Barclays Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barclays Bundle

Barclays operates within a dynamic financial landscape shaped by intense competition, evolving customer expectations, and the constant threat of disruptive innovation. Understanding these forces is crucial for navigating its market effectively.

The complete report reveals the real forces shaping Barclays’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The global banking technology market is quite concentrated, with a few major players like Temenos, Fiserv, and Oracle Financial Services holding substantial market share. This limited number of core banking technology providers means they have significant bargaining power over banks, including Barclays, as there are fewer alternatives available.

Barclays' dependence on these specialized software systems makes switching providers a costly and time-consuming endeavor. Estimates suggest that replacing a core banking platform can cost anywhere from $5 million to $50 million, with implementation timelines stretching 18 to 36 months. These high switching costs further amplify the bargaining power of these technology suppliers.

Barclays experiences considerable bargaining power from suppliers of specialized financial software due to high switching costs. Migrating core banking technology can incur millions in expenses and take years to implement, making it challenging to change vendors. For instance, a major core banking system overhaul can easily cost upwards of $100 million, with implementation phases often spanning 3-5 years.

These substantial financial and operational hurdles empower existing software providers. With typical contract durations ranging from 7 to 10 years, Barclays is effectively locked into these relationships, giving suppliers leverage in negotiations and pricing. This prolonged commitment solidifies the supplier's position, as the disruption and cost of switching outweigh the potential benefits for a significant period.

Suppliers of financial technology and services to Barclays face significant regulatory hurdles, including robust cybersecurity and data protection mandates. These requirements, while crucial for security, naturally narrow the field of potential vendors, bolstering the position of existing, compliant suppliers. For instance, the ongoing investment in meeting evolving data privacy laws, such as GDPR or similar frameworks being implemented globally, represents a substantial cost for any fintech provider, making it harder for new entrants to compete.

Dependence on Human Capital

Barclays, like many in financial services, is highly dependent on specialized human capital. Areas such as investment banking, advanced analytics, and cybersecurity demand a deep pool of talent. A scarcity of these professionals directly translates to increased bargaining power for them, driving up compensation and recruitment costs for the bank.

This reliance on skilled individuals positions human capital as a significant 'supplier' in the Porter's Five Forces framework. Their ability to command higher salaries or move to competitors can directly impact Barclays' operational expenses and its capacity to execute strategic initiatives effectively.

- Talent Shortages: Reports in early 2024 indicated persistent shortages in key tech and data science roles within the financial sector, a trend expected to continue.

- Compensation Trends: Average compensation for senior investment bankers saw an increase of 5-10% in 2023, reflecting competitive market pressures.

- Impact on Costs: Increased salary demands and retention bonuses directly contribute to higher operating costs for financial institutions like Barclays.

Funding Sources and Market Conditions

While individual depositors typically hold minimal sway, Barclays' reliance on institutional investors and large corporate clients for substantial funding means these entities can significantly influence deposit rates and terms. For instance, in early 2024, the average interest rate on large time deposits (over $100,000) in the US, a market Barclays operates in, hovered around 4.5% to 5.0%, demonstrating the potential cost impact of these larger funding sources.

Broader market conditions and central bank policies act as a significant collective supplier force. Changes in benchmark interest rates directly impact the cost of capital for banks. For example, the Bank of England's base rate, which influenced borrowing costs for UK banks like Barclays, saw multiple adjustments throughout 2023 and into early 2024, directly affecting funding expenses.

- Institutional Deposits: Large corporate and institutional deposits are key funding sources, allowing these entities to negotiate more favorable terms and rates.

- Central Bank Policies: Monetary policy decisions, such as interest rate hikes or cuts, directly influence the cost of wholesale funding and interbank lending for banks.

- Market Liquidity: The overall availability of funds in the market can impact a bank's ability to secure stable and cost-effective financing.

- Deposit Rate Environment: The prevailing interest rate landscape dictates the cost banks incur to attract and retain deposits, especially from larger clients.

