Bangkok Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bangkok Bank Bundle

Bangkok Bank's marketing prowess is built on a solid foundation of its 4Ps. From its diverse product portfolio catering to various customer needs to its strategic pricing that balances competitiveness and value, the bank demonstrates a keen understanding of its market. Explore how their strategic placement across numerous channels and impactful promotional campaigns solidify their leadership position.

Unlock the full potential of this analysis by diving deeper into Bangkok Bank's intricate marketing strategies. This comprehensive report offers actionable insights into their product development, pricing architecture, distribution networks, and communication tactics, providing a roadmap for your own business success.

Product

Bangkok Bank's comprehensive retail banking offerings encompass a broad spectrum of products, from easily accessible e-Savings accounts that can be opened entirely online, to a diverse range of credit cards catering to various consumer lifestyles. This extensive product suite aims to address the everyday financial requirements of individuals.

The bank is actively investing in its digital platforms, with a particular focus on enhancing its mobile banking application. This strategic move ensures customers can conduct transactions smoothly and access their accounts conveniently, reflecting a commitment to digital-first service delivery.

As of Q1 2024, Bangkok Bank reported a total retail loan portfolio of THB 396 billion, demonstrating the significant scale of its retail banking operations. Furthermore, its digital banking channels facilitated over 50 million transactions in the same period, underscoring the strong adoption of its enhanced mobile features.

Bangkok Bank offers a comprehensive suite of financial solutions designed to meet the diverse needs of both small and medium-sized enterprises (SMEs) and large corporations. For SMEs, this includes specialized loan products like the Bualuang Transformation Loan, which aims to boost competitiveness and foster sustainable development, reflecting a commitment to supporting business growth.

Beyond loans, the bank provides essential tools for corporate clients, such as commercial cards and merchant services, streamlining transactions and enhancing operational efficiency. These offerings underscore Bangkok Bank's dedication to providing robust payment and collection solutions tailored for businesses of all scales.

Bangkok Bank's investment and wealth management offerings go beyond standard banking, providing a comprehensive suite for asset growth. Customers can directly access a diverse range of investment products like mutual funds, government bonds, and corporate debentures through the bank's integrated digital platforms.

The bank is actively innovating its wealth management services, with a clear focus on empowering its affluent clientele. This includes developing tailored solutions designed to foster long-term asset appreciation and secure financial futures for its customers.

In 2024, Bangkok Bank's wealth management segment saw continued growth, reflecting increased customer trust and demand for sophisticated financial planning. The bank reported a 10% year-on-year increase in assets under management for its wealth clients by the end of Q3 2024.

Extensive International Banking Services

Bangkok Bank leverages its status as a premier regional bank to provide extensive international banking and trade finance solutions. This encompasses vital services like foreign exchange and remittances, crucial for businesses engaged in global commerce. In 2024, the bank continued to expand its digital cross-border payment capabilities, enhancing its partnerships with entities in South Korea and China for seamless QR payment integration, reflecting a growing trend in digital international transactions.

The bank's robust international network is a key differentiator, enabling efficient trade and investment facilitation for a wide array of clients throughout Asia. This network includes its significant stake in Permata Bank in Indonesia, a strategic asset that broadens its reach and service offerings. By the end of 2024, Bangkok Bank reported a substantial increase in its international trade finance portfolio, driven by demand from Thai businesses expanding into ASEAN markets.

- Global Reach: Facilitates cross-border transactions and trade finance across Asia.

- Digital Payments: Offers integrated QR payment solutions with partners in South Korea and China.

- Strategic Network: Utilizes its subsidiary Permata Bank in Indonesia to enhance regional services.

- Trade Finance Growth: Saw a significant uptick in its international trade finance business in 2024, supporting regional expansion.

Digital Banking Innovations and Security

Bangkok Bank is aggressively pursuing digital transformation, evident in its ongoing enhancements to its mobile banking app and online services. These improvements focus on creating a smoother user experience while bolstering security. For instance, the bank has rolled out features like facial verification for transactions, digital e-Statements, and the ability for customers to lock and unlock their accounts instantly, significantly boosting fraud prevention capabilities. In 2024, Bangkok Bank reported a substantial increase in digital transactions, with over 90% of retail transactions conducted through digital channels, highlighting customer adoption and the bank's successful digital push.

