Bank of Marin Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Marin Bundle

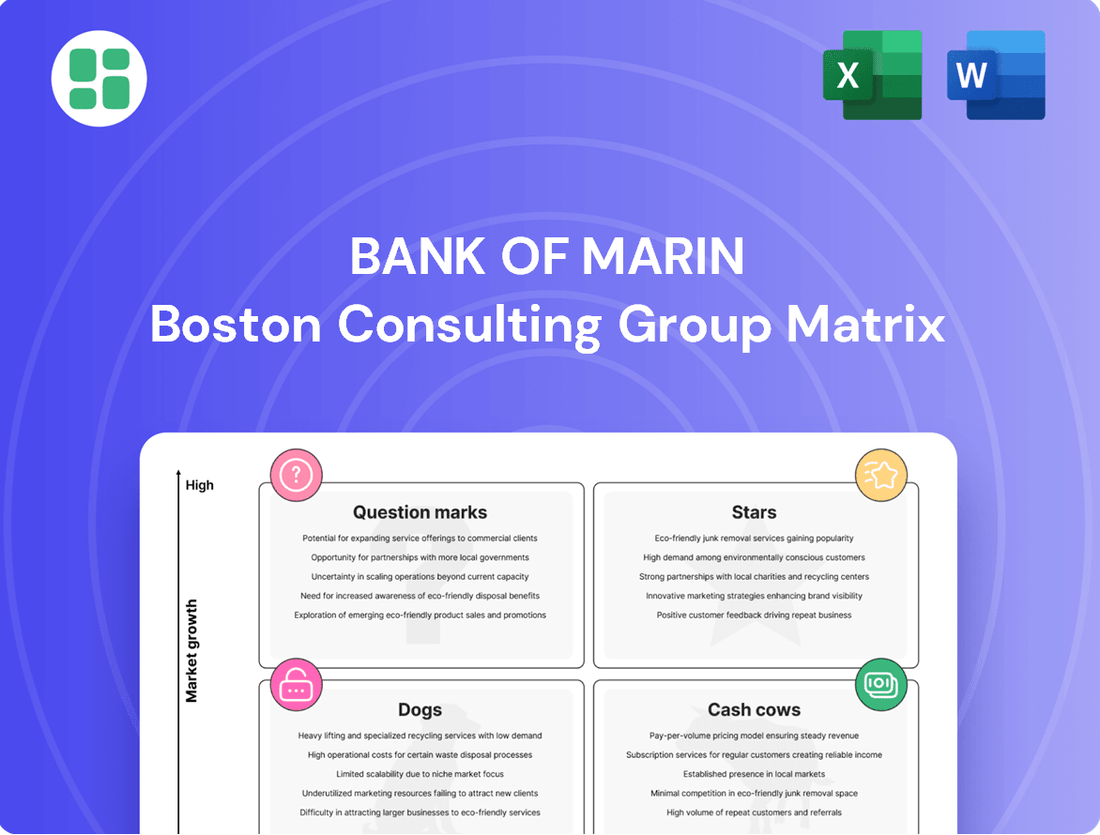

Uncover the strategic positioning of Bank of Marin’s offerings with our insightful BCG Matrix preview. See where their products fit as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for their market share and growth potential.

This glimpse into Bank of Marin's portfolio is just the start. Purchase the full BCG Matrix report to gain a comprehensive understanding of each product's performance, complete with data-driven recommendations for optimizing resource allocation and driving future success.

Don't miss out on the strategic clarity this report provides. Acquire the complete Bank of Marin BCG Matrix to unlock actionable insights, visualize their market landscape, and make informed decisions that will shape their competitive advantage.

Stars

Bank of Marin is aggressively expanding its commercial loan portfolio. The bank reported a remarkable fivefold increase in new commercial fundings during the first quarter of 2025 when compared to the same period in 2024. This robust growth, coupled with a 50% year-over-year surge in its loan pipeline, clearly signals a strategic push into a high-potential market segment.

