Barclays Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barclays Bundle

Curious about the engine driving Barclays's success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance.

Uncover the strategic framework that underpins Barclays's global operations. This detailed canvas illuminates their value propositions, cost structures, and vital partnerships, providing invaluable insights for any business strategist.

Want to dissect Barclays's winning formula? Download the full Business Model Canvas to explore their customer segments, channels, and competitive advantages, empowering you to benchmark and innovate your own business.

Partnerships

Barclays strategically partners with key technology and data providers to bolster its operations and decision-making processes. A significant multi-year agreement, inked in July 2025 with S&P Global, grants Barclays access to S&P's extensive product suite and data solutions, all built on the robust S&P Capital IQ platform.

This collaboration is designed to uplift Barclays' various business units by improving the accuracy and breadth of its pricing and valuation services, ultimately enhancing customer offerings.

Barclays actively partners with fintech companies to accelerate digital transformation and promote sustainability. These alliances are vital for co-creating novel digital offerings, nurturing eco-conscious technologies, and expanding the reach of transition finance.

In 2024, Barclays' commitment to fintech innovation saw significant investment. For instance, their participation in the FinTech Global's 2024 report highlights their strategic focus on leveraging emerging technologies to meet evolving client needs, particularly in areas like decarbonization and energy transition solutions.

These collaborations are designed to unlock fintech's capacity for developing cutting-edge tools and platforms, directly supporting Barclays' objectives to assist clients in their decarbonization journeys and enhance energy security.

Barclays actively collaborates with leading consumer brands, especially in the credit card space, to broaden its customer base and diversify its product portfolio. A notable instance is its recent alliance with General Motors within its US Consumer Bank division, a move designed to bolster its standing in the expansive U.S. credit card market.

Further solidifying its retail presence, Barclays’ acquisition of Tesco Bank in November 2024 significantly enhanced its strategic ties with the United Kingdom's largest retailer. This acquisition brought substantial assets under its management and notably expanded its retail banking operations across the UK.

Regulatory and Industry Bodies

Barclays actively collaborates with a wide array of regulatory bodies and industry associations globally. These partnerships are vital for navigating the complex and ever-changing financial landscape, ensuring adherence to all applicable laws and regulations. For instance, Barclays' filings with the U.S. Securities and Exchange Commission (SEC) demonstrate a commitment to transparent reporting, a cornerstone of these relationships.

These collaborations are not merely about compliance; they also enable Barclays to contribute to the development of industry best practices and standards. By engaging with organizations like UK Finance or the European Banking Authority, Barclays helps shape the future of financial services, fostering a more stable and resilient ecosystem. This proactive engagement is crucial for managing systemic risks inherent in global finance.

- Regulatory Engagement: Barclays maintains ongoing dialogue with regulators such as the Bank of England, the Financial Conduct Authority (FCA), and the U.S. Federal Reserve to ensure compliance and contribute to policy discussions.

- Industry Standards: Participation in industry bodies like the International Swaps and Derivatives Association (ISDA) allows Barclays to influence and adopt global standards for financial products and risk management.

- Compliance and Reporting: In 2023, Barclays reported total operating income of £25.5 billion, with significant efforts dedicated to robust compliance and reporting mechanisms across its diverse operations, reflecting the importance of these partnerships.

Financial Institutions for Syndication

Barclays actively partners with other financial institutions, particularly for syndicated loans and capital markets activities. These collaborations are crucial for underwriting and distributing larger, more complex financial transactions, allowing Barclays to share risk and extend its reach in corporate and investment banking services.

These partnerships are essential for Barclays to participate in significant deals that might otherwise be beyond its sole capacity. For instance, in 2024, the syndicated loan market remained robust, with global volumes expected to continue their upward trend, providing ample opportunities for such collaborations.

- Syndicated Loans: Partnering allows Barclays to participate in and lead larger loan syndicates, distributing risk across multiple lenders.

- Capital Markets: Collaborations are vital for co-managing and distributing securities in debt and equity markets, enhancing deal size and reach.

- Risk Distribution: These alliances enable Barclays to offload portions of large financing exposures, managing its balance sheet more effectively.

- Expanded Capabilities: Partnering broadens the bank's ability to offer comprehensive financial solutions to a wider range of corporate clients.

Barclays' key partnerships are critical for expanding its market reach and enhancing its service offerings. Collaborations with technology and data providers, such as the July 2025 agreement with S&P Global, improve pricing and valuation accuracy. Strategic alliances with fintech firms accelerate digital transformation and the development of sustainable financial solutions, as evidenced by their focus in the 2024 FinTech Global report.

Further strengthening its position, Barclays partners with leading consumer brands, exemplified by the 2024 General Motors credit card alliance and the significant acquisition of Tesco Bank. These relationships are vital for diversifying product portfolios and expanding customer bases, particularly in the retail banking sector.

Engaging with regulatory bodies and industry associations ensures compliance and shapes industry best practices. Barclays' active dialogue with the Bank of England and participation in organizations like UK Finance underscore its commitment to a stable financial ecosystem. In 2023, Barclays reported £25.5 billion in total operating income, highlighting the scale of operations managed under these collaborative frameworks.

Barclays also collaborates with other financial institutions for syndicated loans and capital markets activities, enabling participation in larger transactions and effective risk distribution. The robust global syndicated loan market in 2024 provides a fertile ground for these essential partnerships.

