Barings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barings Bundle

Is your product portfolio a well-oiled machine, or are you navigating uncharted territory? The Barings BCG Matrix is your compass, categorizing your offerings into Stars, Cash Cows, Dogs, and Question Marks to illuminate your strategic path. This preview offers a glimpse into how your business is performing, but to truly unlock your growth potential, you need the full picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Private Credit Solutions represent a significant growth area for Barings, demonstrating strong market traction. In the six months leading up to July 2025, their portfolio finance platform secured over $2.5 billion in new commitments from third-party investors, underscoring robust demand for these specialized offerings.

This strategic focus allows insurance companies and other institutional investors to access directly originated private investment grade debt, a niche that is clearly expanding. Barings' platform manages over $24 billion in assets under management (AUM) and has facilitated more than $48 billion in investment grade privately originated senior secured financings since its 2017 launch.

Barings is strategically expanding into the Middle East and North Africa (MENA) region, planning to establish a headquarters in Abu Dhabi by the end of 2025. This move places Barings within a key financial center known for its significant capital and growing demand for sophisticated investment products.

The primary objective of this expansion is to foster direct engagement with MENA's substantial sovereign wealth funds and institutional investors. These entities are actively seeking to diversify their portfolios, with a particular interest in private equity, infrastructure, and technology investments, areas where Barings has established expertise.

MENA's economic diversification initiatives and increasingly favorable investor policies are drawing a considerable influx of global financial institutions. For instance, the UAE's financial services sector saw substantial growth in 2024, indicating a fertile ground for Barings to cultivate its presence and capture new market opportunities.

Direct lending, a cornerstone of Barings' alternative credit strategy, continues to attract investors seeking robust risk-adjusted returns. With over three decades of expertise, Barings highlights this asset class's resilience and low volatility, evidenced by its growing appeal to a global investor base.

Looking ahead to 2025, Barings anticipates sustained strong performance in direct lending. This optimism is largely fueled by the expectation of a 'higher-for-longer' interest rate environment, which is projected to enhance all-in yield profiles for direct lending investments.

Barings Liquidity Investment Strategy (BLIS)

The Barings Liquidity Investment Strategy (BLIS), managed by Gryphon Capital Investments, targets Australia's substantial $2 trillion residential mortgage-backed securities (RMBS) market.

This strategy is designed to exploit an underappreciated segment of the market that has demonstrated remarkable stability, with no RMBS bond defaults recorded in over three decades.

BLIS leverages a data-driven methodology, concentrating on high-quality, short-duration RMBS, which implies a low-volatility profile and significant potential for market acceptance.

- Market Focus: Australia's $2 trillion RMBS market.

- Key Differentiator: Over 30 years of no RMBS bond defaults.

- Investment Profile: High-quality, short-duration RMBS with limited volatility.

Specialty Finance and Opportunistic Credit Strategies

As the direct lending landscape matures, specialty finance and opportunistic credit strategies are becoming key areas for growth. Limited Partners (LPs) are increasingly seeking diversification beyond traditional private debt, showing a growing appetite for niche areas.

This expansion into specialized strategies reflects a deeper LP comfort with private markets and a desire for uncorrelated returns. Asset-based lending, litigation finance, Net Asset Value (NAV) lending, and royalty financing are prime examples of these evolving opportunities.

Barings is well-positioned to capitalize on these trends. Their extensive range of financing solutions and deep expertise in private market assets enable them to effectively serve these high-potential, evolving segments of the credit market.

- Asset-Based Lending: This strategy leverages a company's assets, such as inventory and receivables, as collateral for loans.

- Litigation Finance: Providing capital to legal claims in exchange for a share of the proceeds if the case is successful.

- Net Asset Value (NAV) Lending: Offering loans secured by the net asset value of a fund's portfolio, often used by private equity and venture capital firms.

- Royalty Financing: Providing capital to businesses in exchange for a percentage of their future revenue or royalty payments.

