worldwide. This hands-on approach is crucial for understanding unique client needs and crafting tailored investment solutions.

In 2024, Barings reported that its direct client engagement strategy was instrumental in acquiring a significant portion of its new assets under management, demonstrating the channel's effectiveness in client acquisition and fostering long-term relationships.

This direct channel facilitates personalized interactions, enabling Barings to deliver bespoke solutions and maintain high levels of client satisfaction, which is a cornerstone of their client retention efforts.

Barings leverages a robust network of investment consultants and third-party distributors to expand its market reach. These crucial intermediaries act as a conduit, introducing Barings' investment solutions to a wider array of institutional investors and wealth management clients.

In 2024, the global investment consulting market continued to grow, with consultants playing a significant role in asset allocation decisions for large pension funds and endowments. Barings' strategic engagement with these firms ensures its expertise is considered for substantial mandates.

Third-party distributors, including platforms and financial advisors, are vital for accessing the retail and high-net-worth segments. These partnerships allow Barings to offer its specialized strategies to a more diverse client base, enhancing distribution efficiency.

Barings utilizes its corporate website as a primary digital platform, offering clients access to vital information, market insights, and performance reports. This digital channel is crucial for transparent communication and client engagement, ensuring accessibility to key data and strategic perspectives.

In 2024, Barings continued to enhance its digital offerings, with its website serving as a central hub for investment solutions and thought leadership. The firm's commitment to digital platforms underscores its strategy of providing clients with timely and comprehensive financial data, fostering trust and informed decision-making.

Industry Conferences and Events

Barings actively participates in major industry conferences and exclusive client events globally. These gatherings serve as crucial touchpoints for demonstrating thought leadership, building professional networks, and engaging directly with both existing and potential clients. For instance, in 2024, Barings representatives were prominent speakers at events like the annual CFA Institute Annual Conference and various regional asset management forums, discussing macroeconomic trends and investment strategies.

These engagements are vital for showcasing Barings' deep expertise and fostering stronger relationships within the financial community. By presenting research and insights at these platforms, the firm reinforces its position as a trusted advisor and thought leader. The firm’s presence at these events in 2024 included participation in over 30 key international financial summits, reaching thousands of industry professionals.

- Thought Leadership: Presenting research and insights at global conferences.

- Networking: Connecting with industry peers, potential clients, and partners.

- Client Engagement: Direct interaction with current and prospective clients to understand needs and showcase capabilities.

- Brand Visibility: Enhancing Barings' presence and reputation in the financial sector.

Media and Public Relations

Barings leverages strategic media and public relations to amplify its market insights and corporate achievements. This channel is crucial for building brand recognition and trust among investors and industry peers, ensuring Barings’ perspectives on financial markets and its latest product developments reach a broad audience. For instance, in 2024, Barings actively engaged with media outlets to discuss evolving market dynamics, particularly concerning inflation and interest rate outlooks, aiming to position itself as a thought leader.

The firm's PR efforts are designed to secure positive financial news coverage, including timely reporting of its financial results. This consistent communication strategy helps to reinforce Barings' reputation for stability and performance. In the first half of 2024, Barings reported a notable increase in assets under management, a key metric often highlighted in its public relations communications, demonstrating growth and investor confidence.

- Strategic Media Outreach: Proactive engagement with financial journalists and media outlets to share Barings' market commentary and firm news.

- Press Releases: Dissemination of official announcements regarding financial performance, new strategies, and significant business developments.

- Financial News Coverage: Securing placements in reputable financial publications to enhance brand visibility and communicate achievements, such as reporting positive asset growth in early 2024.

- Thought Leadership: Positioning Barings' experts as authoritative voices on key economic and investment trends through media interviews and published articles.

Barings utilizes a multi-faceted approach to connect with its clients, prioritizing direct relationships and strategic partnerships. These channels are designed to deliver tailored investment solutions and maintain strong client engagement across diverse investor segments.

The firm's direct sales force and relationship managers focus on institutional clients, insurance companies, and high-net-worth individuals, fostering deep understanding and customized offerings. In 2024, this direct engagement was a key driver of new assets under management.

Furthermore, Barings partners with investment consultants and third-party distributors to broaden its market reach, effectively accessing both institutional and retail markets. This strategy was particularly evident in 2024 as the firm navigated a growing global investment consulting landscape.

A robust digital presence via its corporate website provides clients with essential information and market insights, enhancing transparency and accessibility. Barings' commitment to digital enhancement in 2024 ensured clients had timely access to performance data and thought leadership.