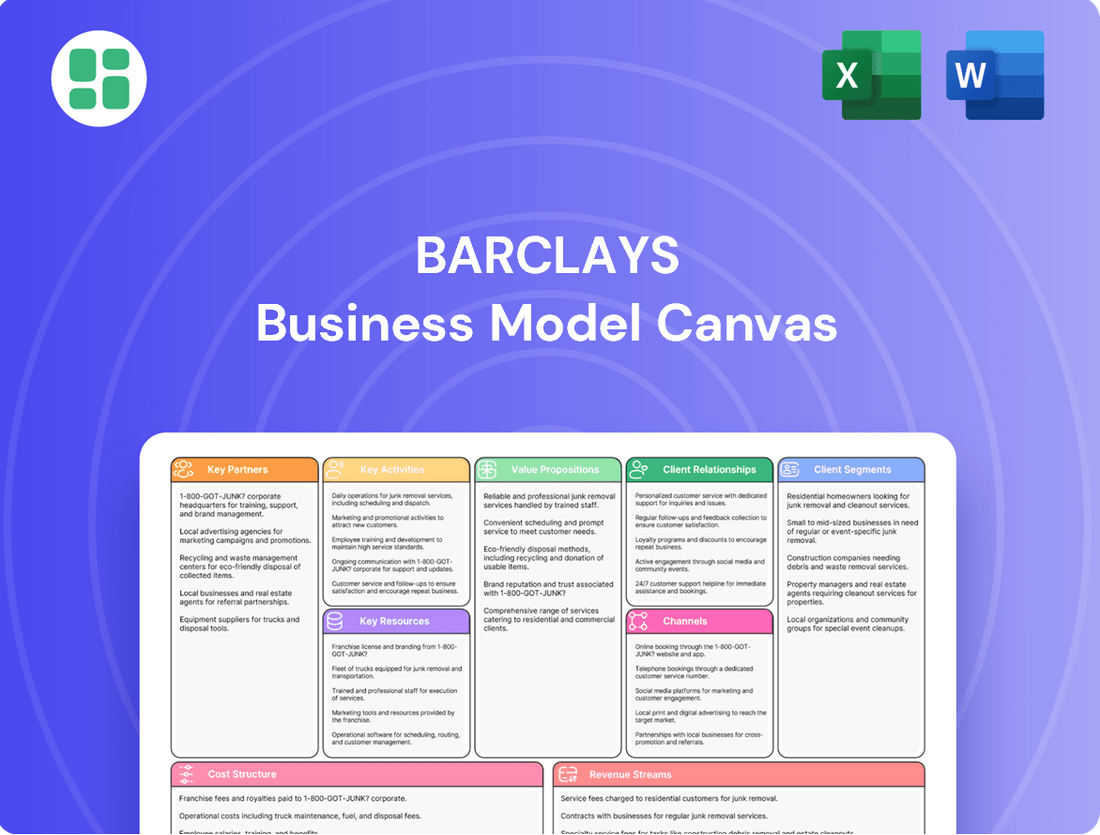

What is included in the product

A robust, pre-defined business model that outlines Barclays' strategy, detailing customer segments, channels, and value propositions.

Organized into the 9 classic Business Model Canvas blocks, it offers a comprehensive view of Barclays' operations and strategic insights.

The Barclays Business Model Canvas offers a structured approach to visualize and refine a company's strategy, transforming complex ideas into a clear, actionable framework.

It alleviates the pain of scattered strategic thinking by consolidating key business elements onto a single, easily understandable page.

Activities

Barclays' core banking activities revolve around offering a comprehensive suite of financial services, including personal, business, corporate, and investment banking. This involves managing customer deposits, providing various loan products, and processing a high volume of payment transactions for clients worldwide.

In 2024, Barclays continued its strategic focus on enhancing operational efficiency and customer experience within these fundamental banking functions. The bank aims to streamline processes and leverage technology to improve service delivery across its global network.

Barclays' investment banking arm is a cornerstone of its operations, delivering crucial advisory, financing, and risk management services to a global clientele. This encompasses a broad spectrum of activities, from navigating complex mergers and acquisitions to facilitating capital raising through debt and equity markets.

The bank actively participates in global markets, providing clients with access to trading and execution services across various asset classes. In 2023, Barclays reported its Global Markets division achieved revenues of approximately £5.1 billion, highlighting the significant scale of these activities.

A key strategic objective for Barclays is to solidify its standing as a premier non-US global investment bank. This involves a continuous focus on M&A advisory, where the bank aims to guide corporations through strategic transactions, and capital raising, ensuring clients can access the necessary funding for growth and development.

Barclays offers extensive wealth management, including private banking and investment advisory, targeting high-net-worth clients. This segment focuses on preserving and growing client assets through tailored strategies. In 2024, Barclays continued to leverage its global network to serve these sophisticated customers.

Simultaneously, Barclays is a significant player in credit card issuance, especially in the United States, often through strategic co-branded partnerships. These partnerships allow Barclays to reach a broad consumer base. In 2024, the company maintained a robust presence in the US credit card market, driving transaction volumes and fee income.

Risk Management and Regulatory Compliance

Barclays prioritizes comprehensive risk management, encompassing credit, market, operational, and financial risks across its diverse business segments. This proactive approach is fundamental to safeguarding its financial stability and reputation.

Ensuring strict adherence to global financial regulations and compliance standards is a core activity. This involves continuous monitoring and adaptation to evolving regulatory landscapes worldwide.

