Barclays Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Barclays Bundle

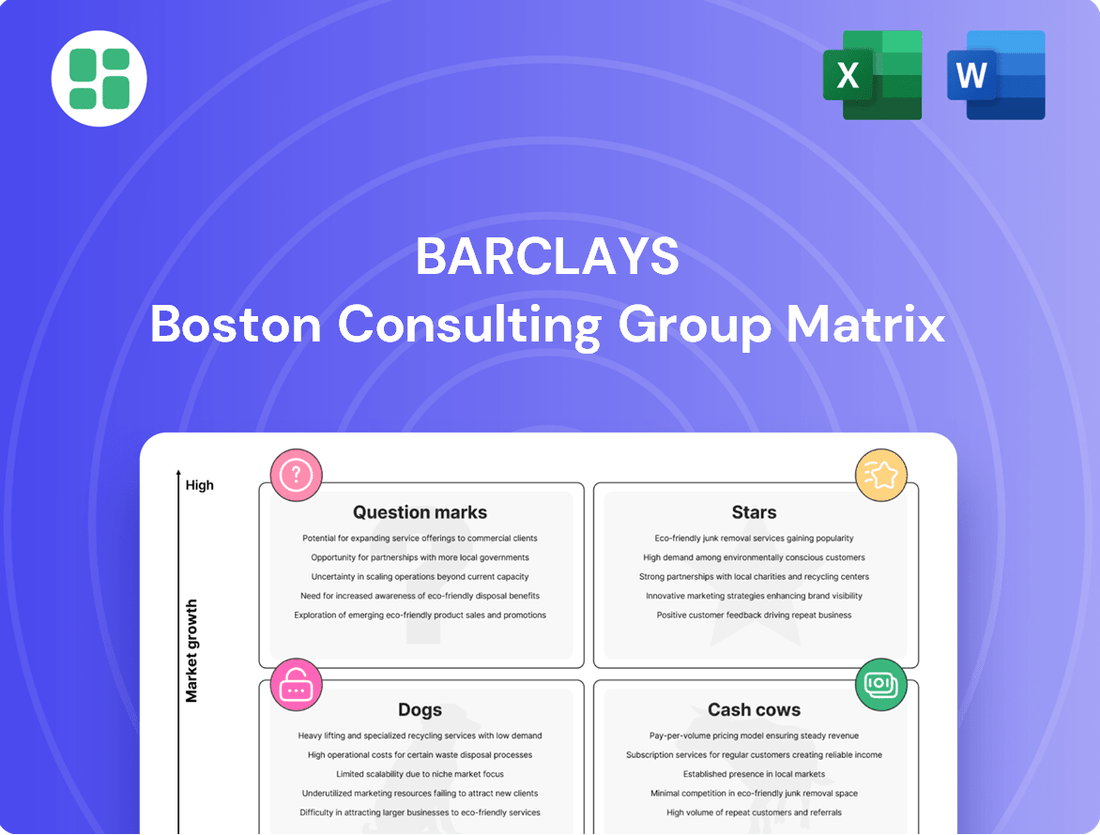

Understand how Barclays strategically categorizes its diverse product portfolio using the BCG Matrix. This powerful framework helps identify Stars, Cash Cows, Dogs, and Question Marks, offering a clear visual of market share and growth potential. Unlock the full potential of this analysis by purchasing the complete BCG Matrix report for actionable insights and a roadmap to optimize Barclays' product investments.

Stars

Barclays' Global Markets division, especially its Fixed Income, Currencies & Commodities (FICC) and equities trading arms, demonstrated impressive strength in the first half of 2025. This segment capitalized on market fluctuations, generating substantial income growth.

The division's ability to profit from volatility underscores its trading acumen and success in generating alpha. For instance, Q1 2025 saw a notable uptick in FICC revenues, with reports indicating a year-over-year increase of over 15% for the segment.

This robust revenue expansion points to a significant market share within a dynamic, albeit unpredictable, market. Consequently, Global Markets is positioned as a Star within Barclays' portfolio, requiring capital investment for its growth but yielding strong financial returns.

