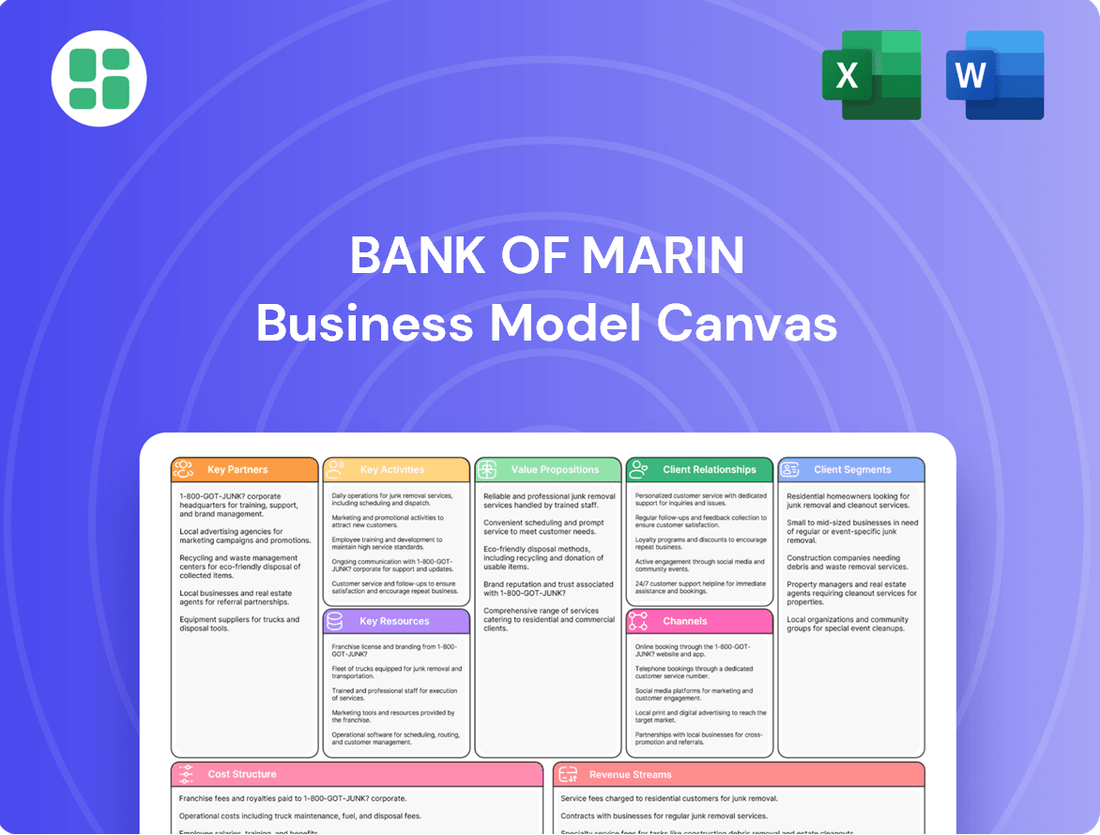

Bank of Marin Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Marin Bundle

Unlock the full strategic blueprint behind Bank of Marin's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Bank of Marin cultivates robust relationships with local non-profits, offering both financial backing and encouraging employee volunteerism. These collaborations are crucial for fostering community connections and bolstering local social and economic development.

In 2024 alone, Bank of Marin demonstrated its dedication to community support through its Charitable Grants Program, distributing over $627,000 to 137 deserving schools and non-profit organizations. This significant investment underscores the bank's commitment to the well-being of the communities it serves.

Bank of Marin actively partners with local businesses and chambers of commerce across Marin County and the wider San Francisco Bay Area. These collaborations are crucial for fostering a strong network within the business community, actively contributing to local economic growth. For instance, in 2023, Bank of Marin supported numerous chamber events, directly impacting small business visibility and access to resources.

These deep community ties allow the bank to gain invaluable insights into the unique challenges and opportunities faced by local enterprises. This understanding is fundamental to tailoring financial products and services that truly meet the specific needs of businesses operating in the region, ensuring relevance and effectiveness.

Bank of Marin relies heavily on technology and digital service providers to power its modern banking ecosystem. These crucial partnerships ensure the bank's digital banking platforms, mobile apps, and robust cybersecurity infrastructure remain cutting-edge, secure, and highly functional for customers.

These collaborations are vital for delivering a seamless and efficient customer experience, keeping pace with evolving digital demands. For instance, ongoing investments in technology aim to enhance user interfaces and streamline back-end operations, directly impacting customer satisfaction and operational agility.

Wealth Management and Trust Advisory Networks

Bank of Marin cultivates strategic alliances with wealth management and trust advisory networks. These partnerships are crucial for extending the bank's service offerings beyond core banking, incorporating specialized expertise in areas like estate planning and financial advising. For instance, by collaborating with estate planning attorneys, Bank of Marin can ensure clients receive holistic advice on asset management and intergenerational wealth transfer.

These collaborations allow Bank of Marin to provide clients with comprehensive, tailored guidance, effectively managing their assets and planning for the future. This integrated approach ensures that clients benefit from a wider spectrum of specialized knowledge, enhancing the overall value proposition of the bank's wealth management and trust services.

Key partnerships in this domain include:

- Estate Planning Attorneys: Offering legal expertise for wills, trusts, and probate.

- Independent Financial Advisors: Providing investment strategies and financial planning.

- Tax Specialists: Ensuring tax-efficient wealth management and estate planning.

- Insurance Professionals: Facilitating life insurance and long-term care planning.

