Bang & Olufsen PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bang & Olufsen Bundle

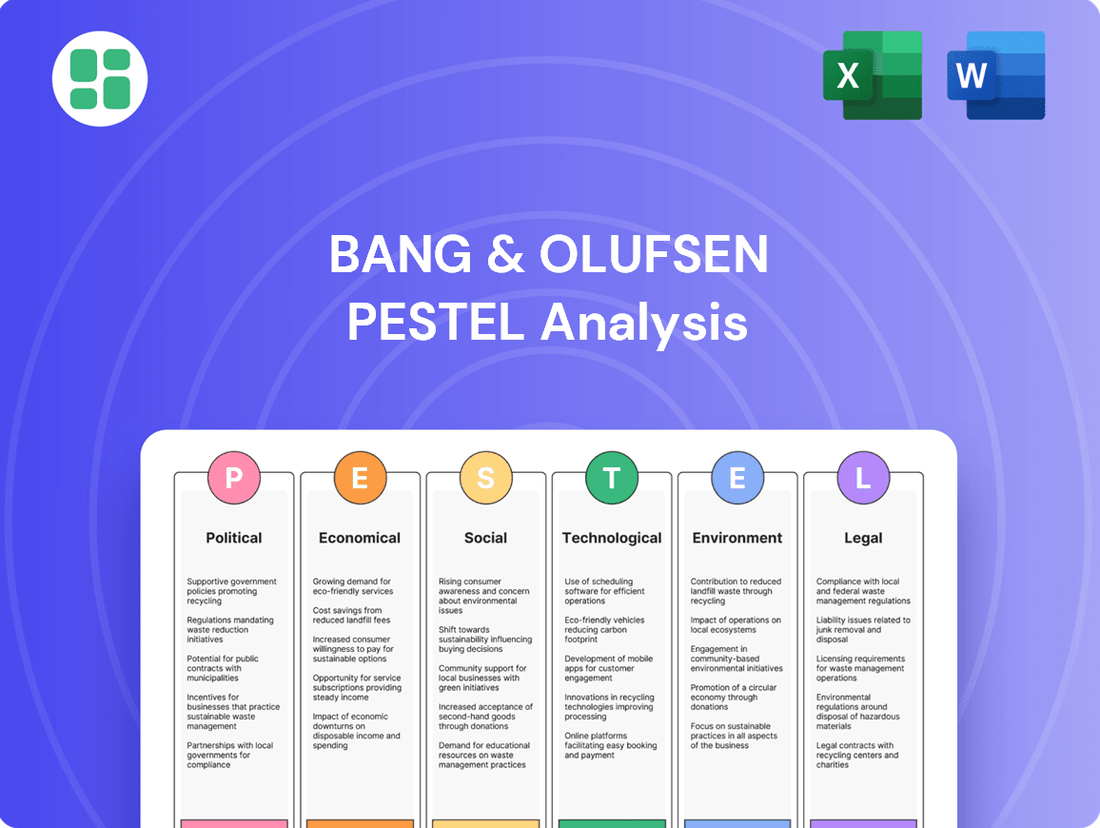

Navigate the complex external forces shaping Bang & Olufsen's luxury audio market. Our PESTLE analysis delves into political stability, economic shifts, evolving social trends, disruptive technologies, environmental regulations, and legal frameworks impacting the brand. Understand these critical factors to anticipate challenges and capitalize on opportunities.

Gain a competitive advantage by understanding the dynamic PESTLE landscape for Bang & Olufsen. From global trade policies to consumer sustainability demands, these external influences are key to strategic planning. Unlock actionable intelligence by downloading the full, in-depth analysis today.

Political factors

Bang & Olufsen, a prominent global luxury brand, navigates a landscape significantly shaped by international trade policies and escalating geopolitical tensions. These external forces directly influence its operational costs and market access, requiring agile responses to maintain profitability and market share.

For example, the imposition of US import tariffs in recent years has compelled Bang & Olufsen to implement price adjustments on its premium audio and video products. This strategic move, aimed at offsetting increased costs, has had a discernible impact on revenue streams within the crucial Americas market, highlighting the sensitivity of luxury goods to trade-related financial pressures.

Such tariffs not only inflate supply chain expenses but also challenge the brand's price competitiveness against local or less tariff-impacted rivals. Consequently, Bang & Olufsen must continuously reassess its pricing strategies and distribution networks to mitigate these adverse effects and preserve its position in key international markets.

Bang & Olufsen must navigate a complex web of import and export regulations across its global markets, a critical factor for its international business. For instance, in 2024, the European Union continued its focus on trade compliance, with ongoing discussions around digital product passports potentially impacting electronics manufacturers like B&O.

