Barings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barings Bundle

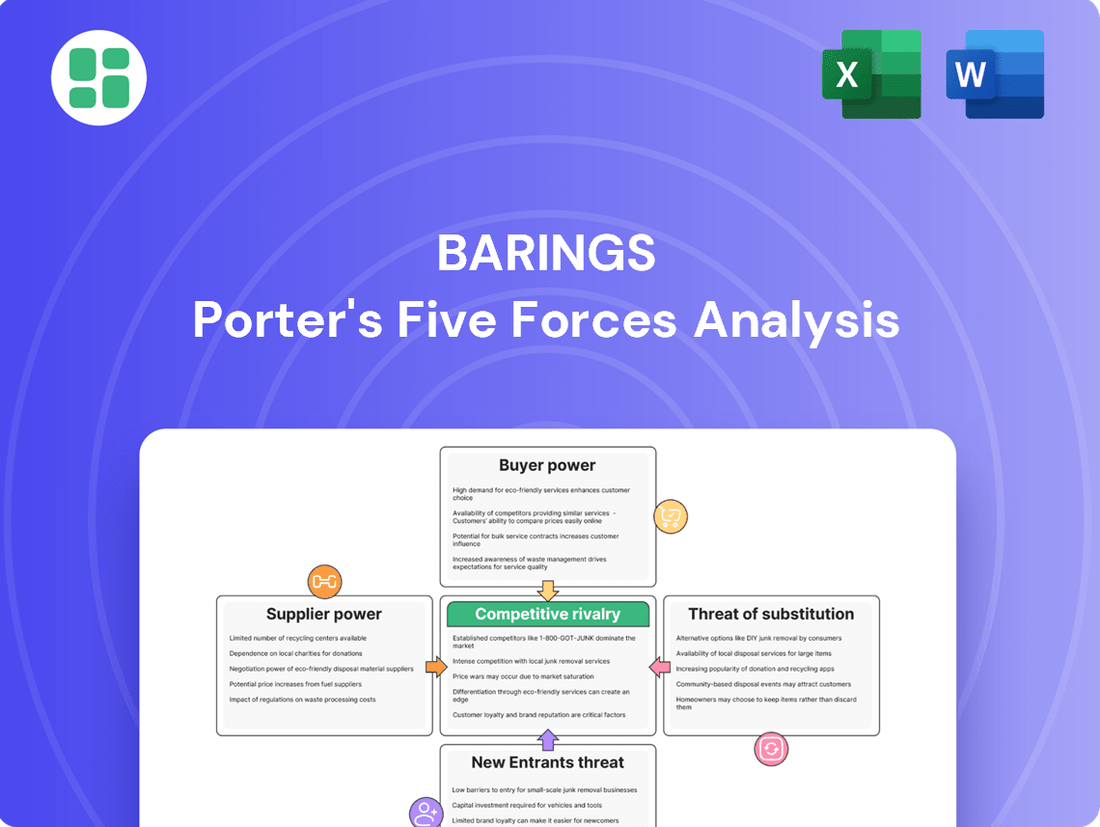

Barings's competitive landscape is shaped by the interplay of five key forces: the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for any strategic decision-making.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Barings’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Barings' reliance on specialized financial data and analytics providers means these suppliers can wield significant bargaining power. If their data is proprietary or offers a unique competitive advantage, Barings faces higher costs. For instance, a significant portion of the global financial data market is dominated by a few key players, allowing them to command premium pricing.

The bargaining power of suppliers, particularly in the form of highly skilled investment professionals, is a significant factor for Barings. The asset management industry's intense competition for top talent means that experienced portfolio managers and analysts can command premium compensation packages and exert considerable influence over their working conditions. This demand for specialized expertise, especially in areas like alternative investments or quantitative analysis, directly impacts Barings' ability to attract and retain the talent essential for its active management strategies.

In 2024, the average compensation for a senior portfolio manager in the US asset management sector often exceeded $250,000 annually, with bonuses and profit-sharing further increasing total earnings. This high cost reflects the direct correlation between skilled talent and investment performance, giving these professionals substantial leverage. Barings, like its peers, must therefore offer competitive remuneration and compelling career growth to secure and keep these crucial individuals, as their departure can disrupt fund management and client relationships.