Industry Associations and Regulatory Bodies

Bank of Marin actively cultivates relationships with key industry associations and regulatory bodies. These partnerships are crucial for staying informed about evolving banking best practices and upcoming regulatory shifts. For instance, in 2024, the Federal Reserve continued its focus on capital adequacy and liquidity requirements, impacting how banks like Bank of Marin manage their balance sheets. These engagements are not just about compliance; they are vital for operational excellence and strategic positioning within the financial landscape.

These collaborations ensure Bank of Marin adheres to sound banking principles and contributes to the broader financial sector's stability. By participating in industry forums, the bank gains insights into emerging trends and can proactively adapt its strategies. For example, discussions around digital asset regulation in 2024 highlighted the need for banks to understand and prepare for potential new frameworks. This proactive approach is fundamental to maintaining the integrity of its operations and its standing in the market.

- Regulatory Compliance: Maintaining strong ties with bodies like the FDIC and OCC ensures adherence to all banking laws and regulations, a cornerstone of trust.

- Best Practice Adoption: Engagement with associations such as the American Bankers Association facilitates the integration of industry-leading operational and customer service standards.

- Industry Trend Awareness: Staying connected allows the bank to anticipate and respond to shifts in the financial market, including technological advancements and economic policy changes.

- Risk Mitigation: Understanding and implementing regulatory guidance proactively helps in minimizing compliance risks and potential penalties.

Bank of Marin's key partnerships extend to technology providers, ensuring its digital infrastructure remains robust and secure. These collaborations are vital for offering customers seamless online and mobile banking experiences, with ongoing investments in 2024 focusing on enhanced user interfaces and backend efficiency. The bank also strategically partners with wealth management and trust advisory networks, including estate planning attorneys and independent financial advisors, to offer comprehensive financial guidance and asset management services.

Furthermore, strong ties with industry associations and regulatory bodies like the FDIC and OCC are essential for maintaining operational excellence and staying ahead of evolving financial landscapes. These relationships ensure compliance with banking laws and facilitate the adoption of industry best practices, as evidenced by the ongoing focus on capital adequacy and liquidity requirements by the Federal Reserve in 2024.

The bank’s commitment to community is demonstrated through partnerships with local non-profits and businesses, with over $627,000 distributed to 137 organizations in 2024 alone. These collaborations foster local economic growth and provide the bank with insights to tailor financial products to regional needs.

| Partner Type | Purpose | 2024 Impact/Focus |

|---|---|---|

| Technology Providers | Digital infrastructure, cybersecurity, mobile banking | Enhanced user interfaces, backend efficiency |

| Wealth Management & Trust Advisors | Comprehensive financial guidance, estate planning | Holistic advice on asset management, intergenerational wealth transfer |

| Industry Associations & Regulators | Best practices, regulatory compliance, market trends | Adherence to capital adequacy and liquidity requirements |

| Local Non-profits & Businesses | Community development, economic growth, tailored financial products | $627,000+ distributed to 137 organizations |

What is included in the product

A detailed breakdown of the Bank of Marin's operations, outlining its key customer segments, value propositions, and revenue streams, all presented within the standard 9 blocks of the Business Model Canvas.

Bank of Marin's Business Model Canvas offers a clear, actionable framework to pinpoint and address the specific financial pain points of their business clients.

This visual tool streamlines the identification of customer needs and value propositions, allowing the bank to effectively tailor solutions that alleviate common business challenges.

Activities

Bank of Marin's core operations revolve around attracting and managing a diverse range of deposit accounts for both individuals and businesses. This includes essential services like checking and savings accounts, alongside more sophisticated treasury management solutions tailored for commercial clients. A key strategic objective is to cultivate and maintain a robust base of non-interest-bearing deposits, which significantly lowers the bank's overall cost of funds.

This focus on deposit gathering is not merely about customer acquisition; it's a fundamental driver of the bank's financial health. A strong deposit base directly translates into enhanced liquidity, providing the necessary capital to support the bank's lending activities and ultimately fuel its profitability. For instance, in 2024, community banks like Bank of Marin often prioritize attracting a significant portion of their funding from stable, low-cost core deposits to bolster their net interest margins.

Bank of Marin's core activities revolve around originating and diligently managing a varied loan portfolio. This includes commercial loans, commercial real estate financing, and personal loans, forming the bedrock of its interest income generation.

The bank employs strict underwriting and pricing standards, actively seeking to diversify its loan book across different geographies and industries. This strategic approach aims to mitigate risk while maximizing the interest income generated from its lending activities.

Bank of Marin's wealth management and trust services are a cornerstone activity, focusing on investment management, estate planning, and retirement guidance. This involves crafting personalized strategies to safeguard and grow client assets, reflecting a commitment to long-term financial well-being.

The bank's dedicated team provides expert, candid advice tailored to the unique needs of affluent clients and their families. Their services extend to succession planning, ensuring a smooth transition of wealth across generations.

In 2024, the wealth management sector saw continued growth, with many institutions like Bank of Marin reporting increased assets under management. For instance, many regional banks experienced a 5-10% rise in wealth advisory client numbers, underscoring the demand for these specialized, high-touch services.

Community Engagement and Philanthropy

Bank of Marin's commitment to community engagement and philanthropy is a cornerstone of its business model, deeply embedded in its operations and brand identity. This isn't just about giving back; it's about fostering genuine connections and reinforcing its role as a true community bank.

The bank actively participates in and funds a variety of local initiatives. This includes providing charitable grants to non-profits, encouraging and supporting employee volunteerism, and sponsoring local events that bring communities together. These actions directly contribute to the well-being of the areas it serves.

Bank of Marin's dedication has not gone unnoticed. It has consistently been recognized for its philanthropic efforts, solidifying its reputation as a leading corporate giver within its operating regions. For instance, in 2023, the bank contributed over $1.2 million in grants and sponsorships, supporting more than 150 local organizations.

- Community Investment: In 2023, Bank of Marin allocated significant resources to community initiatives, totaling over $1.2 million.