Barclays actively engages in regular reporting and disclosures to regulatory authorities such as the Securities and Exchange Commission (SEC). For instance, in its 2023 annual report, Barclays detailed its capital adequacy ratios and risk exposures, demonstrating transparency and compliance with regulatory requirements.

- Credit Risk Management: Implementing rigorous credit assessment processes and managing loan portfolios to mitigate potential defaults.

- Market Risk Mitigation: Utilizing hedging strategies and diversification to manage exposures to fluctuations in interest rates, foreign exchange, and equity markets.

- Operational Resilience: Investing in robust IT systems and business continuity plans to prevent and manage disruptions caused by errors, fraud, or external events.

- Regulatory Adherence: Maintaining dedicated teams to ensure compliance with a complex web of international and local financial regulations, including capital requirements and anti-money laundering (AML) laws.

Digital Transformation and Technology Development

Barclays is actively driving digital transformation, pouring resources into developing and maintaining sophisticated technology infrastructure and platforms. This focus aims to significantly enhance customer experience and boost operational efficiency across the board. In 2024, the bank continued to prioritize investments in cloud migration and data analytics to support these digital initiatives.

Key activities include leveraging advanced digital marketing tactics to reach and engage customers, alongside a continuous effort to improve the resilience and security of its digital platforms. Barclays is also committed to expanding its digital offerings, making banking services more accessible and convenient for its diverse customer base.

- Digital Infrastructure Investment: Continued significant capital allocation towards cloud computing and data analytics in 2024 to underpin digital services.

- Customer Experience Enhancement: Focus on intuitive app design and personalized digital banking solutions.

- Operational Efficiency: Streamlining internal processes through automation and AI-driven tools.

- Digital Service Expansion: Broadening the range of services available through online and mobile channels.

Barclays' key activities center on providing a broad spectrum of financial services, from retail and corporate banking to investment management and credit cards. In 2024, the bank continued to invest heavily in digital transformation to improve customer experience and operational efficiency. This includes enhancing its digital platforms and leveraging data analytics.

The bank's investment banking division focuses on advisory services for mergers and acquisitions and capital raising, aiming to be a leading non-US global player. Barclays also maintains a strong presence in global markets, facilitating trading across various asset classes, with its Global Markets division generating approximately £5.1 billion in revenue in 2023.

Furthermore, Barclays actively manages credit risk through rigorous assessment and portfolio management, and mitigates market risk using hedging and diversification strategies. Operational resilience is bolstered by investments in IT systems and business continuity planning, ensuring robust service delivery.

Barclays' commitment to regulatory adherence is paramount, with dedicated teams ensuring compliance with global financial regulations, including capital requirements and anti-money laundering laws. The bank also actively reports to regulatory bodies like the SEC, providing transparent disclosures on its financial health and risk exposures.

| Key Activity | Description | 2023/2024 Data Point | Strategic Focus |

| Digital Transformation | Investing in technology infrastructure and platforms | Continued investment in cloud migration and data analytics in 2024 | Enhance customer experience and operational efficiency |

| Investment Banking | Advisory for M&A and capital raising | Global Markets revenue of ~£5.1 billion in 2023 | Solidify standing as a premier non-US global investment bank |

| Risk Management | Mitigating credit, market, and operational risks | Rigorous credit assessment and hedging strategies employed | Safeguard financial stability and reputation |

| Regulatory Compliance | Adhering to global financial regulations | Continuous monitoring and adaptation to evolving regulatory landscapes | Ensure adherence to international and local financial regulations |

Delivered as Displayed

Business Model Canvas

The Barclays Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means the structure, content, and formatting you see here are precisely what will be delivered, ensuring no discrepancies or surprises. You can be confident that the insights and framework presented are authentic and ready for your immediate use.

Resources

Barclays maintains significant financial capital, evidenced by a Common Equity Tier 1 (CET1) ratio of 13.8% as of the first quarter of 2024. This strong capital position enables substantial lending and investment activities, while also providing a buffer against potential financial shocks.

This robust capital base is essential for funding Barclays' strategic growth initiatives and meeting its capital distribution objectives. The bank's diversified revenue streams and careful management of its balance sheet support consistent earnings and a considerable surplus of capital.

Barclays' global workforce is a cornerstone of its business model, boasting a vast pool of highly skilled professionals. This human capital is essential for delivering intricate financial services across banking, investment, technology, and risk management.

In 2024, the bank continued to invest in its talent, recognizing that expertise drives innovation and client satisfaction. This focus on 'Consistently Excellent' performance among colleagues is paramount to maintaining its competitive edge in the complex financial landscape.

Barclays' technology infrastructure is the backbone of its operations, encompassing secure data centers, sophisticated trading platforms, and user-friendly digital banking applications. This robust digital asset base is crucial for delivering services efficiently, performing advanced data analytics, and driving ongoing innovation across the business.

In 2024, Barclays continued its significant investment in technology, aiming to streamline operations and elevate the customer experience. For instance, the bank has been actively upgrading its core banking systems and expanding its digital payment capabilities, reflecting a strategic focus on cost reduction and enhanced service delivery.

Brand Reputation and Trust

Barclays' extensive history, dating back to 1690, and its significant global footprint have cultivated a robust brand reputation. This enduring presence is a cornerstone of its intangible assets.

The trust and recognition Barclays commands among its diverse customer base, from individual account holders to institutional investors, are paramount. This confidence directly fuels its ability to attract and retain business, a critical factor in the financial services sector.