Barclays faces significant bargaining power from its technology suppliers due to the concentrated nature of the core banking software market and the substantial costs associated with switching providers. These high switching costs, often running into tens of millions of dollars and taking years for implementation, effectively lock Barclays into existing relationships, granting suppliers considerable leverage in pricing and contract negotiations.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Barclays |

|---|---|---|

| Core Banking Software Providers | Market concentration, high switching costs (millions of dollars, 18-36 months implementation), long contract durations (7-10 years) | Limited vendor choice, increased costs, operational inflexibility |

| Specialized Human Capital | Scarcity of talent in areas like AI, cybersecurity, and investment banking | Higher compensation demands, increased recruitment costs, potential impact on strategic execution |

| Institutional Depositors/Funding Sources | Ability to negotiate rates on large deposits (e.g., >$100,000) | Direct influence on cost of capital; rates on large time deposits in early 2024 averaged 4.5%-5.0% in key markets |

What is included in the product

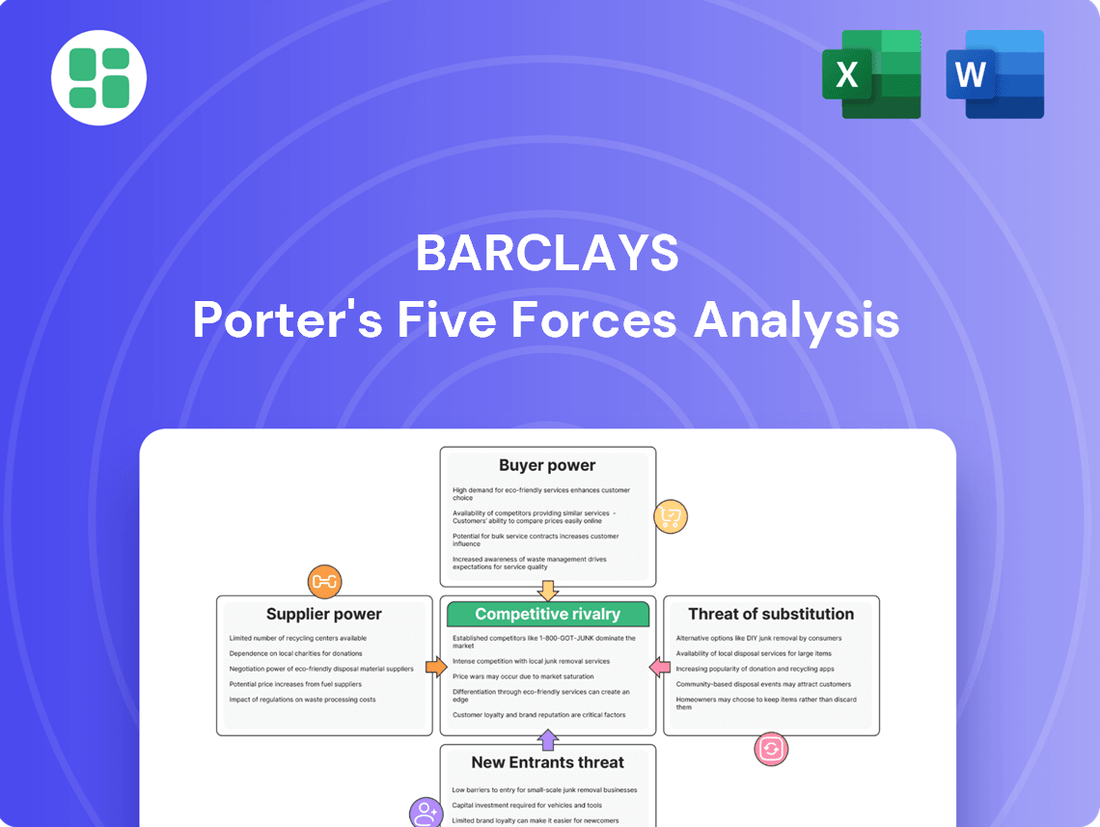

This analysis of Barclays' competitive environment dissects the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors.

Easily visualize competitive intensity and identify strategic vulnerabilities with a dynamic, interactive dashboard that highlights how each of Porter's five forces impacts your business.

Customers Bargaining Power

Barclays faces a significant challenge due to high customer price sensitivity within the competitive UK banking landscape. Many customers actively shop around for better rates on standard financial products like savings accounts and loans, making pricing a key differentiator.