The UK Corporate Bank within Barclays is a clear Star in the BCG matrix. It's consistently delivering strong returns on tangible equity (RoTE), with figures showing a significant contribution to the bank's overall profitability. This segment is actively expanding its lending market share, capturing a substantial portion of the UK’s corporate and SME client base.

Barclays is strategically prioritizing this division to boost its UK-centric risk-weighted assets. The bank's commitment to deepening client relationships within this growing corporate lending landscape underscores its Star positioning. For example, in 2024, the UK Corporate Bank saw a robust increase in its loan book, reflecting successful market penetration.

Barclays is strategically investing in its wealth management arm, focusing on high-net-worth individuals in the UK and expanding into lucrative Asian markets like Singapore and India. This aggressive growth strategy is designed to capture a larger market share in a sector with significant potential.

The bank has set an ambitious target of achieving a high return on tangible equity from its wealth management division by 2026. This indicates a strong belief in the segment's future profitability and a commitment to allocating resources for sustained growth.

By prioritizing organic expansion and channeling increased investment into technology, Barclays is positioning its wealth management services as a Star within its business portfolio. This segment is expected to be a key driver of future revenue and profitability, reflecting its strong market position and growth prospects.

Digital Transformation & AI Integration

Barclays is aggressively pursuing digital transformation, channeling significant capital into AI integration. This focus aims to enhance operational efficiencies, refine product development, and elevate the customer experience. For instance, their Experimentation Hub is a testament to this forward-looking strategy, fostering innovation in digital solutions.

The bank's commitment is evident in its substantial investments, with digital transformation and AI being key pillars for future growth. While precise market share figures for nascent digital offerings are still emerging, the strategic direction points towards a strong position in high-growth technology sectors.

- Digital Transformation Investments: Barclays is allocating significant resources to modernize its operations and customer interfaces through digital technologies.

- AI Integration for Efficiency: The bank is leveraging Artificial Intelligence to streamline processes, reduce costs, and improve service delivery.

- Product and Customer Experience Enhancement: AI and digital initiatives are designed to create more innovative products and a superior customer journey.

- Strategic Partnerships: Barclays actively seeks partnerships to accelerate its digital capabilities and expand its reach in the digital solutions space.

Sustainable and Transition Financing

Barclays is heavily investing in sustainable and transition financing, aiming to provide significant capital by 2030 to help clients decarbonize. This commitment places their sustainable finance offerings firmly in the Star category of the BCG Matrix, reflecting strong growth potential and market leadership in a sector increasingly driven by environmental, social, and governance (ESG) demands.

The global push for sustainability is fueling rapid expansion in this market. Barclays' proactive engagement and substantial financial commitments, even as they navigate strategic shifts like leaving certain alliances, underscore their dedication to this burgeoning sector. For instance, in 2024, Barclays announced plans to raise £100 billion for green and sustainable financing by the end of 2025, demonstrating concrete action towards their longer-term goals.

- Market Growth: The sustainable finance market is experiencing exponential growth, driven by regulatory pressures and investor demand for ESG-aligned investments.

- Barclays' Commitment: Barclays has pledged significant capital towards green and transition financing, aiming to support clients in their decarbonization journeys.

- Strategic Positioning: Despite strategic realignments, Barclays' continued investment in sustainable finance positions them as a leader in a high-growth, high-potential market segment.

- Financial Data: By the end of 2023, Barclays had mobilized over £30 billion towards their £100 billion green and sustainable financing target, showcasing tangible progress.

Barclays' Global Markets division, particularly its FICC and equities trading, is a Star. It generated substantial income growth in H1 2025, capitalizing on market volatility. Q1 2025 saw FICC revenues rise over 15% year-over-year, indicating strong market share and profitability, justifying continued investment.

What is included in the product

The Barclays BCG Matrix categorizes business units by market share and growth, offering strategic guidance.

The Barclays BCG Matrix offers a clear, one-page overview, instantly relieving the pain of deciphering complex portfolio performance.

Cash Cows

Barclays UK Personal Banking, focusing on core deposits and mortgages, stands as a robust cash cow, generating substantial and consistent income. The bank boasts a vast customer base exceeding 20 million UK retail customers, supported by favorable deposit trends and strong net interest income.

