Bangkok Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bangkok Bank Bundle

Bangkok Bank navigates a dynamic financial landscape where the bargaining power of buyers and the threat of new entrants are significant considerations. Understanding these forces is crucial for any player in the Thai banking sector.

The complete report reveals the real forces shaping Bangkok Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bangkok Bank's dependence on technology providers for its core banking infrastructure, digital channels, and crucial cybersecurity measures means these suppliers can wield considerable influence. If these technology solutions are unique, patented, or involve substantial costs and complexities to replace, their bargaining power increases.

However, the presence of a robust and competitive IT services market, coupled with Bangkok Bank's significant operational scale, likely serves to temper the bargaining power of individual technology suppliers. For instance, in 2023, the global IT services market was valued at over $1.3 trillion, indicating a broad range of options for large financial institutions.

The availability of skilled professionals in critical areas like FinTech, data analytics, and cybersecurity significantly shapes the bargaining power of labor suppliers for Bangkok Bank. A scarcity of these specialized talents, a trend observed globally and within Thailand's evolving tech landscape, directly translates to increased leverage for these professionals. This can manifest as demands for higher salaries, more attractive benefits packages, and greater flexibility, all of which directly impact the bank's operational expenses and its ability to drive innovation.

For Bangkok Bank, the entities providing capital, such as depositors and institutional investors, act as powerful suppliers, directly influencing its cost of funds. In 2024, with global interest rates remaining a key consideration, the bargaining power of these capital providers is significant, as they can seek higher returns elsewhere if Bangkok Bank's offerings are not competitive. A robust and diverse funding structure, including a strong retail deposit base, helps mitigate this supplier power.

Payment Network Operators

Payment network operators like Visa, Mastercard, and Thailand's PromptPay hold significant sway due to their extensive infrastructure and broad user adoption. These networks are essential for facilitating transactions, giving them leverage. For instance, Visa and Mastercard's global reach means businesses often need to accept them to serve international customers.

However, the landscape is shifting. Government-backed initiatives, such as PromptPay in Thailand, are designed to foster a more competitive and accessible payment ecosystem. This can dilute the bargaining power of established international networks within domestic markets. In 2023, PromptPay saw a substantial increase in transaction volume, with over 16.7 billion transactions processed, highlighting its growing domestic influence and providing an alternative for businesses and consumers.

- Established Infrastructure: Global networks like Visa and Mastercard benefit from decades of investment in secure and reliable transaction processing systems, creating high switching costs for merchants.

- Widespread Acceptance: Their brand recognition and ubiquity mean that many consumers expect to be able to pay with these cards, pressuring businesses to accept them.

- Domestic Competition: Initiatives like PromptPay are increasing competition, particularly for domestic transactions, by offering lower fees and greater accessibility, thereby reducing the reliance on international card networks.

Regulatory Bodies and Central Bank

The Bank of Thailand (BOT) and other regulatory bodies significantly shape Bangkok Bank's operating landscape. Their pronouncements on interest rates, for instance, directly influence net interest margins, a key driver of profitability. In 2024, the BOT maintained its policy interest rate at 2.50% for several periods, reflecting a cautious approach to inflation and economic growth, which impacts lending volumes and costs for banks.

These authorities also control licensing, including the recent exploration of virtual banking licenses, which could introduce new competitive dynamics. Capital requirements, such as the Basel III framework, dictate how much capital banks must hold, influencing their lending capacity and risk appetite. For example, in 2024, ongoing discussions around digital asset regulations continued to present both opportunities and compliance challenges for financial institutions.

- Bank of Thailand's Policy Rate: Maintained at 2.50% for extended periods in 2024, impacting borrowing costs and loan demand.

- Capital Adequacy Ratios: Banks like Bangkok Bank must adhere to stringent capital requirements, influencing their ability to expand credit.

- Virtual Banking Licenses: The BOT's evolving stance on digital banking licenses introduces potential new competitors and necessitates strategic adaptation.

Suppliers of essential technology and skilled labor can exert significant influence over Bangkok Bank. The bank's reliance on specialized IT solutions and a competitive talent market means that providers of these resources can command higher prices or more favorable terms. For instance, the scarcity of cybersecurity experts in 2024 directly increases their bargaining power, impacting Bangkok Bank's operational costs and innovation capabilities.

