Bang & Olufsen SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bang & Olufsen Bundle

Bang & Olufsen, a name synonymous with luxury audio, faces a dynamic market. Their premium brand image is a significant strength, but high price points can limit accessibility, presenting a key challenge. Understanding these internal capabilities and external pressures is crucial for strategic decision-making.

Want the full story behind Bang & Olufsen's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bang & Olufsen's brand reputation is a significant strength, deeply rooted in its heritage of luxury, quality, and distinctive design. This established identity, built over decades, translates into strong customer loyalty and the ability to maintain premium pricing in the competitive consumer electronics market.

The company's legacy in audio-visual innovation further solidifies its standing in the high-end segment. For instance, in the fiscal year 2023, Bang & Olufsen reported a revenue of DKK 3.1 billion, demonstrating the market's continued appetite for their premium offerings, a testament to the enduring power of their brand.

Bang & Olufsen consistently garners acclaim for its signature artistic product design and exceptional craftsmanship, a hallmark that clearly distinguishes it from the broader audio market. This unwavering commitment to aesthetic superiority resonates deeply with a sophisticated customer base prioritizing refined appearance alongside audio fidelity.

The company's unique design ethos serves as a potent competitive advantage, significantly bolstering its brand desirability and premium positioning. For instance, in 2023, Bang & Olufsen's revenue reached DKK 3.05 billion (approximately $440 million), underscoring the market's willingness to pay a premium for its distinctive offerings.

Bang & Olufsen consistently delivers exceptional sound quality and immersive audio experiences across its product range, a core pillar of its value proposition that attracts audiophiles. In 2024, this commitment to acoustic excellence continues to be a significant differentiator, with many reviews highlighting their superior driver technology and acoustic tuning. The advanced audio engineering contributes significantly to the premium user experience, reinforcing their brand image as a leader in high-fidelity sound.

Niche Market Targeting

Bang & Olufsen's strength lies in its astute niche market targeting, specifically focusing on affluent consumers. This deliberate strategy allows the company to cater precisely to the unique demands for luxury, superior performance, and exclusivity that this demographic values.

By concentrating on this high-end segment, Bang & Olufsen can tailor its product development and marketing with a precision that deeply resonates with its chosen audience. This focus also strategically sidesteps direct competition with the broad, mass-market electronics brands, allowing B&O to maintain its premium positioning.

- Targeted Luxury Appeal: Caters to consumers seeking premium audio-visual experiences and sophisticated design.

- Reduced Mass-Market Competition: Avoids direct price wars and feature parity battles with high-volume electronics manufacturers.

- Brand Exclusivity: Cultivates a perception of prestige and desirability among its core customer base, contributing to strong brand loyalty.

Innovative Technology Integration

Bang & Olufsen consistently integrates advanced acoustic platforms and seamless connectivity, a testament to their innovative spirit. This commitment ensures their products remain at the cutting edge of audio-visual technology.

This technological prowess, combined with their renowned design, creates a distinct value proposition for their discerning, high-end customer base. For instance, their 2023 fiscal year saw continued investment in R&D, with a focus on enhancing smart home integration and personalized audio experiences.

- Technological Leadership: B&O's history of integrating cutting-edge audio and connectivity solutions keeps them ahead in the premium market.

- R&D Investment: Continued focus on smart home integration and personalized audio experiences drives product development.

- Unique Value Proposition: The fusion of advanced technology with iconic design appeals strongly to affluent consumers seeking exclusivity.

Bang & Olufsen's strong brand equity, built on decades of luxury and distinctive design, fosters significant customer loyalty and premium pricing power. Their fiscal year 2023 revenue of DKK 3.1 billion reflects this market's enduring demand for their high-end products.

The company's commitment to exceptional sound quality and advanced acoustic engineering, evident in their continued investment in R&D for personalized audio, serves as a key differentiator. This technological leadership, combined with their unique design ethos, creates a compelling value proposition for affluent consumers.