Technology and software vendors hold considerable sway over financial firms like Barings. These suppliers provide essential tools for trading platforms, risk assessment, client relationship management, and crucially, regulatory adherence. For instance, specialized software for intricate compliance reporting, like the EU's MiFID II or the US's Dodd-Frank Act, demands deep expertise, granting these vendors significant leverage. In 2024, the financial services sector continued to invest heavily in technology, with global IT spending projected to reach over $600 billion, highlighting the reliance on these specialized providers.

The bargaining power of these vendors is amplified by the substantial costs and operational disruptions associated with switching. Implementing new enterprise resource planning (ERP) systems or customer relationship management (CRM) software can take years and cost millions, making incumbent providers difficult to displace. This stickiness is particularly evident in areas like cybersecurity, where a breach could have catastrophic financial and reputational consequences, further solidifying the power of trusted, established software vendors.

Custody, Fund Administration, and Back-Office Service Providers

Custody, fund administration, and back-office service providers can wield significant bargaining power. While the market may appear to have numerous players, the specialized nature of these services, coupled with the substantial costs and risks involved in switching providers, grants existing suppliers considerable leverage. For a global investment manager like Barings, the efficiency and reliability of these outsourced operations are paramount for smooth functioning and regulatory compliance.

The bargaining power of these suppliers is amplified by several factors:

- High Switching Costs: Migrating complex operational data and processes to a new provider can be incredibly time-consuming and expensive, often running into millions of dollars for large asset managers.

- Specialized Expertise: These providers possess niche expertise in areas like regulatory reporting, trade settlement, and NAV calculation, which are critical and difficult to replicate internally or outsource to less specialized firms.

- Interdependence: Barings relies heavily on the accuracy and timeliness of these services to meet client obligations and regulatory deadlines. Any disruption can lead to significant reputational damage and financial penalties.

- Limited True Alternatives: Despite a large number of entities offering these services, the number of providers with the scale, technological infrastructure, and regulatory approvals required by a global investment manager is often more limited, concentrating power.

Research and Advisory Service Firms

Research and advisory service firms can wield significant bargaining power over entities like Barings, particularly when they offer specialized expertise or proprietary data. For instance, a boutique firm with unique insights into emerging markets or a specific alternative asset class might command higher fees, as their specialized knowledge is difficult to replicate internally. This is especially true if their research provides a distinct competitive edge, making Barings more dependent on their services.

The bargaining power of these suppliers can be seen as moderate to high. In 2024, the global market for financial research and advisory services was valued in the tens of billions of dollars, indicating a substantial industry with many players. However, the value of a specific firm's contribution is often tied to its uniqueness and the impact of its insights on investment decisions. For example, if a particular advisory service helps Barings identify a lucrative investment opportunity that generates substantial returns, the perceived value and thus the supplier's bargaining power increases.

- Unique Expertise: Firms offering specialized knowledge in niche markets or complex financial instruments hold stronger bargaining positions.

- Proprietary Data & Models: Exclusive access to unique datasets or analytical frameworks enhances a supplier's leverage.

- Competitive Advantage: Research that provides a tangible edge in investment performance increases reliance and bargaining power.

- Market Dynamics: The overall demand for specialized financial intelligence influences the pricing power of advisory firms.

Suppliers of specialized financial data and proprietary analytics can exert significant bargaining power over Barings. This is due to the critical nature of this data for competitive advantage and the concentrated nature of the data provider market. For example, in 2024, a few dominant firms controlled a substantial portion of global financial data, enabling premium pricing.

Highly skilled investment professionals, such as portfolio managers, represent another powerful supplier group. The intense competition for top talent in asset management, particularly in niche areas like alternative investments, allows these individuals to command high compensation and favorable terms. In 2024, senior portfolio manager compensation in the US frequently surpassed $250,000 annually, underscoring their leverage.

Technology and software vendors also hold considerable sway, providing essential tools for trading, risk management, and regulatory compliance. The high costs and operational risks associated with switching these critical systems, such as specialized compliance software, make incumbent providers difficult to replace. Global IT spending in financial services exceeded $600 billion in 2024, highlighting this reliance.

| Supplier Type | Bargaining Power Factor | Example Impact | 2024 Data Point |

|---|---|---|---|

| Data Providers | Proprietary data, market concentration | Higher subscription costs | Few key players dominate global financial data market |

| Skilled Professionals | High demand, specialized skills | Increased compensation demands | Senior portfolio manager salaries >$250k annually (US) |

| Tech Vendors | High switching costs, critical systems | Vendor lock-in, premium pricing | Financial services IT spending >$600 billion globally |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Barings' financial services environment.

