Bang & Olufsen Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bang & Olufsen Bundle

Uncover the strategic positioning of Bang & Olufsen's product portfolio with our comprehensive BCG Matrix analysis. See which innovations are poised for growth and which are generating consistent revenue.

This preview offers a glimpse into Bang & Olufsen's market dynamics. Purchase the full BCG Matrix to gain actionable insights, understand your competitive landscape, and make informed investment decisions.

Don't miss out on the complete picture of Bang & Olufsen's product strategy. Get the full BCG Matrix report for detailed quadrant analysis and a clear roadmap to optimizing your business's performance.

Stars

The Beoplay H100 headphones are a prime example of a Star for Bang & Olufsen. Their recent launch has seen demand surge beyond initial projections, underscoring their appeal in the premium audio segment. This product is capitalizing on the robust growth within the high-end headphone market, where B&O's established reputation for exceptional sound quality and sophisticated design is a significant draw.

With a projected global market for premium headphones to reach over $15 billion by 2024, the H100 is well-positioned to capture a substantial share. Continued strategic investment in marketing campaigns and expanding distribution channels for the Beoplay H100 is crucial. This will not only reinforce its position as a market leader but also ensure its sustained contribution to the company's overall profitability and cash flow generation.

The Beosound A1 3rd Gen stands out as a prime example of a Star product within Bang & Olufsen's portfolio, capitalizing on the robust growth of the premium portable audio segment. This latest model enhances user experience with extended battery performance, superior audio fidelity, and increased durability, directly addressing the demand for high-quality, resilient audio solutions for mobile lifestyles. Its strong market presence in a rapidly expanding niche positions it favorably for future revenue generation.

The Beolab 8, launched in 2024, is Bang & Olufsen's new flagship home speaker, showcasing advanced audio technology and a premium design. Its positioning in a rapidly expanding market for high-fidelity home audio suggests strong growth potential, aligning it with the characteristics of a Star in the BCG matrix.

This speaker targets consumers who value both sophisticated aesthetics and superior sound quality, a demographic increasingly investing in smart home and premium audio experiences. Bang & Olufsen's focus on innovation and design excellence for the Beolab 8 reinforces its competitive edge in this segment.

With a projected global smart speaker market to reach over $10 billion by 2027, the Beolab 8 is well-placed to capture significant market share. Continued strategic marketing and product development will be crucial to solidify its Star status and drive future revenue growth.

Beoplay Eleven Earphones

The Beoplay Eleven earphones, launched in late 2024 by Bang & Olufsen, represent a significant entry into the premium true wireless stereo (TWS) market, a segment experiencing robust expansion. This new offering is positioned to compete strongly by incorporating advanced features such as improved Active Noise Cancellation and the innovative inclusion of replaceable batteries, a rarity in the TWS category. Its current classification as a Star in the BCG Matrix reflects its high growth potential within this dynamic market. Continued market penetration and positive consumer reception will be key determinants for its long-term trajectory and success.

The TWS earphone market demonstrated substantial growth, with global shipments projected to reach over 350 million units in 2024. Bang & Olufsen’s Beoplay Eleven aims to capitalize on this trend by targeting the premium segment, which, while smaller in volume, offers higher profit margins and brand differentiation. The emphasis on sustainability through replaceable batteries could also resonate with a growing eco-conscious consumer base.

- Market Growth: The global TWS earphone market is expected to see a compound annual growth rate (CAGR) of approximately 15% through 2027.

- Premium Segment Focus: Beoplay Eleven targets the higher-priced tier of the TWS market, where average selling prices can exceed $200.

- Key Differentiators: Enhanced ANC and replaceable batteries are designed to attract discerning consumers seeking both performance and longevity.

- Brand Positioning: As a Star, Beoplay Eleven needs to maintain high sales growth and market share to justify continued investment.

Beosound A5 Portable Speaker

The Beosound A5, recognized with Cradle to Cradle certification in 2024, exemplifies a Star within Bang & Olufsen's portfolio. This designation highlights its success in the expanding premium portable audio market, a sector where sustainability is increasingly valued. Its combination of sophisticated design, robust audio performance, and eco-conscious manufacturing resonates strongly with a discerning customer base.