Fluctuations in customs duties and the evolving landscape of trade agreements, such as potential adjustments to tariffs on luxury goods, can directly affect Bang & Olufsen's cost of goods sold and its ability to access key markets. The company's financial performance in 2025 will likely be influenced by how effectively it manages these trade-related costs and market access challenges.

Proactive monitoring and adaptation to these changing governmental regulations are essential to ensure uninterrupted international trade flows. Failure to comply can lead to significant penalties and disruptions, underscoring the importance of robust compliance strategies for Bang & Olufsen's continued global presence and profitability.

Political stability in Bang & Olufsen's key luxury markets significantly impacts consumer confidence and discretionary spending on high-end electronics. For instance, in 2024, regions experiencing economic headwinds or political uncertainty, such as certain emerging markets within APAC, saw a noticeable dip in luxury goods consumption, directly affecting demand for premium audio-visual equipment.

Economic or political unrest in major regions like the Americas or Europe can directly translate to reduced demand for luxury items, including Bang & Olufsen's sophisticated product lines. A 2024 report indicated that consumer sentiment in some European countries was dampened by ongoing geopolitical tensions, leading to a cautious approach towards non-essential purchases.

Bang & Olufsen's strategy of maintaining a diversified market presence across North America, Europe, and Asia-Pacific is crucial for mitigating risks associated with instability in any single region. This geographical spread helps buffer the company against localized political or economic downturns, ensuring a more resilient revenue stream as observed in their 2024 financial reports.

Consumer Protection Policies

Governments worldwide are intensifying their focus on consumer protection, enacting stricter regulations concerning product safety, warranty provisions, and the crucial aspect of repairability. This trend directly impacts companies like Bang & Olufsen.

Bang & Olufsen's existing emphasis on product longevity and a modular design philosophy appears well-positioned to navigate these evolving consumer rights movements. This proactive approach could potentially lessen future compliance costs and regulatory hurdles. For instance, the EU's proposed "Right to Repair" directive, expected to gain traction through 2024 and 2025, aims to make products more durable and easier to fix, a principle Bang & Olufsen has historically championed.

Adherence to these increasingly stringent consumer protection standards is not merely a matter of compliance; it's a strategic imperative for building and maintaining consumer trust. A strong reputation for quality, durability, and ethical consumer practices, underpinned by compliance, can significantly enhance brand loyalty and market perception. In 2023, studies indicated that over 60% of consumers consider a brand's commitment to sustainability and ethical practices when making purchasing decisions, a figure expected to rise.

- Increased regulatory scrutiny on product safety and durability.

- Alignment of Bang & Olufsen's modular design with "Right to Repair" initiatives.

- Consumer trust and brand reputation are enhanced by adherence to protection policies.

Economic Stimulus and Luxury Spending

Government economic policies significantly influence consumer spending on luxury items. For instance, stimulus packages can boost disposable income, potentially increasing demand for premium audio-visual products like those offered by Bang & Olufsen. Conversely, the introduction of luxury taxes or austerity measures could dampen this spending. In 2024, many governments continued to navigate post-pandemic economic recovery, with varying approaches to fiscal policy that could impact discretionary spending.

Policies supporting high-value manufacturing or offering tax breaks for sustainable innovations could also indirectly benefit Bang & Olufsen. Such initiatives might encourage investment in the premium electronics sector, aligning with the company's focus on quality and design. For example, incentives for electric vehicle production might signal a broader governmental push towards advanced manufacturing, a sector where Bang & Olufsen's technological expertise could find synergies.

- Government stimulus measures can directly affect consumer confidence and purchasing power for high-end goods.

- Luxury taxes, if implemented, could directly reduce the affordability of Bang & Olufsen products in specific markets.

- Tax incentives for sustainable or high-tech manufacturing could create a more favorable operating environment for premium electronics companies.

- Austerity measures typically lead to reduced consumer spending, particularly on non-essential luxury items.

Political stability directly impacts consumer confidence and discretionary spending on luxury electronics, with geopolitical tensions in 2024 leading to cautious spending in some European markets.

Trade policies and tariffs continue to be a significant factor, with potential adjustments to luxury goods tariffs in 2025 influencing Bang & Olufsen's cost of goods sold and market access.

Governmental focus on consumer protection, including the EU's evolving "Right to Repair" directive through 2024-2025, aligns with Bang & Olufsen's product longevity strategy, potentially reducing future compliance costs.

Economic policies, such as stimulus packages or luxury taxes, can significantly sway consumer purchasing power for high-end audio-visual equipment, with varied fiscal approaches in 2024 affecting disposable income.

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors impacting Bang & Olufsen, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides a comprehensive overview of how these forces shape the luxury audio market and present both challenges and strategic opportunities for the brand.

