Bangkok Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bangkok Bank Bundle

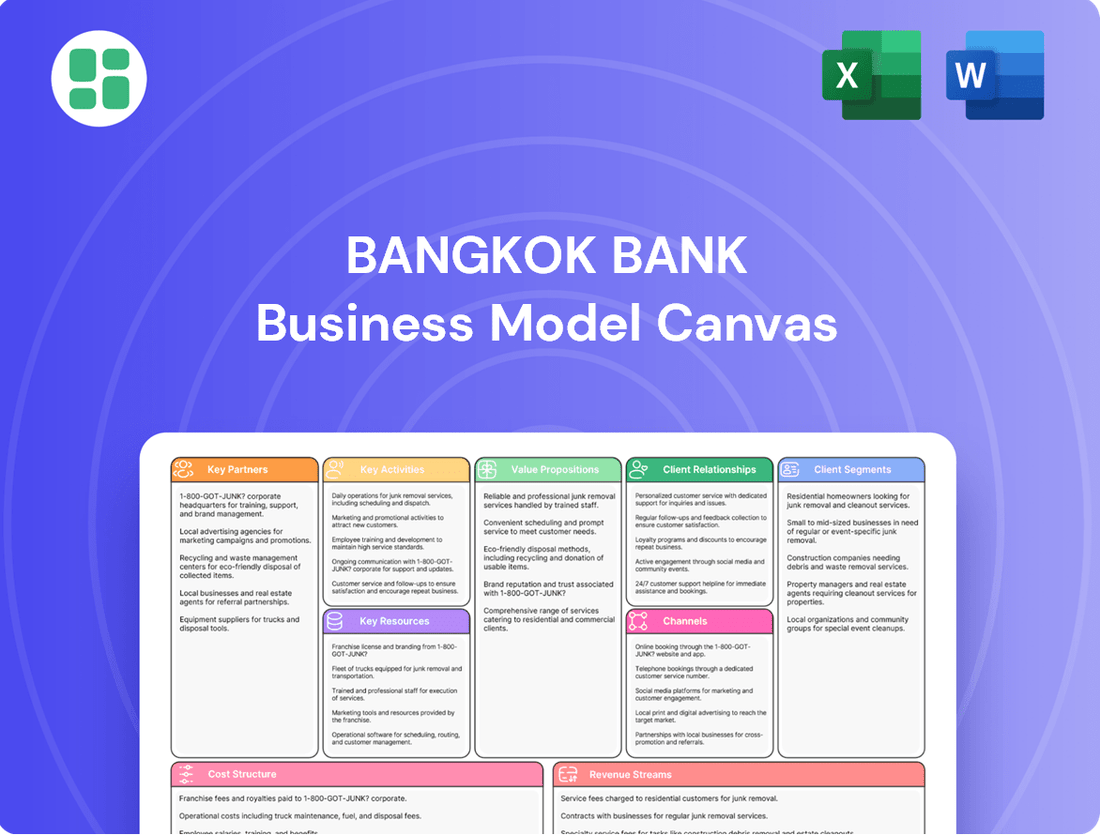

Unlock the strategic framework behind Bangkok Bank's success with our comprehensive Business Model Canvas. This detailed analysis dissects their customer relationships, revenue streams, and key resources, offering a clear roadmap for understanding their market dominance. Perfect for anyone looking to benchmark against a leading financial institution or refine their own business strategy.

Partnerships

Bangkok Bank actively cultivates strategic partnerships, especially within the ASEAN economic community, to bolster its 'Connecting ASEAN' initiative. These alliances are crucial for expanding its reach and service offerings across the region.

A prime example is its collaboration with Permata Bank in Indonesia. This partnership aims to stimulate bilateral trade and investment flows, reinforcing Bangkok Bank's standing as a dominant regional financial institution. Such alliances are instrumental in enabling seamless cross-border transactions and deepening market penetration.

Bangkok Bank actively collaborates with leading technology and digital solution providers to drive its digital transformation forward. This strategic approach involves partnerships with major cloud infrastructure providers like Microsoft Azure, Google Cloud, and Amazon Web Services (AWS) to bolster its IT backbone and data analytics capabilities.

Further strengthening its digital ecosystem, the bank partners with specialized firms focusing on critical areas such as digital identity verification and enhancing user experience across its platforms. These collaborations are instrumental in developing and deploying cutting-edge digital banking solutions that meet evolving customer expectations.

Bangkok Bank actively engages with government and regulatory bodies, aligning its operations with national economic objectives. For instance, in response to economic pressures, the bank has participated in initiatives like interest rate adjustments, a common strategy to support borrowers and stimulate economic activity, as seen in various policy responses throughout 2024.

This collaboration extends to supporting the government's vision for a greener economy. Bangkok Bank's commitment to sustainable finance, including investments in renewable energy projects, directly supports Thailand's national policies aimed at transitioning towards a more environmentally conscious economic model.

By adhering to regulatory frameworks and actively participating in government-led economic programs, Bangkok Bank ensures its operations are not only compliant but also contribute positively to Thailand's broader economic recovery and long-term sustainable development goals, a crucial aspect of its business model in 2024.

Bancassurance and Mutual Fund Partners

Bangkok Bank collaborates with leading insurance providers to offer bancassurance products, allowing customers to access life and non-life insurance solutions directly through the bank's channels. This strategic alliance enhances the bank's ability to provide a holistic financial planning experience.

Furthermore, partnerships with prominent asset management firms are crucial for Bangkok Bank's mutual fund offerings. These collaborations ensure a diverse range of investment products, catering to various risk appetites and financial goals of its clientele.

- Bancassurance: Access to a broad spectrum of insurance products, including life, health, and general insurance, integrated into banking services.

- Mutual Funds: Partnerships with asset managers provide access to a wide array of local and international mutual funds, supporting wealth creation.

- Integrated Wealth Management: These collaborations enable Bangkok Bank to offer comprehensive solutions that combine banking, insurance, and investment services for enhanced customer value.

Industry Associations and Cooperatives

Bangkok Bank actively participates in industry associations such as the Thai Bankers' Association. This involvement helps maintain stability across the banking sector and allows for the coordination of collective initiatives that benefit all members.

