Bangkok Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bangkok Bank Bundle

Navigate the dynamic landscape of Thailand's financial sector with our comprehensive PESTLE analysis of Bangkok Bank. Discover how political stability, economic growth, technological advancements, social shifts, environmental concerns, and legal frameworks are shaping its strategic direction. Equip yourself with actionable intelligence to anticipate challenges and seize opportunities. Download the full PESTLE analysis now and gain a critical edge in understanding Bangkok Bank's future.

Political factors

The stability of the Thai government and its commitment to consistent economic policies are crucial for fostering investor confidence. A predictable political environment allows major financial institutions like Bangkok Bank to engage in long-term strategic planning with reduced regulatory uncertainty.

For instance, Thailand's general election in May 2023 led to a coalition government, which, while initially facing some uncertainty, has since focused on economic recovery and attracting foreign investment. This stability is vital for Bangkok Bank's operational strategies and investment outlook, particularly as it navigates the evolving financial landscape.

The Bank of Thailand (BOT) actively shapes the financial landscape through its regulatory directives, focusing on bolstering security, stability, and safeguarding consumers. For instance, in 2024, the BOT implemented enhanced Know Your Customer (KYC) requirements for new bank account openings, impacting operational procedures for institutions like Bangkok Bank.

Bangkok Bank must navigate these evolving legal frameworks, including responsible lending notifications introduced in late 2023, to ensure operational integrity. Compliance with these measures is critical for maintaining market trust and managing associated risks effectively.

The Thai government, alongside the Bank of Thailand (BOT), is strongly advocating for digital advancements within the banking industry. A key initiative is the planned issuance of virtual bank licenses by mid-2025, signaling a significant shift towards digital-first financial services.

This government-backed push compels established institutions like Bangkok Bank to intensify their digital strategies. Expect accelerated development in mobile banking capabilities and increased investment in cutting-edge technologies to stay ahead in a rapidly digitizing market and cater to changing customer expectations.

Trade policies and international relations affecting cross-border banking

Thailand's trade policies and its international relations, especially within ASEAN and with major economic players like China and the United States, directly influence Bangkok Bank's cross-border banking activities. The bank's strategic focus on 'Connecting ASEAN' relies heavily on favorable trade agreements and policies to boost its regional trade and investment facilitation, a core component of its international business expansion. For instance, as of early 2024, Thailand's commitment to deepening ASEAN economic integration through initiatives like the ASEAN Economic Community (AEC) continues to provide a stable framework for Bangkok Bank's regional operations.

Geopolitical shifts and evolving trade dynamics, such as the ongoing adjustments in global trade relationships, present both potential hurdles and avenues for growth for Bangkok Bank's international segment. The bank's ability to navigate these changes, for example by adapting to new trade regulations or leveraging emerging market opportunities, is critical. In 2023, Bangkok Bank reported a significant portion of its income derived from international operations, underscoring the importance of these external political and economic factors.

- ASEAN Trade Facilitation: Bangkok Bank's 'Connecting ASEAN' strategy benefits from initiatives like the ASEAN Free Trade Area (AFTA), which aims to reduce tariffs and non-tariff barriers among member states, thereby simplifying cross-border transactions for its clients.

- US-China Trade Relations: Fluctuations in US-China trade policies, including potential reciprocal tariffs, can impact supply chains and investment flows, creating both risks and opportunities for Bangkok Bank's clients engaged in trade with these major economies.

- Thailand's Trade Agreements: Thailand's active participation in bilateral and multilateral trade agreements, such as those with key partners, provides a foundation for Bangkok Bank to expand its trade finance and cross-border payment services.

Fiscal and monetary policy directives from the Bank of Thailand

The Bank of Thailand's (BOT) fiscal and monetary policy directives significantly shape Bangkok Bank's operational landscape. Decisions on interest rates, like the BOT's projected adjustments in 2024-2025 to foster economic expansion, directly impact the bank's net interest margins and the overall demand for loans. For example, a potential reduction in the policy rate could lead to lower borrowing costs for customers, potentially boosting loan volumes but compressing interest income.

Furthermore, government stimulus packages, such as targeted cash handouts or digital economy initiatives, can indirectly benefit Bangkok Bank. These measures often encourage consumer spending and accelerate the adoption of digital payment platforms, creating new avenues for the bank to offer innovative fintech services and expand its customer base in these growing digital channels.

Key policy considerations for Bangkok Bank include:

- Interest Rate Environment: The BOT's stance on interest rates, with potential adjustments in 2024-2025, directly affects Bangkok Bank's profitability through its net interest margin.

- Economic Stimulus Measures: Government stimulus, such as cash handouts, influences consumer spending and the uptake of digital payments, creating opportunities for fintech integration.

- Inflationary Pressures: The BOT's management of inflation targets impacts the overall economic stability and the bank's risk assessment for lending.