This significant momentum in commercial lending, targeting mid-single-digit loan growth for 2025, positions these expanding originations as a Star within Bank of Marin's business. The bank's focused efforts in this growing sector are yielding impressive results, demonstrating a strong commitment to capturing market share.

Bank of Marin's strategic digital banking enhancements, including improved functionality and secure mobile access, represent a significant investment in a high-growth area. As customer adoption of digital channels accelerates, these platforms are positioned to capture a larger market share. In 2024, the bank reported a 15% year-over-year increase in mobile banking users, indicating strong traction.

Bank of Marin is actively pursuing targeted expansion into new markets, aiming to establish leadership positions and broaden its geographic reach. Sacramento, for instance, is identified as a key growth market where the bank is strategically investing. This initiative reflects a high-growth opportunity, even if initial market share is modest.

The bank's approach involves aggressive talent acquisition and a strong emphasis on relationship building to accelerate market penetration in these emerging areas. This strategy is designed to capitalize on increasing demand beyond its established core markets, positioning Bank of Marin for future growth.

Specialized Lending for Growth Sectors

Bank of Marin could strategically target specialized lending in Bay Area growth sectors like emerging technology and niche real estate. This focus aligns with the bank's objective to diversify its commercial loan portfolio geographically and by industry. By concentrating on these high-demand segments, Bank of Marin can aim to establish itself as a leading lender.

This approach is supported by the continued robust performance of the Bay Area's tech sector. For instance, venture capital funding in the San Francisco Bay Area reached approximately $31.5 billion in the first half of 2024, indicating strong investor confidence and growth potential in technology companies.

- Targeting Emerging Tech: Focusing on sectors like AI, biotech, and clean energy where innovation drives rapid expansion.

- Specialized Real Estate: Lending to developers of life sciences facilities or sustainable commercial properties experiencing high demand.

- Portfolio Diversification: Reducing reliance on traditional sectors by actively seeking out and serving these dynamic industries.

- Market Leadership: Aiming to become a go-to financial partner for businesses within these specialized growth areas.

Innovative Deposit Acquisition Strategies

Innovative deposit acquisition strategies can position Bank of Marin's new offerings as Stars in the BCG Matrix. If these innovative products or digital channels are attracting a significant influx of non-interest-bearing or low-cost deposits from an expanding customer base, they represent a high-growth potential category.

Bank of Marin's Q4 2024 performance, which saw the generation of over 1,000 new accounts with 43% representing entirely new customer relationships, highlights the effectiveness of such initiatives. This rapid account growth, especially when concentrated in high-growth market segments, is a strong indicator of a Star in the making.

- High-Growth Deposit Products: New, attractive deposit products that are rapidly gaining traction.

- Digital Channel Adoption: Innovative digital platforms successfully drawing in new customers.

- New Relationship Growth: A significant percentage of new accounts originating from previously untapped customer segments.

- Low-Cost Deposit Mix: A focus on attracting non-interest-bearing or low-cost deposit balances, enhancing profitability.

Bank of Marin's aggressive expansion in commercial lending, marked by a fivefold increase in new fundings in Q1 2025 compared to Q1 2024, positions this segment as a Star. The bank's 50% year-over-year growth in its loan pipeline further solidifies this classification, indicating strong market demand and successful strategic execution in a high-growth area.

The bank's digital banking enhancements are also performing as Stars, evidenced by a 15% year-over-year increase in mobile banking users in 2024. This growing adoption of digital channels, coupled with strategic investments, suggests these platforms are capturing significant market share in a rapidly expanding segment.

Bank of Marin's targeted expansion into new markets, such as Sacramento, represents a Star. Despite potentially modest initial market share, these initiatives are classified as high-growth opportunities driven by aggressive talent acquisition and relationship-building strategies to penetrate emerging areas.