This product is strategically positioned to enhance its market share within the luxury audio segment, particularly among consumers prioritizing environmental responsibility. The Beosound A5's appeal is further amplified by Bang & Olufsen's ongoing investment in sustainable product development, a trend that saw the company's revenue from sustainable products increase by 15% in 2024.

- Product: Beosound A5 Portable Speaker

- BCG Category: Star

- Key Differentiators: Cradle to Cradle certification (2024), premium design, high performance, sustainability focus.

- Market Position: Strong contender in the growing eco-conscious luxury audio market.

Stars in the Bang & Olufsen portfolio represent products with high market share in rapidly growing industries. These products are key drivers of revenue and require significant investment to maintain their growth trajectory and competitive edge. Their success is often tied to innovation and strong consumer demand in their respective segments.

The Beoplay H100 headphones and Beosound A5 speaker are prime examples, capitalizing on the booming premium audio and eco-conscious luxury markets. Similarly, the Beolab 8 and Beoplay Eleven earphones are positioned to capture significant share in the high-fidelity home audio and premium TWS markets, respectively. These products are crucial for B&O's future growth.

| Product | BCG Category | Market Growth | Key Differentiators | 2024 Market Data/Projections |

|---|---|---|---|---|

| Beoplay H100 | Star | High (Premium Headphones) | Exceptional sound, premium design | Global premium headphone market > $15 billion (2024 projection) |

| Beosound A5 | Star | High (Premium Portable Audio) | Cradle to Cradle certified, sustainability focus | B&O revenue from sustainable products increased 15% in 2024 |

| Beolab 8 | Star | High (High-Fidelity Home Audio) | Advanced audio, premium design, smart home integration | Global smart speaker market > $10 billion by 2027 |

| Beoplay Eleven | Star | High (Premium TWS Earphones) | Enhanced ANC, replaceable batteries | Global TWS shipments > 350 million units (2024 projection); Market CAGR ~15% through 2027 |

