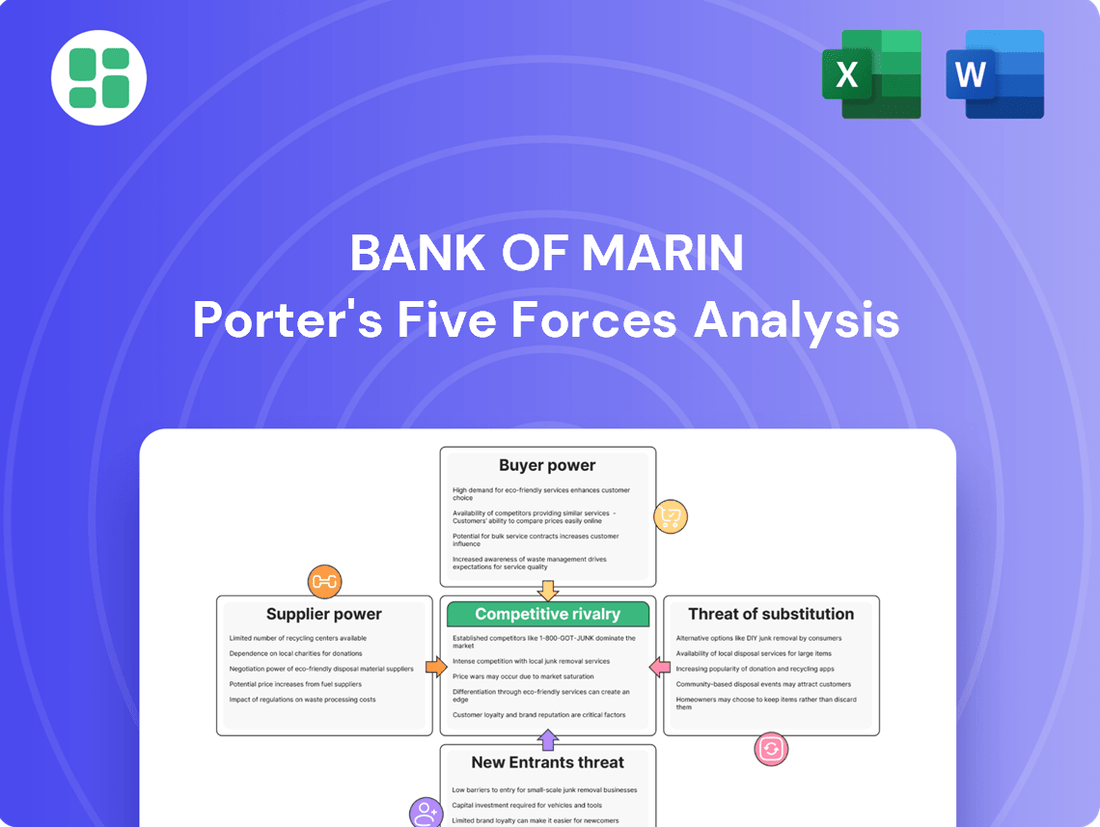

Bank of Marin Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of Marin Bundle

Bank of Marin operates within a dynamic banking landscape, where customer loyalty, the influence of alternative financial services, and the ongoing threat of new entrants significantly shape its competitive environment. Understanding these forces is crucial for navigating the market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bank of Marin’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Depositors are a crucial source of funding for banks like Bank of Marin. Their bargaining power is particularly strong when they hold substantial deposit balances or accounts that do not earn interest, as this directly impacts the bank's cost of funds and overall profitability. Bank of Marin's success in attracting and retaining these vital funds without excessive rate increases is a testament to its ability to manage this aspect of its cost structure.

In 2024, Bank of Marin reported robust deposit growth, underscoring its appeal to customers. A significant portion of these deposits were non-interest bearing, a key factor that helps mitigate the bank's funding costs and bolsters its net interest margin. This strong deposit base provides Bank of Marin with a degree of leverage when negotiating terms and managing its cost of capital.

The specialized skills needed in banking, especially for areas like commercial lending and wealth management, grant employees significant bargaining power. This is particularly true for Bank of Marin, where a community-focused, relationship-driven model relies heavily on experienced staff.

In 2023, the average salary for a bank branch manager in California was around $90,000, with senior roles in specialized banking functions commanding substantially more. This highlights the investment required to secure and keep the talent essential for Bank of Marin's personalized service delivery.