The bank's commitment extends to substantial investments in its underlying core systems and the broader digital ecosystem. This strategic investment ensures the delivery of innovative and highly secure financial services to meet evolving customer needs. By prioritizing these areas, Bangkok Bank aims to stay at the forefront of digital banking innovation. For example, in Q1 2025, the bank allocated THB 5 billion towards technology upgrades and cybersecurity enhancements, a 15% increase from the previous year, underscoring its dedication to a secure digital future.

Key digital banking innovations and security measures include:

- Enhanced Biometric Security: Facial verification and fingerprint login options for secure and convenient access to banking services.

- Advanced Fraud Prevention: Real-time account locking/unlocking features and proactive transaction monitoring to safeguard customer assets.

- Digital Convenience: Access to e-Statements, online loan applications, and seamless fund transfers, all accessible 24/7.

- Robust Core System Investment: Continuous upgrades to backend infrastructure to support a growing volume of digital transactions and maintain system integrity.

Bangkok Bank's product strategy centers on a comprehensive suite catering to diverse customer segments, from individual retail banking needs to sophisticated corporate and wealth management solutions. This includes accessible digital savings accounts, a wide array of credit cards, and specialized business loans like the Bualuang Transformation Loan for SMEs.

The bank actively enhances its digital platforms, notably its mobile banking app, to ensure seamless transactions and convenient account access. This digital-first approach is supported by significant investments in technology, with THB 5 billion allocated in Q1 2025 for upgrades and cybersecurity, a 15% year-on-year increase.

Key product highlights include advanced digital security features like facial verification and instant account locking, alongside robust international banking services. In 2024, Bangkok Bank saw over 90% of retail transactions conducted digitally, and its wealth management segment experienced a 10% year-on-year increase in assets under management by Q3 2024.

| Product Category | Key Offerings | 2024/2025 Data/Highlights |

|---|---|---|

| Retail Banking | e-Savings Accounts, Credit Cards | Over 50 million digital transactions in Q1 2024; 90%+ retail transactions via digital channels in 2024. |

| SME & Corporate Banking | Bualuang Transformation Loan, Commercial Cards, Merchant Services | Significant increase in international trade finance portfolio in 2024. |

| Investment & Wealth Management | Mutual Funds, Bonds, Corporate Debentures | 10% year-on-year increase in AUM for wealth clients by Q3 2024. |

| International Banking | Foreign Exchange, Remittances, Trade Finance | Expanded digital cross-border payment capabilities with partners in South Korea and China in 2024. |

What is included in the product

This analysis offers a comprehensive examination of Bangkok Bank's marketing mix, detailing its Product offerings, Pricing strategies, Place (distribution) channels, and Promotion activities.

It provides a structured overview of how Bangkok Bank positions itself in the market, ideal for understanding its competitive strategies and marketing effectiveness.

Simplifies complex marketing strategies into actionable insights, making Bangkok Bank's 4Ps readily understandable for all stakeholders.

Provides a clear, concise overview of Bangkok Bank's marketing approach, alleviating confusion and streamlining strategic decision-making.

Place

Bangkok Bank boasts an extensive branch network throughout Thailand, offering unparalleled accessibility for a wide range of banking needs. As of late 2024, the bank operates over 1,100 branches and service centers nationwide, ensuring customers have convenient access to traditional services, personalized support, and expert financial advice, especially for those who value face-to-face interactions.

This widespread physical presence is a cornerstone of Bangkok Bank's strategy, facilitating customer engagement and reinforcing its commitment to being a trusted financial partner. The bank's 80th anniversary in 2024 underscored this dedication to customer growth through its deep and broad reach across the country.

Bangkok Bank prioritizes customer convenience by maintaining an extensive network of ATMs and Cash Deposit Machines (CDMs) across Thailand. As of early 2024, the bank operates over 9,000 ATMs nationwide, ensuring widespread availability of cash services.

To further enhance accessibility, Bangkok Bank has strategically partnered with over 13,000 banking agents, including popular chains like 7-Eleven and Thailand Post offices. These partnerships allow customers to perform essential transactions such as cardless withdrawals and cash deposits at numerous retail locations, significantly expanding banking access beyond traditional branches.

Bangkok Bank has prioritized its digital and mobile platforms, recognizing the growing trend of digital-first customer interactions. Their mobile banking app, Bualuang mBanking, is a central hub for a wide array of services, from everyday transactions to investment management. This focus ensures customers can manage their finances conveniently and securely, anytime, anywhere.