Bang & Olufsen's strategic focus on a niche market of affluent consumers allows them to bypass intense mass-market competition and cultivate a perception of exclusivity and prestige. This targeted approach ensures their products resonate deeply with a discerning customer base.

| Key Strengths | Description | Supporting Data (FY2023) |

| Brand Reputation & Heritage | Luxury, quality, and distinctive design create strong customer loyalty. | Revenue: DKK 3.1 billion |

| Design Excellence & Craftsmanship | Signature artistic product design distinguishes them in the audio market. | Revenue: DKK 3.05 billion (approx. $440 million) |

| Audio Quality & Innovation | Superior driver technology and acoustic tuning appeal to audiophiles. | Continued R&D investment in smart home integration and personalized audio. |

| Niche Market Targeting | Focus on affluent consumers seeking luxury, performance, and exclusivity. | Maintains premium positioning by avoiding mass-market competition. |

What is included in the product

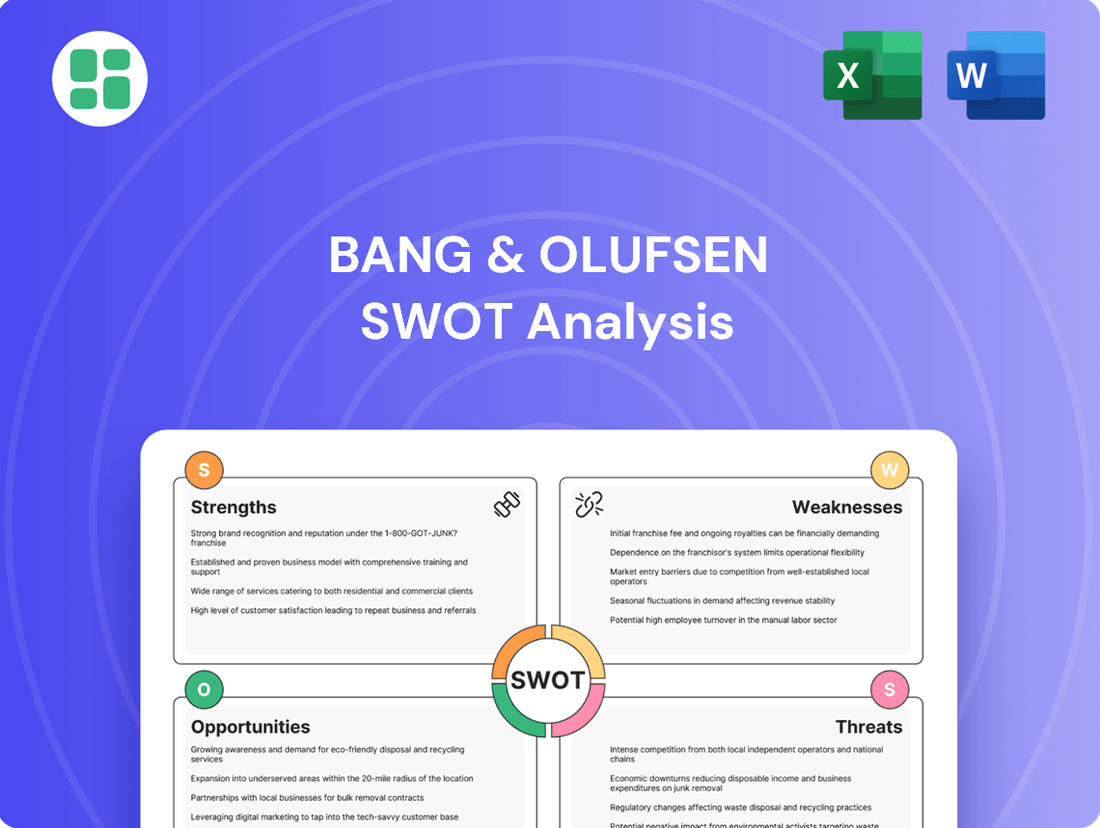

Analyzes Bang & Olufsen’s competitive position through key internal and external factors, detailing its premium brand strengths and market challenges.

Offers a clear visual breakdown of Bang & Olufsen's competitive landscape, simplifying complex market dynamics for strategic decision-making.

