Bank of Marin SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Marin Bundle

Bank of Marin demonstrates strong local market knowledge and a loyal customer base, key strengths in a competitive banking landscape. However, understanding its vulnerabilities to larger financial institutions and potential regulatory shifts is crucial for informed decision-making.

Want the full story behind Bank of Marin’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bank of Marin's strength lies in its deep community engagement and the strong relationships it cultivates with local clients. This focus is a cornerstone of its business model, particularly within Marin County and the broader San Francisco Bay Area. Its consistent recognition as a Top Corporate Philanthropist by the San Francisco Business Times since 2003 underscores this commitment, with the bank dedicating at least 1% of its pre-tax profits annually to community organizations.

Bank of Marin demonstrates a robust capital position, evidenced by a total risk-based capital ratio of 16.25% and a tangible common equity to tangible assets ratio of 9.95% as of June 30, 2025. This financial strength provides significant flexibility for strategic initiatives.

The bank's proactive balance sheet management is highlighted by its successful securities portfolio repositioning in Q2 2025. While this move incurred a short-term loss, it is strategically designed to improve net interest margin and earnings per share in the coming quarters.

With a strong capital base and a high liquidity position, Bank of Marin is well-equipped to navigate market dynamics and pursue sustained, profitable growth.

Bank of Marin excels with an effective deposit strategy, evidenced by its strong reliance on non-interest-bearing deposits, which constituted 42.5% of its total deposits as of June 30, 2025. This healthy mix significantly lowers the bank's overall cost of funds, directly benefiting its net interest margin.

The bank has successfully retained deposits by employing strategic pricing and a customer-centric service model, even when facing intense market competition. This approach has not only secured a stable funding base but also contributed to an improved efficiency ratio in recent quarters, showcasing operational effectiveness.

Improved Loan Origination and Pipeline Growth

Bank of Marin is experiencing robust growth in its loan origination and pipeline, even with a higher volume of loan payoffs. This indicates strong demand for the bank's lending products and effective sales efforts. New loans are being secured at more favorable rates, contributing positively to the bank's net interest income.

Commercial loan originations saw a significant surge, increasing fivefold in the first quarter of 2025 compared to the same period in 2024. Management projects this momentum to continue, anticipating accelerated loan growth in the latter half of 2025 and targeting mid-single-digit growth for the full year. This expansion is supported by a well-diversified loan portfolio and ongoing initiatives to broaden geographic and industry exposures.

- Loan Origination Strength: Despite loan payoffs, new loan generation is robust.

- Rate Improvement: New loans are being originated at higher interest rates.

- Q1 2025 Commercial Loan Surge: Originations increased fivefold year-over-year.

- Growth Outlook: Mid-single-digit loan growth targeted for 2025, with acceleration expected in H2.

Comprehensive Financial Services and Local Market Expertise

Bank of Marin, as a community-focused institution, provides a broad spectrum of financial services. These include various deposit accounts, diverse loan options for both businesses and individuals, and comprehensive wealth management services. This full suite of offerings is designed to meet the multifaceted financial needs of its clientele.

The bank's strategic concentration on the affluent markets of Marin County and the wider San Francisco Bay Area grants it a distinct advantage. This local focus enables specialized market expertise and the development of highly tailored service packages. By understanding the nuances of these specific communities, Bank of Marin can offer more relevant and effective financial solutions.

- Comprehensive Service Offering: Deposit accounts, business and personal loans, and wealth management.

- Targeted Market Expertise: Deep understanding of Marin County and San Francisco Bay Area affluent demographics.

- Personalized Client Approach: Tailored services fostering strong, localized client relationships.