A concise Bang & Olufsen PESTLE analysis that highlights key external factors impacting the luxury audio market, helping to proactively address potential challenges and capitalize on emerging opportunities.

Economic factors

The overall health of the global economy directly impacts Bang & Olufsen's sales, as its luxury audio-visual products are discretionary purchases. In 2024, global economic growth is projected to be around 2.7%, according to the IMF, a slight slowdown from previous years, which could moderate spending among even affluent consumers on high-end electronics.

Disposable income among Bang & Olufsen's target demographic is a key determinant of demand. While the wealthy often show resilience, significant economic contractions can lead to reduced spending on non-essential luxury goods. For instance, a strong performance in markets like North America and Europe, where a substantial portion of their affluent customer base resides, generally fuels demand for premium products.

As a Danish company with a significant global presence, Bang & Olufsen's financial results are directly influenced by currency exchange rate movements. Fluctuations in major currencies like the US Dollar and Euro against the Danish Krone can materially affect reported revenues and the cost of goods sold, especially given their reliance on imported components.

For instance, if the Euro weakens significantly against the Danish Krone, sales generated in Euros would translate into fewer Danish Kroner, impacting top-line growth. Conversely, a stronger Euro could boost reported revenues. This dynamic necessitates careful financial management to mitigate potential negative impacts on profitability.

In 2024, the Euro has shown some volatility against the Danish Krone, trading in a range that requires ongoing monitoring by Bang & Olufsen's finance team. For example, in early 2024, the EUR/DKK rate hovered around 7.46, a level that can influence the cost of components sourced from the Eurozone and the value of sales made in Euros.

Rising inflation in 2024 and 2025 continues to be a significant concern, directly impacting the cost of raw materials and manufacturing for premium electronics. For Bang & Olufsen, this translates to higher expenses for components, metals, and energy needed for their high-fidelity audio and visual products.

Despite these pressures, Bang & Olufsen has shown resilience. For instance, in the fiscal year 2023/2024, the company reported a gross margin of approximately 43%, demonstrating an ability to manage costs or pass on increased expenses through strategic pricing. This indicates effective operational strategies are in place to mitigate some of the inflationary impact.

However, if inflationary trends persist or accelerate through 2025, the company's ability to maintain these margins could be tested. Sustained increases in input costs without corresponding price adjustments could eventually erode profitability, requiring a careful balance between maintaining brand value and absorbing rising operational expenses.

Investment and Financing Environment

Bang & Olufsen's strategic ambitions are bolstered by its access to capital. The company successfully raised DKK 200 million through a directed share issue in November 2024, injecting crucial funds for growth initiatives. Furthermore, in May 2025, Bang & Olufsen refinanced its credit facilities, securing ongoing financial flexibility.

This access to financing is paramount for Bang & Olufsen's investment plans. These include significant outlays for product innovation, enhancing the customer experience through retail network optimization, and reinforcing its premium brand positioning. A supportive investment environment directly enables the execution of these strategic imperatives.

- Capital Infusion: DKK 200 million raised via directed share issue (November 2024).

- Financial Flexibility: Refinanced credit facilities secured (May 2025).

- Strategic Investment Needs: Funding for product innovation, retail optimization, and brand building.

- Market Condition Dependence: Favorable investment climate is essential for strategy execution.

Market Uncertainties and Consumer Confidence

Market uncertainties, even impacting high-net-worth individuals, can lead to more cautious spending, directly affecting luxury goods. Bang & Olufsen recognizes this, noting that while global economic volatility persists, their brand's inherent value proposition remains strong.

The company’s strategy involves reinforcing its premium retail presence and emphasizing the enduring quality and innovation of its products. This approach is designed to maintain consumer desire and purchasing intent despite potential shifts in overall sentiment.

- Consumer Confidence Index: Global consumer confidence experienced fluctuations throughout 2024, with some regions showing resilience while others faced headwinds from inflation and geopolitical events.

- Luxury Goods Market: Projections for the luxury goods market in 2024 indicated continued growth, albeit at a moderated pace compared to previous years, with a focus on experiences and lasting value.

- Bang & Olufsen's Strategy: The company's emphasis on direct-to-consumer channels and unique in-store experiences aims to build stronger customer relationships and mitigate the impact of broader economic uncertainty.