In 2024, Bangkok Bank continued to enhance its digital offerings, aiming to provide a seamless user experience. The bank reported a significant increase in digital transactions, with mobile banking playing a crucial role. This investment reflects a strategic move to meet the evolving needs of its customer base and maintain a competitive edge in the digital banking landscape.

Dedicated Business and International Centers

Bangkok Bank's Dedicated Business and International Centers are a key part of its marketing mix, specifically addressing the 'Place' element. These centers offer specialized support and advisory services tailored for SME and corporate clients, acting as hubs for business development. This focus on dedicated resources demonstrates a commitment to facilitating client growth.

The bank's strategic use of its international network significantly enhances its 'Place' offering. With over 200 branches in Indonesia via its stake in Permata Bank, Bangkok Bank provides crucial access for businesses looking to engage in international trade and investment. This extensive reach is vital for clients pursuing regional and global expansion strategies.

- Dedicated Centers: Specialized support for SMEs and corporations.

- International Network: Over 200 Permata Bank branches in Indonesia.

- Facilitation: Enabling international trade and investment.

- Expansion Support: Critical contact points for regional and global reach.

Strategic Partnerships and Expos

Bangkok Bank actively engages in strategic partnerships and participates in key financial expos to broaden its market presence and deliver comprehensive financial solutions. These initiatives are crucial for reaching diverse customer segments and showcasing the bank's evolving product and service offerings.

The bank's presence at events like the Money Expo, a prominent financial fair in Thailand, provides a direct channel to interact with a wide audience, highlighting its extensive portfolio of retail banking, corporate services, and digital innovations. In 2024, the Money Expo in Bangkok saw significant foot traffic, with an estimated over one million visitors across its various iterations, offering Bangkok Bank a prime opportunity for customer acquisition and brand visibility.

Furthermore, Bangkok Bank cultivates strategic collaborations to bolster its support for small and medium-sized enterprises (SMEs). Notable partnerships, such as those with CP ALL and the Office of Small and Medium Enterprises Promotion (OSMEP), aim to enhance SME growth by facilitating access to crucial sales channels and valuable networking platforms. These alliances reflect a commitment to fostering a robust SME ecosystem within Thailand.

- Strategic Presence: Participation in major financial expos like Money Expo in 2024 attracted over a million visitors, providing Bangkok Bank with extensive reach.

- Integrated Solutions: Expos allow the bank to showcase its full spectrum of financial products, from retail banking to digital services.

- SME Empowerment: Collaborations with entities like CP ALL and OSMEP directly support SMEs by creating new sales avenues and networking opportunities.

- Market Expansion: These partnerships and events are key drivers for expanding Bangkok Bank's market share and customer base.

Bangkok Bank's 'Place' strategy centers on extensive accessibility, both physically and digitally. The bank maintains over 1,100 branches and service centers nationwide as of late 2024, complemented by more than 9,000 ATMs and CDMs. Strategic partnerships with over 13,000 banking agents, including 7-Eleven, further expand this reach, allowing for convenient transactions in numerous retail locations.

The bank also leverages its digital platform, Bualuang mBanking, as a primary channel for customer interaction, seeing significant growth in digital transactions throughout 2024. Furthermore, Bangkok Bank's international presence, notably through its stake in Permata Bank with over 200 branches in Indonesia, solidifies its 'Place' by facilitating international trade and investment for its clients.

| Channel | Count (as of late 2024/early 2024) | Strategic Importance |

|---|---|---|

| Branches & Service Centers | Over 1,100 | Personalized support, expert advice, traditional banking needs |

| ATMs & CDMs | Over 9,000 | Cash services, widespread availability |

| Banking Agents (e.g., 7-Eleven) | Over 13,000 | Expanded access for essential transactions |

| Digital Platform (Bualuang mBanking) | Growing user base, increased digital transactions | Convenient, secure, anytime/anywhere financial management |

| International Network (Permata Bank, Indonesia) | Over 200 branches | Facilitating international trade and investment |

