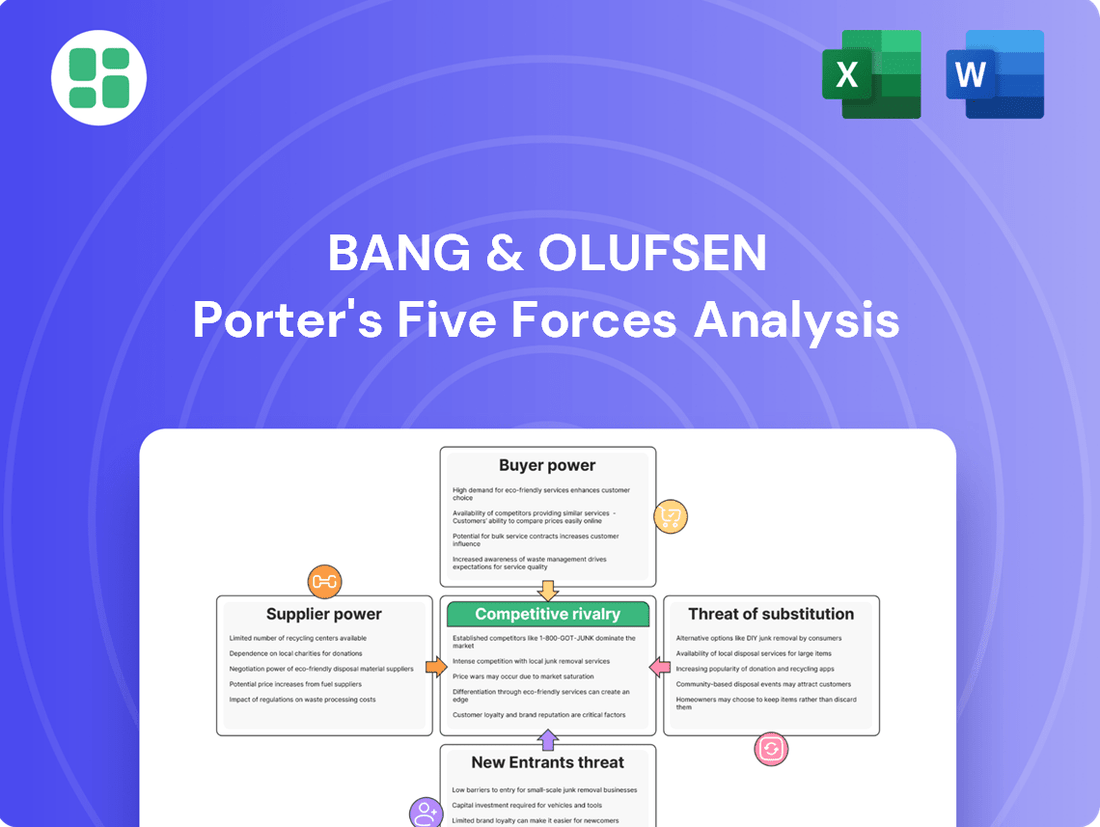

Bang & Olufsen Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bang & Olufsen Bundle

Bang & Olufsen navigates a competitive landscape shaped by powerful buyer loyalty to premium brands and the significant threat of substitutes in the audio-visual market. Their strong brand equity and innovative product design offer a buffer against intense rivalry, but the influence of suppliers in the high-end component sector requires careful management.

The complete report reveals the real forces shaping Bang & Olufsen’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bang & Olufsen's reliance on specialized suppliers for unique, high-quality components such as custom audio drivers and premium metals grants these suppliers considerable bargaining power. These essential materials are often not readily available from multiple sources, making it difficult for Bang & Olufsen to switch suppliers easily. For instance, in 2024, the global market for high-fidelity audio components saw continued consolidation, further concentrating power among a few key manufacturers.

Suppliers offering unique, patented audio technologies or exclusive design elements hold significant leverage. Bang & Olufsen's commitment to premium, innovative products means they may rely on a limited number of suppliers possessing these cutting-edge capabilities. This dependence underscores the importance of nurturing robust supplier partnerships to guarantee ongoing access to advanced solutions, crucial for maintaining their product differentiation.