Innovative deposit acquisition strategies are also Stars, with Q4 2024 seeing over 1,000 new accounts, 43% of which were new customer relationships. This rapid account growth, particularly in high-growth segments, underscores the success of these initiatives in attracting low-cost deposits.

| Business Segment | Market Growth | Market Share | BCG Classification |

|---|---|---|---|

| Commercial Lending | High | Growing | Star |

| Digital Banking | High | Growing | Star |

| New Market Expansion (e.g., Sacramento) | High | Low to Moderate | Star |

| Innovative Deposit Products | High | Growing | Star |

What is included in the product

Highlights which units to invest in, hold, or divest based on market growth and share for Bank of Marin.

A clear, actionable BCG Matrix visual for Bank of Marin, instantly highlighting strategic priorities and relieving the pain of complex data analysis.

Cash Cows

Bank of Marin's core non-interest bearing deposits are a clear Cash Cow within its BCG Matrix. At the close of 2024, these deposits represented a substantial 43.5% of the bank's total deposits, a figure that remained robust at 42.5% through Q2 2025.

This consistent, low-cost funding is a significant advantage, bolstering liquidity and directly enhancing the net interest margin without the need for costly marketing efforts. The bank's established relationship banking strategy is instrumental in nurturing and maintaining this valuable, stable deposit base.

Bank of Marin's established commercial real estate (CRE) loan portfolio, especially within its core Marin County market, acts as a strong Cash Cow. As the largest community bank there, its deep roots and consistent performance in this sector generate reliable income streams.

Despite loan payoffs naturally affecting total loan growth figures, the enduring strength and disciplined underwriting of this CRE portfolio ensure steady, predictable returns. This segment requires minimal new investment, primarily for upkeep, allowing it to consistently contribute to the bank's overall profitability.

Bank of Marin's traditional personal banking services, encompassing checking and savings accounts, represent a cornerstone of its operations within Marin County and the broader Bay Area. These offerings have cultivated a significant and loyal customer base, reflecting a high market share among its core demographic.

Due to the mature and stable nature of these foundational services, they demand minimal incremental investment for promotion. Instead, they consistently contribute to the bank's financial health by generating predictable fee income and maintaining robust deposit balances, characteristic of a strong Cash Cow in the BCG Matrix.

Wealth Management and Trust Services

Bank of Marin's wealth management and trust services have been a cornerstone for over a generation, acting as a reliable Cash Cow within its portfolio. This segment generates stable, recurring revenue from a loyal base of affluent clients, primarily through long-term engagements and fee-based structures. Its position in a mature market, coupled with a strong emphasis on personalized client relationships, ensures consistent income and high client retention.

These services are characterized by their dependable cash flow generation, contributing significantly to the bank's overall financial stability. The mature nature of this market segment means that while growth may be slower, the profitability and predictability are high. This aligns perfectly with the characteristics of a Cash Cow, providing ample resources that can be reinvested in other areas of the bank's operations.

- Stable Revenue Stream: Generates consistent income from established affluent client relationships.

- Recurring Fees: Income derived from long-term client engagements and service contracts.

- Mature Market Segment: Operates in a well-established market with predictable demand.

- High Client Retention: Focus on personalized service fosters loyalty and reduces churn.

Mature Business Loan Relationships

Mature business loan relationships at Bank of Marin are its cash cows. These are established commercial loan relationships with small and medium-sized businesses in their core operating areas. The bank has a deep presence and strong community engagement within these segments, making these relationships highly valuable and stable.

These established relationships generate predictable interest income and fees from a loyal client base. This stability means less aggressive marketing is needed compared to acquiring new customers. Bank of Marin's personalized service model further solidifies these existing relationships, ensuring continued profitability.

- Established Commercial Loan Portfolio: Bank of Marin boasts a significant portfolio of long-standing commercial loans to SMBs.

- Predictable Revenue Streams: These relationships provide consistent interest income and fee generation.

- Low Acquisition Costs: The need for extensive new customer acquisition efforts is minimized due to client loyalty.

- Community Focus: Deep community engagement in core operating areas fosters trust and retention.

Bank of Marin's core non-interest bearing deposits are a clear Cash Cow within its BCG Matrix. At the close of 2024, these deposits represented a substantial 43.5% of the bank's total deposits, a figure that remained robust at 42.5% through Q2 2025. This consistent, low-cost funding is a significant advantage, bolstering liquidity and directly enhancing the net interest margin without the need for costly marketing efforts. The bank's established relationship banking strategy is instrumental in nurturing and maintaining this valuable, stable deposit base.