Despite operating within a mature market, Barclays commands a significant market share in UK personal banking. This strong position ensures a steady stream of cash flow, requiring minimal incremental investment for promotional activities, thereby solidifying its cash cow status.

Barclaycard UK's credit card portfolio is a prime example of a cash cow within Barclays' business structure. This segment benefits from a deeply entrenched customer base and consistent revenue generation through interest and fees, even amidst fluctuating consumer spending patterns. In 2024, the UK credit card market continued to show resilience, with transaction volumes remaining robust, underscoring the stability of Barclaycard's offerings.

Barclays' Payment Acceptance business, bolstered by its partnership with Brookfield Asset Management, is a prime example of a cash cow. This collaboration has revitalized a business with a substantial market share, ensuring consistent and significant revenue generation.

The strategic alliance with Brookfield focuses on optimizing an already established service, thereby enhancing its efficiency and solidifying its position as a stable income generator for Barclays. This mature business continues to produce substantial cash flow, a testament to its robust operational model.

Traditional Transactional Lending (Corporate & Business)

Barclays' traditional transactional lending, encompassing corporate and business lines of credit and working capital solutions, functions as a cash cow within its banking operations. This segment benefits from a mature, predictable market where Barclays maintains a robust competitive stance, ensuring steady revenue streams. While growth is modest, the high margins associated with these established services contribute significantly to profitability.

These lending products are vital for businesses requiring stable financial support for day-to-day operations. The consistent demand, coupled with Barclays' established infrastructure and client relationships, solidifies their position as a reliable income generator. For instance, in 2024, the corporate lending sector saw continued demand for working capital, with major banks like Barclays reporting stable net interest margins on these core products.

- Stable Income: Traditional lending provides a consistent and predictable revenue stream, crucial for overall bank profitability.

- High Margins: Despite low growth, these services typically command healthy profit margins due to established processes and lower risk profiles.

- Market Position: Barclays leverages its strong presence in corporate and business banking to maintain a significant share of this mature market.

- Customer Retention: Offering essential financial tools like lines of credit fosters long-term relationships and customer loyalty.

Structural Hedge Income

Barclays' structural hedge income represents a classic Cash Cow within the BCG framework, generating substantial and predictable revenue. This income stream is a direct outcome of effective balance sheet management, particularly in the current interest rate landscape, offering reliable cash flow without the need for aggressive expansion.

The structural hedge is designed to provide significant gross income visibility for Barclays over the coming years. This stability is a key characteristic of a Cash Cow, allowing the bank to leverage this consistent revenue for other strategic initiatives or to support business units with higher growth potential.

- Stable Income: The structural hedge delivers consistent, longer-term income, a hallmark of a Cash Cow.

- Balance Sheet Prudence: It stems from careful management of Barclays' balance sheet in a mature interest rate environment.

- Predictable Cash Flow: This financial instrument provides reliable and predictable cash flow to the group.

- Low Growth Requirement: Unlike Stars or Question Marks, this segment does not necessitate high growth to remain valuable.

Barclays' UK Personal Banking and Barclaycard UK credit card operations are strong cash cows, consistently generating substantial income. These segments benefit from large, established customer bases and mature markets, requiring minimal new investment for continued revenue generation. In 2024, UK credit card transaction volumes remained robust, supporting Barclaycard's steady performance.

The Payment Acceptance business, particularly with its Brookfield partnership, and traditional corporate lending also function as cash cows. These mature services leverage existing infrastructure and client relationships to deliver predictable cash flow and healthy margins. Corporate lending in 2024 continued to see stable demand for working capital, with major banks reporting consistent net interest margins.