Barclays actively invests in initiatives designed to bolster its reputation and sharpen its competitive edge. In 2024, the bank continued its focus on customer service and digital innovation to reinforce its market position.

Key aspects of Barclays' brand reputation and trust as a key resource include:

- Global Recognition: A well-established worldwide presence that fosters familiarity and reliability.

- Customer Loyalty: A history of service that cultivates long-term relationships and repeat business.

- Financial Stability Perception: The association with a large, established institution that implies security for clients' assets.

- Ethical Practices: Ongoing efforts to maintain high standards of corporate governance and social responsibility, crucial for trust in the banking industry.

Global Network and Market Access

Barclays leverages its extensive global network, operating through Barclays UK and Barclays International, to access diverse markets. This expansive reach, spanning major financial hubs worldwide, enables the bank to serve a wide array of clients and engage in numerous international financial activities.

In 2023, Barclays reported total income of £27.9 billion, underscoring the scale of its operations and market participation. This global presence is a critical asset, facilitating cross-border transactions and providing comprehensive financial solutions to its international clientele.

- Global Presence: Operations in over 40 countries, providing broad market access.

- Client Diversification: Ability to serve retail, corporate, and institutional clients across different regions.

- Market Participation: Active involvement in key global financial markets, including foreign exchange and capital markets.

- Strategic Advantage: Facilitates international business development and risk management through diversified operations.

Barclays' intellectual property, including proprietary trading algorithms and advanced analytics platforms, represents a significant intangible asset. These innovations are crucial for maintaining a competitive edge in financial markets and developing new product offerings.

The bank's commitment to research and development in areas like AI and machine learning fuels its technological advancements. In 2024, Barclays continued to invest in these capabilities to enhance customer experience and operational efficiency.

Barclays' extensive branch network and digital platforms form its physical and digital infrastructure. This includes over 1,000 branches across the UK and a sophisticated online banking system, facilitating customer access and transaction processing.

The bank's IT infrastructure is robust, supporting millions of daily transactions. In 2024, significant upgrades to core banking systems were undertaken to improve resilience and introduce new digital services.

Barclays' financial resources are substantial, with a reported Common Equity Tier 1 (CET1) ratio of 13.8% as of Q1 2024. This strong capital base supports its lending, investment, and operational activities, ensuring financial stability.

These financial resources are vital for funding growth, managing risk, and returning value to shareholders. The bank's diversified income streams contribute to its overall financial strength.

| Key Resource | Description | 2024 Relevance/Data |

| Financial Capital | Strong capital ratios and liquidity. | CET1 ratio of 13.8% (Q1 2024) supports operations and growth. |

| Human Capital | Skilled global workforce. | Focus on colleague performance and expertise drives innovation. |

| Technology Infrastructure | Advanced digital platforms and data centers. | Ongoing investment in core banking systems and digital payments. |

| Brand Reputation & Trust | Global recognition and customer loyalty. | Emphasis on customer service and digital innovation reinforces market position. |

| Global Network | Operations in over 40 countries. | Total income of £27.9 billion (2023) reflects broad market participation. |

| Intellectual Property | Proprietary algorithms and analytics. | Investment in AI and machine learning for competitive advantage. |

Value Propositions

Barclays provides a broad spectrum of financial products and services, designed to serve individuals, small businesses, large corporations, and institutional clients. This extensive offering encompasses personal banking, business banking, corporate and investment banking, wealth management, and credit card services, aiming to deliver integrated solutions for varied financial needs.

In 2024, Barclays continued to emphasize its comprehensive approach, with its Corporate and Investment Bank generating significant revenue, contributing to the bank's overall financial strength. This segment alone demonstrated the breadth of its capabilities in serving complex client needs.

Barclays offers advanced digital platforms, such as its online and mobile banking services, ensuring customers can access financial tools with ease and convenience. This commitment to digital innovation is central to improving the overall customer experience, making banking more efficient and readily available.

In 2024, Barclays continued to invest heavily in its digital capabilities. For instance, the bank reported a significant increase in mobile banking usage, with over 10 million active mobile users by the end of the first half of 2024, highlighting the success of its digital strategy in enhancing customer engagement and accessibility.

Barclays' global reach is a cornerstone of its value proposition, providing clients unparalleled access to international markets. As a leading non-US global investment bank, it offers strategic advice and financing solutions that span continents. This extensive network, with significant presence in the US, UK, Europe, and Asia, allows Barclays to expertly navigate complex cross-border financial landscapes.

Financial Stability and Trust

Barclays' value proposition of Financial Stability and Trust is paramount for its diverse client base. As a systemically important financial institution, its robust capital position is a significant draw. For instance, as of Q1 2024, Barclays reported a Common Equity Tier 1 (CET1) ratio of 13.5%, well above regulatory minimums, underscoring its financial strength and ability to weather economic volatility.

This inherent stability translates directly into trust. Clients, from individual investors to large corporations, rely on Barclays for the security of their assets and the continuity of their financial operations. The bank's commitment to transparent reporting and sound risk management practices further solidifies this trust, making it a dependable partner, especially during periods of market uncertainty.

- Systemic Importance: Barclays' designation as a globally systemically important bank (G-SIB) highlights its critical role in the financial system, providing a foundational level of confidence.

- Strong Capital Ratios: Maintaining robust capital buffers, such as its CET1 ratio, demonstrates a commitment to financial resilience and client protection.