Global supply chain disruptions, like the component shortages and logistical hurdles seen in recent years, can significantly bolster the bargaining power of suppliers. When essential parts are scarce or transportation becomes unreliable, suppliers can dictate terms and increase prices, directly impacting companies like Bang & Olufsen.

As of June 2024, Bang & Olufsen works with 98 suppliers spread across four distinct regions. While this diversification offers some resilience, it also means the company’s operations remain susceptible to global events that can disrupt these interconnected supply lines, potentially giving these suppliers greater leverage.

Brand Reputation and Exclusivity

Some suppliers gain prestige by associating with a luxury brand like Bang & Olufsen, which can elevate their own market reputation. This association can be particularly valuable for suppliers of specialized components, as their unique offerings directly contribute to Bang & Olufsen's premium product differentiation. For instance, a supplier of advanced acoustic drivers might leverage their relationship with B&O to command higher prices or secure more favorable terms, especially if their technology is difficult to replicate.

The bargaining power of these suppliers is influenced by the exclusivity of their offerings. If Bang & Olufsen relies on a particular supplier for a critical, high-performance component that is not readily available elsewhere, that supplier holds significant leverage. This dependency can be seen in the high cost of specialized audio components, where innovation and proprietary technology justify premium pricing. For example, in 2024, the average cost of high-fidelity speaker drivers can range significantly, with custom-designed units for premium brands often exceeding several hundred dollars per unit, reflecting the specialized R&D and manufacturing involved.

- Supplier Prestige: Association with luxury brands like Bang & Olufsen enhances supplier reputation.

- Critical Components: Suppliers of unique, high-performance parts hold considerable power.

- Mutual Dependency: While B&O needs specialized inputs, suppliers benefit from the association.

- Cost of Innovation: Specialized component costs, often in the hundreds of dollars per unit in 2024, reflect supplier R&D and exclusivity.

Switching Costs

Switching suppliers for highly integrated or custom-designed components presents significant challenges for Bang & Olufsen. The process often necessitates substantial re-engineering efforts, rigorous testing protocols, and extensive quality assurance procedures, all of which translate into considerable time and financial investment.

These high switching costs directly bolster the bargaining power of Bang & Olufsen's existing suppliers. The prospect of incurring significant expenses and facing production delays makes it less feasible for Bang & Olufsen to seek alternative suppliers, thereby strengthening the leverage of current partners.

- Component Integration: Bang & Olufsen's reliance on specialized, often proprietary, audio components means that finding direct replacements with equivalent performance and compatibility is difficult.

- R&D Investment: Suppliers who have co-invested in the research and development of unique components for Bang & Olufsen create a strong lock-in effect.

- Supply Chain Disruption: A change in supplier for critical components could lead to a temporary halt in production, impacting Bang & Olufsen's ability to meet market demand and potentially damaging its brand reputation for timely delivery.

Suppliers of unique, high-performance audio components, such as custom drivers and premium metals, hold considerable bargaining power over Bang & Olufsen. This leverage stems from the specialized nature of these inputs, often protected by patents or requiring significant R&D, making them difficult to source elsewhere. For instance, in 2024, the market for advanced acoustic materials saw limited suppliers capable of meeting the stringent quality demands of luxury audio brands.

The high switching costs associated with re-engineering and re-qualifying new suppliers for these critical parts further strengthen supplier leverage. Bang & Olufsen's commitment to premium product differentiation means reliance on a select few suppliers who possess proprietary technologies, creating a dependency that can lead to less favorable pricing and terms for B&O.

The bargaining power of suppliers is also amplified by global supply chain volatility, as seen with component shortages in recent years. When essential parts are scarce, suppliers can dictate terms, increasing prices and impacting production schedules for companies like Bang & Olufsen, which works with 98 suppliers across four regions as of June 2024.

| Factor | Impact on B&O | Example (2024 Data) |

|---|---|---|

| Component Exclusivity | High leverage for suppliers | Custom speaker drivers costing hundreds of dollars per unit |

| Switching Costs | Supplier lock-in | Significant investment in re-engineering and testing |

| Supplier Prestige | Supplier advantage | Association with a luxury brand enhances supplier reputation |

| Supply Chain Disruptions | Increased supplier power | Component shortages leading to price hikes and delivery delays |

What is included in the product

Bang & Olufsen's Porter's Five Forces analysis reveals the intense competition from established audio brands and the growing threat of lower-cost alternatives, while also highlighting the company's strong brand loyalty and premium pricing power.