Barclays' structural hedge income further exemplifies a cash cow, providing significant and predictable revenue through prudent balance sheet management. This financial instrument offers reliable cash flow without the need for aggressive expansion, a key characteristic of a cash cow within the BCG framework.

| Business Segment | BCG Category | Key Characteristics | 2024 Relevance |

|---|---|---|---|

| UK Personal Banking | Cash Cow | Large customer base, stable net interest income | Over 20 million UK retail customers |

| Barclaycard UK | Cash Cow | Consistent fee and interest revenue | Resilient market with robust transaction volumes |

| Payment Acceptance | Cash Cow | Significant market share, stable revenue | Revitalized through Brookfield partnership |

| Traditional Corporate Lending | Cash Cow | Predictable demand, high margins | Steady demand for working capital solutions |

| Structural Hedge Income | Cash Cow | Predictable, long-term revenue | Enhances income visibility through balance sheet management |

Preview = Final Product

Barclays BCG Matrix

The Barclays BCG Matrix preview you are viewing is the identical, fully completed document you will receive immediately after your purchase. This means you're seeing the exact strategic analysis and formatting that will be yours to use, without any watermarks or placeholder content. Rest assured, this preview accurately represents the comprehensive Barclays BCG Matrix report, ready for your immediate application in strategic decision-making.

Dogs

Barclays' commitment to digital transformation and cloud migration means that certain legacy IT systems are likely underperforming. These older infrastructures may be draining resources, with maintenance costs outweighing their contribution to growth. For instance, in 2023, the banking sector globally saw significant investment in IT modernization, with reports indicating that up to 70% of IT budgets were allocated to maintaining legacy systems, often yielding low returns on investment.

Barclays' sale of its German consumer finance business exemplifies a strategic move to shed 'Dogs' – assets that consume resources with limited growth potential. This divestment aligns with the BCG Matrix principle of identifying and disposing of units that are unlikely to generate substantial future returns.

In 2023, Barclays announced the sale of its German consumer finance operations, a business segment that had been facing intense competition and regulatory pressures. This move allowed Barclays to streamline its operations and focus capital on more promising areas, such as its UK retail banking and wealth management divisions.

The disposal of such non-core assets is a common strategy for financial institutions seeking to improve profitability and shareholder value. By exiting markets where it held a smaller share or where growth prospects were dim, Barclays aimed to enhance its overall financial performance and strategic focus.

Certain outdated retail banking products and physical branches within Barclays could be categorized as Dogs in the BCG Matrix. This is due to declining customer engagement and the high operational costs associated with maintaining a large physical footprint in an increasingly digital banking landscape. For instance, in 2023, Barclays continued its strategy of branch consolidation, closing several locations across the UK, a trend that is expected to persist as digital channel adoption grows.

Specific Underperforming Investment Banking Advisory Segments

While Barclays' overall investment banking performance is robust, specific advisory segments like Equity Capital Markets (ECM) have demonstrated underperformance in Q2 2025, lagging behind competitors. This suggests a potential need for strategic recalibration in these areas, even as the broader market shows strength.

Despite a strong overall market for investment banking advisory services, certain segments within Barclays, particularly Equity Capital Markets (ECM) and potentially specific niches within Mergers & Acquisitions (M&A) advisory, have experienced slower growth or underperformance relative to key rivals in the second quarter of 2025. This divergence indicates that these particular advisory areas may possess a smaller market share than their potential suggests, necessitating a thorough evaluation and possibly restructuring to align with overall group objectives.

- Equity Capital Markets (ECM): Exhibited slower growth in Q2 2025 compared to industry benchmarks, potentially indicating a reduced market share in a segment with significant overall market potential.

- Mergers & Acquisitions (M&A) Advisory: Certain sub-segments within M&A may also be showing signs of underperformance or slower growth, warranting a closer look at competitive positioning.

- Strategic Evaluation: These underperforming segments require critical analysis to identify underlying causes, such as competitive pressures or shifts in client demand, and to inform potential restructuring or strategic adjustments.

Low-Margin, Highly Commoditized International Banking Services

Certain highly commoditized international banking services, particularly in areas where Barclays doesn't hold a substantial market share or possess unique advantages, could be classified as Dogs within the BCG Matrix. These offerings typically operate in markets characterized by minimal growth and intense competition, leading to thin profit margins. For instance, in 2024, the global correspondent banking market, a segment often facing commoditization, saw revenue growth projections hovering around 2-3%, significantly below the broader financial services industry average.

