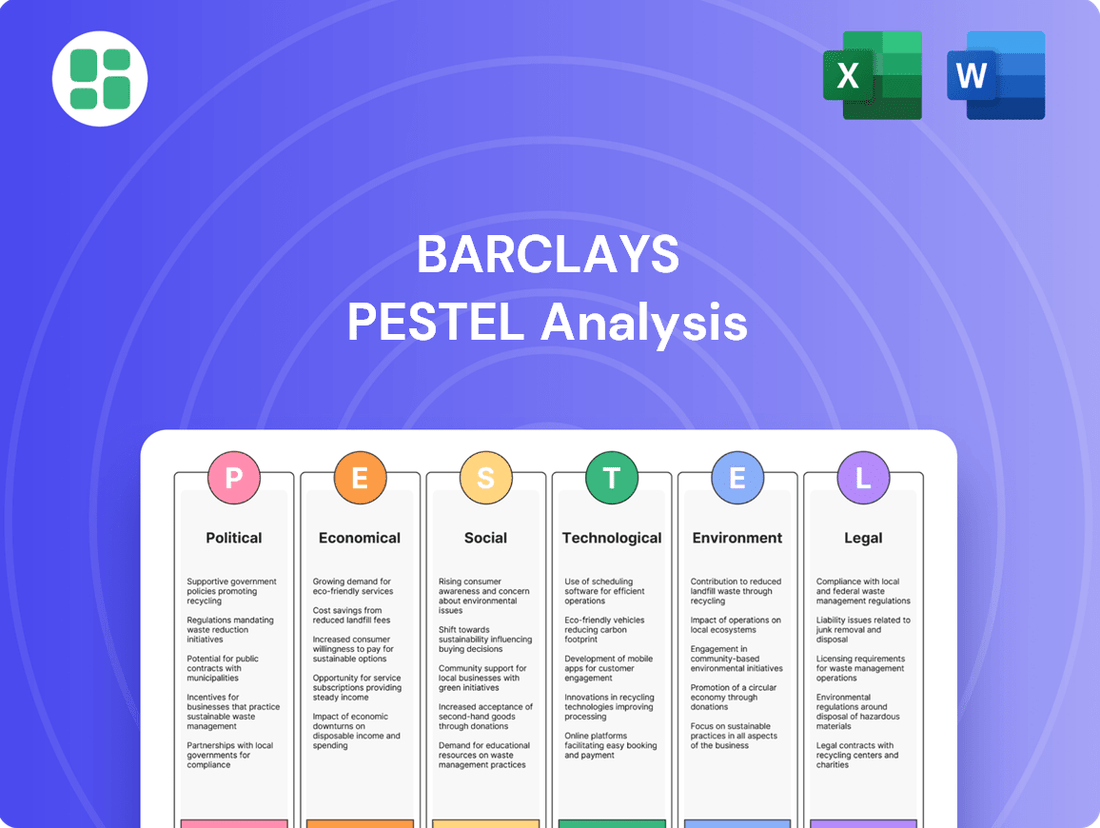

Barclays PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barclays Bundle

Navigate the complex external forces shaping Barclays's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both challenges and opportunities for the banking giant. Equip yourself with actionable intelligence to inform your own strategic decisions and gain a competitive edge. Download the full PESTLE analysis now to unlock critical insights.

Political factors

Government policies significantly shape Barclays' operating landscape. For instance, the Bank of England's monetary policy, including interest rate decisions, directly impacts Barclays' net interest margins and lending volumes. In 2024, the Bank of England maintained its base rate at 5.25% for several months, influencing borrowing costs for customers and profitability for the bank.

Changes in government leadership or policy direction in key markets like the UK and US can alter regulatory frameworks. Stricter capital requirements or new lending regulations, potentially introduced following shifts in government or in response to economic instability, could constrain Barclays' operational freedom and capital allocation strategies.

Political stability is crucial for financial markets. Periods of political uncertainty, such as upcoming elections or significant geopolitical events in regions where Barclays operates, can lead to market volatility, affecting asset valuations and investor confidence, thereby influencing the bank's risk appetite and strategic planning.

Heightened geopolitical tensions, such as ongoing conflicts and trade disputes, pose a significant risk to Barclays' global operations. These tensions can disrupt cross-border transactions and impact foreign exchange rates, affecting the profitability of international business. For instance, the ongoing geopolitical instability in Eastern Europe has led to increased volatility in currency markets, directly influencing the value of international assets and liabilities for financial institutions.

Operating across diverse political landscapes means Barclays must navigate varying regulatory environments and potential sanctions. The imposition of international sanctions can restrict market access and complicate financial flows, as seen with sanctions targeting Russia, which have impacted global financial institutions' ability to conduct business there. This necessitates robust risk management frameworks to mitigate the financial and reputational damage from such events.