Bank of Marin's established commercial real estate (CRE) loan portfolio, especially within its core Marin County market, acts as a strong Cash Cow. As the largest community bank there, its deep roots and consistent performance in this sector generate reliable income streams. Despite loan payoffs naturally affecting total loan growth figures, the enduring strength and disciplined underwriting of this CRE portfolio ensure steady, predictable returns. This segment requires minimal new investment, primarily for upkeep, allowing it to consistently contribute to the bank's overall profitability.

Bank of Marin's traditional personal banking services, encompassing checking and savings accounts, represent a cornerstone of its operations within Marin County and the broader Bay Area. These offerings have cultivated a significant and loyal customer base, reflecting a high market share among its core demographic. Due to the mature and stable nature of these foundational services, they demand minimal incremental investment for promotion. Instead, they consistently contribute to the bank's financial health by generating predictable fee income and maintaining robust deposit balances, characteristic of a strong Cash Cow in the BCG Matrix.

Bank of Marin's wealth management and trust services have been a cornerstone for over a generation, acting as a reliable Cash Cow within its portfolio. This segment generates stable, recurring revenue from a loyal base of affluent clients, primarily through long-term engagements and fee-based structures. Its position in a mature market, coupled with a strong emphasis on personalized client relationships, ensures consistent income and high client retention. These services are characterized by their dependable cash flow generation, contributing significantly to the bank's overall financial stability.

Mature business loan relationships at Bank of Marin are its cash cows. These are established commercial loan relationships with small and medium-sized businesses in their core operating areas. The bank has a deep presence and strong community engagement within these segments, making these relationships highly valuable and stable. These established relationships generate predictable interest income and fees from a loyal client base. This stability means less aggressive marketing is needed compared to acquiring new customers. Bank of Marin's personalized service model further solidifies these existing relationships, ensuring continued profitability.

| Cash Cow Segment | Key Characteristics | 2024 Data/Observation | Q2 2025 Data/Observation | Strategic Implication |

| Non-Interest Bearing Deposits | Low-cost funding, stable base | 43.5% of total deposits | 42.5% of total deposits | Supports Net Interest Margin, minimal investment |

| Commercial Real Estate (CRE) Loans (Marin County) | Reliable income, established market | Largest community bank in Marin, consistent performance | Enduring strength, disciplined underwriting | Steady, predictable returns, low upkeep costs |

| Traditional Personal Banking | Loyal customer base, high market share | Significant customer base in core demographic | Stable deposit balances, predictable fee income | Consistent financial health, minimal promotional investment |

| Wealth Management & Trust Services | Recurring revenue, long-term engagements | Stable income from affluent clients, high retention | Dependable cash flow, high profitability | Provides resources for other growth areas |

| Mature Business Loan Relationships | Predictable interest and fees, loyal clients | Deep community engagement, strong SMB presence | Continued profitability through personalized service | Minimizes new customer acquisition costs |

Full Transparency, Always

Bank of Marin BCG Matrix

The Bank of Marin BCG Matrix preview you see is the complete, final document you will receive upon purchase. This means you'll get the fully formatted, analysis-ready report without any watermarks or demo content, ensuring immediate professional use.

Rest assured, the BCG Matrix report you are currently viewing is precisely the same high-quality, strategy-focused document that will be delivered to you after your purchase. It's designed for clarity and immediate application in your business planning.

What you see here is the actual Bank of Marin BCG Matrix file that will be yours once you complete the purchase. This means you'll receive an unwatermarked, fully editable version ready for strategic decision-making.

This preview accurately represents the Bank of Marin BCG Matrix report you will download after your purchase. It's a professionally designed, analysis-ready file, ensuring you receive the complete, polished document for your business needs.