Capital providers, including depositors and investors, also represent a key supplier group. Their ability to shift funds based on prevailing interest rates, such as the Bank of Thailand's policy rate of 2.50% in 2024, directly affects Bangkok Bank's cost of funds. Maintaining a diverse funding base is crucial to mitigate this power.

Payment network operators like Visa, Mastercard, and domestic alternatives such as PromptPay wield substantial influence due to their infrastructure and user adoption. While global networks benefit from established infrastructure, domestic initiatives like PromptPay, which processed over 16.7 billion transactions in 2023, are increasingly challenging their dominance by offering competitive alternatives.

| Supplier Type | Key Influence Factors | Impact on Bangkok Bank | Mitigation Strategies | Relevant Data (2023-2024) |

| Technology Providers | Uniqueness of solutions, switching costs, market competitiveness | Increased IT costs, potential delays in innovation | Diversifying IT vendors, strategic partnerships | Global IT services market > $1.3 trillion (2023) |

| Labor (Skilled Tech/FinTech) | Talent scarcity, demand for specialized skills | Higher salary/benefit costs, challenges in recruitment | Competitive compensation, training programs, flexible work arrangements | Global trend of talent scarcity in FinTech and cybersecurity |

| Capital Providers (Depositors, Investors) | Interest rate sensitivity, alternative investment opportunities | Higher cost of funds, potential deposit outflows | Strong retail deposit base, competitive deposit rates, diverse funding sources | Bank of Thailand policy rate maintained at 2.50% (2024) |

| Payment Networks (Visa, Mastercard, PromptPay) | Infrastructure, user adoption, transaction fees | Transaction costs, reliance on network services | Promoting domestic payment systems, negotiating network fees | PromptPay processed > 16.7 billion transactions (2023) |