The competitive Bay Area labor market further amplifies this power. Banks like Bank of Marin must offer competitive compensation and benefits to attract and retain individuals with the expertise needed to manage client relationships effectively, directly impacting operational costs and the quality of service provided.

Technology providers hold significant bargaining power over banks like Bank of Marin. As digital transformation accelerates, banks are heavily reliant on specialized fintech firms for everything from core banking software to advanced cybersecurity solutions and data analytics. For instance, in 2024, the global fintech market was valued at over $1.1 trillion, demonstrating the substantial investment and dependence financial institutions have on these technologies. This reliance means banks often have limited alternatives when seeking critical, proprietary systems, allowing tech vendors to dictate terms and pricing.

Regulators and Government Bodies

Regulators and government bodies, while not direct suppliers in the traditional sense, exert considerable influence over banks like Bank of Marin. Their mandates shape the operational landscape, dictating capital adequacy ratios, liquidity requirements, and compliance protocols. For instance, in 2024, the Federal Reserve continued to emphasize robust capital planning and stress testing for regional banks, directly impacting how much capital institutions must hold and manage. This oversight translates into a significant cost of doing business, as banks must invest heavily in compliance infrastructure and personnel.

The power of these bodies lies in their ability to impose penalties for non-compliance and to alter the regulatory framework itself, thereby affecting a bank's strategic direction and profitability. For example, changes in reserve requirements or lending regulations can immediately alter a bank's balance sheet and income generation potential. The ongoing evolution of financial regulations, particularly concerning cybersecurity and data privacy in 2024, means banks must perpetually adapt, incurring ongoing costs and limiting certain operational flexibilities.

- Regulatory Framework: Government bodies establish the rules of engagement for the banking sector, impacting capital requirements, lending practices, and operational standards.

- Compliance Costs: Adhering to regulations, such as those related to anti-money laundering (AML) and Know Your Customer (KYC) protocols, represents a substantial and unavoidable expense for banks.

- Strategic Influence: Regulatory changes can force banks to alter their business models, product offerings, and geographic focus, thereby impacting competitive positioning.

- Risk Management Mandates: Requirements for capital buffers and liquidity management, reinforced by regulators, directly influence a bank's risk appetite and its ability to deploy capital profitably.

Capital Markets and Investors

For Bank of Marin Bancorp (NASDAQ: BMRC), investors in capital markets are crucial suppliers of equity and debt. Their willingness to provide capital directly impacts the bank's capacity for expansion and maintaining sufficient liquidity. For instance, as of late 2023, BMRC's share price has shown resilience, reflecting investor confidence.

The cost of this capital, whether through dividend expectations or share price appreciation, is a key factor. Bank of Marin's management actively works to enhance shareholder value, as evidenced by its share repurchase programs, which can influence investor sentiment and the overall cost of equity.

- Investor Confidence: Bank of Marin Bancorp's stock performance, trading on NASDAQ under BMRC, is a direct indicator of investor sentiment and their willingness to supply capital.

- Cost of Capital: Factors like dividend payouts and share buybacks influence the cost of equity and debt, impacting the bank's financial flexibility.

- Shareholder Value: Management's strategic decisions, including share repurchase programs, aim to bolster shareholder value and attract continued investment.

The bargaining power of suppliers for Bank of Marin is influenced by various entities providing essential inputs. This includes technology providers, specialized talent, and capital market investors, all of whom can impact the bank's operational costs and strategic flexibility.

In 2024, the significant reliance on specialized fintech solutions and the competitive labor market for experienced banking professionals meant Bank of Marin faced considerable pressure from these suppliers. The bank must strategically manage these relationships to control costs and maintain service quality.

The bank's ability to attract and retain skilled employees, particularly in areas like relationship management and commercial lending, is vital. In 2023, average salaries for banking professionals in the Bay Area reflected this demand, with experienced individuals commanding competitive compensation packages.

Technology vendors, operating in a market valued at over $1.1 trillion globally in 2024, often hold strong bargaining power due to the proprietary nature of their solutions, impacting Bank of Marin's IT infrastructure costs.

| Supplier Type | Key Influence on Bank of Marin | 2024 Data/Trend |

|---|---|---|

| Technology Providers | Cost of core banking software, cybersecurity, data analytics | Global fintech market > $1.1 trillion; high dependence on specialized solutions |

| Skilled Employees | Salaries, benefits, retention rates for specialized roles | Competitive Bay Area labor market; average branch manager salary ~$90,000 (2023) |

| Capital Market Investors | Cost of equity and debt, investor confidence | BMRC's resilient share price (late 2023) indicates investor confidence, influencing cost of capital |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Bank of Marin's community banking environment.