- Liquidity Management: BOT's open market operations and reserve requirements influence the liquidity available in the banking system, affecting Bangkok Bank's funding costs.

The political landscape in Thailand, including the stability of its government and its economic policy direction, directly impacts investor confidence and Bangkok Bank's strategic planning. The May 2023 election resulted in a coalition government focused on economic recovery, providing a degree of predictability for financial institutions.

Government initiatives, such as the planned issuance of virtual bank licenses by mid-2025, underscore a strong push towards digital banking, compelling Bangkok Bank to accelerate its digital transformation efforts to remain competitive.

Thailand's trade policies and international relations, particularly within ASEAN, are crucial for Bangkok Bank's cross-border operations. The bank's strategy to connect ASEAN is supported by initiatives like the ASEAN Economic Community (AEC), which fosters regional integration and facilitates trade.

The Bank of Thailand's monetary policy, including potential interest rate adjustments in 2024-2025, significantly influences Bangkok Bank's net interest margins and loan demand. Government stimulus measures also play a role by boosting consumer spending and digital payment adoption.

| Policy Area | Impact on Bangkok Bank | Key Data/Initiatives (2024-2025) |

|---|---|---|

| Government Stability | Investor confidence, strategic planning | Post-May 2023 election coalition government focused on economic recovery |

| Digital Banking Push | Accelerated digital strategy, fintech investment | Planned issuance of virtual bank licenses by mid-2025 |

| Trade Policy (ASEAN) | Cross-border banking, regional expansion | Continued commitment to ASEAN Economic Community (AEC) integration |

| Monetary Policy (BOT) | Net interest margins, loan demand | Potential interest rate adjustments projected for 2024-2025 |

What is included in the product

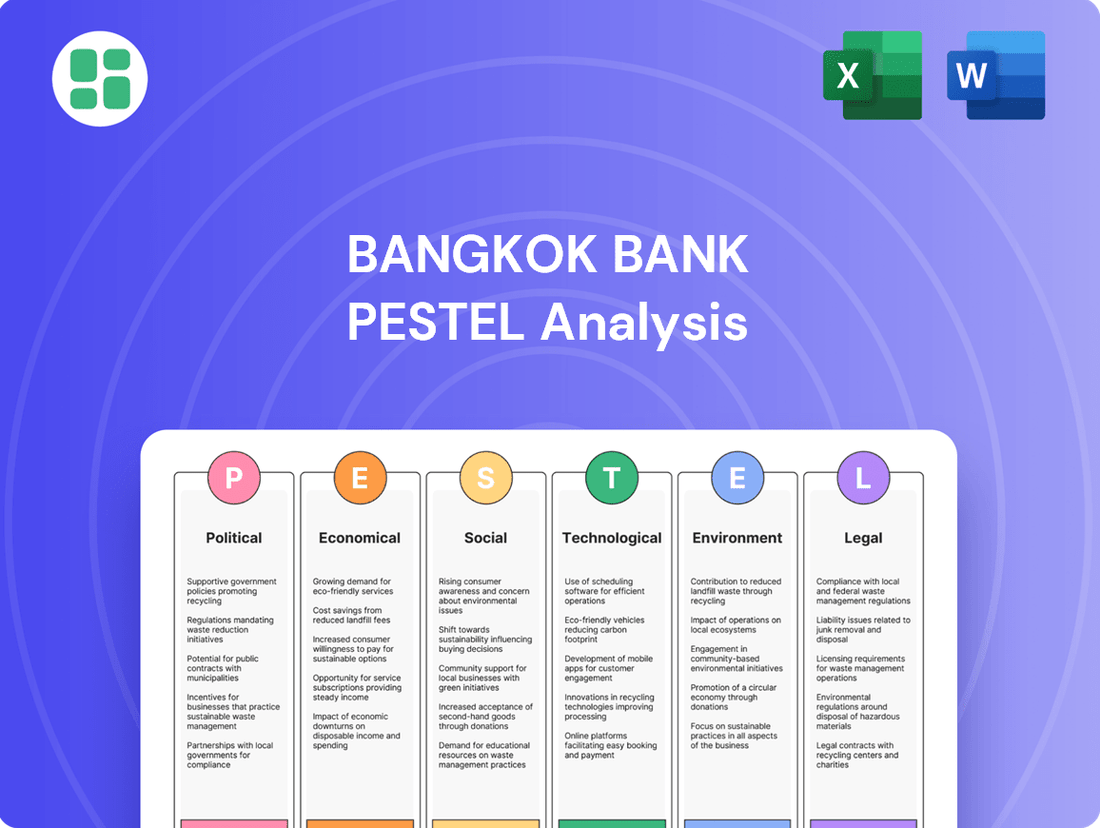

This PESTLE analysis delves into the political, economic, social, technological, environmental, and legal factors impacting Bangkok Bank, offering a comprehensive understanding of its operating landscape.