Effortlessly visualize competitive intensity with a dynamic, interactive dashboard that highlights key pressure points across all five forces.

Customers Bargaining Power

Barings' significant institutional clients, like pension funds and insurance companies, manage immense capital. This scale inherently grants them considerable negotiating power.

These large clients can leverage their substantial assets to demand lower management fees and highly customized investment strategies, directly impacting Barings' profitability and operational focus.

Their capacity to shift large volumes of assets provides significant leverage, allowing them to influence reporting standards and service level agreements, thereby shaping the terms of their relationship with Barings.

The sheer number of investment managers available significantly empowers customers. Clients can choose from large global asset management firms, niche boutique funds, and even low-cost passive investment vehicles like ETFs. For instance, as of early 2024, the global ETF market alone held over $11 trillion in assets, showcasing the vast array of accessible investment options.

This abundance of alternatives means clients can readily switch managers if they find better performance, lower fees, or superior service elsewhere. This ease of switching directly translates into increased bargaining power for customers, forcing investment firms to compete more aggressively on these fronts.

Consequently, firms like Barings must consistently prove their value proposition. This involves demonstrating strong investment performance, competitive fee structures, and exceptional client service to retain their existing client base and attract new ones in a crowded marketplace.

Clients today are highly attuned to both the costs associated with investment management and the actual results delivered. This heightened awareness means that firms like Barings must consistently demonstrate value to retain business.

The asset management sector has seen significant fee compression, with industry-wide average management fees for equity funds dropping to around 0.45% by the end of 2023, according to industry reports. This trend forces clients to demand competitive pricing, particularly when investment strategies fail to beat their respective benchmarks.

Barings, therefore, operates under continuous pressure to validate its fee structure by delivering robust and consistent investment performance. Any perceived underperformance against market benchmarks can quickly lead clients to seek more cost-effective alternatives.

Sophistication and Financial Literacy of Client Base

Barings' client base, comprising sophisticated institutional investors and high-net-worth individuals, demonstrates a high degree of financial literacy. This informed clientele actively scrutinizes investment strategies and demands bespoke solutions, thereby increasing their bargaining power.

Their ability to critically assess Barings' offerings means clients are less likely to accept standardized products, instead seeking highly customized and efficient services. For instance, in 2024, a significant portion of Barings' assets under management came from institutional clients who often have dedicated teams evaluating investment managers.

- Informed Decision-Making: Clients can readily compare Barings' performance and fees against competitors.

- Demand for Customization: Sophisticated clients require tailored investment strategies, increasing operational complexity and service costs for Barings.

- Performance Scrutiny: A well-informed client base actively monitors portfolio returns, pressuring managers to deliver consistent outperformance.

- Fee Sensitivity: High financial literacy often correlates with a greater awareness and negotiation of management fees.

Relatively Low Client Switching Costs for Liquid Assets

The bargaining power of customers is relatively low for Barings when it comes to liquid assets due to low client switching costs. Clients can easily move their investments, such as publicly traded stocks and bonds, from one investment manager to another. This ease of transfer, often facilitated by digital platforms and standardized processes, means clients have significant leverage.

For instance, in 2024, the global asset management industry saw continued emphasis on fee compression, driven by client demand for lower costs. This trend underscores how clients can readily seek out managers offering more competitive fee structures. The ability to reallocate capital quickly based on performance, service quality, or fees directly enhances client bargaining power.

- Low Switching Costs: Clients face minimal financial penalties or complex procedures when moving liquid assets.

- Digital Facilitation: Online platforms and streamlined processes make transferring investments straightforward.

- Fee Sensitivity: Clients are empowered to seek better fee arrangements, pressuring managers to remain competitive.

- Performance Driven: Superior returns or service from a competitor can quickly draw assets away.

Barings' customers possess substantial bargaining power, largely driven by the sheer volume of assets they manage and their sophisticated understanding of financial markets. This allows them to negotiate favorable terms, including lower fees and highly customized investment solutions, directly impacting the firm's profitability.

The availability of numerous alternative investment managers, from global giants to niche boutiques, empowers clients to easily switch providers if they find better performance, lower costs, or superior service. For example, the global ETF market, exceeding $11 trillion in assets by early 2024, highlights the vast array of accessible investment options available to clients.