Easily identify and address competitive pressures with a visual breakdown of each force, allowing for targeted strategic adjustments.

Customers Bargaining Power

Commercial borrowers, especially larger businesses looking for loans and credit lines, have significant bargaining power. This stems from their substantial business volume and their capacity to compare rates and terms across different banks.

Bank of Marin counters this by focusing on personalized service and cultivating strong local relationships, aiming to foster customer loyalty. This strategy is crucial in a market where clients can easily switch providers.

The bank's recent performance highlights this segment's importance, with commercial loan originations showing an increase, suggesting a strategic push to capture more of this market.

Individual borrowers, seeking mortgages, personal loans, or home equity lines of credit, possess significant bargaining power. This is largely due to the wide array of choices available from numerous financial institutions, with decisions often hinging on competitive interest rates, transparent fees, and overall convenience. In 2023, the average rate for a 30-year fixed-rate mortgage in the U.S. hovered around 6.8%, a figure that heavily influences borrower decisions and competition among banks.

Wealth management clients, particularly high-net-worth individuals and businesses, wield substantial bargaining power due to the significant assets they entrust to financial institutions. These clients expect highly customized strategies, consistent performance, and a dedicated level of personal service. For instance, in 2023, the average assets under management for clients seeking specialized wealth management services often exceeded several million dollars, underscoring their leverage in demanding tailored solutions from firms like Bank of Marin.

Depositors (Individuals and Businesses)

Depositors, particularly large institutional clients and those maintaining substantial non-interest-bearing balances, wield significant influence over deposit rates and terms. Bank of Marin actively manages this by offering competitive rates, reinforcing its relationship-focused banking approach. This strategy has proven effective, as evidenced by the bank's success in lowering its average deposit costs in recent quarters, indicating a degree of control over this customer segment.

- Customer Influence: Large depositors and those with high non-interest-bearing balances can negotiate better rates and terms.

- Bank of Marin's Strategy: Focuses on competitive deposit rates and relationship banking to retain and attract depositors.

- Cost Management: The bank has demonstrated success in reducing its overall deposit costs, reflecting effective management of depositor power.

- Data Point: For instance, in Q1 2024, Bank of Marin reported a net interest margin of 3.25%, showing efficient management of funding costs.

Geographic Concentration

The geographic concentration of Bank of Marin, primarily serving Marin County and the San Francisco Bay Area, can influence customer bargaining power. If customers have numerous readily available local alternatives, their ability to negotiate better terms or switch providers increases.

However, Bank of Marin's strong community ties and focus on local relationships serve as a key differentiator. This deep engagement fosters customer loyalty, which can mitigate the impact of competition and reduce customer churn, even within a concentrated geographic area.

- Geographic Focus: Bank of Marin's operations are largely confined to Marin County and the broader San Francisco Bay Area.

- Potential for Increased Bargaining Power: A concentrated customer base in a region with multiple banking options can empower customers.

- Mitigating Factors: Strong community engagement and personalized service build loyalty, lessening customer price sensitivity.

- Customer Retention: In 2024, community banks like Bank of Marin often report higher customer retention rates due to these relationship-driven strategies.

Customers at Bank of Marin, especially those with substantial deposits or borrowing needs, possess considerable bargaining power due to the competitive banking landscape. This power is amplified by the availability of numerous alternative financial institutions offering comparable services and pricing.

Bank of Marin actively manages this by emphasizing personalized service and building strong local relationships, fostering loyalty to offset price-based competition. This approach is vital for retaining clients who can easily switch providers based on interest rates or fees.