This price sensitivity is evident in customer behavior, with a notable portion of UK banking customers frequently comparing financial product rates. For instance, data from 2024 indicates that a substantial percentage of consumers regularly review their banking options, contributing to a relatively high bank account switching frequency, often exceeding 10% annually for certain product categories.

Consequently, Barclays must maintain competitive pricing strategies to attract and retain customers in both its personal and business banking divisions. Failure to do so can lead to customer attrition, impacting market share and profitability.

Barclays caters to a wide array of customers, including individual savers, small businesses, and major international corporations. The leverage each segment holds varies significantly, impacting how Barclays structures its services and pricing.

Large corporate and institutional clients, by virtue of their substantial transaction volumes and complex financial requirements, wield considerable bargaining power. This often leads to negotiations for customized service packages and preferential pricing, a dynamic evident across the banking sector where such clients can command better terms.

In 2024, the banking industry continued to see a bifurcation in customer power, with high-net-worth individuals and large enterprises leveraging their financial clout. For instance, major corporations can often secure lower interest rates on loans or more favorable foreign exchange rates due to the sheer scale of their business with institutions like Barclays.

The financial services landscape has been reshaped by digital advancements, notably through the proliferation of digital banking platforms, open banking mandates, and accessible comparison websites. This surge in transparency means customers can effortlessly scrutinize and contrast services from a multitude of financial institutions, effectively leveling the playing field and diminishing information disparities.

This enhanced digital empowerment directly bolsters customer bargaining power. With readily available information and simplified switching processes, the cost and effort associated with changing banks have dramatically decreased. For instance, by mid-2024, reports indicated that over 70% of consumers surveyed preferred digital channels for their banking needs, signaling a strong preference for the convenience and transparency these platforms offer.

Demand for Personalized and Integrated Services

Customers are increasingly seeking personalized banking experiences, demanding tailored solutions that align with their unique financial needs and life stages. This shift towards relationship-based and intuitive services, including embedded finance, grants them significant leverage.

Barclays, like its peers, faces this challenge head-on. In 2024, the demand for integrated financial services is a key driver for customer choice. For instance, a significant portion of consumers now expect their banking provider to seamlessly integrate with other platforms they use daily, such as e-commerce or accounting software.

- Personalization is Key: 70% of consumers expect personalized offers and advice from their bank, according to a 2024 Accenture report.

- Embedded Finance Growth: The global embedded finance market is projected to reach $7.2 trillion by 2030, indicating a strong customer preference for integrated financial solutions.

- Customer Retention: Banks investing in data analytics for personalization see higher customer retention rates, with some studies showing a 5-10% increase.

Availability of Alternative Financial Service Providers

The growing number of fintech firms and challenger banks significantly expands customer options for specialized financial services like payments and lending. This surge in alternatives diminishes customer reliance on established institutions such as Barclays.

Customers can now select providers offering superior convenience, lower costs, or tailored features, directly amplifying their bargaining power. For instance, by mid-2024, the UK alone saw over 2,000 authorized fintech firms, offering a stark contrast to the limited choices of previous decades.

- Increased Competition: Fintechs and challenger banks offer specialized, often lower-cost, alternatives.

- Reduced Switching Costs: Digital platforms make it easier for customers to move between providers.

- Customer Empowerment: Access to diverse options allows customers to demand better terms and services.

Barclays faces substantial customer bargaining power, amplified by high price sensitivity and the ease of switching providers. Large corporate clients, in particular, leverage their transaction volume to negotiate preferential terms, a trend that continued throughout 2024.

Digitalization has further empowered consumers, with over 70% of UK banking customers preferring digital channels by mid-2024, seeking transparency and convenience. This digital shift, coupled with the rise of over 2,000 fintech firms in the UK by mid-2024, provides customers with numerous alternatives, forcing established banks like Barclays to offer competitive pricing and personalized services.

| Factor | Impact on Barclays | Supporting Data (2024) |

|---|---|---|

| Price Sensitivity | High, driving customer comparison and switching | Over 10% annual switching frequency for certain products |

| Digitalization & Transparency | Increased customer awareness and reduced switching costs | Over 70% of consumers prefer digital banking channels |

| Fintech & Challenger Banks | Expanded customer options, reduced reliance on incumbents | Over 2,000 fintech firms in the UK by mid-2024 |

| Corporate Client Leverage | Negotiation for customized services and preferential pricing | Major corporations secure lower loan rates and better FX rates |

Full Version Awaits

Barclays Porter's Five Forces Analysis

This preview showcases the complete Barclays Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the banking sector. The document you see here is precisely what you will receive instantly upon purchase, ensuring transparency and immediate access to valuable strategic insights. You can confidently acquire this professionally formatted analysis, ready to inform your business decisions without any hidden elements or placeholders.