Clients are increasingly price-sensitive, with average equity fund management fees dropping to approximately 0.45% by the end of 2023. This trend forces firms like Barings to continuously justify their fee structures through strong, consistent investment performance to retain their client base.

The bargaining power of customers is amplified by low switching costs for liquid assets, enabling clients to readily move their investments between managers. This ease of transfer, often facilitated by digital platforms, gives clients significant leverage to seek out more competitive fee arrangements and better performance, as evidenced by the ongoing fee compression trend in the asset management industry throughout 2024.

| Factor | Impact on Barings | Supporting Data (as of early 2024) |

|---|---|---|

| Client Asset Size | High leverage for fee negotiation and customization demands. | Large institutional clients manage immense capital, granting significant negotiating power. |

| Availability of Alternatives | Pressure to differentiate on performance, fees, and service. | Global ETF market exceeded $11 trillion in assets, offering vast choices. |

| Client Financial Literacy | Demand for bespoke solutions and scrutiny of performance/fees. | Sophisticated clients actively assess strategies, often with dedicated evaluation teams. |

| Switching Costs (Liquid Assets) | Low costs empower clients to move assets easily. | Digital platforms and standardized processes facilitate quick asset reallocation. |

Preview the Actual Deliverable

Barings Porter's Five Forces Analysis

This preview showcases the complete Barings Porter's Five Forces analysis, providing a thorough examination of the competitive landscape. You're looking at the actual document; once purchased, you'll receive instant access to this exact, professionally formatted file, ready for immediate use.

Rivalry Among Competitors

The global asset management arena is incredibly crowded, with numerous firms vying for investor capital. This fragmentation means Barings faces intense rivalry from a wide array of competitors, from massive, diversified financial institutions to nimble, specialized boutique firms. For instance, as of Q1 2024, the top 10 global asset managers held over $50 trillion in assets under management, highlighting the scale of the players Barings must contend with.

Barings directly competes with these giants for both institutional mandates and retail investor flows across a spectrum of asset classes. This intense competition for market share forces firms like Barings to constantly innovate and differentiate their offerings, often leading to pressure on fees and a continuous need to demonstrate superior performance and client service.

Competitive rivalry in asset management, including Barings, often centers on demonstrating superior investment performance, particularly in active management. This necessitates building deep expertise in niche or complex asset classes such as private credit and real estate.

Barings' focus on delivering long-term value through active management requires consistent outperformance to attract and retain clients. For instance, in 2023, the average actively managed global equity fund underperformed its benchmark, highlighting the challenge of differentiation. This necessitates continuous innovation in strategies to stand out.

The asset management industry, including firms like Barings, is experiencing continuous pressure on management fees. This is largely due to the rising popularity of passive investment strategies, like index funds, which typically charge lower fees. For instance, in 2024, the trend of assets flowing into passive funds continued, further intensifying competition for active managers who rely on higher fees to cover research, talent, and technology.

This downward pressure on fees directly impacts profitability and profit margins for active managers. Barings, like its peers, must find ways to operate efficiently and maintain investment in critical areas such as advanced analytics, artificial intelligence, and attracting top investment talent, all while facing reduced revenue per dollar managed. This delicate balancing act is crucial for sustaining competitive advantage and delivering long-term value.

Importance of Brand Reputation and Distribution Strength

Barings' established brand reputation and robust global distribution networks are significant competitive advantages. These assets, built on a strong track record, allow the firm to leverage existing client relationships effectively.

However, competitive rivalry is intense, with rivals actively investing in marketing, digital distribution channels, and expanding their geographic footprint. This aggressive pursuit of new clients puts continuous pressure on Barings to innovate and maintain its market position.

For instance, in 2024, many asset management firms reported substantial increases in marketing spend. BlackRock, a major competitor, allocated over $1 billion to marketing and distribution efforts, aiming to enhance its brand visibility and reach. Similarly, Vanguard continued its focus on low-cost investment products, which, combined with its strong brand, attracted significant net inflows, reaching over $300 billion in new assets in early 2024 alone.

- Brand Equity: A strong brand name reduces customer acquisition costs and fosters loyalty.

- Distribution Reach: Extensive networks, both physical and digital, are vital for accessing diverse client segments.

- Competitor Investment: Rivals are channeling significant resources into marketing and digital platforms to gain market share.

- Geographic Expansion: Competitors are actively broadening their presence in emerging markets to tap into new client bases.