The bank's success in managing its deposit costs, as indicated by its net interest margin, suggests effective strategies for leveraging customer relationships to maintain favorable funding costs.

| Customer Segment | Bargaining Power Drivers | Bank of Marin's Counter-Strategy | 2023/2024 Data Insight |

|---|---|---|---|

| Commercial Borrowers | High volume, rate comparison | Personalized service, local relationships | Increased commercial loan originations |

| Individual Borrowers | Numerous choices, rate sensitivity | Competitive rates, transparent fees | Average 30-year mortgage rate ~6.8% (2023) |

| Wealth Management Clients | Significant assets, demand for customization | Tailored strategies, dedicated service | Average AUM often in millions |

| Depositors (Large/Non-Interest Bearing) | Influence on rates/terms | Competitive rates, relationship banking | Lowered average deposit costs (recent quarters) |

Preview the Actual Deliverable

Bank of Marin Porter's Five Forces Analysis

This preview displays the complete Bank of Marin Porter's Five Forces analysis, offering an in-depth examination of competitive forces within the banking sector. You're viewing the actual, professionally formatted document that will be instantly available for download upon purchase, ensuring you receive the exact strategic insights you need.

Rivalry Among Competitors

Bank of Marin contends with a robust competitive environment from numerous community and regional banks concentrated in its Marin County and broader San Francisco Bay Area operating territory. This intense rivalry often centers on securing local market share, expanding branch accessibility, and leveraging deep-seated community relationships. For instance, as of late 2024, the Bay Area hosts a significant number of community banks, many with established presences and loyal customer bases, making market penetration challenging.

The bank's strategic emphasis on delivering highly personalized customer service and actively participating in community initiatives serves as a crucial differentiator. This approach aims to build stronger customer loyalty and trust, setting Bank of Marin apart from larger, less localized financial institutions. In 2024, community banks that emphasized localized support and personalized banking solutions often reported more stable deposit growth compared to those solely focused on digital offerings.

Large national banks, with their vast capital reserves and extensive branch networks, present a formidable competitive force. Institutions like JPMorgan Chase and Bank of America, boasting trillions in assets, can leverage economies of scale to offer highly competitive pricing on loans and deposits, a significant challenge for community banks like Bank of Marin.

These national giants also lead in technological innovation, offering sophisticated mobile banking apps and digital payment solutions that cater to a broad customer base. In 2024, major US banks continued to invest heavily in AI and cybersecurity, aiming to enhance customer experience and operational efficiency, areas where smaller institutions may struggle to match the pace.

While Bank of Marin's strength lies in its personalized community banking approach, the sheer convenience and advanced digital capabilities offered by national competitors mean that maintaining customer loyalty requires continuous investment in technology and service differentiation.

Credit unions present a notable competitive force, particularly in areas like personal banking and small business services. Their non-profit status and member-focused operations often allow them to offer more attractive interest rates on savings and loans, directly challenging traditional banks. For instance, as of early 2024, the average interest rate on savings accounts at credit unions often surpassed that of large commercial banks, a key factor for rate-sensitive customers.

Bank of Marin counters this rivalry through its established relationship banking model and a robust suite of comprehensive business services. By fostering strong customer connections and providing specialized financial solutions for businesses, Bank of Marin differentiates itself from the more standardized offerings that some credit unions may provide. This strategy aims to retain customers who value personalized service and tailored business support.

Fintech Companies

Fintech companies are a significant force, offering specialized services that chip away at traditional banking functions. Think of online lenders, payment processors, and digital wealth management tools; these innovations can bypass established banks for certain customer needs.

For Bank of Marin, this means a constant pressure to innovate. While fintechs aren't typically licensed banks, their ability to disintermediate key services, like loan origination or payment processing, directly impacts revenue streams. In 2024, the fintech sector continued its robust growth, with global fintech investment reaching hundreds of billions of dollars, highlighting the competitive landscape Bank of Marin navigates.

- Disintermediation of Services: Fintechs offer streamlined alternatives for loans, payments, and investments, potentially reducing customer reliance on traditional banks.

- Technological Integration Imperative: Bank of Marin must invest in and integrate advanced digital solutions to remain competitive and retain customers.

- Customer Experience Focus: Fintechs often excel in user-friendly interfaces and personalized digital experiences, setting a high bar for customer expectations.

- Partnership Opportunities: Collaboration with fintechs can also present opportunities for banks to leverage new technologies and expand service offerings.

Interest Rate Environment

The prevailing interest rate environment is a critical factor in the competitive rivalry among banks, including Bank of Marin. Banks actively compete by offering attractive loan rates to borrowers and competitive yields on deposits. When interest rates fluctuate, this competition can intensify, putting pressure on banks' net interest margins, which is the difference between the interest income generated and the interest paid out.

For instance, in 2024, the Federal Reserve maintained a cautious approach to interest rate adjustments. While there were discussions and expectations of rate cuts, the actual pace of reduction was slower than initially anticipated by many market participants. This environment meant that banks had to be particularly agile in managing their funding costs and asset yields.