The bank also collaborates with numerous cooperatives, including the EGAT Savings Cooperative, for significant asset deposit growth. These partnerships are crucial for expanding Bangkok Bank's presence and services within specific economic sectors.

- Industry Stability: Participation in associations like the Thai Bankers' Association contributes to a more stable and regulated financial environment.

- Sectoral Reach: Collaborations with cooperatives, such as those in the energy sector (e.g., EGAT Savings Cooperative), broaden the bank's customer base and deposit opportunities.

- Collective Action: These relationships enable joint efforts on industry-wide challenges and opportunities, fostering innovation and best practices.

Bangkok Bank's key partnerships span across technology, government, and financial service providers to enhance its regional presence and digital capabilities. Collaborations with Permata Bank in Indonesia are vital for boosting bilateral trade, while alliances with cloud providers like Microsoft Azure and AWS strengthen its digital infrastructure, a critical move in 2024’s competitive landscape.

These strategic alliances allow Bangkok Bank to offer integrated financial solutions, including bancassurance and diverse mutual fund products, thereby enriching customer value propositions. Partnerships with cooperatives further expand its reach into specific economic sectors, solidifying its position as a comprehensive financial partner.

| Partner Type | Example Partner | Strategic Benefit |

|---|---|---|

| Regional Bank | Permata Bank (Indonesia) | Facilitates bilateral trade and investment, regional expansion |

| Technology Providers | Microsoft Azure, AWS, Google Cloud | Enhances digital infrastructure, data analytics capabilities |

| Insurance Providers | Various | Offers integrated bancassurance products |

| Asset Management Firms | Various | Provides diverse mutual fund offerings |

| Cooperatives | EGAT Savings Cooperative | Expands sectoral reach and deposit base |

What is included in the product

Bangkok Bank's business model centers on serving a broad spectrum of customers, from retail to corporate, through extensive branch and digital channels, offering a wide range of financial products and services as its core value proposition.

This model is underpinned by strong customer relationships, a robust digital infrastructure, and strategic partnerships, enabling efficient revenue generation through interest income, fees, and commissions.

The Bangkok Bank Business Model Canvas effectively addresses the pain point of complex financial strategy by providing a clear, visual framework for understanding and communicating their core operations.

It simplifies the intricate world of banking, offering a one-page snapshot that allows stakeholders to quickly grasp key value propositions and customer relationships.

Activities

Bangkok Bank's core banking operations are centered on its fundamental role as a financial intermediary. This includes diligently accepting deposits from a broad customer base, which provides the essential liquidity for its lending activities.

A significant portion of their business involves extending various forms of credit. This encompasses substantial corporate lending, crucial support for Small and Medium Enterprises (SMEs), and a wide array of retail loans designed for individual consumers, alongside international financing solutions.

Furthermore, the bank actively manages and grows its credit card portfolio, a key driver for transaction-based revenue and customer loyalty. These activities are the engine of Bangkok Bank's financial performance, underpinning its market presence and profitability.

For the first quarter of 2024, Bangkok Bank reported a net profit of THB 11,076 million, demonstrating the ongoing strength of these core operational activities in a competitive landscape.

Bangkok Bank's key activities heavily revolve around its digital transformation, a crucial element for staying competitive. This involves a significant focus on upgrading its mobile and internet banking platforms, making them more user-friendly and feature-rich.

A core part of this strategy is building digital ecosystems, connecting various services and partners to offer a seamless experience for customers. Integrating artificial intelligence is also a major undertaking, aimed at personalizing services and improving back-end operations.

These efforts are designed to boost operational efficiency, leading to faster processing times and reduced costs. Furthermore, the bank aims to enhance the overall customer experience by providing more convenient and accessible banking solutions, ultimately speeding up the introduction of new financial products and services to the market.

Bangkok Bank's international banking and trade finance activities are central to its strategy, leveraging a robust network to facilitate cross-border transactions. In 2024, the bank continued to be a key player in supporting trade flows, particularly within the ASEAN region, which remains a core focus of its operations.

The bank's expertise in foreign exchange, remittances, and comprehensive trade finance solutions empowers businesses engaged in international commerce. This is crucial for enabling investments and transactions across borders, directly supporting its mission to connect ASEAN economies.

Wealth Management and Investment Services

Bangkok Bank's wealth management and investment services are a cornerstone of its business model, focusing on helping clients grow and protect their assets. This segment offers a comprehensive suite of products, including investment products, bancassurance, and mutual funds, all supported by expert wealth management advice.

These activities directly address the needs of customers aiming for financial growth and stability, moving beyond simple banking to offer sophisticated financial planning. In 2023, Bangkok Bank reported a net profit of THB 36.6 billion, with its fee-based income, which includes wealth management services, playing a significant role in its overall revenue diversification.

- Investment Products: Offering a range of securities, bonds, and structured products to suit diverse risk appetites.

- Bancassurance: Providing life and non-life insurance products through the bank's distribution channels.

- Mutual Funds: Access to a wide selection of domestic and international mutual funds managed by reputable asset managers.

- Wealth Advisory: Personalized financial planning and investment strategies tailored to individual client goals.

Sustainability and Responsible Lending Initiatives

Bangkok Bank actively champions Thailand's shift towards a sustainable economy. This commitment is demonstrated through its provision of green loans and transition finance, directly supporting businesses in their environmental efforts.

The bank's operations are guided by stringent responsible lending principles. This ensures that financial assistance is channeled towards enterprises that are actively adopting and implementing environmentally sound practices.

- Green Loans: Bangkok Bank offers specialized financing for projects with clear environmental benefits, such as renewable energy and energy efficiency upgrades.

- Transition Finance: The bank provides support for industries undergoing significant transformation to reduce their carbon footprint and align with sustainability goals.

- Responsible Lending: Adherence to international best practices in lending ensures that the bank's financing activities contribute positively to environmental and social outcomes.

- Financial Inclusion for Sustainability: Bangkok Bank aims to make sustainable finance accessible to a wider range of businesses, fostering broader adoption of eco-friendly operations.