Bank of Marin's commitment to its community is a significant strength, demonstrated by its consistent philanthropic efforts and deep local client relationships. This focus is further bolstered by a strong capital position, with a total risk-based capital ratio of 16.25% as of June 30, 2025, providing a solid foundation for growth and strategic maneuvers. The bank's effective deposit strategy, relying heavily on non-interest-bearing accounts which made up 42.5% of total deposits on the same date, significantly reduces its cost of funds.

| Metric | Value | Date |

|---|---|---|

| Total Risk-Based Capital Ratio | 16.25% | June 30, 2025 |

| Tangible Common Equity to Tangible Assets Ratio | 9.95% | June 30, 2025 |

| Non-Interest-Bearing Deposits as % of Total Deposits | 42.5% | June 30, 2025 |

| Commercial Loan Origination Growth (Q1 2025 vs Q1 2024) | Fivefold increase | Q1 2025 |

What is included in the product

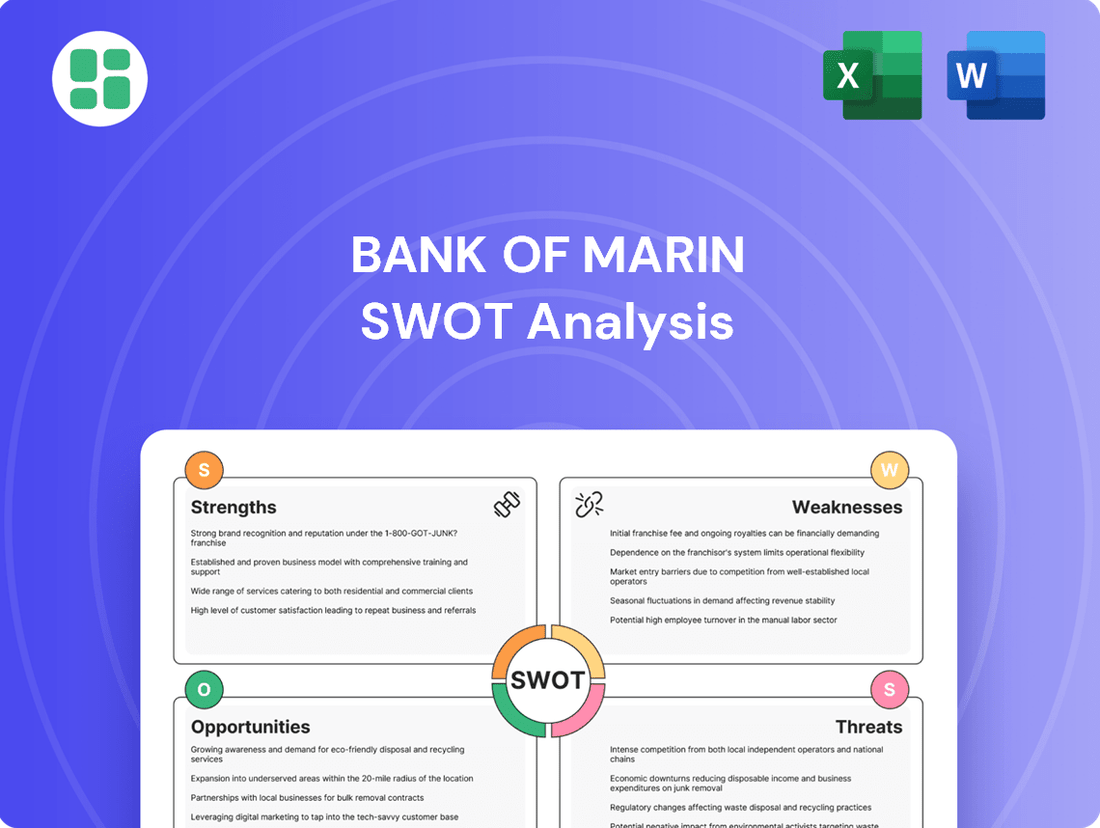

Analyzes Bank of Marin’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Identifies key strengths and weaknesses to proactively address competitive threats and capitalize on opportunities.

Weaknesses

Bank of Marin's primary focus on Marin County and the broader San Francisco Bay Area, while historically a strength due to the region's affluence, presents a significant geographic concentration risk. This means the bank's performance is heavily tied to the economic health of a single, albeit strong, region. For instance, a downturn in the Bay Area's tech sector or a correction in its robust real estate market could have a more pronounced negative effect on Bank of Marin's loan portfolio and deposit stability compared to a more geographically diversified institution.