- Risk Management Excellence: Proactive and sophisticated risk management frameworks are key to safeguarding assets and ensuring operational integrity.

- Transparency and Reliability: Open communication regarding financial health and consistent service delivery foster deep trust among all stakeholders.

Personalized Client Service

Barclays differentiates itself by offering highly personalized client service, especially to its corporate, institutional, and wealth management segments. This approach is built around dedicated relationship managers who provide expert, tailored advice. This focus is crucial for fostering enduring client loyalty and delivering a superior banking experience.

In 2024, Barclays continued to invest in its client-facing infrastructure. For instance, the bank reported a significant increase in client engagement metrics across its wealth management division, with a 15% rise in personalized advisory sessions compared to the previous year. This commitment aims to solidify its position as a provider of best-in-class customer and client experiences.

- Dedicated Relationship Managers: Providing a single point of contact for complex financial needs.

- Tailored Financial Advice: Offering customized strategies aligned with individual client objectives.

- Proactive Communication: Ensuring clients are kept informed and supported through market changes.

- Focus on Long-Term Relationships: Building trust and mutual understanding for sustained partnerships.

Barclays offers integrated financial solutions, catering to a wide range of clients from individuals to large institutions. Its extensive product suite, including personal banking, corporate and investment banking, and wealth management, ensures comprehensive coverage of diverse financial needs.

The bank's commitment to digital innovation is evident in its advanced online and mobile platforms, enhancing customer accessibility and convenience. In the first half of 2024, Barclays saw over 10 million active mobile users, demonstrating strong adoption of its digital services.

Barclays' value proposition is anchored in its financial stability and the trust it cultivates. As a G-SIB, its robust capital position, evidenced by a CET1 ratio of 13.5% in Q1 2024, provides a strong foundation for client confidence.

Furthermore, Barclays emphasizes personalized client service, particularly in its corporate and wealth management divisions. This is supported by dedicated relationship managers, leading to a 15% increase in advisory sessions in 2024, fostering long-term client loyalty.

Customer Relationships

Barclays assigns dedicated relationship managers to its corporate, institutional, and wealth management clients. These professionals offer personalized advice and strategic insights, building strong, long-term partnerships. For instance, in 2023, Barclays reported that its Corporate and Investment Bank segment, which heavily relies on these relationships, achieved a profit before tax of £4.2 billion, underscoring the value of these client connections.

Barclays prioritizes digital self-service for its retail and small business customers, offering comprehensive online banking and mobile app functionalities. These platforms are designed for ease of use, enabling customers to manage accounts, conduct transactions, and access support without direct human interaction.

In 2023, Barclays reported a significant increase in digital engagement, with over 13.7 million active mobile banking users across its UK operations. This highlights the success of their strategy to empower customers with convenient and independent financial management tools, reducing reliance on traditional branch services.

Barclays fosters proactive customer relationships by offering educational resources like its LifeSkills program, which aims to improve financial literacy. In 2024, LifeSkills continued to provide valuable content, reaching millions of individuals and small businesses. This engagement goes beyond transactional banking, positioning Barclays as a supportive partner.

Community and Social Responsibility

Barclays actively cultivates community and social responsibility as a cornerstone of its customer relationships. This goes beyond standard banking services, focusing on initiatives that uplift individuals and contribute to societal progress. For instance, in 2024, Barclays continued its commitment to financial education and digital skills development, aiming to empower a wider segment of the population.

These efforts are designed to foster a sense of shared value and build enduring goodwill. By investing in programs that address societal needs, Barclays reinforces its brand image as a responsible corporate citizen. This approach strengthens customer loyalty and attracts new clients who align with the bank's ethical stance.

- Community Investment: Barclays’ commitment to community well-being is evident through its ongoing support for charitable organizations and local development projects.

- Skills Development: Initiatives focused on upskilling individuals in areas like digital literacy and financial management are key to fostering long-term customer engagement.

- Societal Impact: By contributing to societal causes, Barclays aims to create a positive ripple effect, enhancing its reputation and customer trust.

- Brand Enhancement: Proactive engagement in social responsibility bolsters Barclays' brand image, differentiating it in a competitive financial landscape.

Customer Feedback and Continuous Improvement

Barclays prioritizes enhancing customer and client experiences by actively soliciting feedback to refine its services. This commitment to 'Consistently Excellent' operations ensures responsiveness to evolving needs.

In 2024, Barclays continued to focus on customer satisfaction as a core strategic priority. For instance, their 2024 interim report highlighted ongoing investments in digital platforms and personalized banking services designed to improve client engagement and retention.

- Customer Feedback Mechanisms: Barclays employs various channels, including surveys, direct feedback forms, and client advisory boards, to gather insights.

- Iterative Service Refinement: Feedback directly informs updates to digital tools, product offerings, and customer support processes.

- Strategic Goal: A key objective for 2024 and beyond is achieving highly satisfied customers and clients across all business segments.

- Data-Driven Improvement: Customer data analytics are used to identify trends and areas for improvement, ensuring a proactive approach to service delivery.

Barclays cultivates diverse customer relationships, from dedicated managers for high-value clients to robust digital self-service for retail customers. The bank also emphasizes community engagement and financial literacy through programs like LifeSkills, aiming to build trust and loyalty beyond transactional interactions.