A clear, actionable summary of Bangkok Bank's PESTLE analysis, presented in an easily digestible format, helps alleviate the pain of navigating complex external factors during strategic planning.

This PESTLE analysis for Bangkok Bank offers a concise, easily shareable format, relieving the pain of lengthy reports and facilitating rapid team alignment on market dynamics.

Economic factors

Thailand's economic growth is a key driver for Bangkok Bank's business volume, influencing everything from loan demand to overall financial transaction activity. The Bank of Thailand has projected a moderate GDP growth for the country, anticipating figures between 2.0% and 2.5% for both 2024 and 2025.

This projected growth is primarily expected to be fueled by a continued recovery in the tourism sector, alongside steady private consumption and a rebound in exports. These factors create a generally supportive environment for the banking sector, providing a base for increased financial services demand.

However, the outlook isn't without its challenges. Global trade tensions and persistent internal structural economic issues represent potential headwinds that could dampen this growth trajectory and impact the banking industry's performance.

Inflation and interest rate movements are critical for Bangkok Bank. For instance, Thailand's headline inflation averaged 1.5% in 2023, a notable decrease from the previous year, signaling a more stable price environment.

The Bank of Thailand's monetary policy decisions directly impact Bangkok Bank's profitability. The central bank maintained its policy interest rate at 2.50% as of early 2024, aiming to balance inflation concerns with economic growth stimulation. This stance can compress net interest margins for banks like Bangkok Bank.

While lower interest rates can pressure net interest income, they are intended to boost borrowing and investment activity. This potential increase in loan demand could offset some of the margin compression, offering Bangkok Bank opportunities for growth in its lending portfolio.

Consumer spending is a vital engine for Thailand's economy and a primary focus for Bangkok Bank's retail operations. In 2024, continued economic recovery is expected to support consumer confidence, though the pace of growth will be influenced by global economic conditions.

However, elevated household debt remains a significant concern, impacting private sector spending and potentially limiting the expansion of consumer loans and digital payment services for Bangkok Bank. As of late 2023, household debt to GDP in Thailand hovered around 85-90%, a level that requires careful management.

Bangkok Bank, in collaboration with regulatory bodies, is actively engaged in addressing these debt levels. This includes implementing responsible lending policies and offering financial advisory services to help manage household financial health, thereby supporting sustainable consumer spending patterns.

Impact of global economic slowdowns or recoveries

Bangkok Bank's 'Connecting ASEAN' strategy inherently ties its international business performance to global economic trends. A projected steady global growth for 2024-2025 offers a positive backdrop, but potential slowdowns in major economies like the United States and China pose risks.

These slowdowns could directly impact Bangkok Bank by reducing trade finance volumes and dampening cross-border investment flows, areas crucial to its regional expansion. For instance, a significant economic contraction in China, a key trading partner for many ASEAN nations, could lead to decreased demand for goods and services, affecting Thai exports and, consequently, the bank's financing activities.

The bank is actively employing regionalization as a defense against these global uncertainties. This involves strengthening intra-ASEAN trade and investment, aiming to create a more resilient business model less dependent on distant economic giants. This strategic pivot is vital as global economic volatility remains a persistent concern, with organizations like the IMF forecasting varied growth rates across regions in the coming year.

- Global Growth Outlook: While generally positive, forecasts for 2024-2025 show variability, with potential for slowdowns in key markets.

- Geopolitical Impact: Tensions can disrupt supply chains and reduce international trade, directly affecting trade finance.

- China's Economic Trajectory: A slowdown in China could significantly impact ASEAN economies and Bangkok Bank's regional operations.

- ASEAN Regionalization: Bangkok Bank's strategy to boost intra-ASEAN business aims to mitigate risks from global economic downturns.

SME sector health and corporate loan demand

The vitality of Thailand's Small and Medium-sized Enterprises (SMEs) directly impacts Bangkok Bank's loan portfolio and overall growth. While large corporations are currently driving loan expansion, the SME segment is experiencing a more gradual recovery. This dynamic underscores the bank's strategic focus on supporting SMEs through initiatives designed to foster resilience and adaptation.

Bangkok Bank's 'Bualuang Transformation Loan' exemplifies this commitment, aiming to equip SMEs with the resources needed for digital and green transitions. This program addresses critical challenges such as slow income recovery and persistent structural issues within the SME sector. As of early 2024, the Thai banking system's loan growth was primarily fueled by large corporate borrowing, with SME loan growth lagging behind.

- SME Sector Significance: SMEs represent a substantial portion of Thailand's economy, making their financial health a key indicator for banks like Bangkok Bank.

- Loan Demand Drivers: While large corporations are currently the primary source of loan demand, the recovery of the SME sector is crucial for sustained banking sector growth.