What is included in the product

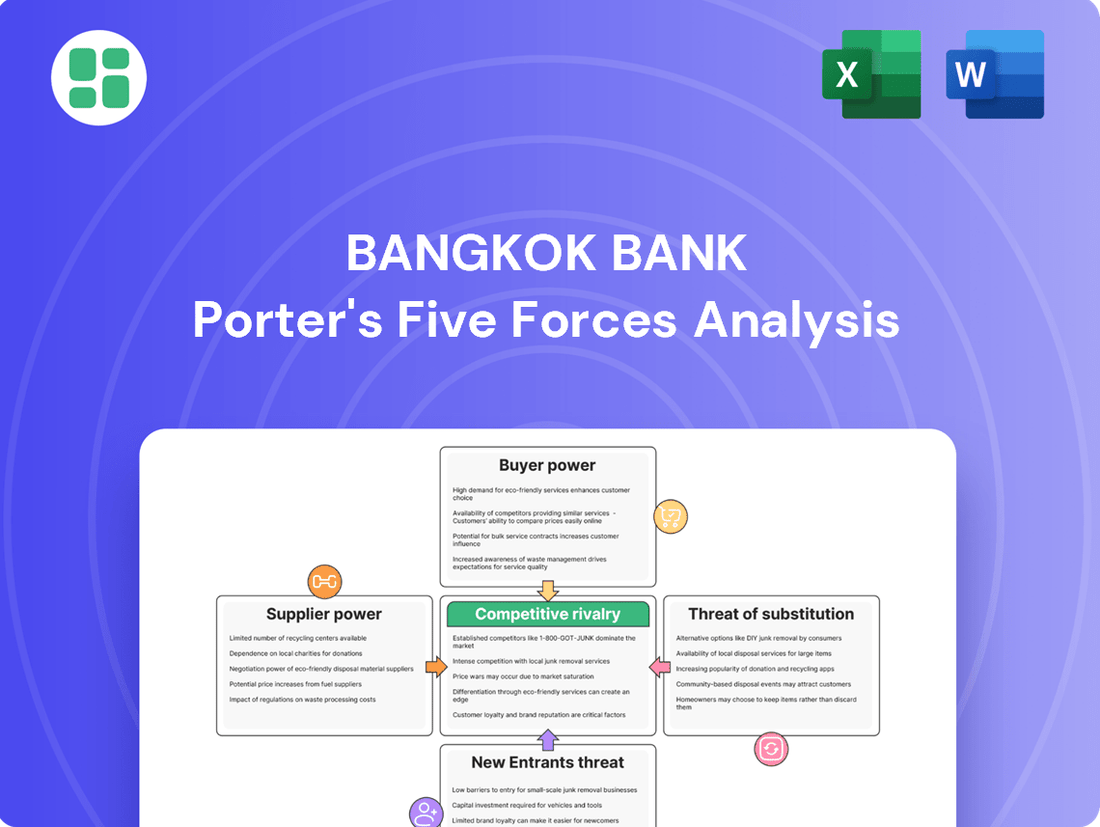

This Porter's Five Forces analysis provides a comprehensive understanding of the competitive environment for Bangkok Bank, examining the intensity of rivalry, the bargaining power of customers and suppliers, and the threats posed by new entrants and substitutes.

Effortlessly gauge competitive intensity by visualizing each of Porter's Five Forces for Bangkok Bank, enabling swift identification of key strategic pressures.

Customers Bargaining Power

Individually, retail customers possess limited bargaining power when it comes to standardized banking products, as their individual transaction volumes are typically small. However, this dynamic is shifting as digital literacy grows. For instance, in 2024, a significant portion of the Thai population, estimated to be over 80%, are active internet users, enabling easier access to comparative banking information.

The increasing ease of switching banks through mobile banking applications, a trend amplified in 2024, significantly bolsters collective customer power. With many Thai banks offering seamless account opening and fund transfer services via their apps, customers face lower friction in moving their business. This heightened mobility forces banks to compete more aggressively on service and pricing to retain their retail base.

The proliferation of diverse financial products from both traditional banks and emerging fintech companies in 2024 has further empowered retail customers. Access to neobanks, digital wallets, and peer-to-peer lending platforms provides viable alternatives, increasing customer choice and reducing reliance on any single institution. This competitive landscape necessitates that banks like Bangkok Bank continually innovate and offer compelling value propositions to their retail clientele.

Small and medium-sized enterprises (SMEs) generally possess moderate bargaining power with banks like Bangkok Bank. While they need specialized financial services, their options for alternative funding can be limited compared to larger businesses, especially if they are not in highly competitive sectors. For instance, in 2024, SMEs in Thailand, which form a significant portion of the economy, often rely on established banking relationships due to the complexities of accessing capital markets.

The financial health and industry of an SME significantly impact its leverage. A financially sound SME in a growing industry can negotiate better terms, whereas a struggling one has less sway. Government support programs and the presence of specialized SME lenders can also bolster their position, providing them with more choices and thus increasing their bargaining power against traditional banks.

Large corporations and institutional clients wield considerable bargaining power with banks like Bangkok Bank. Their sheer transaction volumes and sophisticated financial requirements mean they can demand better pricing on loans, trade finance, and other services. In 2024, many large Thai corporations continued to leverage their financial strength, often maintaining relationships with multiple international and domestic banks to secure the most competitive rates.

Digital Natives and Tech-Savvy Customers

Digital natives, encompassing millennials and Gen Z, wield significant bargaining power. Their strong preference for digital banking channels and demand for intuitive user experiences mean they readily switch providers for better features or pricing. For instance, a 2024 survey indicated that over 70% of Gen Z consumers in Southeast Asia would consider switching banks for a superior digital offering.

This demographic's willingness to explore and adopt new technologies translates into increased pressure on banks like Bangkok Bank to innovate. Failure to offer cutting-edge digital solutions, such as advanced mobile banking apps and personalized financial management tools, can lead to customer attrition.

- Digital Channel Preference: Millennials and Gen Z show a pronounced inclination towards mobile and online banking platforms.

- Demand for Seamless UX: A smooth, user-friendly digital experience is a key differentiator for these customer segments.

- Price and Feature Sensitivity: These groups are highly attuned to competitive pricing and the availability of innovative banking features.