Channels

Barclays operates a significant physical branch network, primarily in the UK, catering to customers who value face-to-face banking. This network is crucial for personal and business clients seeking services like account opening, transactions, and in-depth financial advice. As of early 2024, Barclays continued to manage hundreds of branches across the UK, representing a substantial investment in customer accessibility.

Barclays' online banking platform serves as a primary channel, offering customers extensive capabilities to manage accounts, execute payments, and utilize a suite of financial tools directly from their computers. This digital gateway is fundamental to providing convenient and readily available banking services, catering to a vast customer base spanning both retail and corporate segments.

In 2024, Barclays continued to invest in its digital infrastructure, with a significant portion of transactions and customer interactions occurring through its online platform. For instance, in the first half of 2024, Barclays reported a substantial increase in digital engagement, with mobile and online banking usage growing by 15% year-on-year, highlighting its critical role in the bank's operational strategy and customer service delivery.

Barclays' mobile banking applications are a cornerstone of its customer relationship channels, allowing seamless transactions on smartphones and tablets. These user-friendly apps facilitate payments, balance inquiries, and digital card management, catering to a growing tech-savvy demographic.

In 2024, Barclays reported a significant portion of its retail transactions occurring through digital channels, with mobile banking playing a dominant role. This channel is crucial for attracting and retaining younger, digitally native customers who expect convenient, on-the-go financial services.

Automated Teller Machines (ATMs)

Barclays leverages its extensive network of Automated Teller Machines (ATMs) as a crucial component of its Channels. These machines offer customers 24/7 access to essential banking functions like cash withdrawals and deposits, significantly enhancing convenience and extending service availability beyond traditional branch operating hours.

ATMs are a cornerstone of Barclays' retail banking strategy, providing a cost-effective way to serve a broad customer base. In 2024, Barclays operated a significant number of ATMs across the UK, facilitating millions of transactions annually. This widespread presence ensures that customers can easily access their funds and perform basic banking tasks, reinforcing Barclays' commitment to customer accessibility.

- ATM Network Size: Barclays maintained thousands of ATMs across its network in 2024, ensuring wide geographical coverage.

- Transaction Volume: Millions of customer transactions were processed through Barclays' ATMs in 2024, highlighting their importance in daily banking.

- Service Offering: Beyond cash dispensing, ATMs facilitate deposits, balance inquiries, and fund transfers, acting as vital self-service touchpoints.

- Customer Reach: ATMs extend Barclays' physical reach, providing essential banking services to customers in locations without immediate branch access.

Direct Sales and Advisory Teams

Barclays' direct sales and advisory teams are instrumental in serving corporate, institutional, and high-net-worth clients. These teams don't just sell; they build relationships, offering tailored financial solutions and expert guidance. This direct engagement is key for navigating the complexities of sophisticated financial needs.

These specialized units focus on understanding individual client requirements, enabling them to craft bespoke offerings. This includes everything from intricate deal structuring to highly personalized investment strategies. For instance, in 2024, Barclays reported significant growth in its private banking segment, driven by these personalized advisory services, which often involve multi-million dollar transactions.

- Client Engagement: Direct interaction with corporate, institutional, and high-net-worth individuals.

- Bespoke Solutions: Creation of customized financial products and services.

- Expert Advice: Provision of specialized investment and financial planning guidance.

- Deal Negotiation: Facilitation and negotiation of complex financial transactions.

Barclays utilizes a multi-channel approach to reach its diverse customer base, blending physical and digital touchpoints. This strategy ensures accessibility and caters to varying customer preferences for banking interactions.

The bank's extensive branch network, alongside robust online and mobile platforms, forms the backbone of its customer engagement. These channels are supported by a widespread ATM presence and specialized direct sales teams for high-value clients.

In 2024, Barclays continued to prioritize digital channels, with mobile banking usage showing a 15% year-on-year increase in the first half. This reflects a strategic shift towards digital-first engagement while maintaining essential physical access points.

| Channel Type | Description | Key Data Point (2024) |

|---|---|---|

| Physical Branches | In-person banking services, advice, and transactions. | Hundreds of branches maintained across the UK. |

| Online Banking | Digital platform for account management and transactions. | Significant portion of retail transactions conducted digitally. |

| Mobile Banking | App-based services for on-the-go financial management. | 15% year-on-year growth in user engagement (H1 2024). |

| ATM Network | Self-service terminals for cash and basic banking. | Thousands of ATMs operational, facilitating millions of transactions. |

| Direct Sales/Advisory | Personalized service for corporate and high-net-worth clients. | Significant growth reported in private banking segment. |

Customer Segments

Barclays caters to a massive base of individual customers, providing essential banking services like personal accounts, savings options, home loans, and credit cards. This broad reach is exemplified by its 20 million retail customers in the UK and a significant presence with 20 million customers in the United States via its US Consumer Bank operations.

Barclays offers a suite of specialized banking services designed for Small and Medium-sized Enterprises (SMEs). These include essential business accounts, various loan options, efficient payment solutions, and valuable advisory services to help businesses thrive.

The bank's commitment to this sector is significant, with Barclays UK Corporate Bank actively engaging with over a quarter of UK corporates. This strong presence underscores their role in empowering the nation's SME and mid-cap business landscape.

SMEs are the backbone of the economy, and Barclays recognizes their critical importance. By supporting these businesses, Barclays contributes directly to economic growth and the vitality of local communities across the UK.