Weaknesses

Bang & Olufsen's commitment to premium materials and cutting-edge design results in a high price point, positioning its products at the extreme luxury end of the audio and visual market. This deliberate strategy, while fostering an image of exclusivity, inherently limits its market penetration, making its sophisticated offerings inaccessible to a broad consumer base. For instance, their Beosound A1 (2nd Gen) portable speaker launched in 2021 with a retail price of $259, while their Beolab 90 speakers can cost upwards of $40,000, showcasing the significant financial barrier to entry.

Bang & Olufsen's premium positioning, while fostering a strong brand identity, results in a limited market share within the vast consumer electronics landscape. This focus on luxury segments inherently caps sales volume, preventing the company from rivaling the sheer scale of mass-market players.

For instance, while specific market share figures fluctuate, it's understood that B&O operates in a segment where overall unit sales are significantly lower compared to brands like Samsung or Sony, which dominate the broader market with more accessible price points.

This smaller footprint can hinder the attainment of economies of scale in manufacturing and distribution, potentially impacting cost competitiveness against larger, more diversified competitors who benefit from higher production volumes.

Bang & Olufsen's reliance on luxury consumer spending is a significant weakness. Its financial results are closely tied to the discretionary income of affluent consumers and the general condition of the global luxury goods sector. For instance, during economic downturns, such as the anticipated slowdown in the luxury market in 2024, sales of high-end audio and visual equipment can be disproportionately affected.

This inherent dependence means that events like economic recessions, geopolitical tensions, or a general decline in consumer confidence can have a direct and substantial impact on the company's sales figures. This vulnerability introduces a notable level of unpredictability into its revenue streams, making consistent performance more challenging.

Slow Adaptation to Mass Market Trends

Bang & Olufsen's commitment to premium, handcrafted design, while a core strength, can also be a weakness. This focus can make it challenging to pivot quickly and adapt to the fast-paced, mass-market consumer electronics landscape. For instance, while the company might be developing a new high-fidelity speaker, a competitor could release a similarly performing, yet more affordable, smart speaker that captures a larger market share. This inherent slowness in adaptation means B&O could miss out on significant growth opportunities in rapidly expanding segments of the electronics market.

The company's lengthy product development cycles, often driven by meticulous attention to detail and material quality, can further exacerbate this issue. In 2023, the consumer electronics market saw significant growth in areas like AI-powered audio devices and sustainable materials, trends that B&O might be slower to integrate into its offerings compared to more agile competitors. This strategic choice to prioritize enduring quality over rapid iteration can lead to a perception of being out of step with mainstream consumer preferences, potentially limiting its appeal to a broader audience.

- Niche Focus Limitation: Bang & Olufsen's dedication to its luxury niche may prevent it from effectively responding to rapid shifts in mass-market consumer electronics trends.

- Agility Hindrance: The company's emphasis on bespoke design and extended product development timelines can impede its ability to adapt quickly to new technologies.

- Missed Market Opportunities: This lack of agility could result in Bang & Olufsen failing to capitalize on emerging, high-volume market segments.

Distribution Network Limitations

Bang & Olufsen's commitment to an exclusive distribution strategy, featuring flagship stores and select retail partners, while reinforcing its premium brand image, can inadvertently restrict its market penetration. This approach contrasts with competitors who leverage more extensive retail networks, potentially limiting Bang & Olufsen's accessibility to a wider customer base.

The company's strategic decision to streamline its physical presence was evident in its fiscal year 2024/25 performance, which saw a net decrease of 41 stores. This reduction, while potentially optimizing operational efficiency, further underscores the concentrated nature of its distribution channels.

- Limited Reach: Exclusive partnerships and fewer physical locations compared to mass-market audio brands.

- Reduced Store Count: A net reduction of 41 stores in FY 2024/25 impacts overall accessibility.

- Brand Exclusivity vs. Market Share: The focus on premium positioning may sacrifice broader market capture.

Bang & Olufsen's premium pricing strategy, while cultivating an aura of exclusivity, inherently limits its addressable market. This high cost of entry, exemplified by products ranging from the $259 Beosound A1 (2nd Gen) to the $40,000+ Beolab 90 speakers, restricts its appeal to a more affluent demographic, thereby capping overall sales volume compared to mass-market competitors.