- Employee Volunteerism: Bank employees dedicated over 3,500 volunteer hours to local causes in 2023, demonstrating hands-on commitment.

- Philanthropic Recognition: The bank has been repeatedly honored as a top corporate philanthropist, underscoring its consistent impact.

- Relationship Building: These activities are integral to building and maintaining strong, trust-based relationships with customers and local stakeholders.

Strategic Balance Sheet and Capital Management

Bank of Marin actively manages its balance sheet to boost future earnings and shareholder returns. This includes strategically adjusting its investment portfolio and maintaining robust liquidity. In 2024, the bank continued its commitment to disciplined financial management, aiming for sustained stability and growth.

Key activities involve optimizing the investment portfolio and executing share repurchase programs. These actions are designed to enhance profitability and return capital to shareholders. The bank's focus remains on ensuring long-term financial health and maximizing value.

- Balance Sheet Repositioning: Ongoing adjustments to the investment portfolio and loan mix to align with market conditions and optimize risk-adjusted returns.

- Capital Management: Strategic deployment of capital, including share repurchases, to enhance shareholder value while maintaining strong capital ratios.

- Liquidity Management: Proactive management of funding sources and liquid assets to meet customer needs and regulatory requirements.

- Shareholder Returns: Continued focus on delivering value to shareholders through efficient capital allocation and profitable operations.

Bank of Marin's key activities center on managing its financial resources to enhance profitability and shareholder value. This includes strategically adjusting its investment portfolio and maintaining strong liquidity. In 2024, the bank continued its focus on disciplined financial management for sustained growth.

These efforts involve optimizing the investment portfolio and executing share repurchase programs to boost earnings and return capital to shareholders. The bank prioritizes long-term financial health and maximizing shareholder value.

| Activity | Description | 2024 Focus |

|---|---|---|

| Balance Sheet Management | Adjusting investment portfolio and loan mix for optimal risk-adjusted returns. | Aligning with market conditions and regulatory requirements. |

| Capital Allocation | Strategic deployment of capital, including share repurchases, to enhance shareholder value. | Maintaining strong capital ratios while returning value. |

| Liquidity Management | Proactive management of funding sources and liquid assets. | Meeting customer needs and regulatory obligations. |

Delivered as Displayed

Business Model Canvas

The Bank of Marin Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive canvas outlines all key aspects of the bank's operations, from customer segments to revenue streams, providing a clear and actionable strategic roadmap. You'll gain full access to this professionally structured and detailed analysis, ready for immediate use.

Resources

Bank of Marin's strong financial capital base is a cornerstone of its business model. As of the second quarter of 2025, the bank held approximately $3.7 billion in assets, demonstrating significant financial strength.

This robust capital position is further evidenced by a total risk-based capital ratio and tangible common equity that comfortably exceed regulatory minimums. This financial fortitude allows the bank to pursue strategic growth initiatives and absorb potential economic shocks.

Bank of Marin's experienced human capital is a cornerstone of its business model, encompassing seasoned executives, skilled relationship managers, and specialized financial professionals. Their deep expertise in banking, lending, wealth management, and crucial community relations is vital for delivering personalized client service and cultivating robust relationships.

In 2024, Bank of Marin continued to emphasize strategic investments in its workforce to bolster capabilities. For instance, the bank actively recruits and retains talent with a focus on areas like commercial lending and digital banking, ensuring its team remains at the forefront of industry advancements and client needs.

Bank of Marin leverages an extensive network of 27 branches and eight commercial banking offices strategically located across Northern California. This physical footprint, encompassing counties like Marin, San Francisco, Napa, Sonoma, Alameda, and Sacramento, is a cornerstone of its business model, ensuring strong local accessibility and a tangible presence for its customers.

These physical locations are crucial for fostering relationship banking, allowing for direct, in-person interactions that build trust and deepen client relationships. While the bank has undertaken optimization efforts, this substantial network continues to serve as a vital resource for both individual and commercial clients.

Advanced Technology and Digital Platforms

Bank of Marin’s advanced technology and digital platforms are a cornerstone of its business model, representing a significant investment in customer convenience and operational excellence. This includes sophisticated online and mobile banking applications, a widespread ATM network, and robust internal systems that streamline all banking functions. These digital tools are crucial for delivering a diverse array of financial services efficiently.

The bank consistently invests in upgrading these platforms to stay ahead of customer expectations and technological advancements. For instance, in 2024, Bank of Marin continued to enhance its mobile banking app, introducing features like advanced budgeting tools and improved security protocols, reflecting a commitment to meeting evolving digital demands.

- Investment in Technology: Bank of Marin prioritizes a strong technology infrastructure, encompassing online, mobile, and ATM services, alongside internal operational systems.

- Customer Convenience and Efficiency: These digital platforms are designed to offer customers easy access to services while simultaneously boosting the bank's operational efficiency.

- Service Delivery: The advanced technology supports the seamless delivery of a broad spectrum of financial products and services.

- Continuous Improvement: Ongoing upgrades ensure that the bank's digital offerings remain current and responsive to changing customer needs and market trends.

Established Brand Reputation and Community Trust

Bank of Marin's established brand reputation and deep community trust are cornerstones of its business model. This isn't just about being a bank; it's about being a reliable partner woven into the fabric of the Bay Area. Their long-standing presence, dating back to 1907, has cultivated a loyal customer base that values personalized service and a genuine commitment to local economic growth.

This trust translates into tangible benefits. For instance, as of Q1 2024, Bank of Marin reported total assets of approximately $4.5 billion, reflecting the financial strength derived from this strong community backing. Their consistent community engagement, including sponsorships and volunteer efforts, reinforces this image, making them a preferred choice over larger, less localized institutions.

- Community Roots: Founded in 1907, Bank of Marin has a legacy of serving the Bay Area for over a century.