Stars in the Barings BCG Matrix represent high-growth, high-market-share business areas. These are the areas Barings is actively investing in to maintain and grow their leadership position. They often require significant capital to fund expansion and fend off competitors. The goal is to nurture these Stars into future Cash Cows.

What is included in the product

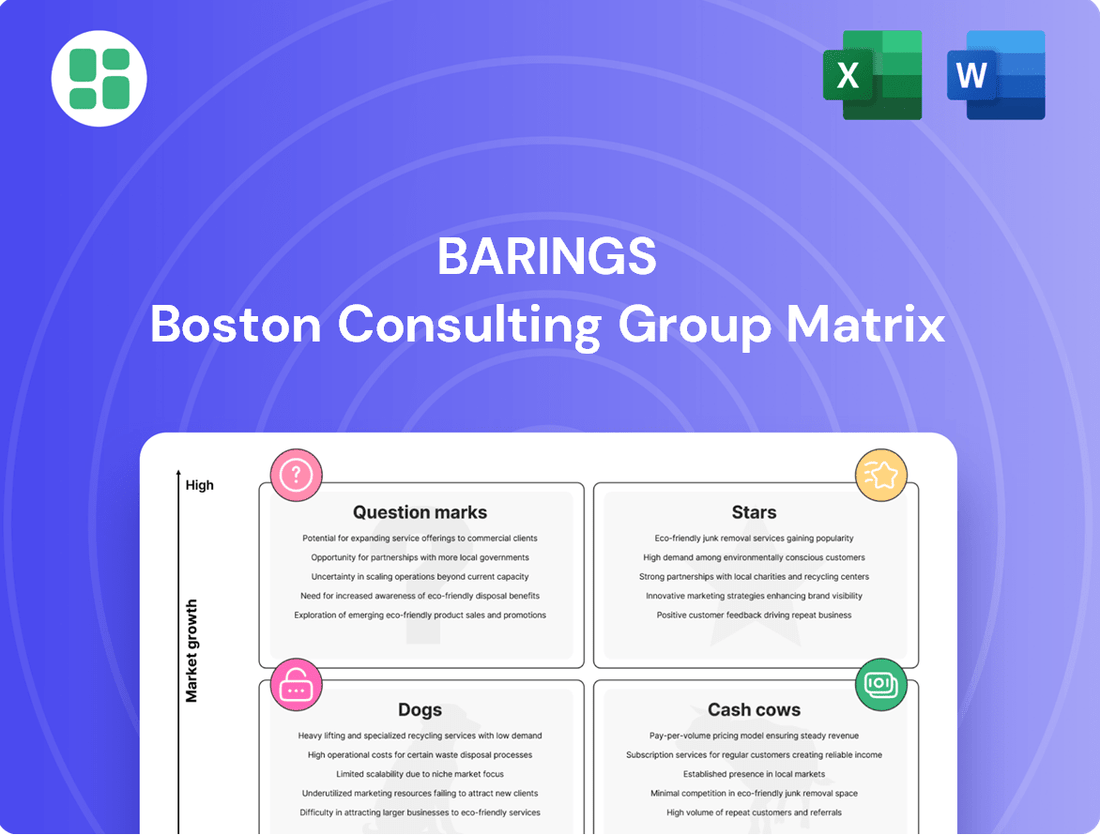

The Barings BCG Matrix categorizes business units by market growth and share, guiding investment decisions.

A clear, visual Barings BCG Matrix instantly clarifies which products are stars, cash cows, question marks, or dogs, alleviating the pain of strategic uncertainty.

Cash Cows

Barings' Global Fixed Income Strategies are considered Cash Cows within the BCG Matrix framework. This is due to their established expertise across mature markets like high yield, emerging markets debt, and investment grade credit, where the firm effectively leverages its extensive resources to find unique investment prospects.

The firm's 2025 outlook highlights a strategic approach to managing the evolving macroeconomic landscape, with a continued emphasis on identifying and capitalizing on attractive income-generating opportunities within the fixed income sector. For instance, as of early 2024, global investment grade corporate bond yields have shown resilience, offering steady income streams.