This niche focus can also hinder the company's ability to achieve significant economies of scale in manufacturing and procurement, potentially impacting cost efficiencies and making it challenging to compete on price with larger, more diversified electronics manufacturers.

Furthermore, Bang & Olufsen's reliance on discretionary spending makes it particularly vulnerable to economic downturns. For instance, a projected slowdown in the luxury goods market in 2024 could disproportionately affect sales of high-end audio-visual equipment.

The company's deliberate emphasis on meticulous design and extended product development cycles, while ensuring quality, can also lead to slower adaptation to rapidly evolving consumer electronics trends, potentially causing it to miss opportunities in fast-growing market segments.

| Weakness | Description | Impact |

|---|---|---|

| High Price Point | Products are positioned at the extreme luxury end of the market. | Limits market penetration and accessibility to a broad consumer base. |

| Limited Market Share | Focus on luxury segments caps sales volume. | Hinders economies of scale and cost competitiveness. |

| Economic Sensitivity | Reliance on discretionary income of affluent consumers. | Vulnerable to economic downturns and recessions. |

| Agility in Innovation | Lengthy product development cycles due to design focus. | Potential to miss rapid shifts in mass-market trends and new technologies. |

What You See Is What You Get

Bang & Olufsen SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive look at Bang & Olufsen's Strengths, Weaknesses, Opportunities, and Threats. This detailed report is ready for your strategic planning needs.

Opportunities

Bang & Olufsen has a significant opportunity in emerging luxury markets, where a growing affluent population is increasingly seeking high-end goods. Regions like Southeast Asia and the Middle East, for instance, are experiencing robust wealth creation. In 2024, the global luxury goods market is projected to grow by 6-8%, with emerging markets being key drivers.

Targeting these developing economies, particularly in Asia and the Middle East, could unlock substantial new customer bases for Bang & Olufsen's premium audio and visual products. For example, the luxury market in the UAE alone saw a 15% increase in spending by high-net-worth individuals in 2023.

Adapting marketing and distribution strategies to resonate with the cultural nuances and consumer preferences of these specific regions could yield considerable returns. This includes localized digital campaigns and strategic partnerships with local high-end retailers to enhance brand visibility and accessibility.

The growing prevalence of smart home ecosystems offers Bang & Olufsen a significant chance to embed its high-fidelity audio and visual products into the fabric of connected living spaces. By ensuring smooth integration with leading platforms like Apple HomeKit, Google Home, and Amazon Alexa, B&O can significantly boost user convenience and broaden its market appeal, tapping into a market segment that values both performance and seamless connectivity.

Strategic partnerships offer a significant avenue for Bang & Olufsen to amplify its market presence. Collaborating with other high-end brands, perhaps in the automotive, fashion, or hospitality industries, can introduce B&O to new affluent consumer bases and solidify its luxury image. For instance, their October 2024 collaboration with Riva, a luxury yacht manufacturer, exemplifies how such alliances can create unique, desirable products and tap into overlapping customer segments.

Subscription Models and Services

Bang & Olufsen could explore subscription models for premium audio content or personalized sound experiences, potentially attracting customers who prefer access over ownership. This approach could unlock new recurring revenue streams and build deeper customer loyalty.

Product leasing or service subscriptions could lower the barrier to entry for consumers seeking Bang & Olufsen's high-end audio, expanding market reach. For instance, a service offering curated playlists with adaptive sound profiles for different environments could be a compelling offering.

The company might also consider tiered subscription services for enhanced smart features or exclusive content, mirroring trends seen in other luxury electronics sectors. This strategy could generate predictable income and provide valuable customer data for future product development.

- Subscription Revenue: Potential for predictable income, reducing reliance on cyclical product sales.

- Customer Acquisition: Lower upfront costs can attract a wider demographic.

- Customer Retention: Fosters ongoing engagement and loyalty through continuous service delivery.

- Market Expansion: Access to new customer segments unwilling or unable to make large initial purchases.

Sustainability and Eco-conscious Products

Growing consumer awareness and demand for sustainable and ethically produced luxury goods present a significant opportunity for Bang & Olufsen. The company can leverage this trend by emphasizing its environmental initiatives and commitment to responsible manufacturing. This aligns with the increasing preference among affluent consumers for brands that demonstrate a genuine dedication to sustainability.