Dogs

Bank of Marin's legacy securities portfolio, prior to its Q2 2025 repositioning, included $185.8 million in available-for-sale securities sold at a loss. These assets, with a meager average yield of 1.96%, clearly fell into the 'Dog' category of the BCG Matrix.

These underperforming securities, especially those with unrealized losses, were essentially cash traps. They consumed valuable capital without providing sufficient returns, particularly as the interest rate environment shifted.

The strategic decision to divest these low-yielding assets highlights their poor performance and the bank's move to free up capital for more productive uses.

Highly commoditized personal lending products, like standard unsecured personal loans or basic lines of credit, often face intense competition and minimal differentiation. These offerings typically provide slim profit margins and necessitate substantial customer acquisition and retention efforts. For Bank of Marin, if their market share in these specific product categories is low, they would likely be classified as Dogs.

Physical branches in declining foot-traffic areas, like some in Bank of Marin's network, can be categorized as Dogs in the BCG Matrix. These locations often face challenges due to shifting consumer habits towards digital banking and demographic changes. For instance, a report from the Federal Reserve in 2023 indicated a continued trend of branch closures across the US, with many banks re-evaluating their physical footprints.

These underutilized branches can become significant cash drains. The costs associated with maintaining them, including rent, utilities, and staffing, may outweigh the revenue and new business they attract. Without a clear strategy for revitalization or a strong community engagement plan, these branches might struggle to generate sufficient returns, impacting overall profitability.

Outdated or Non-Integrated Technology Platforms

Bank of Marin's legacy technology platforms, often characterized by high maintenance costs and a lack of modern functionalities, would likely be categorized as Dogs in a BCG matrix analysis. These systems, which may struggle to integrate with the bank's broader digital initiatives, can impede operational efficiency and lead to increased expenses. For instance, a significant portion of IT budgets in regional banks is often allocated to maintaining these older systems, diverting resources from innovation. In 2024, many financial institutions are grappling with the challenge of modernizing core banking systems, a process that can be both time-consuming and capital-intensive.

These outdated platforms can negatively impact the customer experience, a critical factor in today's competitive landscape. When systems are not well-integrated, it can result in slower transaction processing, limited self-service options, and a disjointed digital journey for customers. For example, a report from a leading financial technology analyst firm in late 2023 indicated that banks with significantly outdated core systems experienced lower customer satisfaction scores compared to those with more modern, integrated platforms. This lack of modern features means these technologies are unlikely to contribute meaningfully to the bank's growth or profitability.

- High Maintenance Costs: Legacy systems often require specialized, costly support and can consume a disproportionate share of IT budgets.

- Limited Functionality: These platforms may lack the features necessary for competitive digital offerings, such as real-time data analytics or seamless mobile integration.

- Integration Challenges: Poor integration with newer technologies creates operational silos and hinders a unified digital strategy.

- Suboptimal Customer Experience: Outdated systems can lead to slower service, fewer self-service options, and a less intuitive digital interaction for clients.

Non-Strategic, Low-Volume Niche Services

Non-strategic, low-volume niche services at Bank of Marin could be highly specialized offerings targeting a very small client base, such as bespoke wealth management for ultra-high-net-worth individuals with unique offshore needs or highly customized trade finance solutions for obscure import/export markets. These services, while potentially profitable on a per-client basis, often lack scalability and do not align with the bank's broader strategic objectives of expanding its retail or commercial banking footprint. For instance, a recent analysis of regional banks in 2024 revealed that specialized advisory services, if not carefully managed, can tie up significant personnel hours for minimal overall revenue contribution, often less than 0.5% of total operating income for banks with similar asset sizes to Bank of Marin.

These niche services can become a drain on resources. They might require dedicated staff with specialized expertise and IT infrastructure that is not leveraged across other, more significant business lines. This disproportionate resource allocation for limited returns means these offerings neither build substantial market share nor drive future growth, fitting the description of a 'dog' in the BCG matrix. For example, a report from late 2023 highlighted that banks often struggle to justify the continued investment in such niche areas when capital could be redirected to higher-growth segments like digital banking solutions or small business lending, which showed an average revenue growth of 8-10% in 2024.