Rivalry Among Competitors

Barclays navigates a fiercely competitive environment, particularly within the UK's concentrated banking sector where a handful of major institutions vie for dominance. This intense rivalry spans personal, business, corporate, and investment banking, forcing continuous innovation and strategic maneuvering.

Globally, the financial services landscape presents an even broader spectrum of competition. In 2024, the UK banking sector saw continued pressure on net interest margins, with major banks like Lloyds and HSBC actively competing for customer deposits and lending opportunities, impacting profitability for all players including Barclays.

Barclays' broad spectrum of services, encompassing retail banking, investment banking, and wealth management, positions it against a vast array of specialized and universal banks worldwide. This extensive service portfolio naturally escalates competitive rivalry.

The bank faces distinct sets of competitors in each market segment, demanding constant innovation and strategic pricing to maintain an edge. For instance, in the UK retail banking sector, Barclays competes with established players like Lloyds Banking Group and HSBC, as well as challenger banks that have gained traction in recent years. In investment banking, it contends with global giants such as JPMorgan Chase and Goldman Sachs. This multi-faceted competitive landscape means Barclays must consistently adapt its offerings and cost structures across its entire business.

Barclays, like many global banks, is navigating a challenging environment where net interest margins (NIMs) are under pressure, partly due to expectations of potential interest rate declines in 2024 and beyond. This squeeze on traditional lending profitability forces intensified competition for non-interest income sources.

The pursuit of fee-based revenues, including investment banking, wealth management, and advisory services, is a key strategy. This diversification effort, however, escalates rivalry as banks vie for market share in these less interest-rate sensitive but highly competitive segments.

For instance, in 2023, investment banking fees globally saw a rebound, but the competition to capture these deals remains fierce, with major players like Barclays constantly innovating and adapting their service offerings to attract and retain clients.

Consolidation and M&A Activity

The UK and European banking sectors are poised for a surge in merger and acquisition (M&A) activity throughout 2025. This anticipated wave of consolidation is largely fueled by the ongoing need for financial institutions to streamline their balance sheets and achieve greater cost efficiencies in an increasingly competitive landscape.

This intensifying rivalry, characterized by increased M&A, suggests that larger, more dominant banks may actively pursue acquisitions of smaller competitors. Such moves could lead to a further concentration of market power, potentially escalating the competitive pressures faced by independent entities like Barclays.

- Industry Consolidation: Expect more M&A deals in the European banking sector in 2025 as banks seek scale and cost synergies.

- Market Power Shift: Acquisitions by larger banks could concentrate market power, impacting competition for smaller players.

- Barclays' Position: Barclays, as a significant player, will need to navigate this evolving competitive landscape, potentially through strategic acquisitions or by defending its market share.

Digitalization and Innovation as Competitive Differentiators

Competitive rivalry in the banking sector is intensifying, with digitalization and innovation emerging as key battlegrounds. Banks are pouring resources into areas like digital platforms, artificial intelligence, and improving the overall customer journey to stand out. This focus aims to boost operational efficiency, offer more tailored services, and bolster fraud prevention capabilities.

Barclays faces a landscape where rivals are aggressively pursuing technological advancements. For instance, in 2024, major banks globally continued to increase their IT spending, with a significant portion allocated to digital transformation initiatives. This relentless pursuit of innovation means Barclays must constantly adapt and invest to maintain its competitive position and meet ever-changing customer demands.

- Digital Investments: Banks are earmarking substantial budgets for AI and digital channel enhancements in 2024, aiming for a 15% improvement in customer onboarding times through digitized processes.

- Customer Experience Focus: Innovation is heavily weighted towards personalized banking experiences, with leading institutions reporting a 20% increase in customer engagement through tailored digital offerings.

- Operational Efficiency Gains: Investments in AI for back-office operations are projected to yield efficiency improvements of up to 10% in processing times by the end of 2024.