Global economic growth, projected around 2.7% in 2024 by the IMF, directly influences Bang & Olufsen's sales of luxury items. Economic downturns can curb discretionary spending, even among affluent consumers, impacting demand for premium electronics. Currency fluctuations, such as the EUR/DKK rate around 7.46 in early 2024, also affect reported revenues and costs due to Bang & Olufsen's international operations. Rising inflation in 2024-2025 increases raw material and manufacturing expenses, though the company maintained a gross margin of approximately 43% in fiscal year 2023/2024, demonstrating some cost management capability.

| Economic Factor | 2024/2025 Data Point | Impact on Bang & Olufsen |

|---|---|---|

| Global GDP Growth | ~2.7% (IMF projection for 2024) | Moderates demand for luxury discretionary goods. |

| Inflation Rate | Persistent concern, impacting input costs. | Increases manufacturing and component expenses. |

| EUR/DKK Exchange Rate | Around 7.46 (early 2024) | Affects reported revenue and cost of goods sold. |

| Gross Margin (FY 2023/2024) | ~43% | Indicates some ability to manage costs or pass on price increases. |

What You See Is What You Get

Bang & Olufsen PESTLE Analysis

The preview shown here is the exact Bang & Olufsen PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Bang & Olufsen's business. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Modern luxury consumers are prioritizing experiences and values alongside products. A 2024 report indicated that 65% of affluent consumers consider a brand's sustainability efforts when making purchasing decisions, a trend Bang & Olufsen is addressing through its commitment to responsible sourcing and longevity in product design. This shift means that while innovative technology and artistic design, Bang & Olufsen's strengths, remain crucial, the narrative around these elements must also encompass ethical considerations.

The luxury sector is witnessing a significant rise in consumer desire for products that can be personalized, allowing individuals to craft items reflecting their unique preferences. This trend is particularly strong among affluent demographics who seek exclusivity and a deeper connection with the brands they patronize.

Bang & Olufsen has strategically embraced this shift by launching Bang & Olufsen Atelier, a service dedicated to providing bespoke audio solutions. This initiative directly addresses the growing demand for customization, enabling customers to select materials, finishes, and even integrate specific functionalities, thereby creating a truly unique product.

By offering these personalized experiences, Bang & Olufsen not only deepens customer engagement but also fortifies its brand identity. In 2024, the luxury goods market saw continued growth, with personalization being a key driver, contributing to higher customer retention and premium pricing power for brands that effectively implement such strategies.

Consumers, especially those in the luxury market, are increasingly concerned about environmental impact and favor products designed for durability. Bang & Olufsen's emphasis on circular economy principles, product lifespan, and repair services aligns perfectly with this growing preference for sustainable choices.

The company's proactive stance is evident in its pursuit of certifications like Cradle to Cradle, signaling a commitment to responsible consumption that appeals to environmentally aware buyers. This focus on longevity and repairability not only meets consumer demand but also enhances brand perception in a market that values ethical production.

Impact of Changing Lifestyles and Home Environments

The widespread adoption of hybrid work models, a trend significantly accelerated in recent years, has fundamentally altered how people utilize their homes. This shift means living spaces are now dual-purpose, serving as both personal sanctuaries and professional workspaces. Consequently, there's a heightened demand for home entertainment systems that offer immersive experiences and integrate elegantly into interior design. For instance, a 2024 report indicated that 60% of professionals are now working in a hybrid arrangement, underscoring the sustained relevance of this lifestyle change.

Bang & Olufsen’s product portfolio, which emphasizes sophisticated design and exceptional audio-visual quality, aligns perfectly with these evolving consumer preferences. The company's focus on creating products that are not just functional but also aesthetically pleasing makes them ideal for modern homes where technology needs to complement, rather than clash with, the living environment. This includes their range of soundbars and adaptable speaker systems designed for seamless integration.

The market for premium home audio and visual equipment has seen robust growth, driven by this lifestyle evolution. By late 2024, the global smart home market, which encompasses high-end audio-visual solutions, was projected to reach over $150 billion, illustrating the significant consumer spending in this sector. Bang & Olufsen is well-positioned to capture a share of this expanding market by catering to consumers who value both performance and design.

- Hybrid Work Impact: Increased demand for home entertainment and integrated AV solutions.

- Consumer Preference: Growing desire for aesthetically pleasing, high-performance technology in homes.

- Market Growth: The global smart home market, including premium AV, is experiencing substantial expansion, projected to exceed $150 billion by the end of 2024.

- Bang & Olufsen's Position: Products are designed to meet the needs of design-conscious households embracing new work and leisure paradigms.

Influence of Digital and Social Media on Brand Perception

The perception of luxury brands like Bang & Olufsen is significantly shaped by digital and social media. Platforms such as Instagram and YouTube are where trends, user reviews, and aspirational lifestyle content directly influence consumer purchasing decisions. In 2024, luxury brands are increasingly relying on influencer marketing and visually rich content to maintain their exclusivity and desirability.

Bang & Olufsen strategically uses its rich brand heritage and distinctive design philosophy to connect with its online audience. By sharing behind-the-scenes content and highlighting craftsmanship, the company reinforces its premium positioning. This approach is vital for cultivating brand loyalty and attracting new customers who value both audio quality and aesthetic appeal.