These services tend to contribute little to Barclays' overall profitability and can represent an inefficient use of capital. They might require ongoing investment simply to maintain a presence, without generating substantial returns. The low margins mean that even significant transaction volumes may not translate into meaningful earnings. For example, a report from PwC in late 2023 indicated that net interest margins for many international wholesale banking activities were compressed, often falling below 1% in highly competitive regions.

- Low Growth Markets: Services in regions with projected GDP growth below 2% annually might be candidates for the Dog category.

- Intense Competition: Markets with more than five significant global players offering similar services can drive down margins.

- Thin Profitability: Banking services with net interest margins consistently below 1.5% in 2024 could be considered low-margin.

- Capital Inefficiency: Business lines requiring substantial capital allocation with returns on equity below 5% may tie up capital.

Dogs in the Barclays context represent business units or products with low market share in low-growth industries. These often consume resources without generating significant returns, prompting divestment or restructuring. For example, Barclays' sale of its German consumer finance business in 2023 fits this description, allowing the company to redirect capital towards more promising ventures.

Outdated retail banking products and a declining physical branch network can also be considered Dogs. High operational costs associated with these legacy assets, coupled with decreasing customer engagement in favor of digital channels, necessitate strategic pruning. Barclays' ongoing branch consolidation efforts reflect this reality, with many closures occurring in 2023 and expected to continue.

Certain commoditized international banking services, particularly those where Barclays lacks a strong competitive edge or faces intense rivalry, also fall into the Dog category. These segments typically exhibit minimal growth and narrow profit margins, as seen in the global correspondent banking market, which projected only 2-3% revenue growth in 2024.

The underperformance of specific advisory segments like Equity Capital Markets (ECM) in Q2 2025, lagging behind competitors, also suggests they might be classified as Dogs. These areas require careful strategic review to determine if they can be revitalized or if divestment is a more prudent course of action.

Question Marks

Barclays UK Ventures, by acquiring equity stakes in fintech firms and forging partnerships, embodies the characteristics of a Question Mark in the BCG matrix. These ventures exhibit high growth potential within the rapidly evolving fintech landscape, yet currently hold a relatively low market share compared to established banking services.

These strategic investments and collaborations require significant cash outlay for incubation and scaling. For instance, in 2023, Barclays reported an increase in its investment in technology and digital transformation initiatives, which includes its fintech ventures, signaling a commitment to nurturing these nascent businesses.

The returns on these ventures are uncertain but hold the promise of substantial future gains. This cash-intensive nature, coupled with an unknown future market position, firmly places these Barclays UK Ventures in the Question Mark category, demanding careful evaluation and strategic decision-making regarding future investment and divestment.

Barclays is actively investing in Generative AI (GenAI) within fintech, recognizing its significant potential. Two-thirds of fintech companies surveyed anticipate GenAI will be critical for their growth by 2025, underscoring the technology's burgeoning importance.

While GenAI offers high growth prospects and transformative capabilities across the financial services sector, Barclays' current market share in novel GenAI-powered products or features remains in its early stages. This positions GenAI applications within Barclays as a Question Mark on the BCG matrix, representing a high-investment, high-potential area.

Barclays' introduction of new digital investment services, such as 'Plan & Invest,' signifies its strategic move into the burgeoning digital wealth management sector. This initiative reflects a commitment to capturing market share in a space increasingly dominated by tech-forward solutions. The bank is actively investing in these platforms to attract a new demographic of investors and to offer more tailored financial guidance.

These nascent digital offerings are positioned to grow by attracting new clients and increasing engagement with existing ones. With a focus on personalized digital experiences, Barclays aims to differentiate itself in a competitive landscape. The success of these services hinges on effective marketing and user adoption, requiring substantial initial investment to establish a strong market presence.

The 'Plan & Invest' services, while new, are designed to evolve into Stars within the BCG framework. They are currently in a high investment, low-market-share phase, necessitating significant capital allocation for development, marketing, and customer acquisition. For instance, in 2024, the digital banking segment for UK retail banks saw a notable increase in investment, with fintech partnerships and platform enhancements being key priorities for major players like Barclays, aiming to boost customer acquisition and digital service uptake by an estimated 15-20% year-on-year.