Bangkok Bank's key activities extend to robust wealth management and investment services, offering clients a comprehensive suite of products like securities, bonds, and mutual funds. These services are complemented by personalized wealth advisory, aiming to help customers grow and protect their assets effectively.

The bank actively facilitates cross-border transactions and trade finance, particularly within the ASEAN region, a core strategic focus. This includes expertise in foreign exchange and remittances, vital for businesses engaged in international commerce and investment.

A significant emphasis is placed on digital transformation, involving the enhancement of mobile and internet banking platforms and the development of digital ecosystems. This strategic push aims to improve operational efficiency and customer experience through AI integration and streamlined services.

Furthermore, Bangkok Bank champions sustainability by providing green loans and transition finance, supporting businesses in their environmental initiatives and adhering to responsible lending principles. This commitment is integral to fostering a more sustainable economy.

| Key Activity Area | Focus | 2024/2023 Data Highlight |

|---|---|---|

| Core Banking | Deposits and Lending (Corporate, SME, Retail) | Net profit of THB 11,076 million in Q1 2024 |

| Digital Transformation | Mobile/Internet Banking, Digital Ecosystems, AI | Enhancing user-friendliness and operational efficiency |

| International Banking & Trade Finance | Cross-border Transactions, ASEAN Focus | Key player in supporting trade flows within ASEAN |

| Wealth Management & Investment Services | Investment Products, Bancassurance, Mutual Funds, Advisory | Net profit of THB 36.6 billion in 2023 (fee-based income significant) |

| Sustainable Finance | Green Loans, Transition Finance, Responsible Lending | Supporting businesses in environmental efforts and carbon footprint reduction |

Preview Before You Purchase

Business Model Canvas

The Bangkok Bank Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you'll get the complete, professionally formatted Business Model Canvas, mirroring exactly what you see here, ready for immediate use and customization.

Resources

Bangkok Bank boasts an extensive physical footprint with a substantial domestic branch network and numerous ATMs throughout Thailand. This widespread accessibility is fundamental, offering both retail and business clients convenient access to traditional banking services. As of the first quarter of 2024, Bangkok Bank operated approximately 1,100 branches and over 10,000 ATMs nationwide, facilitating millions of transactions daily.

Bangkok Bank's human capital is a cornerstone of its business model, featuring a workforce of highly qualified financial professionals, adept relationship managers, and specialized technology experts. This diverse talent pool is crucial for delivering sophisticated financial solutions and maintaining strong client relationships.

The bank champions a 'One Family, One Team' philosophy, cultivating an environment that encourages knowledge exchange and a unified focus on customer needs. This collaborative culture enhances service quality and drives innovation across the organization.

As of the first quarter of 2024, Bangkok Bank reported a robust employee base, underscoring its commitment to developing and retaining skilled personnel. This investment in human capital directly supports its strategic objectives in a competitive financial landscape.

Bangkok Bank's commitment to advanced technology infrastructure is a cornerstone of its business model. The bank has heavily invested in modernizing its core systems, with a significant portion of its IT budget allocated to cloud-based solutions. This strategic move enhances operational efficiency and scalability, allowing for quicker adaptation to market changes.

In 2024, Bangkok Bank continued to bolster its data analytics capabilities, leveraging these insights to personalize customer experiences and identify new business opportunities. The bank's digital platforms for mobile and internet banking are powered by this robust infrastructure, ensuring secure and seamless transactions for millions of users. This focus on innovation supports the development of new digital products and services.

Strong Capital Base and Financial Instruments

Bangkok Bank's robust capital base, evidenced by its healthy capital adequacy ratio, forms a cornerstone of its business model. This strong financial foundation allows the bank to absorb potential losses and maintain operational stability, even amidst economic fluctuations. For instance, as of the first quarter of 2024, Bangkok Bank reported a robust Capital Adequacy Ratio (CAR) under Basel III, with its Total CAR standing strong, significantly above the regulatory minimums. This financial strength is crucial for its ability to underwrite new loans and expand its market reach.

The bank's substantial allowance for expected credit losses further bolsters its resilience. This proactive approach to provisioning ensures that the bank is well-prepared to manage potential defaults within its loan portfolio. By maintaining a high level of loan loss reserves, Bangkok Bank demonstrates its commitment to prudent risk management, which is vital for sustaining long-term growth and investor confidence. This financial prudence enables strategic investments and supports its ongoing commitment to serving its diverse customer base.

- Capital Adequacy: Bangkok Bank consistently maintains a capital adequacy ratio well above regulatory requirements, providing a buffer against financial shocks. In Q1 2024, their total CAR remained robust, reflecting a strong financial position.

- Loan Loss Reserves: A significant allowance for expected credit losses demonstrates the bank's proactive risk management, ensuring it can absorb potential loan impairments.

- Financial Instruments: The bank leverages a diverse range of financial instruments to manage its capital structure, liquidity, and market risks effectively.

- Strategic Investment Capacity: A strong capital base empowers Bangkok Bank to invest in technological advancements, digital transformation, and strategic growth initiatives, enhancing its competitive edge.

Customer Data and Insights

Bangkok Bank leverages its extensive customer data to deeply understand the diverse needs and behaviors of its client base. This allows for the creation of highly personalized financial products and services, from bespoke loan packages to tailored investment advice.

The bank actively gathers customer feedback, especially through its digital platforms, to continuously improve its offerings. For instance, in 2023, Bangkok Bank saw a significant increase in digital transaction volumes, highlighting the importance of refining these channels.

- Customer Data: Over 17 million retail customers and over 1 million corporate clients provide a rich dataset.

- Digital Channel Feedback: Feedback mechanisms are integrated into the mobile banking app and online portal, with over 50% of customer interactions occurring digitally in 2024.

- Product Tailoring: Data insights inform the development of products like flexible loan options and personalized savings plans, contributing to a 10% year-on-year growth in new product uptake.

- Enhanced Experience: Continuous refinement based on feedback has led to improved user interface and faster transaction processing times, boosting customer satisfaction scores by 8% in the last fiscal year.