Bank of Marin's profitability is inherently tied to interest rate shifts. While recent actions like strategic balance sheet repositioning and managing deposit costs have been beneficial, the bank's net interest margin can still be squeezed by unexpected rate hikes, particularly if deposit costs rise faster than anticipated.

For instance, a significant upward swing in the Federal Funds Rate, a key benchmark, could increase the bank's funding expenses more rapidly than it can adjust its loan yields, potentially impacting its earnings. This sensitivity remains a core weakness, even with ongoing efforts to optimize its financial structure.

Bank of Marin faces significant competitive pressure. Larger regional and national banks, boasting greater financial resources, can invest more heavily in advanced technology, expansive marketing campaigns, and wider branch networks, giving them a distinct advantage.

The rise of nimble fintech companies presents another formidable challenge. These innovators are particularly adept at digital banking solutions and niche lending areas, potentially siphoning off market share from established community banks like Bank of Marin. For instance, in 2024, fintechs are projected to capture an increasing percentage of consumer lending, a trend that directly impacts traditional players.

Reliance on Relationship Banking for Growth

Bank of Marin's strong reliance on relationship banking, while a cornerstone of its success, presents a significant weakness if not balanced with digital expansion. This model can be inherently resource-intensive, potentially hindering scalability compared to competitors who more aggressively adopt technology for customer acquisition and service. For instance, while relationship-driven growth has been effective, the bank's digital deposit growth rate, a key indicator of broader market reach, might lag behind industry leaders who invest heavily in online platforms and mobile banking solutions. This dependence could limit its ability to tap into wider customer segments and compete effectively in an increasingly digital financial landscape.

The inherent limitations of a relationship-centric growth strategy can also manifest in slower adoption of new technologies and a less diversified customer base. Banks that prioritize digital channels often achieve faster customer onboarding and broader geographic reach without the need for extensive physical infrastructure. As of early 2024, the banking sector continues to see a significant shift towards digital-first engagement, with customer expectations increasingly shaped by seamless online experiences. A continued heavy reliance on traditional relationship management might therefore constrain Bank of Marin's ability to capture market share from digitally native or digitally aggressive institutions.

- Resource Intensity: Relationship banking requires significant human capital and time investment per customer, potentially limiting the pace of growth.

- Scalability Challenges: The model may not scale as efficiently as technology-driven customer acquisition strategies, impacting market penetration.

- Digital Gap Risk: Over-reliance on personal relationships could lead to a lag in digital transformation, making it harder to compete with digitally advanced banks.

- Customer Acquisition Limitations: This approach might restrict the bank's ability to attract a younger, digitally inclined demographic or customers in geographically distant areas.

Impact of Securities Repositioning on Short-Term Earnings

Bank of Marin's strategic repositioning of its securities portfolio in the second quarter of 2025 led to a significant short-term earnings impact, with a net loss of $8.5 million recorded for that period. This move, aimed at improving the net interest margin over the long haul, temporarily depressed immediate profitability and key return metrics.

This situation underscores a vulnerability to substantial, one-time accounting losses that can obscure the bank's underlying operational strengths and day-to-day performance. Such events can create a perception of weaker financial health than is actually the case based on core business activities.

- Securities Repositioning Impact: Q2 2025 net loss of $8.5 million.

- Strategic Goal: Long-term enhancement of net interest margin.

- Short-Term Consequence: Reduced immediate profitability and return on equity.

- Key Vulnerability: Susceptibility to large, one-time accounting losses masking operational performance.

Bank of Marin's concentrated geographic focus on the San Francisco Bay Area, while beneficial in a strong regional economy, creates a significant vulnerability. A downturn in this specific region, perhaps driven by a tech sector slowdown or a real estate market correction, could disproportionately impact the bank's loan portfolio and deposit base. This makes its financial health closely tied to the economic fortunes of a single, albeit affluent, area.