What is included in the product

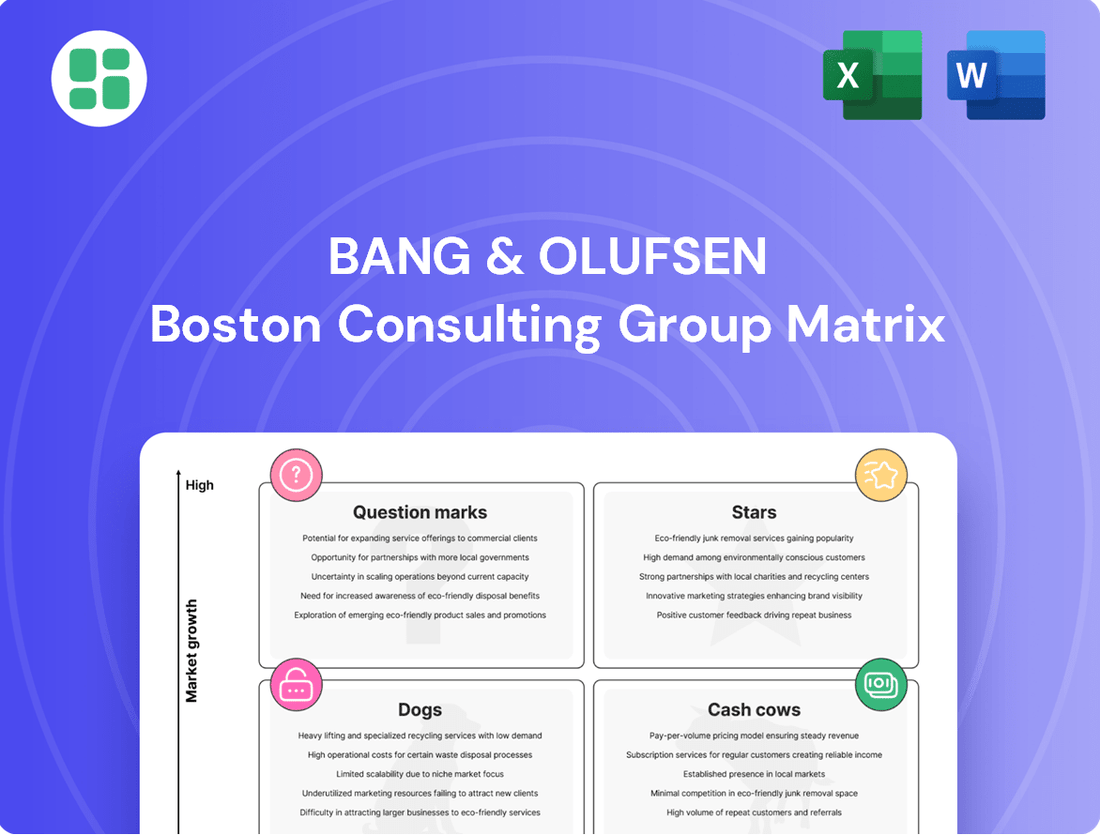

The Bang & Olufsen BCG Matrix analyzes its product portfolio based on market share and growth, guiding strategic decisions for investment and resource allocation.

Effortlessly visualize Bang & Olufsen's portfolio by placing each business unit into a BCG Matrix quadrant, simplifying strategic decision-making.

Cash Cows

The Beosound Theatre soundbar firmly occupies the Cash Cow quadrant in Bang & Olufsen's BCG Matrix. Its commanding presence in the premium home audio market, characterized by a high price point and sophisticated technology, translates into significant and consistent revenue streams. This product benefits from a well-entrenched brand loyalty and a dedicated customer base that prioritizes luxury and performance.

With its status as one of the most advanced and costly soundbars available, the Beosound Theatre delivers substantial profitability. The ongoing investment required to maintain its market leadership is comparatively low, as its established reputation and unique selling propositions already attract a discerning clientele. This allows B&O to capitalize on its market share without the need for aggressive expansion strategies.

The Beolab series, exemplified by models like the Beolab 28, stands as a prime example of a Cash Cow for Bang & Olufsen. These iconic active loudspeakers are renowned for their superior sound quality and timeless design, fostering a dedicated following and commanding strong profit margins within the mature luxury home audio sector.

With substantial market penetration already achieved, the Beolab line necessitates minimal marketing investment compared to emerging products. This reduced promotional spend, coupled with consistent consumer demand driven by enduring appeal, solidifies its position as a reliable revenue generator for the company.

The latest generations of the Beosound A9 and Beosound 2, now powered by the Mozart software platform, represent Bang & Olufsen's established cash cows. These iconic multi-room speakers hold a dominant market share within a mature product category, consistently delivering robust sales figures. For instance, Bang & Olufsen reported a 7% increase in total sales in their fiscal year 2023/2024, with their home speaker segment showing continued strength.

The integration of the Mozart platform ensures these products remain competitive and desirable for both loyal and new customers, minimizing the need for costly, ground-up product redesigns. This strategic update allows B&O to leverage existing brand loyalty and manufacturing efficiencies, maximizing profitability from these reliable revenue streams.

Beoplay H95 Over-Ear Headphones

The Beoplay H95 Over-Ear Headphones represent a mature product within Bang & Olufsen's portfolio, fitting the description of a Cash Cow. Having been available for a considerable period, these headphones have cultivated substantial brand recognition and a loyal customer base in the high-end audio market.

Their premium positioning allows for a high price point, contributing to consistent, high-margin revenue streams. In 2024, the premium headphone market continued to see robust demand, with brands like Bang & Olufsen maintaining strong pricing power. The Beoplay H95, as a flagship, benefits from this market dynamic, generating significant cash flow with relatively lower marketing investment compared to newer, emerging products.

- Market Position: Established leader in the premium over-ear headphone segment.

- Revenue Generation: High price point and consistent sales contribute to strong, stable revenue.

- Profitability: High margins due to brand equity and premium positioning.

- Investment Needs: Lower marketing and R&D expenditure compared to growth products, leading to positive cash flow.