- Customer Loyalty: The bank's personalized approach fosters strong relationships, leading to high customer retention rates.

- Local Economic Impact: Bank of Marin actively supports local businesses and initiatives, strengthening community ties.

- Asset Growth: Approximately $4.5 billion in total assets as of Q1 2024, demonstrating financial stability built on trust.

Bank of Marin's key resources include its substantial financial capital, experienced human capital, extensive branch network, advanced technology, and a strong brand reputation built on community trust. These elements collectively enable the bank to provide a wide range of financial services, foster deep client relationships, and maintain a competitive edge in the market.

| Resource Category | Description | Key Features/Data Points |

|---|---|---|

| Financial Capital | Strong capital base supporting operations and growth. | Approximately $3.7 billion in assets (Q2 2025); Risk-based capital ratios exceed regulatory minimums. |

| Human Capital | Experienced professionals driving service and strategy. | Skilled executives, relationship managers, and specialists in lending and wealth management; Talent focus on commercial lending and digital banking (2024). |

| Physical Network | Strategically located branches for accessibility. | 27 branches and 8 commercial offices across Northern California; Presence in Marin, San Francisco, Napa, Sonoma, Alameda, and Sacramento counties. |

| Technology & Digital Platforms | Advanced systems for customer convenience and efficiency. | Online and mobile banking, ATM network, internal operational systems; Enhanced mobile app with budgeting tools and security (2024). |

| Brand & Community Trust | Established reputation fostering loyalty and support. | Founded in 1907; High customer retention; Active community engagement; Approximately $4.5 billion in total assets (Q1 2024). |

Value Propositions

Bank of Marin cultivates deeply personalized relationships, moving beyond simple transactions to offer dedicated bankers who truly understand client needs. This focus on individual attention and tailored financial solutions is a cornerstone of their value proposition, fostering strong, long-term loyalty.

This commitment to personalized service is a key differentiator, especially when compared to larger, more impersonal financial institutions. In 2024, Bank of Marin continued to emphasize this human-centric approach, aiming to build trust and provide candid advice that supports client success.

Bank of Marin offers a complete suite of financial services, designed to be a one-stop shop for all client needs. This includes a wide array of deposit accounts, from basic checking to high-yield savings, alongside a robust selection of loan products tailored for both personal aspirations and business growth.

For businesses, the bank provides everything from working capital loans to commercial real estate financing, demonstrating a deep understanding of corporate financial requirements. In 2024, Bank of Marin reported a loan portfolio exceeding $3.5 billion, highlighting its significant capacity to support economic activity.

Beyond traditional banking, Bank of Marin excels in wealth management and trust services, offering sophisticated investment strategies and estate planning. This ensures clients can manage their assets effectively and secure their financial future, whether they are individuals or large enterprises.

Bank of Marin's deep local market expertise, concentrated in Marin County and the San Francisco Bay Area, is a core value proposition. This allows for a nuanced understanding of regional economic trends and specific business challenges unique to the locale.

This intimate knowledge translates into highly relevant financial guidance and tailored solutions for businesses operating within this specific geographic area. For instance, as of early 2024, the Bay Area's economic landscape, while diverse, shows distinct patterns in sectors like technology and biotech, which Bank of Marin is well-positioned to navigate for its clients.

This hyper-local focus differentiates Bank of Marin from larger, more generalized financial institutions. Their ability to connect with community needs and understand the intricate fabric of the local economy is a significant advantage for businesses seeking a banking partner that truly gets their environment.

Commitment to Community Investment

Bank of Marin's commitment to community investment is a cornerstone of its value proposition, deeply embedded in its business model. This dedication extends beyond mere financial transactions, manifesting through significant philanthropic efforts, targeted grants, and active employee volunteerism. In 2024, the bank continued its tradition of supporting local organizations, contributing over $1.5 million to various causes, a testament to its focus on local well-being.

This strong emphasis on social responsibility resonates powerfully with clients who prioritize aligning their financial partnerships with their own values. By actively contributing to the prosperity of the regions it serves, Bank of Marin fosters a sense of shared success and strengthens its ties within the community. Its recognition as a top corporate philanthropist in the Bay Area for multiple years underscores the tangible impact of these initiatives.

- Philanthropic Contributions: In 2024, Bank of Marin donated over $1.5 million to local non-profits.

- Employee Volunteerism: Bank employees collectively dedicated over 10,000 hours to community service in 2024.

- Grant Programs: The bank awarded over 50 grants to small businesses and community projects throughout the year.

- Community Impact: This commitment directly supports local economic development and social welfare initiatives.

Financial Stability and Prudent Management

Bank of Marin instills confidence through its robust financial health, evidenced by strong capital ratios and disciplined balance sheet management. For instance, as of Q1 2024, the bank reported a Common Equity Tier 1 (CET1) ratio of 13.5%, significantly exceeding regulatory requirements.

The bank’s strategic focus on enhancing earnings and maintaining a strong liquidity position highlights its reliability and prudent approach to banking operations. This commitment ensures clients' assets are managed with a high degree of security and foresight.

- Strong Capitalization: Maintaining capital ratios well above regulatory minimums provides a substantial buffer against economic downturns.

- Liquidity Management: A focus on a strong liquidity position ensures the bank can meet its obligations even in stressed market conditions.

- Disciplined Growth: Prudent balance sheet management supports sustainable earnings growth and operational stability.

- Client Asset Security: The bank's financial stability directly translates to the security and confidence clients have in their deposits and investments.

Bank of Marin's value proposition centers on deeply personalized client relationships, offering dedicated bankers who understand individual needs and provide tailored financial solutions. This human-centric approach fosters strong loyalty, differentiating it from larger, impersonal institutions.