The bank's profitability remains sensitive to interest rate fluctuations. While efforts are made to manage deposit costs and portfolio positioning, unexpected increases in benchmark rates, such as the Federal Funds Rate, could outpace the bank's ability to adjust loan yields. This could compress its net interest margin, as seen in potential scenarios where funding expenses rise faster than anticipated in 2024 and 2025.

Intense competition from larger banks and agile fintech companies poses a considerable challenge. Larger institutions can leverage greater resources for technology investment and marketing, while fintechs excel in digital offerings and niche markets. For example, the projected growth of fintech in consumer lending during 2024 highlights the need for traditional banks to adapt their digital strategies to avoid market share erosion.

Bank of Marin's reliance on relationship banking, while a strength, can also be a weakness if not complemented by robust digital expansion. This model is often resource-intensive and may limit scalability compared to competitors who prioritize technology-driven customer acquisition. As of early 2024, the banking sector is increasingly favoring digital engagement, and a slower adoption of these channels could hinder the bank's ability to attract a broader customer base, particularly younger demographics.

The strategic repositioning of Bank of Marin's securities portfolio in the second quarter of 2025 resulted in a $8.5 million net loss for that period. This action, intended to boost the net interest margin long-term, temporarily reduced immediate profitability and key return metrics, highlighting a susceptibility to significant one-time accounting impacts that can obscure underlying operational performance.

Full Version Awaits

Bank of Marin SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're getting an accurate look at the Bank of Marin's SWOT analysis, covering its Strengths, Weaknesses, Opportunities, and Threats.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain a comprehensive understanding of the Bank of Marin's strategic position.

Opportunities

Bank of Marin is well-positioned to grow its wealth management offerings, leveraging its strong presence in affluent areas like Marin County and the broader San Francisco Bay Area. This region boasts a high concentration of high-net-worth individuals and successful businesses, presenting a substantial client base for expanded services.

By focusing on deepening relationships with these clients, the bank can significantly boost its non-interest income. For instance, the San Francisco Bay Area's median household income was approximately $137,000 in 2023, indicating a strong capacity for wealth accumulation and investment.

Expanding wealth management services allows Bank of Marin to diversify its revenue streams beyond traditional lending. This strategic move can enhance profitability and provide a more stable financial foundation, especially as the economic landscape continues to evolve through 2024 and into 2025.

Bank of Marin can significantly boost customer satisfaction and operational efficiency by investing more in its digital banking platforms. This move can also attract a younger customer base, which is crucial for long-term growth. For instance, by mid-2024, many regional banks reported a substantial increase in digital transaction volumes, with some seeing over 60% of customer interactions occurring online.

While Bank of Marin is known for its strong relationship banking, integrating digital tools for tasks like account management, loan applications, and personalized financial advice can enhance its existing model. This digital integration allows for expanded reach and service delivery without the need for costly physical branch expansion, a strategy that proved effective for many community banks in 2024 as they sought to optimize their cost structures.

The fragmented community banking landscape in Northern California offers a prime opportunity for Bank of Marin's strategic growth. Acquiring smaller, local banks could significantly broaden its reach and bolster its market share.

By integrating these institutions, Bank of Marin can tap into new customer bases and deposit pools, effectively leveraging its robust capital reserves. For instance, as of Q1 2024, the Northern California banking market remains diverse, with numerous community banks operating below $5 billion in assets, presenting attractive consolidation targets.

Capitalizing on Local Economic Growth Sectors

Bank of Marin can strategically target burgeoning sectors within its operational geography, like the robust Bay Area technology and biotech industries, to stimulate loan origination and attract substantial deposits. For instance, the San Francisco Bay Area's tech sector alone saw significant venture capital funding in 2024, creating ample opportunities for business lending.