- Switching Propensity: A significant portion of digitally savvy customers are open to changing banks if their needs are not met by their current provider.

Customers in Underserved Segments

Customers in underserved segments, such as low-income households and micro-enterprises, traditionally wield limited bargaining power. However, this dynamic is shifting. Initiatives by the Bank of Thailand and the emergence of virtual banks are actively working to empower these populations by enhancing access to financial services.

This increased accessibility and the introduction of more competitive offerings from new entrants bolster the collective bargaining power of these previously overlooked customer groups. For instance, as of early 2024, financial inclusion efforts in Thailand aim to bring millions of unbanked and underbanked individuals into the formal financial system, directly increasing the leverage of these segments.

- Growing Influence: The push for financial inclusion is empowering previously marginalized customer segments, increasing their collective bargaining power.

- Competitive Landscape: New virtual banks and digital platforms offer alternative services, creating competitive pressure on traditional banks like Bangkok Bank.

- Data-Driven Insights: Bangkok Bank's ability to leverage data on these segments can help tailor offerings, mitigating some of this increased bargaining power.

- Regulatory Support: Regulatory encouragement for financial inclusion directly supports the empowerment of these customer bases.

The bargaining power of customers for Bangkok Bank is a mixed but increasingly significant force. While individual retail customers historically had little sway, the rise of digital channels and increased financial literacy, with over 80% of the Thai population using the internet in 2024, has shifted this balance. This growing access to comparative information and the ease of switching banks via mobile apps, a trend that accelerated in 2024, means customers can more readily seek out better deals, forcing banks to be more competitive in their offerings and service quality.

Preview the Actual Deliverable

Bangkok Bank Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape facing Bangkok Bank, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes. This analysis is meticulously prepared to provide actionable insights into Bangkok Bank's strategic positioning.

Rivalry Among Competitors

The Thai banking landscape is characterized by a mature market, with a handful of large domestic institutions, including Bangkok Bank, holding significant sway. This oligopolistic structure means intense competition for market share among these dominant players, as well as from a number of smaller domestic and foreign banks operating within Thailand.

Bangkok Bank, like many financial institutions, faces intense competition where traditional banking products such as savings accounts and loans are often seen as commodities. This commoditization naturally drives competition based on price, making it challenging to stand out solely on product features.

To counter this, Bangkok Bank is actively pursuing differentiation through digital advancements and tailored customer experiences. For instance, their mobile banking app, Bualuang mBanking, offers a wide array of services, aiming to provide convenience and a seamless user journey. This focus on digital innovation is crucial in a market where customer expectations are increasingly shaped by technology.

Furthermore, the bank is developing specialized offerings for distinct customer segments. This includes robust wealth management services catering to high-net-worth individuals and a growing emphasis on sustainable finance solutions, aligning with global trends and attracting environmentally conscious clients. These specialized areas allow Bangkok Bank to carve out unique value propositions beyond basic banking.

Thailand's economic growth is a key driver for the banking sector. For instance, in 2024, Thailand's GDP growth is projected to be around 2.5% to 3.5%, which directly impacts the demand for banking services and credit. A more subdued economic environment, as seen with forecasts for moderate growth, means banks must fight harder for every new customer and loan.

This environment, characterized by high household debt levels, which stood at over 90% of GDP in early 2024, and a noticeable slowdown in loan growth, forces banks to compete more aggressively. With fewer opportunities for expansion, Bangkok Bank and its rivals are intensely focused on market share, leading to heightened rivalry.

Digital Transformation and Fintech Disruption

The financial sector in Thailand, like globally, is experiencing intense competitive rivalry driven by digital transformation and the rise of FinTech. New entrants offering specialized digital payment and lending solutions are challenging established players like Bangkok Bank. This forces traditional banks to accelerate their own digital innovation to maintain market share.

FinTech firms, often unburdened by legacy systems, can respond more quickly to changing customer demands. For instance, by mid-2024, digital lending platforms have seen significant growth, with some reporting over 30% year-on-year increases in loan origination volume. This agility allows them to capture segments of the market previously dominated by traditional banks.