Bangkok Bank's key resources are its extensive branch and ATM network, skilled workforce, robust technological infrastructure, and strong financial capital. These assets are crucial for delivering a wide range of financial services and maintaining a competitive edge in the market.

The bank's significant investment in technology, including cloud solutions and data analytics, enhances operational efficiency and enables personalized customer experiences. Its substantial capital base, demonstrated by strong capital adequacy ratios and loan loss reserves, provides stability and capacity for strategic growth.

Leveraging deep customer data, Bangkok Bank tailors its offerings, with over 50% of customer interactions occurring digitally in 2024. This data-driven approach, combined with a commitment to employee development and a collaborative culture, underpins its ability to meet evolving client needs.

Value Propositions

Bangkok Bank provides a complete suite of financial services, encompassing everything from basic savings and loans to sophisticated investment and global trade solutions. This broad offering ensures that clients, whether individuals, small businesses, or large corporations, can manage all their financial needs through a single, convenient point of access.

In 2024, Bangkok Bank continued to solidify its position by offering a diverse range of products. For instance, their digital banking platforms saw significant growth, with mobile transactions increasing by over 20% year-on-year, demonstrating a strong uptake in their innovative solutions. This comprehensive approach makes them a vital partner for economic activity.

Bangkok Bank strives to be more than just a financial institution; it aims to be a trusted partner and a reliable close friend to its customers. This means offering consistent support, especially during tough economic times. For instance, in 2023, the bank provided significant assistance through debt relief programs and transformation loans specifically designed for small and medium-sized enterprises (SMEs) navigating economic shifts.

By offering tailored financial advice and practical solutions like these, Bangkok Bank fosters deep, lasting relationships. These relationships often span across generations, as families and businesses come to rely on the bank's consistent guidance and support for their evolving financial needs, cementing its role as a steadfast ally.

Bangkok Bank offers unparalleled digital convenience through its robust mobile and internet banking platforms, providing customers with secure, 24/7 access to a comprehensive suite of financial services. This constant availability empowers users to manage their finances anytime, anywhere, aligning perfectly with the demands of modern, fast-paced lifestyles.

The bank consistently invests in upgrading its digital offerings, ensuring a seamless and intuitive user experience. For instance, in 2023, Bangkok Bank reported a significant increase in digital transactions, with its mobile banking app, Bualuang mBanking, seeing a substantial rise in active users, reflecting the growing preference for digital financial management.

Expertise in International Trade and Investment

Bangkok Bank leverages its extensive international network and strategic focus on 'Connecting ASEAN' to provide unparalleled expertise in international trade and investment. This allows businesses to navigate complex cross-border transactions and tap into new markets with confidence.

The bank's specialized services are designed to facilitate regional expansion and enhance global connectivity for its corporate and SME clients. This is crucial in a globalized economy where understanding diverse markets and regulations is key to success.

- Facilitating Regional Trade: In 2023, Bangkok Bank reported a significant increase in trade finance transactions, particularly within the ASEAN region, supporting over 100,000 SMEs in their international trade endeavors.

- Cross-Border Investment Support: The bank actively advised on and facilitated cross-border investments totaling over $5 billion in 2023, connecting Thai businesses with opportunities abroad and foreign investors with the Thai market.

- ASEAN Market Insights: Bangkok Bank's dedicated research teams provide in-depth analysis of ASEAN economies, offering clients critical intelligence for strategic decision-making in international trade and investment.

- Digital Trade Solutions: The bank has invested heavily in digital platforms to streamline international trade processes, with a 25% year-on-year increase in the adoption of its digital trade finance solutions by clients in 2023.

Commitment to Sustainability and Green Finance

Bangkok Bank actively supports businesses in their shift towards sustainability and a low-carbon future. They offer specialized financial products and expert advice to facilitate this transition.

This commitment is demonstrated through offerings like green loans, which provide crucial funding for environmentally friendly projects. These initiatives directly contribute to achieving global environmental targets.

- Green Loans: Bangkok Bank offers financing specifically for projects that reduce environmental impact.

- Advisory Services: The bank provides guidance to help businesses navigate sustainable practices and carbon reduction strategies.

- Client Appeal: These offerings resonate strongly with an increasing segment of socially conscious investors and businesses.

By aligning with international environmental goals, Bangkok Bank not only fosters a greener economy but also attracts clients who prioritize corporate social responsibility, a growing trend in the financial sector.

Bangkok Bank's value proposition centers on being a comprehensive financial partner, offering a full spectrum of services from everyday banking to complex international trade solutions.

They emphasize deep customer relationships, acting as a trusted advisor and offering support, particularly through challenging economic periods, as seen with their SME assistance programs.

The bank also champions digital convenience, providing seamless 24/7 access to financial management, and leverages its extensive ASEAN network to facilitate cross-border trade and investment.

Furthermore, Bangkok Bank is committed to sustainability, offering green financing and advisory services to support businesses in their transition to a low-carbon future.

| Value Proposition Area | Key Offering | 2023/2024 Data Highlight |

|---|---|---|

| Comprehensive Financial Services | End-to-end banking, loans, investments, trade finance | Mobile transactions increased by over 20% YoY in 2024. |

| Trusted Partnership & Support | Debt relief, transformation loans for SMEs | Provided significant SME assistance in 2023. |

| Digital Convenience | 24/7 mobile and internet banking | Bualuang mBanking saw a substantial rise in active users in 2023. |

| International Connectivity (ASEAN Focus) | Trade finance, cross-border investment support | Facilitated over $5 billion in cross-border investments in 2023; 25% YoY increase in digital trade solutions adoption. |

| Sustainability Focus | Green loans, sustainability advisory | Financing for environmentally friendly projects. |

Customer Relationships

Bangkok Bank cultivates enduring, often multi-generational, connections with its diverse clientele, ranging from major corporations to small and medium-sized enterprises. This is primarily achieved through a dedicated relationship management team.

These relationship officers act as a direct conduit, ensuring that financial solutions are precisely tailored to each client's unique requirements and that support is always prompt and relevant. For instance, in 2024, Bangkok Bank continued to emphasize its commitment to personalized service, with relationship managers actively engaging with over 80% of its key corporate accounts to proactively identify evolving financial needs.