Rapid Technological Advancements and Innovation

Competitors are pouring resources into cutting-edge technologies like artificial intelligence, machine learning, and advanced data analytics. These investments aim to sharpen investment decision-making, streamline operations, and deepen client relationships.

Barings faces pressure to not only match but also lead these technological advancements. Staying current is crucial for developing innovative products and enhancing service quality to retain its competitive standing.

The financial services sector, including asset management, sees digital transformation as a primary arena for achieving market leadership. For instance, in 2024, global spending on AI in financial services was projected to reach over $20 billion, highlighting the intensity of this technological race.

- AI and Machine Learning: Used for predictive analytics, algorithmic trading, and risk management.

- Data Analytics: Essential for uncovering market trends and client behavior insights.

- Digital Platforms: Critical for client onboarding, communication, and portfolio management.

- Operational Efficiency: Technology adoption drives cost reduction and faster processing times.

The asset management industry is highly competitive, with Barings facing rivals ranging from global giants to specialized boutiques. In Q1 2024, the top 10 global asset managers collectively managed over $50 trillion, underscoring the scale of competition for market share and investor capital.

This intense rivalry compels firms like Barings to differentiate through superior investment performance, especially in active management, and to manage fee pressures exacerbated by the ongoing shift towards lower-cost passive strategies. For example, in 2023, many actively managed global equity funds underperformed their benchmarks, making differentiation a critical challenge.

Competitors are significantly investing in technology, such as AI and advanced data analytics, to enhance decision-making and operational efficiency. Global spending on AI in financial services was projected to exceed $20 billion in 2024, indicating the critical need for Barings to innovate technologically to maintain its competitive edge.

| Metric | Barings' Competitors (Examples) | 2024 Data/Trend |

|---|---|---|

| Assets Under Management (Top 10 Global) | BlackRock, Vanguard, Fidelity | Over $50 trillion (Q1 2024) |

| Passive Fund Inflows | Vanguard, BlackRock | Over $300 billion (early 2024) |

| Marketing Spend | BlackRock | Over $1 billion |

| AI Spending in Financial Services | Industry-wide | Projected over $20 billion |

SSubstitutes Threaten

The significant and ongoing growth of passive investment vehicles, like ETFs and index funds, presents a substantial threat of substitutes for Barings. These products often come with lower fees and provide broad market exposure, making them attractive to cost-conscious investors who might otherwise choose actively managed funds.

As of early 2024, passive funds continue to capture market share, with assets under management in global ETFs reaching over $11 trillion. This trend directly impacts the demand for Barings' active management strategies, as investors increasingly favor the simplicity and cost-effectiveness of passive options.

Sophisticated institutional investors, family offices, and high-net-worth individuals are increasingly capable of managing their assets internally or investing directly in private markets, effectively bypassing traditional external asset managers. This trend is driven by enhanced access to market data and the proliferation of alternative investment platforms, allowing these clients to disintermediate established asset management services.

For instance, in 2024, a significant portion of institutional capital, particularly within pension funds and endowments, demonstrated a growing preference for direct or co-investment strategies, seeking to reduce fees and gain greater control over their portfolios. This shift directly challenges the value proposition of many asset management firms, as clients can now access opportunities and conduct due diligence with greater ease.

The rise of robo-advisors and digital investment platforms presents a significant threat of substitutes for traditional asset management firms like Barings. These platforms offer automated, low-cost portfolio management, increasingly attracting retail and mass affluent investors who might otherwise seek traditional advisory services.

While these digital solutions may not directly poach Barings' large institutional clients, they are steadily capturing market share in simpler investment segments. For instance, by mid-2024, the assets under management for major robo-advisors in the US alone were projected to surpass $3 trillion, indicating a substantial shift in investor preference towards these more accessible and cost-effective alternatives.

Alternative Asset Classes and Niche Strategies

Clients looking for diversification or unique risk-reward opportunities might steer funds toward alternative asset classes or specialized strategies that Barings doesn't heavily focus on. This includes areas like venture capital, direct real estate development, or specific private equity funds.

These alternative investments can pull capital away from Barings' traditional product lines. For instance, in 2024, global alternative asset managers saw significant inflows, with private equity fundraising reaching an estimated $1.2 trillion by the end of the year, demonstrating a strong appetite for these non-traditional avenues.

- Venture Capital: Targeting high-growth potential startups, often with significant risk but also high reward.