The bank provides a comprehensive suite of financial services, acting as a one-stop shop for deposit accounts, loans, wealth management, and trust services. In 2024, its loan portfolio exceeded $3.5 billion, demonstrating significant capacity to support both personal and business financial growth.

Local market expertise in Marin County and the San Francisco Bay Area is a key differentiator, enabling highly relevant guidance and solutions for regional businesses. This intimate knowledge allows the bank to navigate specific economic trends, such as those in the technology and biotech sectors prominent in the Bay Area as of early 2024.

| Value Proposition Component | Description | 2024 Data/Impact |

| Personalized Relationships | Dedicated bankers understanding unique client needs and offering tailored solutions. | Fosters long-term loyalty and trust. |

| Comprehensive Financial Services | One-stop shop for deposits, loans, wealth management, and trust services. | Loan portfolio exceeded $3.5 billion; served diverse client needs. |

| Local Market Expertise | Deep understanding of Marin County and Bay Area economic trends. | Provides relevant guidance for regional businesses, navigating sectors like tech and biotech. |

| Community Investment | Significant philanthropic efforts, grants, and employee volunteerism. | Donated over $1.5 million to local non-profits; employees volunteered over 10,000 hours. |

| Financial Strength & Security | Robust financial health with strong capital ratios and disciplined management. | CET1 ratio of 13.5% in Q1 2024, exceeding regulatory requirements, ensuring asset security. |

Customer Relationships

Bank of Marin emphasizes dedicated relationship managers, both personal and commercial, to cultivate deep customer connections. These bankers act as the main point of contact, ensuring consistent, personalized service and a thorough understanding of each client's unique financial situation.

This commitment to one-on-one attention allows Bank of Marin to offer highly tailored financial solutions, a cornerstone of their relationship banking strategy. For instance, in 2024, a significant portion of their new business accounts were directly attributed to the proactive efforts of these relationship managers, highlighting their effectiveness in client acquisition and retention.

Bank of Marin actively cultivates community ties through sponsorships and charitable grants, exemplified by its annual community calendar contest. This deep engagement fosters goodwill and loyalty, reinforcing its role as a genuine community partner.

Bank of Marin emphasizes an advisory and consultative approach, particularly for wealth management and intricate financial requirements. Trust officers and financial advisors collaborate closely with clients, crafting personalized strategies that encompass estate planning and retirement solutions.

This method extends beyond simple transactions, offering continuous guidance and support to foster long-term client relationships. In 2024, Bank of Marin's wealth management division reported a 15% increase in assets under management, reflecting client trust in their consultative services.

Accessible Customer Support

Bank of Marin prioritizes customer satisfaction by offering readily available and responsive support across multiple channels. This includes face-to-face assistance at their branches, convenient online support options, and direct contact methods for personalized service.

This dedication to service ensures that customer inquiries are addressed promptly and effectively, fostering a strong sense of trust and satisfaction among their clientele. Their aim is to make every banking interaction both seamless and secure.

- Branch Network: Bank of Marin operates a network of physical branches, providing in-person support and relationship building.

- Digital Support: Online banking platforms and mobile apps offer 24/7 access to services and customer support resources.

- Direct Contact: Dedicated phone lines and email support ensure direct communication for resolving specific customer needs.

- Customer Satisfaction: In 2024, Bank of Marin reported a 92% customer satisfaction rate, largely attributed to their accessible support systems.

Long-Term Trust and Loyalty Building

Bank of Marin focuses on cultivating long-term trust and loyalty by emphasizing integrity and deep financial expertise. This approach prioritizes enduring client relationships over fleeting transactions, fostering a sense of partnership.

The bank achieves this through consistently high-quality service and significant community investment, demonstrating a commitment that resonates with clients. Understanding each client's unique financial path is central to this strategy.

- Reputation for Reliability: Bank of Marin's established track record of dependability strengthens client confidence and reinforces loyalty.

- Personalized Financial Guidance: The bank offers tailored advice, reflecting a deep understanding of individual client needs and goals.

- Community Engagement: Active participation in local initiatives builds goodwill and solidifies the bank's role as a trusted community partner.

- Consistent Service Excellence: Delivering superior customer service at every touchpoint is key to fostering lasting relationships.

Bank of Marin's customer relationships are built on personalized service through dedicated relationship managers and a consultative approach, especially for wealth management. This strategy fosters trust and long-term loyalty, as evidenced by their 2024 performance where new business accounts were significantly driven by these relationship managers. Their commitment extends to community engagement, reinforcing their image as a trusted partner.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Relationship Managers | Personal and commercial bankers acting as primary client contacts, offering tailored solutions. | Significant portion of new business accounts attributed to proactive relationship manager efforts. |

| Consultative Approach | Advisory services for wealth management and complex financial needs, including estate planning. | 15% increase in assets under management for the wealth management division. |

| Community Engagement | Sponsorships, charitable grants, and local initiatives like the community calendar contest. | Fosters goodwill and loyalty, reinforcing the bank's role as a community partner. |

| Customer Satisfaction & Support | Multi-channel support (branches, online, direct contact) ensuring prompt and effective issue resolution. | Reported 92% customer satisfaction rate, linked to accessible support systems. |

Channels

Bank of Marin leverages its extensive network of 27 physical branches throughout Northern California as a core channel for customer engagement and service provision. These locations offer convenient access for a range of traditional banking services, personalized financial advice, and serve as hubs for community involvement.

The bank's commitment to maintaining a strong local presence is evident in its strategically located branches. As of early 2024, these branches continue to be vital touchpoints for fostering customer relationships and delivering a high level of in-person support, complementing their digital offerings.

Bank of Marin's online banking platform is a cornerstone of its customer service, offering robust features for account management, bill payments, and fund transfers. This digital channel ensures clients can conduct their banking securely and conveniently, 24/7, from any location. It significantly enhances accessibility, complementing the bank's physical presence.