Bangkok Bank champions a customer-centric philosophy, meticulously crafting products and services to address the dynamic needs of its diverse clientele. This commitment is evident in their proactive approach to gathering customer feedback, which directly informs the adaptation and enhancement of their offerings, aiming for superior satisfaction.

In 2024, Bangkok Bank continued to leverage digital channels for customer engagement, with mobile banking transactions seeing a significant uplift. Their focus on personalized financial solutions, informed by data analytics, aims to deepen relationships and foster loyalty across all customer segments.

Bangkok Bank goes beyond simple transactions by offering robust financial advisory and educational services. This commitment helps customers navigate complex financial landscapes, empowering them to make smarter decisions about their investments and business expansion.

A prime example of this is their Green Transition Academy, designed specifically to equip entrepreneurs with the knowledge and insights needed to adapt their businesses for a sustainable future. This initiative underscores the bank's dedication to fostering growth and resilience within the business community.

In 2024, Bangkok Bank continued to emphasize personalized guidance, with a significant portion of its retail and SME clients actively engaging with advisory services. This focus on education and support aims to build long-term, trusted relationships, moving beyond a purely transactional approach.

Proactive Support during Economic Challenges

Bangkok Bank proactively supports its business clients through economic challenges, recognizing the impact of downturns and natural disasters on their operations. In 2024, the bank continued to offer a range of relief measures and specialized loan programs designed to ease financial burdens and foster resilience.

These initiatives are crucial for maintaining customer relationships during turbulent times. For instance, the bank provided tangible assistance through measures such as interest rate adjustments and the introduction of transformation loans aimed at helping businesses adapt and recover.

- Interest Rate Adjustments Bangkok Bank offered flexible interest rate options to reduce the immediate cost of borrowing for affected businesses.

- Transformation Loans Specialized loan facilities were available to support businesses in pivoting their strategies or investing in necessary upgrades to navigate economic shifts.

- Financial Advisory Services Beyond financial products, the bank provided guidance and support to help clients manage their cash flow and plan for recovery.

Digital Engagement and Feedback Mechanisms

Bangkok Bank actively cultivates customer relationships through robust digital engagement. The bank consistently updates its mobile banking application, incorporating user feedback to ensure a seamless and intuitive experience. For instance, in 2024, the bank launched several new features based directly on customer suggestions gathered through in-app surveys and social media listening.

These digital channels are crucial for maintaining relevance and security. By prioritizing user-driven improvements, Bangkok Bank aims to foster loyalty and trust. This approach is reflected in their commitment to regular security enhancements, which are communicated proactively to users, reinforcing the bank's dedication to protecting customer data.

- Digital Channel Enhancement: Bangkok Bank continuously refines its mobile banking platform, integrating user feedback for improved functionality and ease of use.

- User-Centric Updates: In 2024, the bank implemented new features directly sourced from customer input, demonstrating a responsive approach to digital service development.

- Security Focus: Proactive communication about security updates reassures customers and strengthens the perceived reliability of digital banking services.

Bangkok Bank fosters deep customer relationships through a dedicated relationship management team and a customer-centric approach, ensuring tailored financial solutions and proactive support. In 2024, the bank's focus on personalized service saw relationship managers actively engaging with over 80% of key corporate accounts to anticipate evolving financial needs.

Digital channels are also central to this strategy, with the mobile banking app seeing significant transaction growth in 2024, enhanced by user-driven updates. This digital engagement, coupled with robust financial advisory and educational services like the Green Transition Academy, aims to build long-term loyalty and empower clients.

| Customer Relationship Strategy | Key Initiatives | 2024 Impact/Focus |

|---|---|---|

| Dedicated Relationship Management | Personalized financial advice and solutions | Proactive engagement with over 80% of key corporate accounts |

| Customer-Centric Product Development | Gathering feedback for service enhancement | Continuous adaptation of offerings based on client needs |

| Digital Engagement | Mobile banking app improvements and new features | Significant uplift in mobile banking transactions; user-centric updates implemented |

| Financial Advisory & Education | Empowering clients with knowledge for better decision-making | Active engagement with retail and SME clients in advisory services |

Channels

Bangkok Bank boasts an extensive network of over 1,100 domestic branches throughout Thailand. This vast physical presence ensures widespread accessibility for traditional banking services, customer support, and personalized financial advice, particularly for its retail and SME clientele.

These branches act as crucial physical touchpoints, facilitating customer engagement and transactions. As of the first quarter of 2024, Bangkok Bank reported a robust customer base, with its branch network playing a pivotal role in maintaining strong relationships and offering a comprehensive suite of banking solutions.

Bangkok Bank operates the most extensive international branch network of any Thai bank, reaching key economic hubs across ASEAN, Asia, Europe, and the United States. This expansive global footprint, including operations in China, Hong Kong, Singapore, and London, is fundamental to facilitating international trade and investment for its clients.

In 2024, Bangkok Bank continued to leverage its international presence to support businesses engaged in cross-border activities. For instance, its branches in major trade corridors are instrumental in providing financing and advisory services for Thai companies expanding overseas and foreign entities investing in Thailand.

Bangkok Bank's mobile banking application serves as a crucial digital storefront, providing customers with round-the-clock access to a comprehensive suite of banking services. This platform facilitates everything from routine transactions to more complex financial management, significantly enhancing customer convenience and engagement.

The bank actively invests in the continuous evolution of its mobile app, regularly introducing new functionalities and bolstering security measures. For instance, in 2024, Bangkok Bank has focused on integrating AI-driven personalized financial advice and expanding its peer-to-peer payment capabilities, aiming to stay ahead in the competitive digital banking landscape.

Internet Banking Platform

Bangkok Bank's internet banking platform serves as a robust digital hub, complementing its mobile offerings by providing extensive online services for both individual and corporate clients. This platform is crucial for delivering sophisticated financial solutions.

It offers advanced functionalities like cash management through iCash and international trade finance via iTrade, catering to the complex needs of businesses. These services are designed for efficiency and accessibility, supporting a wide range of transactions and operational requirements.