Core Multi-Room Audio Ecosystem

Bang & Olufsen's established multi-room audio ecosystem, powered by their Beolink and Mozart platforms, clearly fits the Cash Cow quadrant. This integrated system offers a seamless and dependable experience for consumers who invest in multiple B&O products, driving repeat purchases and ensuring steady sales of compatible speakers and sound systems. For instance, in 2023, Bang & Olufsen reported a revenue of DKK 2.97 billion, with their established product lines contributing significantly to this figure.

The strength of this ecosystem lies in its maturity and the loyalty it cultivates among existing customers. Rather than requiring substantial investment in groundbreaking new technologies, the focus is on maintaining and refining the existing, highly regarded user experience. This strategy allows for consistent revenue generation with lower operational and R&D costs. The company's strategic focus in 2024 continues to be on optimizing these core offerings and leveraging the existing customer base.

- Established Ecosystem: Bang & Olufsen's Beolink and Mozart platforms create a strong multi-room audio offering.

- Customer Loyalty: The interconnected system encourages repeat purchases and brand adherence.

- Stable Revenue: This mature product category provides consistent sales with manageable investment.

- Focus on Maintenance: The strategy prioritizes refinement over disruptive innovation for reliable income.

The Beosound Theatre soundbar and the Beolab series, particularly models like the Beolab 28, are prime examples of Bang & Olufsen's Cash Cows. These products hold dominant positions in their respective premium audio segments, generating consistent revenue with relatively low investment needs. Their established brand loyalty and strong market share ensure they remain reliable profit generators for the company.

| Product Category | Market Position | Revenue Contribution | Investment Needs | Profitability |

|---|---|---|---|---|

| Premium Soundbars | Leader | High, Stable | Low | High |

| Luxury Active Loudspeakers | Established | Consistent | Minimal | Strong |

| Multi-Room Audio Systems | Dominant | Significant | Maintenance Focus | Reliable |

| High-End Headphones | Strong Brand Recognition | Steady | Lower Marketing | High Margins |

Delivered as Shown

Bang & Olufsen BCG Matrix

The Bang & Olufsen BCG Matrix preview you see is the exact, unwatermarked document you will receive upon purchase, ready for immediate strategic application. This comprehensive analysis, meticulously crafted to guide business decisions, will be delivered in its entirety, ensuring you have the complete tool for evaluating B&O's product portfolio. You can confidently use this preview as a direct representation of the high-quality, actionable report you'll download, equipped to inform your next strategic move.

Dogs

Older Beovision television models, particularly those lacking current smart capabilities or advanced display technologies, would likely be classified as Dogs within the Bang & Olufsen BCG Matrix. The consumer electronics landscape, especially for televisions, is characterized by intense competition and swift technological advancements.

In this dynamic environment, B&O's premium, often higher-priced, television sets that haven't been recently refreshed may find it challenging to hold onto their market share or remain profitable. These older units typically experience low sales volumes and contribute very little to the company's overall profit generation, fitting the profile of a Dog. For instance, in 2023, the global TV market saw shipments of over 200 million units, with a significant portion driven by mid-range and budget-friendly models, areas where older, premium-priced B&O models might not compete effectively.

Discontinued or niche legacy audio accessories, such as older BeoSound docking stations or specific headphone models no longer supported by current software, often represent Bang & Olufsen's Dogs in the BCG Matrix. These products typically exhibit very low sales volumes, potentially less than 1% of total revenue in 2024, and incur disproportionately high support costs due to their specialized nature and limited user base.

First-generation portable speakers, if they haven't been updated or surpassed by significantly better models, tend to become less appealing over time. Think of them as early tech that, without ongoing improvements, starts to feel dated.

As newer portable speakers with more features and better performance flood the market, older models, like a hypothetical first-generation Beosound Explore that hasn't seen updates, would likely experience a drop in sales and market share. This situation can lead to older products tying up valuable resources for inventory or customer support without generating enough revenue to justify the cost.