Bang & Olufsen has already taken steps in this direction, notably through its Cradle to Cradle certifications. For instance, their Beosound Level speaker achieved a Gold level certification, highlighting its design for circularity and reduced environmental impact. This demonstrates a tangible commitment that can resonate strongly with environmentally conscious luxury buyers, potentially driving sales and brand loyalty.

- Growing Demand: The global market for sustainable luxury goods is expanding, with consumers increasingly willing to pay a premium for eco-friendly products.

- Brand Reputation: Highlighting sustainability efforts can enhance Bang & Olufsen's brand image, differentiating it from competitors.

- Product Innovation: Opportunities exist to develop new products using recycled materials and design for greater longevity and repairability.

- Transparency: Communicating transparently about sourcing, manufacturing processes, and end-of-life solutions can build trust with consumers.

Bang & Olufsen can capitalize on the growing demand for integrated smart home solutions by ensuring seamless compatibility with major platforms like Apple HomeKit and Google Home. This focus on connectivity enhances user experience and broadens the appeal of their premium audio-visual products to a tech-savvy consumer base.

Strategic collaborations with other luxury brands, particularly in sectors like automotive or fashion, offer a pathway to reach new affluent customer segments and reinforce B&O's luxury positioning. Their 2024 partnership with Riva, a luxury yacht manufacturer, exemplifies this strategy, creating unique co-branded products and tapping into shared clientele.

Exploring subscription-based models for premium audio content or personalized sound experiences could unlock recurring revenue streams and foster deeper customer loyalty. This approach allows consumers to access B&O's high-fidelity offerings without the significant upfront investment, potentially expanding market reach.

The increasing consumer preference for sustainable and ethically produced luxury goods presents a significant opportunity for Bang & Olufsen to differentiate itself. By highlighting their environmental initiatives, such as the Cradle to Cradle certification for products like the Beosound Level, B&O can attract environmentally conscious buyers and enhance its brand reputation.

Threats

Bang & Olufsen faces significant pressure from tech behemoths like Apple, Sony, Bose, and Samsung. These giants boast enormous research and development budgets, far exceeding B&O's, allowing them to invest heavily in new technologies and product development. For instance, Apple's Beats brand alone generated billions in revenue in 2023, showcasing its market penetration and financial muscle.

The sheer scale of these competitors means they can leverage economies of scale to offer premium audio products at more accessible price points, directly challenging B&O's premium positioning. Furthermore, their established global distribution networks and immense brand loyalty, cultivated over decades, provide a substantial advantage in reaching and retaining customers worldwide.

These tech giants also possess the agility and resources to rapidly adapt to evolving market trends and consumer preferences, often integrating cutting-edge smart features and connectivity into their audio devices. This rapid innovation cycle can quickly shift consumer expectations, making it challenging for a more niche player like Bang & Olufsen to keep pace without substantial strategic investment.

Global economic instability, including potential recessions and persistent inflation, poses a significant threat to Bang & Olufsen. These factors can drastically curtail discretionary spending on luxury items, directly impacting the company's sales and overall profitability. For instance, during periods of economic contraction, consumers tend to prioritize essential goods, often cutting back on high-end electronics first.

This vulnerability to economic downturns highlights the need for robust financial planning and strategic market diversification for Bang & Olufsen. As of late 2024 and early 2025, many developed economies are navigating inflationary pressures and cautious consumer sentiment, making the luxury goods sector particularly susceptible to shifts in disposable income.

Bang & Olufsen's premium status unfortunately makes it a prime target for counterfeiters, especially in online marketplaces and developing economies. The availability of fake products can significantly tarnish the brand's esteemed reputation for superior craftsmanship and exclusivity, thereby undermining consumer confidence and directly impacting sales revenue.

Combating this persistent issue of intellectual property infringement and the spread of counterfeit goods represents a continuous and resource-intensive challenge for the company. For instance, a 2024 report by the OECD estimated that the global trade in counterfeit and pirated goods reached $461 billion annually, highlighting the scale of this threat across industries.