- Digital Payments Growth: Thailand's digital payment market is projected to reach over $100 billion by the end of 2024, a testament to the rapid adoption and competitive pressure from non-bank providers.

- FinTech Investment: Global FinTech funding in 2023, while seeing some recalibration, still represented billions of dollars flowing into startups focused on disrupting traditional banking services, including lending and payments.

- Virtual Bank Licenses: The issuance of virtual bank licenses in various markets, including potential consideration in Thailand, signals a direct challenge to incumbent banks, introducing entirely new, digitally native competitors.

Entry of Virtual Banks

The competitive landscape for Bangkok Bank is intensifying with the impending arrival of virtual banks. The Bank of Thailand has greenlit virtual bank licenses, with these new digital-only players expected to commence operations by mid-2026. This move is specifically aimed at fostering greater competition within the financial sector.

These virtual banks are poised to disrupt the market by focusing on cost reduction and expanding financial inclusion. They will leverage innovative, digital-first strategies to reach segments of the population that have traditionally been underserved by conventional banking models.

- Increased Digital Competition: Virtual banks will offer a fully digital experience, challenging incumbents like Bangkok Bank to enhance their own digital offerings and customer interfaces.

- Focus on Underserved Segments: These new entrants are expected to target specific customer groups with tailored digital products, potentially drawing away market share from traditional banks.

- Innovation in Services: Expect a wave of new digital financial products and services designed for convenience and accessibility, pushing all players to innovate rapidly.

Bangkok Bank operates in a highly competitive Thai banking sector, characterized by a few dominant domestic players and numerous smaller local and foreign banks. This oligopolistic environment intensifies rivalry, especially as traditional banking products become commoditized, forcing banks to compete on price and digital innovation.

The rise of FinTech firms and the anticipated launch of virtual banks by mid-2026 are further escalating competitive pressures. These new entrants, unburdened by legacy systems, offer agile, digital-first solutions, particularly in payments and lending, challenging incumbents to enhance their own digital offerings and customer experiences.

Thailand's digital payment market is expanding rapidly, projected to exceed $100 billion by the end of 2024, highlighting the competitive threat from non-bank providers. Global FinTech funding in 2023, despite some recalibration, still saw billions invested in startups aiming to disrupt traditional banking services.

| Metric | 2024 Projection/Status | Impact on Rivalry |

| Digital Payment Market Growth | Projected to exceed $100 billion by end of 2024 | Increased competition from non-bank payment providers |

| FinTech Funding (2023) | Billions invested globally | Fuels innovation and new market entrants |

| Virtual Bank Licenses | Greenlit by Bank of Thailand, operations by mid-2026 | Directly introduces new, digitally native competitors |

| Household Debt to GDP (Early 2024) | Over 90% | Limits loan growth opportunities, intensifying competition for existing customers |

SSubstitutes Threaten

Non-bank digital payment platforms such as TrueMoney and PromptPay present a substantial threat of substitution for traditional banking services in Thailand. These platforms offer convenience and often lower transaction fees, particularly for everyday retail purchases, directly competing with bank-offered payment methods.

The rapid and widespread adoption of these e-wallets is a key indicator of their impact. For instance, PromptPay, a national retail payment network, saw transaction volumes surge significantly. In 2024, it's estimated that PromptPay facilitated billions of transactions, highlighting its deep integration into the Thai consumer landscape and its effectiveness as a substitute for traditional bank transfers.

Peer-to-peer (P2P) lending platforms present a notable threat of substitutes for Bangkok Bank. These platforms offer alternative avenues for both borrowers and lenders, particularly for individuals and small to medium-sized enterprises (SMEs) seeking quicker or more adaptable financing solutions compared to traditional bank loans. For instance, in 2023, the Thai P2P lending market saw continued growth, with platforms facilitating a significant volume of transactions, providing an accessible option for those who might find traditional banking processes cumbersome.

Large corporations increasingly bypass traditional bank lending by accessing capital markets directly. In 2024, global bond issuance reached record highs, offering an alternative funding source that can be more cost-effective than bank loans for well-established companies.

This direct access to capital markets, through avenues like corporate bond sales and initial public offerings (IPOs), represents a significant substitution threat to banks like Bangkok Bank. Companies can often secure lower interest rates and greater flexibility by tapping into these markets, diminishing their reliance on bank financing.