- Interest Rate Impact: Fluctuations in interest rates directly influence how banks compete on loan pricing and deposit attractiveness, shaping overall competitive intensity.

- Margin Pressure: A dynamic rate environment can compress net interest margins if a bank cannot effectively adjust its asset yields or deposit costs in tandem.

- Bank of Marin's Strategy: Bank of Marin has proactively repositioned its balance sheet and adjusted deposit rates to navigate these changing interest rate conditions and protect its net interest margin.

Competitive rivalry for Bank of Marin is intense, primarily driven by numerous community and regional banks in its core operating areas. These local competitors vie for market share by emphasizing community ties and branch accessibility, with many established players holding loyal customer bases. In 2024, the San Francisco Bay Area continued to host a dense network of such institutions, making it challenging for any single bank to dominate.

Larger national banks, with their vast resources and advanced digital offerings, also pose a significant threat. Their ability to leverage economies of scale allows for competitive pricing on financial products. For example, in 2024, major banks continued substantial investments in AI and cybersecurity to enhance customer experience, a pace that smaller banks often find difficult to match.

Credit unions further contribute to the competitive landscape by often offering more attractive rates on savings and loans due to their non-profit status. As of early 2024, credit unions frequently provided higher savings account yields than many commercial banks, appealing to rate-sensitive consumers.

Fintech companies also disrupt traditional banking by offering specialized, often digital-first, services like online lending and payment processing. This disintermediation pressures Bank of Marin to continuously innovate its digital platforms and customer service models to retain clients in 2024, a year that saw continued robust growth and investment in the fintech sector globally.

SSubstitutes Threaten

Credit unions and online banks present a significant threat of substitution for Bank of Marin's offerings. These institutions often provide more competitive pricing, such as lower fees and higher interest rates on savings accounts, or more attractive loan rates. For instance, as of early 2024, many online banks were offering savings account APYs exceeding 4.5%, a rate often difficult for traditional banks to match. This cost advantage can draw customers away from traditional banking models, forcing institutions like Bank of Marin to emphasize their value proposition beyond price.

Bank of Marin counters this threat by focusing on its strong community ties and personalized customer service, aiming to build loyalty that transcends purely transactional relationships. This strategy is crucial as the banking landscape becomes increasingly commoditized, with digital-first banks often seen as interchangeable. The ability to offer tailored advice and build rapport with clients is a key differentiator in retaining market share against these more price-competitive substitutes.

Non-bank lenders, including alternative lending platforms, peer-to-peer lending, and specialized finance companies, present a significant threat by offering loan products that bypass traditional banks. These entities often cater to small businesses and consumers seeking quicker access to funds or more flexible loan terms than what traditional banks might provide. For instance, the alternative lending market in the US saw substantial growth, with originations estimated to be in the hundreds of billions of dollars annually in recent years, demonstrating a clear alternative for borrowers.

For wealth management and investment services, traditional investment firms, robo-advisors, and brokerage houses represent significant substitutes. These alternatives offer a wide array of investment products and advisory services, often with competitive fee structures. For instance, the global robo-advisory market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially, indicating strong customer adoption of these digital alternatives.

Bank of Marin's wealth management division faces direct competition from these substitutes, which provide diverse investment products and advisory services. The ease of access and lower costs associated with some of these platforms can attract clients looking for straightforward investment solutions.

Bank of Marin competes by emphasizing its customized strategies and the value of trusted, personalized advice. This approach aims to differentiate its services from the more automated or standardized offerings of many substitutes, focusing on building deeper client relationships and providing tailored financial planning.

Payment Service Providers and Digital Wallets

The rise of payment service providers and digital wallets presents a significant threat of substitutes for traditional banking services. Companies like PayPal, Square, and numerous digital wallet apps allow consumers and businesses to conduct transactions without directly engaging with a bank's core services. This bypasses traditional payment rails and can siphon off valuable transactional revenue streams.

These fintech disruptors, while not offering the full suite of banking products, effectively substitute for the transactional aspects of banking. For instance, PayPal reported processing over $1.7 trillion in total payment volume in 2023, highlighting the scale of these alternative payment ecosystems. This directly impacts a bank's ability to generate fees from card processing and other transaction-based services.

- Erosion of Transactional Revenue: Digital wallets and payment platforms capture a significant share of everyday transactions, reducing the volume and associated fees for banks.