By the end of 2023, Bangkok Bank reported a significant increase in digital transactions, with its internet banking and mobile banking channels handling a substantial volume of customer interactions. For example, the bank's digital channels facilitated millions of transactions annually, underscoring the platform's importance in its business model.

- Comprehensive Service Offering: Extends beyond basic banking to include specialized services like cash management and international trade finance.

- Customer Segments: Caters to a broad user base, encompassing both retail individuals and diverse business entities.

- Digital Transaction Growth: Reflects the increasing reliance on digital platforms, with millions of transactions processed annually.

- Key Platforms: Features iTrade for trade finance and iCash for cash management, highlighting specialized digital capabilities.

ATMs and Self-Service Kiosks

Bangkok Bank leverages its extensive ATM network and self-service kiosks as a core component of its customer relationship and service delivery. These touchpoints offer essential banking functions, enhancing accessibility and convenience for a broad customer base. As of early 2024, Bangkok Bank operates a significant number of ATMs across Thailand, facilitating millions of transactions daily, including cash withdrawals, deposits, fund transfers, and bill payments. This widespread presence ensures customers can access critical services anytime, anywhere, reducing reliance on physical branch visits.

The self-service kiosks further expand Bangkok Bank's reach, offering more advanced functionalities beyond traditional ATMs. These machines often support tasks like account opening, loan applications, and investment services, catering to evolving customer needs. The bank's investment in this infrastructure underscores its commitment to digital transformation while maintaining a strong physical presence. In 2023, Bangkok Bank reported a substantial increase in digital transactions facilitated through its various channels, including ATMs and mobile banking, highlighting the continued importance of these self-service options in its overall business model.

- Extensive ATM Network: Bangkok Bank maintains a large footprint of ATMs nationwide, providing 24/7 access to fundamental banking services.

- Self-Service Kiosks: These advanced machines offer a broader range of banking transactions, enhancing customer convenience and self-sufficiency.

- Transaction Volume: Millions of daily transactions are processed through these channels, demonstrating their crucial role in customer engagement.

- Digital Integration: The ATM and kiosk network is increasingly integrated with digital banking platforms, supporting the bank's digital transformation strategy.

Bangkok Bank utilizes a multi-channel strategy, blending extensive physical touchpoints with robust digital platforms to serve its diverse customer base. This approach ensures accessibility for traditional banking needs while embracing the convenience of modern technology.

The bank's digital channels, including its mobile app and internet banking, are central to its strategy, facilitating millions of transactions annually and offering advanced services like cash management and international trade finance. This focus on digital innovation is key to its competitive edge.

Furthermore, its widespread ATM network and self-service kiosks provide essential, round-the-clock banking functions, complementing its digital offerings and reinforcing its commitment to customer convenience and accessibility across Thailand.

| Channel | Description | Key Services | Customer Segment | 2024 Highlights |

|---|---|---|---|---|

| Domestic Branches | Over 1,100 locations across Thailand | Full-service banking, personalized advice | Retail, SME | Continued strong customer engagement and support |

| International Branches | Presence in key economic hubs (ASEAN, Asia, Europe, US) | International trade finance, cross-border investment support | Corporates, Businesses with international operations | Facilitating Thai businesses abroad and foreign investment in Thailand |

| Mobile Banking App | 24/7 digital access | Transactions, financial management, P2P payments | All customer segments | AI-driven personalized advice, enhanced security |

| Internet Banking | Online hub for extensive services | iCash (cash management), iTrade (trade finance) | Retail, Corporate | Advanced functionalities for businesses, millions of transactions processed |

| ATM & Self-Service Kiosks | Nationwide network | Cash withdrawals/deposits, fund transfers, bill payments, account opening | All customer segments | Millions of daily transactions, integration with digital platforms |

Customer Segments

Bangkok Bank's retail customers are individuals seeking comprehensive financial services to secure their present and grow their wealth. This segment encompasses a broad range of needs, from everyday banking with deposit accounts and credit cards to significant life events like purchasing a home with mortgage loans.

The bank actively supports these customers by offering diverse investment products tailored to different risk appetites and financial goals, aiming to foster financial well-being across all life stages. In 2024, Bangkok Bank continued to focus on digital channels, with a significant portion of retail transactions occurring through its mobile banking app, reflecting a growing preference for convenient, self-service options among its customer base.

Small and Medium-sized Enterprises (SMEs) are a cornerstone of Bangkok Bank's customer base, with the bank offering specialized lending products designed to fuel their growth. In 2023, Bangkok Bank continued its commitment to supporting SMEs, providing them with access to capital through offerings like the Bualuang Transformation Loan, specifically crafted to assist businesses in adapting and evolving.

Beyond just financing, Bangkok Bank actively engages with SMEs to enhance their competitiveness and facilitate digital adoption. This includes providing advisory services and resources to help them navigate market changes and leverage technology for sustainable development, recognizing their vital role in the Thai economy.

Bangkok Bank is a dominant force in corporate banking, offering a comprehensive suite of services like syndicated loans, trade finance, project finance, and investment banking to large corporations.

In 2024, the bank continued its leadership by facilitating significant deals, including a major syndicated loan facility for a leading Thai conglomerate involved in infrastructure development, demonstrating its capacity to support substantial enterprise growth.

This segment encompasses both established domestic giants and ambitious international firms operating within or expanding into Thailand, highlighting Bangkok Bank's role in driving national and regional economic activity.

International Businesses and Investors

Bangkok Bank actively supports international businesses and investors, particularly those looking to engage with the dynamic ASEAN market. Leveraging its extensive global network, the bank provides crucial assistance for foreign direct investment and facilitates cross-border trade. In 2024, Thailand continued to attract significant FDI, with key sectors like manufacturing and technology seeing robust inflows, a trend Bangkok Bank is well-positioned to capitalize on.

The bank offers a suite of specialized international banking services tailored to the needs of global clients. These include trade finance solutions, foreign exchange services, and overseas remittance, all designed to streamline international operations. For instance, Bangkok Bank’s trade finance volume in 2023 demonstrated its significant role in facilitating international commerce for its clients.