Barclays operates in a highly competitive banking sector, characterized by intense rivalry among established institutions and emerging digital players. This competition is particularly fierce in the UK, where major banks like Lloyds and HSBC actively vie for market share in retail, corporate, and investment banking. The drive for efficiency and customer acquisition means constant pressure on pricing and service innovation.

In 2024, the banking industry continued to see a strong emphasis on digital transformation, with significant investment in AI and customer experience enhancements. This technological race intensifies rivalry, as banks aim to improve operational efficiency and offer more personalized services. For instance, many banks increased IT spending in 2024, with a focus on digital channels to improve customer onboarding and engagement.

The global financial services landscape presents an even broader competitive spectrum for Barclays. It contends with specialized fintech firms and global investment banking giants, necessitating a multi-faceted strategy across its diverse service offerings. This broad competition forces Barclays to continually adapt its business model and cost structures to maintain its edge.

| Competitor Type | Key Competitive Actions | Impact on Barclays |

| Established UK Banks (e.g., Lloyds, HSBC) | Aggressive deposit gathering, competitive mortgage rates, digital service expansion | Pressure on net interest margins, need for enhanced customer retention strategies |

| Global Investment Banks (e.g., JPMorgan Chase, Goldman Sachs) | Dominance in capital markets, innovative financial products, talent acquisition | Intensified competition for large corporate clients and deals, need for strong M&A advisory capabilities |

| Challenger Banks & Fintechs | Agile digital platforms, lower fee structures, niche product offerings | Erosion of market share in specific segments, pressure to accelerate digital innovation and cost reduction |

SSubstitutes Threaten

The rise of fintech and digital payment platforms presents a significant threat of substitutes for Barclays. These agile companies offer streamlined alternatives for core banking services like payments, lending, and even wealth management. For instance, platforms like PayPal and Square are increasingly handling transaction volumes that might otherwise flow through traditional banking channels.

Digital payment solutions, including mobile wallets such as Apple Pay and Google Pay, directly compete with Barclays' card and transfer services, potentially eroding transaction fee income. In 2024, global digital payment transaction values were projected to exceed $10 trillion, highlighting the massive scale of this shift away from traditional methods.

These fintech substitutes often attract customers with lower fees, enhanced user experience, and faster processing times. This competitive pressure forces established institutions like Barclays to innovate and adapt to retain market share in a rapidly evolving financial landscape.

The rise of embedded finance presents a substantial threat to traditional banking models like Barclays. This trend sees financial services, such as lending or payments, integrated directly into non-financial platforms. For example, a customer buying a product on an e-commerce site might be offered instant financing at checkout, bypassing traditional banking interactions.

This seamless integration means consumers and businesses can access financial solutions at their precise moment of need, often without ever directly engaging with a bank. This bypasses Barclays' established customer touchpoints and relationships. By 2024, the global embedded finance market was projected to reach hundreds of billions of dollars, demonstrating its rapid expansion and increasing influence.

Peer-to-peer (P2P) lending platforms and alternative credit providers present a significant threat of substitutes to Barclays' traditional lending services, particularly for individuals and small businesses. These platforms often offer more streamlined application processes and potentially more competitive rates, diverting borrowers away from established banks. For instance, the global P2P lending market was valued at approximately $91.4 billion in 2023 and is projected to grow substantially, indicating a rising preference for these alternative financing avenues.

Innovations such as Buy Now, Pay Later (BNPL) schemes and rapidly evolving digital lending platforms further intensify this threat. BNPL services, integrated at the point of sale, provide immediate, often interest-free, credit for purchases, directly competing with credit card and short-term loan products offered by banks like Barclays. The adoption of BNPL has surged, with transaction volumes reaching hundreds of billions globally, demonstrating a clear shift in consumer behavior towards these accessible credit solutions.

Emergence of Challenger Banks and Neo-banks

The rise of challenger banks and neo-banks presents a significant threat of substitutes to traditional institutions like Barclays. These digital-first entities, operating with leaner cost structures, offer streamlined banking experiences that appeal to specific customer demographics. For instance, by mid-2024, the UK neo-banking sector saw continued growth, with some platforms reporting millions of active users, indicating a tangible shift in customer preference for digital convenience and competitive fees.