- Bangkok Bank's Initiatives: Programs like the 'Bualuang Transformation Loan' are designed to boost SME competitiveness by supporting digital and green business models.

- Recovery Trends: As of early 2024, overall loan growth in Thailand was led by large corporate clients, indicating a slower pace of recovery for SME lending.

Thailand's economic growth is projected to be moderate, with the Bank of Thailand forecasting GDP growth between 2.0% and 2.5% for both 2024 and 2025, driven by tourism and consumption.

Inflation has stabilized, with headline inflation at 1.5% in 2023, and the Bank of Thailand maintained its policy rate at 2.50% in early 2024, balancing growth and price stability.

Elevated household debt, around 85-90% of GDP in late 2023, poses a risk to consumer spending and loan expansion, though Bangkok Bank is implementing responsible lending practices.

Global economic slowdowns in major economies like the US and China present risks to Bangkok Bank's international business, impacting trade finance and cross-border investments.

| Economic Indicator | 2023 Value/Trend | 2024-2025 Forecast/Outlook | Impact on Bangkok Bank |

|---|---|---|---|

| GDP Growth (Thailand) | Moderate recovery | 2.0% - 2.5% | Supports loan demand and transaction volumes |

| Inflation (Thailand) | 1.5% (Headline) | Stable, monitored by BoT | Affects interest margins and lending costs |

| Policy Interest Rate (BoT) | 2.50% (early 2024) | Maintained to balance growth/inflation | Can compress net interest margins |

| Household Debt to GDP (Thailand) | 85-90% (late 2023) | Key concern, requires management | Limits consumer loan expansion, impacts spending |

| Global Economic Growth | Varied, potential slowdowns | Steady but with risks in major economies | Impacts international trade finance and regional operations |

What You See Is What You Get

Bangkok Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Bangkok Bank.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Bangkok Bank.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for Bangkok Bank.

Sociological factors

Thai consumers are increasingly embracing digital financial services, with smartphone penetration reaching approximately 80% by early 2024, fueling this trend. Bangkok Bank is actively responding by investing heavily in its mobile banking app, which saw a 25% increase in active users in 2023, to cater to this tech-savvy population.

This growing preference for digital channels means that a substantial portion of banking transactions, estimated to be over 60% for retail customers in 2024, are now conducted online or via mobile. Consequently, Bangkok Bank's strategy emphasizes continuous innovation in its digital offerings and user interface to maintain a competitive edge and meet evolving customer expectations for seamless, convenient banking experiences.

Thailand's demographic landscape is evolving, with an increasing proportion of the population aging while a younger, digitally native generation emerges. This shift directly impacts financial service demands, requiring Bangkok Bank to adapt its strategies.

The aging population, for instance, presents a growing need for retirement planning, wealth management, and healthcare-related financial products. Conversely, younger demographics, comfortable with technology, seek seamless digital banking experiences, mobile payment solutions, and accessible investment platforms. By 2024, Thailand's elderly population (60+) is projected to constitute over 20% of the total population, highlighting the significant market for services catering to this group.

Bangkok Bank must therefore develop a dual-pronged approach. This involves enhancing wealth management and advisory services for older customers, ensuring financial security and legacy planning. Simultaneously, investing in intuitive, user-friendly digital platforms and mobile applications is crucial to attract and retain the tech-savvy youth, promoting financial inclusion and engagement across all age segments.

Financial literacy levels differ significantly among Bangkok Bank's customer base, influencing their adoption of sophisticated financial products and digital banking tools. For instance, a 2023 survey indicated that while 70% of urban customers felt confident with digital banking, only 45% of rural customers expressed similar ease.

Bangkok Bank actively addresses these disparities through targeted programs. In 2024, they launched an enhanced financial education module for visually impaired customers, alongside a nationwide campaign to combat financial fraud, reaching over 500,000 individuals.

By boosting financial acumen, the bank aims to equip all customers with the knowledge to make sound financial choices and securely utilize evolving digital platforms, fostering greater financial inclusion.

Urbanization trends and access to banking services in rural areas

Urbanization in Southeast Asia, a key trend impacting Bangkok Bank's strategy, is driving significant economic activity. For instance, the United Nations projects that by 2030, over 60% of the region's population will reside in urban areas, creating substantial demand for infrastructure development and boosting consumer spending. This presents a prime opportunity for Bangkok Bank to expand its lending in areas like construction and to tap into the growing urban consumer market.

However, this shift also highlights the need to maintain and enhance banking access in rural regions. Bangkok Bank's commitment to financial inclusion means developing strategies for these areas, which could involve leveraging digital banking solutions. By 2024, mobile banking penetration in Southeast Asia was already exceeding 70% in many countries, indicating a strong receptiveness to digital financial services among rural populations.

- Urban Growth: Southeast Asia's urbanization is expected to see over 60% of its population living in cities by 2030, creating demand for financial services.