By cultivating deep knowledge and tailored financial products for these high-growth niches, the bank can position itself as the go-to financial institution for innovative companies. This focus can lead to a more resilient and higher-yielding loan portfolio. For example, specialized real estate financing for life sciences facilities could tap into a growing demand driven by increased R&D investment.

- Targeted Sector Growth: Focus on sectors like technology and biotech, which are experiencing substantial investment and expansion in the Bay Area.

- Enhanced Loan Demand: Capitalize on increased demand for business loans from companies within these identified growth sectors.

- Deposit Growth Opportunities: Attract deposits from successful businesses and their employees in these thriving industries.

- Improved Portfolio Quality: Develop specialized expertise to underwrite loans in niche markets, potentially leading to better risk-adjusted returns.

Cross-Selling to Existing Client Base

Bank of Marin's established relationship banking approach presents a significant opportunity for cross-selling. By leveraging existing customer loyalty, the bank can introduce a wider array of financial products, such as offering loan products to deposit-only clients or wealth management services to those primarily using checking accounts. This strategy is projected to boost customer lifetime value and enhance profitability per client.

For instance, as of the first quarter of 2024, Bank of Marin reported a robust customer base. Expanding services to just 10% of its checking account holders with new loan products could yield substantial revenue growth. Similarly, introducing wealth management to a fraction of its business clients, who often have complex financial needs, offers a clear path to increased revenue diversification.

- Increased Revenue Streams: Cross-selling directly contributes to higher revenue per customer.

- Enhanced Customer Loyalty: Offering integrated solutions deepens client relationships.

- Improved Profitability: Expanding service offerings can significantly improve net interest margin and fee income.

- Data-Driven Opportunities: Analyzing existing customer data can pinpoint specific needs for tailored product offerings.

Bank of Marin can capitalize on the high concentration of affluent individuals and successful businesses in the San Francisco Bay Area by expanding its wealth management services. This strategy aims to significantly increase non-interest income and diversify revenue streams beyond traditional lending, a move that proved beneficial for many regional banks in 2024.

Investing in digital banking platforms offers a dual benefit of attracting a younger demographic and improving operational efficiency, mirroring trends seen in mid-2024 where digital interactions constituted a majority of customer engagements for many financial institutions.

The fragmented community banking market in Northern California presents a prime opportunity for strategic acquisitions, allowing Bank of Marin to expand its market share and customer base, a consolidation trend that was evident among smaller banks below $5 billion in assets throughout early 2024.

Targeting high-growth sectors like technology and biotech in the Bay Area, which attracted substantial venture capital in 2024, can drive loan origination and deposit growth, leading to a more resilient loan portfolio.

Leveraging its existing customer base for cross-selling opportunities, such as offering loan products to deposit-only clients or wealth management to business clients, can boost customer lifetime value and profitability, with even a small percentage of existing clients adopting new services projected to yield significant revenue increases.

| Opportunity Area | Rationale | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Wealth Management Expansion | Leverage affluent Bay Area demographics for increased non-interest income. | San Francisco Bay Area median household income: ~$137,000 (2023). High net worth individuals concentrated in region. |

| Digital Platform Enhancement | Attract younger customers and improve operational efficiency. | Over 60% of customer interactions occurring digitally for some regional banks by mid-2024. |

| Strategic Acquisitions | Expand market share and customer base in a fragmented market. | Numerous community banks under $5 billion in assets in Northern California (Q1 2024), presenting consolidation targets. |

| Targeted Sector Lending | Capitalize on growth in tech and biotech for loan and deposit growth. | Significant venture capital funding in Bay Area tech sector during 2024. |

| Cross-Selling Initiatives | Increase revenue per customer by offering additional products. | Projected revenue growth by expanding services to a small percentage of the existing customer base. |

Threats

A significant economic downturn or a correction in the San Francisco Bay Area's real estate market presents a substantial threat to Bank of Marin. Such a scenario could trigger a rise in loan defaults and a decrease in demand for new loans. For instance, if the regional unemployment rate, which stood at 3.1% in April 2024 according to the Bureau of Labor Statistics, were to climb significantly, it would directly impact borrowers' ability to repay loans.