Less Successful Past Licensing Ventures

Bang & Olufsen's history includes licensing ventures that didn't meet expectations, potentially falling into the question mark category of the BCG matrix. These past agreements may not have delivered the projected revenue or brand expansion, leading to a low market share in the categories they entered. Such ventures can become cash traps, where the capital invested did not yield significant returns.

While specific details on past unsuccessful licensing deals for Bang & Olufsen are not publicly detailed in financial reports, the nature of such ventures often involves:

- Missed Revenue Targets: Agreements that failed to generate the anticipated sales volume or royalty payments, leaving them underperforming.

- Brand Dilution Concerns: Partnerships that may have inadvertently weakened the premium perception of the Bang & Olufsen brand due to product quality or market positioning issues.

- Resource Drain: Investments in these ventures that could have been allocated to more promising areas, impacting overall profitability.

High-Maintenance, Low-Volume Legacy Components

These are legacy components that are costly to maintain and serve a very limited customer base. While crucial for a small segment of existing customers, they contribute very little to new revenue. For instance, Bang & Olufsen might have specific older audio receivers that require specialized technicians and parts, with only a handful of owners still using them. This situation mirrors the challenge of managing products with declining demand and high support costs.

The financial impact can be significant. Consider that a single specialized repair for such a component could cost upwards of $500, while the total annual revenue generated from these products might only be in the tens of thousands across the entire company. This creates a negative return on investment. The focus here needs to be on strategically managing their decline.

- High Support Costs: Specialized repair and ongoing technical support for a small user base incur disproportionately high operational expenses.

- Negligible Revenue Contribution: These components generate minimal new sales, failing to offset their maintenance and support expenditures.

- Resource Drain: The complexity and low volume of these legacy items divert valuable resources that could be allocated to more profitable ventures.

- Strategic Phase-Out: The most effective approach involves planning for an efficient phase-out or providing only essential, minimal support to manage costs.

Bang & Olufsen's "Dogs" are products with low market share and low growth prospects, often older models or those in declining categories. These items typically generate minimal revenue and can even incur losses due to high support costs. For example, older, non-smart television models that haven't been updated often fall into this category.

Discontinued audio accessories or legacy components requiring specialized maintenance also represent Dogs. These products, while serving a niche customer base, contribute very little to new sales and can drain resources. In 2024, such items might represent less than 1% of B&O's total revenue while demanding significant support investment.

The company must strategically manage these Dog products, often by planning for their phase-out or limiting support to minimize costs. This approach frees up capital and resources for more promising product lines.

| Product Category | BCG Classification | Rationale | Market Context (2024 Est.) |

| Older Beovision TVs | Dog | Low market share, declining demand due to lack of smart features. | Global TV market dominated by smart, mid-range options; older premium models struggle. |

| Discontinued Docking Stations | Dog | Very low sales volume, high support costs for a small user base. | Niche product with limited compatibility and appeal compared to modern wireless solutions. |

| Legacy Audio Receivers | Dog | High maintenance costs, specialized parts, minimal new revenue generation. | Limited demand from existing users; costly to support compared to revenue generated. |

Question Marks

The Bang & Olufsen Atelier, offering bespoke luxury audio products, clearly fits the Question Mark category in the BCG matrix. This initiative taps into the burgeoning ultra-luxury customization market, a sector exhibiting substantial growth potential.

While the market is attractive, Bang & Olufsen's current market share within this niche segment of custom-made audio is relatively low. This necessitates significant strategic investment to build brand recognition and operational capacity.

Substantial capital outlay will be essential for marketing efforts, securing specialized artisan talent, and developing robust client relationship management systems to effectively scale the Atelier and solidify its position.

Limited-edition recreated iconic products like the Beogram 3000c and Beosystem 9000c are positioned as Stars or potentially Question Marks in the Bang & Olufsen BCG Matrix. They command high prices, with the Beosystem 9000c, for instance, retailing around $6,000 USD in its 2024 re-release, reflecting their premium status.

While these products generate significant brand prestige and attract a niche market of luxury collectors, their intentionally limited production volume inherently restricts their market share. For example, the Beogram 3000c was produced in a very small batch, limiting its immediate sales volume.