- Infrastructure Lending: Bangkok Bank can capitalize on urban growth by providing loans for infrastructure projects and urban development.

- Digital Inclusion: Ensuring banking access in rural areas through digital channels is crucial, with mobile banking adoption already high in the region.

- Rural Opportunities: Digital solutions can bridge the gap, offering financial services to underserved rural communities and fostering broader economic participation.

Cultural attitudes towards savings, credit, and investment

Cultural attitudes in Thailand significantly shape how people approach savings, credit, and investment, directly impacting consumer financial behavior and the uptake of banking products. Bangkok Bank's success hinges on understanding these deep-seated cultural nuances to tailor its offerings effectively.

For example, a traditional Thai emphasis on saving for future security often translates into a strong preference for deposit accounts and fixed-term investments. This is evident in the high savings rates observed, with Thailand's household savings rate hovering around 15-20% in recent years, providing a solid foundation for banks to build upon with various savings-linked products.

Conversely, evolving attitudes, particularly among younger generations, are showing a greater willingness to utilize credit for lifestyle enhancements and business ventures. This shift necessitates that Bangkok Bank adapt its credit products, perhaps offering more flexible loan terms or digital credit solutions that align with modern consumer expectations.

- Savings Emphasis: Traditional Thai culture prioritizes saving for the future, influencing a strong demand for secure deposit and investment products.

- Credit Evolution: Younger Thais are increasingly open to credit for consumption and entrepreneurship, prompting banks to innovate in loan product design.

- Investment Diversification: As financial literacy grows, there's a rising interest in diverse investment vehicles beyond traditional savings, requiring banks to offer a broader spectrum of wealth management solutions.

Thai society's increasing reliance on digital platforms, with smartphone penetration near 80% by early 2024, drives Bangkok Bank's focus on mobile banking, which saw a 25% user increase in 2023. This digital shift means over 60% of retail transactions are now online, pushing the bank to continuously innovate its digital offerings. Furthermore, Thailand's aging population, projected to be over 20% by 2024, necessitates tailored retirement and wealth management services, while younger, tech-savvy demographics demand intuitive digital experiences.

Financial literacy disparities, with 70% of urban customers comfortable with digital banking versus 45% of rural customers in 2023, highlight the need for targeted financial education programs. Bangkok Bank's nationwide campaign in 2024 aimed to combat fraud and improve financial acumen for over 500,000 individuals. Cultural attitudes, such as a strong emphasis on savings, evident in Thailand's 15-20% household savings rate, influence product demand, while younger generations show a growing interest in credit for lifestyle and business, requiring adaptable loan solutions.

| Sociological Factor | Impact on Bangkok Bank | 2023/2024 Data/Trend |

|---|---|---|

| Digital Adoption | Increased demand for mobile and online banking services. | Smartphone penetration ~80% (early 2024); 25% active user growth for Bangkok Bank's app (2023). |

| Demographic Shift (Aging Population) | Need for retirement planning, wealth management, and healthcare-related financial products. | Over 20% of Thailand's population expected to be 60+ by 2024. |

| Demographic Shift (Youth) | Demand for seamless digital banking, mobile payments, and accessible investment platforms. | Digitally native generation requires intuitive user interfaces and mobile-first solutions. |

| Financial Literacy | Varying adoption rates of sophisticated products and digital tools. | 70% urban vs. 45% rural comfort with digital banking (2023 survey); nationwide fraud awareness campaign reached 500,000+ (2024). |

| Cultural Attitudes (Savings) | Strong preference for deposit accounts and fixed-term investments. | Thailand's household savings rate around 15-20%. |

| Cultural Attitudes (Credit) | Growing willingness to use credit for lifestyle and business. | Need for flexible digital credit solutions and adaptable loan products. |

Technological factors

Bangkok Bank is aggressively pursuing digital transformation, channeling significant investment into its mobile banking app and online payment systems. This strategic push aims to elevate customer satisfaction and streamline internal operations, a crucial move in today's competitive landscape.

The bank has witnessed a remarkable surge in mobile banking adoption, with a substantial majority of its financial transactions now occurring through its mobile platform. This trend underscores the growing consumer preference for digital channels.

This ongoing digital evolution is paramount for Bangkok Bank to maintain its competitive edge, not only against established financial institutions but also against the burgeoning number of digital-only banks entering the market.

The financial landscape in Thailand is rapidly evolving with the emergence of FinTech competitors and new payment platforms. This surge, including the anticipated launch of virtual banks, intensifies competition for traditional institutions like Bangkok Bank. For instance, in 2024, Thailand's digital payment volume is projected to continue its upward trajectory, driven by mobile banking and e-wallets.

Bangkok Bank is actively addressing this competitive pressure by prioritizing innovation in its digital services. The bank is also forging strategic partnerships and integrating advanced technologies such as artificial intelligence and blockchain. These efforts aim to not only enhance its existing offerings but also to solidify its market position amidst this dynamic technological shift.