Targeted International Expansion in Emerging Wealth Markets

Barclays' strategic focus on emerging wealth markets, such as India and Singapore, positions it within the question marks of the BCG Matrix. These regions exhibit robust wealth creation potential, with India's affluent population projected to grow significantly. For instance, by 2027, India's high-net-worth individual (HNWI) population is expected to see a substantial increase, presenting a fertile ground for wealth management services.

However, capturing market share in these dynamic environments requires considerable investment. Barclays may face established local and international competitors who already possess strong brand recognition and client relationships. This necessitates a strategic allocation of resources to build brand awareness, develop tailored product offerings, and establish a competitive pricing structure to gain traction.

Key considerations for Barclays' expansion include:

- Market Penetration: Investing in localized marketing campaigns and digital platforms to reach a broader customer base in India and Singapore.

- Product Development: Offering bespoke wealth management solutions that cater to the specific needs and investment preferences of emerging affluent clients in these regions.

- Partnerships: Collaborating with local financial institutions or fintech companies to accelerate market entry and leverage existing distribution networks.

- Regulatory Navigation: Understanding and adapting to the diverse regulatory landscapes in both India and Singapore to ensure compliance and operational efficiency.

New Payment Acceptance Partnerships (e.g., with Brookfield beyond initial scope)

Expanding payment acceptance partnerships, such as those beyond the initial Brookfield agreement, would likely be classified as question marks within Barclays' BCG Matrix framework. While the core payment acceptance business is a strong performer, these new ventures target emerging, high-growth payment sectors. They require significant investment to gain traction and establish market share.

These new partnerships, potentially exploring innovative payment technologies or expanding into new geographic regions, represent opportunities for future growth but carry inherent uncertainty. They need to demonstrate a clear path to profitability and a competitive advantage to transition out of the question mark category.

- New payment partnerships are question marks due to their high-growth, uncertain market potential.

- These ventures require investment to build market share and prove profitability.

- Success hinges on demonstrating competitive advantage in emerging payment sectors.

Barclays' foray into generative AI (GenAI) within fintech exemplifies a question mark, characterized by high potential growth but currently low market share. The significant investment required for developing and integrating these advanced technologies is evident, with a substantial portion of fintech firms anticipating GenAI's critical role by 2025.

While GenAI promises transformative capabilities, Barclays' current market penetration in novel GenAI-powered financial products remains nascent. This necessitates considerable capital allocation for research, development, and customer adoption, mirroring the investment-intensive nature of question mark ventures.

The success of these GenAI initiatives hinges on effectively capturing market share in a rapidly evolving technological landscape. This requires strategic decision-making to nurture these high-potential, high-investment areas, aiming to convert them into future stars.

| Barclays Venture Area | BCG Category | Key Characteristics | Investment Focus | Market Position |

|---|---|---|---|---|

| Fintech Investments/Partnerships | Question Mark | High growth potential, low current market share, high investment needs. | Incubation and scaling of nascent businesses. | Emerging in a rapidly evolving landscape. |

| Generative AI (GenAI) in Fintech | Question Mark | Transformative capabilities, high growth prospects, early-stage market penetration. | R&D, integration of advanced technologies. | Nascent in novel product development. |

| Digital Wealth Management ('Plan & Invest') | Question Mark | High investment, low market share, aims to attract new demographics. | Platform development, marketing, customer acquisition. | New entrant in a competitive digital space. |

| Emerging Wealth Markets (India, Singapore) | Question Mark | Robust wealth creation potential, requires significant investment for market entry. | Brand awareness, tailored product development, partnerships. | Facing established local and international competitors. |

| New Payment Acceptance Partnerships | Question Mark | Targeting emerging, high-growth payment sectors, uncertain future success. | Gaining traction and establishing market share in new payment technologies. | In early stages of development and adoption. |

BCG Matrix Data Sources

Our Barclays BCG Matrix is informed by a blend of proprietary market research, financial disclosures, and industry performance data, ensuring a robust and actionable strategic overview.