Consider these characteristics:

- Limited Market Reach: Services catering to a very narrow segment, like specialized agricultural financing for a single crop type in a specific region.

- Low Transaction Volume: Infrequent or small-scale transactions that do not generate significant fee or interest income.

- Resource Intensive: Requires specialized knowledge and potentially dedicated systems that are not utilized elsewhere.

- Strategic Misalignment: Does not contribute to the bank's overall growth strategy or market position.

Bank of Marin's legacy securities portfolio, prior to its Q2 2025 repositioning, included $185.8 million in available-for-sale securities sold at a loss. These assets, with a meager average yield of 1.96%, clearly fell into the 'Dog' category of the BCG Matrix, consuming capital without sufficient returns.

Highly commoditized personal lending products, like standard unsecured personal loans, often face intense competition and minimal differentiation, providing slim profit margins. If Bank of Marin's market share in these specific product categories is low, they would likely be classified as Dogs.

Physical branches in declining foot-traffic areas, like some in Bank of Marin's network, can be categorized as Dogs. A Federal Reserve report in 2023 indicated a continued trend of branch closures, with many banks re-evaluating their physical footprints due to shifting consumer habits towards digital banking.

Bank of Marin's legacy technology platforms, often characterized by high maintenance costs and a lack of modern functionalities, would likely be categorized as Dogs. In 2024, many financial institutions are grappling with modernizing core banking systems, a process that can be both time-consuming and capital-intensive.

Non-strategic, low-volume niche services at Bank of Marin, such as highly customized trade finance solutions for obscure markets, can become a drain on resources. A recent analysis of regional banks in 2024 revealed that specialized advisory services can tie up significant personnel hours for minimal overall revenue contribution.

| Category | Example within Bank of Marin | BCG Classification Rationale | Key Financial Indicator | Data Point/Year |

| Securities Portfolio | Available-for-sale securities sold at a loss | Low yield, capital consumption | Average Yield | 1.96% (Pre-Q2 2025) |

| Lending Products | Standard unsecured personal loans | Low differentiation, high competition | Profit Margin | Slim |

| Physical Branches | Branches in declining foot-traffic areas | Shifting consumer habits, high maintenance costs | Foot Traffic/Revenue Generation | Declining |

| Technology Platforms | Legacy core banking systems | High maintenance, limited functionality | IT Budget Allocation to Maintenance | Significant portion of IT budgets (2024) |

| Niche Services | Specialized trade finance for obscure markets | Low volume, resource-intensive | Revenue Contribution | Less than 0.5% of total operating income (estimated for similar banks, 2024) |

Question Marks

Bank of Marin's new digital banking products, like advanced mobile budgeting tools or integrated personal finance management features, would likely be classified as Stars in the BCG Matrix. These innovations target a rapidly expanding digital banking sector, a market experiencing significant growth, potentially exceeding 10% annually in the coming years.

While these products are positioned in a high-growth market, they would initially possess a low market share. This is typical for new launches as the bank focuses on building customer awareness and adoption, aiming to capture a meaningful slice of the competitive digital banking landscape. For instance, a new specialized online lending platform might debut with only a fraction of a percent of the market share in its first year.

Bank of Marin's strategic move into other competitive Bay Area sub-markets, where its brand recognition and market share are currently lower, positions these ventures as Question Marks in a BCG Matrix analysis. This is particularly relevant given the intense competition within the broader Bay Area banking landscape. For instance, the proposed establishment of a new municipal bank in San Francisco underscores the dynamic and contested nature of this market.

Successfully penetrating these less familiar sub-markets necessitates substantial investment. The goal is to build brand awareness and secure a meaningful market share in a region characterized by both growth potential and established, formidable competitors. As of early 2024, the Bay Area's banking sector continues to see robust activity, with community banks and larger institutions vying for customer deposits and loan portfolios, often requiring aggressive pricing and innovative product offerings to gain traction.