As digital banking continues its rapid expansion, Bangkok Bank faces increasing cybersecurity threats and data privacy concerns. The bank is acutely aware of the need to safeguard customer information and financial transactions, making IT risk management and robust cybersecurity protocols a top priority.

Bangkok Bank has invested significantly in advanced security measures, including multi-factor authentication and encryption technologies, to fortify its digital infrastructure. This commitment is crucial given the evolving landscape of cyberattacks, which saw a notable increase in sophisticated phishing and malware attempts targeting financial institutions globally in late 2024 and early 2025.

Recent regulatory shifts, such as the enhanced data protection requirements introduced by the Bank of Thailand in 2024, underscore the critical importance of data privacy and fraud prevention. These regulations mandate stricter controls on data handling and reporting, compelling banks like Bangkok Bank to continually update their compliance frameworks and security practices to meet these evolving standards.

Application of AI and machine learning for personalized services and risk assessment

Bangkok Bank is actively leveraging AI and machine learning to create more personalized customer experiences and refine its risk assessment capabilities. This strategic integration aims to boost operational efficiency across the board.

The bank's commitment to data-driven insights is evident in programs like 'The Big Blue Ocean,' which utilizes advanced analytics. Furthermore, its Tech Adoption Challenge actively seeks innovative AI applications.

- Personalized Services: AI algorithms analyze customer data to offer tailored financial products and advice, enhancing customer engagement and loyalty.

- Risk Assessment: Machine learning models are employed to improve credit scoring, fraud detection, and overall risk management, leading to more robust financial health.

- Operational Efficiency: Automation of routine tasks through AI frees up human resources for more complex, value-added activities.

Development of blockchain and distributed ledger technologies for financial transactions

The burgeoning development and adoption of blockchain and distributed ledger technologies (DLT) are significant technological factors influencing Thailand's fintech sector, with notable implications for financial transactions. Bangkok Bank, like many forward-thinking financial institutions, is actively exploring and investing in advanced financial infrastructure, indicating a strategic awareness of blockchain's potential to revolutionize transaction security and efficiency.

While specific public implementations by Bangkok Bank are still unfolding, the broader trend shows DLT's increasing relevance in digital payments and the burgeoning digital asset market within Thailand. For instance, the Bank of Thailand has been actively involved in pilot projects for Central Bank Digital Currencies (CBDC), showcasing the government's and financial sector's engagement with DLT's underlying principles.

- DLT's potential for enhanced security and transparency in financial record-keeping.

- Increased efficiency and reduced costs in cross-border payments through blockchain solutions.

- The growing regulatory landscape surrounding digital assets and their integration with traditional finance.

- Bangkok Bank's ongoing investment in digital transformation initiatives, which likely encompass the evaluation of DLT applications.

Bangkok Bank is heavily investing in digital transformation, particularly its mobile app and online payment systems, to boost customer satisfaction and operational efficiency. By late 2024, a significant majority of its transactions were already occurring via its mobile platform, reflecting a clear shift in customer preference towards digital channels.

This digital focus is vital for Bangkok Bank to compete with both traditional banks and emerging digital-only banks. The Thai fintech landscape is rapidly expanding, with new payment platforms and the anticipated launch of virtual banks intensifying competition, a trend supported by projections of continued growth in Thailand's digital payment volume throughout 2024.

To stay ahead, Bangkok Bank is prioritizing innovation in digital services, forging partnerships, and integrating technologies like AI and blockchain. This proactive approach is essential to enhance its offerings and maintain market leadership amid rapid technological changes.

The bank is also proactively addressing cybersecurity threats and data privacy concerns, crucial given the increasing sophistication of cyberattacks. In response, Bangkok Bank has bolstered its digital infrastructure with advanced security measures, a move reinforced by stricter data protection regulations introduced by the Bank of Thailand in 2024.

Legal factors

The Bank of Thailand (BOT) mandates stringent regulations for banking and financial services, which Bangkok Bank must meticulously follow. These rules encompass crucial areas like capital adequacy ratios and loan loss provisions, ensuring the financial sector's robustness.

Recent BOT directives, including new responsible lending guidelines and frameworks for virtual banks, are shaping the competitive landscape. For instance, the BOT's ongoing efforts to foster digital innovation and consumer protection through these regulations directly impact Bangkok Bank's strategic planning and operational compliance.

Bangkok Bank is dedicated to upholding strong corporate governance, which includes rigorous anti-money laundering (AML) and counter-terrorism financing (CTF) protocols. This commitment is essential for maintaining financial integrity and complying with international standards.

Recent policy adjustments for foreign national accounts in Thailand underscore a nationwide push against financial fraud and illicit transactions. These measures necessitate banks like Bangkok Bank to implement enhanced Customer Due Diligence (CDD) processes, ensuring thorough vetting of all clients.