Major global events, like shifts in major economic powers' policies or the rise of protectionism, can significantly alter the strategic landscape for international banks. Barclays' 2024 strategy, for example, must account for potential impacts from evolving trade agreements and the increasing focus on national economic security, which could influence investment flows and market access in key regions.

The ongoing adjustments to the UK's relationship with the European Union post-Brexit continue to influence Barclays' operational landscape. Evolving trade agreements and regulatory divergence between the UK and the EU necessitate ongoing strategic recalibration for the bank's dual market focus.

Barclays faces persistent challenges and opportunities stemming from shifts in capital movement and talent mobility between the UK and EU. These factors directly impact the bank's ability to serve clients across both regions and adapt its business model to new market realities, with significant implications for its European banking license and operational footprint.

In 2024, the UK's trade deficit with the EU remained a key indicator of economic integration challenges. For Barclays, this translates to a need for robust strategies to navigate potential trade barriers and maintain seamless financial flows, ensuring continued market access and competitive positioning.

Political Pressure on Banking Practices

Political pressure significantly shapes Barclays' operations, particularly concerning lending practices and executive pay. Public and governmental scrutiny often targets perceived excessive executive remuneration, pushing for greater alignment with bank performance and broader economic conditions. For instance, in the UK, discussions around banking bonuses and their tax implications are recurrent political talking points, influencing how institutions structure compensation packages.

Government intervention can also manifest in policies aimed at directing credit flow or promoting financial inclusion. Regulators might encourage lending to small and medium-sized enterprises (SMEs) or specific sectors deemed vital for economic growth. Barclays, like other major banks, must navigate these directives, balancing commercial objectives with political expectations for societal contribution. The bank's commitment to corporate social responsibility (CSR) initiatives is also under political watch, with expectations to address issues like climate finance and ethical business conduct.

- Executive Remuneration Scrutiny: Political discourse frequently centers on executive pay at major banks, impacting compensation structures.

- Lending Policy Influence: Government and regulatory bodies can exert pressure on lending practices, encouraging support for SMEs or specific economic sectors.

- Corporate Social Responsibility (CSR): Political expectations are rising for banks to demonstrate strong CSR, including environmental and social governance (ESG) commitments.

- Financial Inclusion Initiatives: Political agendas often promote greater financial inclusion, requiring banks to adapt services for underserved populations.

Taxation Policies and Fiscal Stability

Barclays' profitability is directly influenced by shifts in corporate tax rates and banking levies across its operating regions. For instance, a rise in the UK's corporation tax from 19% to 25% effective April 2023, impacts its effective tax rate. Furthermore, the fiscal stability of key markets, such as the UK and the US, with their respective government debt-to-GDP ratios, can indirectly affect interest rate environments and regulatory pressures on financial institutions like Barclays.

These fiscal dynamics have significant implications for capital allocation and shareholder returns. Higher taxes or increased government borrowing can lead to tighter liquidity or necessitate greater capital buffers, potentially constraining dividend payouts or share buybacks. For example, in 2023, the UK's Office for Budget Responsibility projected a debt-to-GDP ratio of 94.3%, highlighting the ongoing fiscal considerations for businesses operating within the UK.

- Corporate Tax Rate Changes: Increases in statutory corporate tax rates, such as the UK's move to 25%, directly reduce net income.

- Banking Levies: Specific taxes on financial institutions can add to operating costs and impact the profitability of banking operations.

- Fiscal Stability Impact: High government debt and deficit levels can lead to economic uncertainty, higher borrowing costs for banks, and potential regulatory changes.

- Capital Allocation: Adverse fiscal policies can reduce retained earnings available for investment, dividends, or share repurchases, affecting shareholder value.

Government policies significantly shape Barclays' operating landscape, with monetary policy decisions by central banks directly impacting net interest margins. For instance, the Bank of England's consistent base rate of 5.25% through much of 2024 influenced borrowing costs and bank profitability. Political stability is paramount; uncertainty, such as upcoming elections or geopolitical events, can trigger market volatility, affecting Barclays' risk appetite and strategic planning.

Geopolitical tensions and trade disputes pose considerable risks, disrupting cross-border transactions and currency markets, as evidenced by the impact of instability in Eastern Europe on global financial institutions. Additionally, evolving trade agreements and national economic security concerns, particularly in the context of UK-EU relations post-Brexit, necessitate ongoing strategic adjustments for Barclays' international operations.

Barclays faces scrutiny over executive remuneration and lending practices, with political pressure often pushing for greater alignment with bank performance and societal contributions. Government directives can encourage lending to specific sectors, like SMEs, requiring banks to balance commercial goals with political expectations for financial inclusion and corporate social responsibility.