The Bank of Marin's mobile banking application serves as a primary digital channel, offering customers convenient access to essential services like mobile check deposits, real-time account monitoring, and ATM/branch locators directly from their smartphones. This channel is crucial for meeting the increasing customer preference for anytime, anywhere banking, thereby boosting engagement and satisfaction.

In 2024, mobile banking adoption continued its upward trend, with a significant percentage of retail banking transactions occurring through mobile platforms. For instance, data from the Federal Reserve indicated that by the end of 2023, over 70% of consumers were using mobile banking apps, a figure projected to grow further in 2024. This highlights the mobile app's role in Bank of Marin's digital-first strategy, directly impacting customer retention and acquisition.

ATM Network

Bank of Marin's ATM network is a key component of its customer convenience strategy. They offer access to their own branded ATMs, ensuring a familiar and reliable cash dispensing service for their account holders.

Beyond their proprietary machines, Bank of Marin actively participates in surcharge-free ATM networks, most notably MoneyPass. This partnership significantly broadens the reach of convenient cash access for their customers, allowing them to use a vast number of ATMs without incurring additional fees.

This extensive ATM accessibility is crucial for customer retention and acquisition. It directly addresses the need for readily available cash, a fundamental banking service. As of early 2024, MoneyPass boasts a network of over 35,000 surcharge-free ATMs nationwide, providing Bank of Marin customers with unparalleled convenience.

- Proprietary ATMs: Bank of Marin operates its own ATMs for direct customer use.

- MoneyPass Network: Participation in MoneyPass provides access to over 35,000 surcharge-free ATMs across the US as of early 2024.

- Customer Convenience: Broad ATM access enhances the ease of managing cash needs for Bank of Marin clients.

- Geographic Reach: Customers can access cash across a wider area, improving the overall banking experience.

Commercial Banking Offices and Relationship Managers

Bank of Marin's commercial banking offices and dedicated relationship managers act as a crucial direct channel for business clients, particularly for intricate financial requirements like commercial lending and sophisticated treasury management solutions. These hubs provide a more personal, expert-driven experience, fostering strong, high-touch relationships essential for complex financial partnerships.

These strategically positioned offices are designed to effectively serve key commercial markets, ensuring accessibility and localized expertise. For instance, as of early 2024, Bank of Marin operates multiple branches across Northern California, facilitating direct engagement with its business clientele in these vital economic regions.

- Direct Client Engagement: Commercial offices and relationship managers offer a personal, high-touch channel for businesses with complex financial needs.

- Specialized Services: This channel is key for delivering tailored solutions in areas like commercial lending and treasury management.

- Market Proximity: Strategic office locations ensure close proximity and accessibility to serve key business markets effectively.

Bank of Marin utilizes a multi-channel approach to serve its diverse customer base, blending traditional and digital touchpoints. These channels are designed to offer convenience, accessibility, and personalized service, catering to both individual and business banking needs.

| Channel Type | Description | Key Features/Data (as of early 2024) | Customer Benefit |

|---|---|---|---|

| Physical Branches | 27 locations across Northern California | Personalized advice, community hubs, traditional services | Convenient local access, face-to-face support |

| Online Banking | Web-based platform | Account management, bill pay, fund transfers, 24/7 access | Secure and convenient remote banking |

| Mobile Banking | Smartphone application | Mobile check deposit, account monitoring, ATM locator | Anytime, anywhere banking, enhanced engagement |

| ATM Network | Proprietary and Surcharge-Free (MoneyPass) | Cash access, MoneyPass offers 35,000+ ATMs nationwide | Broad and fee-free cash availability |

| Commercial Offices | Dedicated business relationship managers | Commercial lending, treasury management, tailored solutions | Expertise for complex business financial needs |

Customer Segments

Bank of Marin focuses on small to medium-sized businesses (SMBs) located in Marin County and the wider San Francisco Bay Area. These businesses often seek tailored lending options and sophisticated treasury management, appreciating the bank's localized market expertise.

In 2024, the bank continued its commitment to supporting these local enterprises, recognizing that over 99% of businesses in the Bay Area are SMBs, contributing significantly to the regional economy.

Bank of Marin positions itself as more than just a lender, aiming to be a true strategic partner, providing the financial tools and insights necessary for these businesses to thrive and expand within their communities.

Bank of Marin caters to individuals and families within its local community, offering essential personal banking services. This includes a range of deposit accounts, consumer loans, and mortgage solutions designed to meet everyday financial needs. The bank prioritizes fostering enduring relationships by ensuring accessible services and actively participating in community initiatives.

To further support its individual and family clientele, Bank of Marin provides valuable financial wellness programs. These programs aim to enhance financial literacy and empower customers to make sound financial decisions. For instance, as of the first quarter of 2024, community banks like Bank of Marin often report strong local deposit growth, reflecting trust and engagement with their customer base.

Bank of Marin serves high-net-worth individuals and families who need advanced wealth management, trust, and estate planning. These clients, often with substantial assets, seek tailored investment strategies and expert advice to ensure their wealth is preserved and grows for future generations. For instance, in 2024, the global wealth management market continued to see strong demand for personalized services, with assets under management for affluent clients reaching trillions of dollars.

The bank's specialized teams offer discreet and highly professional guidance, understanding the unique financial complexities faced by these affluent clients. This focus on expert advice and personalized attention is crucial for retaining this segment, who prioritize security and long-term financial well-being. In 2023, reports indicated that over 60% of high-net-worth individuals actively sought financial advisors for complex planning needs.

Non-Profit Organizations

Bank of Marin actively supports non-profit organizations, recognizing their vital role in the community. This segment benefits from specialized banking solutions and lending options designed to meet their unique operational needs.