Barings Participation Investors (MPV), a closed-end fund, functions as a cash cow within Barings' investment portfolio. Its core strategy revolves around investing in privately placed, below-investment grade, long-term debt of middle-market companies. This focus on credit quality and conservative capital structures has consistently delivered current yield to shareholders since its inception in 1988.

Barings' North American Private Finance (NAPF) platform, with over three decades of experience, represents a significant Cash Cow. As of March 31, 2025, it boasts commitments exceeding $25 billion in private credit, underscoring its established market position and consistent revenue generation.

The platform's ability to act as a lead or co-lead lender in over 80% of its originated transactions highlights its strong market influence and control over deal terms. This dominance allows for favorable credit agreements, directly contributing to the stable and predictable cash flows characteristic of a Cash Cow.

Core Real Estate Debt and Equity

Barings' core real estate debt and equity business, a significant driver of its managed assets, focuses on loans secured by commercial properties across North America and Europe. This segment, despite broader market headwinds, represents a mature area for Barings, leveraging its extensive history and deep market knowledge to generate consistent income.

The firm's commitment to long-term value creation, coupled with a sophisticated understanding of global real estate dynamics, underpins the stability of its real estate debt and equity operations. This strategic positioning allows Barings to navigate market fluctuations effectively.

- Significant Asset Allocation: Barings' real estate debt and equity strategies collectively manage a substantial portion of its total assets under management, highlighting its importance to the firm's overall portfolio.

- Geographic Focus: The primary investment regions for these strategies are North America and Europe, where Barings possesses established networks and market insights.

- Income Generation: This segment is characterized by its ability to produce steady income streams, reflecting the mature nature of its investments and Barings' expertise in managing real estate assets.

- Market Resilience: Despite cyclical challenges in real estate markets, Barings' long-standing presence and deep understanding contribute to the resilience and stability of its real estate debt and equity offerings.

Traditional Institutional Client Mandates

Barings' traditional institutional client mandates, such as those for pension funds and insurance companies, represent a significant Cash Cow. These relationships are characterized by long-term commitments and diversified investment solutions across multiple asset classes.

The stability derived from these mandates translates into a consistent and predictable stream of management fees for Barings. For instance, by the end of 2023, Barings managed approximately $340 billion in assets, with a substantial portion stemming from these long-standing institutional relationships, underscoring their reliable revenue generation.

- Stable Revenue: Long-term mandates from pension funds and insurance companies provide a predictable income through recurring management fees.

- Diversified Solutions: Barings offers a broad range of investment strategies catering to the complex needs of institutional clients.

- Active Management Focus: The firm's commitment to active management for these clients aims to deliver consistent long-term value, reinforcing client retention and fee stability.

Barings' Global Fixed Income Strategies, including high yield and emerging markets debt, function as cash cows due to their established market presence and consistent income generation. The firm's 2025 outlook emphasizes capitalizing on attractive income opportunities, with global investment grade corporate bond yields showing resilience in early 2024.

Barings' North American Private Finance platform, with over $25 billion in commitments as of March 31, 2025, is a prime example. Its leading role in originated transactions ensures favorable terms, contributing to predictable cash flows characteristic of cash cows.

The firm's real estate debt and equity business, a mature segment across North America and Europe, also acts as a cash cow. Despite market fluctuations, its deep market knowledge and long history ensure steady income streams, managing a significant portion of Barings' assets.

Traditional institutional client mandates, such as those from pension funds and insurance companies, represent another cash cow. These long-term relationships provide stable management fees, with Barings managing approximately $340 billion in assets by the end of 2023, largely from these stable sources.

| Barings' Cash Cow Strategies | Key Characteristics | Supporting Data (as of early 2024/2025) |

|---|---|---|

| Global Fixed Income | Mature markets, consistent income | Resilient investment grade corporate bond yields |

| North American Private Finance | Established market position, strong deal control | Over $25 billion in commitments (March 31, 2025) |

| Real Estate Debt & Equity | Deep market knowledge, steady income | Significant portion of total assets under management |

| Institutional Client Mandates | Long-term relationships, predictable fees | ~ $340 billion AUM managed (end of 2023) |

Preview = Final Product

Barings BCG Matrix

The Barings BCG Matrix preview you're currently viewing is the exact, fully intact document you will receive upon purchase. This comprehensive report, designed for strategic clarity, is ready for immediate application without any watermarks or demo content. You'll gain access to a professionally formatted analysis tool, perfect for informing your business planning and decision-making processes. This is the final, ready-to-use version that will be delivered directly to you.