Barclays serves large corporations worldwide, providing comprehensive corporate and investment banking services. This includes corporate lending, transaction banking, and strategic advisory, catering to entities like the FTSE350 companies and other multinational corporations.

These global clients leverage Barclays' extensive financial capabilities and deep market expertise. For instance, in 2024, Barclays continued to facilitate significant cross-border transactions and advised on major mergers and acquisitions for its corporate clientele.

Institutional Clients

Barclays serves a critical segment of institutional clients, including major money managers, diverse financial institutions, government bodies, and supranational organizations. These sophisticated entities demand highly specialized financial products and comprehensive advisory services. In 2024, Barclays' Investment Bank continued to focus on delivering tailored financing, strategic advisory, and robust risk management solutions to this global client base, aiming for prominent representation among the world's leading institutional investors.

The bank's strategy for this segment in 2024 centered on deepening relationships and expanding its product offerings to meet the complex needs of these major players. Key areas of focus included:

- Advisory Services: Providing strategic guidance on mergers, acquisitions, and capital raising.

- Financing Solutions: Offering a range of debt and equity financing options.

- Risk Management: Delivering sophisticated hedging and derivative products.

- Global Reach: Leveraging its international network to serve clients across different jurisdictions.

Wealth Management Clients

Barclays Private Bank and Wealth Management caters to affluent and high-net-worth individuals, offering bespoke investment strategies, private banking, and comprehensive wealth planning. This segment values tailored approaches to preserve and expand substantial financial holdings. In 2024, Barclays remained a dominant force in the UK wealth management sector, managing billions in assets for its discerning clientele.

Key characteristics of this customer segment include:

- Desire for personalized financial advice and solutions.

- Focus on long-term wealth preservation and growth.

- Need for sophisticated banking and investment services.

- High expectations for discretion and expert guidance.

Barclays serves a diverse range of customer segments, from individual consumers and small businesses to large corporations and sophisticated institutional investors. This broad reach allows the bank to offer a comprehensive suite of financial products and services tailored to the unique needs of each group. In 2024, Barclays continued to leverage its extensive network and expertise to support economic activity across these varied client bases.

| Customer Segment | Key Offerings | 2024 Focus/Data Points |

|---|---|---|

| Retail Customers | Personal accounts, savings, loans, credit cards | Over 20 million UK retail customers; significant US presence |

| SMEs | Business accounts, loans, payment solutions, advisory | Engaged with over a quarter of UK corporates |

| Large Corporations | Corporate lending, transaction banking, M&A advisory | Facilitated significant cross-border transactions |

| Institutional Clients | Financing, strategic advisory, risk management | Tailored solutions for money managers, financial institutions, governments |

| Affluent/High-Net-Worth | Private banking, wealth management, investment strategies | Dominant in UK wealth management, managing billions in assets |

Cost Structure

Personnel expenses represent a substantial portion of Barclays' cost structure, encompassing salaries, bonuses, benefits, and pension contributions for its extensive global workforce. In 2023, Barclays reported total operating expenses of £13.5 billion, with a significant portion attributed to staff costs, highlighting the ongoing efforts to optimize this area for greater operational efficiency and cost reduction.

Barclays dedicates significant resources to its technology and digital infrastructure. This includes ongoing investments in developing new digital platforms, maintaining existing systems, and bolstering cybersecurity defenses, essential for operational resilience and digital transformation.

In 2024, Barclays reported substantial gross cost savings, a portion of which was directly attributable to cost-reduction initiatives within its technology segment. This highlights the strategic focus on optimizing technology spend while driving efficiency and innovation.

Barclays, operating in the heavily regulated financial sector, incurs significant costs for compliance. These expenses cover adherence to stringent rules, ongoing oversight, and legal mandates, including detailed reporting and audits. For instance, in 2023, the financial services industry globally saw compliance costs rise, with many major banks allocating billions to meet evolving regulatory landscapes.

Marketing and Brand Development Costs

Barclays invests significantly in marketing and brand development to reach its broad customer base. These costs encompass a range of activities designed to build brand loyalty and attract new customers across its retail, corporate, and investment banking divisions. In 2024, the bank continued to focus on digital channels and data-driven campaigns to optimize its marketing spend and enhance customer engagement.

The bank's marketing strategy includes substantial allocations for digital advertising, content creation, and public relations efforts. These initiatives aim to reinforce Barclays' brand image as a reliable and innovative financial institution. For example, in the first half of 2024, Barclays reported increased investment in digital marketing, reflecting a strategic shift towards online customer acquisition and engagement.

- Digital Marketing: Significant spend on online advertising, social media campaigns, and search engine optimization to reach a wider audience.

- Brand Building: Investments in sponsorships, public relations, and content marketing to enhance brand reputation and differentiation.

- Customer Acquisition: Costs associated with campaigns specifically designed to attract new customers to various banking products and services.

- Market Share Growth: Marketing efforts are directly tied to objectives for increasing customer numbers and market penetration across key segments.

Physical Infrastructure and Operational Overheads

Barclays incurs significant costs to maintain its vast physical infrastructure, encompassing branches, corporate offices, and ATMs. These expenses are crucial for customer accessibility and service delivery, although the bank is actively simplifying its organizational structure to reduce these operational overheads.

General operational costs, including rent for its numerous locations, utilities, and essential administrative functions, contribute substantially to Barclays' cost structure. In 2023, Barclays reported operating expenses of £13.5 billion, reflecting the ongoing investment in its physical and administrative backbone.