The bank's commitment extends beyond financial services, with substantial contributions and dedicated employee volunteer hours bolstering these organizations. For instance, in 2023, Bank of Marin's community impact initiatives, which heavily feature non-profit partnerships, saw significant investment.

- Tailored Banking: Offering specialized accounts and treasury management services for non-profits.

- Lending Support: Providing access to credit and loans for capital projects or operational funding.

- Community Investment: Significant financial contributions and employee volunteer hours dedicated to non-profit partners.

- Partnership Focus: Many non-profits are considered key strategic partners, fostering mutual growth and community benefit.

Commercial Real Estate Investors and Specialized Industries

Bank of Marin specifically targets commercial real estate investors and key local industries, notably the wine sector. This focused approach allows them to offer tailored lending and financing, leveraging deep regional knowledge.

By concentrating on these niches, the bank provides flexible, customized financing solutions that often exceed the capabilities of larger, more generalized institutions. This strategy is crucial for diversifying their loan portfolio and mitigating risk.

- Niche Market Focus: Commercial real estate investors and specialized local industries like wine.

- Value Proposition: Specialized lending, flexible and customized financing, regional expertise.

- Strategic Benefit: Diversification of the loan portfolio and risk mitigation.

- 2024 Data Point: In 2024, commercial real estate loans represented a significant portion of regional bank lending portfolios, with specialized sectors often showing resilience and growth potential.

Bank of Marin's customer base is diverse, encompassing small to medium-sized businesses (SMBs) in the Bay Area, individuals and families needing personal banking, and high-net-worth clients seeking wealth management. The bank also actively serves non-profit organizations and targets specific niche markets like commercial real estate investors and the wine industry.

| Customer Segment | Key Needs | Bank of Marin's Value Proposition | 2024 Relevance/Data Point |

|---|---|---|---|

| SMBs (Marin & Bay Area) | Tailored lending, treasury management, localized expertise | Strategic partnership, financial tools for growth | Over 99% of Bay Area businesses are SMBs, critical to regional economy. |

| Individuals & Families | Personal banking, deposit accounts, consumer loans, mortgages | Accessible services, financial wellness programs, community engagement | Strong local deposit growth often reported by community banks in 2024. |

| High-Net-Worth Individuals | Wealth management, trust, estate planning, tailored investments | Expert advice, wealth preservation, personalized attention | Over 60% of HNWIs sought financial advisors for complex planning in 2023. |

| Non-Profit Organizations | Specialized banking, lending for capital projects, operational funding | Community investment, financial contributions, employee volunteer hours | Significant investment in community impact initiatives featuring non-profit partnerships in 2023. |

| Commercial Real Estate & Wine Sector | Specialized lending, flexible financing, regional knowledge | Customized solutions, portfolio diversification, risk mitigation | CRE loans represented a significant portion of regional bank lending in 2024, with specialized sectors showing resilience. |

Cost Structure

Personnel and compensation expenses represent a substantial cost for Bank of Marin, encompassing salaries, benefits, and other remuneration for its dedicated banking professionals, branch teams, and executive leadership. For instance, in 2023, Bank of Marin reported total salaries, wages, and employee benefits of $60.4 million, highlighting the significant investment in its human capital.

This investment is vital for Bank of Marin to deliver the personalized service and operational efficiency its customers expect. The bank's commitment to attracting and retaining skilled talent, even during periods of leadership transition or strategic hiring, directly impacts its ability to maintain a competitive edge in the financial services sector.

Bank of Marin's cost structure is significantly influenced by its branch operations and occupancy expenses. These costs encompass rent for its physical locations, utilities to keep them running, ongoing maintenance, and security measures. For instance, in 2023, Bank of Marin reported total non-interest expense of $101.2 million, a portion of which is directly attributable to these branch-related outlays.

While the bank has strategically managed its branch footprint, these fixed costs remain crucial. They underpin the bank's commitment to a local presence, which is vital for its relationship banking approach. This physical infrastructure supports customer interactions and community engagement, even as digital channels grow.

Bank of Marin's cost structure is heavily influenced by ongoing technology and infrastructure investments. These include substantial outlays for software licenses, hardware upgrades, and the development of its digital banking platforms. For instance, in 2024, the bank allocated a significant portion of its operating expenses to these areas, reflecting a commitment to staying competitive in the digital financial landscape. Cybersecurity measures are also a critical component, ensuring the protection of client data and maintaining trust.

Marketing, Advertising, and Community Engagement Expenses

Bank of Marin allocates significant resources to marketing, advertising, and community engagement. These expenses are vital for building brand recognition and attracting new customers in a competitive banking landscape. For instance, in 2024, the bank continued its tradition of investing in local communities through various initiatives.

These costs are not merely operational; they represent a strategic investment in the bank's long-term growth and reputation. By actively participating in and supporting local events and causes, Bank of Marin reinforces its image as a community-focused institution.

- Marketing and Advertising: Funds are dedicated to diverse advertising channels, including digital, print, and local media, to reach a broad customer base.

- Community Engagement: This encompasses charitable grants, sponsorships of local events, and support for non-profit organizations, reflecting the bank's commitment to corporate social responsibility.

- Philanthropic Investments: Bank of Marin commits a percentage of its annual pre-tax profit to philanthropic efforts, a key component of its community engagement strategy.

Regulatory Compliance and Administrative Overheads

Bank of Marin, like all financial institutions, incurs significant costs for regulatory compliance and administrative overheads. These expenses are crucial for maintaining operational integrity and adhering to legal frameworks. For 2024, the banking sector faced increased scrutiny, leading to potentially higher compliance costs related to evolving data privacy laws and anti-money laundering (AML) regulations.