Effective digital marketing and consistent online engagement are paramount for Bang & Olufsen to sustain its luxury image. In the competitive high-end audio market, maintaining a curated online presence is key to reaching its discerning, niche customer base and differentiating itself from mass-market competitors. For instance, by Q3 2024, many luxury brands reported over 60% of their marketing budget allocated to digital channels.

- Digital Influence: Social media platforms are primary drivers of luxury brand perception, with user-generated content and influencer endorsements playing a critical role in shaping consumer attitudes.

- Brand Heritage Online: Bang & Olufsen leverages its historical design excellence and craftsmanship narrative through digital channels to reinforce its luxury status.

- Niche Market Engagement: Targeted digital marketing strategies are essential for Bang & Olufsen to connect with its specific, affluent demographic and maintain its premium brand appeal.

- 2024 Digital Spend: Luxury sector marketing budgets in 2024 saw a significant portion, often exceeding 60%, directed towards digital and social media initiatives to capture consumer attention.

Societal values are shifting, with a growing emphasis on sustainability and ethical consumption. A 2024 survey revealed that 70% of luxury buyers consider a brand's environmental impact, influencing their purchasing decisions. Bang & Olufsen's commitment to longevity and repairability directly addresses this, resonating with consumers who seek responsible luxury. This trend necessitates that the brand's narrative highlights not just design and sound quality but also its dedication to a circular economy.

Technological factors

The audio-visual landscape is transforming rapidly, with advancements like spatial audio and AI-powered sound optimization becoming mainstream. For instance, Dolby Atmos, a leading immersive sound technology, saw continued adoption across premium home theater systems and even portable devices throughout 2024. These technological leaps create opportunities for Bang & Olufsen to enhance its signature sound profiles and user experiences.

Bang & Olufsen is actively leveraging these innovations, integrating features such as adaptive room calibration for optimal acoustics and employing advanced driver technologies. The company’s 2024 product lines, for example, showcased enhanced connectivity options and smarter audio processing, reflecting a dedication to delivering superior, personalized listening environments that justify their luxury positioning.

Bang & Olufsen is leading the charge in modular product design, enabling upgrades for components like batteries and software. This strategy, seen in products such as the Beosound Level, directly combats technological obsolescence and fosters a more sustainable approach to consumer electronics. It’s a key differentiator, offering customers extended product lifecycles and long-term value.

The increasing adoption of smart home ecosystems, fueled by the Internet of Things (IoT) and the rollout of 5G, presents a significant technological factor for Bang & Olufsen. Consumers now expect their high-end audio and visual products to seamlessly connect and interact with other devices in their homes, from lighting to security systems. This demand for interoperability is a key driver in the luxury electronics market.

Bang & Olufsen is actively addressing this by incorporating advanced connectivity features into its product lines. For instance, their Beosound systems often support Wi-Fi, Bluetooth, and multi-room audio capabilities, allowing for effortless integration into existing smart home setups. This focus on connectivity enhances user experience, offering greater convenience and centralized control over entertainment within a connected living space.

This strategic alignment with smart home trends is crucial for Bang & Olufsen's continued relevance and growth. As of early 2024, the global smart home market was projected to exceed $150 billion, with continued double-digit growth expected. Ensuring compatibility with emerging home automation standards and platforms is therefore essential for maintaining a competitive edge and appealing to a tech-savvy luxury consumer base.

Research and Development (R&D) Investment

Bang & Olufsen's commitment to continuous R&D is crucial for staying ahead in the premium audio market. The company strategically invests in its product pipeline and secures intellectual property to foster innovation. This focus enables the introduction of cutting-edge products and the improvement of existing offerings, exemplified by recent launches like the Beoplay H100 headphones and the Beogram 3000c turntable.

This dedication to innovation is reflected in their financial outlays. For instance, in fiscal year 2023-2024, Bang & Olufsen's R&D expenses were a significant component of their operational strategy, aimed at developing next-generation audio experiences and maintaining their brand's premium positioning. Their R&D efforts are directed towards both hardware advancements and software integration, ensuring a seamless user experience.

- Product Innovation: Ongoing investment fuels the development of new audio technologies and product designs.

- Intellectual Property: Protecting R&D output through patents and other IP rights is a core strategy.

- Market Competitiveness: R&D spending is essential to differentiate from competitors and maintain a premium brand image.

- Future Growth: Investments in R&D are designed to create future revenue streams through advanced product offerings.