Instantly gauge competitive intensity with a visual representation of each force, enabling swift strategic adjustments.

Customers Bargaining Power

Bang & Olufsen's focus on a niche luxury market significantly dampens customer bargaining power. Affluent consumers in this segment prioritize design, sound quality, and brand status, making them less sensitive to price fluctuations. For instance, in 2024, the global luxury goods market continued its upward trajectory, with consumers demonstrating a willingness to invest in high-quality, exclusive products, a trend that directly benefits brands like Bang & Olufsen.

Customers in the luxury audio segment often display remarkable brand loyalty, a trait significantly influenced by the superior user experience, the enduring quality of products, and a deep emotional attachment to a brand's rich history and distinctive design ethos. This loyalty directly curtails their bargaining power.

Bang & Olufsen actively cultivates this loyalty by prioritizing the creation of memorable, long-lasting customer experiences and offering tailored solutions. For instance, their commitment to craftsmanship and innovation, evident in their premium pricing strategies, suggests a customer base willing to pay a premium for perceived value and exclusivity, thereby reducing their propensity to bargain aggressively.

While Bang & Olufsen is known for its distinctive design, customers in the premium audio segment still have a range of high-end alternatives. Competitors such as Bowers & Wilkins, Sennheiser, and Bose offer sophisticated audio products, providing consumers with choices that might better align with their specific requirements or budget considerations.

Direct-to-Consumer (D2C) and Retail Experience

Bang & Olufsen is actively refining its retail presence, focusing on direct-to-consumer (D2C) channels and enhancing the in-store customer journey. This strategic shift allows them to cultivate direct relationships with buyers, offering a more controlled and personalized experience. By doing so, they aim to build stronger brand loyalty and a deeper understanding of consumer desires, which can effectively mitigate the bargaining power of customers.

This direct engagement is crucial for several reasons:

- Enhanced Customer Relationships: Direct interaction allows B&O to gather valuable feedback and tailor offerings, fostering a sense of exclusivity and connection that can reduce price sensitivity.

- Controlled Brand Experience: By managing their own retail and online platforms, B&O ensures a consistent brand message and service quality, differentiating themselves from competitors and potentially lessening the impact of price-based comparisons by customers.

- Data-Driven Insights: Direct sales provide rich data on purchasing habits and preferences, enabling B&O to optimize product development and marketing, thereby increasing perceived value and diminishing customer reliance on price alone.

- Reduced Reliance on Intermediaries: Cutting out traditional retail partners can lead to better margins and a more direct line of communication with the end-user, giving B&O more control over the sales process and customer perception.

Influence of Reviews and Social Media

In today's digitally connected world, online reviews and social media have become powerful tools for customers. A single negative review can quickly gain traction, potentially influencing the purchasing decisions of many others. For instance, by mid-2024, platforms like Trustpilot and social media channels are often the first stop for consumers researching high-end audio equipment.

While a single customer's direct bargaining power with a premium brand like Bang & Olufsen might be limited in price negotiations, their collective voice, amplified through online platforms, can significantly shape public perception. This indirect influence on brand reputation and future sales is a critical aspect of customer power.

- Online Sentiment Impact: Studies in 2024 indicate that over 80% of consumers read online reviews before making a purchase, especially for luxury goods.

- Social Media Amplification: Viral social media posts, whether positive or negative, can reach millions, impacting brand perception far beyond individual customer interactions.

- Reputation Management: Companies must actively monitor and respond to online feedback to mitigate negative sentiment and leverage positive experiences.

The bargaining power of customers for Bang & Olufsen is generally low, primarily due to the brand's luxury positioning and the nature of its target market. In 2024, the luxury audio segment continued to see discerning consumers who value brand prestige, superior craftsmanship, and unique design over price alone. This customer base is often less price-sensitive and more focused on the overall experience and perceived exclusivity.

Bang & Olufsen's strategy of cultivating strong brand loyalty through direct customer engagement and premium product offerings further diminishes customer bargaining power. By controlling the customer journey and emphasizing product quality and innovation, the company reinforces its value proposition, making customers less inclined to negotiate on price.