- Direct Real Estate Development: Engaging in the construction and management of properties, offering tangible asset returns.

- Specialized Private Equity: Focusing on specific industries or distressed assets for targeted value creation.

- Infrastructure Funds: Investing in long-term projects like roads, bridges, and energy grids, often providing stable, inflation-linked returns.

In-house Asset Management by Large Institutions

Large institutions like pension funds, endowments, and insurance companies increasingly possess the scale and resources to build their own in-house asset management divisions. This trend, often termed insourcing, offers these entities greater control over their investment strategies and potentially lower management fees compared to outsourcing to external firms. For instance, a 2024 survey indicated that over 40% of large pension plans were considering or actively expanding their internal asset management capabilities.

This internal asset management acts as a direct substitute for external managers. By bringing investment expertise in-house, these institutions reduce their need for external asset management services, directly impacting firms like Barings. The ability to customize mandates and retain more assets under management internally provides a compelling alternative that can erode the market share of traditional asset managers.

The cost savings and enhanced control offered by insourcing are significant drivers. As of early 2025, industry estimates suggest that internal management can reduce overall asset management costs by 10-20 basis points for large portfolios. This economic advantage, coupled with the desire for greater strategic alignment, makes in-house asset management a potent substitute threat.

- Growing Insourcing Trend: Over 40% of large pension plans explored or expanded internal asset management in 2024.

- Cost Efficiency: Internal management can reduce asset management costs by 10-20 basis points for large portfolios.

- Enhanced Control: Institutions gain greater oversight and customization of investment mandates.

- Direct Competition: In-house capabilities directly substitute the services offered by external asset managers.

The threat of substitutes for Barings is amplified by the increasing accessibility of alternative investment vehicles and direct investment strategies. Investors are no longer solely reliant on traditional asset managers for diversification or specific market exposure.

The proliferation of digital platforms and the growing trend of institutional insourcing directly challenge the core offerings of firms like Barings. These substitutes often provide lower costs and greater control, forcing traditional players to adapt.

As of early 2025, the landscape shows a clear shift, with passive funds managing over $11 trillion globally and robo-advisors projected to exceed $3 trillion in the US alone by mid-2024, highlighting the significant inroads made by these alternative approaches.

| Substitute Type | Key Characteristics | Investor Appeal | Impact on Barings | 2024/2025 Data Point |

|---|---|---|---|---|

| Passive Investment Vehicles (ETFs, Index Funds) | Low fees, broad market exposure, simplicity | Cost-conscious investors, passive strategy seekers | Reduces demand for active management | Global ETF AUM > $11 trillion (early 2024) |

| Robo-Advisors & Digital Platforms | Automated, low-cost portfolio management | Retail and mass affluent investors | Captures simpler investment segments | US Robo-Advisor AUM projected > $3 trillion (mid-2024) |

| Direct/In-house Asset Management | Greater control, customized mandates, potential cost savings | Large institutions (pension funds, endowments) | Reduces need for external asset managers | 40%+ of large pension plans explored/expanded internal capabilities (2024) |

| Alternative Investments (VC, Private Equity, Real Estate) | Unique risk-reward profiles, tangible assets | Investors seeking diversification beyond traditional markets | Pulls capital away from traditional products | Global Private Equity fundraising ~$1.2 trillion (end 2024) |

Entrants Threaten

High capital requirements are a major deterrent for new players in the global asset management arena. Establishing the necessary technological infrastructure, robust operational systems, and effective marketing campaigns demands significant upfront investment, often running into tens of millions of dollars. For instance, setting up a compliant trading and risk management system alone can cost several million.

Navigating the complex web of global regulations presents another formidable barrier. New entrants must secure licenses, implement stringent compliance protocols, and establish robust risk management and cybersecurity frameworks. In 2024, the cost of compliance for financial institutions globally continued to rise, with many firms allocating over 10% of their operating budget to regulatory adherence, a substantial burden for newcomers.

The sheer cost and time involved in adhering to evolving international regulations, such as those related to data privacy and anti-money laundering, further solidify the threat of new entrants. Firms must continuously adapt to new rules, requiring ongoing investment in legal, compliance, and IT departments, making it exceptionally difficult for smaller, less capitalized entities to compete effectively.

The need for an established brand reputation and trust presents a significant barrier for new entrants in the asset management industry. Building a credible brand, earning client trust, and demonstrating consistent performance requires substantial time and a proven track record, which new firms lack. Barings, for instance, leverages its long history and existing client relationships, making it difficult for newcomers to rapidly gain market acceptance and attract substantial assets under management.