Fiscal policies, including corporate tax rates and banking levies, directly affect Barclays' profitability. The UK's corporation tax increase to 25% in April 2023, for example, impacted its effective tax rate. High government debt levels, such as the UK's projected 94.3% debt-to-GDP ratio in 2023, can indirectly influence interest rates and regulatory pressures, affecting capital allocation and shareholder returns.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Barclays, dissecting them across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering immediate strategic insights for Barclays.

Economic factors

Central bank policies, particularly interest rate decisions by the Bank of England and the US Federal Reserve, significantly shape Barclays' profitability. For instance, a rising interest rate environment generally benefits banks like Barclays by widening the net interest margin, the difference between interest income from loans and interest paid on deposits. In late 2023 and early 2024, major central banks maintained higher rates to combat inflation, which likely supported Barclays' net interest income.

Barclays' lending profitability is directly tied to these rate shifts. Higher base rates translate to increased revenue on variable-rate loans and mortgages, a key component of Barclays' income. Conversely, deposit growth can be influenced by the attractiveness of savings rates offered by the bank in response to central bank policy changes.

Different segments within Barclays exhibit varying sensitivity to rate fluctuations. The retail banking and mortgages division, for example, is highly exposed to interest rate changes, impacting both borrower affordability and the bank's funding costs. Investment banking and wealth management arms might see different effects, with some activities benefiting from increased market volatility often associated with monetary policy shifts.

High inflation erodes consumer purchasing power, potentially dampening demand for banking services like loans and mortgages. For instance, persistent inflation in the UK and US throughout 2024 could lead to cautious consumer spending, impacting retail banking revenues. This uncertainty also affects business investment, as higher costs and uncertain future demand make expansion less attractive.

The economic growth outlook significantly shapes the banking sector. A robust US economy in 2024, with projected GDP growth around 2-3%, typically fuels higher loan demand and improves credit quality for banks. Conversely, a more stagnant European economy, facing headwinds from geopolitical tensions and energy prices, might see reduced corporate lending and increased credit risk, impacting investment banking and trading revenues.

Consumer confidence is closely tied to inflation and growth. When inflation is high and economic prospects dim, consumer confidence often falls, leading to reduced spending and a greater propensity to save rather than borrow. This can create a challenging environment for banks reliant on consumer credit and transaction volumes.

Fluctuations in major currency exchange rates, such as the GBP, USD, and EUR, significantly impact Barclays' international earnings and the valuation of its global assets. For instance, a stronger pound can reduce the sterling value of profits earned in dollars or euros. Conversely, a weaker pound might boost the translated value of foreign earnings, but it can also increase the cost of dollar-denominated liabilities.

Currency movements directly influence the competitiveness of Barclays' global businesses. When the pound strengthens, UK-based operations become relatively more expensive for foreign customers, potentially dampening demand for services. Conversely, a weaker pound can make Barclays’ services more attractive internationally, boosting transaction volumes and fee income.

Barclays employs various hedging strategies to mitigate currency risk, including forward contracts and options, to lock in exchange rates for future transactions. Effective currency risk management is crucial for protecting profitability and maintaining stable asset valuations amidst unpredictable global economic shifts, especially as the bank navigates a complex macroeconomic landscape in 2024 and 2025.

Unemployment Rates and Consumer Spending

Unemployment rates significantly impact Barclays' credit risk. Higher joblessness often translates to increased loan defaults in both retail and business banking. For instance, in the UK, the unemployment rate stood at 4.3% in the three months to April 2024, a slight increase from previous periods, signaling potential headwinds for consumer credit. This directly affects demand for products like credit cards and personal loans, as individuals face reduced disposable income.

The health of the job market is intrinsically linked to the financial stability of Barclays' customer base. When unemployment rises, consumers tend to cut back on discretionary spending, which in turn reduces the overall demand for credit. This can lead to a decline in new loan origination and increased pressure on existing borrowers, potentially escalating non-performing loans for the bank.

- UK Unemployment Rate: 4.3% (three months to April 2024).

- Impact on Retail Banking: Higher unemployment leads to increased defaults on credit cards and personal loans.

- Impact on Business Banking: Businesses facing reduced consumer demand may struggle with loan repayments.

- Consumer Confidence: Job market health directly correlates with consumer confidence and willingness to take on new debt.

Global Economic Cycles and Recession Risks

Global economic cycles significantly influence banking operations, with potential recessions posing substantial risks. A downturn typically leads to decreased business investment and a lower demand for corporate finance services, directly impacting revenue streams. For Barclays, this could translate into higher provisions for bad debts across its retail, corporate, and investment banking segments.

In 2024 and leading into 2025, many economies are navigating a complex landscape. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight slowdown from previous years, indicating a cautious economic environment. This slowdown heightens recession risks in major markets, which could directly affect Barclays' profitability and asset quality.