- Reduced Customer Touchpoints: As customers increasingly use third-party payment solutions, banks lose direct interaction opportunities, weakening customer loyalty and cross-selling potential.

- Competitive Pressure: Banks are compelled to either develop their own competitive digital payment solutions or partner with existing providers to remain relevant in the payments landscape.

- Shifting Consumer Behavior: The convenience and integration offered by digital wallets are altering consumer expectations for payment speed and ease, forcing banks to adapt quickly.

Direct Capital Markets Access

Larger corporations often bypass traditional banking by issuing bonds or selling stock directly in capital markets. For instance, in 2024, U.S. non-financial corporate bond issuance reached approximately $1.7 trillion, demonstrating a significant alternative to bank loans.

This trend directly impacts banks by siphoning off their most lucrative clients. Bank of Marin, as a community bank, focuses on small and medium-sized enterprises (SMEs). These businesses typically lack the scale and creditworthiness to access public capital markets effectively.

Consequently, the threat of substitutes from direct capital markets access is relatively low for Bank of Marin's core customer base. While large corporations have this option, SMEs remain largely dependent on traditional bank lending for their financing needs.

- Direct Capital Markets Access: Larger firms can raise funds via bonds or equity, bypassing banks.

- 2024 Data: U.S. non-financial corporate bond issuance was around $1.7 trillion.

- Impact on Banks: This reduces reliance on traditional lending for larger entities.

- Bank of Marin's Position: As a community bank, its SME clients have limited direct capital market access, mitigating this threat.

The threat of substitutes for Bank of Marin is multifaceted, encompassing digital alternatives, non-bank lenders, and direct capital markets. Online banks and credit unions offer competitive pricing, while fintech companies disrupt payment services, potentially eroding transactional revenue. For its core small and medium-sized enterprise (SME) clients, however, direct access to capital markets is a less significant substitute.

| Substitute Category | Key Offerings | Impact on Bank of Marin | Example Data (2023-2024) |

|---|---|---|---|

| Digital Banks & Credit Unions | Lower fees, higher savings rates, competitive loan rates | Customer attrition due to price | Online savings APYs > 4.5% (early 2024) |

| Non-Bank Lenders | Faster, more flexible loan terms | Loss of lending business, especially for SMEs | Alternative lending market originations in hundreds of billions annually |

| Wealth Management Substitutes | Robo-advisors, online brokerages, lower fees | Competition for investment and advisory services | Global robo-advisory market valued at ~$2.5 billion (2023) |

| Payment Service Providers | Digital wallets, online payment platforms | Reduced transactional revenue, fewer customer touchpoints | PayPal processed > $1.7 trillion in payment volume (2023) |

| Direct Capital Markets | Bond issuance, stock offerings | Limited impact on Bank of Marin's SME base | U.S. non-financial corporate bond issuance ~$1.7 trillion (2024) |

Entrants Threaten

The banking sector is inherently challenging for newcomers due to stringent regulatory requirements. Entities looking to establish a bank must meet significant capital adequacy ratios, adhere to complex compliance protocols, and obtain extensive licensing, all of which represent substantial upfront costs and operational complexities. For instance, as of early 2024, many jurisdictions require new banks to hold millions in initial capital, a figure that can easily escalate with ongoing compliance obligations.

Establishing a new bank, like Bank of Marin, demands substantial capital. Think millions, if not billions, for physical branches, cutting-edge technology, and the hefty regulatory reserves required by governing bodies. This immense financial hurdle acts as a significant deterrent for most aspiring new players looking to enter the banking sector.

In 2023, for instance, the average Tier 1 capital ratio for U.S. banks hovered around 12.5%. Bank of Marin, reporting a CET1 ratio of 12.8% as of Q1 2024, demonstrates a strong capital foundation. This robust capital position provides a considerable advantage, making it more difficult for startups with less initial funding to compete effectively.

Brand loyalty acts as a significant barrier for new entrants in the banking sector, particularly for community-focused institutions like Bank of Marin. Customers, especially those who value a personal touch and long-standing relationships, tend to stick with banks they trust. For instance, in 2024, community banks across the US continued to demonstrate resilience, with many reporting stable or growing customer bases primarily due to this ingrained loyalty.

Bank of Marin's deliberate strategy of deep community involvement and offering tailored, personalized banking experiences cultivates a strong sense of trust and commitment among its clientele. This makes it considerably more difficult for newcomers to rapidly acquire a substantial market share, as they must first overcome the established reputational capital and emotional connections that Bank of Marin has nurtured over time.