Dogs

Within Barings' diverse equity offerings, certain niche or regional strategies might exhibit limited assets under management (AUM) and struggle to capture substantial market share. For instance, a specific emerging market small-cap strategy with only $50 million in AUM, significantly trailing its benchmark by 8% in 2024, could fall into this category.

When these specialized segments consistently underperform their relevant benchmarks or fail to attract new investor capital, they can be classified as 'Dogs' in a BCG-like analysis. Such areas may consume valuable resources and management attention without yielding commensurate returns, prompting a strategic review or even consideration for divestment.

Legacy funds experiencing sustained net outflows, a clear sign of a shrinking client base and diminishing market share, would be categorized here. These funds often represent mature or declining investment themes where investor interest has significantly waned.

For instance, consider actively managed equity funds focused on sectors that have seen structural decline, like traditional print media or certain heavy manufacturing industries. If such a fund, say, experienced net outflows totaling over 15% of its assets under management in 2023 and continued that trend into early 2024, it would exemplify this quadrant.

Continuing to manage these funds can become a significant drain on resources. The administrative costs associated with maintaining operations, coupled with the lack of growth potential, make them inefficient assets. For example, a fund with under $50 million in assets, actively managed with high operational overhead, might become unprofitable if it consistently loses clients.

In segments of the public market where products are highly commoditized and Barings doesn't have a unique edge, profit margins tend to be slim. Think of basic index funds or widely available ETFs; competition is fierce, often from giants with massive scale and lower operating costs.

These low-margin products can barely break even or yield very little profit. For instance, in 2024, the average expense ratio for actively managed equity funds in the US was around 0.70%, significantly higher than passive funds which averaged closer to 0.04%. This price pressure makes it tough for smaller players to compete effectively.

Products in this category need a hard look. Given their low growth prospects and limited market share, Barings must assess whether continuing to invest resources makes strategic sense, especially when compared to opportunities in more promising areas of the BCG matrix.

Small, Unprofitable Equity Co-Investments

Small, unprofitable equity co-investments, often seen in structures like Barings participation investors, can be categorized as Dogs within the BCG Matrix. These are typically minority stakes in private companies that consistently fail to generate profits or appreciate in value. For instance, if a fund has several such small co-investments that, as of 2024, have collectively resulted in a realized loss of 5% of their initial capital over a three-year period, they would firmly reside in the Dog quadrant. These positions, while individually small, can become a drag on overall portfolio performance by tying up valuable capital that could be deployed in more promising ventures.

The classification as a Dog highlights a strategic challenge for investors. These investments consume resources, including management time and capital, without contributing positively to returns. For example, a 2024 report indicated that private equity funds with a higher concentration of these "small, unprofitable equity co-investments" experienced an average net IRR that was 1.5% lower than those with more diversified, performing portfolios. Effective management requires a critical assessment of these positions, potentially leading to divestment to free up capital.

- Definition: Small, unprofitable equity co-investments represent minority stakes in private companies that consistently underperform.

- Impact: These investments tie up capital and can negatively affect overall fund performance, potentially lowering Internal Rates of Return (IRR).

- Example: In 2024, funds with a higher allocation to such assets saw IRRs that were, on average, 1.5% lower than their peers.

- Management: Strategic review and potential divestment are crucial to reallocate capital to more productive opportunities.

Outdated or Niche Fixed Income Strategies with Declining Interest

Certain older fixed income strategies, like those heavily focused on long-duration corporate bonds issued before significant interest rate hikes, now face declining relevance. These strategies often struggle to attract new capital as investors seek more dynamic approaches in the current higher-yield environment.