- Recessionary Impact: A global recession could reduce corporate loan demand by an estimated 5-10% and increase non-performing loans by 1-2% for major banks like Barclays, based on historical downturns.

- Interest Rate Sensitivity: While higher interest rates can boost net interest margins, aggressive rate hikes aimed at curbing inflation also increase the likelihood of recession, creating a delicate balancing act for financial institutions.

- Contingency Planning: Barclays, like other major banks, maintains robust capital buffers and stress-testing frameworks to withstand economic shocks, ensuring resilience even in adverse scenarios. For example, regulatory capital ratios, such as the Common Equity Tier 1 (CET1) ratio, remain a key indicator of a bank's ability to absorb losses.

Economic factors significantly influence Barclays' performance. Central bank policies, particularly interest rate decisions by the Bank of England and the US Federal Reserve, directly impact net interest margins. For instance, higher rates in late 2023 and early 2024 likely boosted Barclays' net interest income.

Inflation erodes consumer purchasing power, potentially dampening demand for banking services, while economic growth outlook shapes loan demand and credit quality. For example, the IMF projected global growth around 3.2% for 2024, indicating a cautious environment.

Unemployment rates, such as the UK's 4.3% in early 2024, increase credit risk and affect consumer confidence, impacting loan demand. Global economic cycles, including recession risks, necessitate robust capital buffers for banks like Barclays to ensure resilience.

| Economic Factor | Barclays Impact | Relevant Data (2024/2025) |

|---|---|---|

| Interest Rates | Net Interest Margin (NIM) | BoE Bank Rate: 5.25% (as of May 2024) Fed Funds Rate: 5.25-5.50% (as of May 2024) |

| Inflation | Consumer Spending, Loan Demand | UK CPI: 2.3% (April 2024) US CPI: 3.4% (April 2024) |

| Economic Growth | Loan Demand, Credit Quality | IMF Global Growth Projection: 3.2% (2024) |

| Unemployment | Credit Risk, Consumer Confidence | UK Unemployment Rate: 4.3% (Feb-Apr 2024) |

What You See Is What You Get

Barclays PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Barclays PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a detailed understanding of the external forces shaping Barclays' strategic landscape.

Sociological factors

Consumer behaviour is rapidly evolving, with a growing demand for instant, personalized, and digitally-driven financial services. Barclays must adapt to this shift, focusing on intuitive mobile banking apps and user-friendly online platforms to meet these heightened expectations. For instance, in 2024, mobile banking usage continued its upward trajectory, with a significant percentage of transactions occurring via smartphone, highlighting the need for seamless digital experiences.

Demographic shifts, particularly the ageing populations in developed markets like the UK and the US, are reshaping demand for financial products. For instance, in the UK, the proportion of people aged 65 and over is projected to increase significantly, driving demand for retirement planning and wealth management services. Barclays needs to adapt by enhancing its offerings for this segment, perhaps through specialized investment funds or later-life lending solutions.

Conversely, emerging markets often feature a younger demographic, presenting opportunities for digital-first financial products. Barclays can cater to this by developing user-friendly mobile banking apps and investment platforms tailored to the needs of a growing, tech-savvy youth population. In 2024, over 60% of global internet users are under 30, highlighting the importance of digital engagement.

Societal emphasis on financial literacy is growing, with initiatives aimed at improving individuals' understanding of money management. Barclays actively participates in this by offering financial education programs, which can bolster its brand image and attract new customers.

The drive for financial inclusion is also a significant sociological factor, pushing for broader access to banking services for underserved populations. By extending its reach to these communities, Barclays not only fulfills a social responsibility but also taps into new market segments.

For instance, in the UK, efforts to improve financial inclusion are ongoing, with organizations like Fair4All Finance aiming to increase access to affordable financial products. Barclays' involvement in such efforts, perhaps through partnerships or direct service expansion, aligns with these societal goals.

Ethical Banking and Corporate Social Responsibility (CSR)

Societal expectations are increasingly pushing financial institutions towards more ethical operations. This includes a strong demand for responsible lending practices, full transparency in all dealings, and a genuine commitment to supporting social causes. Barclays' engagement in Corporate Social Responsibility (CSR) is therefore crucial. For instance, their investments in community programs and their focus on sustainable finance are key to shaping public perception. These efforts not only attract customers who prioritize social impact but also boost employee morale and foster a sense of purpose within the organization. Ultimately, robust CSR initiatives are vital for reputation management and building lasting stakeholder trust, especially in the current climate where ethical conduct is paramount.