Access to Funding and Deposit Base

New entrants into the banking sector often struggle to build a substantial and cost-effective deposit base, a critical component for lending and operational stability. Established institutions, such as Bank of Marin, benefit from long-standing customer relationships and a demonstrated history of reliability, which naturally attracts and retains deposits.

Bank of Marin's robust deposit growth, a key indicator of its competitive strength, underscores this advantage. For instance, the bank reported significant increases in its deposit accounts, including a notable rise in non-interest-bearing deposits, which represent a cheaper source of funding compared to interest-bearing accounts.

- Established Deposit Base: Bank of Marin leverages its existing customer relationships and reputation to attract and retain deposits, making it harder for new banks to compete for this essential funding source.

- Cost of Funds Advantage: A strong deposit base, particularly non-interest-bearing deposits, allows Bank of Marin to maintain a lower cost of funds, enhancing its profitability and lending capacity.

- Deposit Growth: The bank's consistent growth in deposits demonstrates its ability to attract new customers and deepen relationships with existing ones, a hurdle for new market entrants.

Technological Infrastructure and Expertise

The threat of new entrants in banking is significantly influenced by the technological infrastructure and expertise required. Developing and maintaining sophisticated systems like secure online banking platforms, intuitive mobile applications, and robust cybersecurity measures demands substantial capital outlay and specialized knowledge. New players often face the daunting task of building this technological foundation from the ground up or incurring considerable costs by outsourcing these critical functions. For instance, in 2023, the average cost for a bank to upgrade its core banking system could range from tens of millions to hundreds of millions of dollars, a substantial barrier for many potential entrants.

Bank of Marin, like many established institutions, consistently invests in its digital capabilities to stay competitive and meet evolving customer expectations. This ongoing commitment to technological advancement creates a high bar for newcomers. A recent report indicated that IT spending in the banking sector globally reached approximately $300 billion in 2024, highlighting the scale of investment necessary to compete effectively in the digital banking landscape.

- High Capital Investment: Significant upfront costs for developing and maintaining advanced technological infrastructure deter new entrants.

- Specialized Expertise: The need for skilled IT professionals in areas like cybersecurity and software development presents a human capital challenge.

- Third-Party Reliance: Outsourcing technology solutions can be costly, impacting profitability for new banks.

- Bank of Marin's Digital Focus: Continuous investment by Bank of Marin in its digital offerings strengthens its competitive position against potential new entrants.

The threat of new entrants for Bank of Marin is generally low due to substantial barriers. Stringent regulatory requirements, including high capital adequacy ratios, demand significant upfront investment, often in the millions, deterring many potential new banks. For instance, as of early 2024, many jurisdictions mandate substantial initial capital reserves, a figure that can easily escalate with ongoing compliance needs.

Established brand loyalty and the difficulty in building a cost-effective deposit base further solidify this low threat. Customers often prefer established relationships, making it hard for newcomers to gain traction. Bank of Marin's focus on community and personalized service cultivates strong loyalty, a hard-to-replicate asset for new entrants.

Technological infrastructure is another significant hurdle. The substantial investment and specialized expertise required for secure online platforms and mobile banking, with global IT spending in banking reaching approximately $300 billion in 2024, create a high barrier. New entrants must either invest heavily or rely on costly outsourcing, impacting their competitive edge against established players like Bank of Marin.

| Barrier Type | Impact on New Entrants | Bank of Marin's Position |

|---|---|---|

| Regulatory Requirements | High (significant capital, licensing) | Well-established compliance, strong capital base (CET1 ratio 12.8% Q1 2024) |

| Capital Investment | High (millions for infrastructure, reserves) | Robust financial foundation, enabling continuous investment |

| Brand Loyalty & Trust | High (customers prefer established relationships) | Deep community ties, personalized service foster strong loyalty |

| Deposit Base | Challenging to build cost-effectively | Leverages existing relationships for stable, growing deposits (including non-interest-bearing) |

| Technological Infrastructure | High (significant IT spending, e.g., $300B globally in 2024) | Continuous investment in digital capabilities, maintaining competitive edge |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bank of Marin leverages data from the bank's annual reports, investor presentations, and SEC filings. We supplement this with industry-specific research from financial publications and market data providers to capture competitive dynamics.