What You See Is What You Get

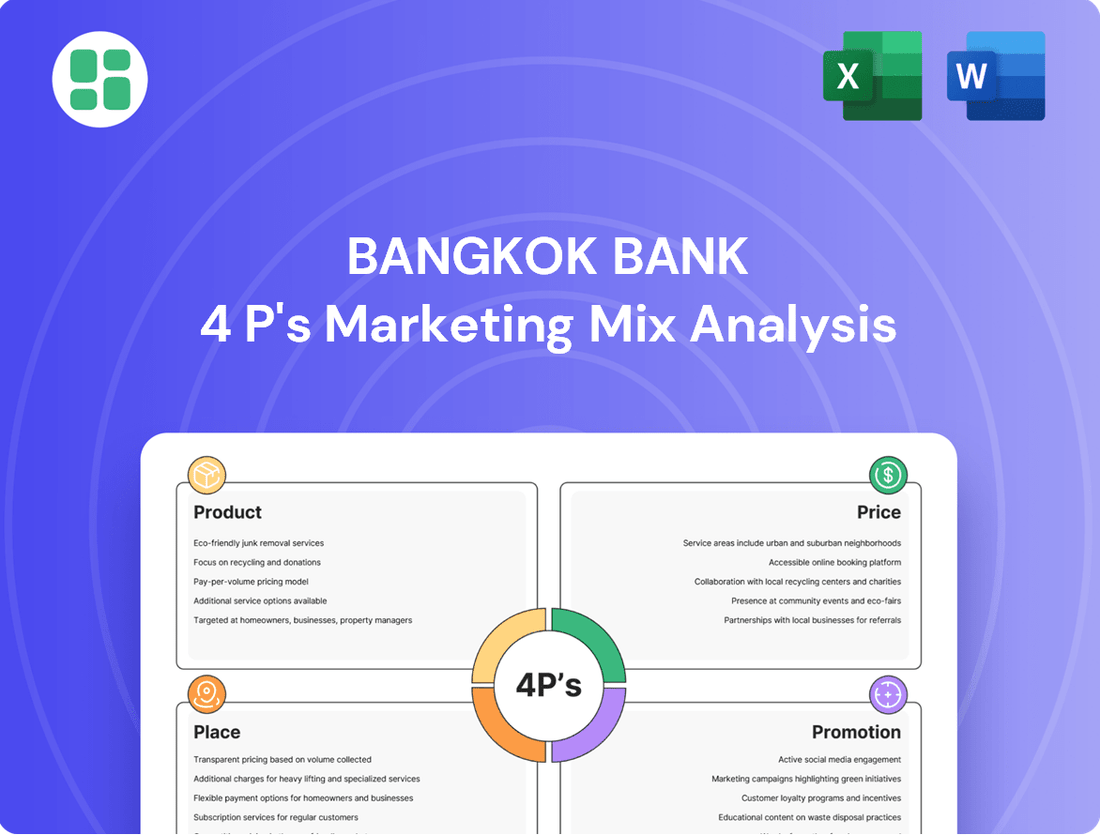

Bangkok Bank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Bangkok Bank 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies in detail. You'll gain valuable insights into how Bangkok Bank positions itself in the market.

Promotion

Bangkok Bank leverages integrated marketing communications to connect with its broad customer base. This involves a blend of traditional advertising across various media platforms and a strong presence at key industry gatherings such as the Money Expo. For instance, in the first half of 2024, the bank reported a net profit of THB 22.2 billion, underscoring its robust financial standing which supports these extensive promotional activities.

The bank's promotional messaging consistently highlights its commitment to being a 'trusted partner and reliable close friend.' This customer-centric positioning is reinforced through campaigns that showcase its dedication to service excellence and building long-term relationships. Their digital marketing efforts, including social media engagement and online content, also play a crucial role in disseminating this message and fostering customer loyalty.

Bangkok Bank leverages digital engagement and social media to connect with customers, highlighting its mobile banking app's new features and sharing financial insights. This approach ensures they meet customers on their preferred platforms, offering timely updates and interactive content to build stronger relationships and encourage digital service use. For instance, in Q1 2024, Bangkok Bank reported a significant increase in mobile banking transactions, with over 70% of customer interactions occurring through digital channels, demonstrating the effectiveness of their online presence.

Bangkok Bank actively fosters financial literacy and engages in robust Corporate Social Responsibility (CSR) programs, aligning with its marketing objectives. For instance, in 2024, the bank continued its efforts to educate SMEs on Environmental, Social, and Governance (ESG) principles, a key component of its sustainable growth strategy.

The bank's commitment is further exemplified by events like the 'Modern Agriculture Fair,' which not only supports community development but also reinforces Bangkok Bank's image as a responsible financial partner. These initiatives are crucial for building trust and enhancing brand perception among diverse stakeholders.

Customer Relationship Management (CRM) Focus

Bangkok Bank places a significant emphasis on Customer Relationship Management (CRM) as a core element of its marketing strategy. This focus translates into building and nurturing enduring connections with its diverse customer base, encompassing retail clients, high-net-worth individuals, and large corporate entities. The bank's communications frequently underscore this commitment to personalized service and ongoing support.