Barclays' commitment to CSR is reflected in various initiatives. In 2023, the bank reported investing £42.6 million in communities through its Helping Britain Thrive program. Furthermore, their sustainable finance efforts are gaining traction, with a target to facilitate £100 billion of finance for the transition to a low-carbon economy by 2030.

- Growing demand for ethical banking: Customers and investors are increasingly scrutinizing banks' lending policies and social impact.

- CSR initiatives influence perception: Barclays' community investments and sustainable finance efforts directly shape its public image and attract socially conscious consumers.

- Reputation and trust are key: Strong CSR performance enhances stakeholder trust, which is critical for long-term business success and resilience.

- Employee engagement: Demonstrating a commitment to social responsibility can significantly improve employee morale and retention.

Workforce Diversity, Equity, and Inclusion (DEI)

Societal expectations increasingly emphasize diversity, equity, and inclusion (DEI) within corporate structures. Barclays' proactive approach to cultivating a varied and inclusive workforce is crucial for attracting premier talent, fostering innovation, and refining decision-making processes. A strong DEI commitment can significantly boost employee engagement, positively shape corporate culture, and improve the bank's capacity to cater to a broad and diverse clientele.

Barclays has publicly stated goals for increasing representation. For instance, as of early 2024, the bank aimed to have 33% of its senior leadership positions held by women and 11% by ethnic minority individuals by the end of 2025. These initiatives are not merely ethical imperatives but also strategic advantages.

- Talent Attraction: A reputation for strong DEI practices makes Barclays more appealing to a wider pool of skilled candidates, particularly among younger generations who prioritize inclusive workplaces.

- Innovation and Performance: Research consistently shows that diverse teams, in terms of background and thought, lead to more innovative solutions and better financial performance. A 2023 McKinsey report highlighted that companies in the top quartile for gender diversity were 25% more likely to have above-average profitability.

- Customer Reach: A workforce that mirrors the diversity of its customer base is better equipped to understand and meet varied customer needs, leading to enhanced customer loyalty and market penetration.

Societal values are increasingly prioritizing ethical conduct and corporate social responsibility (CSR) in financial institutions. Barclays' engagement in community programs, such as its Helping Britain Thrive initiative, which invested £42.6 million in 2023, directly influences its public perception and builds stakeholder trust. Furthermore, the bank's commitment to sustainable finance, aiming to facilitate £100 billion for the low-carbon economy by 2030, aligns with growing environmental consciousness.

Technological factors

Barclays must persistently invest in digital transformation to satisfy customer expectations for banking services that are seamless, easily accessible, and highly efficient. This includes developing and maintaining robust mobile banking applications and online platforms, ensuring these digital tools are integrated across every customer interaction point.

The focus is on leveraging technology to elevate the user experience and streamline operational processes. For instance, in 2024, Barclays reported a significant increase in digital transactions, with over 70% of customer interactions occurring through its digital channels, highlighting the critical need for ongoing investment in these areas to maintain competitiveness and customer satisfaction.

Barclays, like all global financial institutions, faces escalating cybersecurity threats. The constant risk of data breaches and sophisticated cyber-attacks demands substantial and ongoing investment in advanced security protocols and continuous monitoring to safeguard customer data and financial transactions.

Failure to maintain robust security can lead to severe reputational damage and significant financial penalties. For instance, in 2023, the financial services sector globally experienced a notable increase in ransomware attacks, with average recovery costs climbing. Barclays' commitment to cybersecurity is therefore paramount to its operational integrity and customer trust.

Barclays is leveraging AI and ML to enhance its operations, notably in fraud detection where these technologies can identify suspicious patterns with greater speed and accuracy than traditional methods. This not only protects customers but also reduces financial losses for the bank. For instance, in 2023, the financial services industry reported significant savings through AI-powered fraud prevention, with some estimates suggesting billions saved globally.

The bank is also employing AI to personalize customer service, offering tailored product recommendations and support. This data-driven approach to understanding customer behavior allows Barclays to anticipate needs and improve engagement, potentially boosting customer loyalty and revenue. Predictive analytics, powered by AI, are crucial for assessing credit risk more effectively, leading to better lending decisions and a stronger balance sheet.

By automating routine tasks and providing deeper insights, AI and ML are significantly improving Barclays' operational efficiency and decision-making capabilities. This technological adoption is a key driver for gaining a competitive advantage in the rapidly evolving financial landscape, enabling faster adaptation to market changes and more agile strategic planning.

Fintech Competition and Collaboration

Fintech companies are significantly reshaping the financial landscape, challenging traditional banking models with their agility and specialized offerings in areas like payments, lending, and wealth management. Barclays is actively responding to this disruption by investing in its own digital innovation and exploring strategic collaborations or acquisitions to integrate cutting-edge fintech capabilities. For instance, the global fintech market was valued at approximately $111.8 billion in 2021 and is projected to grow substantially, indicating the scale of this competitive pressure.