Customer Segments

Institutional investors, including major pension funds, university endowments, charitable foundations, and significant sovereign wealth funds, represent a core client base for Barings. These sophisticated entities demand highly tailored investment strategies, comprehensive risk oversight, and transparent, in-depth performance analytics.

Barings is actively focused on deepening relationships with large sovereign wealth funds, recognizing their substantial capital and long-term investment horizons. As of early 2024, sovereign wealth funds globally managed assets exceeding $10 trillion, with many seeking diversified, global investment opportunities that Barings is well-positioned to provide.

Barings offers insurance companies specialized investment strategies designed to meet their specific regulatory requirements, capital needs, and liability management objectives. These solutions often concentrate on fixed income and private credit to achieve desired yield and duration targets, crucial for insurers' long-term financial health.

Insurers, by their nature, place a high priority on safety and stability, thus favoring investments in higher-rated securities. For instance, in 2024, the demand for investment-grade corporate bonds, a common allocation for insurers, remained robust, with total issuance exceeding $1.5 trillion globally, reflecting this preference.

High-Net-Worth Individuals (HNWIs) and family offices represent a key customer segment for Barings, characterized by their substantial financial assets and demand for sophisticated wealth management. These clients, often with investable assets exceeding $1 million, seek personalized investment strategies and direct access to experienced financial professionals. In 2024, the global HNWI population continued to grow, with estimates suggesting over 22 million individuals worldwide, managing trillions in wealth.

Barings caters to this discerning clientele by providing bespoke portfolio management, alternative investment opportunities, and comprehensive financial planning services. This includes access to Barings' global investment expertise across various asset classes, from public equities and fixed income to private equity and real estate, ensuring strategies are aligned with individual risk tolerance and long-term wealth preservation goals.

Financial Intermediaries and Advisors

Financial intermediaries and advisors, including wealth managers and independent broker-dealers, form a crucial customer segment for Barings. These professionals leverage Barings' investment products and deep market expertise to construct and manage portfolios for their diverse client base. By offering accessible investment vehicles and dedicated support, Barings empowers these advisors to meet their clients' financial objectives.

Barings' strategic partnerships with these intermediaries are instrumental in expanding its market reach. These collaborations allow Barings to tap into established networks of clients, fostering growth and increasing distribution of its investment solutions. As of 2024, the global wealth management market continues to see significant inflows, with many advisors actively seeking specialized investment strategies and robust support services, areas where Barings excels.

- Key Intermediary Needs: Access to diverse asset classes, institutional-grade research, and efficient trading platforms.

- Barings' Value Proposition: Providing tailored investment solutions and dedicated advisor support to enhance client outcomes.

- Market Trend: Continued growth in outsourcing investment management by financial advisors, driving demand for external asset managers like Barings.

- 2024 Data Point: The global assets under management for wealth management firms are projected to reach over $100 trillion by the end of 2024, highlighting the scale of this intermediary segment.

Middle-Market Companies

Barings actively supports middle-market companies through its private credit and capital solutions. These businesses, spanning diverse sectors, seek adaptable financing options like direct lending and private placements.

The firm's focus within this segment is on providing senior secured loans. This strategy aligns with Barings' commitment to offering robust capital to growing enterprises.

In 2024, the middle market continued to be a significant area of focus for private credit investors. For instance, the middle market private debt market saw substantial deal activity, with many companies leveraging these avenues for expansion and operational needs.

- Targeting Diverse Industries: Barings caters to a broad range of middle-market businesses, from manufacturing to technology, requiring tailored financing.

- Flexible Financing Solutions: The emphasis is on providing direct lending and private placement debt, offering alternatives to traditional bank financing.

- Senior Secured Loan Focus: Barings primarily invests in senior secured loans, aiming for lower risk profiles and strong collateral backing within this segment.

Barings serves a diverse array of institutional investors, including pension funds, endowments, and foundations. These clients require sophisticated, customized strategies and rigorous risk management, often seeking global diversification and long-term capital appreciation.

The firm also targets sovereign wealth funds, recognizing their substantial capital pools and long-term investment horizons. As of early 2024, sovereign wealth funds globally managed assets exceeding $10 trillion, with many actively seeking diversified global investment opportunities.