The bank's strategy aims to foster customer satisfaction and cultivate loyalty by proactively addressing individual financial requirements and overcoming specific challenges. This relationship-centric approach is designed to differentiate Bangkok Bank in a competitive market.

- Customer Segmentation: Bangkok Bank tailors its CRM efforts to distinct customer segments, from everyday banking needs to complex corporate finance solutions.

- Personalized Advice: The bank provides customized financial guidance, leveraging data analytics to understand and anticipate customer needs.

- Digital Engagement: Enhancing customer relationships through user-friendly digital platforms and responsive online support is a key priority.

- Loyalty Programs: Initiatives are in place to reward long-term customers and strengthen their connection with the bank.

Public Relations and Media Outreach

Bangkok Bank prioritizes public relations and media outreach to cultivate a positive image and disseminate crucial information. This includes timely announcements of financial performance and strategic directions to stakeholders. For instance, in early 2024, the bank actively communicated its robust 2023 financial results, which saw a net profit of THB 37.5 billion, a significant increase from the previous year.

The bank consistently issues press releases and investor presentations to leading financial media. This practice ensures transparency and keeps Bangkok Bank at the forefront of financial discussions. In the first quarter of 2024, Bangkok Bank continued this tradition by releasing detailed reports on its asset quality and loan growth, highlighting a 4.5% increase in loans year-on-year.

- Reputation Management: Bangkok Bank proactively manages its public perception through consistent and transparent communication.

- Information Dissemination: Key financial results and strategic updates are shared promptly with the public and investors via press releases and presentations.

- Media Engagement: The bank actively engages with major financial news outlets to ensure broad reach and maintain visibility in the financial discourse.

- Transparency and Trust: Regular issuance of financial data, such as the THB 37.5 billion net profit for 2023, builds trust with investors and the public.

Bangkok Bank employs a multi-faceted promotional strategy, integrating digital outreach with traditional advertising and event participation. Their messaging consistently emphasizes trust and a close customer relationship, supported by strong financial performance. For example, the bank's continued investment in digital channels, which saw over 70% of customer interactions in Q1 2024, underpins their commitment to accessible and engaging communication.

The bank's promotional efforts extend to fostering financial literacy and engaging in CSR initiatives, such as educating SMEs on ESG principles in 2024. These activities, like the 'Modern Agriculture Fair,' build brand image and reinforce their role as a responsible partner.

Bangkok Bank's public relations strategy focuses on transparency and positive image cultivation, evident in their communication of robust financial results, like the THB 37.5 billion net profit in 2023. Active engagement with financial media ensures broad dissemination of information, maintaining investor confidence and public awareness.

| Promotional Aspect | Key Initiatives/Data | Impact/Objective |

|---|---|---|

| Integrated Marketing | Digital engagement (70%+ interactions via mobile in Q1 2024), Money Expo participation | Customer connection, brand visibility |

| Brand Messaging | Trusted partner, reliable friend positioning | Customer loyalty, relationship building |

| Financial Literacy & CSR | SME ESG education (2024), 'Modern Agriculture Fair' | Brand reputation, community support |

| Public Relations | Press releases, investor presentations, 2023 Net Profit THB 37.5 billion | Transparency, stakeholder trust |

Price

Bangkok Bank actively manages its interest rates across a spectrum of products, from savings accounts to business loans, to remain competitive and responsive to the evolving economic landscape. This strategic pricing is a core component of their marketing mix.

Demonstrating this flexibility, Bangkok Bank notably reduced its Minimum Retail Rate (MRR) in recent periods. For instance, by cutting the MRR, they aimed to ease the financial pressure on both individual borrowers and small and medium-sized enterprises (SMEs), mirroring government efforts to stimulate the economy.

Bangkok Bank employs tiered fee structures for its diverse banking services, with charges varying based on transaction types, account features, and usage levels. This approach allows them to cater to a broad customer base, from individuals to large corporations, by offering tailored pricing. For instance, international wire transfer fees might differ depending on the currency and destination country, reflecting the complexity and associated costs.

Net fees and service income are a crucial component of Bangkok Bank's revenue stream, contributing significantly to its non-interest income. In the first quarter of 2024, Bangkok Bank reported a net interest margin of 2.35%, while its fee-based income also played a vital role in its overall financial performance. The bank actively works to optimize these fees while simultaneously focusing on cost management and operational efficiency to maintain a healthy cost-to-income ratio, which stood at 43.5% at the end of 2023.