Furthermore, a decline in asset values, particularly in the bank's loan portfolio, would erode its capital base and profitability. This could manifest as a decrease in the value of collateral backing loans, increasing the risk of loss for the bank. The bank's net interest margin, a key profitability driver, could also be squeezed by falling interest rates often associated with economic slowdowns.

Bank of Marin contends with escalating competition from larger regional and national banks. These larger entities leverage their significant economies of scale, expansive branch networks, and substantial marketing resources. For instance, in 2024, major national banks continued to invest heavily in digital transformation and customer acquisition strategies, often outspending community banks by considerable margins.

This competitive pressure means larger institutions can frequently offer a broader array of financial products and services, alongside more aggressive pricing structures. This capability allows them to attract and retain clients, potentially siphoning business away from community-focused banks like Bank of Marin, which may struggle to match the breadth of offerings or the depth of resources available.

The banking sector faces ongoing regulatory scrutiny, and Bank of Marin is not immune. New or tightened regulations, such as those potentially arising from Basel III endgame reforms or evolving consumer protection mandates, could significantly increase compliance costs. For instance, the Federal Reserve's proposed capital requirements for larger banks, which could influence regional banks indirectly, might necessitate substantial investments in technology and personnel to maintain adherence, potentially impacting profitability.

Cybersecurity Risks and Data Breaches

As a financial institution, Bank of Marin faces significant cybersecurity risks and the potential for data breaches, making it a prime target for malicious actors. The increasing sophistication of cyber threats necessitates constant vigilance and investment. For instance, the U.S. financial sector experienced an estimated $30 billion in losses due to cybercrime in 2023, highlighting the scale of the threat.

A successful cyberattack could result in substantial financial losses for Bank of Marin, including direct theft, recovery costs, and potential legal liabilities. Beyond financial impact, a breach would severely damage the bank's reputation, erode customer trust, and could lead to significant regulatory penalties. The Federal Reserve has been increasingly focused on cybersecurity resilience, with new guidelines expected to further increase compliance costs.

- Cyber Threats: Financial institutions are consistently targeted by phishing, ransomware, and malware attacks.

- Data Breach Impact: Potential consequences include financial loss, reputational damage, and loss of customer confidence.

- Regulatory Scrutiny: Increased focus from regulators on data protection and cybersecurity preparedness.

- Operational Costs: Ongoing and escalating investment required for robust cybersecurity infrastructure and personnel.

Fluctuations in Deposit Costs and Funding Environment

While Bank of Marin has historically managed its deposit costs well, the current and projected interest rate environment presents a significant threat. A sudden increase in market rates or intensified competition for customer deposits could force the bank to offer higher yields, directly increasing its funding expenses. For instance, if the Federal Reserve continues its rate hikes through 2024 and into 2025, the cost of acquiring and retaining deposits will likely rise, potentially impacting margins.

This pressure on funding costs can directly compress the bank's net interest margin, which is the difference between the interest income generated and the interest paid out on deposits and borrowings. If Bank of Marin needs to pay significantly more for deposits to remain competitive, its profitability could be negatively affected, especially if it cannot quickly reprice its assets to match the increased cost of funds.

- Increased Deposit Rates: A potential rise in average deposit rates from the current levels, which stood at approximately 1.5% for checking and savings accounts in early 2024, could significantly increase funding costs.

- Competitive Landscape: Aggressive deposit-gathering strategies by larger national banks or credit unions could force Bank of Marin to increase its offered rates to retain its customer base.

- Net Interest Margin Compression: A scenario where deposit costs rise faster than the yield on the bank's loan portfolio could lead to a contraction in the net interest margin, impacting overall profitability.

Intensified competition from larger financial institutions poses a significant threat, as they can leverage greater resources for marketing and product development. This can lead to Bank of Marin losing market share in key areas. For example, in 2024, major banks continued aggressive digital expansion, potentially drawing customers away from community banks.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Bank of Marin's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.