Insurance companies represent another key segment, with Barings providing specialized investment strategies to meet regulatory needs and liability management objectives. These often focus on fixed income and private credit, crucial for insurers' long-term financial stability, with investment-grade corporate bonds remaining a favored, high-demand asset class in 2024.

| Customer Segment | Key Characteristics | Barings' Offering | 2024 Market Insight |

|---|---|---|---|

| Institutional Investors | Large asset pools, need for tailored strategies, risk oversight, performance analytics. | Customized investment strategies, global diversification, alternative investments. | Continued demand for yield and diversification in a complex market. |

| Sovereign Wealth Funds | Significant capital, long-term investment horizons, global diversification needs. | Global investment expertise across asset classes, long-term partnerships. | Global SWF assets exceeded $10 trillion in early 2024. |

| Insurance Companies | Regulatory requirements, capital needs, liability management, preference for safety. | Fixed income, private credit, strategies aligned with duration and yield targets. | Robust demand for investment-grade corporate bonds, exceeding $1.5 trillion in global issuance in 2024. |

Cost Structure

Barings dedicates a substantial portion of its expenses to its personnel, encompassing salaries, bonuses, and benefits for its extensive team of investment professionals and support staff. This significant investment underscores the human capital-intensive nature of their active asset management approach.

In 2024, compensation for Barings' employees, including the annual board retainers for independent trustees, represents a core cost driver. This reflects the specialized skills and expertise required to navigate complex financial markets and deliver value to clients.

Barings invests heavily in its technology and data infrastructure, recognizing its critical role in delivering value. These costs are substantial, encompassing everything from cutting-edge financial technology platforms to essential data subscriptions. For example, in 2024, the financial services industry saw significant spending on cloud migration and advanced analytics tools, with some firms allocating upwards of 15-20% of their IT budgets to these areas to enhance operational efficiency and data-driven decision-making.

Marketing and distribution costs are a significant expense for Barings, encompassing client acquisition and retention efforts. These expenditures fuel brand visibility and client engagement through various initiatives.

In 2024, Barings continued to invest in digital marketing campaigns and participation in key industry conferences to reach a wider audience and strengthen relationships with existing clients. Such activities are crucial for maintaining a competitive edge in the asset management sector.

Operational and Administrative Overheads

Barings’ operational and administrative overheads are fundamental to its global investment management activities. These costs encompass essential day-to-day expenditures necessary for maintaining a robust business infrastructure.

Key components include significant outlays for office leases across its international locations, supporting a global workforce. Administrative support, encompassing human resources, IT, and back-office functions, is also a substantial cost driver. Furthermore, Barings incurs considerable legal and compliance fees to navigate complex regulatory environments worldwide.

- Office Leases: Barings maintains a global presence, requiring expenditure on prime office spaces in key financial centers.

- Administrative Support: Costs associated with IT infrastructure, HR, finance, and other essential administrative functions.

- Legal and Compliance: Fees for legal counsel, regulatory filings, and ongoing compliance efforts are significant.

- Other Day-to-Day Expenditures: Includes utilities, insurance, travel, and general office supplies.

Research and Analytics Costs

Barings' cost structure is significantly influenced by its substantial investment in research and analytics. These costs are essential for conducting thorough market research, detailed economic analysis, and rigorous due diligence on potential investment opportunities. This commitment to data-driven insights directly supports informed and strategic investment decisions across all their portfolios.

These expenses encompass critical elements such as:

- Subscriptions to leading financial data providers and research services, ensuring access to real-time market intelligence and expert analysis.

- Internal research team salaries and operational expenses, supporting a dedicated group of analysts and economists focused on identifying and evaluating investment prospects.

- Data acquisition and analytical software licenses, enabling sophisticated modeling and quantitative analysis.

- Travel and due diligence expenses related to on-site assessments of companies and markets globally.

For instance, in 2024, the global financial services industry saw significant spending on data and analytics, with firms allocating a notable portion of their budgets to these functions to maintain a competitive edge and navigate complex market conditions.

Barings' cost structure is heavily weighted towards its people, reflecting the talent-driven nature of asset management. Significant investments in compensation and benefits for its skilled workforce are paramount. In 2024, employee compensation, including executive and trustee retainers, remained a primary cost. This highlights the value placed on specialized expertise in navigating global markets.

Technology and data infrastructure are also substantial cost centers for Barings. These investments are crucial for operational efficiency and informed decision-making. In 2024, the firm continued to allocate resources to advanced analytics and cloud solutions, mirroring industry trends where such spending can represent a significant portion of IT budgets to maintain a competitive edge.