While competitors offer alternatives, Bang & Olufsen differentiates itself through its distinct design language and heritage, creating a loyal following that is less susceptible to switching based on price alone. The company's focus on direct-to-consumer channels in 2024 also allows for greater control over pricing and customer interaction, reinforcing its premium brand image.

The collective voice of customers, amplified through online reviews and social media, represents an indirect form of power. However, for a brand like Bang & Olufsen, positive sentiment, driven by exceptional product experiences, often outweighs negative feedback, thereby maintaining the brand's perceived value and limiting the impact of price-based bargaining.

What You See Is What You Get

Bang & Olufsen Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Bang & Olufsen Porter's Five Forces Analysis provides an in-depth examination of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. What you're previewing is exactly what you'll receive, offering actionable insights for strategic decision-making.

Rivalry Among Competitors

The luxury audio-visual market, where Bang & Olufsen operates, is characterized by a concentrated niche with a limited number of key players. While the overall market is expanding, it remains a space dominated by established brands that have built strong reputations over time.

Competition within this segment is fierce, with companies like Bang & Olufsen, Bowers & Wilkins, and Devialet vying for market share. The focus is heavily on differentiating through superior design aesthetics, exceptional sound fidelity, cutting-edge technological innovation, and the prestige associated with the brand name, rather than engaging in price wars.

For instance, in 2023, the global luxury audio market was valued at approximately $10.5 billion, with projections indicating continued growth. This concentration means that new entrants face significant barriers to entry, and existing players must constantly innovate to maintain their competitive edge.

Bang & Olufsen's competitive rivalry is softened by its deeply ingrained brand legacy and a design differentiation that's incredibly hard for others to match. This isn't just about making speakers; it's about creating iconic pieces of art that happen to produce sound. This focus on unique aesthetics and superior craftsmanship, honed over decades, creates a significant barrier to entry for rivals looking to compete purely on price in the premium audio space.

For instance, in 2023, Bang & Olufsen reported revenue of DKK 2.7 billion (approximately $390 million USD), a testament to the enduring appeal of their distinct product philosophy. Competitors often struggle to replicate this level of brand recognition and design coherence, which allows Bang & Olufsen to command premium pricing and avoid the intense price wars seen in less differentiated markets.

Competitive rivalry in the audio industry is intensely fueled by a constant race to innovate in audio technology, smart home integration, and connectivity. This drive for advancement means companies must continually invest in research and development to stay relevant.

Major players such as Sony, Bose, and Harman International are at the forefront of this technology race, pouring significant resources into R&D. For instance, Sony's investments in audio technology are substantial, aiming to deliver superior sound quality and cutting-edge features that capture consumer interest and market share.

Global Players and Regional Focus

The competitive landscape for Bang & Olufsen is characterized by a mix of global luxury audio specialists and broader consumer electronics manufacturers with premium product lines. While North America and Europe represent significant markets, with substantial market share held by luxury audio brands, the intensity of rivalry varies by region.

Bang & Olufsen contends with competitors who often possess greater scale and broader product portfolios, allowing for potential price advantages or wider distribution networks. For example, in 2024, the premium audio segment saw continued growth, with companies like Apple and Samsung expanding their high-fidelity offerings, directly challenging established luxury players.

- Global Presence: Major competitors operate worldwide, intensifying rivalry across key markets.

- Regional Dominance: North America and Europe are critical battlegrounds for luxury audio market share.

- Diverse Competitors: Bang & Olufsen faces both niche luxury brands and large consumer electronics conglomerates.

- Premium Offerings: Competition is fierce from companies offering high-end audio solutions as part of their broader electronics portfolios.

Marketing and Distribution Strategies

Competitive rivalry in the audio sector significantly involves how companies market and distribute their products. Firms are constantly working to refine their retail presence and elevate the overall customer journey. This includes optimizing the in-store experience and building strong online platforms.

Bang & Olufsen, for instance, places a strong emphasis on reinforcing its luxury brand image and developing its own branded sales channels. This approach aims to directly engage consumers and differentiate its offerings in a crowded market. By controlling more of the distribution and customer interaction, B&O seeks to better compete and capture a larger share of the premium audio market.

- Retail Network Optimization: Bang & Olufsen's strategy involves a curated selection of own-brand stores and partnerships with high-end electronics retailers to ensure a consistent luxury experience.