These new entrants often excel in user experience and offer specialized services, making them attractive alternatives for retail and small business customers. While they may not yet match the comprehensive product portfolios of established banks, their agility allows them to quickly adapt to market demands. By early 2025, reports indicated that a notable percentage of younger consumers, particularly Gen Z and Millennials, were actively using or considering neo-banks for their primary banking needs, driven by factors like seamless onboarding and intuitive mobile applications.

- Challenger banks and neo-banks offer digital-first, low-overhead alternatives to traditional banking.

- They attract specific customer segments with superior digital experiences and competitive pricing.

- By mid-2024, UK neo-banks reported millions of active users, signaling a growing preference for digital banking.

- Early 2025 data suggests a significant portion of younger consumers are adopting neo-banks due to ease of use and attractive features.

Big Tech Companies Entering Financial Services

Big Tech companies like Apple, Google, and Amazon are increasingly encroaching on traditional financial services. For instance, Apple Pay has seen significant adoption, with over 500 million users globally as of early 2024, directly competing with traditional payment methods.

These tech giants leverage their massive customer bases and advanced data analytics to offer compelling alternatives. Their ability to integrate financial services seamlessly into existing ecosystems, such as offering credit through Apple Card or payment solutions via Google Pay, presents a substantial threat by providing convenient substitutes for banking functions.

- Apple Pay's user base exceeds 500 million globally.

- Google Pay processed over 10 billion transactions in 2023.

- Big Tech's integrated ecosystems offer direct competition to traditional banking services.

The threat of substitutes for Barclays is substantial, driven by fintech innovations and Big Tech's expanding financial services. Digital payment platforms and neo-banks offer streamlined, often cheaper, alternatives to traditional banking. For example, by early 2025, a growing percentage of younger consumers were opting for neo-banks due to their user-friendly interfaces and competitive fees, indicating a clear shift in customer preference away from established institutions.

Buy Now, Pay Later (BNPL) schemes and peer-to-peer lending also present direct competition, diverting transaction volumes and lending opportunities. The global P2P lending market was valued at approximately $91.4 billion in 2023, showcasing the significant uptake of these alternatives. These substitutes challenge Barclays by offering greater convenience, lower costs, and specialized services, forcing the bank to continuously adapt.

| Substitute Type | Key Characteristics | Impact on Barclays | 2024/2025 Data Point |

|---|---|---|---|

| Fintech & Digital Payments | Streamlined, low-fee transactions, enhanced UX | Erodes transaction fee income, bypasses traditional channels | Global digital payment transaction values projected to exceed $10 trillion in 2024 |

| Embedded Finance | Financial services integrated into non-financial platforms | Bypasses direct customer engagement and relationships | Global embedded finance market projected to reach hundreds of billions of dollars by 2024 |

| P2P Lending & Alternative Credit | Faster applications, potentially competitive rates | Diverts borrowers from traditional lending services | Global P2P lending market valued at ~$91.4 billion in 2023 |

| BNPL Services | Point-of-sale, interest-free credit | Competes directly with credit cards and short-term loans | Transaction volumes in the hundreds of billions globally |

| Challenger & Neo-banks | Digital-first, low-overhead, superior UX | Attracts specific customer segments, particularly younger demographics | UK neo-banks reported millions of active users by mid-2024 |

| Big Tech Financial Services | Leverages massive user bases and ecosystems | Offers convenient, integrated alternatives for payments and credit | Apple Pay had over 500 million users globally as of early 2024 |

Entrants Threaten

The banking sector, especially for a global player like Barclays, faces substantial barriers to entry due to massive capital needs and strict regulations. For instance, in 2024, the Basel III framework continues to impose rigorous capital adequacy ratios, requiring banks to hold significant amounts of equity relative to their risk-weighted assets, making it incredibly expensive for newcomers to establish a comparable financial footing.

Securing a banking license in major jurisdictions involves navigating complex legal and compliance landscapes, a process that can take years and substantial investment. Furthermore, ongoing adherence to evolving anti-money laundering (AML) and know-your-customer (KYC) regulations demands sophisticated technology and operational infrastructure, adding to the prohibitive cost of entry for potential new entrants in 2024.