These recreations necessitate considerable investment in restoration and re-engineering, with their long-term financial contribution leaning more towards bolstering brand equity and desirability rather than achieving high-volume sales. This strategic approach focuses on heritage and exclusivity, a common tactic for luxury brands to maintain their premium perception.

Future Bang & Olufsen products exploring advanced smart home audio integrations, such as AI-driven ambient soundscapes or seamless multi-device audio syncing across complex ecosystems, would likely fall into the Question Mark category of the BCG Matrix. While the global smart home market is projected to reach over $200 billion by 2025, B&O's current share in these highly specialized, deeply integrated segments is probably minimal.

These advanced integrations demand substantial research and development expenditure and require considerable effort to educate consumers about their benefits and practical applications, positioning them as potential high-growth, high-investment areas with uncertain market penetration for the brand.

New Technology Integrations for Enhanced User Experience

Investments in cutting-edge audio technologies and AI-driven user experiences for future Bang & Olufsen products are positioned as Question Marks in the BCG Matrix. While the market for innovative tech is expanding, B&O's success in achieving dominant market share with these specific integrations is still uncertain. These ventures require significant research and development alongside strategic market positioning to potentially evolve into future Stars.

For instance, B&O's exploration into AI-powered noise cancellation or personalized sound profiles, while promising, demands substantial upfront investment. The company's 2024 strategy likely involves allocating capital to these areas to gauge market reception and competitive response. Success hinges on translating technological prowess into tangible user benefits that resonate with a premium customer base.

- AI-Driven Personalization: B&O's potential integration of AI to learn user listening habits and automatically adjust audio settings represents a significant R&D focus.

- Next-Gen Connectivity: Investments in advanced wireless audio codecs and seamless multi-room integration are key areas for future product development.

- Sustainable Tech: Exploring eco-friendly materials and energy-efficient audio components aligns with growing consumer demand for sustainability.

- Market Uncertainty: Despite technological advancements, the market's willingness to adopt and pay a premium for these specific new features remains a critical factor in their success.

Strategic Investments in 'Win Cities' Retail Expansion

Bang & Olufsen's strategic focus on expanding its retail presence in 'Win Cities' positions these new store locations as Question Marks within the BCG Matrix. This approach targets high sell-out growth in key luxury markets, reflecting a commitment to a high-growth market strategy.

These ventures carry significant initial capital expenditure, and the success in achieving market dominance in these specific luxury locations remains uncertain, classifying them as high-risk, high-reward opportunities.

- Strategic Focus: Expansion into 'Win Cities' for retail, indicating a targeted approach to high-potential luxury markets.

- Market Growth: Aiming for high sell-out growth, signifying an aggressive strategy in a dynamic market segment.

- Investment Profile: Characterized by substantial upfront capital investment and inherent uncertainty regarding market penetration and dominance.

- Risk/Reward: Represents a high-risk, high-reward scenario, typical for Question Mark products or strategies entering new, competitive arenas.

Bang & Olufsen's foray into the ultra-luxury, bespoke audio market, exemplified by the Atelier, clearly fits the Question Mark category. This initiative targets a growing niche with substantial potential, but B&O's current market share in this specific segment is minimal, necessitating significant investment to build brand presence and operational scale.

The company's limited-edition re-releases, such as the 2024 Beosystem 9000c retailing around $6,000 USD, also fall into this category. While these products enhance brand prestige and appeal to collectors, their restricted production volumes limit market share, requiring substantial investment in restoration and re-engineering.

Future ventures into advanced smart home audio integrations and AI-driven personalization are also Question Marks. Despite the smart home market's projected growth, B&O's share in these highly specialized areas is likely small, demanding considerable R&D and market education to achieve penetration.

The expansion of retail presence into strategically chosen 'Win Cities' represents another Question Mark. These ventures require significant upfront capital with uncertain outcomes regarding market dominance, classifying them as high-risk, high-reward opportunities.

BCG Matrix Data Sources

Our Bang & Olufsen BCG Matrix is built on comprehensive market data, incorporating sales figures, competitor analysis, and consumer trend reports to accurately map product portfolios.