- Facilitating Foreign Direct Investment: Bangkok Bank assists foreign companies entering or expanding within Thailand and the wider ASEAN region, providing market entry guidance and financial solutions.

- International Trade Services: The bank offers comprehensive trade finance, including letters of credit and guarantees, to support import and export activities for its international clientele.

- Market Insights and Advisory: Bangkok Bank provides valuable market intelligence and expert advice on navigating regional economic landscapes and regulatory environments.

- Global Network Access: With branches and representative offices strategically located worldwide, the bank offers seamless connectivity and support for international business transactions.

Wealth Customers

Bangkok Bank is increasingly focusing on its Wealth Customers, a segment comprising individuals who require advanced wealth management, investment opportunities, and expert financial guidance to expand and safeguard their wealth. This demographic is crucial for driving fee income and deepening customer relationships.

The bank is actively developing and launching new services tailored to this sophisticated clientele. These offerings aim to provide comprehensive solutions, from personalized investment portfolios to estate planning and cross-border wealth management, reflecting a growing demand for integrated financial services.

In 2024, the global wealth management market continued its upward trajectory, with assets under management (AUM) expected to reach new highs. For instance, the Asia-Pacific region, a key market for Bangkok Bank, has seen robust growth in high-net-worth individuals (HNWIs) and their investable assets, underscoring the potential within the wealth segment.

- Growing HNWI Population: The number of HNWIs in Thailand and surrounding regions is expanding, creating a larger pool of potential clients for sophisticated wealth management services.

- Demand for Digital Solutions: Wealth customers expect seamless digital platforms for managing their investments, accessing market insights, and interacting with their advisors, driving innovation in digital wealth offerings.

- Personalized Advisory Services: Clients are seeking bespoke financial advice that goes beyond standard investment products, including tax planning, legacy management, and philanthropic strategies.

- Focus on Sustainable Investing: There is a rising interest among wealthy individuals in environmental, social, and governance (ESG) factors, prompting wealth managers to incorporate sustainable investment options into their product suites.

Bangkok Bank serves a diverse customer base, ranging from individual retail clients seeking everyday banking and wealth growth to Small and Medium-sized Enterprises (SMEs) requiring capital and advisory support. The bank also caters to large corporations with complex financial needs and international businesses looking to tap into the ASEAN market.

In 2024, the bank's retail segment saw continued adoption of digital channels, with mobile banking transactions forming a significant portion of customer interactions. SMEs, a vital part of the Thai economy, received continued support through specialized lending and digital transformation initiatives.

The corporate segment remained a strong focus, with Bangkok Bank facilitating major deals, including substantial syndicated loans for infrastructure projects. International business growth was supported by a strong global network, aiding foreign direct investment and cross-border trade, with Thailand attracting robust FDI in 2024.

Wealth customers represent a growing segment, demanding sophisticated wealth management, personalized advisory, and digital solutions, aligning with the global trend of increasing HNWIs and interest in sustainable investing.

| Customer Segment | Key Needs | 2024 Focus/Activity |

|---|---|---|

| Retail Customers | Everyday banking, wealth growth, mortgages | Digital channel enhancement, mobile banking adoption |

| SMEs | Capital, growth funding, digital adoption | Specialized lending, advisory services, Bualuang Transformation Loan |

| Corporates | Syndicated loans, trade finance, project finance | Facilitating large-scale deals, supporting infrastructure development |

| International Businesses | FDI support, cross-border trade, market entry | Leveraging global network, supporting ASEAN market engagement |

| Wealth Customers | Wealth management, investment, legacy planning | Developing advanced digital platforms, personalized advisory |

Cost Structure

Personnel costs represent a significant portion of Bangkok Bank's operating expenses. These costs encompass employee salaries, comprehensive benefits packages, and ongoing investment in training and development programs. A key focus for training in 2024 and beyond is equipping staff with advanced technology skills and reinforcing a strong customer-centric service ethos.

Bangkok Bank's cost structure heavily features technology and infrastructure expenses, reflecting significant investments in its IT backbone. These costs are essential for maintaining and upgrading the bank's digital platforms, ensuring robust cybersecurity, and supporting its cloud infrastructure. For instance, in 2023, the bank continued its digital transformation efforts, which inherently involve substantial capital expenditure on technology to enhance operational efficiency and customer experience.

Bangkok Bank's extensive physical presence, both within Thailand and internationally, represents a substantial expense. Costs associated with maintaining this branch network, including property leases, utilities, and the staff required for daily operations, are a core component of their cost structure. For instance, in 2023, the bank reported operating expenses of THB 110.5 billion, a portion of which directly supports its vast network of branches.

Expected Credit Losses (ECL) and Provisions

Bangkok Bank incurs costs through provisions for expected credit losses (ECL). This reflects a proactive approach to managing potential defaults on loans. For instance, in 2023, the bank's net profit was THB 42.05 billion, with provisions for loans and accrued interest amounting to THB 36.76 billion.

These provisions are dynamic, adjusting based on prevailing economic conditions and the assessed quality of the bank's loan portfolio. A significant portion of these costs is directly tied to the bank's commitment to maintaining a healthy balance sheet by setting aside funds for anticipated loan losses.

- ECL Provisions: Costs are recognized as provisions for expected credit losses, a key component of prudent financial management.

- Economic Sensitivity: These provisions are directly influenced by macroeconomic factors and the overall health of the borrower base.

- Loan Quality Impact: The quality of the bank's loan book is a primary driver in determining the level of ECL provisions required.

Marketing and Administrative Expenses

Bangkok Bank allocates significant resources to marketing and administrative expenses, crucial for customer acquisition and operational efficiency. These costs encompass a wide range of activities, from broad advertising campaigns aimed at enhancing brand visibility to the day-to-day management of its extensive branch network and corporate functions.

The bank actively manages these expenditures to maintain a competitive cost-to-income ratio. For instance, in 2024, Bangkok Bank reported a cost-to-income ratio of 45.2%, demonstrating a commitment to operational discipline and cost control amidst its growth strategies.