Bangkok Bank excels in offering customized lending and financing options, a key element of their marketing mix. They provide a wide array of solutions with flexible terms designed to meet diverse customer needs. For instance, the Bualuang Transformation Loan specifically targets SMEs, featuring a fixed interest rate and a defined repayment schedule, showcasing their commitment to tailored support.

The bank's approach centers on delivering the right financial resources and expert guidance. They carefully consider the unique requirements of various customer segments and navigate current economic challenges, ensuring their financing solutions are both relevant and impactful. This focus on personalized service helps clients achieve their business objectives.

Foreign Exchange and Remittance Rates

Bangkok Bank, with its extensive international network, provides competitive foreign exchange and remittance rates. These rates are vital for businesses involved in global trade and individuals managing cross-border financial flows, ensuring cost-effectiveness for international transactions.

The bank's commitment to transparency extends to its fee structures for these services. For instance, as of early 2024, Bangkok Bank's remittance fees for transfers to major currencies like USD or EUR typically start from a competitive percentage or a fixed low fee, depending on the amount and destination.

- Competitive Exchange Rates: Bangkok Bank offers favorable rates for a wide range of foreign currencies, crucial for international trade and personal remittances.

- Transparent Fee Structure: The bank clearly outlines its fees for foreign exchange and remittance services, ensuring customers understand the costs involved.

- Remittance Services: Facilitating money transfers across borders, Bangkok Bank aims to provide efficient and cost-effective solutions for both individuals and businesses.

- International Presence: Leveraging its significant global footprint, the bank ensures accessibility and competitive pricing for its international financial services.

Value-Added Service Pricing

Bangkok Bank prices its value-added services, such as bancassurance and mutual fund offerings, to align with the tangible benefits and specialized guidance customers receive. This strategy aims to capture the willingness of customers to invest in enhanced convenience and expertise beyond basic banking.

The bank's focus on non-interest income streams reflects a successful pricing approach for these supplementary services. For instance, Bangkok Bank reported a significant increase in fee and service income in their 2024 financial results, demonstrating customer acceptance of these value-added propositions.

- Bancassurance Premiums: Bangkok Bank's bancassurance segment saw a notable rise in new business premiums in early 2024, indicating competitive pricing that resonates with customer needs for financial protection.

- Mutual Fund Sales Growth: The bank experienced a double-digit percentage increase in mutual fund sales during the first half of 2024, suggesting that their pricing for investment products is attractive relative to market alternatives.

- Fee Income Contribution: Fee and service income constituted a substantial portion of Bangkok Bank's overall revenue in 2024, underscoring the effectiveness of their pricing strategy for value-added services in driving profitability.

Bangkok Bank's pricing strategy is multifaceted, encompassing competitive interest rates on loans and deposits, tiered fees for services, and value-based pricing for enhanced offerings. The bank actively adjusts its rates to remain competitive, as seen with reductions in its Minimum Retail Rate (MRR) to support borrowers. This approach ensures their pricing is both attractive to customers and aligned with market conditions.

The bank's fee structures are designed to accommodate a wide range of customers, from individuals to large corporations, with charges varying based on the specific service and usage. This tiered approach is crucial for generating non-interest income, which formed a significant part of their revenue. For instance, in Q1 2024, Bangkok Bank reported a net interest margin of 2.35%, with fee-based income also contributing substantially to overall financial performance.

Furthermore, Bangkok Bank offers customized lending solutions, like the Bualuang Transformation Loan for SMEs, featuring fixed interest rates and clear repayment terms. Their international services also benefit from competitive foreign exchange and remittance rates, with transparent fee structures, making cross-border transactions more cost-effective for clients.

| Metric | Value (as of Q1 2024/End 2023) | Significance |

|---|---|---|

| Net Interest Margin | 2.35% (Q1 2024) | Indicates profitability on interest-earning assets. |

| Cost-to-Income Ratio | 43.5% (End 2023) | Reflects operational efficiency in managing costs against income. |

| Minimum Retail Rate (MRR) | Reduced in recent periods | Demonstrates competitive pricing to support borrowers. |

4P's Marketing Mix Analysis Data Sources

Our Bangkok Bank 4P's Marketing Mix Analysis is built on a foundation of verified, up-to-date information. We leverage official company reports, investor relations materials, and public announcements to understand their product offerings, pricing strategies, distribution channels, and promotional activities.