Marketing and distribution expenses are vital for client acquisition and relationship management. Barings invests in digital campaigns and industry events to enhance brand visibility. Operational and administrative overheads, including global office leases, IT support, HR, and legal compliance, form another significant layer of costs necessary for global operations.

| Cost Category | Description | 2024 Relevance/Example |

|---|---|---|

| Personnel Costs | Salaries, bonuses, benefits for investment and support staff. | Core driver, reflecting human capital intensity. Includes board retainers. |

| Technology & Data Infrastructure | Financial platforms, data subscriptions, analytics tools. | Significant investment in cloud migration and advanced analytics, mirroring industry trends. |

| Marketing & Distribution | Client acquisition and retention efforts, brand building. | Investment in digital marketing and industry conferences. |

| Operational & Administrative Overheads | Office leases, IT support, HR, legal, compliance. | Essential for global operations; includes prime office spaces and regulatory compliance fees. |

| Research & Analytics | Data provider subscriptions, internal research teams, software licenses. | Crucial for market intelligence and due diligence, with notable industry spending in 2024. |

Revenue Streams

Barings' primary revenue engine is its management fees, a crucial component of its business model. These fees are directly tied to the assets under management (AUM), representing a percentage charged for the ongoing stewardship of client investment portfolios.

As of the first quarter of 2024, Barings reported a substantial $442 billion in assets under management. This significant AUM base underscores the scale of its operations and the consistent revenue generated from these asset-based fees.

Barings may earn performance fees, often referred to as incentive fees, for specific investment strategies or funds. These fees are typically calculated based on the achievement of pre-defined investment benchmarks or outperforming a particular market index. For instance, if a fund exceeds its benchmark by a certain percentage, Barings might receive a portion of those excess returns, which can include realized capital gains. This structure is designed to directly align the firm's interests with those of its clients, motivating Barings to strive for superior investment results.

Barings earns revenue through fees tied to specific investment activities, especially within private markets like private credit and real estate. These fees often come from originating new loans or structuring private placements.

In 2024 alone, Barings successfully completed 53 new private placement investments, demonstrating a robust pipeline and active deal origination that directly contributes to their fee-based revenue.

Advisory and Consulting Fees

Barings generates revenue through advisory and consulting fees, offering specialized, bespoke advice to institutional clients. These fees are tied to services like portfolio strategy development, risk management solutions, and tailored asset allocation guidance. This revenue stream supplements their primary investment management offerings.

These advisory services are particularly valuable for clients seeking in-depth expertise beyond standard fund management. For instance, during 2024, Barings continued to emphasize its role as a strategic partner, with a significant portion of its institutional client base engaging these specialized advisory services. While specific figures for advisory fees are often bundled within broader service agreements, the growth in demand for customized financial solutions underscores the importance of this revenue stream.

- Specialized Advice: Fees are generated from providing expert guidance on complex financial matters.

- Client Focus: Services are tailored for institutional clients needing custom solutions.

- Complementary Offering: Advisory fees enhance the core investment management business.

- Strategic Partnership: Barings positions itself as a long-term advisor, not just a fund manager.

Interest Income from Debt Investments

Barings generates substantial interest income by investing in a wide array of debt instruments, particularly within the fixed income and private credit markets. This forms a predictable and core part of its revenue. For instance, as of the first quarter of 2024, Barings reported strong performance in its private credit strategies, which directly contribute to this income stream.

A significant portion of this interest income is derived from senior secured loans extended to middle-market companies. These loans typically offer attractive yields and are considered a cornerstone of Barings’ investment income. The firm's expertise in underwriting and managing these credit facilities ensures a consistent return for its investors.

- Interest Income: Barings earns revenue from the interest paid on its debt investments.

- Fixed Income and Private Credit: This revenue is primarily generated from holdings in these asset classes.

- Senior Secured Loans: A key source is interest from loans to middle-market businesses.

- Consistent Revenue Stream: This income is a reliable component of Barings' overall financial performance.

Barings' revenue streams are diverse, primarily driven by management fees on its substantial assets under management, which reached $442 billion in Q1 2024. Additionally, performance fees are earned when investment strategies exceed benchmarks, aligning firm interests with client success. The firm also generates revenue from origination and structuring fees in private credit and real estate, evidenced by 53 new private placement investments in 2024. Advisory and consulting fees for bespoke institutional client solutions, alongside significant interest income from fixed income and private credit investments like senior secured loans, further bolster its financial performance.

| Revenue Stream | Description | 2024 Data/Context |

|---|---|---|

| Management Fees | Percentage of Assets Under Management (AUM) | $442 billion AUM (Q1 2024) |

| Performance Fees | Based on outperforming investment benchmarks | Tied to fund performance against specific targets |

| Private Markets Fees | Origination and structuring fees | 53 new private placement investments (2024) |

| Advisory & Consulting Fees | Bespoke financial guidance for institutional clients | Growing demand for customized solutions |

| Interest Income | From debt instruments, fixed income, and private credit | Strong performance in private credit strategies (Q1 2024) |

Business Model Canvas Data Sources

Barings' Business Model Canvas is built upon comprehensive market intelligence, internal financial data, and strategic assessments of industry trends. These diverse sources ensure a robust and accurate representation of our business strategy.