Thailand's Personal Data Protection Act (PDPA), effective since June 2022, significantly impacts Bangkok Bank's operations. This legislation mandates stringent rules for collecting, using, and disclosing personal data, requiring explicit consent and clear purpose limitation. For Bangkok Bank, compliance means investing in advanced data security measures and transparent data handling practices to safeguard customer information and maintain trust in an increasingly digital financial landscape.

Consumer protection laws related to financial products

Consumer protection laws are a cornerstone of financial sector integrity, ensuring fair treatment and security for customers. These regulations are particularly crucial for financial products, demanding transparency and responsible conduct from institutions like Bangkok Bank.

The Bank of Thailand's new Notification on Responsible Lending, which takes effect in January 2025, highlights this. It introduces updated measures designed to support debtors and foster equitable practices. This means banks must adapt their lending strategies, including offering clear pathways for debt restructuring.

- Enhanced Transparency: Regulations mandate clear disclosure of all fees, interest rates, and terms for financial products, preventing hidden charges.

- Fair Debt Collection: Laws govern how financial institutions can pursue overdue payments, prohibiting harassment and unfair practices.

- Product Suitability: Certain regulations require banks to assess if a financial product is appropriate for a customer's financial situation and needs.

- Dispute Resolution: Frameworks are in place to help consumers resolve grievances with financial providers, ensuring access to recourse.

International compliance standards (e.g., Basel III, FATCA, CRS)

Bangkok Bank, operating as a major regional financial institution with a broad international presence, is subject to a complex web of international compliance standards. These include frameworks like Basel III, which dictates rigorous capital adequacy and liquidity requirements for banks globally. For instance, as of the first quarter of 2024, Bangkok Bank's Capital Adequacy Ratio (CAR) stood at a robust 19.3%, significantly exceeding the Bank of Thailand's minimum requirement of 11.0%.

Furthermore, regulations such as the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS) necessitate strict adherence to international tax information reporting. These rules require financial institutions to identify and report on account holders who are U.S. persons or tax residents of other participating countries. Bangkok Bank’s commitment to these standards is demonstrated by its consistent maintenance of strong financial health and liquidity ratios, often surpassing regulatory minimums, ensuring operational integrity across its diverse markets.

- Basel III Compliance: Bangkok Bank's total CAR was 19.3% in Q1 2024, well above the regulatory minimum of 11.0%.

- Liquidity Coverage Ratio (LCR): The bank maintained an LCR of 198.6% as of Q1 2024, indicating ample high-quality liquid assets to meet short-term obligations.

- International Tax Reporting: Adherence to FATCA and CRS is critical for managing cross-border financial relationships and data transparency.

Thailand's legal framework, overseen by the Bank of Thailand (BOT), imposes strict operational guidelines on Bangkok Bank, covering capital adequacy and responsible lending practices. The introduction of new virtual banking regulations and enhanced consumer protection measures by the BOT in 2024-2025 directly influences the bank's strategic direction and compliance efforts.

Bangkok Bank adheres to robust corporate governance, including stringent anti-money laundering (AML) and counter-terrorism financing (CTF) protocols, aligning with international financial integrity standards. Recent policy updates in Thailand, such as those affecting foreign national accounts, necessitate enhanced Customer Due Diligence (CDD) processes to combat financial fraud.

The Personal Data Protection Act (PDPA), fully effective since June 2022, mandates strict data handling and security measures for Bangkok Bank, requiring explicit consent and transparency in data usage. Consumer protection laws ensure fair practices and product suitability, with new responsible lending guidelines from the BOT, effective January 2025, requiring banks to adapt lending strategies and support debt restructuring.

International compliance standards like Basel III remain critical, with Bangkok Bank reporting a strong Capital Adequacy Ratio (CAR) of 19.3% in Q1 2024, significantly above the 11.0% minimum. Adherence to FATCA and CRS regulations is also vital for cross-border data transparency and reporting.

| Regulatory Area | Key Requirement/Impact | Bangkok Bank Performance/Action (as of Q1 2024/2025) |

|---|---|---|

| Capital Adequacy | Basel III mandates minimum CAR | 19.3% CAR, exceeding the 11.0% BOT minimum |

| Liquidity | Basel III mandates minimum LCR | 198.6% LCR, indicating strong liquidity |

| Data Protection | PDPA requires strict data handling | Investment in advanced data security and transparent practices |

| Lending Practices | BOT's Responsible Lending (effective Jan 2025) | Adaptation of lending strategies, focus on debt restructuring |

| International Reporting | FATCA & CRS for tax information | Strict adherence to identify and report account holders |

Environmental factors

Bangkok Bank is actively embedding Environmental, Social, and Governance (ESG) principles into its core business strategy. This integration is driven by a recognition of ESG's role in fostering long-term, sustainable growth and meeting the evolving expectations of its diverse stakeholders.