Barclays' strategy involves not only enhancing its in-house digital platforms but also actively seeking partnerships with or acquiring promising fintech startups. This approach allows the bank to quickly adopt new technologies and business models, thereby maintaining its competitive edge. As of early 2024, major banks are increasingly prioritizing digital transformation, with significant capital allocated to R&D and M&A activities in the fintech space to counter the rise of nimble competitors.

- Agile Fintech Disruption: Specialized fintechs are challenging established players like Barclays in key financial services.

- Barclays' Response: The bank is focusing on digital innovation and exploring partnerships/acquisitions.

- Market Growth: The global fintech market's rapid expansion underscores the competitive intensity.

- Strategic Imperative: Collaboration and acquisition are crucial for Barclays to remain competitive in the evolving financial ecosystem.

Blockchain and Distributed Ledger Technology (DLT)

Blockchain and Distributed Ledger Technology (DLT) present significant opportunities for financial institutions like Barclays to enhance efficiency and security. These technologies can streamline cross-border payments and trade finance by reducing intermediaries and settlement times. For instance, by 2024, the global blockchain in finance market is projected to reach $10.1 billion, indicating substantial growth potential.

Barclays has been actively exploring DLT applications, including pilot programs for trade finance platforms and digital asset issuance. These initiatives aim to improve transparency and reduce operational risks. By 2025, it's estimated that DLT could unlock significant cost savings in areas like reconciliation and compliance for major banks.

- Efficiency Gains DLT can automate processes, reducing manual intervention in areas like payments and securities settlement, potentially lowering operational costs for Barclays.

- Enhanced Security and Transparency The immutable and distributed nature of blockchain offers improved data integrity and auditability, crucial for regulatory compliance and fraud prevention.

- New Revenue Streams Barclays can leverage DLT for digital asset management, tokenized securities, and innovative payment solutions, opening up new market opportunities.

- Regulatory Evolution As regulators adapt to DLT, Barclays must navigate evolving frameworks for digital assets and decentralized finance to fully capitalize on these technologies.

Barclays' technological advancement hinges on AI and machine learning, particularly for fraud detection and personalized customer service. These tools are crucial for identifying suspicious patterns and anticipating customer needs, boosting efficiency and loyalty. By 2023, the financial services industry saw billions saved globally through AI-powered fraud prevention, a trend Barclays is actively participating in.

Legal factors

Barclays operates within a complex and constantly shifting global regulatory environment. Key frameworks like Basel IV, which aims to finalize the post-crisis reforms for capital requirements, and MiFID II (Markets in Financial Instruments Directive II), governing European financial markets, significantly shape its operational blueprint and risk management strategies. Compliance with these extensive rules demands substantial investment in technology and personnel, with non-adherence carrying the risk of severe penalties.

Barclays operates under a complex web of global Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) laws. These regulations are designed to prevent illicit financial activities and require robust systems for transaction monitoring, customer due diligence (CDD), and suspicious activity reporting (SARs). Failure to comply can lead to significant reputational damage and severe legal penalties, as evidenced by the substantial fines levied against financial institutions in recent years. For instance, in 2023, financial firms globally faced billions in AML-related fines, highlighting the critical importance of rigorous compliance.

Barclays, like all financial institutions, faces significant operational and reputational risks stemming from data privacy and protection regulations. The General Data Protection Regulation (GDPR) in Europe, and similar laws enacted globally, mandate stringent requirements for how customer data is collected, processed, stored, and secured. Failure to comply can result in substantial financial penalties; for instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher.

These regulations necessitate robust data governance frameworks, requiring explicit consent for data usage, transparent data handling policies, and swift notification procedures in the event of a data breach. For Barclays, this means investing heavily in cybersecurity infrastructure and data management systems to ensure compliance and maintain customer trust. The ongoing evolution of these laws, with new interpretations and enforcement actions, demands continuous adaptation and vigilance.

Consumer Protection Laws and Fair Treatment of Customers

Barclays operates within a robust legal environment designed to safeguard financial consumers. Regulations mandate transparency in product information, ensuring customers understand terms and conditions, and promote fair lending practices, preventing discriminatory or predatory lending. The Financial Conduct Authority (FCA) in the UK, for example, imposes strict rules on how financial products are marketed and sold, directly influencing Barclays' product development and customer service protocols to ensure fair outcomes.

Regulatory scrutiny over consumer conduct is a significant factor. In 2024, the FCA continued its focus on ensuring firms treat vulnerable customers fairly and provide clear, understandable information. Barclays, like other major banks, faces ongoing oversight regarding its complaints handling procedures and the redress provided to customers who have experienced mistreatment or mis-selling.