Barclays benefits from a long-standing history, strong brand recognition, and established customer trust, which are difficult for new entrants to replicate quickly. For instance, in 2024, Barclays reported a customer satisfaction score of 85%, a testament to its enduring appeal.

Building the necessary reputation and customer base to compete with a diversified bank like Barclays requires substantial time and investment, acting as a significant deterrent for new players. The cost to acquire a new retail banking customer for a major UK bank can range from £100 to £500, a considerable hurdle for startups.

The threat of new entrants in banking is significantly shaped by the substantial technological investments and infrastructure costs involved. Developing and maintaining cutting-edge systems for cybersecurity, data analytics, and artificial intelligence requires immense capital outlay.

For instance, in 2024, major banks are projected to spend billions on digital transformation initiatives, a barrier for startups. New players must build these complex systems from the ground up, whereas established institutions like Barclays can amortize these costs over their existing operational scale and customer base, providing a competitive advantage.

Niche Market Entry by Fintechs and Challenger Banks

While entering the universal banking sector is challenging, the real threat from new players stems from nimble fintechs and challenger banks. These companies often target specific market niches or provide innovative digital-first solutions, making it easier for them to gain traction.

Their agility and lower operational costs, often a result of technology-driven models, allow them to bypass some traditional entry barriers. For instance, in 2023, the global fintech market was valued at an estimated $1.17 trillion, showcasing significant growth and investment in this disruptive sector.

- Fintechs target specific profitable segments, such as payments, lending, or wealth management, rather than broad universal banking.

- Digital-only models reduce overhead costs, enabling competitive pricing and faster service delivery compared to traditional banks.

- Innovative technology adoption allows them to offer user-friendly interfaces and personalized customer experiences.

- Regulatory arbitrage can sometimes provide a pathway for new entrants to operate with fewer immediate compliance burdens in certain areas.

Evolving Regulatory Scrutiny of Bank-Fintech Partnerships

The evolving regulatory landscape, particularly concerning bank-fintech partnerships, presents a significant hurdle for new entrants. Regulators are increasingly focused on ensuring clear accountability and robust risk management frameworks within these collaborations. For instance, in 2024, several jurisdictions intensified their oversight of data sharing and consumer protection in fintech-bank alliances, potentially increasing compliance costs for startups.

This heightened scrutiny can make it more difficult for emerging fintech companies to secure and maintain partnerships with established banks. New entrants often depend on these collaborations to leverage existing infrastructure and customer bases. However, the emphasis on clearly defined roles and stringent risk controls means that banks are more cautious about onboarding new partners, thereby raising the barrier to entry.

- Increased Compliance Burden: New fintechs must navigate complex and often evolving regulatory requirements for bank partnerships.

- Slower Partnership Formation: Banks are applying more rigorous due diligence, extending the time it takes to establish new collaborations.

- Higher Operational Costs: Meeting regulatory demands for risk management and data security adds significant expense for nascent firms.

The threat of new entrants for a global bank like Barclays remains moderate, primarily due to the immense capital requirements and stringent regulatory environment. For instance, in 2024, the ongoing implementation of Basel III necessitates substantial capital reserves, making it prohibitively expensive for newcomers to match the financial strength of established players.

Securing banking licenses and adhering to complex compliance frameworks, including AML and KYC regulations, further elevates the cost and time investment, acting as significant deterrents. The established brand reputation and customer loyalty of institutions like Barclays, evidenced by their high customer satisfaction scores in 2024, are also difficult and costly for new entrants to replicate.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High initial investment needed to meet regulatory capital ratios. | Very High | Basel III capital adequacy ratios require significant equity. |

| Regulatory Hurdles | Complex licensing, compliance (AML, KYC), and ongoing oversight. | Very High | Years and substantial investment to navigate legal frameworks. |

| Brand & Reputation | Established trust and customer base built over time. | High | Barclays' 85% customer satisfaction score in 2024. |

| Technological Investment | Massive spending on cybersecurity, AI, and data analytics. | High | Billions spent by major banks on digital transformation. |

| Customer Acquisition Cost | Significant expense to attract and retain customers. | High | £100-£500 per retail customer acquisition in the UK. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Barclays leverages data from financial statements, investor relations disclosures, and industry-specific market research reports. We also incorporate insights from regulatory filings and economic databases to provide a comprehensive view of the competitive landscape.