The bank's sustainability policy and overarching framework are deliberately aligned with the United Nations Sustainable Development Goals (SDGs). This alignment underscores Bangkok Bank's firm commitment to responsible financial provision and robust, effective risk management practices across its operations.

In 2023, Bangkok Bank reported a 10.4% increase in its sustainable finance portfolio, reaching THB 233 billion. This growth reflects a tangible commitment to channeling capital towards environmentally and socially beneficial projects, aligning with global sustainability trends and regulatory pressures.

The increasing global and national push towards a low-carbon economy is fueling a significant rise in demand for sustainable finance and green lending products. This trend presents a clear opportunity for financial institutions like Bangkok Bank to align their offerings with environmental goals.

Bangkok Bank is actively supporting its customers in their sustainability journeys through technological adoption and innovation. Initiatives such as the 'Green Transition Academy' and the 'Bualuang Transformation Loan' are designed to facilitate this transition, offering financial backing for greener business practices.

Climate change presents tangible risks to sectors like agriculture and tourism, directly affecting Bangkok Bank's loan portfolios. For instance, Thailand's agricultural output, a significant borrower base, is vulnerable to altered rainfall patterns and extreme weather events, potentially impacting loan repayment capabilities. Similarly, the tourism sector, heavily reliant on natural attractions, faces threats from rising sea levels and coral bleaching.

Bangkok Bank is actively integrating environmental and climate considerations into its operations. The bank is collaborating with clients across these vulnerable sectors to implement strategies for reducing greenhouse gas emissions and effectively managing climate-related financial risks, aiming to build resilience within its lending activities.

Bank's own operational carbon footprint and sustainability initiatives

Bangkok Bank is actively working to shrink its operational carbon footprint, embedding sustainability into its core operations and fostering an internal culture of environmental responsibility. This focus aligns with Thailand's national objectives for carbon neutrality and net-zero emissions, encouraging employees to recognize their individual contributions to these overarching goals.

The bank's commitment is demonstrated through tangible actions:

- Energy Efficiency: Implementing measures across its branches and offices to reduce electricity consumption, a key component of its operational emissions.

- Waste Management: Enhancing recycling programs and reducing paper usage through digitalization initiatives to minimize waste sent to landfills.

- Sustainable Procurement: Prioritizing suppliers with strong environmental credentials and opting for eco-friendly products and services.

- Employee Engagement: Conducting training and awareness campaigns to educate staff on sustainability best practices and their role in the bank's environmental targets.

Regulatory pressure for climate-related financial disclosures

Regulators, including the Bank of Thailand, are intensifying their demands for financial institutions to disclose climate-related financial information. This push is designed to enhance transparency and accountability within the financial sector regarding environmental risks and opportunities.

Bangkok Bank actively addresses this by detailing its environmental, social, and governance (ESG) performance in its sustainability reports. The bank's commitments reflect adherence to policy directives mandating concrete actions in social and environmental stewardship.

- Increased Regulatory Scrutiny: The Bank of Thailand's focus on climate disclosures means financial institutions must provide more detailed information on their environmental impact and risk management strategies.

- Transparency in ESG Reporting: Bangkok Bank's sustainability reports showcase its commitment to ESG principles, offering stakeholders insights into its performance and strategic approach to environmental and social responsibility.

- Policy Adherence: The bank aligns its operations with evolving policy directions that require measurable progress in social and environmental responsibility, demonstrating a proactive stance on sustainability.

Environmental factors significantly influence Bangkok Bank's operations and strategy, particularly concerning climate change and the global shift towards a low-carbon economy. The bank's proactive stance on sustainability, evidenced by its growing sustainable finance portfolio and initiatives like the Green Transition Academy, positions it to capitalize on the rising demand for green lending products.

Climate risks, such as altered weather patterns impacting agriculture and rising sea levels affecting tourism, pose direct threats to the bank's loan portfolios. Bangkok Bank is actively mitigating these risks by integrating environmental considerations into its operations and assisting clients in reducing their carbon footprints and managing climate-related financial risks.

Regulatory requirements, including enhanced climate-related financial disclosures mandated by the Bank of Thailand, are driving greater transparency within the financial sector. Bangkok Bank addresses this through its comprehensive sustainability reports, demonstrating its commitment to environmental stewardship and policy adherence.

| Metric | 2023 Data | Trend |

|---|---|---|

| Sustainable Finance Portfolio | THB 233 billion | 10.4% increase |

| Operational Carbon Footprint Reduction Initiatives | Energy efficiency, waste management, sustainable procurement, employee engagement | Ongoing |

| Climate Risk Management in Lending | Integration into operations, client support for transition | Active |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bangkok Bank is grounded in data from official Thai government sources, reports from international financial institutions like the IMF and World Bank, and reputable market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.