- Marketing Campaigns: Investment in advertising, digital marketing, and promotional activities to attract new customers and retain existing ones.

- Brand Building: Costs associated with maintaining and enhancing the bank's reputation and public image.

- Administrative Functions: Expenses related to human resources, IT infrastructure, legal, compliance, and general overhead.

- Cost Management Focus: Continuous efforts to optimize operational spending to improve profitability and shareholder value.

Bangkok Bank's cost structure is multifaceted, encompassing personnel, technology, physical infrastructure, credit loss provisions, and operational expenses. The bank's commitment to digital transformation and maintaining a broad branch network are significant cost drivers, alongside prudent risk management through ECL provisions.

In 2023, Bangkok Bank reported operating expenses of THB 110.5 billion. The cost-to-income ratio for 2024 was 45.2%, indicating effective cost management. Provisions for loans and accrued interest in 2023 were THB 36.76 billion, reflecting a conservative approach to credit risk.

| Cost Category | 2023 Data (THB Billion) | 2024 Data (Ratio) |

|---|---|---|

| Operating Expenses | 110.5 | N/A |

| Cost-to-Income Ratio | N/A | 45.2% |

| Provisions for Loans & Accrued Interest | 36.76 | N/A |

Revenue Streams

Bangkok Bank's primary revenue stream, Net Interest Income (NII), is generated from the spread between the interest it earns on its loan portfolio and investments, and the interest it pays out on customer deposits. This core banking activity is fundamentally driven by the volume of loans disbursed, the interest rates, or yields, earned on those loans and its investments, and crucially, the cost of funding through deposits.

In 2024, Bangkok Bank continued to leverage its extensive customer base and strong lending capabilities to drive NII. For the first quarter of 2024, the bank reported a net interest income of THB 34,923 million, reflecting a stable performance in its core lending operations amidst evolving market interest rate environments.

Bangkok Bank generates substantial revenue from its net fees and service income, a key component of its non-interest income. This stream encompasses earnings from a diverse range of fee-based services. For instance, in 2024, the bank's credit card business, including spending and interest income, along with its growing bancassurance partnerships, contributed significantly to this segment.

Further diversifying its fee income, Bangkok Bank also earns from its mutual fund services, transaction fees for various banking operations, and its robust global markets services. These offerings cater to a broad customer base, from retail investors to corporate clients seeking sophisticated financial solutions. This multifaceted approach ensures a steady flow of income beyond traditional lending.

Bangkok Bank generates income from gains on financial instruments and investments, particularly those measured at Fair Value Through Profit or Loss (FVTPL). These gains can be a substantial part of the bank's non-interest income, especially when market conditions are favorable for trading and investment activities.

In 2024, Bangkok Bank's trading and investments portfolio likely saw fluctuations influenced by global economic trends and interest rate movements. While specific figures for this revenue stream are often embedded within broader financial reporting, it's a critical component for banks to supplement traditional lending income.

International Banking and Trade Finance Income

Bangkok Bank generates revenue from international banking and trade finance by facilitating foreign exchange transactions and remittances for its clients. Fees from trade finance services, crucial for businesses involved in global commerce, also contribute significantly. This revenue stream is amplified by the bank's substantial international network, enabling seamless cross-border financial operations.

- Foreign Exchange and Remittance Fees: Income derived from currency conversions and international money transfers.

- Trade Finance Service Fees: Charges for services like letters of credit, guarantees, and documentary collections supporting import/export activities.

- Leveraging Overseas Network: Revenue enhancement through the bank's presence in key international markets.

Wealth Management Income

Bangkok Bank generates substantial revenue from its wealth management services, offering tailored advisory, expert portfolio management, and specialized financial solutions to its high-net-worth clientele and broader wealth customer base.

This segment is a key focus for expansion, with the bank actively investing in enhancing its offerings and client outreach to capture a larger share of this lucrative market.

In 2024, the wealth management sector continued to be a significant contributor to the bank's overall income, reflecting the growing demand for sophisticated financial planning and investment strategies.

- Wealth Advisory Fees: Income derived from personalized financial planning and investment advice.

- Portfolio Management Fees: Revenue generated from managing client investment portfolios.

- Specialized Service Charges: Fees for services like estate planning, trust services, and offshore investments.

- Asset Under Management Growth: The bank aims to increase its Assets Under Management (AUM) in wealth management, directly correlating with higher fee-based income.

Bangkok Bank's diverse revenue streams extend beyond core lending and deposits, encompassing a significant contribution from fees and commissions generated by a wide array of financial services. These non-interest income sources are crucial for bolstering profitability and reducing reliance on traditional interest margins.

The bank actively generates income from its investment banking activities and capital markets operations, including underwriting and advisory services for corporate clients. Furthermore, income from foreign exchange and international trade finance services, facilitated by its extensive global network, adds another layer to its revenue generation.

In 2024, Bangkok Bank saw continued growth in its fee-based income, with credit cards and bancassurance partnerships being key drivers. The bank's wealth management segment also performed strongly, with increasing Assets Under Management (AUM) translating into higher advisory and management fees.

| Revenue Stream | Description | 2024 (Q1) Contribution (THB Million) |

| Net Interest Income (NII) | Interest earned on loans and investments minus interest paid on deposits. | 34,923 |

| Net Fees and Service Income | Income from credit cards, bancassurance, mutual funds, transaction fees, etc. | [Data not explicitly provided for Q1 2024 as a single figure, but significant contribution noted] |

| Gains on Financial Instruments | Profits from trading and investments (FVTPL). | [Data not explicitly provided for Q1 2024 as a single figure, but a critical component] |

| International Banking & Trade Finance | Fees from FX transactions, remittances, and trade finance services. | [Data not explicitly provided for Q1 2024 as a single figure, but amplified by global network] |

| Wealth Management Fees | Advisory, portfolio management, and specialized service charges. | [Data not explicitly provided for Q1 2024 as a single figure, but significant contributor with growing AUM] |

Business Model Canvas Data Sources

The Bangkok Bank Business Model Canvas is informed by a blend of internal financial data, customer transaction analysis, and extensive market research. This ensures a robust understanding of customer needs and market opportunities.