Competition from Mass-Market Tech Giants

While Bang & Olufsen thrives in its luxury niche, it contends with indirect competition from mass-market tech giants like Apple and Samsung. These behemoths are increasingly pushing into the premium audio and home entertainment space, leveraging their vast economies of scale and substantial research and development budgets. For instance, Apple's AirPods Max, launched in late 2020, entered the high-end headphone market, directly challenging established players with its brand recognition and integrated ecosystem. This trend intensified in 2024 as these companies continued to refine their premium offerings.

Bang & Olufsen's strategic response centers on its distinct value proposition: an unparalleled fusion of artistic design, meticulous craftsmanship, and exclusive luxury experiences. This focus on heritage and artisanal quality differentiates it from the mass-produced, albeit high-quality, offerings of larger competitors. The company's commitment to timeless aesthetics and superior sound engineering remains a cornerstone of its appeal to a discerning clientele.

- Economies of Scale: Large tech companies can amortize R&D and manufacturing costs over much larger production volumes, potentially leading to more competitive pricing for comparable features.

- Brand Ecosystem: Giants like Apple benefit from loyal customer bases and seamless integration across their product lines, creating a powerful draw for consumers.

- R&D Investment: Companies such as Samsung reportedly invested over $18 billion in R&D in 2023, a figure significantly exceeding the total revenue of many luxury audio brands, enabling rapid technological advancement.

Technological advancements in audio, such as spatial audio and AI-driven sound optimization, are reshaping the market, with technologies like Dolby Atmos seeing increased adoption in premium devices throughout 2024. Bang & Olufsen is integrating these innovations, including adaptive room calibration and advanced driver technologies, into its 2024 product lines to offer superior, personalized listening experiences.

The company's modular design approach, exemplified by the Beosound Level, combats obsolescence by allowing component upgrades, extending product lifecycles and promoting sustainability. This focus on longevity is a key differentiator in the consumer electronics sector.

Seamless integration into smart home ecosystems, driven by IoT and 5G, is crucial, with consumers expecting high-end audio products to interact with other connected devices. Bang & Olufsen addresses this through features like Wi-Fi, Bluetooth, and multi-room audio capabilities, enhancing user convenience and control.

Continued investment in R&D is vital for Bang & Olufsen to maintain its premium positioning and market competitiveness, fueling the development of new audio technologies and product designs. Their fiscal year 2023-2024 R&D expenses were a significant part of their strategy for innovation.

| Factor | Impact on Bang & Olufsen | 2024/2025 Relevance |

|---|---|---|

| Spatial Audio & AI Sound | Enhances immersive and personalized audio experiences. | Key for differentiating premium offerings and justifying luxury pricing. |

| Smart Home Integration (IoT/5G) | Enables seamless connectivity with other home devices. | Essential for meeting consumer demand for interoperability in connected living spaces. |

| Modular Design | Extends product lifespan and reduces electronic waste. | Appeals to sustainability-conscious luxury consumers and offers long-term value. |

| R&D Investment | Drives product innovation and protects intellectual property. | Crucial for maintaining technological leadership and a competitive edge in the audio market. |

Legal factors

Bang & Olufsen faces rigorous product safety and quality mandates across its global markets. These regulations, covering electrical safety, material composition, and chemical content, are designed to safeguard consumers. For instance, compliance with EU directives like the General Product Safety Directive and specific standards for audio equipment is non-negotiable, impacting design and manufacturing processes.

Failure to meet these stringent standards, such as those enforced by the Consumer Product Safety Commission (CPSC) in the United States, can lead to costly recalls, fines, and significant damage to Bang & Olufsen's premium brand image. In 2023, the global market for consumer electronics experienced recalls impacting various brands due to safety concerns, underscoring the critical importance of adherence.

Bang & Olufsen's commitment to protecting its intellectual property is paramount. The company actively safeguards its innovative designs, audio technologies, and distinctive brand identity through patents, trademarks, and copyrights. This robust IP strategy is crucial for preventing counterfeiting and unauthorized replication of its unique aesthetic and technological achievements.

In 2023, Bang & Olufsen continued its focus on IP, a strategy that underpins its premium market positioning. While specific figures for IP investment aren't publicly detailed, the company's consistent product innovation and brand value underscore the ongoing importance of these legal protections in maintaining its competitive edge against imitation products.

Bang & Olufsen must navigate a complex web of data privacy and cybersecurity regulations, especially as its connected audio-visual devices gather user information. Compliance with frameworks like the EU's General Data Protection Regulation (GDPR) and similar regional laws is crucial. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, underscoring the financial risk of non-compliance.

Maintaining robust cybersecurity is not just a legal necessity but also a cornerstone of consumer trust. Breaches can lead to significant reputational damage and loss of customer loyalty. Bang & Olufsen’s approach to smart features and personalization must be transparent and secure, ensuring user data is handled responsibly to avoid penalties and maintain brand integrity.