New entrants face significant hurdles in establishing robust distribution channels, often finding it difficult to replicate the extensive networks and global reach of established players like Barings. This limits their ability to access diverse client segments effectively.

Attracting and retaining top-tier investment talent is another major challenge. The financial services industry, particularly asset management, is highly competitive for skilled professionals. New firms must invest substantial resources in recruitment and compensation to compete with the established benefits and career progression offered by incumbent firms.

For instance, in 2024, the average compensation for a senior portfolio manager in a major financial hub could easily exceed $300,000 annually, including bonuses, a significant cost for a startup. Building a sales and marketing infrastructure to rival that of a firm with decades of client relationships, as Barings possesses, requires immense capital outlay and time.

Economies of Scale Enjoyed by Incumbents

Established asset managers like Barings leverage substantial economies of scale, particularly in their technology infrastructure, operational efficiency, and robust risk management frameworks. This scale translates directly into a lower cost per unit of asset managed.

For instance, in 2024, major asset management firms often reported operating expense ratios significantly lower than those of boutique or newly formed entities. This cost advantage makes it challenging for new entrants to compete on fees without sacrificing profitability or investment in essential capabilities. The sheer volume of assets under management allows incumbents to spread fixed costs over a larger base, creating a substantial barrier.

- Cost Efficiency: Incumbents can amortize technology and compliance costs over vast asset pools, reducing per-asset overhead.

- Negotiating Power: Larger firms often secure better terms with service providers, further lowering operational expenses.

- Investment Capacity: Economies of scale enable greater investment in research, talent, and proprietary trading systems, enhancing competitive offerings.

Incumbent Advantage in Client Relationships and Proprietary Data

Barings benefits from deeply entrenched client relationships, fostering significant loyalty and making its assets less susceptible to churn. This incumbent advantage is a substantial barrier for new entrants aiming to disrupt the market.

Newcomers struggle to replicate the proprietary data sets that established firms like Barings possess. This historical market and client data offers invaluable insights for strategy development and client targeting, which new entrants simply cannot match in their early stages.

- Client Loyalty: Barings' long-standing relationships contribute to sticky assets, estimated to be in the hundreds of billions as of early 2024, making client acquisition for new firms a costly and lengthy process.

- Data Advantage: Access to decades of market performance and client behavior data allows Barings to refine its strategies and product offerings, a capability new entrants lack, hindering their ability to compete on insight.

- Brand Recognition: Established firms often enjoy higher brand recognition and trust, further solidifying their market position against less-known new entrants.

The threat of new entrants into the asset management sector is considerably low due to substantial barriers. High capital requirements, stringent regulatory environments, and the necessity for established brand trust and distribution networks make it exceedingly difficult for newcomers to gain traction. Economies of scale enjoyed by incumbents like Barings further exacerbate this challenge, creating a cost advantage that new firms struggle to overcome.

| Barrier Type | Description | Impact on New Entrants (2024) |

|---|---|---|

| Capital Requirements | Significant upfront investment for technology, operations, and marketing. | Tens of millions of dollars required; trading systems alone can cost millions. |

| Regulatory Compliance | Navigating complex global regulations, licensing, and cybersecurity. | Compliance costs can exceed 10% of operating budgets for financial firms. |

| Brand Reputation & Trust | Building credibility and client trust takes time and proven performance. | New firms lack the track record to attract substantial assets quickly. |

| Distribution Channels | Replicating extensive networks of established players. | Limited access to diverse client segments without established reach. |

| Talent Acquisition | Competing for skilled professionals with high compensation demands. | Senior portfolio managers can earn over $300,000 annually in major hubs. |

| Economies of Scale | Lower per-asset overhead due to large asset pools. | Incumbents often have significantly lower operating expense ratios. |

| Client Relationships & Data | Deeply entrenched loyalty and access to historical data. | Client loyalty contributes to billions in sticky assets; data offers strategic advantage. |

Porter's Five Forces Analysis Data Sources

Our Barings Porter's Five Forces analysis is built upon a robust foundation of data, including Barings' own financial disclosures, industry-specific market research reports, and macroeconomic trend analyses.

We leverage internal Barings financial statements, competitor annual reports, and reputable financial news outlets to provide a comprehensive view of the competitive landscape.