- Branded Channel Strength: The company focuses on enhancing its direct-to-consumer (DTC) channels, including its website and flagship stores, to build brand loyalty and control the customer journey.

- Customer Experience Focus: Investments are made in creating immersive in-store and online experiences that highlight the craftsmanship and premium nature of Bang & Olufsen products.

- Market Share Ambition: By strengthening these marketing and distribution avenues, Bang & Olufsen aims to solidify its position in the competitive high-fidelity audio segment.

Competitive rivalry for Bang & Olufsen is intense, primarily driven by differentiation through design, sound quality, and brand prestige rather than price. While the luxury audio market is growing, with the global luxury audio market valued at approximately $10.5 billion in 2023, it's dominated by established players. Companies like Bang & Olufsen, Bowers & Wilkins, and Devialet compete fiercely, with innovation in audio technology and smart home integration being key battlegrounds. For instance, major players like Sony and Bose invest heavily in R&D to capture market share.

Bang & Olufsen's unique design legacy and brand recognition create a strong barrier to entry, allowing it to command premium pricing. In 2023, Bang & Olufsen reported revenue of DKK 2.7 billion (approximately $390 million USD). However, they face competition from larger consumer electronics companies like Apple and Samsung, who are expanding their high-fidelity offerings in 2024, intensifying rivalry across key global markets, particularly in North America and Europe.

| Competitor | 2023 Revenue (Approx. USD) | Key Differentiator |

| Bang & Olufsen | $390 Million | Iconic Design, Brand Prestige |

| Bowers & Wilkins | Undisclosed (Private) | Sound Fidelity, Engineering Excellence |

| Devialet | Undisclosed (Private) | Advanced Acoustic Technology |

| Sony | $85 Billion (Electronics Segment) | Technological Innovation, Broad Portfolio |

| Apple | $383 Billion (Total Revenue) | Ecosystem Integration, User Experience |

SSubstitutes Threaten

The threat of substitutes for Bang & Olufsen's premium audio solutions is significant, primarily stemming from mass-market audio products. Brands like Sonos, Bose, and even tech giants such as Apple and Amazon offer soundbars, headphones, and smart speakers that provide a functional audio experience at much lower price points. For instance, a Sonos Beam soundbar, a popular mid-range option, might retail for around $400, a fraction of the cost of many Bang & Olufsen systems.

These mass-market alternatives cater to a broad consumer base that prioritizes convenience and acceptable audio quality over the high-fidelity, design-centric experience offered by Bang & Olufsen. While they may not match the sonic precision or aesthetic appeal of B&O products, their accessibility and performance are sufficient for many users, thereby limiting the pricing power and market share expansion of premium brands.

Integrated home entertainment systems pose a significant threat. Modern televisions and smart home ecosystems frequently include built-in audio or easily pair with less expensive soundbars and speakers. For instance, by 2024, many mid-range TVs offer sound output comparable to entry-level dedicated sound systems, making them a viable alternative for budget-conscious consumers.

While these integrated solutions may not replicate the superior audio fidelity of Bang & Olufsen’s high-end products, they cater to a growing segment of the market prioritizing convenience and affordability. This accessibility means consumers can achieve a satisfactory home entertainment experience without investing in separate, premium audio components, thereby limiting the perceived need for specialized, high-priced systems.

The increasing quality of audio from smartphones, tablets, and laptops, coupled with the proliferation of portable Bluetooth speakers and true wireless earbuds, presents a significant threat of substitutes for personal listening. These devices offer a highly convenient and accessible alternative, catering to the basic need for audio consumption for a vast consumer base. For instance, the global true wireless stereo (TWS) earbuds market was projected to reach over $30 billion in 2024, demonstrating substantial consumer adoption of these substitute products.

DIY and Custom Home Audio Setups

For dedicated audiophiles, the allure of crafting their own home audio sanctuary is strong. These enthusiasts often opt for DIY or custom-built systems, piecing together high-fidelity components from a variety of specialized manufacturers. This approach can deliver exceptional sound quality, often rivaling or exceeding that of integrated luxury systems, but at a potentially more accessible price point. This allows them to bypass the premium associated with established luxury brands by curating a personalized, high-performance audio experience.