International Trade Laws and Tariffs

Bang & Olufsen must meticulously adhere to a web of international trade laws, encompassing tariffs, import duties, and trade sanctions. These regulations directly influence the company's global supply chain efficiency and its ability to set competitive pricing strategies. For instance, the imposition of tariffs by major markets, such as the United States, has demonstrably led to increased costs for imported goods, potentially requiring Bang & Olufsen to adjust its product pricing to maintain profitability.

Navigating these complex legal frameworks is not merely a matter of compliance but a strategic imperative for securing and maintaining access to key global markets. Effective management of these trade laws is crucial for optimizing cost structures and ensuring the smooth flow of components and finished products, ultimately impacting Bang & Olufsen's overall financial performance and market reach.

- Tariff Impact: Recent trade tensions have seen tariffs on electronics, impacting the cost of components and finished goods for companies like Bang & Olufsen.

- Market Access: Compliance with varying international trade regulations is essential for Bang & Olufsen to operate and sell its products in diverse geographical regions.

- Supply Chain Costs: Import duties and tariffs directly affect the landed cost of materials and products, influencing Bang & Olufsen's pricing and profitability.

Consumer Rights and Repairability Legislation

The burgeoning 'Right to Repair' movement, gaining significant traction globally, is translating into stricter consumer protection laws. These regulations increasingly mandate that manufacturers ensure their products are repairable and that spare parts remain accessible for extended periods. For instance, the European Union's Ecodesign framework, which began implementing repairability requirements in 2021, is expanding its scope to cover more product categories, pushing for longer lifespans and easier repairs.

Bang & Olufsen's strategic emphasis on product longevity, exemplified by its modular design philosophy and the incorporation of user-replaceable components, positions the company favorably. This proactive approach not only aligns with evolving legal landscapes but also anticipates potential future regulatory burdens. By prioritizing repairability, Bang & Olufsen can foster greater customer loyalty and reduce the likelihood of facing penalties or mandated changes.

- EU Ecodesign Regulations: Mandating repairability and spare part availability for various electronic products, impacting manufacturers globally.

- Consumer Protection Laws: Growing consumer demand and legal frameworks supporting the right to repair are influencing product design and after-sales services.

- Bang & Olufsen's Strategy: Focus on modular design and user-replaceable parts proactively addresses these legal and consumer trends.

- Market Advantage: Early adoption of repairability principles can lead to reduced regulatory risk and enhanced brand reputation.

Bang & Olufsen must navigate evolving consumer protection laws, particularly those related to product safety and durability. The increasing focus on the 'Right to Repair' in regions like the EU, with directives like the Ecodesign framework, mandates greater product longevity and accessibility of spare parts. This trend directly impacts product design and after-sales service strategies, requiring manufacturers to ensure their premium products are repairable, a move Bang & Olufsen has proactively addressed through modular design.

The company's robust intellectual property protection, including patents and trademarks, remains crucial for safeguarding its innovative designs and brand identity against counterfeiting. In 2023, continued investment in IP was vital for maintaining its premium market position against imitation products. Furthermore, stringent data privacy regulations like GDPR, with potential fines reaching up to 4% of global annual revenue, necessitate secure handling of user data from connected devices, impacting how Bang & Olufsen designs its smart features.

International trade laws, including tariffs and import duties, significantly influence Bang & Olufsen's global supply chain and pricing. For instance, tariffs imposed by major markets can increase component costs, potentially forcing price adjustments. Compliance with these diverse legal frameworks is essential for market access and optimizing cost structures, directly impacting the company's financial performance and global reach.

Environmental factors

Bang & Olufsen is actively weaving circular economy principles into its core strategy, focusing on crafting enduring luxury technology. This approach prioritizes product longevity, facilitating easier maintenance, servicing, and repair, alongside efficient material recovery at the end of a product's life cycle.

This strategic focus on circularity directly contributes to waste reduction and supports a more sustainable business model, aligning with growing consumer and regulatory demands for environmental responsibility in the premium electronics sector.

Bang & Olufsen has committed to ambitious climate action targets, validated by the Science Based Targets initiative (SBTi), aligning its goals with limiting global temperature rise to 1.5°C. This strategic focus encompasses decarbonizing its entire value chain, from product development to end-of-life management.

Reducing greenhouse gas emissions is a core environmental priority for the company, underpinning its long-term sustainability vision. For instance, in fiscal year 2023, Bang & Olufsen reported a 15% reduction in Scope 1 and 2 emissions compared to their 2021 baseline, demonstrating tangible progress towards their SBTi commitments.