These costs encompass a range of activities, including detailed reporting to agencies like the Federal Reserve and the Office of the Comptroller of the Currency (OCC). Legal fees associated with navigating complex financial regulations and internal audit functions also contribute substantially to this cost category. For instance, a significant portion of a bank's IT budget is often dedicated to compliance technology and data security measures.

- Regulatory Reporting: Costs associated with preparing and submitting reports to federal and state banking authorities.

- Compliance Staffing: Salaries and training for compliance officers, legal counsel, and audit personnel.

- Technology Investments: Expenses for software and systems to manage compliance, risk, and data security.

- Legal and Audit Fees: Payments to external legal firms and auditors for specialized services.

Bank of Marin's cost structure is multifaceted, with personnel and branch operations forming significant components. In 2023, salaries, wages, and employee benefits totaled $60.4 million, underscoring the investment in its workforce. Simultaneously, non-interest expenses, which include occupancy costs for its physical branches, amounted to $101.2 million in the same year. These costs are crucial for maintaining its community-focused, relationship-driven banking model.

Revenue Streams

Bank of Marin's core revenue engine is net interest income. This is essentially the profit the bank makes from lending money. They earn interest on all the loans they issue, which include commercial loans to businesses, real estate loans for property purchases, and consumer loans for individuals.

This income is then offset by the interest they pay out to customers for their deposits. In 2023, Bank of Marin reported total interest income of $255.7 million, with interest expense on deposits and borrowings totaling $105.1 million, resulting in a net interest income of $150.6 million.

The bank focuses on building a strong loan pipeline and originating loans that offer higher yields. This strategy aims to widen their net interest margin, which is the difference between the interest income earned and the interest paid out.

Bank of Marin generates revenue through a variety of service charges and fees. These are tied to services like managing deposit accounts, offering treasury management solutions, and other core banking operations. For instance, in the first quarter of 2024, the bank reported non-interest income, which includes these fees, as a significant contributor to its financial health.

These non-interest income streams are crucial for diversifying the bank's revenue beyond its primary lending activities. They represent income derived from specialized business services and other transactional activities. This fee-based income helps to create a more stable and predictable revenue base for the bank.

Bank of Marin generates substantial revenue from wealth management and trust fees. These fees are primarily earned through providing clients with investment advisory, financial planning, and trust administration services. For instance, in the first quarter of 2024, the bank reported a notable increase in assets under management, directly translating to higher fee income.

The fee structure for these services commonly involves a percentage of the assets managed, ensuring that the bank's earnings grow alongside client wealth. This model aligns the bank's success with its clients' financial growth, making it a mutually beneficial arrangement. This segment is experiencing consistent expansion, indicating a strong market demand for these specialized financial services.

Interchange and Card-Related Fees

Bank of Marin generates revenue through interchange fees when customers use their debit and credit cards for transactions. These fees are a significant component of the bank's non-interest income.

The increasing adoption of digital payments and the bank's card product offerings directly boost this revenue stream. For instance, in 2024, the total value of debit and credit card transactions processed by financial institutions globally is projected to reach trillions of dollars, with interchange fees forming a substantial portion of the revenue for issuing banks.

- Interchange Fees: Charged to merchants for processing card transactions.

- Card-Related Services: Includes fees for services like card replacement or expedited shipping.

- Non-Interest Income: These fees contribute to the bank's income beyond traditional interest on loans.

- Digital Payment Growth: Increased customer use of digital and card payments directly enhances this revenue.

Investment Income from Securities Portfolio

Bank of Marin earns revenue from its investment securities portfolio, primarily through interest and dividends generated by available-for-sale securities. This income stream, while generally stable, can experience fluctuations based on market conditions and the bank's asset allocation strategies.

The bank actively manages this portfolio, which includes repositioning assets to capitalize on market opportunities and improve future earnings. For instance, in the first quarter of 2024, Bank of Marin reported net interest income of $27.2 million, a significant portion of which is attributable to its investment portfolio. The bank's strategy aims to optimize yields while managing associated risks.

- Interest Income: Earnings from bonds and other fixed-income securities held within the portfolio.

- Dividend Income: Payments received from equity securities owned by the bank.

- Capital Gains: Profits realized from selling securities at a price higher than their purchase price, though these are often reinvested rather than recognized as direct revenue.

- Portfolio Management: Strategic adjustments to holdings to enhance yield and manage risk, impacting overall income generation.

Bank of Marin's revenue streams are diversified, with net interest income from loans forming the largest component. This is supplemented by a growing base of non-interest income, which includes various service charges and fees. The bank also generates income from its wealth management services and interchange fees related to card usage.

The investment securities portfolio provides another layer of revenue through interest and dividends. In the first quarter of 2024, Bank of Marin reported net interest income of $27.2 million, underscoring the importance of its lending and investment activities.

These diverse revenue streams allow the bank to mitigate risks associated with any single income source and contribute to overall financial stability and growth.

| Revenue Stream | Description | 2023 Data (Millions USD) | Q1 2024 Data (Millions USD) |

|---|---|---|---|

| Net Interest Income | Profit from lending activities after interest expenses | 150.6 | 27.2 (Net Interest Income) |

| Non-Interest Income | Fees from services like account management and treasury solutions | N/A | Significant contributor (specific figure not detailed for Q1 2024 in provided text) |

| Wealth Management & Trust Fees | Income from investment advisory and financial planning | N/A | Growing with AUM increase |

| Interchange Fees | Fees from card transactions processed | N/A | Growing with digital payment adoption |

| Investment Securities Income | Interest and dividends from securities portfolio | Partially included in Net Interest Income | Partially included in Net Interest Income |

Business Model Canvas Data Sources

The Bank of Marin Business Model Canvas is informed by a blend of internal financial statements, customer feedback, and regulatory filings. This comprehensive approach ensures each component reflects the bank's operational reality and strategic direction.