The DIY segment represents a significant threat to brands like Bang & Olufsen because it directly targets a core customer base that values performance and customization. In 2024, the global market for custom installation and DIY audio equipment continued to grow, with many consumers actively seeking out individual components like amplifiers, speakers, and digital-to-analog converters to build their ideal setups. This trend is fueled by online communities and readily available technical information, making it easier than ever for consumers to assemble sophisticated systems without relying on a single brand.

- Customization: DIY setups offer unparalleled personalization, allowing users to select specific components to match their exact sonic preferences and room acoustics.

- Cost-Effectiveness: By avoiding the brand premium and assembling components, audiophiles can often achieve superior performance for a lower overall investment compared to high-end integrated systems.

- Performance Focus: This segment prioritizes raw audio fidelity, often sourcing components from niche manufacturers known for specific technological advancements or sound signatures.

- Market Reach: The accessibility of online resources and specialized component retailers means this threat can reach a broad spectrum of technically inclined consumers.

Technological Convergence and Software Solutions

The increasing prevalence of high-resolution streaming services and sophisticated audio processing software significantly lowers the barrier to entry for enjoying premium sound quality. This technological convergence allows consumers to experience excellent audio fidelity on a broader array of devices, not just specialized, high-end audio equipment.

This shift means that a substantial portion of the value proposition moves from the physical hardware itself to the software and the content delivered. Consequently, the unique selling proposition of ultra-premium, dedicated hardware like Bang & Olufsen's may face erosion as comparable audio experiences become more accessible through less expensive means.

- Streaming Quality: Services like Tidal and Apple Music offer lossless audio, making high-fidelity sound widely available.

- Software Advancements: Digital Signal Processing (DSP) software in smartphones and soundbars can emulate premium audio characteristics.

- Device Versatility: High-quality audio can now be enjoyed on premium headphones, soundbars, and even advanced car audio systems, all powered by sophisticated software.

The threat of substitutes for Bang & Olufsen (B&O) is substantial, driven by accessible mass-market audio products and integrated entertainment systems. While B&O offers unparalleled design and sonic precision, alternatives from brands like Sonos and Bose provide satisfactory audio experiences at significantly lower price points. For instance, a Sonos Arc soundbar, a premium offering in its category, retails for around $800, a stark contrast to B&O's high-end systems that can easily exceed $5,000.

Furthermore, the increasing quality of audio from smartphones, laptops, and the widespread adoption of true wireless stereo (TWS) earbuds present a convenient and affordable alternative for personal listening. The global TWS market alone was projected to exceed $30 billion in 2024, highlighting a massive consumer shift towards these accessible audio solutions. This broad availability of functional audio across numerous devices directly challenges the necessity of investing in specialized, high-priced B&O products for basic audio needs.

The DIY audio segment also poses a threat, as enthusiasts increasingly build custom systems, sourcing individual high-fidelity components. This trend, fueled by online communities and specialized retailers, allows consumers to achieve exceptional sound quality, often rivaling or surpassing integrated luxury systems, but at a more controlled cost. In 2024, the market for custom installation and DIY audio continued its growth trajectory, indicating a segment of consumers actively seeking alternatives to premium brand ecosystems.

Entrants Threaten

The luxury audio-visual market demands a significant upfront financial commitment. Companies looking to enter this space need to invest heavily in cutting-edge research and development, establish sophisticated, high-precision manufacturing capabilities, and fund extensive marketing campaigns to cultivate a strong brand image. For instance, developing a new high-fidelity speaker system can easily cost millions in R&D alone, with manufacturing setup adding tens of millions more. This substantial capital requirement acts as a formidable barrier, effectively deterring many potential new competitors from entering the market.

Bang & Olufsen's nearly century-long legacy, established in 1925, has cemented a powerful brand reputation. This heritage is intrinsically linked with luxury, exceptional design, and superior audio performance, creating significant barriers for newcomers. In 2023, the luxury goods market, a key segment for B&O, continued its robust growth, with global sales reaching an estimated €362 billion, underscoring the value of established brand equity.

Bang & Olufsen's commitment to proprietary technology and design expertise creates a significant barrier to entry. Their unique blend of advanced engineering and artistic aesthetics, protected by patents and deeply ingrained design processes, is exceptionally difficult for newcomers to replicate. This focus on innovation, evident in their premium audio and visual products, requires substantial R&D investment and a specialized skillset that deters potential competitors.