Cryptocurrencies and Digital Assets

The rise of cryptocurrencies and digital assets presents a potential long-term threat of substitution for traditional banking services. While still subject to significant regulation and volatility, growing interest in these digital forms of value, including central bank digital currencies (CBDCs), could offer alternative methods for transactions, especially for remittances and cross-border payments. The Bank of Thailand, for instance, is actively exploring the development of its own CBDC, indicating a shift in the digital asset landscape.

This evolving digital currency environment could impact Bangkok Bank by offering consumers and businesses alternative ways to store value and conduct transactions outside of traditional banking channels. For example, if CBDCs become widely adopted for cross-border payments, they could reduce reliance on traditional remittance services offered by banks. By mid-2024, global cryptocurrency market capitalization fluctuated, but the underlying technology continues to mature, pushing the boundaries of what financial services can encompass.

- Cryptocurrency Adoption: While still nascent for mainstream banking, adoption rates for digital assets continue to climb globally, signaling a growing comfort with non-traditional financial tools.

- CBDC Development: Numerous central banks, including Thailand's, are in various stages of exploring or piloting CBDCs, which could fundamentally alter payment systems.

- Remittance Alternatives: Digital assets offer a potentially faster and cheaper alternative for remittances compared to traditional methods, a key area for many banks.

- Regulatory Landscape: The evolving regulatory environment for digital assets will significantly shape their viability as substitutes for traditional financial services.

Informal Lending and Community-Based Finance

Informal lending and community-based finance present a viable threat of substitutes, particularly in rural and underserved regions of Thailand. These alternatives often cater to individuals and small businesses that may find formal banking processes cumbersome or inaccessible. For instance, village funds or rotating savings and credit associations (ROSCAs) provide accessible capital for immediate needs, bypassing the longer approval times associated with traditional bank loans.

While these informal avenues may operate on a smaller scale, their accessibility can divert potential customers from formal financial institutions like Bangkok Bank. The Bank of Thailand (BOT) has been actively promoting financial inclusion initiatives, aiming to bring these informal services into a more regulated framework. As of late 2024, the BOT's ongoing efforts to digitalize financial services and promote accessible digital lending platforms are designed to compete directly with these informal offerings by providing convenient and regulated alternatives.

The threat is amplified by the agility of these informal networks, which can often respond more quickly to local economic demands.

- Informal lending networks are prevalent in rural Thailand, offering quick access to capital.

- Community-based finance, like ROSCAs, provides alternative funding sources for local needs.

- The Bank of Thailand's financial inclusion drive aims to formalize and regulate these substitute services.

- Digitalization efforts by the BOT are intended to offer competitive, accessible alternatives to informal lending.

The threat of substitutes for Bangkok Bank is significant, driven by digital payment platforms like PromptPay and TrueMoney, which offer convenience and lower fees for everyday transactions. These platforms are deeply embedded in the Thai consumer landscape, with PromptPay facilitating billions of transactions in 2024 alone. Furthermore, peer-to-peer lending platforms and direct access to capital markets by large corporations provide alternative financing avenues, bypassing traditional bank loans.

| Substitute Type | Description | Impact on Bangkok Bank | 2024 Data/Trend |

|---|---|---|---|

| Digital Payment Platforms | Convenient, low-fee transaction methods | Reduces reliance on bank payment services | PromptPay transaction volumes surged, indicating widespread adoption. |

| P2P Lending | Alternative financing for individuals and SMEs | Diverts loan business from banks | Thai P2P lending market saw continued growth in 2023. |

| Capital Markets Access | Direct funding for corporations via bonds/IPOs | Diminishes demand for corporate bank loans | Global bond issuance reached record highs in 2024. |

Entrants Threaten

The banking sector in Thailand is heavily regulated, demanding substantial capital, rigorous adherence to compliance standards, and specific operating licenses issued by the Bank of Thailand. These demanding regulatory requirements, such as the minimum capital thresholds for new virtual banks, create a significant barrier for prospective entrants aiming to compete.