Rapid Technological Obsolescence

The consumer electronics landscape is defined by relentless technological evolution, making product lifecycles increasingly short. This rapid obsolescence poses a significant threat to Bang & Olufsen, as it necessitates substantial and ongoing investment in research and development to maintain a competitive edge. For instance, the global consumer electronics market was valued at approximately $1.1 trillion in 2023 and is projected to grow, but the pace of innovation means that products can become outdated quickly.

Failure to adapt swiftly to emerging audio technologies, evolving connectivity standards like Wi-Fi 7, or intuitive user interface designs could diminish the appeal of Bang & Olufsen's premium products. This challenge is compounded by the fact that the high-end segment, where B&O typically operates, often demands even more sophisticated and seamlessly integrated technology to justify its premium pricing. Companies that lag in adopting new features, such as advanced spatial audio codecs or next-generation Bluetooth capabilities, risk losing market share to more agile competitors.

- Constant R&D Investment: Bang & Olufsen must allocate significant capital to R&D to stay ahead of technological curves.

- Adaptation to New Standards: Keeping pace with new audio formats and connectivity protocols is crucial for product relevance.

- User Interface Innovation: Modern consumers expect intuitive and seamless user experiences, requiring continuous UI development.

- Competitive Landscape: Competitors are also investing heavily, making it a race to introduce and perfect new technologies.

Supply Chain Disruptions

Bang & Olufsen's reliance on global supply chains for its high-end audio and video products presents a significant threat. Geopolitical tensions, trade disputes, and unforeseen events like natural disasters or pandemics can severely disrupt the flow of essential components and finished goods. For instance, the semiconductor shortage that began in 2020 impacted numerous industries, and while specific data for Bang & Olufsen's Q3 2024 performance isn't publicly detailed regarding this specific threat, the broader industry faced production slowdowns and increased component costs. This vulnerability can lead to production delays, impacting inventory levels and the ability to fulfill customer orders, ultimately affecting sales and brand reputation.

To mitigate these risks, Bang & Olufsen must focus on building a more resilient supply chain. This involves actively diversifying its supplier base across different geographical regions to reduce dependence on any single source. Furthermore, investing in strategies such as nearshoring or regionalizing production where feasible, alongside maintaining strategic buffer stock for critical components, can significantly enhance business continuity. The company's ability to adapt to these external shocks will be crucial for maintaining consistent product availability and managing operational costs in the face of ongoing global uncertainties.

Key considerations for Bang & Olufsen's supply chain resilience include:

- Supplier Diversification: Reducing reliance on single-source suppliers, particularly for specialized electronic components.

- Inventory Management: Strategically increasing buffer stock for critical inputs to cushion against short-term disruptions.

- Logistics Optimization: Exploring alternative transportation routes and partners to maintain distribution flow.

- Risk Monitoring: Proactively tracking geopolitical and environmental factors that could impact supply chain operations.

Intense competition from established tech giants with vast R&D budgets and economies of scale poses a significant threat. These competitors, like Apple and Sony, can leverage their financial power to innovate rapidly and offer premium products at more accessible price points, challenging B&O's market position. For instance, Apple's Beats brand alone generated billions in revenue in 2023, illustrating their market dominance.

Economic instability, including inflation and potential recessions, directly impacts discretionary spending on luxury goods like B&O's products. Consumer sentiment in late 2024 and early 2025 indicates caution, making the high-end electronics sector particularly vulnerable to reduced disposable income.

The rapid pace of technological advancement and short product lifecycles necessitate continuous, substantial R&D investment for B&O to remain competitive. Failure to integrate emerging audio technologies and connectivity standards, such as advanced spatial audio or next-gen Bluetooth, risks diminishing product appeal and market share.

Supply chain disruptions due to geopolitical tensions or unforeseen events can severely impact production and availability. The semiconductor shortage experienced in 2020-2021 serves as a stark reminder of this vulnerability, potentially leading to delays and increased costs.

SWOT Analysis Data Sources

This Bang & Olufsen SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence from leading industry analysts, and expert insights from seasoned professionals in the luxury goods sector.