Established Distribution Channels

Bang & Olufsen's success is heavily reliant on its access to specialized luxury retail networks, high-end dealerships, and custom installation partners. These channels are crucial for effectively reaching and engaging its target affluent customer base who expect a premium purchasing experience.

Gaining entry into these exclusive and often relationship-driven distribution channels presents a significant barrier for new competitors. For instance, securing prime retail space in luxury shopping districts or partnering with established custom installers requires substantial investment and proven credibility.

- Exclusive Retail Presence: Bang & Olufsen operates a curated network of over 700 own and partner-owned stores globally, many in prime luxury locations.

- Custom Installation Networks: The brand collaborates with a select group of custom integrators, vital for its high-end home theater and integrated audio systems.

- High Barrier to Entry: New entrants face considerable challenges in replicating this established network, which is built on years of trust and exclusive agreements.

Potential Entry by Tech Giants

The threat of new entrants, particularly from tech giants, poses a significant consideration for Bang & Olufsen. While the high-end audio market traditionally has high barriers to entry, large technology companies like Apple and Google possess substantial financial resources and established ecosystems that could facilitate market entry.

These tech behemoths could leverage their immense brand recognition and advanced software integration capabilities to challenge existing players. For instance, Apple's AirPods Pro, launched in late 2019 and seeing continued strong sales through 2024, demonstrates their ability to capture significant market share in premium audio through seamless ecosystem integration and brand loyalty.

However, their approach might diverge from Bang & Olufsen's core design-centric philosophy, potentially creating a different competitive dynamic. In 2023, Apple reported revenues exceeding $383 billion, highlighting the vast financial firepower that could be deployed into new market segments.

- Tech Giant Entry: Companies like Apple and Google possess the financial might and ecosystem integration to challenge the high-end audio market.

- Brand and Software Leverage: Existing brand loyalty and advanced software capabilities are key assets for potential tech entrants.

- Divergent Philosophies: A potential clash exists between the tech giants' focus on software and integration versus Bang & Olufsen's emphasis on premium design and craftsmanship.

- Market Share Impact: The success of products like Apple's AirPods Pro, which saw continued strong demand through 2024, underscores the potential for tech firms to disrupt established markets.

The luxury audio-visual market presents substantial barriers to entry due to high capital requirements for R&D, manufacturing, and brand building. Bang & Olufsen's established brand equity, built over a century, and its proprietary technology further solidify its position, making it difficult for new companies to compete effectively. While tech giants like Apple and Google could leverage their financial strength and ecosystems, their market approach may differ from B&O's design-centric focus.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point |

|---|---|---|---|

| Capital Requirements | High investment in R&D, precision manufacturing, and marketing. | Deters many potential competitors. | New high-fidelity speaker R&D can cost millions; manufacturing setup tens of millions. |

| Brand Reputation & Legacy | Nearly century-long heritage associated with luxury, design, and audio quality. | Creates significant difficulty in replicating brand loyalty and perception. | Global luxury goods market reached €362 billion in 2023. |

| Proprietary Technology & Design | Unique blend of advanced engineering, artistic aesthetics, patents, and design processes. | Extremely difficult for newcomers to replicate. | Substantial R&D investment required for innovation. |

| Distribution Channels | Access to specialized luxury retail networks, high-end dealerships, and custom installers. | Challenging to replicate established, relationship-driven networks. | B&O operates over 700 stores globally and collaborates with select custom integrators. |

| Competition from Tech Giants | Large tech companies with vast financial resources and ecosystems. | Potential to disrupt market through brand recognition and software integration. | Apple's AirPods Pro sales demonstrate market capture ability; Apple's 2023 revenue exceeded $383 billion. |

Porter's Five Forces Analysis Data Sources

Our Bang & Olufsen Porter's Five Forces analysis is built upon a foundation of comprehensive data, including annual reports, industry-specific market research from firms like Statista and Euromonitor, and detailed competitor financial filings.

We leverage insights from financial news outlets, Bloomberg terminals, and expert analysis from investment banks to accurately gauge the bargaining power of buyers and suppliers, as well as the threat of new entrants and substitutes.