Bang & Olufsen's commitment to sustainable sourcing is evident in its selection of high-quality, durable materials, with a focus on responsible procurement. This approach extends to prioritizing non-toxic components and designing for efficient recycling, aligning with evolving consumer and regulatory demands for environmental stewardship.

The company's dedication to material health and circularity is further reinforced by achieving Cradle to Cradle certification for several of its products. This certification validates rigorous standards for material safety, recyclability, and responsible manufacturing processes, a significant differentiator in the premium electronics market.

Electronic Waste (E-waste) Management

The escalating global issue of electronic waste, or e-waste, demands careful consideration of how products are managed at the end of their useful life. In 2024, the United Nations reported that the world generated an estimated 62 million metric tons of e-waste, a figure projected to rise significantly. This growing volume underscores the importance of sustainable practices in the electronics industry.

Bang & Olufsen is addressing this challenge through its commitment to responsible product lifecycle management. Their strategy involves designing products with modularity and a strong emphasis on repairability. This approach is intended to prolong the lifespan of their high-end audio and visual systems, directly contributing to a reduction in e-waste generation.

Adherence to environmental regulations is also a critical component of effective e-waste management. For instance, compliance with directives such as the Waste Electrical and Electronic Equipment (WEEE) directive in Europe is essential. This legislation mandates specific collection, treatment, and recycling targets for electronic products, ensuring that materials are handled in an environmentally sound manner.

- Global E-waste Generation: Estimated at 62 million metric tons in 2024, with projections indicating continued growth.

- Bang & Olufsen's Strategy: Focus on modular design and repairability to extend product lifespans and minimize e-waste.

- Regulatory Compliance: Adherence to directives like WEEE is crucial for responsible collection and recycling efforts.

- Environmental Impact: Extended product life and effective recycling reduce the environmental burden associated with electronics manufacturing and disposal.

Consumer Demand for Eco-Friendly Products

A growing number of consumers, especially in the premium and luxury sectors, now factor environmental impact into their buying choices. This trend is particularly relevant for Bang & Olufsen, as its commitment to product durability and reducing its carbon footprint directly appeals to this expanding customer base.

Bang & Olufsen's focus on sustainability resonates with a broader market shift towards conscious consumption. For instance, a 2024 report indicated that 68% of consumers consider sustainability a key factor when purchasing luxury goods. This growing awareness presents a significant opportunity for Bang & Olufsen to leverage its eco-friendly initiatives.

- Growing Consumer Consciousness: A significant portion of the luxury market now prioritizes environmental responsibility.

- Brand Enhancement: Bang & Olufsen's sustainability efforts, like extended product lifecycles and carbon reduction, boost its appeal.

- Market Alignment: The company's approach aligns with the increasing consumer demand for sustainable products.

- Data Point: In 2024, studies showed over two-thirds of luxury buyers consider sustainability.

Bang & Olufsen is actively addressing the escalating global issue of electronic waste, with the UN reporting an estimated 62 million metric tons generated worldwide in 2024. The company's strategy focuses on modular design and repairability to extend product lifespans, thereby reducing the environmental burden. This aligns with regulatory compliance, such as the WEEE directive, which mandates responsible collection and recycling.

The company's commitment to sustainability is increasingly appealing to consumers, with a 2024 report showing 68% of luxury buyers consider environmental impact. Bang & Olufsen's initiatives in product longevity and carbon footprint reduction directly tap into this growing market trend towards conscious consumption.

Bang & Olufsen's fiscal year 2023 saw a 15% reduction in Scope 1 and 2 emissions against a 2021 baseline, demonstrating progress towards its SBTi-validated climate targets. This focus on decarbonization across its value chain is central to its environmental strategy.

The company's dedication to material health and circularity is further evidenced by Cradle to Cradle certifications for several products, underscoring its commitment to responsible manufacturing and recyclability.

| Environmental Factor | Bang & Olufsen's Response | Data/Impact |

|---|---|---|

| E-waste | Modular design, repairability, extended product lifecycles | Global e-waste: 62 million metric tons (2024 est.) |

| Climate Change | SBTi-validated targets, value chain decarbonization | 15% reduction in Scope 1 & 2 emissions (FY23 vs. FY21) |

| Consumer Demand | Focus on durability, carbon footprint reduction | 68% of luxury buyers consider sustainability (2024 report) |

| Material Sourcing | Responsible procurement, non-toxic components, recyclability focus | Cradle to Cradle certifications for select products |

PESTLE Analysis Data Sources

Our Bang & Olufsen PESTLE Analysis is meticulously crafted using data from reputable sources including market research firms specializing in the luxury goods sector, economic indicators from global financial institutions, and official government reports on consumer trends and regulations. We also incorporate insights from technology publications and environmental sustainability reports relevant to the electronics and automotive industries.