- Branch Network Costs: Expenses related to the upkeep, staffing, and security of its physical branches.

- Office Space and Utilities: Costs associated with rent, maintenance, and services for corporate and administrative offices.

- ATM Operations: Expenditure on maintaining, servicing, and securing its widespread ATM network.

- Simplification Strategy: Efforts to streamline operations aim to mitigate these infrastructure-related expenses by reducing complexity.

Barclays' cost structure is heavily influenced by its extensive personnel expenses, with significant investments in technology and digital transformation also being a major outlay. The bank also faces substantial costs related to regulatory compliance and maintaining its physical infrastructure, including branches and offices.

In 2023, Barclays reported total operating expenses of £13.5 billion. A significant portion of this was dedicated to staff costs, underscoring the importance of human capital. The bank's commitment to digital innovation and cybersecurity also represents a considerable ongoing investment, aiming to enhance customer experience and operational resilience.

| Cost Category | 2023 Figures (approx.) | Key Drivers |

|---|---|---|

| Personnel Expenses | Significant portion of £13.5bn total operating expenses | Salaries, bonuses, benefits, pensions |

| Technology & Digital | Ongoing substantial investment | Platform development, system maintenance, cybersecurity |

| Compliance & Regulatory | Billions globally for financial sector | Adherence to rules, legal mandates, reporting |

| Infrastructure & Operations | Significant portion of £13.5bn total operating expenses | Branch upkeep, office rent, utilities, ATM operations |

Revenue Streams

Barclays' net interest income (NII) is a cornerstone of its revenue, stemming from the spread between interest earned on loans and other assets, and interest paid on deposits and other liabilities. This fundamental banking activity remains a primary engine for the company, especially within its Barclays UK division and its extensive lending operations.

In 2024, Barclays continued to emphasize the generation of higher-quality income growth, with NII playing a critical role in achieving this objective. The bank's strategy focuses on optimizing its balance sheet and leveraging its diverse customer base to enhance this core revenue stream.

Barclays generates significant revenue through fees and commissions, a diverse income stream that includes advisory services, transaction banking, and credit card operations. For instance, its US Consumer Bank reported substantial credit card income, contributing to the overall fee-based revenue. This diversification across various banking services, including those from its Investment Bank, helps create a more stable and predictable income profile.

Barclays' Investment Bank thrives on trading and investment income, a crucial component of its revenue. This includes substantial earnings from fixed income, currencies, commodities (FICC), and equities trading across global markets. For instance, in the first half of 2024, Barclays reported strong performance in its Corporate and Investment Bank division, with trading revenues demonstrating resilience.

Wealth and Investment Management Fees

Barclays generates significant revenue from wealth and investment management fees, encompassing asset management and performance-based charges for its Private Bank and Wealth Management clients. This segment focuses on delivering sophisticated investment strategies and personalized financial advice, aiming for robust client asset growth.

In 2024, Barclays' Wealth and Investment Management division demonstrated strong performance, with assets under management reaching substantial figures. For instance, the firm reported growth in its wealth management client base, directly translating into increased fee income from managing these assets and achieving performance targets.

- Asset Management Fees: Charges levied on the total value of assets managed for clients, a consistent revenue source.

- Performance Fees: Additional fees earned when investment strategies exceed predetermined benchmarks, incentivizing high returns.

- Private Banking Services: Fees associated with bespoke financial planning, lending, and advisory services for high-net-worth individuals.

- Client Asset Growth: The expansion of managed assets directly correlates with higher fee generation for the division.

Sustainable and Transition Finance Revenues

Barclays is seeing significant revenue growth from its sustainable and transition finance offerings. These activities are designed to help clients decarbonize their operations and invest in climate-focused technologies.

- Revenue Generation: In 2024, Barclays reported approximately £500 million in revenue specifically from sustainable and transition finance initiatives.

- Strategic Alignment: This revenue stream directly supports the bank's commitment to Environmental, Social, and Governance (ESG) goals.

- Future Ambition: Barclays has set an ambitious target to mobilize $1 trillion in sustainable and transition finance by the year 2030.

Barclays' revenue streams are diverse, encompassing core banking activities like net interest income and fee-based services. The Investment Bank contributes significantly through trading and investment income, while wealth management generates fees from asset management and performance. Emerging areas like sustainable finance are also becoming increasingly important revenue drivers.

| Revenue Stream | Description | 2024 Data/Notes |

|---|---|---|

| Net Interest Income (NII) | Interest earned on loans minus interest paid on deposits. | A cornerstone of revenue, particularly strong in Barclays UK. |

| Fees and Commissions | Income from advisory, transaction banking, credit cards, etc. | US Consumer Bank credit card income a notable contributor. |

| Trading and Investment Income | Earnings from fixed income, currencies, commodities (FICC), and equities trading. | Strong performance reported in the Corporate and Investment Bank division in H1 2024. |

| Wealth and Investment Management Fees | Asset management charges and performance fees for high-net-worth clients. | Assets under management showed growth in 2024, boosting fee income. |

| Sustainable and Transition Finance | Revenue from financing clients' decarbonization efforts. | Generated approximately £500 million in 2024; target to mobilize $1 trillion by 2030. |

Business Model Canvas Data Sources

The Barclays Business Model Canvas is informed by a comprehensive array of data, including internal financial reports, customer interaction data, and market intelligence gathered from industry analysis. This multi-faceted approach ensures a robust and accurate representation of Barclays' strategic operations.