For instance, a strategy primarily invested in investment-grade corporate bonds with average maturities exceeding 10 years, which might have performed well in a low-rate environment, could be experiencing reduced inflows. As of early 2024, the average yield on a 10-year U.S. Treasury note has significantly increased compared to previous years, making older, lower-yielding fixed income products less attractive.

- Declining Investor Interest: Strategies focused on legacy, lower-coupon bonds are seeing reduced demand as investors chase higher yields available in newer issuances or alternative fixed income sectors.

- Asset Retention Challenges: These strategies may struggle to retain existing assets as investors reallocate capital to more competitive offerings, potentially leading to outflows.

- Limited Growth Prospects: While maintained for legacy clients, these outdated strategies offer minimal potential for future growth or significant market share expansion.

- Performance Drag: Consistently underperforming or failing to attract new assets, these fixed income approaches can act as a drag on the overall performance of a diversified portfolio.

Dogs represent investment strategies or products with low market share and low growth potential. These are often characterized by declining investor interest and limited profitability, consuming resources without generating significant returns. For Barings, identifying and managing these 'Dogs' is crucial for optimizing capital allocation and portfolio performance.

For instance, a specific actively managed emerging market small-cap fund that, as of 2024, had only $50 million in assets under management and underperformed its benchmark by 8% in the same year, would be a prime example of a Dog. Such a strategy struggles to gain traction and deliver competitive results.

Legacy fixed income strategies focused on older, lower-yielding bonds also fall into this category. With rising interest rates in 2024, these products are less attractive, leading to reduced inflows and potential outflows as investors seek higher yields elsewhere.

Consider the challenge of commoditized products like basic index funds where Barings might not have a competitive edge. The average expense ratio for actively managed equity funds in the US in 2024 was around 0.70%, compared to passive funds at 0.04%, highlighting the intense price competition that can make these offerings unprofitable for smaller players.

| Category | Characteristics | Example Scenario (2024) | Potential Action |

| Niche Equity Strategy | Low AUM, Underperformance | Emerging market small-cap fund with $50M AUM, 8% underperformance | Divestment or strategic review |

| Legacy Fixed Income | Declining Investor Interest, Low Yields | Long-duration corporate bonds, less attractive in higher rate environment | Consolidation or wind-down |

| Commoditized Products | High Competition, Low Margins | Basic index funds with high expense ratios relative to passive | Focus on differentiation or exit |

Question Marks

Emerging Markets Debt (EMD) might represent a smaller allocation within Barings' BCG Matrix due to its inherent volatility and the challenge of achieving a dominant market share across all its diverse sub-segments. While Barings possesses significant expertise in this area, the fluctuating nature of EMD means it may not consistently qualify as a "Star" or "Cash Cow" across the board.

Despite potential volatility, compelling opportunities exist in EMD, particularly when prices are attractive, as seen in periods of market dislocation. However, capitalizing on these opportunities demands substantial investment and diligent, active management to carve out and maintain market share in this competitive landscape.

Geopolitical shifts and evolving trade policies, such as the potential for tariffs, introduce both significant risks and unique opportunities within EMD. For instance, the IMF's World Economic Outlook in April 2024 highlighted that while global growth is projected to reach 3.2% in 2024, emerging market and developing economies are expected to grow at a faster pace, though regional variations and policy uncertainties remain key factors.

Barings' commitment to sustainable practices positions new ESG-focused funds in a high-growth market, aligning with increasing investor demand for responsible investments. This strategic move leverages the growing trend towards environmental, social, and governance (ESG) considerations in financial markets.

However, as new entrants, these ESG funds might initially exhibit a low market share, necessitating significant marketing and investment to build brand recognition and attract assets under management (AUM). This phase requires careful resource allocation to overcome the initial hurdles of establishing a presence in a competitive landscape.

Data from 2024 illustrates this challenge: while sustainable funds' AUM reached a record high, their overall market share experienced a decline. This indicates intense competition and highlights the substantial capital required for new funds to carve out a leadership position and gain meaningful traction.