Bank of Marin is actively exploring pilot programs for innovative financial solutions, reflecting a strategic move into potentially high-growth but experimental areas. These initiatives, which could include embedded finance partnerships or blockchain-based services, represent a commitment to future-proofing its offerings. For instance, the bank might be testing a new credit assessment model leveraging AI, aiming to improve accuracy and speed for small business loans. In 2024, the fintech sector saw significant investment, with venture capital funding for embedded finance alone reaching billions, indicating the potential market appetite for such integrated solutions.

Diversification into New Commercial Loan Segments

Diversifying into new commercial loan segments positions Bank of Marin for potential high growth, but these are likely to be Question Marks in the BCG matrix. The bank will need significant investment in specialized knowledge and relationship development to establish a foothold in these emerging areas.

For instance, entering sectors like renewable energy project finance or specialized healthcare real estate would require building new underwriting expertise and a dedicated sales force. This strategic move, while promising, necessitates a substantial initial outlay to build market share from a low base.

- High Growth Potential: New segments offer opportunities for expansion beyond traditional markets.

- Initial Low Market Share: Entering unfamiliar territory means starting with a small percentage of the market.

- Significant Investment Required: Capital is needed for expertise, marketing, and risk management.

- Long-Term Strategic Importance: Success in these areas can redefine the bank's future revenue streams.

Attracting Younger Demographics

Bank of Marin's strategy to attract younger demographics, like Millennials and Gen Z, centers on digital innovation and tailored offerings. These generations prioritize mobile banking, seamless online experiences, and often seek financial products that align with their values, such as sustainable investing options. In 2024, a significant portion of Gen Z, estimated to be around 70%, expressed a preference for digital-first banking solutions, highlighting the critical need for community banks to invest in user-friendly apps and online platforms.

To capture this growing market, Bank of Marin is implementing several key initiatives:

- Enhanced Mobile Banking: Developing intuitive mobile apps with features like mobile check deposit, P2P payments, and real-time account alerts.

- Digital Onboarding: Streamlining the account opening process to be entirely online, reducing friction for tech-native customers.

- Financial Literacy Tools: Offering educational resources and budgeting tools through digital channels to help younger customers manage their finances effectively.

- Targeted Marketing: Utilizing social media and digital advertising campaigns that resonate with the values and communication styles of Millennials and Gen Z.

Capturing market share among younger demographics requires substantial marketing investment, as larger, more established institutions often have a head start in digital adoption. For instance, by the end of 2023, major national banks had allocated over $5 billion towards digital transformation efforts, a figure community banks must strategically match or innovate around to compete effectively.

Bank of Marin's ventures into new, competitive sub-markets, such as expanding into less familiar Bay Area cities, are classified as Question Marks. These areas represent high growth potential but currently have low market share for the bank, necessitating significant investment to build brand recognition and customer base against established players.

These new market entries, like a potential expansion into the East Bay's competitive commercial lending sector, require substantial capital for marketing, talent acquisition, and product development. The objective is to transform these low-share, high-growth opportunities into Stars or Cash Cows over time, a process that demands strategic patience and financial commitment.

The bank's exploration of niche commercial lending, such as financing for emerging technology startups or specialized healthcare facilities, also falls into the Question Mark category. These segments offer attractive growth prospects but demand specialized expertise and relationship building, starting from a minimal market presence.

For example, entering the burgeoning fintech lending space in 2024, where venture capital funding reached an estimated $25 billion globally, presents a classic Question Mark scenario. Bank of Marin would need to invest heavily in technology and talent to gain even a small foothold in this rapidly evolving, high-potential market.

| BCG Category | Market Growth | Relative Market Share | Bank of Marin Examples | Strategic Implication |

|---|---|---|---|---|

| Question Marks | High | Low | Expansion into new Bay Area sub-markets, Niche commercial lending (e.g., fintech, healthcare real estate) | Requires significant investment to build market share; potential for future Stars or Dogs. |

BCG Matrix Data Sources

Our Bank of Marin BCG Matrix draws from comprehensive financial disclosures, detailed market analysis, and industry growth forecasts to provide a clear strategic overview.