- FCA Consumer Duty: This 2024 regulation requires firms to act to deliver good outcomes for retail customers, impacting product design, pricing, and customer support at Barclays.

- Fair Lending Enforcement: Barclays must adhere to regulations preventing unfair discrimination in credit decisions, a key area of focus for consumer protection bodies.

- Data Protection Compliance: Adherence to GDPR and similar data privacy laws is critical for protecting customer information and maintaining trust.

- Complaints Resolution Standards: Barclays is legally obliged to have effective systems for handling customer complaints, with regulatory bodies monitoring resolution times and fairness.

Competition Law and Market Dominance Scrutiny

Competition authorities globally, including the UK's Competition and Markets Authority (CMA) and the European Commission, are increasingly scrutinizing the banking sector. This focus aims to prevent anti-competitive practices and ensure fair market access for all players. For instance, the CMA has been active in investigating potential collusion and ensuring that mergers and acquisitions within the financial services industry do not unduly concentrate market power.

Barclays, like other major banks, faces potential investigations into market dominance, particularly concerning areas like retail banking, corporate lending, and payment services. Pricing strategies, such as excessive fees or discriminatory interest rates, can also attract regulatory attention if deemed anti-competitive. The legal implications of market concentration are significant, potentially leading to fines, divestitures, or stricter operational oversight.

Fostering a competitive environment is crucial for innovation and consumer benefit. Recent data from the Financial Conduct Authority (FCA) in the UK highlights ongoing efforts to promote competition in banking, with a particular emphasis on challenger banks and fintech firms. For example, in 2024, the FCA continued its Open Banking initiative, which aims to increase competition by allowing third-party providers access to customer banking data with consent.

- Market Dominance Scrutiny: Regulators examine whether large banks, including Barclays, hold excessive market share in specific financial services, potentially stifling competition.

- Merger and Acquisition Oversight: Proposed mergers or acquisitions involving major banks are rigorously reviewed to prevent the creation of entities with undue market power.

- Pricing and Fee Investigations: Competition authorities may investigate pricing structures and fees to ensure they are not exploitative or indicative of anti-competitive behavior.

- Promoting Open Banking: Initiatives like Open Banking, supported by regulators, aim to foster a more competitive landscape by enabling new entrants and services.

Barclays' legal landscape is heavily influenced by evolving consumer protection laws and stringent data privacy regulations. The FCA's Consumer Duty, implemented in 2024, mandates that financial firms deliver good outcomes for retail customers, impacting product design and customer support. Failure to comply with data protection laws like GDPR can result in substantial fines, potentially reaching up to 4% of global annual turnover, underscoring the need for robust data governance and cybersecurity measures.

Environmental factors

Barclays faces significant physical risks from climate change, such as extreme weather events impacting its property and infrastructure, and transition risks as the world shifts to a low-carbon economy, potentially affecting the value of its investments in carbon-intensive industries. For instance, in 2024, the bank continued to integrate climate-related financial disclosures, aligning with Task Force on Climate-related Financial Disclosures (TCFD) recommendations, and conducted scenario analysis to assess its exposure to various climate futures.

The transition to a greener economy presents substantial opportunities for Barclays in green finance, including underwriting green bonds and providing financing for renewable energy projects and sustainable infrastructure. By the end of 2024, Barclays had committed to mobilizing £100 billion in green finance by 2030, reflecting a strategic focus on supporting clients in their decarbonization efforts.

Environmental factors are increasingly shaping investment strategies, with ESG considerations becoming paramount. Barclays' focus on strong ESG performance is crucial for attracting capital, as investors, both institutional and retail, are prioritizing sustainability. For instance, in 2024, the global sustainable investment market reached an estimated $37.4 trillion, demonstrating a significant shift in capital allocation.

Barclays' commitment to ESG directly impacts its reputation and ability to meet client demand for sustainable investment products. By integrating ESG criteria into its lending and investment frameworks, the bank can align with evolving market expectations and potentially unlock new revenue streams. This integration is vital as regulatory bodies worldwide, including the EU with its Sustainable Finance Disclosure Regulation (SFDR), are mandating greater transparency in ESG reporting.

Barclays is actively expanding its sustainable finance offerings, including green bonds and sustainability-linked loans, to support clients in their transition to a lower-carbon economy. In 2024, the bank continued to see significant growth in demand for ESG-focused investment funds, reflecting a broader market trend towards environmentally conscious financial solutions.

The bank's commitment extends to facilitating large-scale green financing projects, aiming to channel capital towards renewable energy and sustainable infrastructure. This strategic focus aligns with increasing regulatory pressures and investor expectations for responsible corporate behavior and measurable environmental impact.