Barings' expansion into Abu Dhabi and the broader MENA region marks a strategic push into a dynamic financial center. This move into a region with significant growth potential, as evidenced by the UAE's projected GDP growth of around 3.5% for 2024, positions Barings to capture new opportunities.

Further ventures into less developed or more challenging markets within MENA, or other entirely new geographies, would represent Stars or Question Marks on the BCG Matrix. These initiatives demand substantial investment and deep understanding of local nuances to establish a foothold and gain market share from a nascent position.

Newly Launched Private Equity or Infrastructure Strategies

Barings' newly launched private equity or infrastructure strategies, while leveraging existing expertise in private equity and real assets, would likely fall into the Question Mark category of the BCG Matrix. These strategies target high-growth areas, reflecting a positive market outlook. For instance, the global infrastructure market alone was projected to reach $14.9 trillion by 2025, with private capital playing an increasingly vital role.

These emerging strategies would initially possess a low market share due to their recent inception. Significant capital deployment and dedicated fundraising efforts would be necessary to achieve scale and competitive positioning. The success hinges on securing robust deal flow, delivering competitive returns that attract investors, and fostering effective client adoption within these specialized niches.

- High Growth Potential: Targeting emerging sectors within private equity and infrastructure aligns with strong market tailwinds.

- Low Initial Market Share: As new ventures, these strategies would start with a limited footprint.

- Capital Intensive: Scaling requires substantial investment and successful fundraising campaigns.

- Performance Dependent: Success is tied to deal sourcing, return generation, and client acceptance.

Innovative Technology-driven Investment Solutions

Barings might introduce new investment solutions powered by advanced technology, like AI-driven portfolio management or alternative data analytics. These offerings, while catering to emerging investor demands for sophisticated strategies, would likely begin with a modest market share due to their newness. For instance, the global AI in financial services market was projected to reach over $25 billion by 2024, indicating significant growth potential for innovative tech-based products.

Achieving market leadership for these novel products will require substantial investment. This includes allocating capital towards cutting-edge technology infrastructure, attracting specialized talent in data science and quantitative analysis, and dedicating resources to client education. Barings would need to demonstrate the value proposition of these tech-driven solutions to build trust and drive adoption, aiming to replicate the success seen in areas like robo-advisory services which have seen rapid growth in recent years.

- New Tech-Driven Offerings: Barings could launch AI-powered investment platforms or strategies utilizing alternative data.

- Initial Low Market Share: Due to their novelty, these innovative solutions would likely start with a smaller market presence.

- Investment Requirements: Significant capital will be needed for technology, talent acquisition, and client education to foster growth.

- Market Potential: The growing adoption of fintech solutions globally, with the AI in financial services market expected to exceed $25 billion by 2024, highlights the opportunity.

Question Marks in Barings' BCG Matrix represent business units or strategies with high market growth but low market share. These are often new ventures or products that require significant investment to gain traction and compete effectively. For example, Barings' new ESG-focused funds or emerging tech-driven investment solutions would fit this description, needing substantial capital to build brand recognition and market presence.

These ventures are characterized by their potential to become future Stars or Cash Cows, but they also carry higher risk due to their unproven market position. The success of these Question Marks hinges on strategic investment, effective marketing, and the ability to adapt to market dynamics. The global AI in financial services market, projected to exceed $25 billion by 2024, exemplifies the growth potential these new offerings aim to tap into.

Barings' expansion into new geographies like Abu Dhabi and the MENA region, particularly into less developed markets within these areas, also falls under the Question Mark category. These initiatives require deep local understanding and significant investment to establish a foothold and build market share from a nascent position, mirroring the UAE's projected GDP growth of around 3.5% for 2024.

The challenge for Question Marks is to convert their high growth potential into market leadership. This requires a deliberate strategy of investing heavily to increase market share, or alternatively, divesting if the potential for growth is not sufficient to justify the required investment. The success of these ventures is directly tied to their ability to attract capital and demonstrate competitive returns.

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial statements, market research reports, and industry growth forecasts to provide accurate strategic insights.