Establishing a commercial bank, even a digital one, requires significant capital. In 2024, this includes substantial investments in robust IT infrastructure, cybersecurity measures, and meeting stringent regulatory capital adequacy ratios, often running into billions of Thai Baht. These high upfront costs act as a formidable barrier, deterring many potential new players and largely limiting entry to well-funded consortia or existing financial institutions with deep pockets.

Bangkok Bank, like other established Thai banks, enjoys significant brand loyalty, a crucial barrier for new entrants. Customers often stick with banks they trust, especially for significant financial services. In 2023, Bangkok Bank reported a net profit of THB 41.0 billion, underscoring its strong market position and the deep-seated trust it commands among its vast customer base.

Economies of Scale and Distribution Networks

Incumbent banks like Bangkok Bank benefit significantly from substantial economies of scale. This allows them to spread costs across a vast customer base, leading to lower per-unit operational, technological, and marketing expenses. For instance, in 2024, major Thai banks continued to invest heavily in digital transformation, with Bangkok Bank reporting significant IT expenditure aimed at enhancing efficiency and customer experience, a cost prohibitive for new, smaller entrants.

Furthermore, established banks possess extensive distribution networks, both physical branches and robust digital platforms. New entrants, particularly digital-only banks, face the considerable challenge of replicating this reach. They must either invest heavily in building their own infrastructure or rely on strategic partnerships, which can be costly and complex to establish, especially when competing with the established presence of banks like Bangkok Bank, which boasts over 1,100 branches and service centers across Thailand.

- Economies of Scale: Bangkok Bank's large operational footprint allows for cost efficiencies in technology and marketing, making it harder for new players to match pricing.

- Distribution Network: The extensive physical and digital presence of incumbent banks presents a significant barrier for new entrants needing to build or partner for similar reach.

- Digital vs. Physical: Digital-only banks lack the immediate advantage of physical touchpoints, requiring substantial investment to compete with established networks.

Incumbent Reaction and Innovation Pace

Bangkok Bank's existing players are far from idle; they are actively investing in digital transformation to enhance customer experiences and launch innovative products. This proactive stance by incumbents makes it considerably tougher for new entrants to establish a strong presence and offer truly unique value propositions.

For instance, in 2024, Thai banks collectively poured billions of dollars into technology upgrades, focusing on areas like AI-driven customer service and enhanced cybersecurity. This aggressive innovation by established institutions acts as a significant barrier, forcing potential new entrants to not only match but exceed these already high standards.

- Digital Investment: Thai banks' commitment to digital transformation is substantial, with significant capital allocation in 2024 towards improving online and mobile banking platforms.

- Customer Experience Focus: Incumbents are prioritizing seamless and personalized customer journeys, a benchmark that new entrants must meet or surpass.

- Product Differentiation: Established banks are continuously developing new financial products and services, increasing the challenge for newcomers to carve out a niche.

The threat of new entrants in Thailand's banking sector, while present, is significantly mitigated by substantial barriers to entry. These include stringent regulatory capital requirements, the immense cost of building robust IT infrastructure and cybersecurity, and the entrenched brand loyalty enjoyed by established players like Bangkok Bank. The sheer scale of investment needed to compete effectively, coupled with the need to replicate extensive distribution networks, makes it exceptionally difficult for newcomers to gain a foothold.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High minimum capital thresholds set by the Bank of Thailand. | Deters undercapitalized entrants; requires significant funding. |

| Infrastructure Investment | Costs for IT, cybersecurity, and digital platforms. | Prohibitive for many, especially smaller or digital-only players. |

| Brand Loyalty & Trust | Established customer relationships and reputation. | Makes customer acquisition challenging for new banks. |

| Economies of Scale | Cost advantages for large-scale operations. | New entrants struggle to match pricing and service costs. |

| Distribution Network | Extensive physical and digital reach of incumbents. | Requires significant investment or complex partnerships for new entrants to match. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bangkok Bank leverages data from the bank's annual reports, investor presentations, and official filings with the Stock Exchange of Thailand. We also incorporate industry-specific data from reputable financial news outlets and market research reports to provide a comprehensive view of the competitive landscape.