Regulatory Pressure for Environmental Disclosure

Regulatory bodies worldwide are intensifying pressure on financial institutions like Barclays to disclose their environmental impact and climate-related financial risks. Frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD) are becoming increasingly influential, pushing for greater transparency and accountability in how firms manage climate risks.

Compliance with these evolving regulations demands robust data collection, sophisticated reporting mechanisms, and the seamless integration of environmental factors into core risk management processes. This shift is driven by a growing recognition that climate change poses systemic financial risks that need to be understood and managed proactively.

By mid-2024, a significant number of major global financial institutions, including many in the UK, had adopted TCFD recommendations, with regulatory mandates for disclosure expanding. For instance, the UK’s Financial Conduct Authority (FCA) has been progressively implementing rules requiring listed companies and financial institutions to report on climate-related matters, with further enhancements expected through 2025.

- TCFD Adoption: Over 4,000 organizations globally, representing a substantial portion of the world's market capitalization, have now aligned with TCFD recommendations as of early 2024.

- Regulatory Mandates: Jurisdictions like the UK, EU, and increasingly the US are moving towards mandatory climate-related financial disclosures for listed companies and financial services firms, with deadlines approaching in 2025.

- Data Integration Challenges: Financial institutions face significant hurdles in collecting and verifying the granular environmental data needed for accurate reporting, often requiring substantial investment in new systems and expertise.

- Risk Management Focus: Regulators are scrutinizing how financial firms integrate climate risk into their governance, strategy, risk management, and metrics and targets, moving beyond mere disclosure to demonstrate tangible action.

Resource Scarcity and Operational Environmental Footprint

Barclays is actively addressing resource scarcity and its operational environmental footprint. Concerns over water and energy availability directly influence operational costs and strategic planning. The bank is committed to reducing its carbon emissions, targeting a 50% reduction in financed emissions by 2030 compared to a 2020 baseline, and aims for net-zero financed emissions by 2050. Furthermore, Barclays has set targets to reduce its own direct operational emissions (Scope 1 and 2) by 50% by 2025, building on a 2018 baseline.

These sustainability initiatives offer tangible benefits. By improving energy efficiency and reducing waste across its global operations and supply chain, Barclays can achieve cost savings. For instance, their commitment to renewable energy sourcing for their operations contributes to both environmental goals and potential long-term cost stability. Beyond efficiency gains, these practices enhance Barclays' reputation, appealing to environmentally conscious investors and customers, which is increasingly important in the 2024-2025 financial landscape.

Barclays' focus on sustainable operations is also reflected in its supply chain management. The bank is working to integrate environmental considerations into its procurement processes, encouraging suppliers to adopt similar reduction targets for emissions and resource consumption. This holistic approach aims to minimize the bank's indirect environmental impact and foster a more sustainable ecosystem within its sphere of influence.

Key operational environmental initiatives include:

- Reducing financed emissions: Targeting a 50% reduction by 2030 and net-zero by 2050.

- Improving operational efficiency: Aiming for a 50% reduction in Scope 1 and 2 emissions by 2025.

- Sustainable supply chain: Integrating environmental criteria into supplier selection and management.

Barclays faces physical and transition risks from climate change, with extreme weather impacting infrastructure and the shift to a low-carbon economy affecting investments. The bank is actively integrating climate-related financial disclosures, aligning with TCFD recommendations and conducting scenario analysis to assess exposure.

The transition to a greener economy offers Barclays opportunities in green finance, such as underwriting green bonds and financing renewable energy projects. By the close of 2024, Barclays had committed to mobilizing £100 billion in green finance by 2030, underscoring its strategic focus on supporting client decarbonization.

Environmental factors are increasingly driving investment strategies, with ESG considerations becoming paramount. Barclays' commitment to strong ESG performance is crucial for attracting capital, as evidenced by the estimated $37.4 trillion in the global sustainable investment market by early 2024.

Barclays is expanding its sustainable finance offerings, including green bonds and sustainability-linked loans, to aid clients in their low-carbon transition. The bank observed significant growth in demand for ESG-focused investment funds throughout 2024, reflecting a broader market trend.

| Environmental Factor | Barclays' Response/Initiative | Key Data/Target |

| Climate Change Risks | Integrating climate-related financial disclosures (TCFD) | Scenario analysis conducted in 2024 |

| Green Economy Transition | Mobilizing green finance | £100 billion by 2030 |

| ESG Investment Demand | Focus on ESG performance | Global sustainable investment market ~ $37.4 trillion (early 2024) |

| Sustainable Finance Offerings | Expanding green bonds and sustainability-linked loans | Growth in demand for ESG funds in 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Barclays is built on a comprehensive blend of data from official regulatory bodies, leading financial institutions, and reputable market research firms. We meticulously gather insights from economic reports, technological advancements, and socio-political trends to ensure a robust and accurate assessment.